BlackLine Bundle

How is BlackLine Revolutionizing Finance and Accounting?

BlackLine, Inc. is at the forefront of the digital finance revolution, offering cutting-edge BlackLine SWOT Analysis. This innovative company specializes in cloud-based

With a strong showing in Q1 2025, BlackLine continues to demonstrate its prowess in the

What Are the Key Operations Driving BlackLine’s Success?

BlackLine creates value by providing cloud-based solutions to automate and streamline financial and accounting processes. Its main offerings include solutions for financial close and consolidation, intercompany accounting, and invoice-to-cash. These solutions cater to a diverse customer base, ranging from large enterprises to mid-sized organizations globally. The company focuses on digital finance transformation and integrates AI-powered solutions across its products, enhancing its offerings.

The operational processes involve centralizing financial data and automating tasks like account reconciliations and journal entry postings. BlackLine's platform, mainly running on the Google Cloud Platform, ensures accurate and complete closings through enhanced financial controls and continuous auditing. The Studio360 Platform further enhances financial operations for the Office of the CFO. BlackLine's collaborative approach ensures continuous transformation, delivering immediate impact and sustained value to its customers.

BlackLine's comprehensive, unified, and flexible cloud-based platform distinguishes it from competitors by addressing the entire financial close process. This results in reduced manual errors, time savings, improved efficiency, enhanced data integrity, and accelerated decision-making for finance and accounting teams. To learn more about the company, you can read a Brief History of BlackLine.

BlackLine's core operations involve providing cloud-based BlackLine software solutions. These solutions automate and streamline critical financial and accounting processes. The platform centralizes financial data and automates tasks, ensuring accurate and complete closings.

The value proposition of BlackLine solutions lies in reducing manual errors and saving time. It improves operational efficiency and enhances data integrity. This leads to accelerated decision-making for finance and accounting teams.

Customers benefit from reduced errors and significant time savings. There is also improvement in operational efficiency and enhanced data integrity. These benefits contribute to faster decision-making.

Key features include accounting automation and financial close capabilities. The platform offers real-time visibility into financial data. It also includes AI-powered solutions for enhanced efficiency.

BlackLine's operational advantages include a unified cloud-based platform. This addresses the entire financial close process. The company's focus on digital finance transformation and AI integration differentiates its offerings.

- Reduced manual errors and time savings.

- Improved operational efficiency.

- Enhanced data integrity.

- Accelerated decision-making.

BlackLine SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BlackLine Make Money?

The revenue streams and monetization strategies of BlackLine primarily revolve around its cloud-based software platform. This platform offers BlackLine solutions for accounting automation and financial close processes. The company leverages subscriptions and professional services to generate income.

In 2024, subscriptions accounted for approximately 95% of BlackLine's total revenue, while the remaining 5% came from professional services. BlackLine's focus on subscription-based revenue highlights its commitment to providing ongoing value to its customers through its cloud-based accounting software.

BlackLine is transitioning to a value-based and platform-based pricing model, which is expected to drive future growth by aligning pricing with customer revenue and consumption. This shift, combined with industry-specific solutions, positions BlackLine for continued expansion in the market. You can learn more about Marketing Strategy of BlackLine.

Subscription revenue is the primary driver for BlackLine, representing the majority of its income.

Professional services contribute to BlackLine's revenue, providing additional value to customers.

BlackLine's total GAAP revenues for 2024 were $653.3 million, reflecting an 11% increase from the previous year.

In the first quarter of 2025, BlackLine's total revenue reached $166.93 million, marking a 6.01% growth.

BlackLine's Annual Recurring Revenue (ARR) reached $656 million in Q1 2025, demonstrating an 8% increase.

BlackLine is moving to a value-based and platform-based pricing model to align with customer revenue.

BlackLine's financial success is driven by its subscription model and strategic pricing adjustments.

- Subscription-Based Revenue: Primarily relies on subscriptions to its cloud-based BlackLine software.

- Professional Services: Offers professional services to supplement subscription revenue.

- Value-Based Pricing: Transitioning to a value-based and platform-based pricing model.

- Industry-Specific Solutions: Developing solutions tailored to specific industries, including the public sector.

BlackLine PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped BlackLine’s Business Model?

The journey of BlackLine has been marked by significant milestones and strategic initiatives. Founded in 2001, the company initially aimed to replace Excel with accounting software, marking its entry into the accounting automation space. A pivotal moment arrived in 2013 when Silver Lake Partners invested over $200 million, providing substantial funding that fueled its growth.

Recent strategic initiatives include the rollout of the Studio360 Platform, which enhances financial operations for the Office of the CFO, and the expansion of its industry-specific strategy. BlackLine has also made significant inroads into the public sector, developing a strong pipeline across federal, state, and local governments. The company is accelerating innovation by integrating cutting-edge Agentic AI experiences across its products, aiming to fundamentally reimagine how accounting and finance professionals work.

BlackLine's competitive advantages stem from its brand strength, technology leadership, and comprehensive cloud-based platform that automates the entire financial close process. It is recognized as a leader in the 2024 IDC MarketScape for Worldwide Accounts Receivable Automation Applications for the Enterprise. The company's ERP-agnostic solutions support companies transitioning to cloud solutions, and it is strengthening partnerships with key players like SAP and Workday. For a deeper understanding of the company's mission and growth strategy, consider reading this article: Growth Strategy of BlackLine.

BlackLine's initial goal was to replace Excel with accounting software. In 2013, it secured over $200 million in funding from Silver Lake Partners. The company formed a strategic alliance with McGladrey in 2015, leading to the offering of a business process as a service (BPaaS) platform.

Recent strategic initiatives include the rollout of the Studio360 Platform. BlackLine is expanding its industry-specific strategy and making inroads into the public sector. The company is also integrating Agentic AI experiences across its products.

BlackLine's competitive advantages include brand strength and technology leadership. The company offers a comprehensive cloud-based platform for automating the financial close process. It is recognized as a leader in the 2024 IDC MarketScape for Worldwide Accounts Receivable Automation Applications for the Enterprise.

BlackLine is strengthening partnerships with key players like SAP and Workday. The company is focusing on innovation, strategic partnerships, and geographic expansion in regions like Mainland Europe and Asia. Despite challenges, BlackLine continues to adapt and innovate.

BlackLine software offers a comprehensive cloud-based platform designed to automate the financial close process, improving efficiency and accuracy. The platform integrates with various ERP systems and supports companies transitioning to cloud solutions.

- Automation: Automates the entire financial close process.

- Integration: Integrates with major ERP systems.

- Cloud-Based: Provides a cloud-based accounting solution.

- AI Integration: Incorporates Agentic AI to enhance user experience.

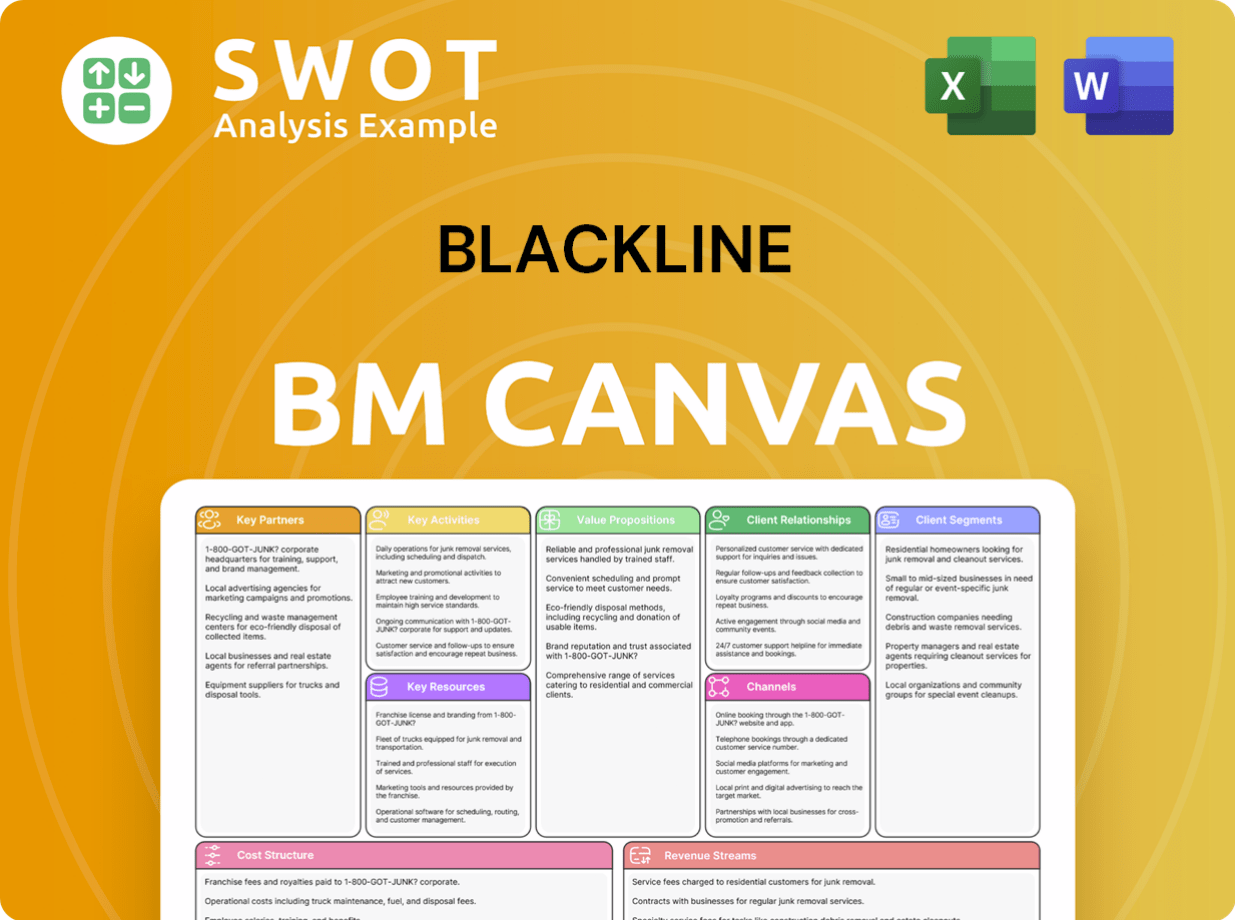

BlackLine Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is BlackLine Positioning Itself for Continued Success?

Let's explore the industry position, risks, and future outlook for BlackLine. BlackLine holds a strong position in the market as a leading provider of cloud-based solutions for financial accounting automation. This analysis will delve into its current standing, the challenges it faces, and its strategic plans for growth.

As of March 31, 2025, BlackLine served a substantial customer base, with a total of 4,455 customers and 393,892 users. The company's dollar-based net revenue retention rate was 104% at March 31, 2025, indicating strong customer loyalty and effective upselling strategies. This high retention rate is a key indicator of BlackLine's success in the market.

BlackLine is a leader in cloud-based accounting solutions, focusing on financial close automation. Their robust customer base and high retention rate highlight their market dominance. BlackLine's solutions help businesses streamline their financial processes.

Macroeconomic conditions, potential tariffs, and market saturation pose risks. Rising operating expenses, particularly in research and development and sales, are a concern. The company must navigate these challenges to maintain growth.

BlackLine anticipates growth in the latter half of 2025, driven by demand generation. The company aims for 13-16% revenue growth over the next 3-5 years. Strategic initiatives include expanding platform adoption and AI integration.

Ongoing initiatives include expanding Studio360 platform adoption, implementing new pricing strategies, and growing its public sector business. BlackLine is focused on AI integration to enhance its software. This will help them maintain a competitive edge.

BlackLine faces several risks, including unpredictable macroeconomic conditions and potential U.S. tariffs. Market saturation in some regions is another challenge. To mitigate these, BlackLine is focusing on strategic initiatives to drive revenue growth.

- Market Position: BlackLine is a leading provider of BlackLine software for accounting automation, with a focus on financial close processes.

- Financial Performance: The company achieved a dollar-based net revenue retention rate of 104% as of March 31, 2025.

- Strategic Focus: BlackLine is investing in AI integration and automation to enhance its software's value proposition and expanding its BlackLine solutions.

- Growth Targets: The company aims for a 13-16% revenue growth over the next three to five years. For more insights, read about the Growth Strategy of BlackLine.

BlackLine Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BlackLine Company?

- What is Competitive Landscape of BlackLine Company?

- What is Growth Strategy and Future Prospects of BlackLine Company?

- What is Sales and Marketing Strategy of BlackLine Company?

- What is Brief History of BlackLine Company?

- Who Owns BlackLine Company?

- What is Customer Demographics and Target Market of BlackLine Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.