Compagnie des Alpes Bundle

Can Compagnie des Alpes Conquer the European Leisure Market?

The European leisure industry is a dynamic arena, constantly reshaped by consumer demands and technological leaps. In this environment, Compagnie des Alpes SWOT Analysis provides a crucial lens through which to view this major player. Founded in 1989, CDA has evolved from a ski resort operator to a diversified leisure group, making it a compelling subject for strategic analysis.

Understanding the Compagnie des Alpes competitive landscape is essential for grasping its market position. This company analysis delves into CDA's key competitors, its competitive advantages, and the industry trends shaping its future. We'll explore questions like: Who are Compagnie des Alpes' main competitors? and How does Compagnie des Alpes compare to its rivals? Examining its business strategy, financial performance overview, and recent acquisitions provides a comprehensive view of its potential for future growth.

Where Does Compagnie des Alpes’ Stand in the Current Market?

Compagnie des Alpes (CDA) holds a leading market position within the European leisure industry, particularly in its core segments of ski resorts and amusement parks. The company's strategic focus on these areas has allowed it to establish a strong presence and brand recognition across Europe. This strong foundation supports its ability to attract a large customer base and generate substantial revenue.

CDA's business model centers around providing integrated leisure experiences, which include ski resorts and amusement parks. The company has invested in infrastructure upgrades, digital solutions, and diversified offerings beyond traditional skiing or rides. CDA's strategic approach focuses on enhancing the visitor experience, which has contributed to its strong financial performance and market position. This approach is crucial for maintaining its competitive edge and driving future growth.

CDA is a significant player in the European leisure market, with a strong presence in the ski industry and amusement park segments. It operates in key markets such as France, Belgium, and the Netherlands, serving a diverse customer base. The company's market position is supported by its diverse portfolio of assets and its ability to adapt to industry trends. For a deeper understanding of its growth strategies, you can explore Growth Strategy of Compagnie des Alpes.

CDA manages approximately 20% of the French ski lift market share. This significant market share underscores its dominance in the French ski industry. The company's ski resorts are consistently among the most visited in the Alps, attracting a large number of tourists annually.

CDA operates several amusement parks, including Parc Astérix, Futuroscope, and Walibi parks. These parks are key contributors to the company's revenue streams and attract millions of visitors annually. This segment is a significant part of CDA's overall business strategy.

The company's primary presence is in France, where it operates the majority of its ski resorts and a significant number of its leisure parks. CDA's amusement park operations extend to Belgium and the Netherlands, showcasing a broader European reach. This geographic diversification helps mitigate risks and expand its customer base.

CDA serves a diverse customer base, including families, avid skiers, and snowboarders. The company focuses on enhancing the visitor experience through infrastructure upgrades and diversified offerings. This approach helps to maintain customer loyalty and attract new visitors.

For the first half of the 2023/2024 financial year, CDA reported a revenue of €524.6 million, a 4.9% increase compared to the previous year. This financial performance indicates a healthy scale compared to many industry averages. The company's ability to maintain and grow its revenue is a key indicator of its success.

- The ski industry is subject to seasonal variations, with the second half of the year typically being stronger.

- CDA is continuously seeking to optimize its portfolio and explore new growth avenues within the broader leisure and tourism sector.

- Strategic partnerships and acquisitions are potential avenues for expansion and diversification.

- The competitive landscape includes other major players in the European leisure market.

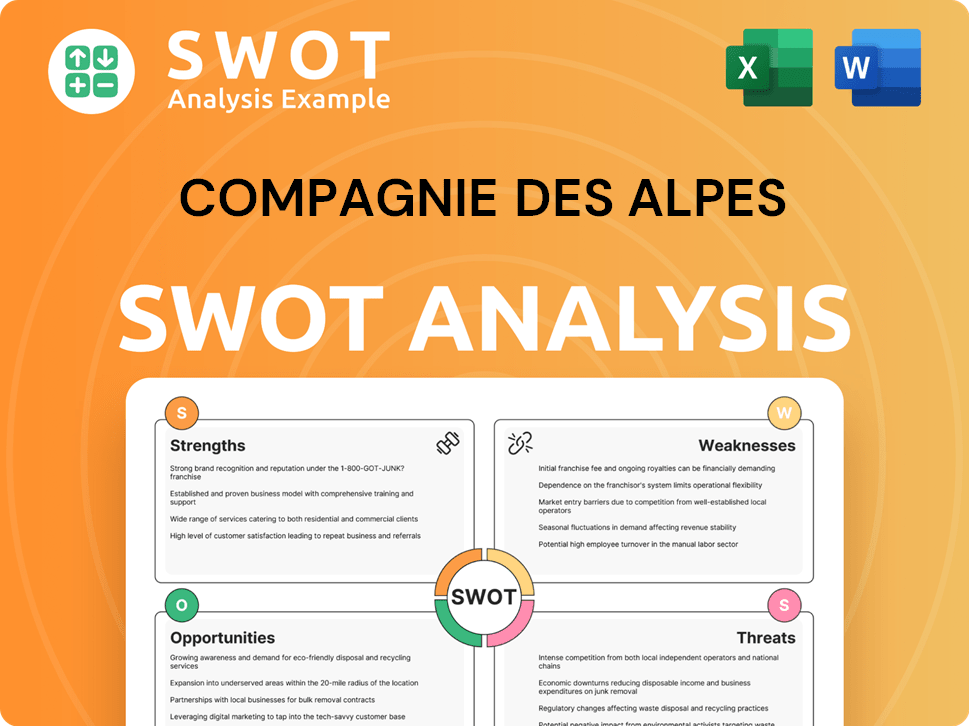

Compagnie des Alpes SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Compagnie des Alpes?

The competitive landscape for Compagnie des Alpes (CDA) is multifaceted, encompassing both direct and indirect competitors across its ski resort and amusement park operations. A thorough company analysis reveals a dynamic environment shaped by established players, emerging trends, and the evolving preferences of leisure consumers. Understanding the competitive landscape is crucial for CDA to maintain and enhance its market share and ensure sustainable growth.

CDA faces competition from various entities, each employing different business strategy approaches. These strategies include pricing models, investment in infrastructure, and the development of complementary services. The competitive dynamics are further complicated by the rise of experience-economy businesses and technological advancements, which push CDA to continuously innovate and adapt its offerings.

For more details on CDA's financial structure, consider exploring the Revenue Streams & Business Model of Compagnie des Alpes.

In the ski resort sector, CDA competes with large-scale operators like Vail Resorts, which has a significant global presence. Smaller, independent ski domains across the Alps and regional ski resort groups also pose competition, especially for attracting domestic visitors. These competitors influence CDA through pricing and new infrastructure investments.

In the amusement park segment, CDA competes with major international players like Merlin Entertainments and Europa-Park. These competitors differentiate themselves through intellectual property, continuous investment in new rides, and extensive marketing campaigns. Innovation in ride technology directly challenges CDA's parks to refresh their offerings.

Indirect competition comes from experience-economy businesses, such as glamping sites and adventure tourism operators. Technological advancements, like virtual reality attractions, also impact CDA's need to innovate. Mergers and alliances could alter competitive dynamics in the European leisure market.

Compagnie des Alpes competitive advantages include its strong presence in popular ski resorts and amusement parks. The company's ability to adapt to changing consumer preferences and invest in new attractions and infrastructure is also crucial. Strategic partnerships and acquisitions further enhance its competitive position.

Industry trends such as the demand for unique experiences and technological integration are significant. Compagnie des Alpes market position analysis shows the importance of continuously updating offerings and adapting to these trends. The rise of digital experiences and sustainability concerns also influence the market.

Compagnie des Alpes future growth strategies include expanding its portfolio through acquisitions, investing in new attractions, and enhancing the guest experience. Strategic partnerships and a focus on sustainability are also key. The company's ability to innovate and adapt will determine its long-term success.

Who are Compagnie des Alpes' main competitors? The main competitors include Vail Resorts, Merlin Entertainments, and Europa-Park. These companies compete through pricing, infrastructure investment, and the development of unique experiences. How does Compagnie des Alpes compare to its rivals? CDA competes by investing in new attractions and adapting to industry trends. What are the challenges facing Compagnie des Alpes? Challenges include competition from established and emerging players, changing consumer preferences, and the need for continuous innovation. Compagnie des Alpes SWOT analysis would highlight strengths in its established market presence, weaknesses in its susceptibility to economic downturns, opportunities in expanding its portfolio, and threats from evolving consumer demands.

- Compagnie des Alpes faces a complex competitive landscape.

- Direct competitors include Vail Resorts and Merlin Entertainments.

- Indirect competition comes from experience-economy businesses.

- Compagnie des Alpes must continuously innovate to maintain its market share.

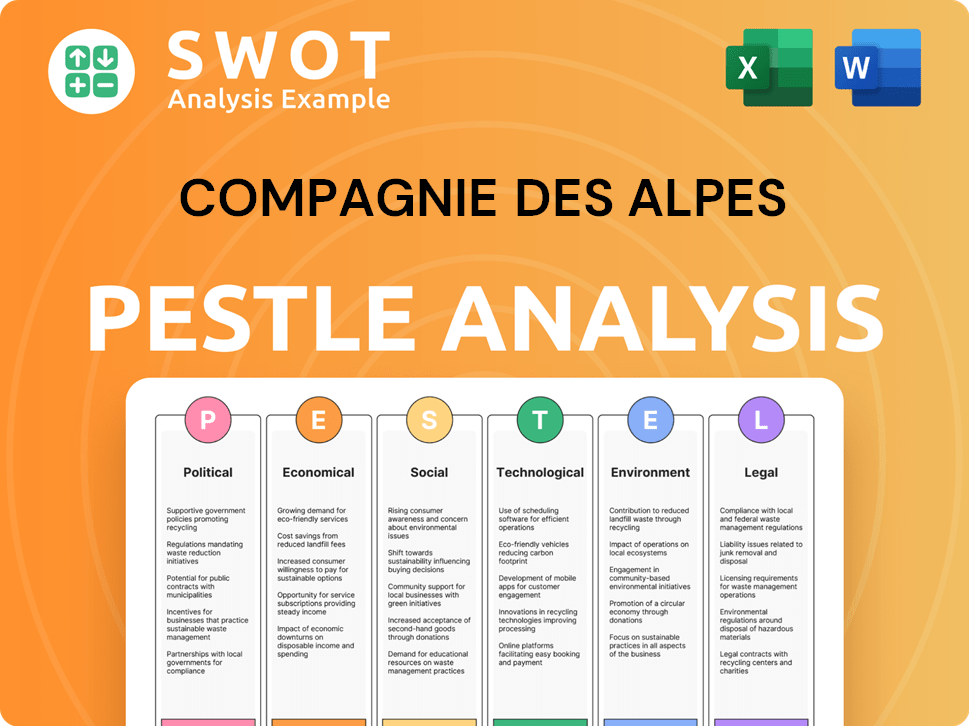

Compagnie des Alpes PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Compagnie des Alpes a Competitive Edge Over Its Rivals?

Analyzing the Compagnie des Alpes (CDA) reveals a robust competitive landscape, shaped by its strategic moves and operational strengths. CDA has consistently expanded its portfolio, focusing on premium leisure experiences. This has allowed the company to establish a strong market position. The company's commitment to innovation and sustainability further enhances its appeal to a broad customer base.

The company's success is rooted in its ability to adapt to industry trends and leverage its assets effectively. CDA's business strategy focuses on integrating diverse offerings, from ski resorts to amusement parks, creating a diversified revenue stream. This approach has allowed the company to navigate economic fluctuations and maintain a strong financial performance.

Understanding CDA's competitive advantages is crucial for assessing its long-term prospects. These advantages, coupled with its strategic initiatives, position CDA favorably in the leisure market. The company's ability to innovate and adapt to changing consumer preferences will be key to its continued success.

CDA's ownership of iconic ski resorts in the French Alps is a significant competitive advantage. These resorts, known for their quality and scale, create a high barrier to entry for competitors. The strong brand equity and premium experiences foster customer loyalty, ensuring repeat visits year after year.

The company's leisure parks, such as Parc Astérix and Futuroscope, benefit from strong brand recognition and unique intellectual property. These parks consistently attract tourists, supported by innovative attractions and themed experiences. CDA's ability to develop and integrate new attractions enhances its appeal.

CDA benefits from economies of scale in procurement, marketing, and operational management across its diverse portfolio. This allows for cost efficiencies that smaller operators cannot replicate. These efficiencies contribute to CDA's strong financial performance and market position.

CDA's focus on sustainable tourism practices, including investments in renewable energy and waste reduction, is a growing competitive advantage. Strong relationships with local authorities provide a stable operational environment. These factors support CDA's long-term growth and resilience.

Compagnie des Alpes leverages several key advantages in the leisure market. These advantages include a strong portfolio of ski resorts, brand recognition in its leisure parks, and operational efficiencies. The company's focus on sustainable practices and local relationships further strengthens its position.

- Extensive portfolio of iconic ski resorts in the French Alps, creating a high barrier to entry.

- Strong brand recognition for key parks like Parc Astérix and Futuroscope, attracting consistent tourist flows.

- Economies of scale in procurement and operational management, enhancing cost efficiencies.

- Strong relationships with local authorities and communities, providing a stable operational environment.

- Focus on sustainable tourism practices, appealing to environmentally conscious consumers.

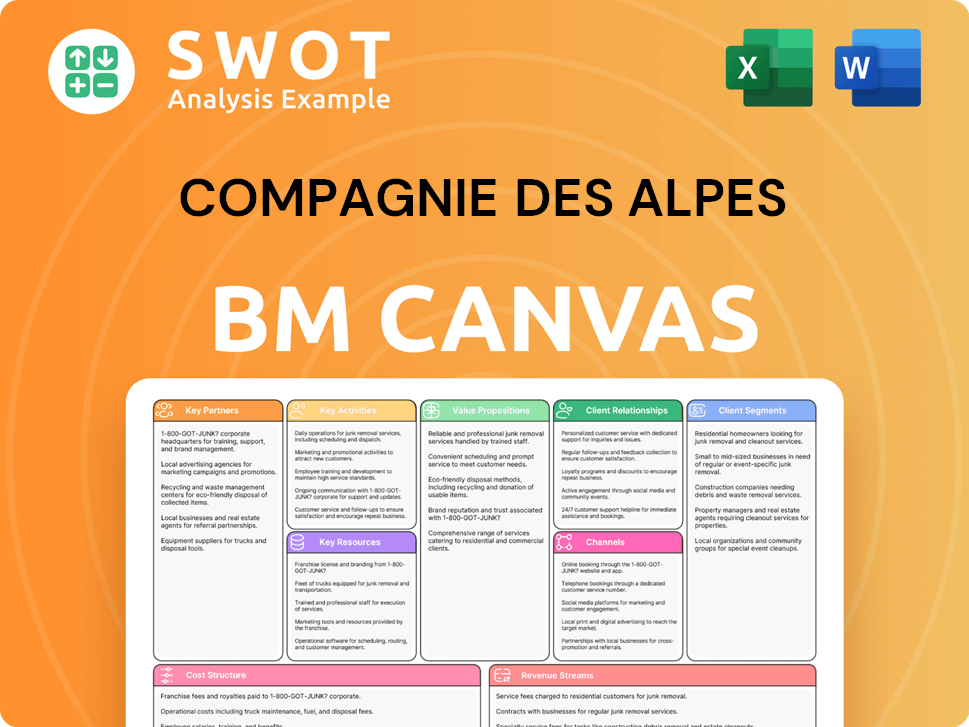

Compagnie des Alpes Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Compagnie des Alpes’s Competitive Landscape?

The European leisure industry, where Compagnie des Alpes (CDA) operates, is experiencing significant shifts driven by technological advancements, evolving consumer preferences, and regulatory changes. These factors influence CDA's competitive landscape and shape its business strategy. Understanding these industry trends is crucial for assessing CDA's market position analysis and future prospects.

CDA faces challenges from climate change impacting ski resort operations and increasing competition. Simultaneously, the company has opportunities in sustainable tourism, year-round activities, and digital technology integration. CDA's ability to adapt and innovate will determine its success in this dynamic environment. For a deeper dive, consider the Growth Strategy of Compagnie des Alpes.

Technological advancements, such as AI and VR, are reshaping visitor experiences. Sustainability and accessibility regulations are becoming more stringent, requiring investment. Consumer demand is shifting towards personalized and eco-friendly experiences, influencing CDA's offerings.

Climate change poses a direct threat to CDA's ski resort operations and snow reliability. Increased competition from niche players and established rivals demands constant innovation. Economic uncertainties and inflation could impact consumer spending on leisure activities, affecting revenue.

Sustainable tourism presents an opportunity to attract environmentally conscious travelers. Diversification into year-round mountain activities mitigates climate change impacts. Integrating digital technologies enhances the visitor experience and improves efficiency. Expansion into new markets can unlock growth.

Optimizing existing assets and enhancing visitor experiences are key. Exploring sustainable development initiatives is crucial for long-term success. CDA's focus on these areas will help it navigate evolving trends and maintain its competitive edge. The company's strategic focus is crucial.

CDA's future growth strategies should prioritize climate adaptation and diversification. Investments in digital technology and sustainable practices are essential. Strategic partnerships and expansion into new markets could offer significant advantages. CDA's key performance indicators will reflect its ability to adapt.

- Climate change mitigation through snowmaking and alternative activities.

- Enhancing visitor experiences with digital tools and personalized offerings.

- Expanding into year-round activities to reduce reliance on seasonal ski operations.

- Strategic partnerships to broaden its market reach and service offerings.

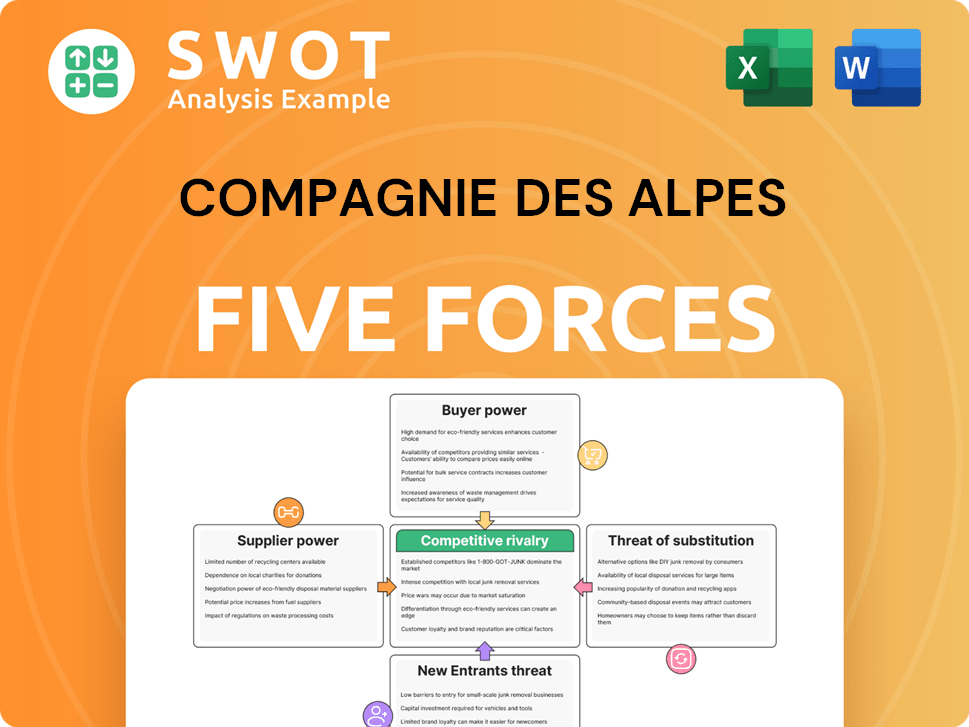

Compagnie des Alpes Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Compagnie des Alpes Company?

- What is Growth Strategy and Future Prospects of Compagnie des Alpes Company?

- How Does Compagnie des Alpes Company Work?

- What is Sales and Marketing Strategy of Compagnie des Alpes Company?

- What is Brief History of Compagnie des Alpes Company?

- Who Owns Compagnie des Alpes Company?

- What is Customer Demographics and Target Market of Compagnie des Alpes Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.