Escalade Bundle

Who Really Owns Escalade, Inc.?

Delving into the ownership of Escalade, Inc. is key to understanding its strategic moves and market position. From its roots as Williams Manufacturing Company to its current status as a publicly traded entity on the Nasdaq (ESCA), Escalade's journey has been marked by significant shifts in ownership and strategic direction. Understanding the Escalade SWOT Analysis is a great start.

Escalade's history, from its 1922 founding to its evolution as a leading sporting goods manufacturer, reveals a complex ownership structure. Knowing who owns Escalade provides insights into its decision-making processes, financial health, and future prospects. This exploration will uncover the Escalade parent company and its impact on the Cadillac Escalade brand, its production location, and the overall company strategy.

Who Founded Escalade?

The origins of Escalade, Inc. are rooted in two key companies: The Williams Manufacturing Company and Indian Archery & Toy Corporation. These companies, founded in the early 20th century, laid the groundwork for the diversified manufacturing entity that would later become known as Escalade.

The journey to Escalade, Inc. involved several mergers and acquisitions, culminating in the company's official formation in 1973. Key figures like Robert E. Griffin played pivotal roles in shaping the company's direction and growth, transitioning from an ownership stake in Indian Archery to becoming CEO and later Chairman of Escalade.

The evolution of the company reflects a strategic vision to broaden its product lines beyond its initial offerings. This expansion, driven by mergers and acquisitions, was a critical step in establishing Escalade as a significant player in the manufacturing sector. The company's listing on the Nasdaq exchange further solidified its presence in the market.

Founded in 1922 in Portsmouth, Ohio, by the Williams brothers. It initially focused on footwear and office products.

Established in 1927 in Evansville, Indiana, by H.M. Brading. It specialized in archery equipment, badminton sets, and darts.

Played a significant role in Escalade's history. He sought equity ownership and helped shape the company's future.

Formed through mergers in 1972-1973. Williams Manufacturing merged with Martin-Yale Industries and acquired Indian Industries and Harvard Table Tennis.

Williams Manufacturing Company was reincorporated and renamed Escalade, Incorporated, on March 23, 1973. It was then listed on the Nasdaq exchange.

Griffin rolled his ownership from Indian Archery into Escalade, Inc. in 1973. He became CEO in 1976 and Chairman until 2015.

The early history of Escalade involves a series of strategic moves that shaped its ownership and direction. From the initial founders of Williams Manufacturing and Indian Archery to the key figures like Robert E. Griffin, the company's evolution reflects a focus on diversification and growth. For more insights into the company's financial strategies, consider reading about the Revenue Streams & Business Model of Escalade.

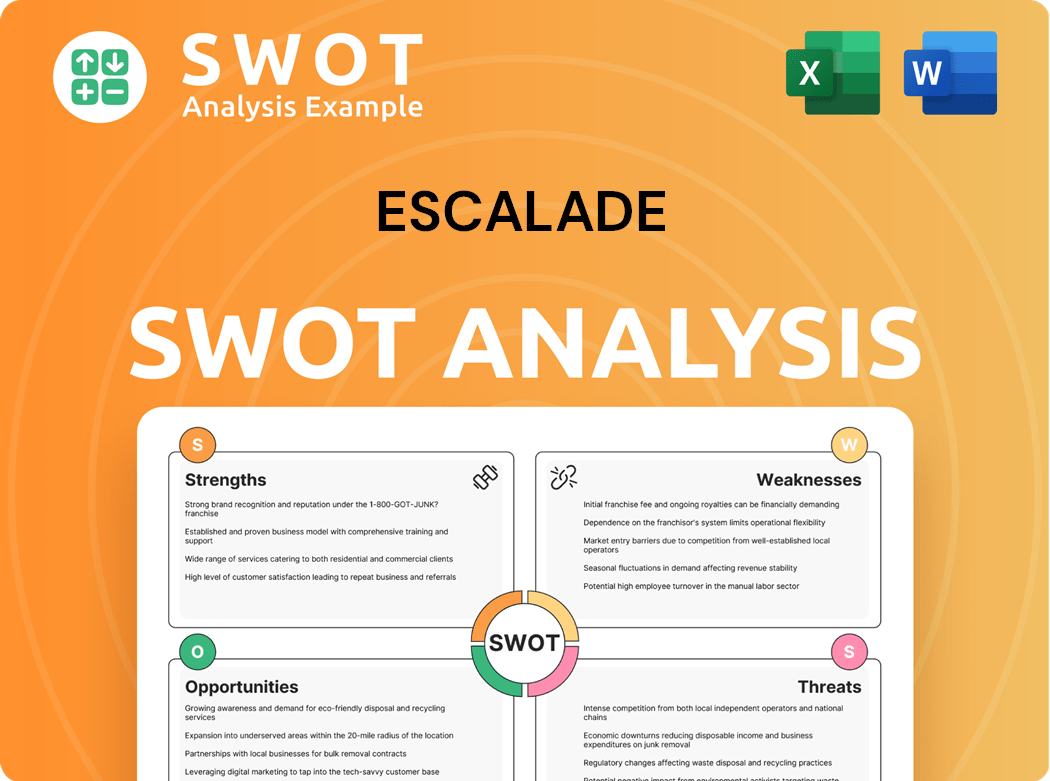

Escalade SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Escalade’s Ownership Changed Over Time?

The ownership structure of Escalade, Inc. has evolved since its reincorporation in 1973. As of June 11, 2025, the company is publicly traded on Nasdaq under the ticker symbol ESCA. The market capitalization is approximately $195 million, with roughly 13.8 million shares outstanding. This structure includes a mix of institutional investors, insiders, public companies, and individual investors, reflecting a diverse shareholder base.

Several strategic acquisitions have shaped Escalade's growth and, indirectly, its ownership dynamics. The acquisitions of Brunswick Billiards in January 2022, RAVE Sports in December 2020, and American Heritage Billiards in October 2020, among others, have expanded Escalade's presence in the sporting goods market. Furthermore, the company's capital management strategies, including debt management and equity repurchases, have influenced the ownership distribution. As of December 31, 2024, Escalade had a revolving credit facility of $60 million and had repurchased 2,297,715 shares.

| Ownership Category | Percentage of Shares | Approximate Shares |

|---|---|---|

| Institutional Investors | 39.91% | Approximately 5.5 million |

| Insiders | 29.07% | Approximately 4 million |

| Public Companies and Individual Investors | 31.02% | Approximately 4.3 million |

Key individual stakeholders include Patrick J. Griffin, who holds the largest share at 20.38%, equivalent to 2,809,680 shares. Other significant individual shareholders are Walter Glazer with 3.82% (527,051 shares) and Edward E. Williams with 3.25% (447,589 shares). Among institutional investors, Vanguard holds 3.59% (494,550 shares), Vanguard Index Funds holds 3.15% (434,141 shares), and Northern Lights Fund Trust II holds 3.11% (428,481 shares). This distribution highlights the influence of both individual and institutional investors in Escalade ownership.

Understanding Escalade ownership involves recognizing the roles of institutional investors, insiders, and public shareholders.

- Institutional investors hold a significant portion of the company's stock.

- Insiders, including key executives, also have a considerable stake.

- Public companies and individual investors make up the remaining ownership.

- The Marketing Strategy of Escalade has been influenced by these ownership dynamics.

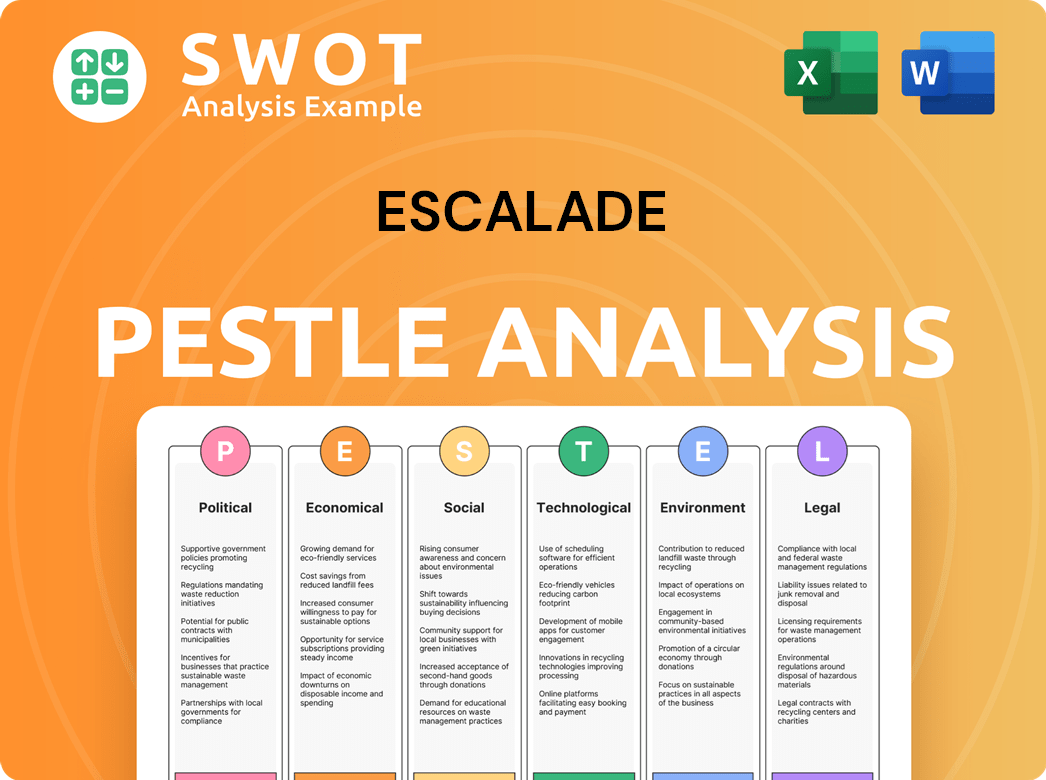

Escalade PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Escalade’s Board?

As of the 2024 Annual Meeting of Stockholders held on May 8, 2024, the Board of Directors of Escalade, Incorporated comprised five members. The nominees for election included Richard Baalmann, Jr., Katherine F. Franklin, Walter P. Glazer, Jr., Patrick J. Griffin, and Edward E. Williams. Each director elected serves a one-year term, expiring at the 2025 Annual Meeting or until their successors are elected. The current leadership structure includes Walter P. Glazer, Jr. as Chief Executive Officer, President, and Chairman of the Board, and Edward E. Williams as Lead Independent Director.

The board's composition includes both independent and executive members. Edward E. Williams, Katherine F. Franklin, and Richard F. Baalmann, Jr. are independent members. Walter P. Glazer, Jr. and Patrick J. Griffin are executive officers of the company. This structure is designed to balance strategic and operational leadership, with Mr. Glazer's extensive experience in both areas playing a key role. The company's commitment to shareholder engagement is evident through its annual advisory votes on executive compensation, with the Board and Compensation Committee considering the results in future compensation decisions.

| Director | Title | Independent |

|---|---|---|

| Walter P. Glazer, Jr. | Chief Executive Officer, President, and Chairman | No |

| Edward E. Williams | Lead Independent Director | Yes |

| Katherine F. Franklin | Director | Yes |

| Richard F. Baalmann, Jr. | Director | Yes |

| Patrick J. Griffin | Director | No |

The voting structure for Escalade's common stock is one-share-one-vote. As of February 28, 2024, there were 13,754,851 shares outstanding, each entitled to one vote. Patrick J. Griffin holds a significant voting power, owning 2,809,680 shares, which represents 20.38% of the company. For more information on the company's strategic approach, consider reviewing the Growth Strategy of Escalade.

Understanding Escalade ownership involves examining its board of directors and voting power. The company's structure ensures a balance between executive and independent leadership, with a clear voting structure. Key stakeholders influence decisions through their shareholdings.

- The Board of Directors consists of five members.

- Walter P. Glazer, Jr. serves as CEO, President, and Chairman.

- Patrick J. Griffin holds a significant percentage of voting power.

- Shareholders have advisory votes on executive compensation.

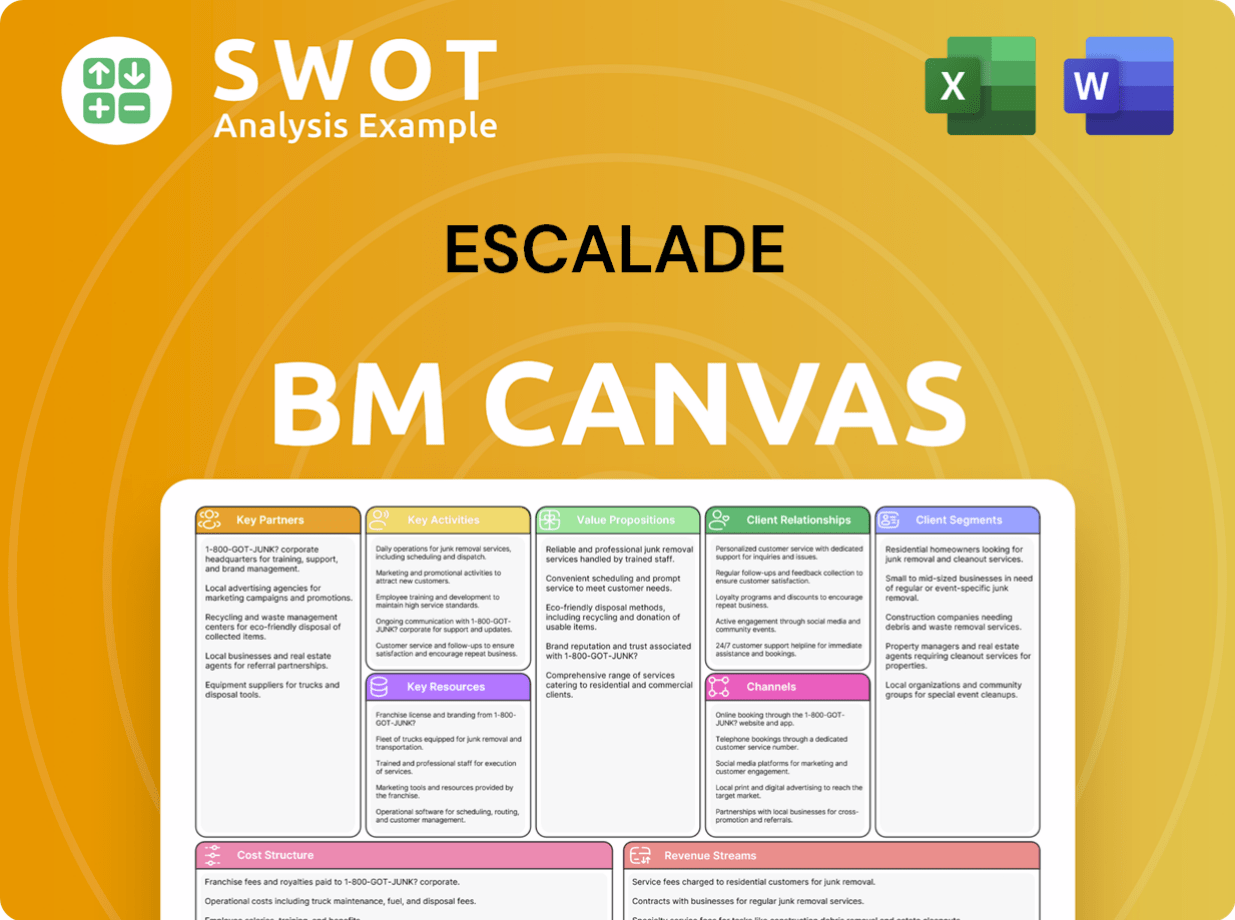

Escalade Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Escalade’s Ownership Landscape?

Over the past few years, Escalade, Inc. has shown a commitment to strategic financial management and leadership transitions. In February 2025, Armin Boehm took over as CEO and President. This change followed Walter P. Glazer, Jr.'s retirement, who then became Chairman of the Board. This shift reflects a focus on adapting to market dynamics and ensuring strong leadership for the future. Understanding Escalade's growth strategy provides insights into its operational approach and future direction.

Financially, Escalade has prioritized debt reduction and shareholder returns. In the fourth quarter of 2024, the company decreased its debt by $3.9 million, leading to a net debt to trailing twelve-month EBITDA ratio of 0.8x by the end of December 31, 2024, a significant improvement from 2.2x at the end of 2023. For the entire year of 2024, Escalade generated over $36 million in operating cash flow, allocating $25 million towards debt reduction. The board has also authorized a reset of the share repurchase program, allowing for up to $20.0 million in future stock repurchases, with $2.2 million in shares repurchased during the fourth quarter of 2024. Furthermore, a quarterly dividend of $0.15 per share was approved, payable on January 13, 2025.

| Metric | Value | Date |

|---|---|---|

| Institutional Ownership | Approximately 39.91% | Recent Data |

| Insider Ownership | 29.07% | Recent Data |

| Debt Reduction (Q4 2024) | $3.9 million | Q4 2024 |

| Net Debt to EBITDA (December 31, 2024) | 0.8x | December 31, 2024 |

| Operating Cash Flow (Full Year 2024) | Over $36 million | Full Year 2024 |

| Debt Reduction (Full Year 2024) | $25 million | Full Year 2024 |

| Share Repurchases (Q4 2024) | $2.2 million | Q4 2024 |

| Dividend per Share | $0.15 | January 13, 2025 |

In terms of ownership trends, institutional investors hold a substantial portion of Escalade's stock, around 39.91%, while insider ownership stands at 29.07%. The company continues to focus on strategic acquisitions and product development to boost growth in its Sporting Goods segment. For example, in 2024, the sale of its facility in Mexico for $6.6 million, resulting in a gain of $3.9 million, demonstrates its efforts to improve asset efficiency. Escalade is concentrating on accelerating new product development and reducing inventory in 2025. Despite some softness in consumer demand, Escalade remains committed to operational excellence and disciplined capital allocation, preparing for potential market upswings.

Escalade, Inc. has significant institutional ownership, indicating strong investor confidence. Insider ownership also plays a crucial role in the company's strategic direction and decision-making processes.

The company has shown strong financial discipline by reducing debt and returning capital to shareholders. This includes share repurchases and the payment of quarterly dividends, demonstrating a commitment to shareholder value.

Escalade is focused on strategic acquisitions and new product development to drive growth. The sale of the Mexico facility is an example of efforts to improve asset efficiency.

The company plans to accelerate new product development and reduce inventory in 2025. Despite market challenges, Escalade remains focused on operational excellence and disciplined capital allocation.

Escalade Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Escalade Company?

- What is Competitive Landscape of Escalade Company?

- What is Growth Strategy and Future Prospects of Escalade Company?

- How Does Escalade Company Work?

- What is Sales and Marketing Strategy of Escalade Company?

- What is Brief History of Escalade Company?

- What is Customer Demographics and Target Market of Escalade Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.