Cazoo Bundle

Can Cazoo Rebound in the Used Car Market?

Once valued at billions, Cazoo, the online car retailer, has undergone a dramatic transformation. From its ambitious beginnings as a direct-to-consumer used car sales platform, Cazoo has pivoted significantly. Now relaunched, the company operates as a marketplace, connecting buyers with dealers.

This shift in strategy prompts critical questions about Cazoo SWOT Analysis and its future in the competitive online car buying landscape. Understanding how Cazoo works now, as a car marketplace, is key for anyone interested in the used car sales industry. This analysis will explore the current business model, revenue streams, and the overall Cazoo car buying experience.

What Are the Key Operations Driving Cazoo’s Success?

Following its acquisition by Motors.co.uk, the Cazoo company now operates as a pure-play online automotive marketplace. This shift focuses on connecting car buyers with a network of over 5,000 trusted dealers across the UK. The core of its operations centers on providing a platform for used car sales, facilitating online transactions, and offering data-driven insights.

The platform provides detailed vehicle information, including specifications, photos, and service history. It supports interactions between consumers and car dealers using its e-commerce technology and data analytics. This includes providing car dealers with customer and market insights, derived from data like the 185,000 valuations it provides monthly.

Cazoo aims to simplify the car-buying journey through search filters, an easy-to-use interface, and a user-friendly app, which had over 400,000 downloads by July 2024. Dealers with multisite advertising packages can list their vehicles on the new Cazoo marketplace at no additional cost during the launch phase, ensuring a wide selection of over 200,000 cars for buyers.

Cazoo functions as an online car marketplace, connecting buyers with dealers. This model offers a wide selection of vehicles and simplifies the car-buying process. The platform leverages an established e-commerce technology platform to support transactions.

Cazoo utilizes data to provide valuable insights to both consumers and dealers. It offers tools like car valuation and market analysis. This data-driven approach enhances the user experience and supports informed decision-making.

The new Cazoo model focuses on empowering car dealers. It provides them with a platform to showcase their inventory and connect with potential buyers. This approach ensures a wide selection of vehicles and supports the dealers' sales efforts.

Cazoo benefits from its nationally recognized brand, which builds trust with consumers. This brand recognition is a key asset in the competitive online car market. The brand's reputation supports customer acquisition and retention.

Cazoo's operational model revolves around its online platform, connecting used car buyers with a network of dealers. The platform simplifies the car-buying process through search filters and detailed vehicle information.

- Offers a vast selection of used cars from trusted dealers.

- Provides detailed vehicle information and facilitates online transactions.

- Leverages data analytics to offer insights to both buyers and sellers.

- Focuses on a dealer-centric marketplace model.

Cazoo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Cazoo Make Money?

The current revenue streams for the Cazoo company are primarily derived from its transition into an automotive marketplace. This shift means the company now acts as a platform where car dealers can list their inventory, connecting them with potential buyers. The specifics of recent revenue figures for this new marketplace model are still emerging.

Previously, under its direct-to-consumer model, the company's annual revenue reached £622 million as of December 31, 2021. However, the reported earnings for 2022 were -$0.64 billion USD. As of June 2025, Cazoo's TTM (Trailing Twelve Months) revenue is reported as ₹129.39 billion.

The monetization strategies for the new marketplace model involve charging dealers for advertising and potentially transaction fees for sales completed through the platform. During the launch phase, dealers with multisite advertising packages on the Motors network can list their vehicles on Cazoo for free. This approach aims to build up inventory and attract both dealers and buyers.

Cazoo plans to offer dealers customer and market insights, which could become a future revenue stream through data analytics services. The focus on driving consumer leads directly to automotive retailers and continuous investment in marketing indicates a strategy to grow its user base. This, in turn, is intended to increase the value proposition for dealers, leading to higher advertising and transaction-based revenues. The shift to a marketplace model reflects a strategic pivot, as discussed in detail in the Growth Strategy of Cazoo.

- Charging dealers for advertising on the platform.

- Potentially implementing transaction fees for sales completed through the platform.

- Offering customer and market insights to dealers via data analytics services.

- Focusing on increasing the user base to enhance the value proposition for dealers.

Cazoo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Cazoo’s Business Model?

The evolution of the Cazoo company has been marked by significant shifts and strategic maneuvers. Founded in 2018, it quickly gained traction in the used car sales market. Initially, the company aimed to revolutionize online car buying, offering a fully digital experience.

Cazoo's journey included an aggressive expansion into mainland Europe, but this strategy proved unsustainable. The company faced operational and market challenges that led to restructuring and a change in direction. The company's initial model, which included financing and delivery, was later abandoned.

The company's trajectory took a dramatic turn in May 2024 when it entered administration, burdened by over £260 million in debt. However, the brand was acquired in June 2024 by Motors.co.uk, setting the stage for a relaunch in March-April 2025 as a pure-play online automotive marketplace.

Cazoo launched its online marketplace in December 2019. It achieved an $8 billion valuation upon listing on the New York Stock Exchange in August 2021. The company expanded into several European markets before exiting them in September 2022.

Exiting European markets was a key strategic shift, along with closing showrooms and ceasing direct car sales. The acquisition by Motors.co.uk and the subsequent relaunch as a marketplace represent a significant pivot. This move leveraged Cazoo's brand recognition.

Cazoo's competitive advantage now lies in its established brand equity, supported by extensive advertising and sports sponsorships. The new marketplace model aims to provide a strong alternative to Auto Trader. The platform provides a platform for over 5,000 dealers.

Cazoo is now operating as an online car marketplace, focusing on connecting dealers with consumers. The company is leveraging its brand recognition to attract both dealers and buyers. The new model is designed to facilitate Owners & Shareholders of Cazoo.

Cazoo's debt at the time of administration exceeded £260 million. The brand was acquired for £5 million by Motors.co.uk. The relaunch in March-April 2025 signifies a new chapter for the company. The new Cazoo marketplace aims to challenge the market leader, Auto Trader.

- The company stopped buying and selling cars directly in March 2024.

- Motors.co.uk has 17 years of experience in the marketplace sector.

- The new platform focuses on providing a platform for over 5,000 dealers.

- The company's brand recognition remains strong due to past marketing efforts.

Cazoo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Cazoo Positioning Itself for Continued Success?

Cazoo, now operating as a pure-play automotive marketplace under Motors.co.uk, is strategically positioned within the UK's online used car market. This shift aims to challenge Auto Trader's dominance, leveraging its brand recognition and a network of over 5,000 dealers. As of March 2025, Cazoo lists an average of over 230,000 cars monthly, attracting 7.5 million website views.

The company's relaunch of its mobile app in July 2024, which has surpassed 400,000 downloads, demonstrates strong consumer engagement. However, Cazoo faces significant challenges, including intense competition and the need to rebuild dealer trust. The future depends on scaling the marketplace model and enhancing its platform.

Cazoo's current position is as a challenger in the UK's used car market. They are aiming to be the second-largest player, competing with Auto Trader. The company is focusing on leveraging its brand recognition and dealer network to gain market share. Cazoo's approach involves a marketplace model, connecting buyers and sellers.

Key risks for Cazoo include intense competition from established players like Auto Trader. Rebuilding trust with car dealers after previous financial struggles is crucial. Consumer preferences are evolving, with some still preferring human interaction in the online car buying process. The company must also effectively scale its new marketplace model.

The future outlook for Cazoo hinges on effectively scaling its marketplace model and enhancing its technology platform. Continuous improvements to its website and app are planned. Sustained investment in marketing is essential to drive audience reach and dealer leads. Motors' CEO, Barry Judge, aims for Cazoo to double in size and become the 'undisputed number two' in the market.

Cazoo operates as an online car marketplace, connecting buyers and sellers of used cars. This platform allows users to browse a wide selection of vehicles, view detailed information, and potentially arrange financing. The company focuses on providing a user-friendly experience, aiming to streamline the car buying process. For more details, check out the Marketing Strategy of Cazoo.

Cazoo is focusing on enhancing its platform and expanding its reach to drive growth. The company is investing in technology to improve the user experience and attract more dealers. They are aiming to capture a significant share of the online car buying market. As of March 2025, Cazoo's monthly listings average over 230,000 cars, and they receive 7.5 million monthly website views.

- Continuous website and app enhancements are planned.

- Sustained investment in marketing to increase audience reach.

- Focus on delivering value to both dealers and car buyers.

- Aiming to become the second-largest player in the used car market.

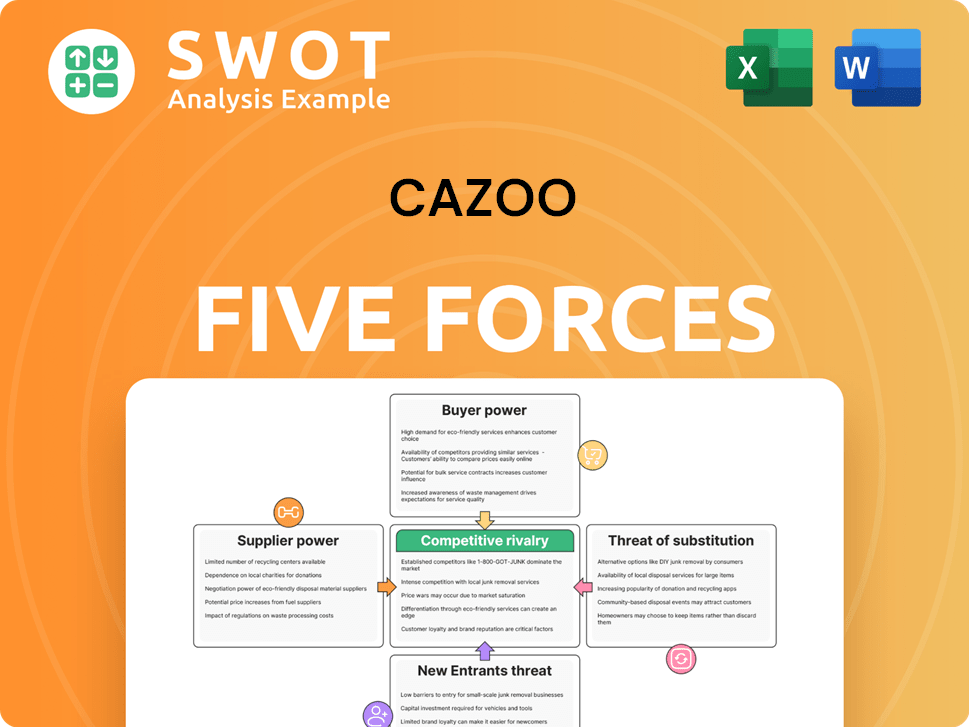

Cazoo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cazoo Company?

- What is Competitive Landscape of Cazoo Company?

- What is Growth Strategy and Future Prospects of Cazoo Company?

- What is Sales and Marketing Strategy of Cazoo Company?

- What is Brief History of Cazoo Company?

- Who Owns Cazoo Company?

- What is Customer Demographics and Target Market of Cazoo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.