Bourbon Bundle

From Sugar to Seas: What's the Story Behind Bourbon Corporation?

Imagine a company's dramatic transformation, shifting from sweet beginnings to conquering the high seas. Bourbon Corporation's story is one of remarkable adaptation, starting in the sugar industry before charting a course toward the dynamic offshore energy sector. This evolution highlights the power of strategic foresight and the ability to thrive in changing global markets.

Initially rooted in Reunion Island's sugar industry as Sucreries de Bourbon in 1948, the company's journey offers a compelling narrative of strategic pivots. The Bourbon SWOT Analysis reveals how this evolution, from sugar cane and rum to offshore services, was driven by market dynamics and visionary leadership. Understanding this brief history is crucial for anyone interested in Bourbon companies and the broader trends shaping the maritime industry.

What is the Bourbon Founding Story?

The Bourbon Group's story began in 1948 on Reunion Island, a French overseas territory. The company was formed through the consolidation of several family-owned businesses. This strategic move was aimed at revitalizing the local sugar industry, which was a cornerstone of the island's economy.

From its inception, the group's focus was on the production and sale of sugar and rum, primarily targeting the French metropolitan market. Émile Hugot led the company during its formative years. The name 'Bourbon' itself is a nod to Reunion Island's historical name, reflecting its deep roots in the region's heritage.

The company's initial business model was rooted in agricultural production and processing, a significant departure from its later ventures in the maritime sector. The establishment of the Bourbon Group was heavily influenced by the cultural and economic landscape of Reunion Island, with a focus on a vital local industry. The company's early years set the stage for its future growth and diversification.

The Bourbon Group was established in 1948 on Reunion Island through the merger of family companies.

- The primary goal was to revive the local sugar industry.

- Initial products included sugar and rum, mainly for metropolitan France.

- Émile Hugot was a key figure in the early days.

- The name 'Bourbon' reflects Reunion Island's historical identity.

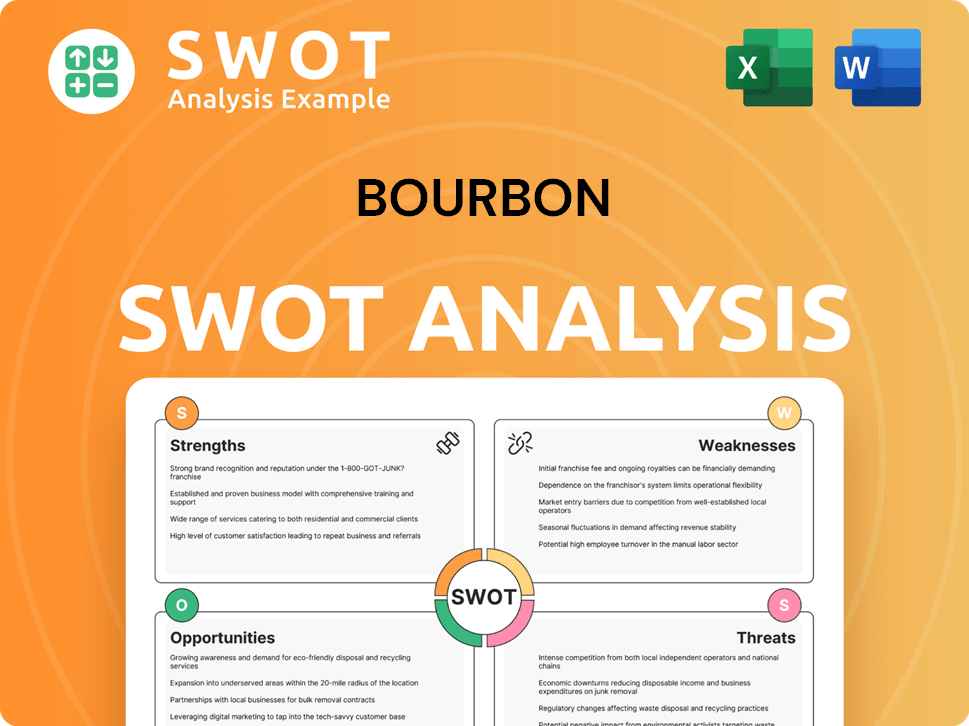

Bourbon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Bourbon?

The early growth and expansion of the [Company Name] marked a significant shift in its business strategy. This period, from 1989 to 1999, saw the company diversify beyond its initial focus on sugar and rum. These strategic moves set the stage for its future specialization in offshore energy services, transforming the company into a key player in the maritime industry.

The [Company Name] began its diversification journey in 1989, venturing into industrial fishing. This was followed by entries into mass distribution in 1991 and dairy products in 1992, all within Reunion Island. A pivotal move was the acquisition of a 50% stake in Compagnie Chambon in 1991, which brought Surf under its control, marking the company's initial foray into offshore oil and gas marine services. This early phase of expansion laid the groundwork for future strategic realignments.

In 1996, the company expanded its maritime portfolio by acquiring Les Abeilles (towing) and Setaf-Saget (dry bulk shipping). This strategic direction was further solidified as it sought to broaden its service offerings. The year 1998 was significant as the company listed on the Second Market of the Paris stock exchange, providing access to capital for further growth and expansion. These acquisitions and the public listing were crucial steps in establishing the company's presence in the marine services sector.

The early 2000s saw the company strategically refocus on maritime services, divesting its historical activities between 2001 and 2002. From 2003, the company accelerated its positioning in deep offshore maritime services, particularly in Brazil and West Africa. This strategic shift towards the offshore energy sector was a defining moment. The company's focus on offshore services helped it to become a leader in the industry.

In 2004, the company expanded into subsea operations by acquiring Gaia Enterprise, later renamed Bourbon Offshore Gaia. The company officially became BOURBON in 2005, relocating its head office to Paris. By 2006, it had emerged as a leading international player in marine services, listed on the SBF 120 of the Paris stock exchange. This period of strategic growth and specialization solidified its position in the offshore energy services market.

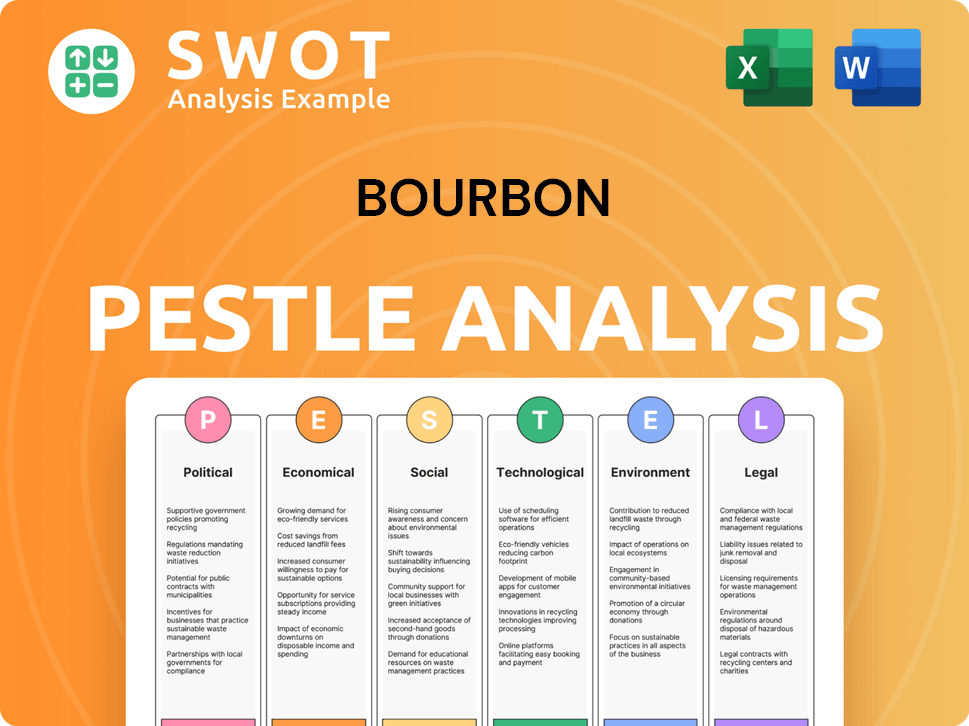

Bourbon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Bourbon history?

The brief history of Bourbon showcases a journey marked by strategic shifts, technological advancements, and responses to economic pressures. From focusing on offshore marine services to adapting to the energy transition, the company's evolution reflects the dynamic nature of the industry.

| Year | Milestone |

|---|---|

| 2007 | Sold port towage business, focusing on offshore oil and gas marine services. |

| 2008 | Acquired DNT Offshore, an Italian company specializing in underwater robot operations. |

| 2015 | Aimed to become a world leader with the 'BOURBON 2015 Leadership' strategic plan. |

| 2018 | Announced '#Bourboninmotion' plan, reorganizing activities into three subsidiaries and investing in digitalization. |

| 2019-2020 | Requested reorganization proceedings and underwent financial restructuring due to the oil market downturn and the COVID-19 crisis. |

| 2020 | Société Phocéenne de Participations (SPP) acquired 100% of Bourbon Corporation's assets, leading to a delisting. |

| 2020 | Emerged from receivership with a significant debt reduction of over €1.5 billion. |

| 2022 | Updated corporate vision and established Bourbon Wind, a division dedicated to offshore wind. |

Innovations at the company included the strategic plan '#Bourboninmotion' in 2018, which involved digitalizing its fleet to reduce costs and emissions. The company also invested €75 million over three years to modernize its fleet of supply vessels.

The digitalization of the fleet aimed to enhance operational efficiency and reduce environmental impact. This involved integrating advanced technologies into existing vessels.

The reorganization into three distinct subsidiaries was a key strategic move. This allowed for better focus and management of different operational areas.

The creation of Bourbon Wind marked a significant pivot towards renewable energy. This expansion aimed to capture opportunities in the growing offshore wind market.

Successfully reducing debt by over €1.5 billion was a crucial step in financial recovery. This strengthened the company's financial position.

Challenges included the severe oil market downturn starting in late 2014, which deeply affected the offshore market. Financial restructuring and the COVID-19 crisis in 2019-2020 further complicated the company's operations.

The fluctuations in oil prices significantly impacted the demand for offshore services. This led to reduced activity and financial strain.

The need for financial restructuring highlighted the severity of the economic challenges. This process involved significant debt reduction and changes in ownership.

The overall downturn in the offshore market severely affected the company's revenue streams. This required strategic adjustments to survive.

The COVID-19 pandemic further exacerbated the existing challenges. This led to operational disruptions and increased financial pressures.

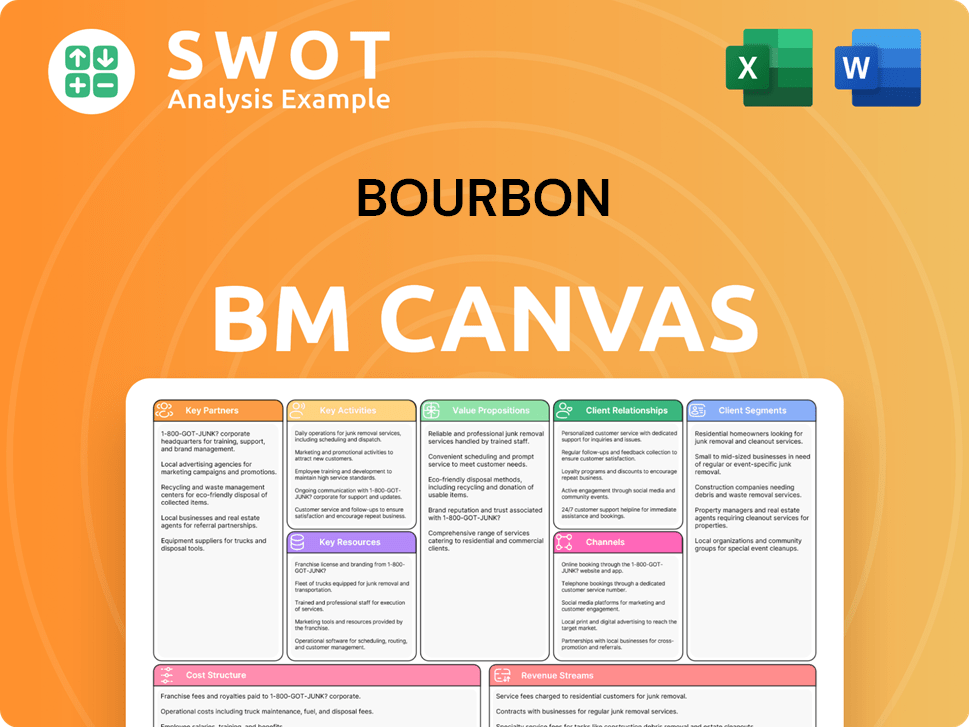

Bourbon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Bourbon?

The brief history of Bourbon is a story of transformation, beginning in 1948 as Sucreries de Bourbon, a sugar and rum producer. Over the years, the company diversified into various sectors before strategically refocusing on maritime services. This shift included acquisitions, such as Compagnie Chambon in 1991 and Gaia Enterprise in 2004, and culminated in the company becoming BOURBON in 2005. The company navigated challenges, including the 2014 oil crisis, and underwent significant restructuring, emerging from receivership in December 2020. This led to a new vision in 2022, emphasizing offshore energy development and expansion into the offshore wind sector.

| Year | Key Event |

|---|---|

| 1948 | Bourbon Group founded on Reunion Island as Sucreries de Bourbon, focused on sugar and rum. |

| 1991 | Acquisition of 50% of Compagnie Chambon, marking entry into offshore oil and gas marine services. |

| 1998 | Bourbon Group listed on the Second Market of the Paris stock exchange. |

| 2005 | Bourbon Group officially becomes BOURBON and moves its headquarters to Paris. |

| 2014 | Beginning of a deep crisis in the oil sector due to a sudden drop in oil prices. |

| 2020 | Bourbon exits receivership with significant debt reduction. |

| 2022 | New corporate vision adopted, focusing on offshore energy development and the creation of Bourbon Wind. |

| 2024 | Bourbon Mobility orders six new crewboats for delivery in 2025, aiming for a 20% reduction in fuel consumption. |

Bourbon is strategically positioned to capitalize on the growing offshore wind market. The company plans to install three wind turbines for the Eolmed project in 2025. Bourbon aims to support offshore wind projects ranging from 250 MW to 1 GW by 2030, demonstrating its commitment to sustainable energy solutions and the energy transition.

The offshore support vessel market is expected to reach USD 20.45 billion in 2025. The market is projected to grow to USD 29.97 billion by 2030. This represents a Compound Annual Growth Rate (CAGR) of 7.94%, indicating significant opportunities for Bourbon in the coming years.

Bourbon is actively working to reduce its environmental impact. The company is partnering with Opsealog to cut emissions from its OSV fleet. A pilot project has demonstrated savings of 45-50 tonnes of CO2 per vessel per month. This commitment to sustainability is central to Bourbon's future strategy.

Bourbon continues to secure new contracts and expand its services. In November 2024, Bourbon Logistics secured a new integrated logistics contract for an oil and gas exploration campaign off Namibia. The company's focus on local communities and skill development supports its growth.

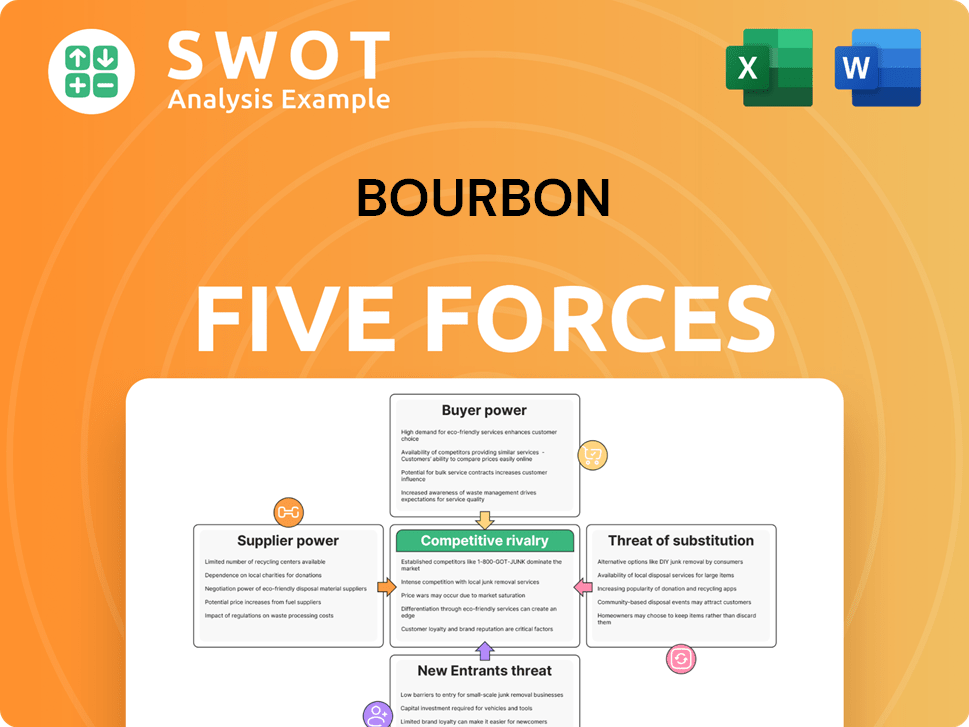

Bourbon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Bourbon Company?

- What is Growth Strategy and Future Prospects of Bourbon Company?

- How Does Bourbon Company Work?

- What is Sales and Marketing Strategy of Bourbon Company?

- What is Brief History of Bourbon Company?

- Who Owns Bourbon Company?

- What is Customer Demographics and Target Market of Bourbon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.