Cazoo Bundle

What's the Story Behind Cazoo's Rise and Fall?

Launched in 2018, Cazoo, a British online car retailer, set out to disrupt the used car market. The company promised a seamless online buying experience, aiming to simplify the often-tedious process of purchasing a vehicle. This innovative approach quickly attracted significant investment, positioning Cazoo as a major player in the automotive industry.

The Cazoo SWOT Analysis reveals the company's journey, from its ambitious beginnings to its strategic pivot in 2024. This brief history of Cazoo explores its business model, early days, and the challenges it faced. Learn about Cazoo's acquisitions and its current status as it navigates the competitive landscape of the used car market.

What is the Cazoo Founding Story?

The story of Cazoo, a company aiming to revolutionize the used car market, began in 2018. Founded by Alex Chesterman, a serial entrepreneur, Cazoo emerged from Chesterman's personal frustrations with the traditional car-buying process. His vision was to create a seamless online experience, simplifying the purchase of used cars.

Chesterman's previous successes, including co-founding LoveFilm and Zoopla, provided a strong foundation for Cazoo. He identified a significant opportunity to digitally transform a market he perceived as inefficient. The goal was to make buying a car as easy as ordering any other product online, focusing on convenience and customer satisfaction.

Cazoo officially launched its online marketplace on December 2, 2019, marking a significant milestone in its history. The company's initial business model centered around purchasing, reconditioning, and selling used cars through its website. Key features included detailed descriptions, high-quality images, a 7-day money-back guarantee, and free home delivery within 72 hours, setting it apart from traditional dealerships.

Cazoo's early success was fueled by substantial financial backing, enabling rapid expansion and market penetration. The company's ability to secure significant funding before and after its launch underscores the confidence investors had in its business model and growth potential.

- Alex Chesterman, the founder, raised over £30 million in pre-seed funding in December 2018.

- By December 2019, before its official launch, Cazoo had raised over £80 million, a record for pre-launch funding.

- Early investors included Daily Mail and General Trust (DMGT), Stride Capital, Octopus Ventures, and Entree Capital.

The initial capital was crucial for building the team, developing the online platform, and investing in marketing and operational infrastructure. This early investment allowed Cazoo to establish a strong presence in the market quickly. The company also offered various financing options, extended warranties, and a car subscription service, which was introduced in 2020, further expanding its offerings. For more detailed information, you can also review Owners & Shareholders of Cazoo.

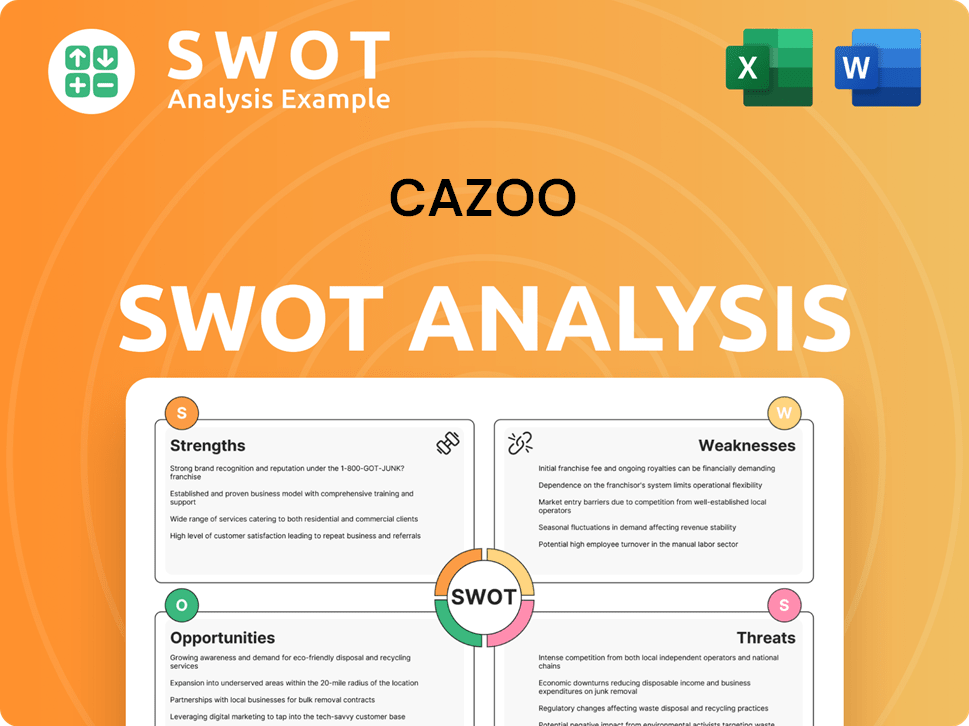

Cazoo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Cazoo?

The [Company Name] experienced rapid expansion soon after its December 2019 launch. This growth was fueled by significant investments and an aggressive marketing approach. The company quickly made its mark through sponsorships and strategic acquisitions. The Cazoo history is marked by quick growth and ambitious expansion plans.

In October 2020, [Company Name] secured £240 million in a Series C funding round. This funding round valued the company at over £2 billion, demonstrating strong investor confidence in its business model. The company's financial performance showed revenue of £1.2 billion in 2022.

A key milestone in the [Company Name] timeline was its public listing on the New York Stock Exchange (NYSE) in August 2021. This was achieved through a merger with a Special Purpose Acquisition Company (SPAC) called Ajax I. This merger provided [Company Name] with $1.6 billion in gross proceeds. The company was valued at an impressive $7 billion, or approximately £5 billion.

The company pursued an ambitious expansion strategy into mainland Europe. This aimed to replicate its success in the UK market. [Company Name] acquisitions included Drover for its car subscription service in December 2020 for £65 million and Cluno in February 2021 for €80 million to enter the German market.

SMH Fleet Solutions was acquired in April 2021 for £70 million, enhancing vehicle reconditioning and logistics. By early 2022, [Company Name] had launched used car marketplaces in Germany, France, Italy, and Spain. The company's focus was on convenience and transparency, offering thoroughly inspected and reconditioned cars.

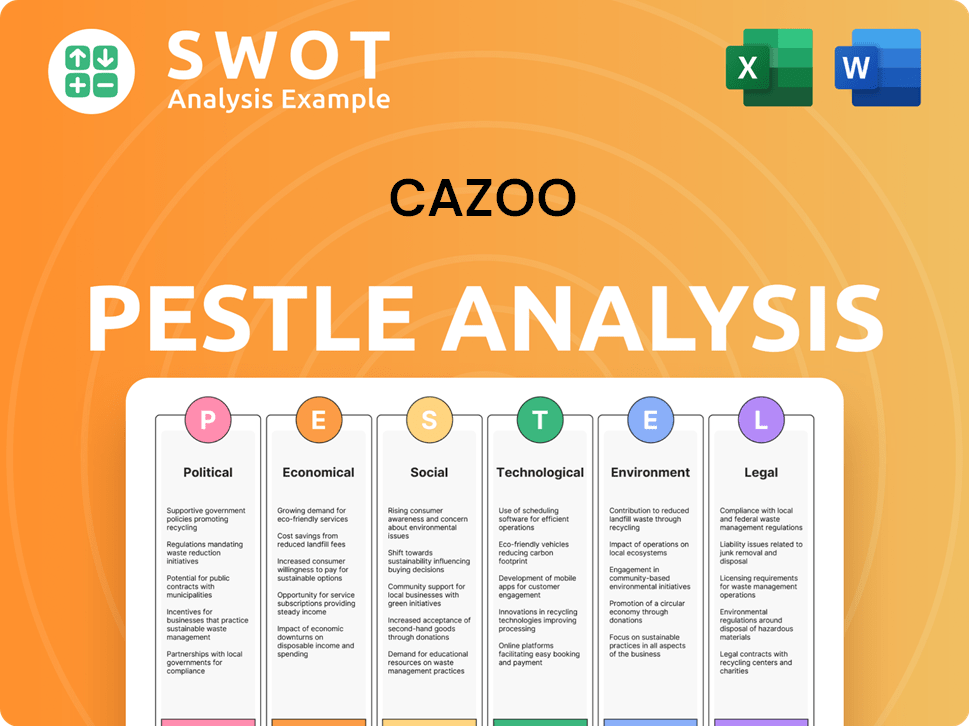

Cazoo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Cazoo history?

The Cazoo company's journey, from its inception to its strategic shifts, showcases a dynamic evolution in the automotive retail sector. The Cazoo history is filled with rapid growth, substantial investment, and significant strategic pivots in response to market challenges.

| Year | Milestone |

|---|---|

| 2018 | Founded by Alex Chesterman, Cazoo was established with the aim of revolutionizing the used car market. |

| 2020 | Cazoo achieved unicorn status, reaching a valuation of over $1 billion just 18 months after its founding. |

| 2022 | The company announced its withdrawal from mainland European operations to focus on the UK market. |

| 2023 | Paul Whitehead succeeded Alex Chesterman as CEO in January. |

| 2023 | Cazoo completed a debt restructuring, reducing its debt from $630 million to $200 million by December. |

| 2024 | Cazoo announced a shift to a pure-play automotive marketplace model in March, marking a significant strategic change. |

Cazoo pioneered a digital-first approach to used car sales, offering an entirely online purchase experience. This included home delivery, which was a groundbreaking concept in the UK market. Its business model was designed to capitalize on the growing trend of online shopping, providing convenience and a streamlined process for consumers.

Cazoo offered an entirely online purchase experience, including finance and subscription options.

Cazoo provided home delivery, a key differentiator in the used car market.

Cazoo offered a subscription model, providing flexibility for customers.

Cazoo faced substantial challenges, including high operational costs and fluctuating market conditions. Aggressive marketing strategies, while building brand recognition, also contributed to high expenses. The company's financial performance was impacted by the changing dynamics of the automotive industry.

High operational costs, including purchasing and reconditioning cars, logistics, and customer centers, led to a high cash burn rate.

Fluctuations in car prices, supply chain issues, and changing consumer demand impacted profitability.

Cazoo faced intense competition from traditional dealerships and other online retailers.

A global automotive chip shortage reduced new car production, impacting used car stocks and acquisition costs.

The company underwent debt restructuring, reducing its debt significantly.

Cazoo shifted its focus to the UK market and transitioned to a pure-play automotive marketplace.

For more insights into the target market of Cazoo, you can explore the Target Market of Cazoo.

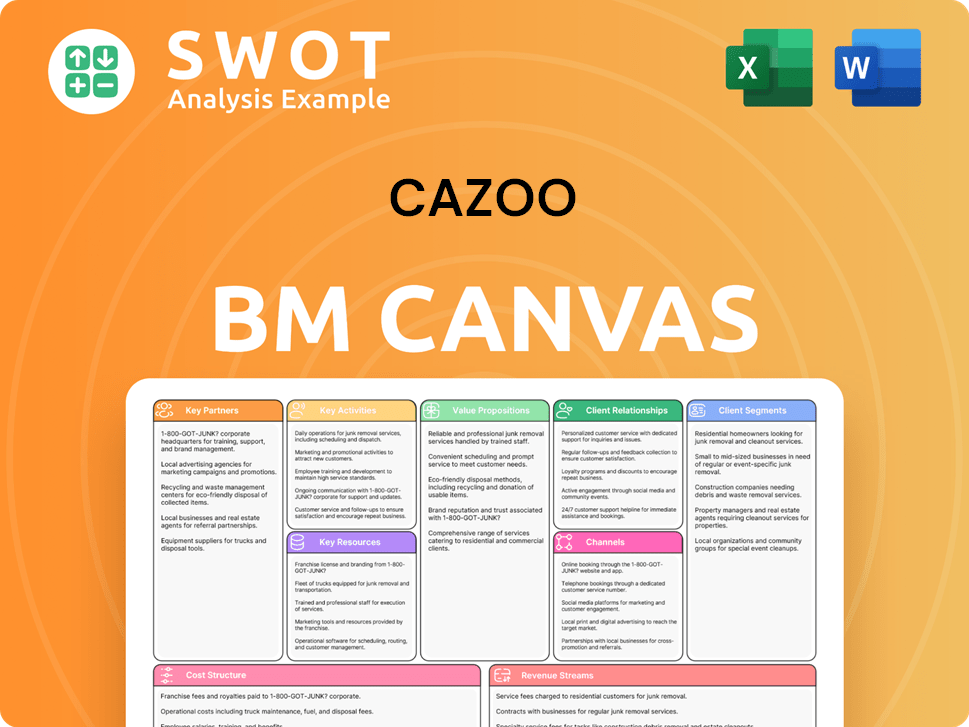

Cazoo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Cazoo?

The Cazoo history is marked by rapid growth and significant strategic shifts. Founded in 2018 by Alex Chesterman, the company quickly gained traction, securing substantial funding and expanding rapidly through acquisitions. Initially focused on an online car retail model, Cazoo experienced a meteoric rise, culminating in a high-profile listing on the New York Stock Exchange. However, challenges emerged, leading to a restructuring and a pivot towards a marketplace model under new ownership.

| Year | Key Event |

|---|---|

| 2018 | Cazoo was founded by Alex Chesterman. |

| December 2018 | Cazoo raised over £30 million in pre-seed funding. |

| December 2, 2019 | Cazoo officially launched its online marketplace. |

| October 2020 | Cazoo raised £240 million in Series C funding, valuing the company at over £2 billion. |

| December 2020 | Cazoo acquired Drover for £65 million to accelerate its car subscription service. |

| February 2021 | Cazoo acquired Cluno for €80 million, expanding into the European market. |

| August 2021 | Cazoo listed on the New York Stock Exchange via a SPAC merger, valuing the company at $7 billion. |

| September 2021 | Cazoo acquired Cazana for £25 million to enhance data analytics capabilities. |

| January 2022 | Cazoo acquired Brumbrum, an Italian car retailer and subscription platform. |

| September 2022 | Cazoo announced its withdrawal from European Union operations, focusing solely on the UK. |

| January 2023 | Founder Alex Chesterman stepped down as CEO, becoming executive chairman; Paul Whitehead took over as CEO. |

| December 2023 | Cazoo completed debt restructuring, reducing debt from $630 million to $200 million. Alex Chesterman stepped down from the company. |

| March 6, 2024 | Cazoo announced a transition to a pure-play automotive marketplace business model; Paul Whitehead stepped down as CEO. |

| May 2024 | Cazoo Holdings Limited and Cazoo Ltd. filed for administration in the UK. |

| June 2024 | MOTORS acquired the Cazoo brand. |

| April 2, 2025 | Cazoo website relaunched as a dedicated used car search platform under MOTORS ownership, featuring over 200,000 listings from more than 5,000 UK dealers. |

As of April 2025, Cazoo operates as a pure-play automotive marketplace. This shift allows the company to connect buyers and sellers directly, focusing on platform services rather than inventory ownership. This strategic move aims to reduce operational complexities and capital requirements.

Cazoo benefits from strong brand recognition in the UK, with six in ten consumers familiar with the name. The company is leveraging this brand awareness to attract both car buyers and dealerships to its platform. This is a key asset as it re-enters the market.

The relaunched Cazoo website and mobile app, as of April 2025, offer a user-friendly experience designed to facilitate car searches and transactions. Continuous improvements to the platform are planned to enhance user engagement and drive conversions. The focus is on making the platform intuitive.

Sustained marketing efforts are crucial for re-establishing Cazoo as a top choice for car buyers and a valuable partner for dealerships. This investment will support brand visibility and drive traffic to the platform. The goal is to regain market share.

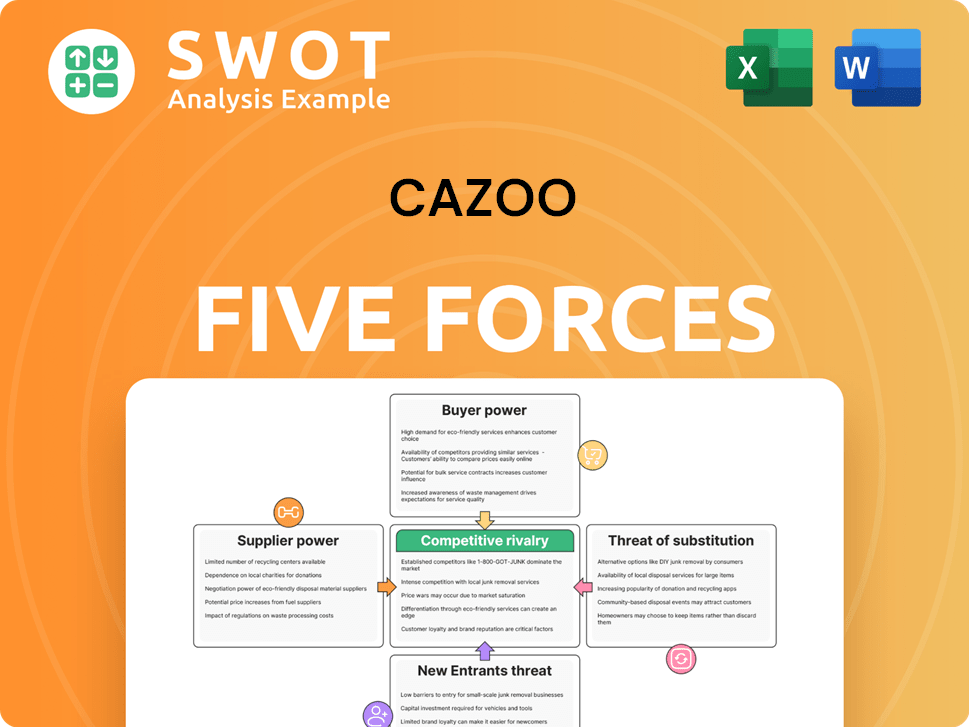

Cazoo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Cazoo Company?

- What is Growth Strategy and Future Prospects of Cazoo Company?

- How Does Cazoo Company Work?

- What is Sales and Marketing Strategy of Cazoo Company?

- What is Brief History of Cazoo Company?

- Who Owns Cazoo Company?

- What is Customer Demographics and Target Market of Cazoo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.