Cazoo Bundle

Can Cazoo Revive Its Automotive Ambitions?

Cazoo, the once high-flying online car retailer, has dramatically shifted gears. After a turbulent journey, the company, now under new ownership, is being reborn as a used car marketplace. This strategic pivot marks a critical turning point for Cazoo, promising a fresh approach to navigating the competitive automotive industry.

This Cazoo SWOT Analysis provides a deep dive into Cazoo's revamped business model, analyzing its potential within the used car market. Understanding the Cazoo growth strategy is crucial, especially considering its past financial performance and the challenges it faced. We'll explore Cazoo's future prospects, examining its expansion plans, and evaluating its impact on the automotive industry, offering a comprehensive Cazoo company analysis.

How Is Cazoo Expanding Its Reach?

Following its relaunch by Motors in April 2025, Cazoo's expansion initiatives are now focused on solidifying its position as a leading online used car marketplace within the UK. This strategic shift involves transitioning from its previous direct-retail model to a dealer-centric platform. The primary goal is to broaden its network of listed vehicles and dealers, offering UK car buyers immediate access to a vast selection of vehicles.

The core strategy revolves around providing UK car buyers with access to a wide range of vehicles. This approach aims to challenge the dominance of existing market leaders by offering dealers a credible and competitive alternative for their vehicle advertising. Cazoo's renewed focus is on enhancing its marketplace model, supported by strategic partnerships and technological advancements, which is crucial for its future growth and market penetration.

The company is aiming to provide over 200,000 car listings from more than 5,000 dealers, challenging the existing market leaders. This strategy underscores the importance of a robust dealer network and a wide selection of vehicles to attract and retain customers in the competitive used car market. The ability to offer a diverse inventory is a key factor in driving sales and increasing market share.

Motors is integrating Cazoo into its existing multisite advertising packages. This allows over 5,000 dealers to list vehicles on Cazoo at no extra charge during the initial launch phase. This integration is designed to rapidly increase stock visibility and offer buyers a diverse range of used vehicles from the outset. This strategy is designed to increase stock visibility and offer buyers a diverse range of used vehicles.

Cazoo is committed to continuous development, with plans for new features and tools to be added to the website and app in the coming months. These enhancements aim to improve lead generation for dealers and provide a better user experience for customers. This commitment to innovation is crucial for staying competitive in the rapidly evolving online car market.

Cazoo is leveraging its brand recognition through strategic marketing and partnerships. One key example is its expanded multi-year content partnership with Brentford FC, which will include matchday activations and social media campaigns for the 2025/26 Premier League season. Such partnerships help to maintain brand visibility and reach a wider audience.

The re-emphasis on a marketplace model, supported by strategic partnerships and technological enhancements, is crucial for Cazoo's future growth and market penetration. This shift allows Cazoo to leverage a wider network of dealers and vehicles, enhancing its appeal to both buyers and sellers. This is a strategic move to capture a larger share of the used car market.

Cazoo's expansion strategy focuses on building a robust marketplace. This involves integrating dealers, enhancing the platform with new features, and leveraging strategic partnerships to increase brand visibility and market share. The company aims to create a comprehensive platform for buying and selling used cars.

- Dealer Network Expansion: Increasing the number of dealers listed on the platform to offer a wider selection of vehicles.

- Technological Enhancements: Continuously improving the website and app with new features to enhance the user experience and support dealer lead generation.

- Strategic Partnerships: Forming partnerships to increase brand awareness and reach a broader customer base. For example, the partnership with Brentford FC.

- Marketplace Focus: Shifting to a dealer-centric model to provide a larger inventory and competitive pricing.

For more insights into the company's financial performance and strategic direction, consider exploring the details provided in Owners & Shareholders of Cazoo.

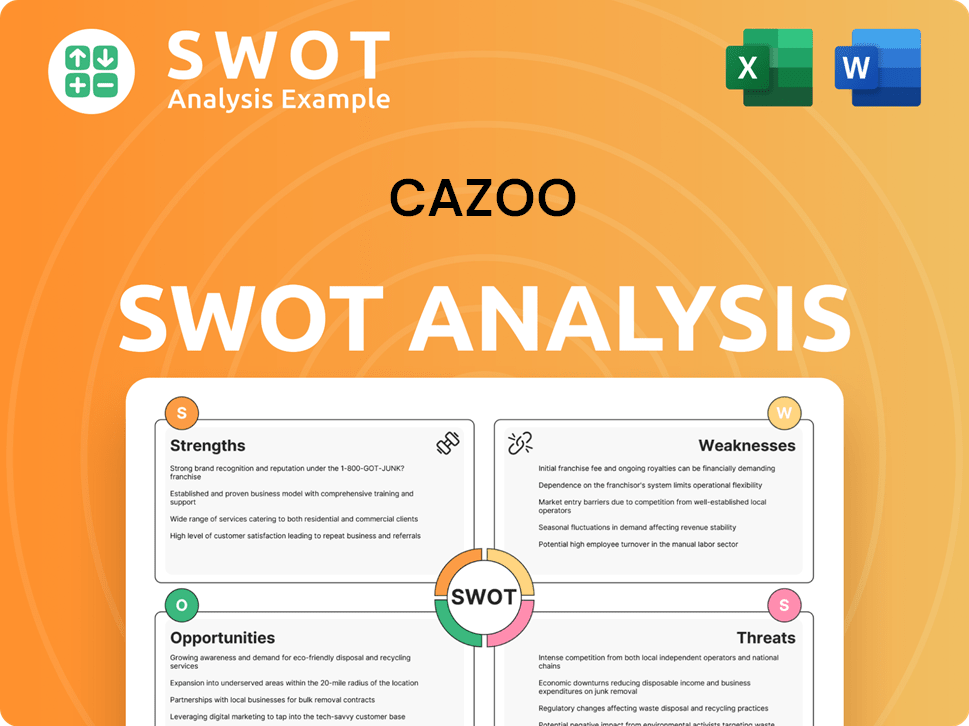

Cazoo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Cazoo Invest in Innovation?

The innovation and technology strategy of the relaunched entity focuses on leveraging its established platform to create a leading online marketplace for used cars. This approach builds on the prior investment of over £100 million in the brand and e-commerce platform, aiming to provide a seamless experience for both dealers and car buyers. The goal is to enhance the online car retailer's capabilities and market position within the automotive industry.

The company is emphasizing a scalable architecture to facilitate continuous adaptation and optimization of its platform. This commitment supports dealers by connecting them with potential customers. The strategy includes exploring the use of artificial intelligence (AI) to improve the business model and overall user experience, ultimately driving growth.

The relaunched website, which was introduced in April 2025, has been developed 'from a clean sheet' with enhanced functionality to improve the experience for both dealers and car buyers. This will include a user-friendly app and website designed to simplify the car buying journey, offering features like handy lifestyle filters to help buyers find cars based on their needs, as well as car buying advice, reviews, and videos.

The core of the technology strategy is a user-friendly platform. This includes a website and app designed to simplify the car buying process. The goal is to provide a seamless experience for both dealers and car buyers.

The technological approach emphasizes a scalable architecture. This allows for continuous adaptation, optimization, and enhancement of the platform. The goal is to support long-term growth and adaptability.

The company is exploring how artificial intelligence (AI) can be utilized. This includes potentially using AI to drive dealer engagement and improve the buyer experience. The aim is to generate high-quality leads.

The technology strategy aims to provide actionable insights and support to dealers. This includes connecting them with the one million consumers who, on average, visit the website every month. The goal is to help dealers succeed.

The strategy is designed to generate high-quality leads for dealers. This is achieved through the improved buyer experience and the use of technology. The ultimate objective is to contribute to growth objectives.

The company is using data to make informed decisions. This includes analyzing user behavior and market trends. The aim is to continuously improve the platform and meet customer needs.

The focus is on creating a leading online marketplace. This involves several key initiatives to drive the Cazoo growth strategy and capitalize on the used car market.

- Platform Enhancements: Continuous improvements to the website and app to enhance user experience.

- AI Integration: Exploring AI to improve dealer engagement and customer interactions.

- Data Analytics: Using data to understand user behavior and market trends.

- Dealer Support Tools: Providing dealers with actionable insights and support.

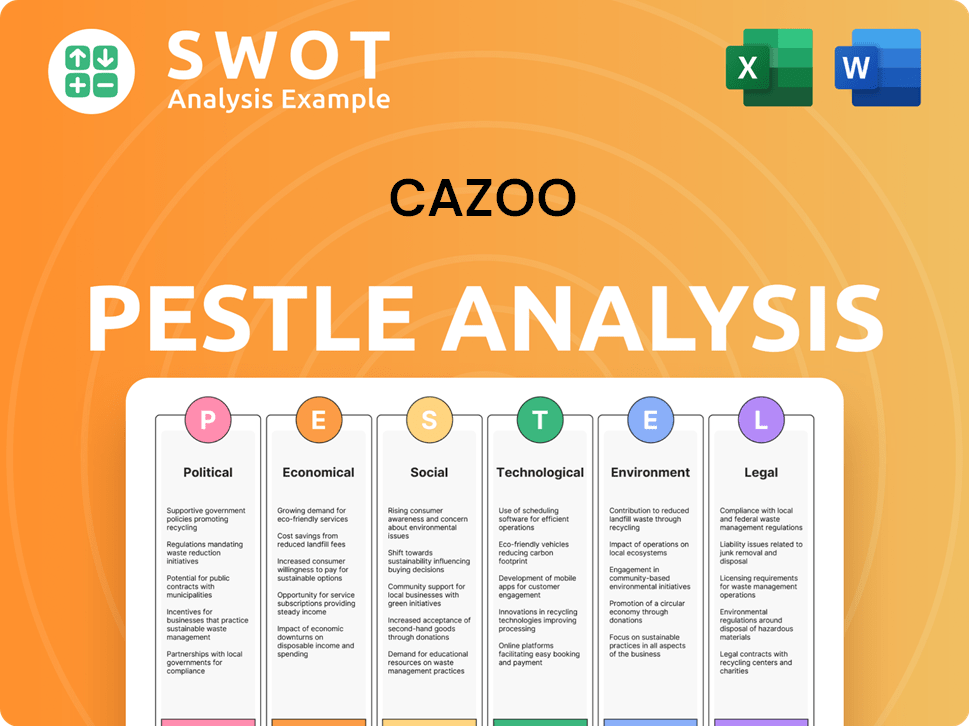

Cazoo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Cazoo’s Growth Forecast?

The financial trajectory of Cazoo, an online car retailer, has been marked by significant shifts and challenges. Initially, the company experienced persistent losses, accumulating approximately £1.4 billion in losses by June 30, 2023. Despite a revenue increase to £1.2 billion in 2022, substantial losses of £704 million were reported that year. This financial performance review highlights the difficulties faced by the company in its early years.

Cazoo's financial strategy has evolved, with a focus on restructuring and adapting its business model. The company aimed to reduce its cash burn and improve its financial foundation. By the end of 2023, the company projected cash and cash equivalents to be between £100 million and £115 million, with a reduction in quarterly cash utilization. These efforts were part of a broader strategy to achieve sustainable growth within the automotive industry.

In May 2024, Cazoo entered administration, leading to a change in its operational structure. The brand was subsequently acquired by Motors, and Cazoo now operates as a marketplace. This transition towards a marketplace model signifies a strategic pivot to a more capital-efficient approach, focusing on advertising and lead generation. The Cazoo growth strategy now emphasizes scalability and profitability.

In September 2023, Cazoo undertook a debt-for-equity swap. This move significantly reduced its debt from $630 million to $200 million. The restructuring was intended to provide a stronger financial base for future operations and support its Cazoo expansion plans.

Under Motors' ownership, Cazoo is operating as a marketplace. The company aims to double in size over the next couple of years. Its goal is to become the 'undisputed number two' in the market, trailing only Auto Trader.

Analysts' forecasts for Cazoo Group Ltd (CZOO) for 2025-12-31 project an annual EBITDA of 24MM and an annual EBIT of -35MM. The Cazoo stock price forecast for CZOO indicates an anticipated trading channel between $6.03 and $6.04 in 2025.

The shift to a marketplace model represents a strategic pivot away from the high operational costs associated with direct car retail. This change is designed to improve efficiency and focus on advertising and lead generation.

The future prospects of Cazoo are closely tied to its ability to execute its marketplace strategy and achieve profitability. The company faces challenges in the used car market, including competition and economic conditions. Understanding the Revenue Streams & Business Model of Cazoo is crucial for evaluating its potential.

- Focus on advertising and lead generation.

- Aim to become the second-largest player in the market.

- Improve financial performance through a more capital-efficient model.

- Navigate the competitive landscape of the automotive industry.

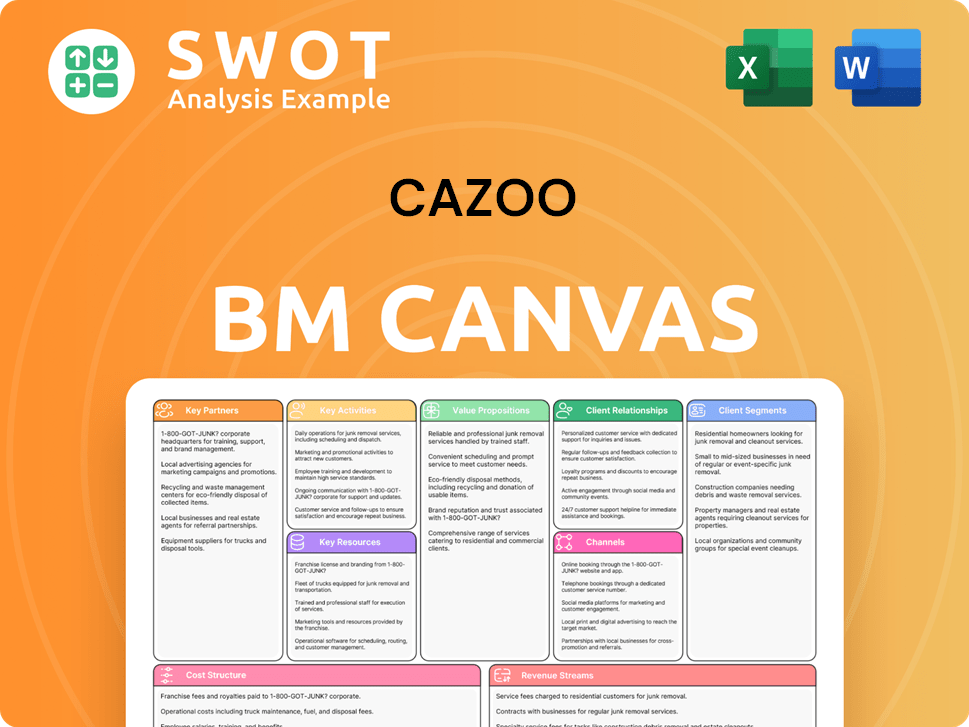

Cazoo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Cazoo’s Growth?

The Cazoo growth strategy, particularly its shift to a marketplace model, faces several significant risks and obstacles. These challenges stem from its past financial difficulties, the competitive landscape of the used car market, and the need to rebuild trust with both consumers and dealers. A successful turnaround hinges on navigating these hurdles effectively.

Cazoo's future prospects depend heavily on its ability to overcome these issues. The company must address its past financial performance, strengthen its market position against established competitors, and adapt to potential supply chain disruptions and economic uncertainties. The company's ability to execute its new strategy is crucial for its long-term viability.

The Cazoo company analysis reveals a complex situation, with the potential for both opportunities and significant risks. Its marketplace model aims to reduce operational costs, but it also introduces new challenges related to dealer relations, customer service, and competition. The company's ability to adapt and innovate will be critical for its success.

One of the primary risks is the legacy of its financial troubles. The company incurred significant losses, approximately £1.4 billion as of June 30, 2023, and faced high operational costs. The transition to a marketplace model aims to alleviate some of these burdens, but requires careful financial management.

Competition from established players, such as Auto Trader, poses a significant challenge. The company needs substantial investment in marketing to gain market share and attract both customers and dealers. This requires a robust strategy to differentiate itself in the automotive industry.

Rebuilding trust with car dealers is crucial for the success of the marketplace model. Many dealers were creditors during the company's collapse, with over £260 million owed. Successful partnerships are essential for the company's operations.

Although the marketplace model reduces direct exposure, supply chain issues can still affect the used car market. The global chip shortage, for instance, previously impacted new car production, which in turn affected used car prices and stock levels. This can impact the volume of listings and consumer interest.

A challenging macroeconomic environment in the UK could adversely affect revenue growth. Economic downturns can reduce consumer spending on discretionary items such as cars. This could impact sales volume and profitability.

Rapid scaling can lead to inefficiencies. Maintaining quality control and customer service in a high-volume marketplace environment is crucial to rebuilding consumer trust. The company's ability to manage this growth effectively is critical.

The company's prior aggressive expansion into Europe, which was later abandoned, serves as a cautionary tale. This highlights the risks associated with rapid, unstrategic growth and the importance of careful planning. This includes thorough market analysis and a phased approach.

Rebuilding customer trust and a positive reputation is essential for attracting buyers and sellers to the marketplace. This involves providing excellent customer service, ensuring quality listings, and addressing any past negative experiences. This is vital for the success of the online car retailer.

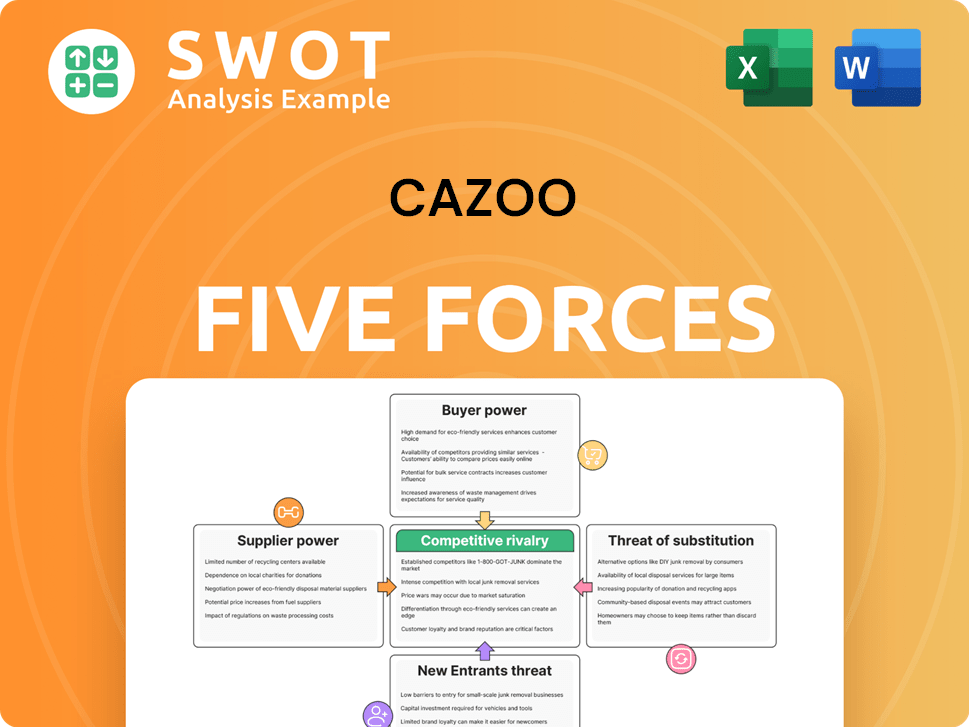

Cazoo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cazoo Company?

- What is Competitive Landscape of Cazoo Company?

- How Does Cazoo Company Work?

- What is Sales and Marketing Strategy of Cazoo Company?

- What is Brief History of Cazoo Company?

- Who Owns Cazoo Company?

- What is Customer Demographics and Target Market of Cazoo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.