Bourbon Bundle

Can Bourbon Corporation S.A. Navigate the Shifting Sands of the Energy Market?

Bourbon Corporation S.A. has a rich history, evolving from a small French maritime service provider to a global player in the offshore energy sector. Founded in 1948, the company's journey reflects its ability to adapt and thrive in a constantly changing industry. But what does the future hold for this key player?

To understand the Bourbon SWOT Analysis, we must delve into the company's Bourbon growth strategy and assess its Bourbon company future. This analysis will explore the Bourbon industry prospects, considering factors like the American whiskey market and broader spirits industry trends. We will also examine how Bourbon adapts to market changes, considering Bourbon brands and potential Bourbon industry investment opportunities.

How Is Bourbon Expanding Its Reach?

The expansion initiatives of the company are primarily centered on adapting to the evolving offshore energy market. This involves a strategic shift towards renewable energy sources, particularly offshore wind, and continued support for the oil and gas sector. The company aims to diversify its revenue streams and leverage its existing expertise to capitalize on emerging opportunities.

A key aspect of this strategy is the expansion within the offshore wind market, which is projected to experience significant growth. The company is investing in specialized vessels and technologies to support the development and maintenance of offshore wind farms. Simultaneously, it continues to optimize its fleet for specialized oil and gas operations, focusing on high-value services.

The company is also exploring strategic partnerships to enhance its geographical reach and service offerings, especially in emerging offshore energy hubs. These initiatives are designed to access new customer segments, reduce reliance on a single energy source, and maintain a competitive edge in a rapidly changing industry. The company's focus on adaptability and diversification is crucial for long-term sustainability and growth.

The company is actively expanding its presence in the offshore wind market. This includes investments in crew transfer vessels (CTVs) and service operation vessels (SOVs). This strategic move is in response to the increasing global investment in renewable energy, with the offshore wind sector expected to grow substantially in the coming years.

The company continues to optimize its fleet for specialized oil and gas operations. This involves focusing on high-value subsea services and integrated logistical support. The company aims to maintain a strong presence in regions with ongoing exploration and production activities, adapting to the evolving demands of the oil and gas sector.

The company is exploring partnerships and collaborations to enhance its geographical reach and service offerings. This is particularly focused on emerging offshore energy hubs. These collaborations aim to access new customer segments and strengthen the company's position in a competitive market.

The company's expansion initiatives are driven by the need to diversify revenue streams. This reduces the risk associated with reliance on a single energy source. By diversifying its services and markets, the company aims to maintain a competitive edge in a rapidly transforming industry.

The company's growth strategy includes a strong focus on the offshore wind market and continued optimization of services for the oil and gas sector. These initiatives are supported by strategic partnerships and a drive to diversify revenue streams. The company is adapting to market changes to ensure long-term sustainability.

- Investment in specialized vessels for offshore wind.

- Focus on high-value subsea services in oil and gas.

- Exploration of partnerships for geographical expansion.

- Diversification to reduce reliance on a single energy source.

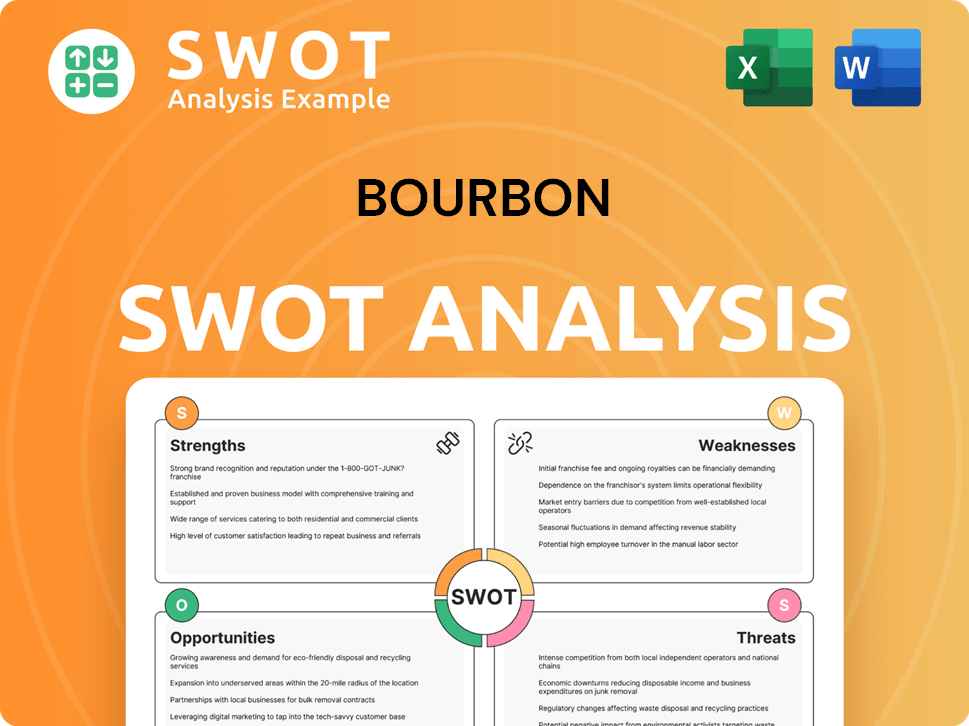

Bourbon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bourbon Invest in Innovation?

The innovation and technology strategy of the company is crucial for its continued expansion, focusing on enhancing operational efficiency, safety, and environmental performance across its operations. The company is making substantial investments in research and development to integrate advanced technologies into its marine services. This includes advancements in digitalization and automation, such as the implementation of remote-controlled operations and data analytics platforms to optimize vessel performance and predictive maintenance.

The company is also exploring the application of artificial intelligence (AI) and the Internet of Things (IoT) to improve decision-making, reduce fuel consumption, and enhance crew safety. A key aspect of their innovation drive is the development of more sustainable solutions, including exploring alternative fuels and hybrid propulsion systems to reduce their carbon footprint, aligning with global decarbonization efforts in the maritime industry. These technological advancements not only contribute to operational excellence but also enable the company to offer specialized, high-value services that differentiate it in a competitive market, thereby supporting its long-term growth objectives.

This focus on innovation is vital for navigating the evolving American whiskey market and the broader spirits industry. By embracing new technologies and sustainable practices, the company positions itself to meet future challenges and capitalize on emerging opportunities.

Implementing remote-controlled operations and data analytics platforms to optimize vessel performance and predictive maintenance. These technologies enhance operational efficiency and reduce downtime.

Exploring the use of artificial intelligence (AI) and the Internet of Things (IoT) to improve decision-making, reduce fuel consumption, and enhance crew safety. These technologies provide real-time insights and improve operational safety.

Developing more sustainable solutions, including exploring alternative fuels and hybrid propulsion systems to reduce their carbon footprint. This aligns with global decarbonization efforts and supports environmental stewardship.

Technological advancements contribute to operational excellence by improving efficiency, reducing costs, and enhancing safety. This leads to better service delivery and customer satisfaction.

Enabling the company to offer specialized, high-value services that differentiate it in a competitive market. This supports long-term growth objectives and increases market share.

Significant investment in research and development to integrate cutting-edge technologies into marine services. This commitment drives innovation and ensures the company remains at the forefront of technological advancements.

The company's technology strategy focuses on several key areas to enhance its operations and market position. These initiatives are designed to improve efficiency, sustainability, and service offerings.

- Digitalization: Implementing advanced data analytics and remote monitoring systems to optimize vessel performance and reduce operational costs.

- Automation: Utilizing automated systems to streamline processes, improve safety, and enhance the efficiency of marine operations.

- AI and IoT: Integrating AI and IoT technologies to improve decision-making, enhance crew safety, and optimize resource allocation.

- Sustainable Technologies: Investing in alternative fuels and hybrid propulsion systems to reduce the carbon footprint and align with environmental regulations.

- Predictive Maintenance: Employing predictive maintenance strategies to minimize downtime and ensure the reliability of marine assets.

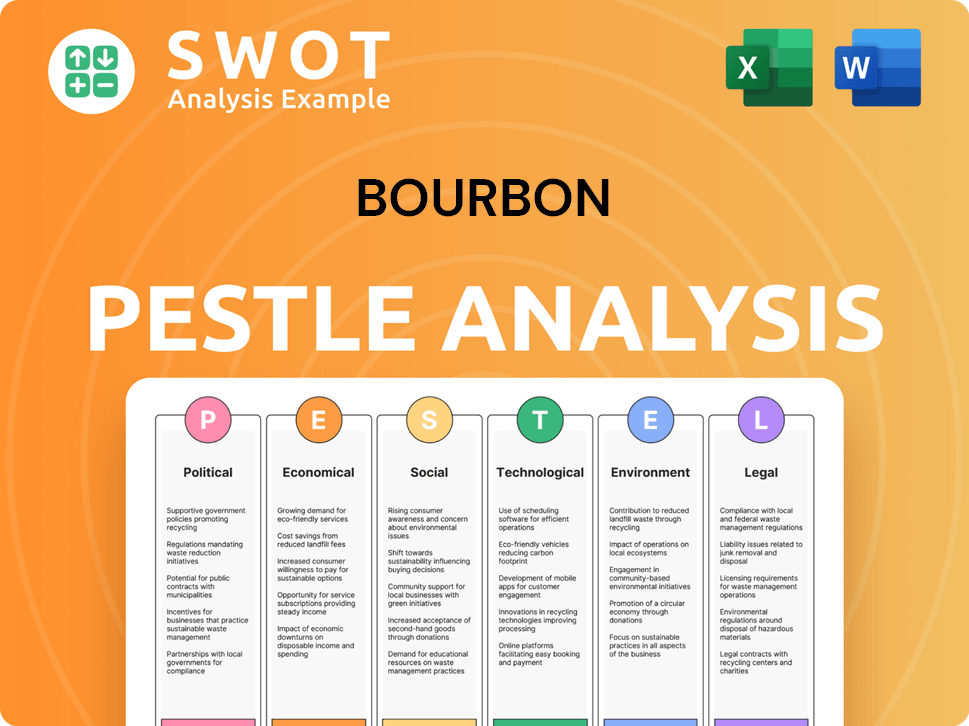

Bourbon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Bourbon’s Growth Forecast?

The financial outlook for the company is closely tied to the global energy transition and its strategic shift within the offshore marine services sector. While precise financial projections for 2024-2025 are subject to market dynamics and company-specific information, the financial strategy appears focused on optimizing existing assets and investing in growth areas, particularly offshore wind. Recent financial reports and industry analyses suggest a cautious but optimistic outlook, driven by the recovery in oil and gas activity and the rapid expansion of the offshore wind market.

The company's financial health will be influenced by its ability to secure long-term contracts in the growing offshore wind sector, which offers more stable revenue streams compared to the more volatile oil and gas market. Overall, the financial narrative supports a strategic shift towards a more diversified and sustainable business model, aiming for improved profitability and long-term resilience. The company is likely to prioritize maintaining strong liquidity and managing debt to support investments in new technologies and fleet modernization.

Analyst forecasts for the broader offshore support vessel (OSV) market indicate a gradual improvement in day rates and utilization, which would positively impact revenue generation. The company's financial performance will also be influenced by its ability to secure long-term contracts in the growing offshore wind sector, which offers more stable revenue streams compared to the more cyclical oil and gas market. For more insights into the company's structure, consider reading about Owners & Shareholders of Bourbon.

The company's revenue growth is expected to be driven by the expansion of the offshore wind market and the recovery in oil and gas activities. Securing long-term contracts in the offshore wind sector will provide more stable revenue streams. The company is also focusing on fleet modernization and investing in new technologies to enhance its service offerings.

The company aims to improve profitability through a diversified and sustainable business model. The shift towards the offshore wind sector, with its more stable revenue streams, is expected to improve profit margins. Effective cost management and operational efficiency will also be crucial for enhancing profitability.

The company's capital allocation strategy focuses on maintaining healthy liquidity and managing debt effectively. Investments in new technologies and fleet modernization are key priorities. Strategic investments in the offshore wind sector are also expected to drive future growth and financial performance.

The company faces risks related to market volatility, particularly in the oil and gas sector. Diversifying into the offshore wind market helps mitigate these risks. Effective risk management includes securing long-term contracts and managing debt to ensure financial stability.

The offshore support vessel (OSV) market is expected to see gradual improvements in day rates and utilization. The offshore wind market is experiencing rapid expansion, creating new opportunities. These trends are crucial for the company's financial performance and future growth.

The company aims to improve profitability and achieve long-term resilience through a diversified business model. Maintaining strong liquidity and managing debt are key financial goals. Securing long-term contracts in the offshore wind sector is also a priority.

The company's investment strategy focuses on fleet modernization and investments in new technologies. Strategic investments in the offshore wind sector are also essential. These investments are aimed at enhancing service offerings and driving future growth.

Key performance indicators (KPIs) include revenue growth, profit margins, and utilization rates. The ability to secure long-term contracts in the offshore wind sector is also a critical KPI. These metrics will be closely monitored to assess financial performance.

Challenges include market volatility and cyclical trends in the oil and gas sector. Opportunities lie in the rapid expansion of the offshore wind market. The company's strategic shift aims to capitalize on these opportunities.

The long-term outlook is cautiously optimistic, driven by the energy transition and the growth of the offshore wind market. The company's diversified business model is expected to provide improved profitability and resilience. Strategic investments will support sustainable growth.

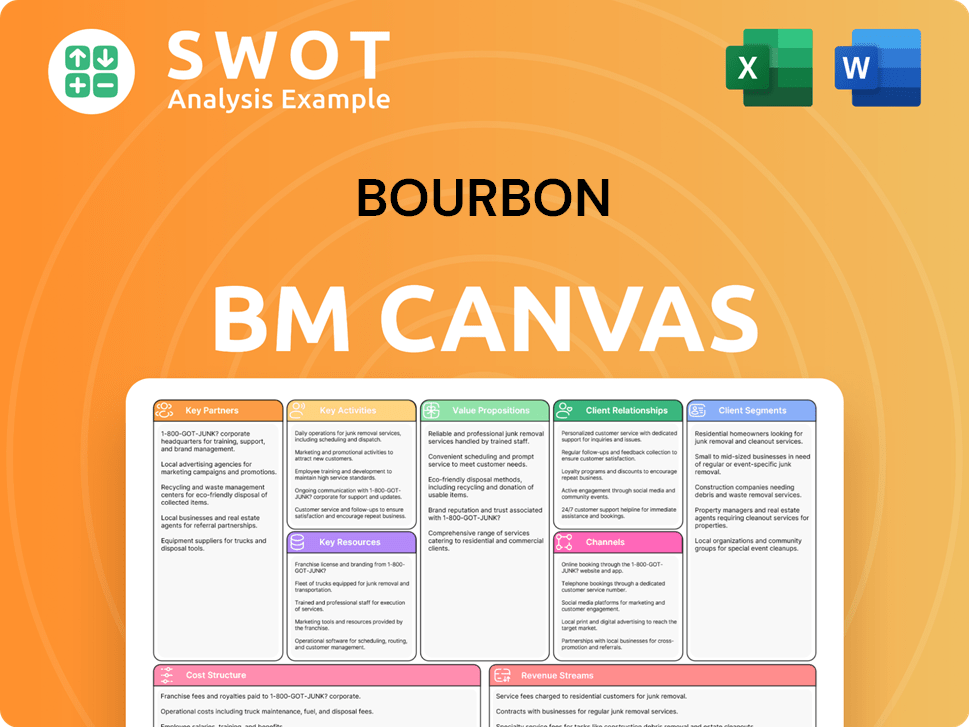

Bourbon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Bourbon’s Growth?

The path forward for the Bourbon Company is not without its hurdles. Several risks and obstacles could impact its growth and overall success. Understanding these challenges is crucial for investors, strategists, and anyone assessing the future of the company.

One significant risk is the cyclical nature of the offshore energy market, which is heavily influenced by oil and gas prices. Demand for the company's services can fluctuate dramatically with price changes. Moreover, the transition into the offshore wind sector, while promising, introduces new risks related to market maturity, regulatory changes, and competition.

Supply chain issues, amplified by global events, could cause delays in vessel maintenance and new construction, impacting operational efficiency. Technological advancements, such as automation and sustainable propulsion systems, also pose a risk if the company fails to adapt. Furthermore, environmental regulations and emissions standards may require substantial capital investments for fleet upgrades.

Fluctuations in oil and gas prices directly affect the demand for the company's services, creating uncertainty. This volatility can lead to unpredictable revenue streams and financial planning challenges. The offshore energy market's inherent cyclicality demands robust risk management strategies.

Entering the offshore wind market introduces new challenges. These include the market's early stage, evolving regulatory frameworks, and competition from established players. Successfully navigating this sector requires strategic adaptation and investment.

Global events can disrupt supply chains, leading to delays in vessel maintenance and new construction. Such delays can negatively affect operational efficiency and increase costs. Effective supply chain management is critical for minimizing these risks.

Rapid technological advancements, such as automation and sustainable propulsion, present both opportunities and risks. The company must keep pace with these innovations to remain competitive. Failure to adapt can lead to obsolescence and market share loss.

Changes in environmental standards and emissions regulations may require significant capital expenditure. Compliance with new regulations can strain financial resources. Proactive planning and investment are essential to meet these requirements.

Managing a large and diverse fleet across various geographical regions presents operational complexities. Resource constraints and logistical challenges can impact efficiency. Effective fleet management and resource allocation are crucial for success.

The Bourbon Company employs a diversified approach, spreading investments across different energy sectors and geographical areas. This helps mitigate the impact of market fluctuations. Robust risk management frameworks, including scenario planning, are also utilized to prepare for potential challenges. For example, the company has previously adapted to low oil prices by optimizing its fleet and reducing costs.

The American whiskey market is experiencing growth, with the bourbon brands segment being a key driver. However, the spirits industry trends are constantly evolving. The company must continuously monitor market dynamics and adapt its strategies to remain competitive. Understanding the bourbon market share analysis is crucial.

Investors should consider the bourbon industry investment opportunities, but also be aware of the challenges facing bourbon companies today. Analyzing the bourbon company financial performance is essential. Strategic decisions about bourbon export market analysis and bourbon consumer behavior trends are vital for sustained growth.

The future of bourbon production and demand depends on innovation. The best bourbon growth strategies for small distilleries and large companies alike include new product development. Exploring the future of bourbon aging and innovation is important, as is understanding the impact of bourbon tourism and its impact on growth. For more insights, see Revenue Streams & Business Model of Bourbon.

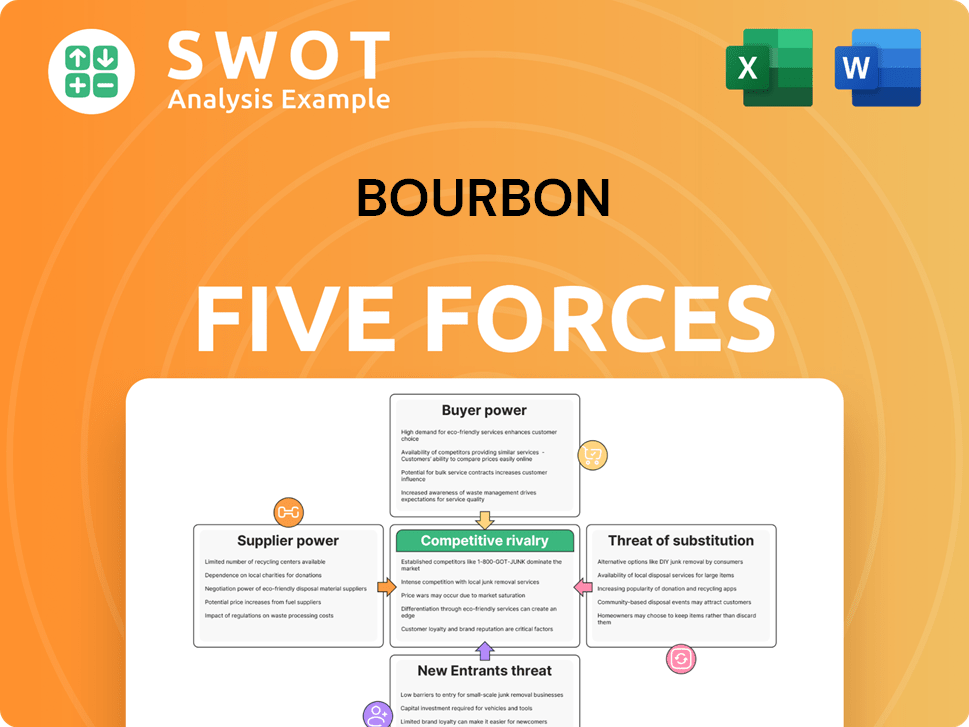

Bourbon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bourbon Company?

- What is Competitive Landscape of Bourbon Company?

- How Does Bourbon Company Work?

- What is Sales and Marketing Strategy of Bourbon Company?

- What is Brief History of Bourbon Company?

- Who Owns Bourbon Company?

- What is Customer Demographics and Target Market of Bourbon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.