Compagnie des Alpes Bundle

Can Compagnie des Alpes Conquer the Future of Leisure?

Compagnie des Alpes (CDA) has evolved from a ski resort operator to a European leisure powerhouse, but what does its growth strategy entail? This analysis explores CDA's journey, from its French Alps origins to its current portfolio of theme parks like Parc Astérix and Walibi. Understanding CDA's strategic shifts is crucial for anyone interested in the future of the leisure industry.

This report will dissect CDA's Compagnie des Alpes SWOT Analysis, expansion plans, and financial performance, offering insights into its future prospects. We'll examine how CDA plans to navigate the competitive landscape, including its growth strategy for ski resorts and theme parks, and how it aims to generate revenue. Furthermore, we will discuss the impact of climate change on Compagnie des Alpes and how it is addressing sustainability initiatives.

How Is Compagnie des Alpes Expanding Its Reach?

The growth strategy of Compagnie des Alpes (CDA) centers on expanding its business through geographical and product diversification, along with strategic mergers and acquisitions. This approach aims to attract a broader customer base and diversify revenue streams. CDA is actively exploring new markets beyond its traditional European base, focusing on regions with growing leisure tourism markets.

A key element of CDA's expansion strategy involves enhancing existing park attractions and ski resort infrastructure. This includes significant investments in new rides, themed areas, and accommodation options at its leisure parks, and modernizing ski lifts and snowmaking capabilities in its resorts. This focus is designed to improve the visitor experience and increase capacity, thereby boosting financial performance.

CDA's financial performance is also tied to its ability to adapt to evolving consumer preferences, such as increasing demand for sustainable tourism and unique, immersive experiences. The company's strategic objectives include continuous evaluation of opportunities that align with its growth objectives, such as potential acquisitions and partnerships.

CDA is looking at new territories, especially those with growing leisure tourism. This could involve entering new markets or expanding its presence in existing ones. The company's expansion plans are focused on regions that offer strong growth potential for both theme parks and ski resorts.

CDA is working to enhance its existing offerings to attract a wider customer base. This includes adding new attractions, improving infrastructure, and providing more diverse experiences. The goal is to diversify revenue streams and reduce reliance on any single product or service.

CDA actively pursues strategic partnerships and potential acquisitions to strengthen its market position. This approach allows the company to gain access to new customer segments and specialized expertise. Recent acquisitions have focused on integrating operations to optimize synergies.

The company is adapting to the increasing demand for sustainable tourism and unique experiences. This includes incorporating eco-friendly practices and developing immersive attractions. CDA's sustainability initiatives are becoming increasingly important for long-term growth.

CDA's expansion strategy is multifaceted, focusing on geographical and product diversification, along with strategic mergers and acquisitions. The company's growth strategy for ski resorts and theme parks includes significant investments in infrastructure and the integration of acquisitions to optimize operational synergies. For more details on how CDA generates revenue, explore Revenue Streams & Business Model of Compagnie des Alpes.

- Geographical Expansion: Entering new markets with high growth potential.

- Product Enhancement: Improving existing attractions and infrastructure.

- Strategic Partnerships: Forming alliances to gain expertise and market access.

- Sustainability: Focusing on eco-friendly practices and sustainable tourism.

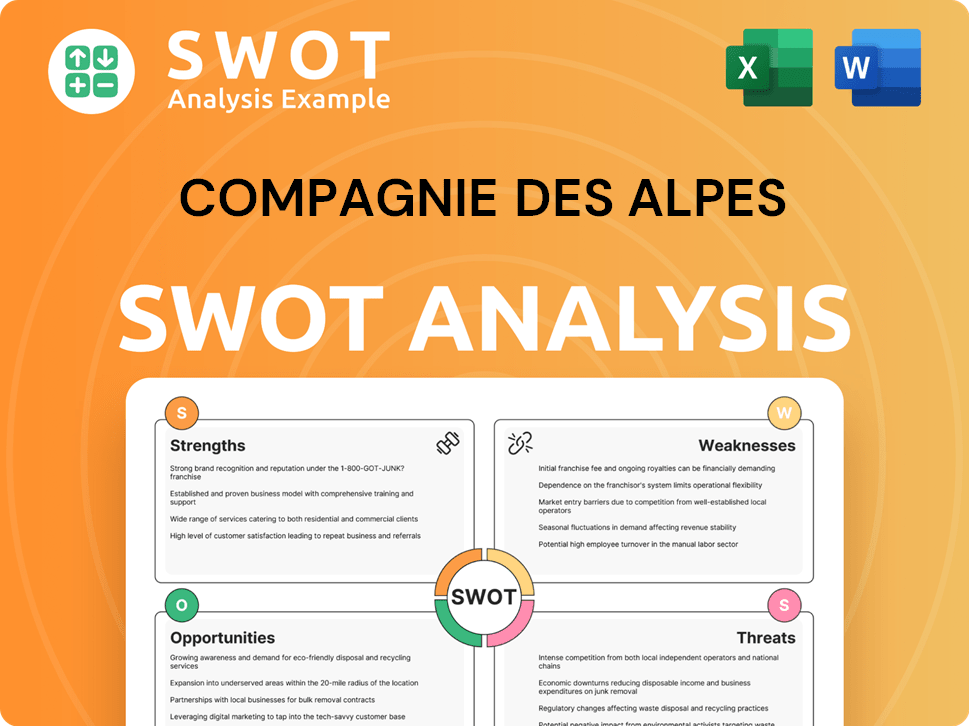

Compagnie des Alpes SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Compagnie des Alpes Invest in Innovation?

Compagnie des Alpes (CDA) focuses on leveraging technology and innovation to foster sustained growth and enhance visitor experiences across its ski resorts and leisure parks. This approach is central to its growth strategy, aiming to streamline operations, personalize customer interactions, and improve overall efficiency. The company's investments in digital transformation are a key component of its long-term plans.

The company's strategic initiatives include developing advanced online booking platforms and mobile applications. These tools offer real-time information and services within their parks and resorts. Data analytics also plays a crucial role in understanding visitor behavior, enabling CDA to tailor its offerings and improve customer satisfaction.

The implementation of dynamic pricing models and personalized offers through digital channels is a key part of their strategy to optimize revenue and customer satisfaction. CDA's commitment to innovation is evident in its continuous investments in digital infrastructure and sustainable practices, which are cornerstones of its long-term growth objectives.

CDA invests heavily in digital transformation to enhance customer experiences and operational efficiency. This includes advanced online booking systems and mobile apps. These tools provide real-time information and services, improving visitor engagement.

Data analytics is used to understand visitor behavior, enabling personalized offers and optimized revenue. CDA uses data insights to tailor experiences and improve customer satisfaction. This data-driven approach supports strategic decision-making.

CDA explores AI and IoT to boost operational efficiency and create new attractions. In ski resorts, IoT sensors monitor snow conditions and predict maintenance needs. AI helps optimize crowd management and resource allocation.

Sustainability is a key part of CDA's innovation strategy, focusing on energy efficiency and waste reduction. Investments in renewable energy and sustainable water management are also priorities. These initiatives align with long-term growth objectives.

Dynamic pricing models and personalized offers are implemented through digital channels. This strategy helps optimize revenue and improve customer satisfaction. These initiatives enhance the overall visitor experience.

CDA continuously invests in digital infrastructure and sustainable practices. This demonstrates a commitment to innovation as a cornerstone of its long-term growth objectives. These investments support the company's future prospects.

CDA is also exploring cutting-edge technologies such as AI and IoT to enhance operational efficiency and create new attractions. For instance, in its ski resorts, this includes utilizing IoT sensors for real-time snow condition monitoring and predictive maintenance of ski lifts, while AI could be deployed for optimizing crowd management and resource allocation in both ski resorts and leisure parks. Sustainability initiatives are increasingly integrated into their innovation strategy, with a focus on energy efficiency, waste reduction, and promoting eco-friendly practices across their sites. This includes investments in renewable energy sources and sustainable water management systems. While specific patents or industry awards for 2024-2025 are not yet widely publicized, CDA's continuous investment in digital infrastructure and sustainable practices demonstrates its commitment to innovation as a cornerstone of its long-term growth objectives. For more insights into the company's history, consider reading a Brief History of Compagnie des Alpes.

CDA's innovation strategy focuses on digital transformation, data analytics, and sustainable practices to drive growth. These initiatives aim to enhance customer experiences and improve operational efficiency across ski resorts and theme parks. The integration of AI and IoT, along with dynamic pricing, are key components.

- Digital Platforms: Development of advanced online booking systems and mobile applications.

- Data Analytics: Utilizing data to understand visitor behavior and personalize offers.

- AI and IoT: Implementing AI for crowd management and IoT for real-time monitoring.

- Sustainability: Investing in renewable energy and sustainable water management.

- Dynamic Pricing: Optimizing revenue through flexible pricing models.

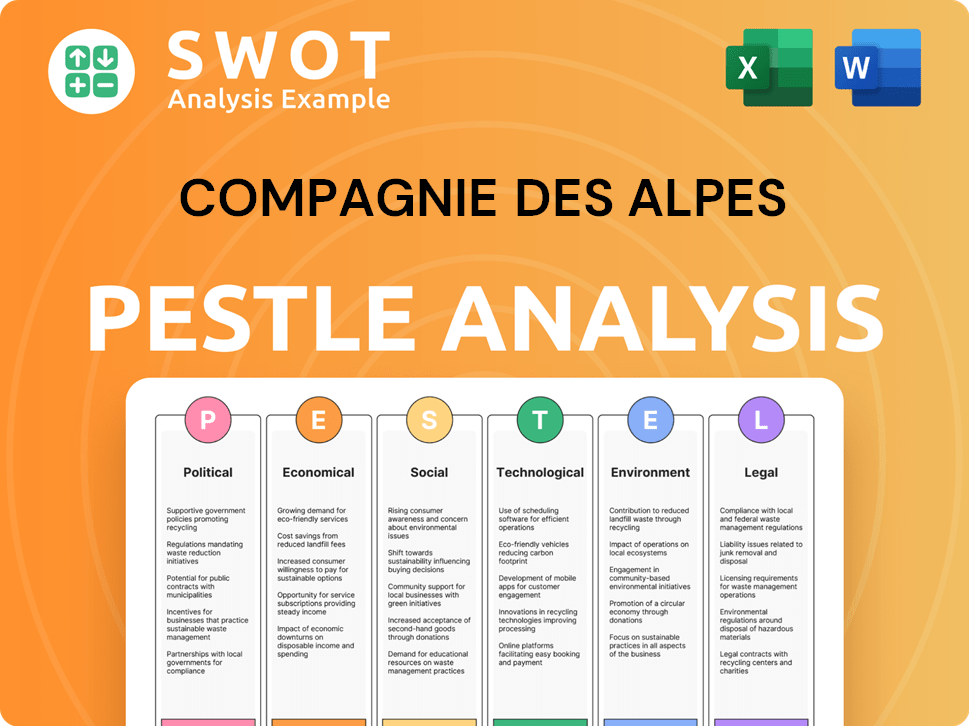

Compagnie des Alpes PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Compagnie des Alpes’s Growth Forecast?

The financial outlook for Compagnie des Alpes (CDA) is positive, with the company demonstrating a strong ability to rebound and achieve growth. For the fiscal year 2023-2024, CDA reported a revenue of €1,130.6 million, marking a 2.1% increase compared to the previous year. This financial performance reflects the effectiveness of its growth strategy and its ability to adapt to market conditions.

The company's financial success is driven by its diversified portfolio, including ski resorts and theme parks. The leisure parks division saw a revenue increase of 6.0%, reaching €514.8 million. The ski areas division also performed well, achieving €546.0 million in revenue, despite facing challenging snow conditions at the beginning of the winter season. These results highlight CDA's resilience and strategic approach to managing its diverse business segments.

CDA's commitment to maintaining a strong operating margin and generating sufficient cash flow is evident in its financial strategy. The company's EBITDA for the 2023-2024 fiscal year was €336.8 million, representing a 29.8% margin. CDA plans to invest around €175 million in 2024, focusing on its existing sites, strategic acquisitions, and digitalization to drive future growth. This demonstrates CDA's confidence in its future prospects and its commitment to long-term value creation.

CDA's revenue increased by 2.1% to €1,130.6 million in the 2023-2024 fiscal year. This growth was driven by the performance of both leisure parks and ski areas, demonstrating the effectiveness of CDA's diversified business model.

The company achieved an EBITDA of €336.8 million, with a margin of 29.8% for the 2023-2024 fiscal year. This strong profitability allows CDA to reinvest in its business and pursue strategic growth initiatives.

CDA plans to invest approximately €175 million in 2024. These investments will focus on existing sites, strategic acquisitions, and digitalization efforts. These investments are crucial for supporting the long-term growth of the company.

CDA aims to further increase revenue and profitability through continued investments, strategic acquisitions, and digitalization. Strengthening its balance sheet and improving its debt structure are also key objectives. These goals highlight CDA's commitment to sustainable growth.

The company's strategic objectives include strengthening its balance sheet and improving its debt structure to support future expansion. This aligns with analyst forecasts that generally remain positive, anticipating sustained growth in the leisure and tourism sectors. CDA's financial strategy also emphasizes prudent capital allocation, balancing shareholder returns with the need for reinvestment to secure future growth. For more insights into the competitive landscape, you can check out the Competitors Landscape of Compagnie des Alpes.

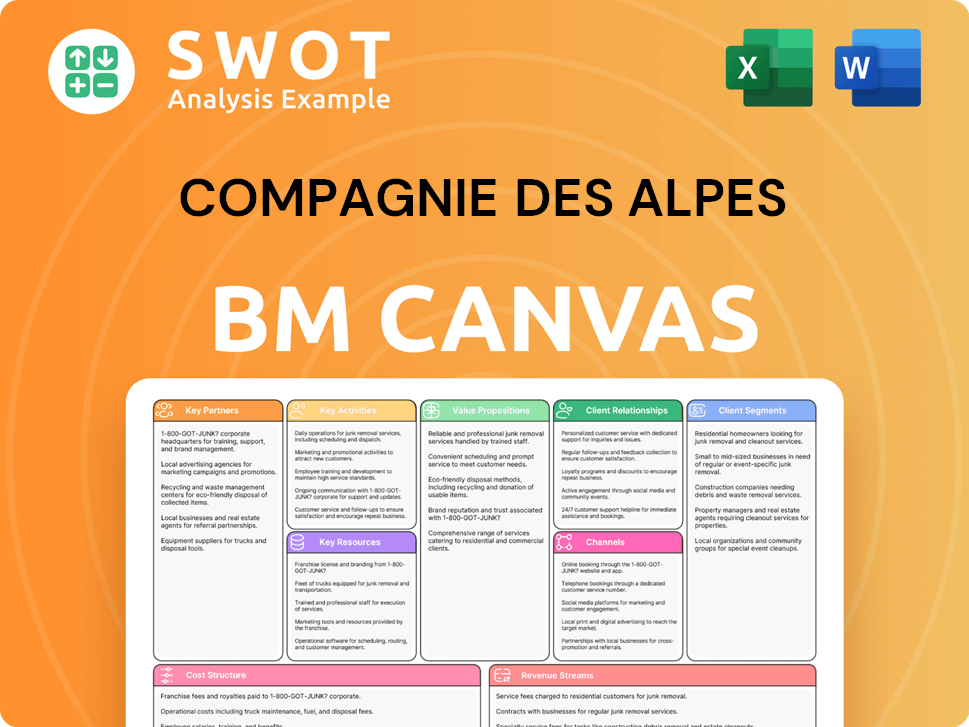

Compagnie des Alpes Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Compagnie des Alpes’s Growth?

The Compagnie des Alpes (CDA) faces several potential risks and obstacles that could affect its growth strategy and future prospects. These challenges span market competition, regulatory changes, supply chain issues, technological disruption, and internal resource constraints. Effective risk management and strategic planning are crucial for CDA to navigate these complexities and achieve its long-term goals within the ski resorts and theme parks sectors.

Intense competition from both established and emerging players in the ski resorts and amusement park industries poses a significant threat. This competition can lead to pricing pressures and necessitate continuous investment in new attractions and experiences. Regulatory changes, particularly in environmental regulations, labor laws, and safety standards, can increase operational costs and require infrastructure adaptations.

Supply chain vulnerabilities and technological disruptions also present risks. While less pronounced than in manufacturing, supply chain issues can affect the timely delivery of equipment. Failing to adapt to new digital trends and entertainment technologies could also shift consumer preferences. Internal resource constraints, such as attracting and retaining skilled seasonal staff, could hinder operational efficiency.

The Compagnie des Alpes operates in a competitive market, facing rivals in both the ski resort and theme park industries. This competition can lead to pricing pressures and the need for continuous innovation. CDA must continually invest in new attractions and enhance the guest experience to maintain its market position.

Changes in environmental regulations, labor laws, and safety standards can increase operational costs. Evolving climate change regulations, for instance, could impact snowmaking operations in ski resorts. CDA must adapt to these changes to ensure compliance and mitigate potential financial impacts.

Although less pronounced than in manufacturing, supply chain issues can still affect the timely delivery of equipment for new attractions or the maintenance of existing facilities. Disruptions can lead to project delays and increased costs. CDA must manage its supply chains effectively to minimize these risks.

Failing to keep pace with evolving digital trends and entertainment technologies could shift consumer preferences. CDA needs to invest in new technologies and adapt its offerings to remain competitive. This includes integrating digital experiences and enhancing online platforms.

Attracting and retaining skilled seasonal staff, especially in a tight labor market, could hinder operational efficiency and service quality. CDA must implement strategies to attract and retain employees. This includes competitive compensation and benefits, and opportunities for professional development.

Climate change poses a significant risk, particularly to ski resorts, due to its impact on snowfall and the length of the ski season. CDA invests in snowmaking capabilities to mitigate this risk. The company is also exploring sustainability initiatives to reduce its environmental footprint.

CDA addresses these risks through diversification across its two core businesses, ski resorts and leisure parks. The company implements robust risk management frameworks and engages in scenario planning to prepare for various contingencies. Recent acquisitions, such as the purchase of a new ski resort, help to diversify revenue streams and reduce reliance on any single location.

These risks can directly impact the financial performance of CDA, affecting revenue, profitability, and stock performance. For example, a decline in snowfall can reduce revenue at ski resorts. CDA's financial reports reflect the impact of these challenges and the effectiveness of its mitigation strategies. The company's ability to adapt to these challenges is critical for its investment opportunities.

CDA's strategic objectives include expanding its presence in both the ski resorts and theme parks sectors. This involves acquisitions, new developments, and enhancing existing facilities. The company's expansion plans are carefully considered to balance growth with risk management. CDA's approach includes assessing potential acquisitions and developing new projects.

CDA is increasingly focused on sustainability initiatives to address environmental concerns and enhance its long-term viability. These initiatives include investments in renewable energy, waste reduction programs, and eco-friendly practices. CDA's commitment to sustainability is becoming increasingly important for its stakeholders.

For further insights into the company's values and mission, please refer to Mission, Vision & Core Values of Compagnie des Alpes.

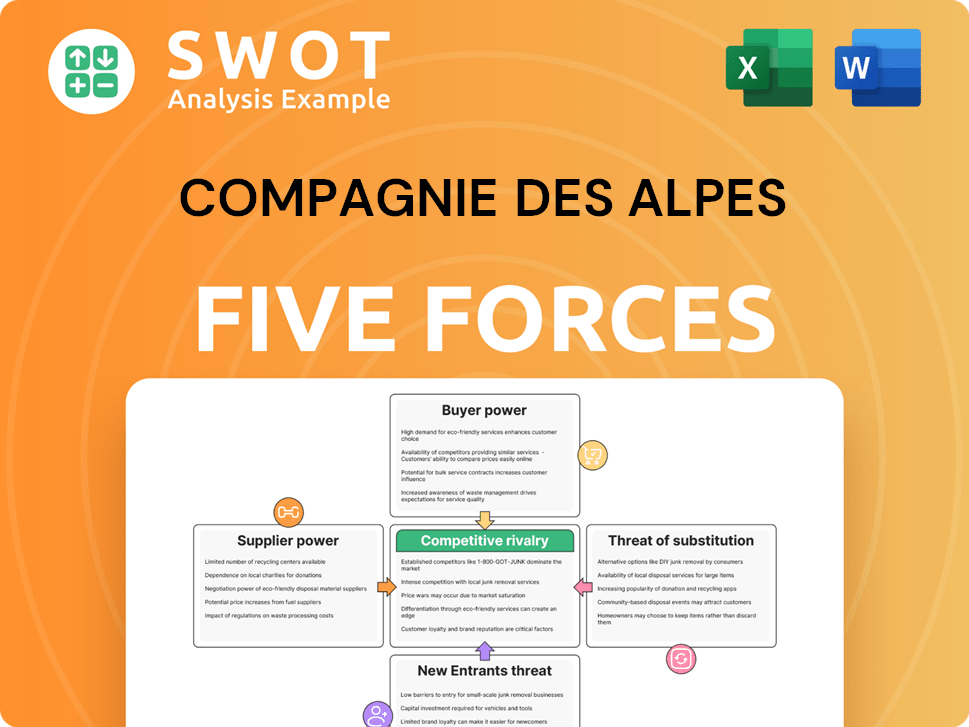

Compagnie des Alpes Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Compagnie des Alpes Company?

- What is Competitive Landscape of Compagnie des Alpes Company?

- How Does Compagnie des Alpes Company Work?

- What is Sales and Marketing Strategy of Compagnie des Alpes Company?

- What is Brief History of Compagnie des Alpes Company?

- Who Owns Compagnie des Alpes Company?

- What is Customer Demographics and Target Market of Compagnie des Alpes Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.