BlackLine Bundle

Who Does BlackLine Serve? Unveiling Its Customer Profile

In the dynamic world of financial software, understanding the BlackLine SWOT Analysis and its customer base is crucial. BlackLine's journey from a startup to a global leader is a testament to its ability to adapt and meet the evolving needs of its customers. This exploration delves into the BlackLine target market and customer demographics, revealing the key factors driving its success.

From its inception in 2001, BlackLine company has strategically shifted its focus, impacting its BlackLine users and overall BlackLine customer profile. This analysis examines the evolution of BlackLine's BlackLine audience, highlighting how the company has expanded its reach and tailored its solutions to serve a diverse range of organizations seeking financial transformation. Understanding the BlackLine company’s customer base is essential for grasping its market position and future growth potential.

Who Are BlackLine’s Main Customers?

Understanding the customer demographics and target market of the company is crucial for grasping its market position and growth potential. The company primarily focuses on a business-to-business (B2B) model, with its main customer base residing within the finance and accounting departments of various organizations. This focus allows the company to tailor its products and services to meet the specific needs of these professionals, driving adoption and retention. The company's target market is well-defined, which facilitates efficient marketing and sales strategies.

The company's customer profile is segmented into mid-market and large enterprise organizations. This segmentation strategy enables the company to offer customized solutions and pricing models that cater to the unique requirements of each segment. As of May 2025, the company's customer base is split between mid-market and enterprise clients, with each contributing differently to the company's Annual Recurring Revenue (ARR). This balanced approach helps the company diversify its revenue streams and mitigate risks.

The company's success extends to the world's largest corporations, including a significant portion of the Fortune 500 and the Dow Jones Industrial Average. This strong presence among industry leaders underscores the company's reputation and the value it provides to its clients. The company's ability to attract and retain such high-profile clients is a testament to its robust product offerings and customer service.

The company segments its customer base into mid-market and enterprise clients. Mid-market clients account for approximately 50% of the customer base and contribute about 25% of the ARR. Enterprise clients also make up about 50% of the customer base, contributing roughly 75% of the ARR.

The company serves a diverse range of industries, including manufacturing, retail, energy, financial services, healthcare, and technology. This broad industry presence reduces the company's dependence on any single sector. The company's industry-agnostic approach allows it to adapt its solutions to meet the varying needs of different sectors.

The company has a strong track record of expanding revenue within existing customer accounts. The 2012 customer cohort has achieved a 4.9x growth multiple, demonstrating the effectiveness of its 'land and expand' strategy. This growth model is a key driver of the company's long-term financial performance.

The company is expanding into the public sector, although this segment currently represents less than 1% of its customers and ARR. This expansion highlights the company's efforts to broaden its market reach and deepen its penetration within complex financial operations. This is a strategic move to diversify its customer base.

The company's customer demographics are primarily focused on finance and accounting departments within mid-market and large enterprise organizations. The company has a strong presence in the Fortune 500 and the Dow Jones Industrial Average, showcasing its market leadership. The company's 'land and expand' strategy and industry-agnostic approach contribute to its sustained growth.

- The company's customer base is split between mid-market and enterprise clients.

- The company serves a diverse range of industries, including manufacturing, retail, energy, financial services, healthcare, and technology.

- The company is expanding into the public sector to broaden its market reach.

- For more information on the competitive landscape, read about the Competitors Landscape of BlackLine.

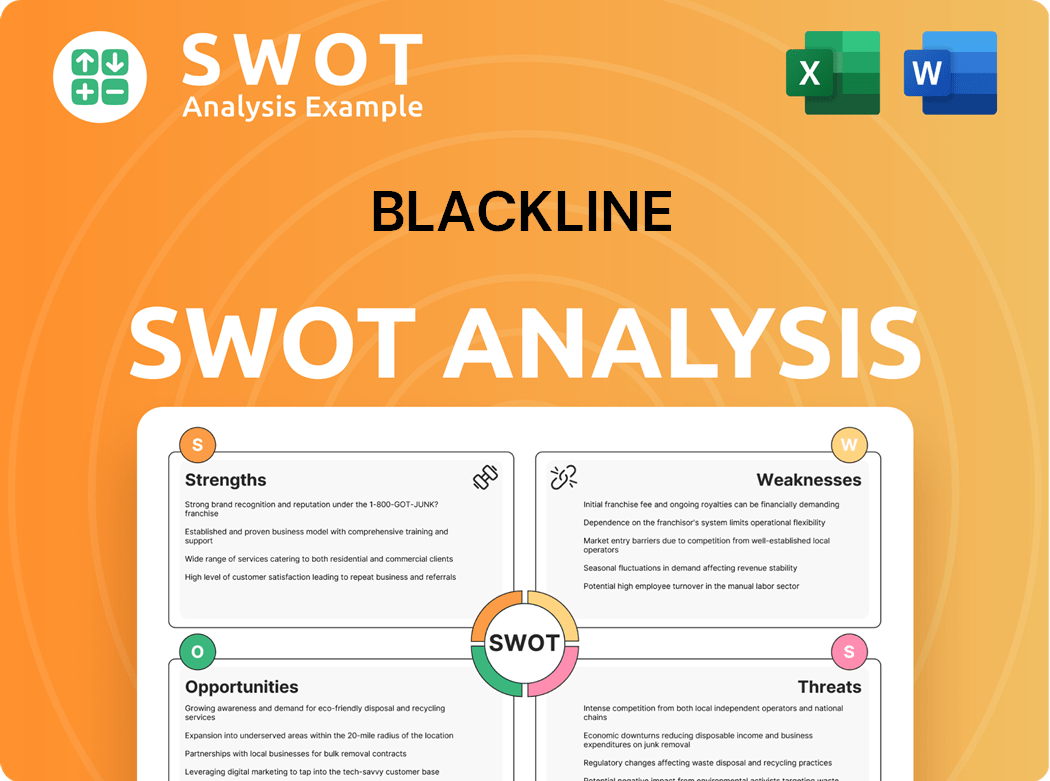

BlackLine SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do BlackLine’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business. For the company, this involves focusing on efficiency, accuracy, control, and real-time visibility within financial operations. The goal is to streamline complex processes, reduce manual effort, and ensure data integrity. This approach helps to define the Growth Strategy of BlackLine.

The primary aim is to automate and streamline financial processes, which addresses common pain points like account reconciliation, delivery inconsistencies, and data inaccuracies. Customers seek solutions that offer real-time, accurate information, and improved search and filtering functionalities. This focus on customer needs drives the company's product development and market strategy.

The target market, or the customer demographics, of the company is driven by the need for comprehensive solutions that solve specific financial challenges. The platform simplifies complex processes, enabling businesses to streamline operations and enhance accuracy. Decision-making criteria often revolve around cost-efficiency, speed to value, and overall digital finance transformation. The company's offerings typically provide payback within the first year of deployment, with expected savings of over 20% in the second year.

Customers prioritize efficiency, accuracy, and real-time visibility in their financial operations. They seek to automate and streamline complex processes to reduce manual effort and ensure data integrity. This includes addressing pain points such as account reconciliation and data inaccuracies.

Purchasing decisions are influenced by the need for comprehensive solutions that address specific financial challenges. The platform simplifies complex financial processes, enabling businesses to streamline operations and enhance accuracy. Cost-efficiency, speed to value, and digital finance transformation are key decision-making criteria.

Customers strongly rely on features like account reconciliation automation, transaction matching, and financial reporting analytics. The company continues to tailor its product development with new AI-powered capabilities, such as Matching Agents and Variance Anomaly Detection Agents, to meet evolving customer needs and improve efficiency.

Loyalty is fostered by a customer-centric approach, actively seeking feedback to refine offerings and providing resources to maximize platform usage. A recent survey suggested that 70% of customers are more likely to remain loyal to a brand that incorporates their feedback.

The company's commitment to customer-centricity is evident in its efforts to gather and incorporate customer feedback. This approach helps refine offerings and provide valuable resources to clients. By focusing on customer needs and preferences, the company aims to build strong, lasting relationships.

- Prioritizing real-time, accurate information and improved search and filtering.

- Offering payback within the first year of deployment, with expected savings of over 20% in the second year.

- Providing features like account reconciliation automation and financial reporting analytics.

- Tailoring product development with new AI-powered capabilities.

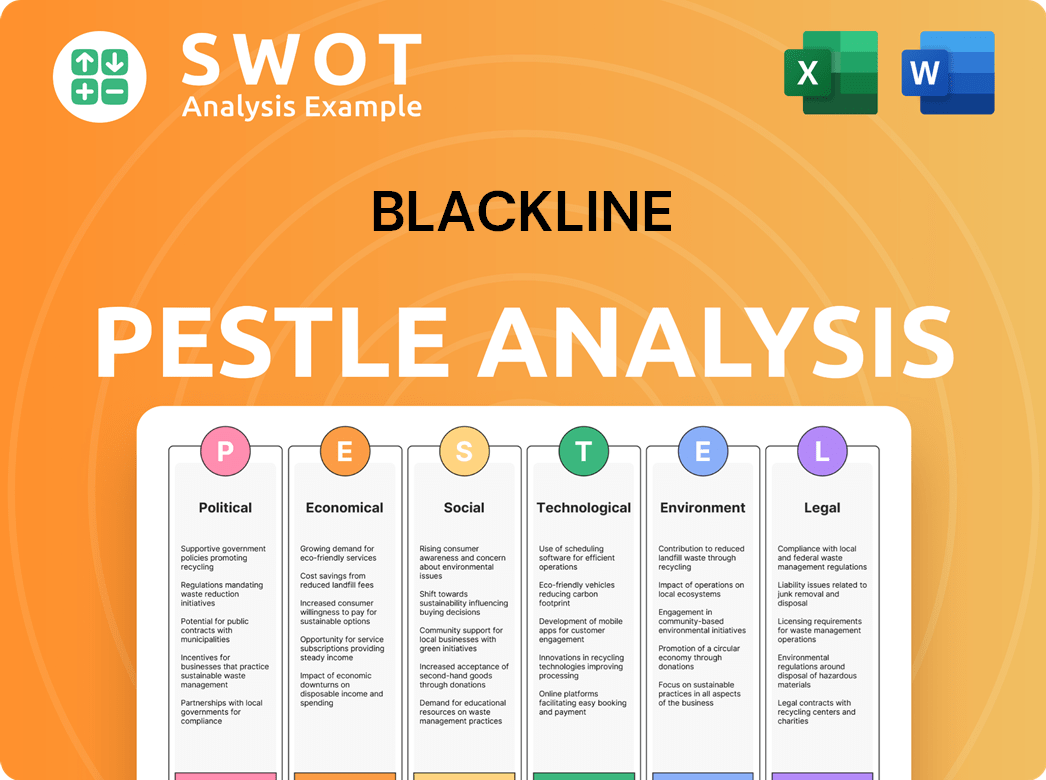

BlackLine PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does BlackLine operate?

The geographical market presence of the BlackLine company is substantial, with its services reaching over 75 countries. While specific market share data for each country is not publicly available, the company has a strong foothold in the United States. This is reflected in the growth of Blackline Safety, a related entity, which saw a 49% year-over-year increase in the U.S. market, reaching $19.3 million in Q1 2025.

The "Rest of World" region experienced significant growth in fiscal Q2 2025, with a 78% increase in revenue, indicating successful expansion efforts, particularly in the Middle East. Canada and Europe also demonstrated strong performance, with revenue increases of 23% and 14% respectively in Q2 2025. These figures highlight the company's ability to penetrate and grow in diverse international markets.

BlackLine strategically adapts its offerings and marketing strategies to succeed in various markets. The company's refocus in 2023 included specific geographical expansion initiatives in Mainland Europe and Asia. This localization strategy is supported by partnerships, leveraging a strong partner ecosystem for distribution across different regions. The company's global customer base, which exceeded 4,400 organizations as of December 31, 2024, underscores its widespread international reach.

BlackLine's customer base spans over 75 countries, demonstrating a broad international presence. The company's reach is global, with significant growth observed in regions like the Middle East and Europe. This widespread distribution indicates a successful strategy for international expansion and market penetration, targeting various customer demographics.

The company's expansion efforts in Mainland Europe and Asia, initiated in 2023, reflect a strategic focus on growing its target market. This expansion is supported by localized marketing and partnerships. These initiatives are designed to cater to the specific needs of different customer demographics in these regions.

In Q2 2025, the "Rest of World" region saw a 78% revenue increase, showcasing strong growth. Canada and Europe also contributed significantly, with revenue up 23% and 14% respectively. These figures highlight the success of BlackLine's customer acquisition strategy and its ability to meet the needs of its target market.

BlackLine localizes its offerings and marketing to succeed in diverse markets. This includes adapting to local regulations and partnering with regional distributors. This approach is crucial for understanding BlackLine's customer profile and addressing their specific needs and pain points in different geographic areas.

As of December 31, 2024, BlackLine had a global customer base of over 4,400 organizations. This large customer base is a testament to the company's success in attracting and retaining clients worldwide. Understanding BlackLine's customer base size is key to assessing its market penetration.

BlackLine leverages a strong partner ecosystem for distribution in various regions. This network helps the company reach a wider audience and provide localized support. These partnerships are essential for the company's customer acquisition strategy and its ability to serve the target market effectively.

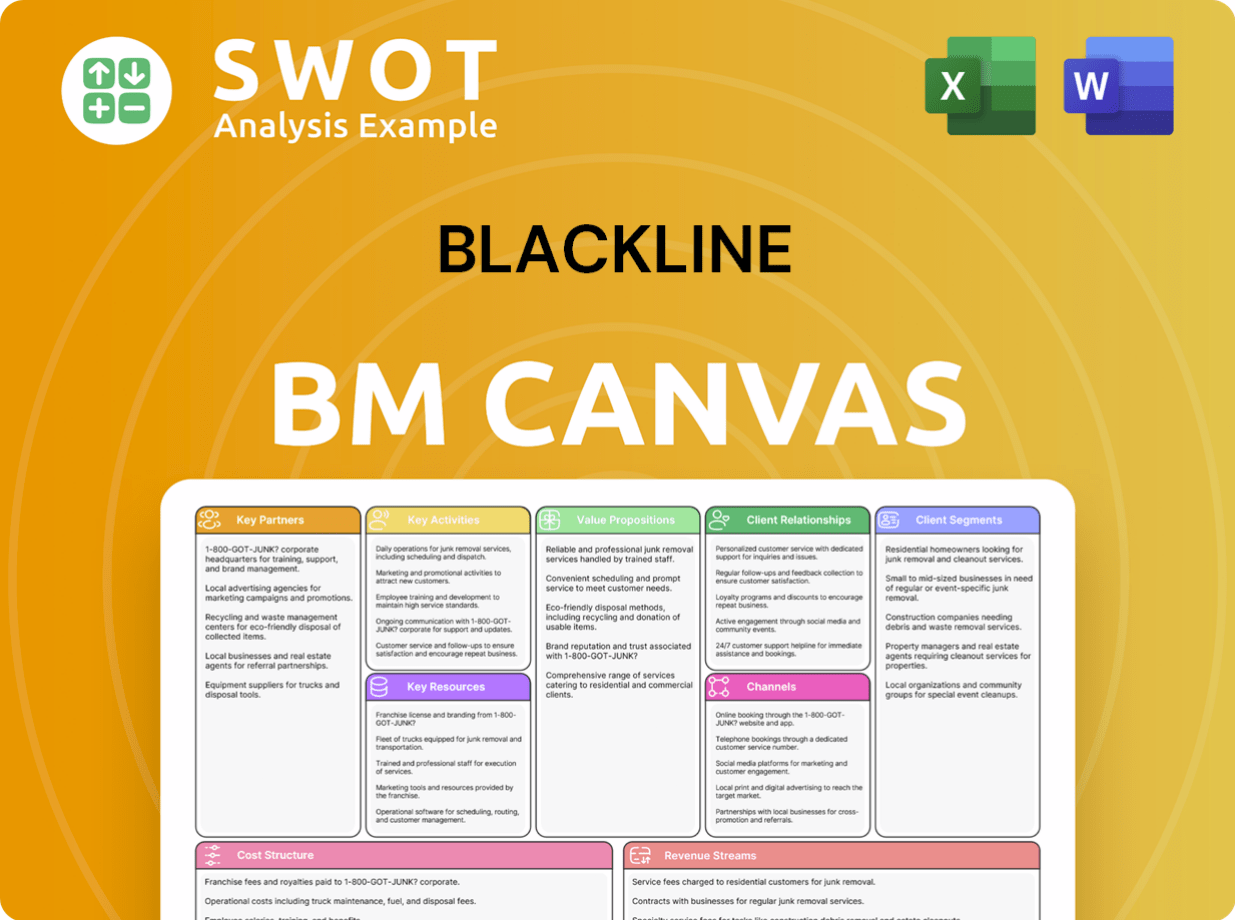

BlackLine Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does BlackLine Win & Keep Customers?

The company's strategy for customer acquisition and retention is built around a 'land and expand' model. This approach focuses on acquiring new customers while also encouraging existing clients to adopt more solutions, add entities, and increase the number of users. This dual strategy is crucial for sustainable growth. Understanding the Growth Strategy of BlackLine helps to clarify these methods.

As of December 31, 2024, the company had a total of 4,443 customers, with its user base expanding to 397,477 users. The dollar-based net revenue retention rate was 102% at the end of 2024. This indicates a high level of customer loyalty and the success of upselling and cross-selling efforts within the existing customer base.

The company also focuses on customer engagement through various programs and optimization workshops. Strategic investments in innovation, technology, and partnerships, including AI initiatives and the Studio360 Platform, are central to its acquisition and retention efforts, aiming to drive future growth and customer satisfaction.

Content marketing focuses on relevant keywords and in-depth articles to address finance and accounting challenges. This attracts potential customers searching for solutions. This is a key aspect of reaching the

The company actively seeks and uses feedback from users to improve its offerings. This approach fosters loyalty and builds a community of advocates. Focusing on

Partnerships with technology vendors and professional services firms, such as SAP and Workday, broaden its reach and integrate solutions. These partnerships are essential for capturing a wider

The company is transitioning from a seat-based to a value-based pricing model, designed to align its success with customer revenue and consumption. This new platform-based pricing model is expanding globally. This approach aims to better serve the

The company's customer acquisition and retention strategies are multi-faceted and focused on both attracting new clients and expanding relationships with existing ones. This involves a combination of marketing, product development, and strategic partnerships.

- 'Land and expand' model to grow the customer base and increase revenue.

- Content marketing to attract potential customers.

- Customer-centric product development to enhance loyalty.

- Strategic partnerships to extend market reach.

- Transition to a value-based pricing model.

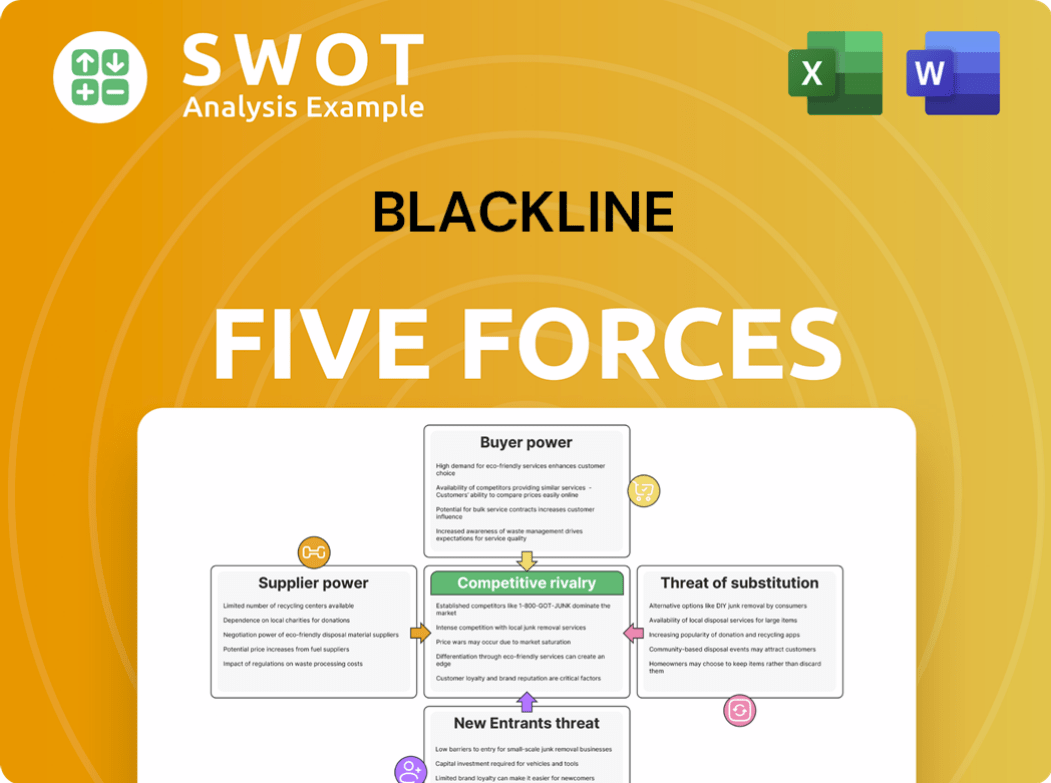

BlackLine Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BlackLine Company?

- What is Competitive Landscape of BlackLine Company?

- What is Growth Strategy and Future Prospects of BlackLine Company?

- How Does BlackLine Company Work?

- What is Sales and Marketing Strategy of BlackLine Company?

- What is Brief History of BlackLine Company?

- Who Owns BlackLine Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.