Escalade Bundle

How Did Escalade, Inc. Transform from Footwear to Sporting Goods?

Embark on a journey through time to uncover the fascinating Escalade SWOT Analysis and the remarkable evolution of Escalade, Inc. From its inception in 1922 as a humble manufacturer, the company has undergone a significant transformation. Discover how strategic partnerships and a clear vision propelled Escalade into the competitive world of sporting goods, leaving a lasting impact on the industry.

Escalade's story is a testament to adaptability and foresight, showcasing how a company can navigate market changes and seize new opportunities. The journey from its early days to its current market position, with a market capitalization of $211 million as of May 27, 2025, is a compelling narrative of growth. Explore the key milestones, innovations, and challenges that have shaped Escalade's trajectory, and learn how it became a prominent player in the sporting goods industry, rivaling even the success of the Cadillac Escalade in the automotive world.

What is the Escalade Founding Story?

The story of the Escalade company begins with a blend of manufacturing and the burgeoning sports goods market. It's a tale of two companies merging to create a new entity. This new company would eventually become a major player in the sporting goods industry.

The roots of the company can be traced back to the early 20th century. This era was marked by industrial growth and an increasing interest in leisure activities. This set the stage for the creation and evolution of the businesses that would eventually come together.

The company's history is a story of strategic consolidation and adaptation. It reflects the changing economic and cultural landscape of the United States.

The corporate lineage of the company is rooted in The Williams Manufacturing Company and Indian Archery and Toy Company. These two companies merged, setting the stage for Escalade Inc. The company focused on a diverse range of products.

- The Williams Manufacturing Company was established in 1922 in Portsmouth, Ohio, by Forest, Paul, and A. Graves Williams.

- Indian Archery & Toy Corporation was founded in 1927 in Evansville, Indiana, by H.M. Brading.

- The convergence of these companies began with transactions in 1972-1973, leading to the formation of Escalade Inc.

- The original business model involved manufacturing and reselling a diverse range of products.

The Williams Manufacturing Company, founded in 1922, initially produced footwear and office products. Indian Archery & Toy Corporation, established in 1927, specialized in archery equipment and table tennis manufacturing. The formal inception of Escalade Inc. in the 1970s saw a focus on both general manufacturing and the growing sporting goods market. Early offerings included footwear, office products, archery equipment, and table tennis. While the exact initial problems the founders identified are not readily available, the merger suggests an opportunity in the expanding sporting goods sector.

The corporate headquarters of the company, located in Evansville, Indiana, has an interesting history. The building was originally constructed in 1919 by Graham Brothers Trucks. It later passed through several owners, including The Dodge Brothers Company and Chrysler Corporation. This repurposed industrial infrastructure now serves as the company's home, highlighting the evolution of industry and recreation. The formation of Escalade Inc. through mergers indicates a strategic consolidation of established businesses. For more insights into the company's strategic direction, you can read about the Growth Strategy of Escalade.

The cultural and economic context of the early to mid-20th century influenced the creation and evolution of these companies. The growth in leisure activities and industrial advancements played a crucial role in shaping their trajectory. While specific funding details for the precursor companies are not available, the merger strategy suggests a focus on leveraging existing business strengths.

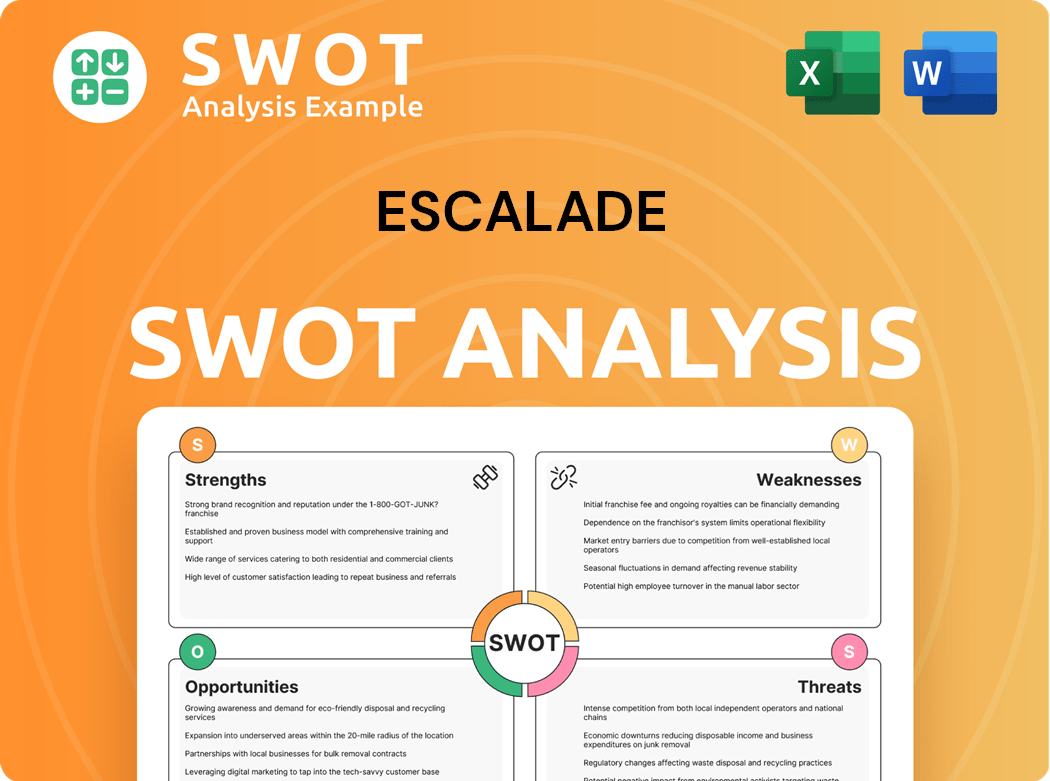

Escalade SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Escalade?

The early growth and expansion of the Escalade company involved strategic diversification and key acquisitions, especially after its formal establishment. Under the leadership of Robert E. Griffin, the company shifted its focus and expanded its product lines. This period saw the addition of various products and the acquisition of several companies to broaden its market presence.

After the formation of Escalade Inc. in 1972-1973, the company refined its focus. A significant change occurred in 1976 when Williams Manufacturing's footwear operations were discontinued, signaling a shift towards other product categories. This move allowed the company to explore new markets and product offerings.

In 1973, Escalade acquired the table tennis and billiards assets of IDEAL Toy Company. This acquisition expanded the company's indoor game offerings, allowing it to enter a new market segment. This strategic move broadened Escalade's product portfolio.

A new product line was added in 1977 with the commencement of pool table manufacturing. This expansion further diversified Escalade's offerings within the indoor games market. This addition increased the company's revenue streams.

Throughout the 1980s and 1990s, Escalade continued its expansion through strategic acquisitions. In 1986, it acquired Harvard Sports, Inc., a California manufacturer of table tennis tables and home pool tables. This acquisition solidified Escalade's position in game tables.

In 1986, Escalade added basketball backboards, goals, and poles to its product line, expanding into a major sporting goods category. The company also entered the fitness market by acquiring Marcy Fitness Products, Inc., a California manufacturer of home fitness and exercise equipment. These moves allowed Escalade to diversify its revenue streams.

Escalade has shown a commitment to operational efficiency, reducing inventories, with an additional $16 million reduction in 2024, an effort continuing into 2025. The sale of its facility in Mexico for $6.6 million in 2024 further improved operating leverage. Escalade's customer acquisition strategies have leveraged established relationships with major retailers. Learn more about the Target Market of Escalade.

As of December 31, 2024, Escalade employed 457 people, with the majority based in the USA. This highlights the company's focus on domestic operations and its contribution to the local economy. The company's workforce is a key asset in its continued growth and success.

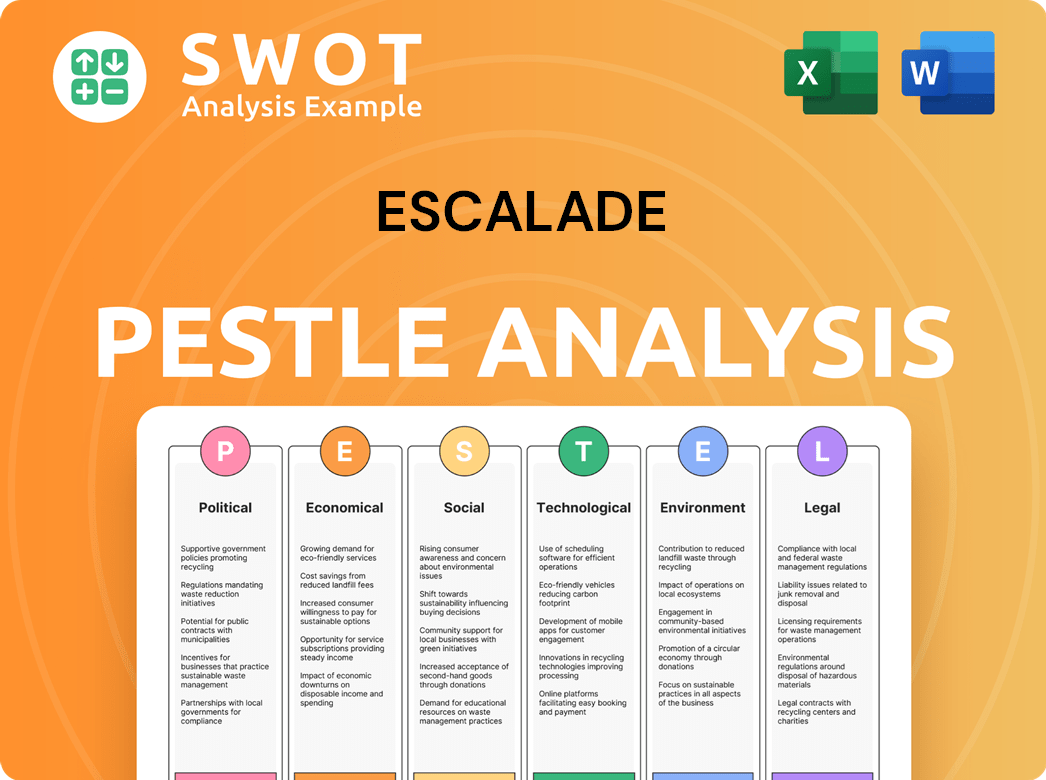

Escalade PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Escalade history?

The Escalade company has marked several significant milestones throughout its history, demonstrating its adaptability and growth within the sports and recreation industry. The company has consistently expanded its product offerings and brand presence, establishing itself as a notable player in various markets.

| Year | Milestone |

|---|---|

| Ongoing | Sustained focus on product development and brand building across its diverse portfolio, including Bear Archery®, STIGA®, Goalrilla™, and Onix®. |

| 2025 | Improved net income of $2.6 million in the first quarter, up from $1.8 million in the same period of 2024. |

| 2025 | Gross margin increased to 26.7% in Q1, up from 25.0% in Q1 2024, due to better cost management. |

Escalade's commitment to innovation is evident through its investment in new technologies and continuous product development. This includes advancements in archery, such as automatic sights and precision broadheads, as well as aligning with emerging consumer trends in healthy, active lifestyles.

Focus on developing new products and improving existing ones across its brands.

Investment in new technologies, such as automatic sights in archery, enhancing product performance.

Continuous development of products that align with emerging consumer trends in healthy, active lifestyles.

Onix-brand products have been a key player in the sport's rapid growth.

Escalade has faced challenges, including softer consumer demand in certain product categories and scrutiny during the COVID-19 pandemic. The company is actively managing the evolving global trade environment and evaluating options to mitigate the effect of new tariffs and potential supply chain disruptions.

Experienced softer consumer demand, particularly for basketball and table tennis products, leading to a 3.2% decrease in net sales in the first quarter of 2025 compared to the same period in 2024.

Received $5.6 million in federally backed small business loans during the COVID-19 pandemic, which it subsequently repaid in full.

Actively managing the evolving global trade environment and evaluating options to mitigate the effect of new tariffs and potential supply chain disruptions.

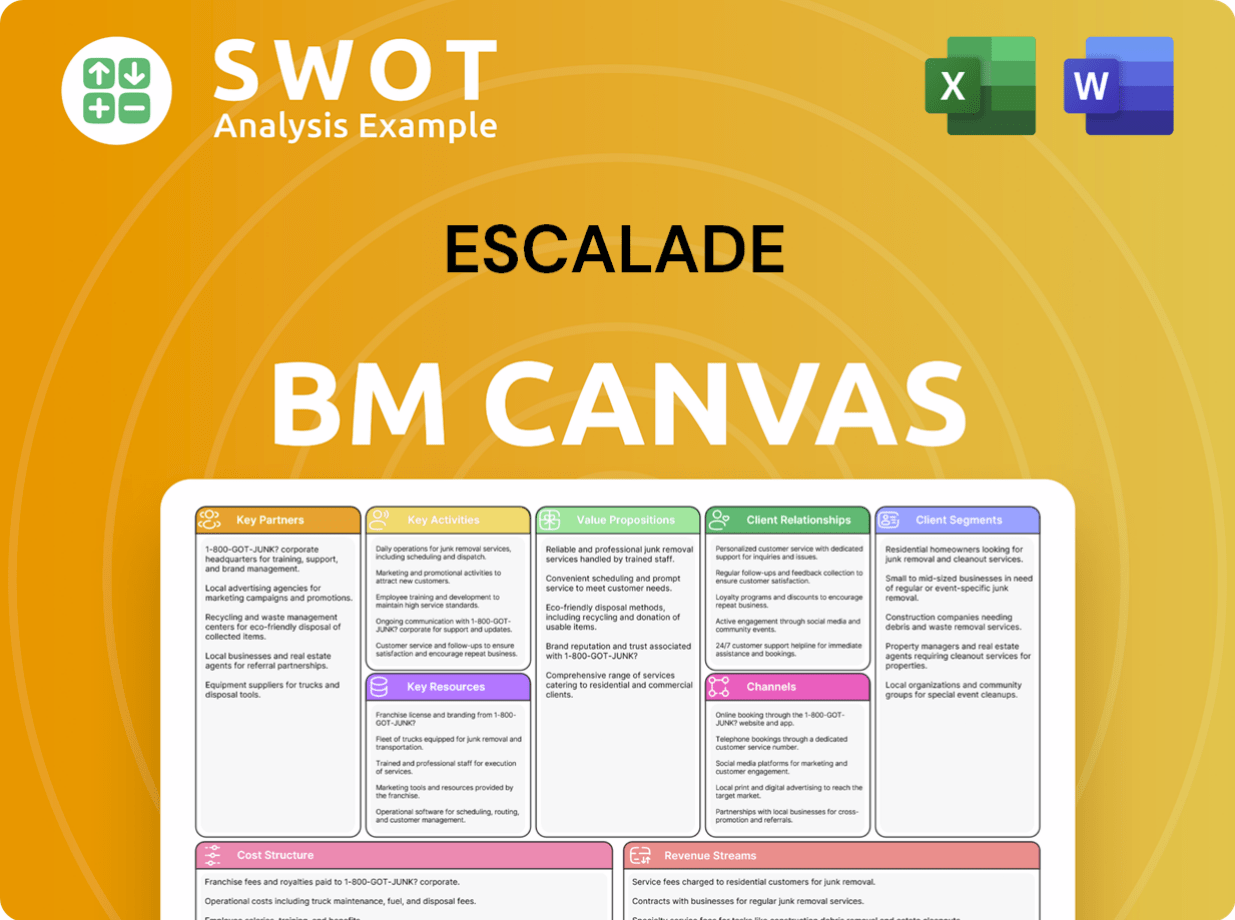

Escalade Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Escalade?

The history of Escalade, now a significant player in the sporting goods sector, reflects a journey of strategic acquisitions and product diversification. The company's roots trace back to the early 20th century, evolving through various mergers and acquisitions to establish its current form. The timeline showcases the company's expansion into diverse product categories, from table tennis to fitness equipment and water sports.

| Year | Key Event |

|---|---|

| 1922 | The Williams Manufacturing Company, a predecessor, was founded in Ohio. |

| 1927 | Indian Archery & Toy Corporation, another predecessor, was founded in Evansville, Indiana. |

| 1972-1973 | A series of transactions formally forms Escalade Inc. |

| 1973 | Acquisition of table tennis and billiards assets of IDEAL Toy Company. |

| 1976 | Williams Manufacturing footwear operations were discontinued. |

| 1977 | Company began manufacturing pool tables. |

| 1986 | Acquired Harvard Sports, Inc., and added basketball backboards, goals, and poles to the product line. |

| 1994 | Acquired Marcy Fitness Products, Inc., entering the fitness market. |

| 2020 | Acquired RAVE Sports, entering the water sports and recreation category. |

| 2022 | Acquired Brunswick Billiards business unit for $32 million. |

| December 31, 2024 | Reported full-year net sales of $251.5 million, a decrease of 4.6% from 2023, and reduced total debt to $25.6 million. |

| March 31, 2025 | Reported net sales of $55.5 million for Q1 2025, a 3.2% decrease from Q1 2024, with net income rising to $2.6 million. |

| April 1, 2025 | Armin Boehm assumed the role of CEO and President. |

| May 5, 2025 | Escalade held its First Quarter 2025 Results Conference Call. |

Escalade's growth strategy includes strategic acquisitions to expand its product portfolio and market presence. Recent acquisitions, such as RAVE Sports and Brunswick Billiards, demonstrate the company's commitment to diversifying its offerings. The company aims to leverage these acquisitions to strengthen its position in the sporting goods market.

In Q1 2025, Escalade reported net sales of $55.5 million, with a slight decrease compared to the previous year, but net income increased to $2.6 million. The company is focused on generating cash from operations and has sufficient credit for its operations in 2025. The company's strategic pillars are designed to ensure sustained growth and long-term shareholder value.

Escalade is working on expanding its customer base and market presence by leveraging its strong brands and customer relationships. The company is also prioritizing investments in new product development across its portfolio. They are focused on strengthening their direct-to-consumer and e-commerce presence to reach a wider audience.

Escalade's operational strategy is built on four pillars: Innovate, Operate, Generate, and Allocate. This framework is designed to drive sustained growth and long-term shareholder value. The company is committed to a balanced return of capital program, including dividends and share repurchases. Despite macroeconomic uncertainties, Escalade is well-positioned for profitable long-term growth.

Escalade Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Escalade Company?

- What is Growth Strategy and Future Prospects of Escalade Company?

- How Does Escalade Company Work?

- What is Sales and Marketing Strategy of Escalade Company?

- What is Brief History of Escalade Company?

- Who Owns Escalade Company?

- What is Customer Demographics and Target Market of Escalade Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.