Escalade Bundle

How Does Escalade, Inc. Stack Up in the Sporting Goods Arena?

The sporting goods industry is a dynamic battlefield, constantly reshaped by consumer desires and technological leaps. Escalade, Inc., a company with roots stretching back to 1927, has navigated these changes to become a prominent player. From its early days in archery to its current diverse product range, Escalade's journey offers a fascinating case study in market adaptation.

This Escalade SWOT Analysis will dissect the company's position within the Escalade competitive landscape, examining its key Escalade rivals and competitive advantages. We'll explore Escalade market analysis, including industry trends and future challenges, to understand how Escalade aims to maintain its edge. Understanding Escalade competitors 2024 and the broader Escalade vs Lincoln Navigator comparison, will provide valuable insights for investors and industry watchers alike.

Where Does Escalade’ Stand in the Current Market?

Escalade, Inc. carves out its space in the sporting goods industry, focusing on recreational and competitive equipment. While specific market share data for 2024-2025 isn't readily available, the company operates across key product areas such as table tennis, basketball goals, game tables, and archery. Its main offerings also include fitness equipment and outdoor games, catering to a diverse customer base, from individual consumers to educational institutions and commercial entities.

Escalade distributes its products through various channels, including mass merchants, sporting goods retailers, specialty dealers, and a growing online presence. This demonstrates a strong geographic reach across North America and internationally. Over time, Escalade has strategically positioned itself to emphasize quality and accessibility, serving both budget-conscious and premium segments within its product lines. For example, in table tennis, Escalade offers a range of tables from recreational models to professional-grade equipment, showcasing its ability to meet diverse customer needs.

Escalade's financial health, as shown in its latest annual reports for 2023-2024, reveals consistent revenue generation, with net sales reported as $290.4 million for the fiscal year ending December 30, 2023, and a gross profit of $68.5 million. This financial scale, while not always directly comparable to industry giants, positions Escalade as a stable mid-sized company within the fragmented sporting goods market. The company holds a particularly strong position in categories like table tennis and basketball goals, where its brands are well-recognized.

Escalade's market presence is primarily in North America, with increasing international reach. Its distribution network includes mass merchants, sporting goods retailers, and online platforms. The company's diverse product range, from table tennis to fitness equipment, targets a broad customer base.

Escalade's net sales for the fiscal year ending December 30, 2023, were $290.4 million, with a gross profit of $68.5 million. This demonstrates a stable financial position within the sporting goods industry. The company's financial performance is a key factor in its ability to compete effectively.

Escalade focuses on quality and accessibility across its product lines. This strategy allows it to cater to both budget-conscious and premium segments. The company's ability to offer a range of products, such as table tennis tables, highlights its diverse market approach.

Escalade's competitive advantages include a strong brand presence in categories like table tennis and basketball goals. Its diverse distribution channels and product offerings contribute to its market position. The company's financial stability also supports its competitive edge.

Escalade's market position is characterized by its diversified product portfolio and broad distribution network. The company's focus on quality and accessibility allows it to serve a wide range of customers. To better understand the company's strategies, you can explore the Marketing Strategy of Escalade.

- Strong presence in table tennis and basketball goals.

- Multiple distribution channels including online sales.

- Focus on both recreational and competitive equipment.

- Consistent revenue generation and financial stability.

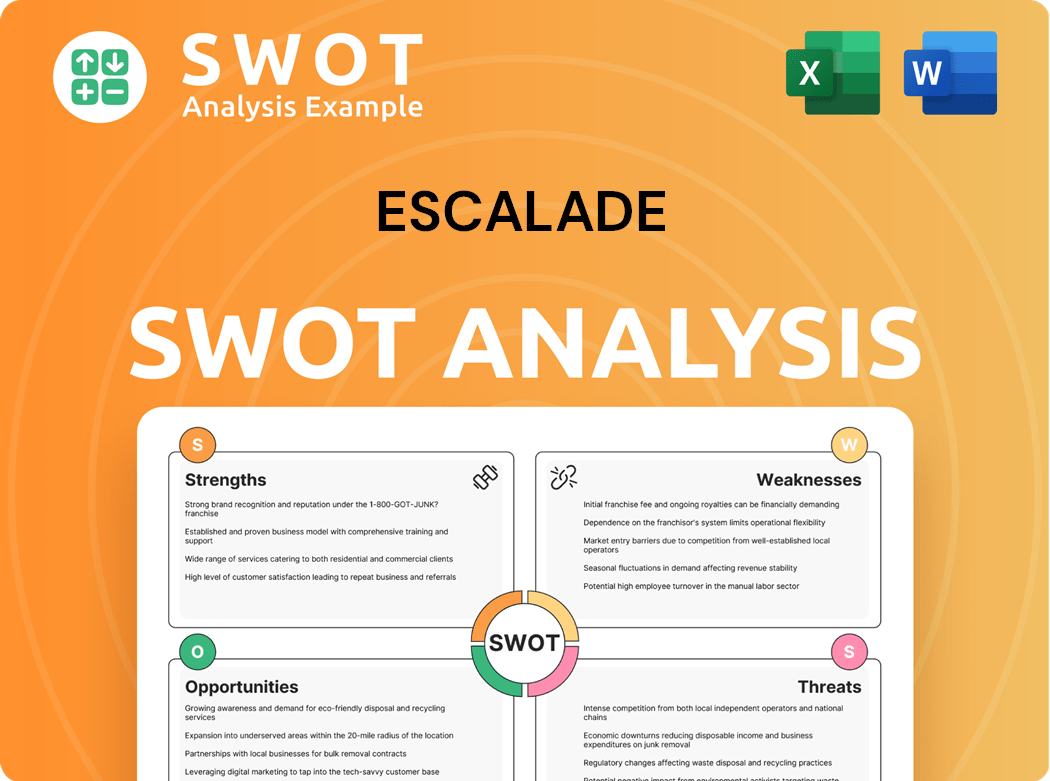

Escalade SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Escalade?

The Growth Strategy of Escalade is significantly influenced by the competitive landscape it navigates. The company faces a diverse array of rivals across its various product categories, from specialized manufacturers to large sporting goods companies. Understanding these competitors is crucial for Escalade to maintain its market position and drive growth.

Escalade's competitive environment is dynamic, shaped by factors such as technological advancements, consumer preferences, and the strategies of both established and emerging players. The company must continually assess its strengths and weaknesses relative to its competitors to make informed decisions about product development, pricing, and marketing.

The competitive landscape for Escalade varies significantly depending on the product category. In the table tennis segment, Escalade competes with established brands that have strong brand recognition and professional endorsements. For basketball hoops, the rivalry includes companies that differentiate themselves through material quality, innovative design, and ease of installation.

Key competitors in the table tennis segment include JOOLA, Butterfly, and Stiga. These companies offer a wide range of tables, paddles, and accessories.

In the basketball hoop market, Escalade faces competition from Lifetime Products, Goalrilla, and Spalding. These competitors often focus on material quality and design.

Escalade competes with numerous smaller manufacturers and private label brands in the broader game table market. Price is a significant competitive factor in this segment.

In archery, Escalade competes with PSE Archery, Bear Archery, and Mathews Inc. These companies often focus on high-performance bows and accessories.

Emerging players in online retail and direct-to-consumer models disrupt the traditional competitive landscape. They offer competitive pricing and direct customer engagement.

Large retailers like Dick's Sporting Goods and Amazon act as indirect competitors. They influence pricing and distribution dynamics through private labels and broad product assortments.

The competitive environment is shaped by mergers and acquisitions, which can alter market share and competitive strategies. Escalade must adapt to these changes to maintain its competitive advantages.

- Escalade market analysis requires ongoing monitoring of competitor strategies.

- Understanding the Escalade rivals helps in identifying opportunities for differentiation.

- Analyzing Escalade competitive landscape is crucial for strategic decision-making.

- The Escalade competitors 2024 include a mix of established and emerging players.

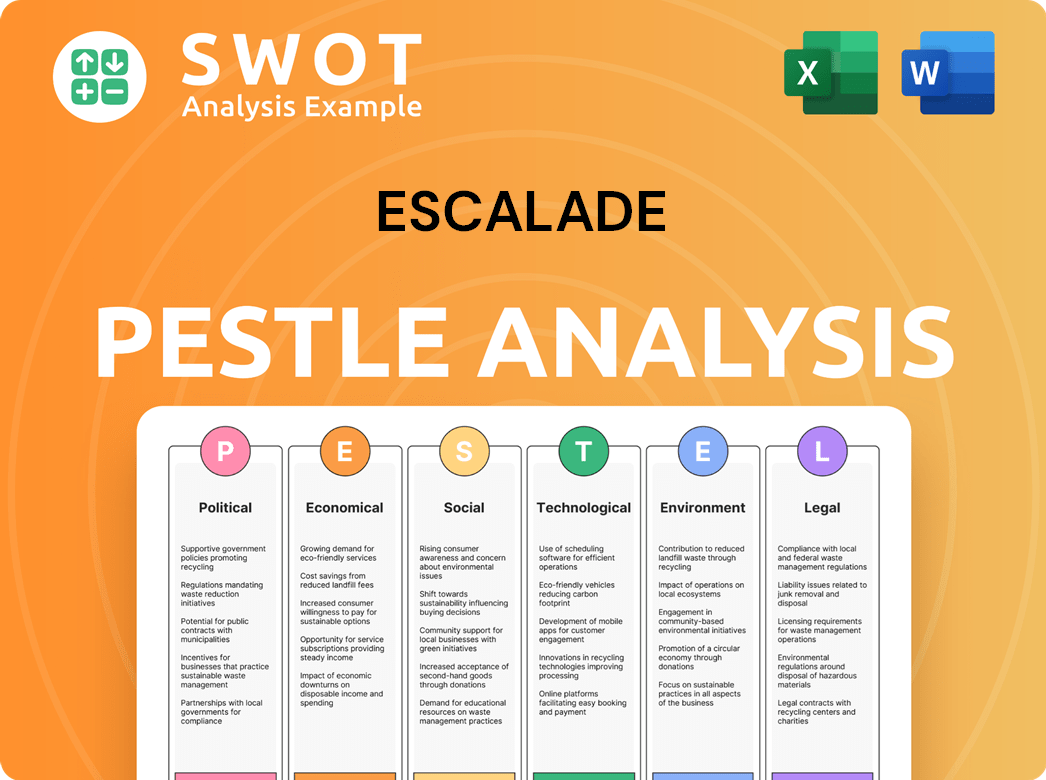

Escalade PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Escalade a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Escalade requires a deep dive into its strengths. The company's competitive advantages are rooted in its established brand equity, a diverse product portfolio, and an extensive distribution network. These factors collectively contribute to its strong market position.

Escalade's portfolio includes well-recognized brands such as Goalrilla, Silverback, STIGA (for table tennis), and Bear Archery, which have cultivated strong customer loyalty over the years. This brand recognition reduces customer acquisition costs and fosters repeat purchases. The breadth of Escalade's product offerings across multiple sporting goods categories allows it to cater to a wider audience and mitigate risks associated with reliance on a single product line.

Furthermore, Escalade benefits from a robust and extensive distribution network that includes relationships with major mass merchants, sporting goods retailers, specialty dealers, and a growing e-commerce presence. This widespread reach ensures product availability and accessibility to a broad consumer base. The company's operational efficiencies, including supply chain management and manufacturing capabilities, contribute to cost advantages and the ability to bring products to market effectively.

Escalade's portfolio of brands, such as Goalrilla and Bear Archery, enjoys strong customer loyalty. This loyalty results in lower customer acquisition costs. The established brands provide a significant competitive advantage in the sporting goods market.

The company offers a wide range of products across various sporting goods categories. This diversification helps mitigate the risks associated with relying on a single product line. It also allows for cross-selling opportunities and strengthens relationships with retailers.

Escalade has a robust distribution network, including major mass merchants and online platforms. This widespread reach ensures product availability and accessibility to a broad consumer base. The network supports its omnichannel approach.

Operational efficiencies, including supply chain management and manufacturing capabilities, contribute to cost advantages. These efficiencies enable the company to bring products to market effectively. This is a key factor in maintaining a competitive edge.

Escalade's competitive advantages include brand recognition, a diversified product line, and an extensive distribution network. These advantages are supported by continuous brand investment and strategic partnerships. However, the company faces threats from aggressive pricing by competitors and rapidly evolving consumer preferences.

- Brand Equity: Strong brand recognition across its portfolio.

- Product Diversification: Offers products in multiple sporting goods categories.

- Distribution Network: Wide reach through various retail channels and e-commerce.

- Operational Efficiency: Effective supply chain and manufacturing processes.

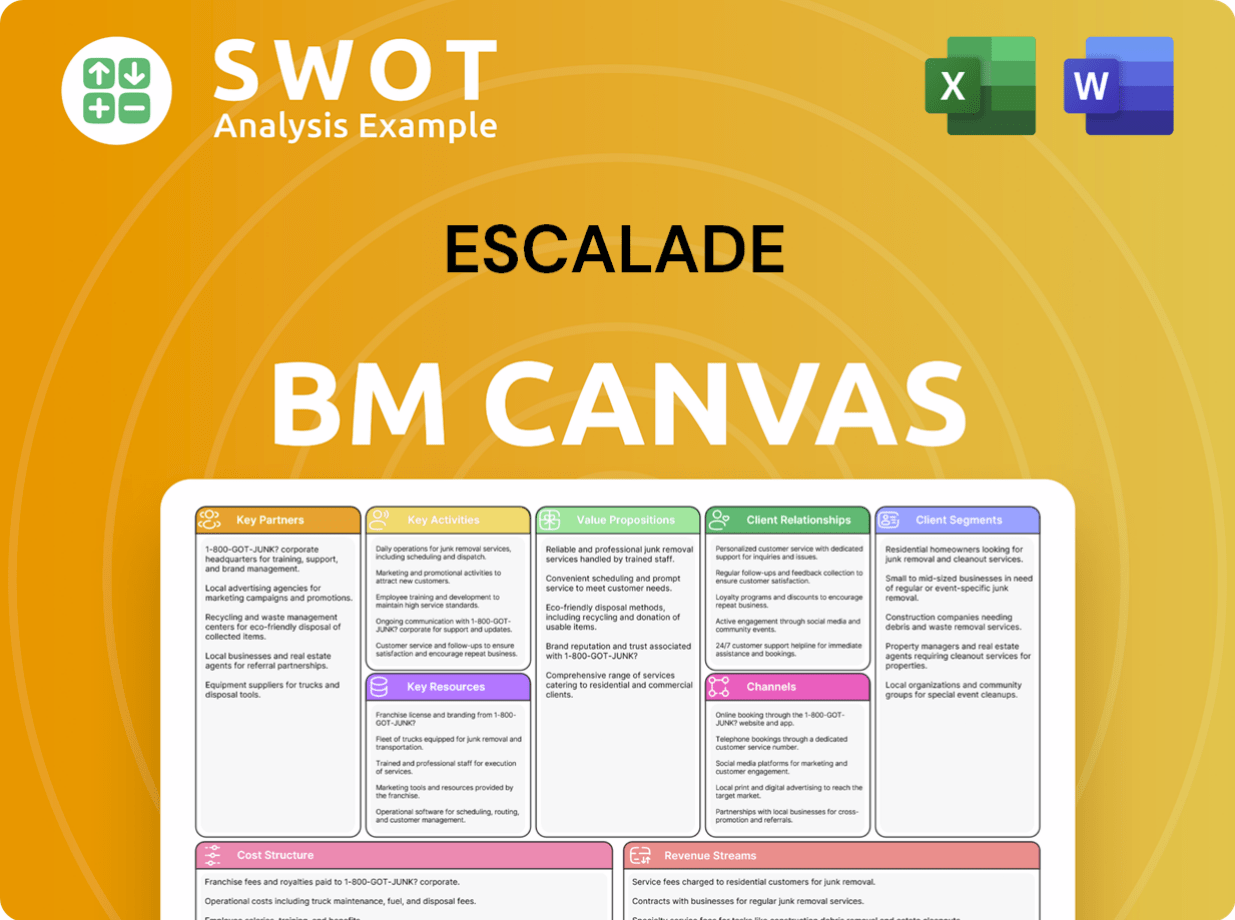

Escalade Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Escalade’s Competitive Landscape?

The sporting goods industry is currently undergoing significant shifts. These changes include the rise of e-commerce, an increased emphasis on health and wellness, and the growing demand for connected fitness products. Adapting to these trends is crucial for companies like Escalade to maintain a competitive edge in the market.

Escalade, like its competitors, must navigate challenges such as the accelerated shift to online retail and evolving consumer preferences for technologically integrated fitness solutions. Geopolitical factors and supply chain disruptions also continue to impact manufacturing and product availability. However, these challenges are balanced by opportunities in a market that is still growing.

The sporting goods market is seeing a surge in e-commerce, with online sales growing. Health and wellness continue to drive demand for fitness products. Connected fitness products are becoming increasingly popular, integrating technology for enhanced user experiences.

Adapting to the rapid growth of online retail requires continuous investment in digital infrastructure. Consumer demand for personalized and technologically advanced fitness solutions presents a need for innovation. Geopolitical factors and supply chain issues continue to impact manufacturing costs and product availability.

The global focus on health and active lifestyles sustains demand for sporting goods, offering significant market opportunities. Emerging markets provide avenues for expansion as disposable incomes rise. Product innovation, especially in smart fitness equipment, can attract new consumers.

Escalade should enhance its e-commerce capabilities to meet online demand. The company needs to introduce innovative products to cater to evolving consumer needs. Strategic acquisitions can help expand market reach and diversify the product portfolio. Also, Escalade needs to monitor Escalade competitors 2024.

Escalade's success hinges on adapting to market trends and seizing opportunities. The company's resilience depends on its ability to respond to industry changes and proactively pursue new avenues for growth. The Brief History of Escalade provides context to the company's evolution and strategic direction.

- Focus on e-commerce and digital marketing.

- Invest in product innovation, particularly in smart fitness.

- Explore strategic partnerships and acquisitions.

- Monitor and respond to geopolitical and supply chain risks.

Escalade Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Escalade Company?

- What is Growth Strategy and Future Prospects of Escalade Company?

- How Does Escalade Company Work?

- What is Sales and Marketing Strategy of Escalade Company?

- What is Brief History of Escalade Company?

- Who Owns Escalade Company?

- What is Customer Demographics and Target Market of Escalade Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.