Estia Health Bundle

What's the Story Behind Estia Health?

Ever wondered how an Australian aged care provider became a major player? Estia Health, a key name in Estia Health SWOT Analysis, began its journey in 2005, quickly expanding its network of residential aged care homes across the country. From its initial public offering to its recent acquisition, Estia Health's story is one of significant growth and strategic shifts within the Australian aged care landscape.

This brief history of Estia Health explores the company's evolution, from its founding to its current status as a privately held entity. We'll delve into key milestones, including its IPO and acquisition by Bain Capital, and examine its operational footprint across Australia. Understanding the Estia Health company background is crucial for anyone interested in the aged care sector and the dynamics of retirement villages.

What is the Estia Health Founding Story?

The story of Estia Health began in 2005, founded by Australian entrepreneur Peter Arvanitis. The company's inception was driven by a clear vision: to provide residential aged care homes. These homes would offer a comprehensive suite of services designed to support elderly residents, including accommodation, personal care, and clinical support.

Headquartered in Sydney, Australia, Estia Health's establishment was a direct response to the growing demand for quality aged care services within the country. This focus on meeting the needs of an aging population has been a central theme throughout the company's history, shaping its growth and development within the Australian aged care sector.

In 2014, Estia Health made a significant move by going public on the Australian Securities Exchange (ASX). This initial public offering (IPO) valued the company at approximately $725 million. The IPO followed the amalgamation of three major care providers: Estia Health, Padman Health Care, and Cook Care. This merger created a larger entity capable of addressing the increasing demands of the aged care sector. Peter Arvanitis, a key figure in the company’s founding, became a director and the largest shareholder, remaining involved until his resignation as a director in 2016.

The founding of Estia Health in 2005 marked the beginning of its journey in the Australian aged care sector.

- 2005: Estia Health is founded by Peter Arvanitis.

- 2014: Estia Health is listed on the ASX, valued at $725 million. This was a pivotal moment, providing the company with significant capital for expansion and development.

- 2014: The amalgamation of Estia Health, Padman Health Care, and Cook Care further solidified its position in the market.

- 2016: Peter Arvanitis resigns as a director.

The initial funding sources for Estia Health before its IPO are not explicitly detailed in the provided information; however, the public listing in 2014 clearly indicates a substantial capital raise. The company's formation was influenced by the cultural and economic context of an aging Australian population, which led to an increasing demand for sophisticated and supportive aged care solutions. The company's strategic decisions, including its IPO and acquisitions, have been instrumental in shaping its growth and its ability to meet the evolving needs of its residents. For more insights into how Estia Health approaches its market, you can explore the Marketing Strategy of Estia Health.

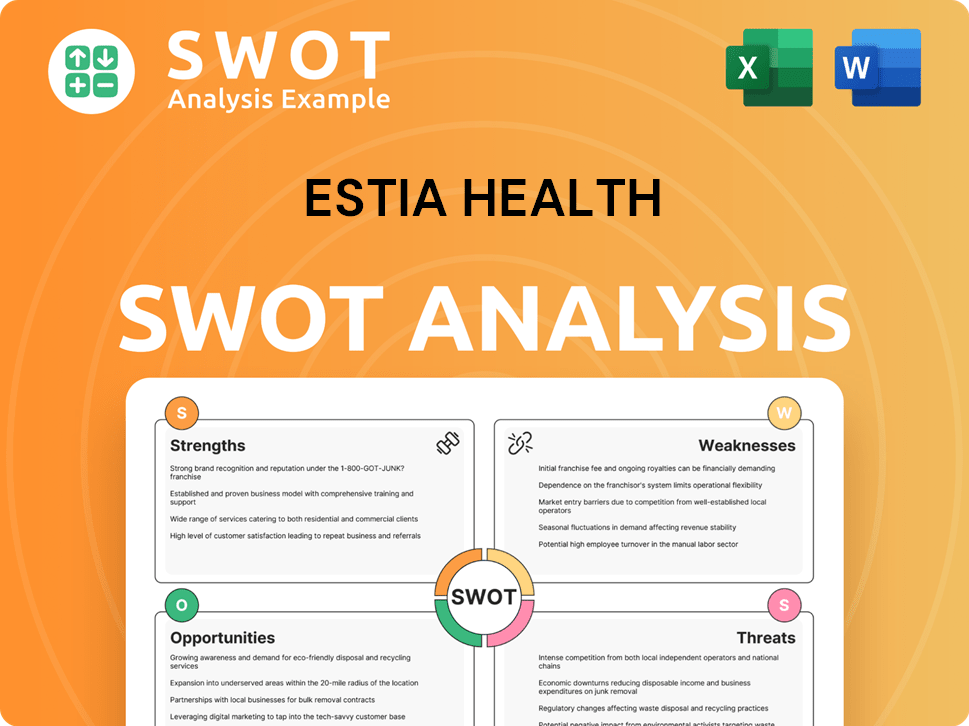

Estia Health SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Estia Health?

The early growth and expansion of Estia Health, a significant player in the Australian aged care sector, began after its founding in 2005. This phase was particularly marked by strategic moves following its listing on the Australian Securities Exchange (ASX) in December 2014. The company focused on building a strong network of facilities and broadening its geographical reach. This strategic direction has shaped Estia Health's trajectory, establishing it as a prominent provider in the Australian aged care landscape.

A key aspect of Estia Health's early expansion involved partnerships and facility development. For example, in June 2015, the company partnered with Living Choice to construct two new aged care facilities on the Sunshine Coast. These facilities were projected to add 216 aged care beds by the end of the 2019 financial year. This approach aligned with a broader industry trend towards integrated communities offering a range of health and aged care services.

Estia Health has actively pursued growth through strategic acquisitions. In 2022, the company acquired four residential aged care homes and two development sites from Premier Health Care Group for over $100 million. This acquisition added 409 resident places to its portfolio, with the potential for an additional 160-179 places from the development sites. These acquisitions have been crucial in expanding Estia Health's footprint and service capacity within the Australian aged care market.

Leadership transitions also played a role in shaping Estia Health's development. Sean Bilton was appointed CEO and Managing Director in July 2022, succeeding Ian Thorley. Prior to this, Bilton served as Chief Operating Officer and Deputy CEO since October 2018. During this time, he led key teams and oversaw the commissioning of new homes. These leadership changes have been instrumental in guiding Estia Health through its growth phases.

The expansion efforts of Estia Health have significantly impacted the Australian aged care sector. By developing new facilities, acquiring existing ones, and integrating services, the company has contributed to the availability and accessibility of aged care services. These strategic moves have helped Estia Health become a key player in the industry, influencing how aged care is delivered and experienced across Australia. For more insights, you can read a detailed overview of the company's history and services in this article about Estia Health history.

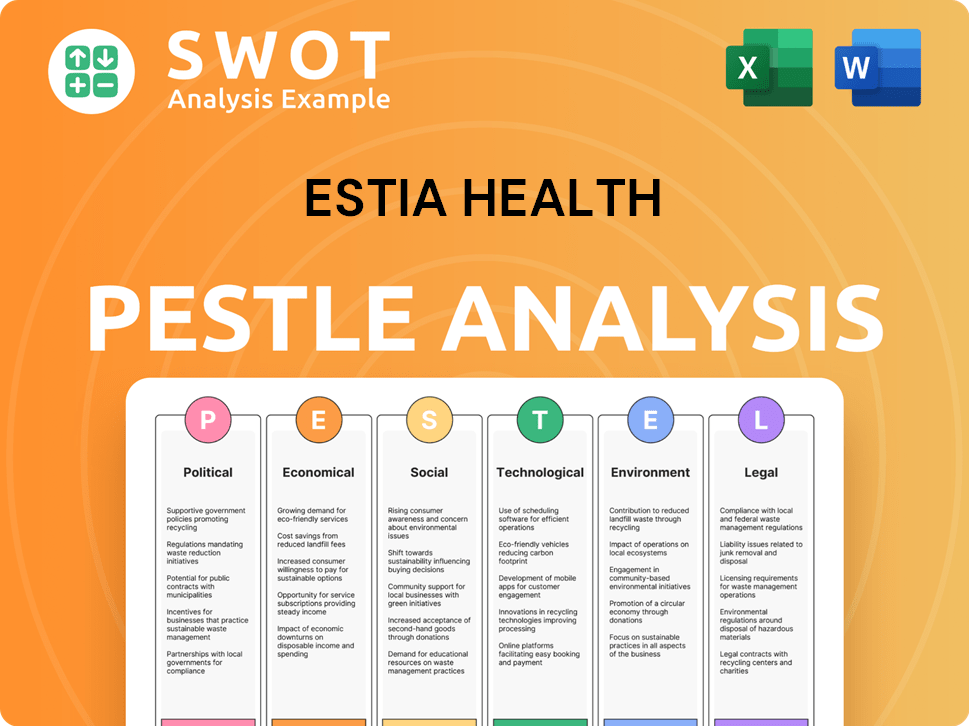

Estia Health PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Estia Health history?

The Estia Health company has experienced significant growth and transformation. This Estia Health history includes key Estia Health milestones that have shaped its journey within the Australian aged care sector.

| Year | Milestone |

|---|---|

| December 2014 | Estia Health listed on the Australian Securities Exchange (ASX), valued at $725 million, marking a significant step in its expansion. |

| 2019 | Partnered with CarePage to implement a digital customer experience survey for residents and families, enhancing service feedback. |

| December 2023 | Acquired by Bain Capital for $838 million, leading to a major strategic shift and privatization. |

| December 2024 | Undertook an enforceable undertaking to address non-compliance regarding Care Minute Responsibilities. |

Estia Health has focused on innovations to enhance resident care. They have partnered with Concentric to provide enhanced physiotherapy, rehabilitation, and other allied health services through their Wellness Centres, aiming to offer comprehensive care.

Estia Health collaborates with Concentric to provide enhanced physiotherapy and rehabilitation services. This partnership aims to offer comprehensive care through Wellness Centres.

The company works with Meat & Livestock Australia (MLA) to source high-quality Australian lamb and beef for resident meals. Chefs receive training to enhance culinary offerings.

Estia Health has partnered with CarePage since 2019 to implement a digital customer experience survey. This initiative gathers feedback from residents and families to improve services.

Estia Health has faced challenges, including financial and operational hurdles. The company's financial performance in FY22 was impacted by the COVID-19 pandemic, resulting in a net loss after tax of $52.4 million, and in September 2018, the share price declined following the government's announcement of a public inquiry into misconduct in the aged care sector.

In September 2018, Estia Health's share price dropped due to a public inquiry into misconduct in the aged care sector. This event highlighted concerns about industry practices.

The COVID-19 pandemic increased costs and staffing pressures, impacting Estia Health’s financial performance, with a net loss of $52.4 million in FY22. The pandemic created significant operational challenges.

Estia Health faced regulatory scrutiny regarding Care Minute Responsibilities, leading to an enforceable undertaking in December 2024. The company is working to address non-compliance.

The acquisition by Bain Capital in December 2023 for $838 million marked a major strategic shift. This move aims to position Estia Health for future growth in the Australian aged care sector.

Estia Health navigates industry trends and regulatory changes to maintain its focus on resident care. The company’s resilience is key to adapting its business model.

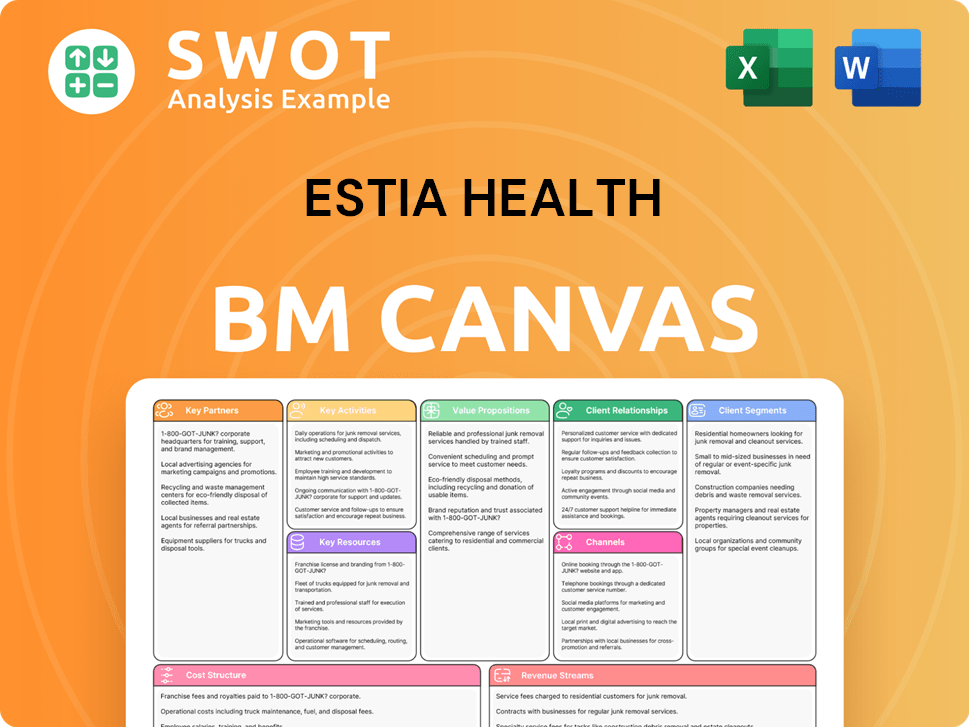

Estia Health Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Estia Health?

The Estia Health history is a journey marked by strategic expansions and adaptations within the Australian aged care landscape. Founded in 2005 by Peter Arvanitis, the company quickly grew, going public in December 2014 with a valuation of $725 million. Key milestones include partnerships, leadership changes, and navigating the challenges of the COVID-19 pandemic. Recent developments, such as acquisitions and the transition to private ownership under Bain Capital in December 2023, highlight its ongoing commitment to growth and its response to the evolving needs of the Australian aged care sector. The company's focus on acquisitions and development, especially in Queensland and NSW, aligns with the increasing demand for aged care services.

| Year | Key Event |

|---|---|

| 2005 | Peter Arvanitis founded Estia Health. |

| December 2014 | Estia Health listed on the Australian Securities Exchange (ASX). |

| June 2015 | Announced a partnership with Living Choice for new aged care facilities. |

| 2016 | Peter Arvanitis resigned as a director. |

| September 2018 | Company value declined following a public inquiry into the aged care sector. |

| 2019 | Established a partnership with CarePage for digital customer experience surveys. |

| 2020-2022 | Navigated significant challenges posed by the COVID-19 pandemic. |

| July 2022 | Sean Bilton appointed CEO and Managing Director. |

| 2022 | Acquired 4 residential aged care homes and 2 development sites from Premier Health Care Group. |

| July 2023 | Anthony Rice joined as Chief Financial Officer. |

| December 2023 | Ownership transferred to Bain Capital, taking Estia Health private. |

| November 2024 | Completed the purchase of Calvary Health Care's three aged care homes. |

| December 2024 | Entered into an enforceable undertaking with the Aged Care Quality and Safety Commission. |

| January 2025 | Acquired seven residential aged care homes from Aurrum Aged Care. |

| March 2025 | Confirmed plans to acquire two Mark Moran Group aged care homes. |

| April 2025 | Broke ground on a new 124-bed aged care home in Findon, Adelaide. |

Under Bain Capital's ownership, Estia Health is focused on expanding its portfolio through acquisitions and new developments. The acquisition of Mark Moran Group homes and the new facility in Findon, Adelaide, demonstrate this commitment. This strategic approach is designed to solidify its position as a leading provider within the Australian aged care market.

The company's strategic initiatives include investments in person-centered care and employee development. These investments are designed to enhance the quality of care provided, aligning with the evolving standards and expectations within the aged care sector. This focus is critical to maintaining a competitive edge.

The aged care sector in Australia is experiencing increased consolidation, with private equity firms playing a larger role. This trend is expected to continue. Analysts forecast a positive outlook for Estia Health, projecting potential revenue increases, reflecting the company's strategic positioning within a growing market.

If Estia Health were still public, analysts predict its stock price would be around AU$3.06 by the end of the current quarter and AU$2.99 in one year. A long-term increase to AU$4.376 by December 2028 is also predicted. This suggests a potential 42.09% revenue increase over a 5-year investment, supporting its mission to provide essential services.

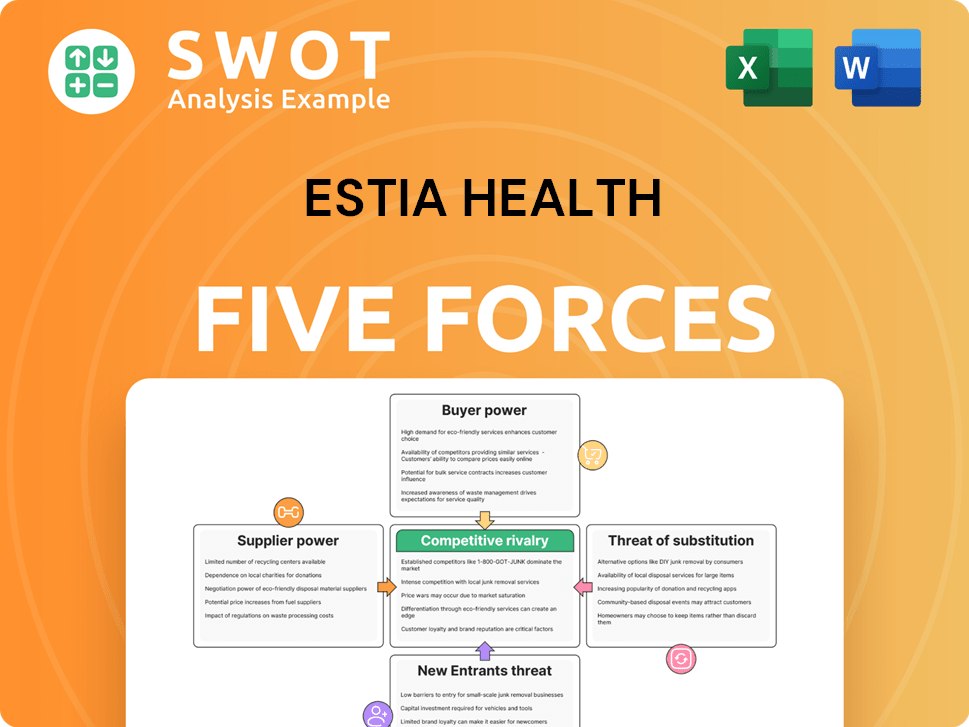

Estia Health Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Estia Health Company?

- What is Growth Strategy and Future Prospects of Estia Health Company?

- How Does Estia Health Company Work?

- What is Sales and Marketing Strategy of Estia Health Company?

- What is Brief History of Estia Health Company?

- Who Owns Estia Health Company?

- What is Customer Demographics and Target Market of Estia Health Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.