Compagnie des Alpes Bundle

How did Compagnie des Alpes become a leisure industry powerhouse?

Founded in 1989, Compagnie des Alpes (CDA) began its journey by revolutionizing the management of Compagnie des Alpes SWOT Analysis French ski resorts. Initially focused on enhancing mountain experiences, CDA quickly recognized the broader potential within the leisure industry. This strategic foresight paved the way for its significant expansion and diversification across Europe.

From its roots as a ski resorts company, CDA's evolution showcases a remarkable ability to adapt and thrive. The company's strategic acquisitions and expansion into theme parks demonstrate a deep understanding of market dynamics. By exploring the CDA history, we uncover the key decisions and milestones that shaped this leisure industry leader, examining its impact and future plans.

What is the Compagnie des Alpes Founding Story?

The story of Compagnie des Alpes (CDA) began on July 19, 1989. The goal was clear: bring professional management to the often-fragmented ski resort industry in the French Alps. This marked the official founding of a company that would become a major player in the leisure industry.

The late 1980s set the stage for CDA's creation. There was a growing demand for leisure activities and a recognition of the potential to modernize ski resort operations. The initial plan involved acquiring and improving the management of ski areas to boost appeal and efficiency. This focus on growth and professionalization set CDA apart from the start.

While not a traditional startup with individual founders, CDA was backed by institutional support, notably from the Caisse des Dépôts et Consignations, a major French financial institution. This backing provided the initial funding and strategic direction, allowing CDA to pursue acquisitions and consolidation from the outset. The business model focused on operating ski lifts, maintaining slopes, and developing related services within the ski areas, aiming to improve the visitor experience and profitability.

CDA's early strategy centered on acquiring and consolidating management of ski resorts, aiming to improve operational efficiency and enhance the visitor experience.

- The initial focus was on the French ski resorts, leveraging the growing demand for leisure activities.

- The company's business model involved operating ski lifts, maintaining slopes, and developing related services.

- CDA aimed to improve profitability through economies of scale and professional management.

- This approach allowed CDA to quickly establish a strong presence in the leisure industry.

The company's early success was built on a clear vision: to transform the management of ski resorts. This involved not just operating ski lifts but also improving the overall experience for visitors. The focus on professional management and economies of scale set the stage for future growth. For those looking to understand the competitive landscape, you can read more about it here: Competitors Landscape of Compagnie des Alpes.

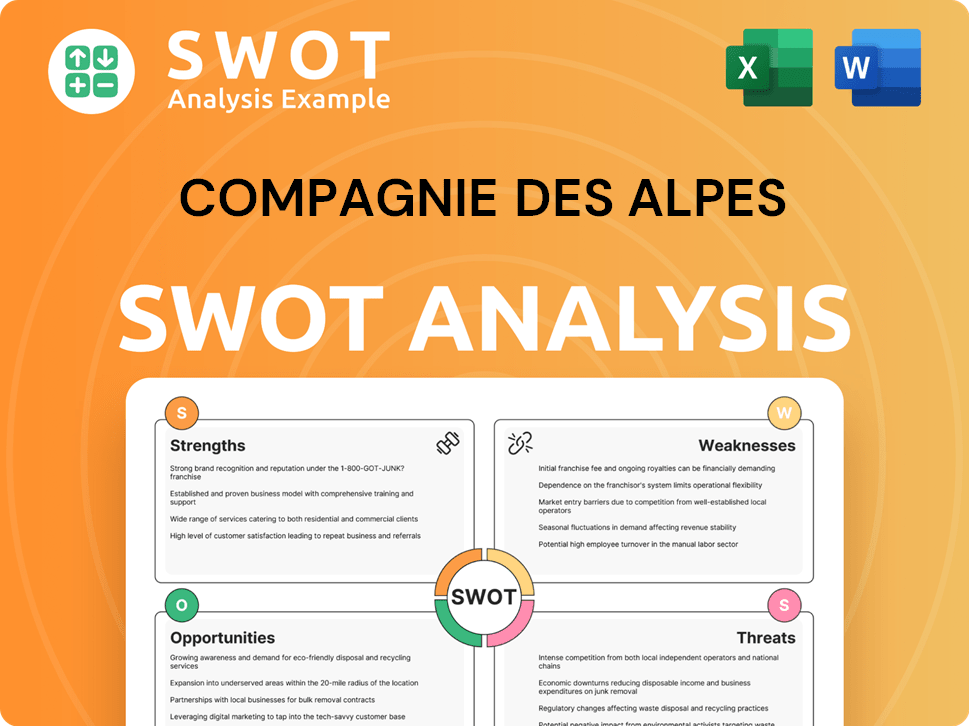

Compagnie des Alpes SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Compagnie des Alpes?

The early growth of Compagnie des Alpes (CDA) was marked by swift acquisitions within the French ski resort sector. Founded in 1989, CDA quickly gained stakes in prominent ski domains, including Val d'Isère and Tignes. This initial phase focused on consolidating operations and improving infrastructure. By the mid-1990s, CDA had become a key player in French alpine tourism.

CDA's early strategy centered on acquiring and managing French ski resorts. This involved integrating operations, standardizing management, and investing in upgrades like modern ski lifts and snowmaking systems. These efforts aimed to enhance the visitor experience and improve financial outcomes. The company's focus on ski resorts was a foundational element of its initial expansion.

Recognizing the seasonal nature of the ski industry, CDA strategically diversified into the leisure industry. This expansion included acquiring amusement parks to balance its portfolio and capture year-round revenue streams. The acquisition of Parc Astérix in 2001 was a significant step in this diversification. This move was crucial for the company's long-term growth.

The acquisition of theme parks such as Parc Astérix, Futuroscope, and Grévin marked a significant shift for CDA. These acquisitions transformed CDA from a specialized ski operator into a broader European leisure group. This expansion was supported by substantial capital raises, fueling the company's growth. This strategic move broadened the company's market reach.

The early growth phase of CDA was characterized by strong market reception, driven by professional management and improved visitor experiences. CDA's financial performance benefited from these strategic moves, leading to increased profitability across its assets. The company's ability to integrate and improve its acquisitions was key to its success. For further insights, explore the Target Market of Compagnie des Alpes.

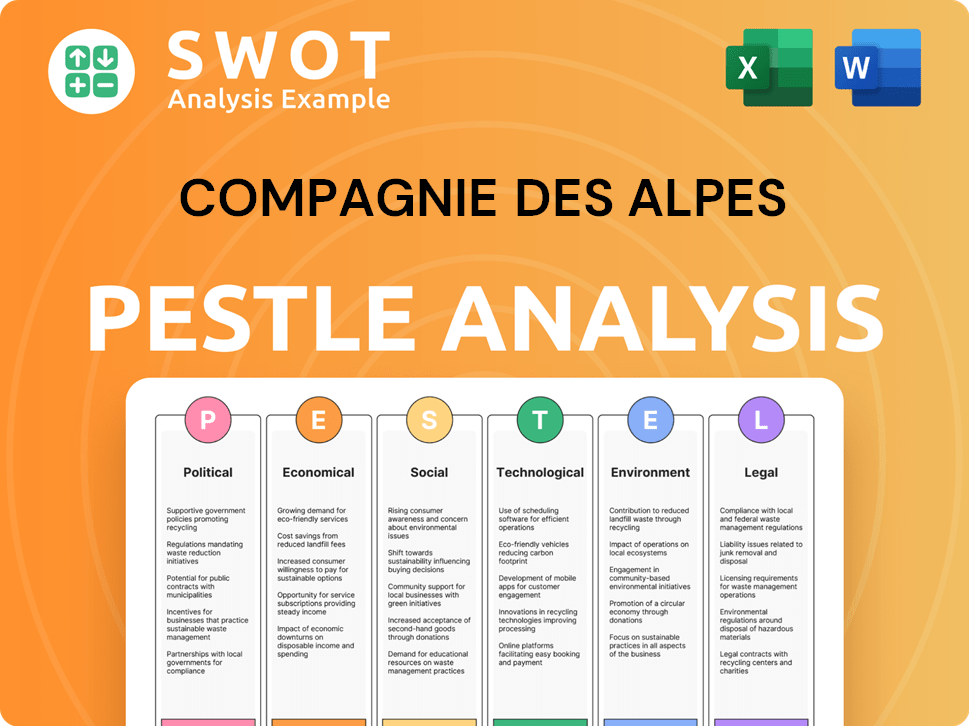

Compagnie des Alpes PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Compagnie des Alpes history?

The CDA history is marked by significant milestones, including strategic acquisitions and expansions within the leisure industry. These achievements have helped shape the company's position as a leading theme park operator and a key player in the French ski resorts market.

| Year | Milestone |

|---|---|

| 1989 | Founded with the aim of consolidating and managing ski resorts. |

| 2001 | Acquired Parc Astérix, marking a significant diversification into the theme park sector. |

| 2011 | Acquired Futuroscope, further expanding its portfolio of leisure destinations. |

| 2020-2021 | Faced unprecedented challenges due to the COVID-19 pandemic, leading to temporary closures and financial impacts. |

| 2024 | Continues to invest in new attractions and experiences to enhance its appeal and maintain its competitive edge. |

A key innovation has been the consolidation of the fragmented ski resort industry, introducing professional management and significant infrastructure investments. This approach enhanced visitor experiences and increased operational efficiency across its mountain domains, setting a new standard for the French ski resorts.

CDA pioneered the consolidation of numerous smaller, independent ski resorts, bringing them under unified management. This allowed for centralized investment in infrastructure and marketing, improving the overall experience for visitors.

The acquisition of Parc Astérix and Futuroscope marked a strategic shift, diversifying revenue streams beyond the seasonality of the ski industry. This diversification made CDA a prominent theme park operator.

CDA consistently invested in new attractions and upgrades to existing facilities across its parks and resorts. These investments aimed to keep the offerings fresh and appealing to a broad audience.

The company has embraced digital technologies to enhance the customer experience, from online ticketing and booking systems to interactive park guides and virtual reality experiences. This has improved operational efficiency.

CDA has increasingly focused on sustainable practices, including energy-efficient infrastructure, waste reduction programs, and initiatives to protect the natural environment in its mountain domains. This is part of the CDA history.

CDA has focused on improving the overall visitor experience through enhanced services, better theming, and more efficient operations. These improvements have been key to maintaining a competitive edge.

CDA has faced challenges, including market downturns and economic crises, along with the inherent seasonality of its core businesses. The COVID-19 pandemic significantly impacted revenues, particularly in 2020 and 2021, leading to the need for cost-cutting measures.

Economic recessions can reduce consumer spending on leisure activities, impacting attendance at both ski resorts and theme parks. This can affect CDA's financial performance.

The ski resort business is highly seasonal, with the majority of revenue generated during the winter months. This seasonality creates challenges in managing cash flow and maintaining year-round operations.

The pandemic caused widespread closures of ski resorts and theme parks, severely impacting CDA's revenues in 2020 and 2021. The company responded with cost-cutting measures and government support.

CDA faces competition from other leisure operators, both in the ski resort market and the theme park sector. This necessitates continuous innovation and investment to remain competitive.

Climate change poses a long-term threat to the ski industry, with rising temperatures potentially reducing snowfall and shortening the ski season. CDA is adapting through sustainability initiatives.

Managing large-scale operations across multiple sites, including staffing, maintenance, and safety, presents ongoing challenges. CDA continuously works to improve efficiency and safety.

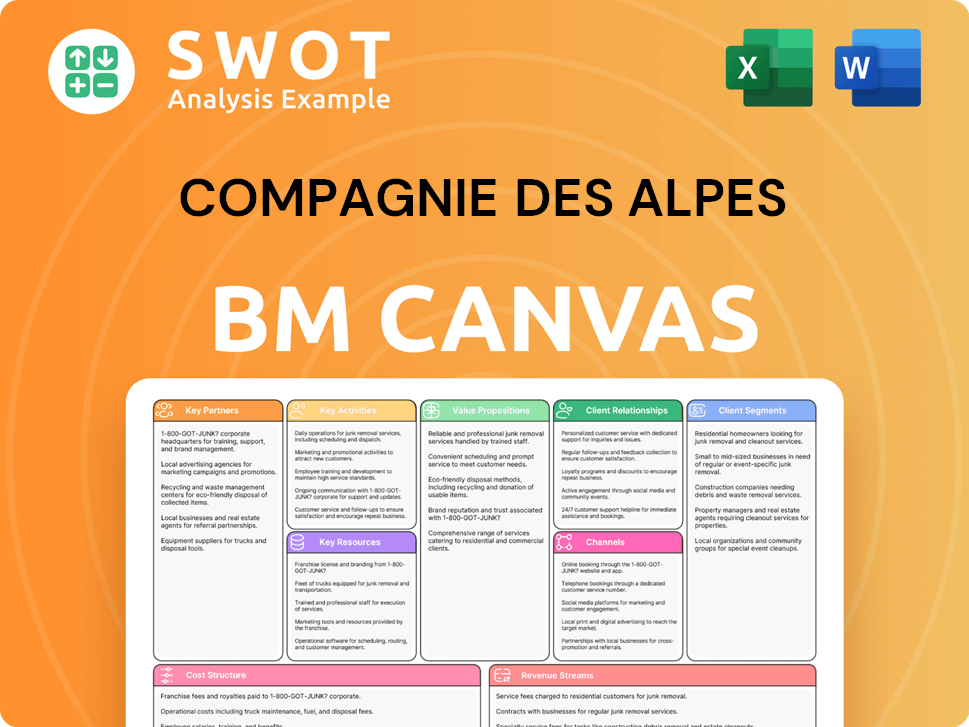

Compagnie des Alpes Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Compagnie des Alpes?

The CDA history is marked by strategic acquisitions and a focus on the leisure industry. Founded in 1989, Compagnie des Alpes began by professionalizing ski resort management. Rapid expansion followed in the 1990s with the acquisition of major French ski domains. The company diversified into theme parks in 2001 with Parc Astérix and further expanded its portfolio with Futuroscope in 2011. CDA history also includes international expansion in the ski industry in 2006 and a focus on digitalization and customer experience since 2015. The COVID-19 pandemic significantly impacted operations in 2020-2021, followed by a strong recovery in 2022. In 2023, the company emphasized sustainable development, and in 2024, it continued investing in new attractions and infrastructure, reporting a significant revenue increase in the first half of the 2023-2024 financial year, driven by strong performance in both ski and leisure park divisions.

| Year | Key Event |

|---|---|

| 1989 | Founding of Compagnie des Alpes, focusing on professionalizing ski resort management. |

| 1990s | Rapid acquisition of major French ski domains, including Val d'Isère and Tignes. |

| 2001 | Acquisition of Parc Astérix, marking the company's entry into the amusement park sector. |

| 2006 | CDA expands its international presence in the ski industry. |

| 2011 | Acquisition of Futuroscope, further diversifying its amusement park portfolio. |

| 2015 | Continued investment in digitalization and customer experience across all sites. |

| 2020-2021 | Significant impact from the COVID-19 pandemic, leading to temporary closures and financial challenges. |

| 2022 | Recovery post-pandemic, with strong visitor numbers returning to both ski resorts and parks. |

| 2023 | Strategic focus on sustainable development and energy transition across its operations. |

| 2024 | Continued investment in new attractions and infrastructure, with a focus on enhancing visitor experience and operational efficiency. |

Compagnie des Alpes plans to modernize infrastructure, particularly in its ski resorts. This includes enhancing visitor comfort and reducing environmental impact. Investments in new lifts, snowmaking systems, and other facilities are ongoing. These improvements aim to provide a better experience for visitors while also contributing to sustainability goals.

Further expansion in the European leisure market is a key focus for Compagnie des Alpes. This could involve targeted acquisitions or partnerships to grow its presence. The company is exploring opportunities to expand its portfolio of theme parks and ski resorts. Strategic growth is a key element of their future plans.

CDA is heavily invested in digital transformation to improve customer engagement and operational efficiency. This includes enhancing online booking systems, mobile apps, and digital experiences at its sites. Technology is also being used to streamline operations and gather data for better decision-making. The goal is to create a seamless experience for visitors.

Compagnie des Alpes is committed to sustainable development, aiming to achieve carbon neutrality in its operations. This includes reducing energy consumption, using renewable energy sources, and implementing eco-friendly practices. The company is investing in initiatives to minimize its environmental impact and contribute to a greener future. This commitment is a core part of their strategy.

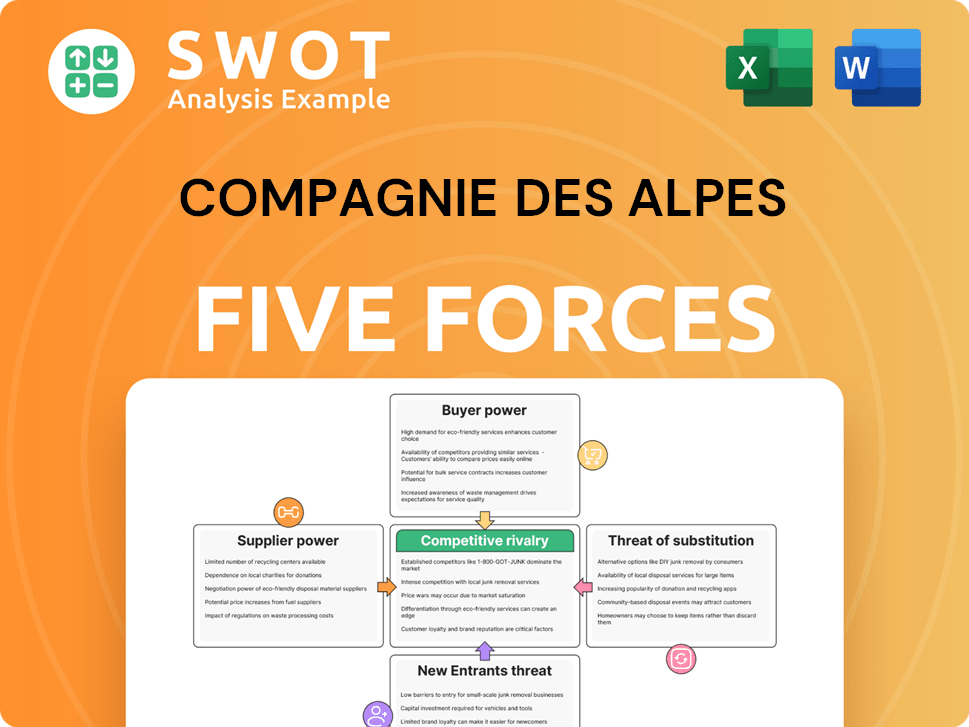

Compagnie des Alpes Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Compagnie des Alpes Company?

- What is Growth Strategy and Future Prospects of Compagnie des Alpes Company?

- How Does Compagnie des Alpes Company Work?

- What is Sales and Marketing Strategy of Compagnie des Alpes Company?

- What is Brief History of Compagnie des Alpes Company?

- Who Owns Compagnie des Alpes Company?

- What is Customer Demographics and Target Market of Compagnie des Alpes Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.