Estia Health Bundle

Can Bain Capital's Acquisition Propel Estia Health's Future?

Following its acquisition by Bain Capital in late 2023, Estia Health, a leading Australian aged care provider, is embarking on a new chapter. This transition from a publicly listed entity to a private company marks a significant strategic shift, prompting a deep dive into its Estia Health SWOT Analysis and future prospects. With a robust presence across Australia, operating 78 homes and serving thousands, understanding Estia Health's growth strategy is crucial.

This analysis explores the dynamic landscape of the Aged Care sector, focusing on Estia Health's expansion plans and its ability to navigate the evolving needs of the retirement living market. We'll examine how Estia Health is adapting to industry changes, its strategic partnerships, and the long-term growth potential in the context of its financial performance and competitive landscape. The insights provided will be invaluable for anyone seeking to understand the future of Healthcare and investment opportunities within the Australian market.

How Is Estia Health Expanding Its Reach?

Estia Health's growth strategy heavily emphasizes expansion through strategic acquisitions and brownfield developments within the aged care sector. The company has been actively pursuing opportunities to increase its footprint and service offerings. This approach is designed to capitalize on the evolving dynamics of the Australian aged care market and meet the rising demand for aged care services.

A key aspect of Estia Health's expansion involves acquiring existing aged care homes. This strategy allows the company to quickly add capacity and enter new geographical areas. These acquisitions are a direct response to the consolidation trends within the industry, where some providers face challenges due to capital constraints and regulatory changes.

The company's expansion plans are also influenced by the growing demand for aged care services in Australia. The aged care sector is valued at approximately AU$36.4 billion and is projected to reach AU$61.0 billion by 2033. This represents a compound annual growth rate (CAGR) of 6.70% during 2025-2033, indicating significant potential for growth and investment.

In late 2024, Estia Health expanded its presence in Queensland by acquiring three Calvary aged care homes. This acquisition strengthened its existing operations and provided additional capacity to serve the growing demand for aged care services in the region. This move is part of a broader strategy to increase its market share.

Estia Health is set to acquire seven residential aged care homes from Aurrum Aged Care in New South Wales and Victoria. This transaction, expected to be effective from April 1, 2025, will add approximately 800 residential aged care places to its portfolio. The acquisition allows Estia Health to enter new geographical areas, such as the Central Coast of NSW.

Estia Health has signaled its intention to consider brownfield developments at multiple sites. These developments involve expanding or redeveloping existing facilities. This approach allows the company to increase its capacity and improve its service offerings. This strategy supports the company's long-term growth objectives.

The company's expansion initiatives are designed to broaden its customer base, diversify its geographical presence, and take advantage of consolidation opportunities in the Australian aged care sector. By focusing on acquisitions and brownfield developments, Estia Health aims to stay ahead of industry changes and meet the growing demand. This strategic approach is key to its future prospects.

Estia Health's expansion strategy offers several key benefits, including increased market share and enhanced service offerings. The acquisitions and developments are aimed at improving the company's financial performance and long-term growth. This approach also allows Estia Health to better serve the needs of its residents.

- Increased access to new customers and markets.

- Diversification of the company's geographical footprint.

- Capitalization on consolidation opportunities within the aged care sector.

- Enhanced ability to meet the growing demand for aged care services.

For more detailed insights into the company's structure and financial performance, you can review information about Owners & Shareholders of Estia Health. This expansion strategy is crucial for Estia Health's future prospects in the Australian healthcare market, especially within the retirement living and aged care sectors.

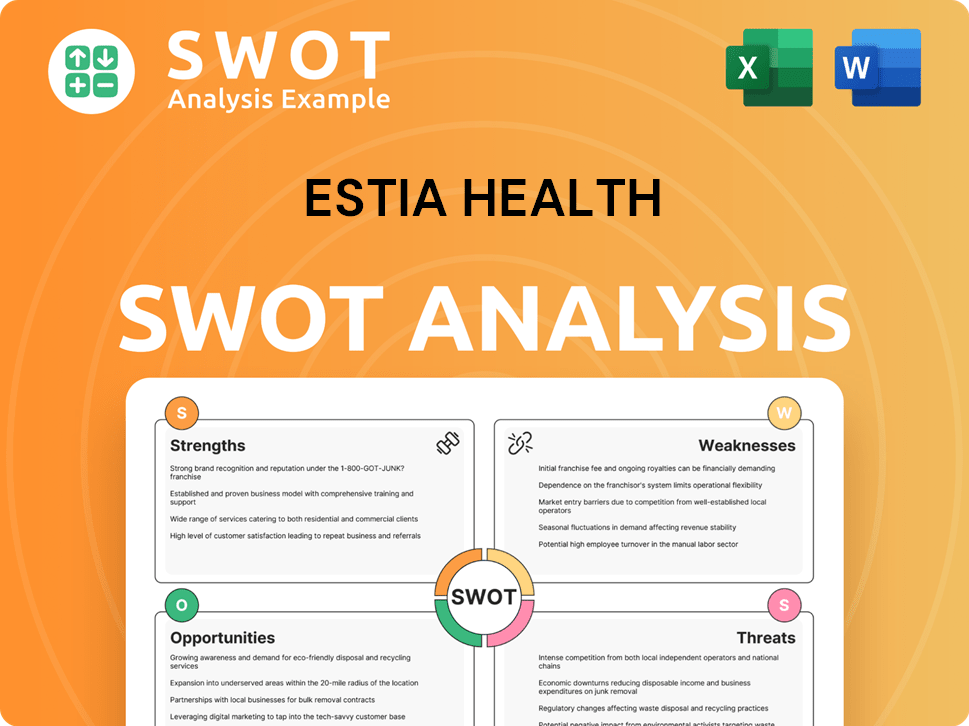

Estia Health SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Estia Health Invest in Innovation?

In the context of aged care, Estia Health's growth strategy is significantly influenced by its approach to innovation and technology. The company is adapting to the digital transformation sweeping the healthcare sector, particularly in Australia, where the Royal Commission into Aged Care Quality and Safety has highlighted the need for technology to improve client outcomes.

The integration of technology is crucial for enhancing care delivery and operational efficiency. This includes using digital tools to gain deeper insights into client needs, improving care analysis, and automating administrative tasks. Such advancements are essential for meeting the evolving demands of older Australians who increasingly seek personalized care plans.

While specific details on Estia Health's R&D investments or key patents are not publicly available, the company's commitment to technology is evident in its efforts to address workforce challenges, a pervasive issue in the sector.

Estia Health leverages technology to enhance care delivery and operational efficiency. Digital transformation is a key trend in the aged care sector, driven by the need to improve client outcomes and streamline operations.

In 2025, digital technology, AI, and automation are expected to play a significant role in delivering personalized, high-quality care. This includes tools for better care analysis and reducing administrative burdens.

Estia Health is using digital platforms to mitigate staffing challenges, a growing trend in the aged care sector. This is crucial for meeting increased direct care minute targets.

The aged care sector is seeing increased integration of smart technology, including wearables and remote monitoring tools. This improves health tracking and enhances quality of life.

The company is navigating regulatory changes such as increased direct care minute targets, which necessitate efficient workforce management. Technology-driven solutions are becoming essential.

These advancements contribute to growth objectives by improving care quality, optimizing resource allocation, and meeting the evolving needs of older Australians. This aligns with the overall Marketing Strategy of Estia Health.

The aged care sector is increasingly integrating smart technologies to enhance care and operational efficiency. These technologies are vital for meeting the needs of an aging population and improving the quality of life for residents.

- Wearable Devices: Used for health tracking and monitoring vital signs, leading to early detection of health issues.

- Remote Monitoring Tools: Enable continuous monitoring of residents' health, reducing the need for frequent in-person check-ups.

- Robotics: Assist with tasks such as medication dispensing and mobility support, improving efficiency and resident care.

- AI: Used for data analysis to personalize care plans and predict health risks, contributing to better outcomes.

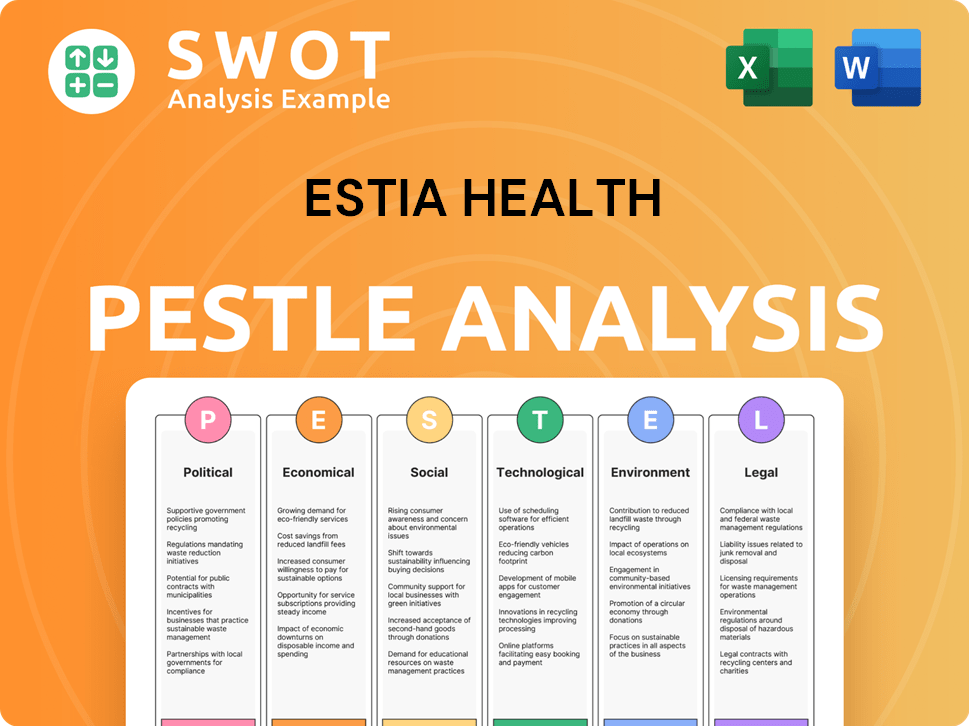

Estia Health PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Estia Health’s Growth Forecast?

The financial trajectory of Estia Health reflects a significant turnaround, driven by strategic operational improvements within the aged care sector. For the fiscal year ending June 30, 2023, the company reported a substantial increase in sales, reaching AUD 754.3 million, compared to AUD 671.07 million the previous year. Despite a net loss after tax of $33.9 million in FY23, this represented an improvement from a $52.4 million net loss in the prior year, indicating progress in financial stability.

The company's EBITDA for mature homes saw a significant increase, reaching $116.1 million in FY23, a notable rise from $37.5 million in FY22. This improvement highlights the effectiveness of operational strategies. Furthermore, the total revenue for 2024 reached $999,045,000, demonstrating continued growth.

The acquisition by Bain Capital Private Equity, LP in December 2023, for an enterprise value of $959 million, underscores a strong vote of confidence in the company's future. This acquisition, based on a cash consideration of $3.08 per share, represented a 50% premium over the closing share price on March 21, 2023, before the initial proposal, providing a significant capital injection to support growth initiatives.

As of December 2023, Estia Health's market capitalization was AUD 800.36 million. The acquisition by Bain Capital Private Equity, LP reflects a strong belief in the company's potential. This strategic move is expected to propel future growth.

Estia Health's average occupancy for FY23 was 92.3%, improving from 91.6% in FY22. Spot occupancy reached 93.5% as of August 2023. These high occupancy rates are crucial for financial health and operational success.

The company demonstrated strong sales growth, with revenue reaching AUD 754.3 million in FY23. The improvement in EBITDA for mature homes to $116.1 million in FY23 is a positive sign. The company's financial performance signals a strong turnaround and improved operational efficiency.

The acquisition by Bain Capital provided a significant capital injection. This investment is expected to support future growth initiatives, including acquisitions and developments. The deal's premium over the share price indicates confidence in Estia Health's future.

The strategic plans are supported by the significant capital injection from the acquisition. This capital is expected to support acquisitions and developments. The focus on strategic initiatives suggests a commitment to long-term growth.

For a deeper understanding of the company's revenue streams and business model, refer to the analysis of Revenue Streams & Business Model of Estia Health. This provides valuable insights into the company's operational structure.

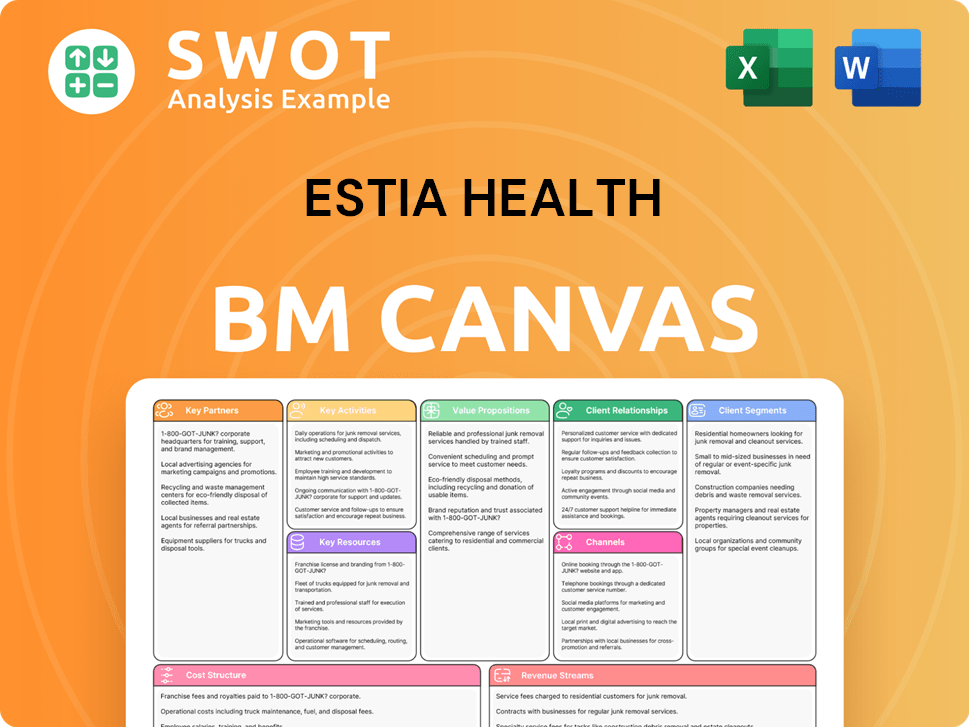

Estia Health Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Estia Health’s Growth?

The aged care sector and, by extension, Estia Health, navigates several significant risks that could hinder its growth strategy. These challenges encompass workforce shortages, regulatory changes, competitive pressures, and broader industry vulnerabilities. Understanding these potential obstacles is crucial for evaluating the company's future prospects and investment viability.

A major concern is the ongoing struggle to secure and retain a skilled workforce. Compliance with evolving regulations, including the new Aged Care Act starting in July 2025, adds further complexity. Moreover, the company must contend with market competition and potential industry consolidation, which could impact its operational and financial performance.

Estia Health must proactively address these risks to ensure sustained growth and maintain its position within the Healthcare and Retirement Living sectors. Strategic initiatives and adaptability will be key to overcoming these challenges and capitalizing on opportunities.

The aged care sector in Australia faces a critical shortage of staff. Projections indicate a need for over 17,551 additional aged care nurses by 2035. Over 41% of current workers feel they lack sufficient time to provide quality care, impacting service delivery and potentially increasing operational costs.

The introduction of the new Aged Care Act on July 1, 2025, brings a new regulatory model. This new model focuses on protecting resident rights, person-centered care, risk prevention, and continuous improvement. Compliance with direct care minute targets, which increased to 215 direct care minutes on October 1, 2024, also presents ongoing challenges.

The aged care market is subject to competition and consolidation. Some providers may exit the market due to capital constraints. This creates opportunities for Estia Health to expand through mergers and acquisitions. However, the company must navigate these market dynamics strategically to maintain its competitive edge.

The healthcare sector faces general risks from supply chain vulnerabilities and technological disruptions. Estia Health addresses these risks through its sustainability strategy. This includes targets for reducing waste and carbon emissions by 2024, aiming to mitigate the impact of these challenges.

Estia Health's financial performance is crucial for its Growth Strategy. The company's ability to manage costs, maintain occupancy rates, and adapt to regulatory changes directly impacts its financial health. Investors should carefully monitor these factors to assess the long-term viability of their investment.

Strategic partnerships can help Estia Health overcome operational challenges. Collaboration with healthcare providers, technology companies, and educational institutions can enhance service delivery and improve workforce training. These partnerships are critical for the company's ability to adapt to industry changes.

The aged care sector is constantly evolving. Estia Health must be agile in adapting to changes. This includes embracing new technologies, improving operational efficiencies, and responding to shifts in consumer preferences. The company's ability to adapt to these changes will significantly influence its Future Prospects.

Estia Health's sustainability initiatives are part of its risk mitigation strategy. These initiatives, including waste reduction and emission targets, help the company reduce its environmental footprint. This also enhances its reputation and aligns with broader societal goals, which is essential for long-term success. For more information on Estia Health's mission and values, visit Mission, Vision & Core Values of Estia Health.

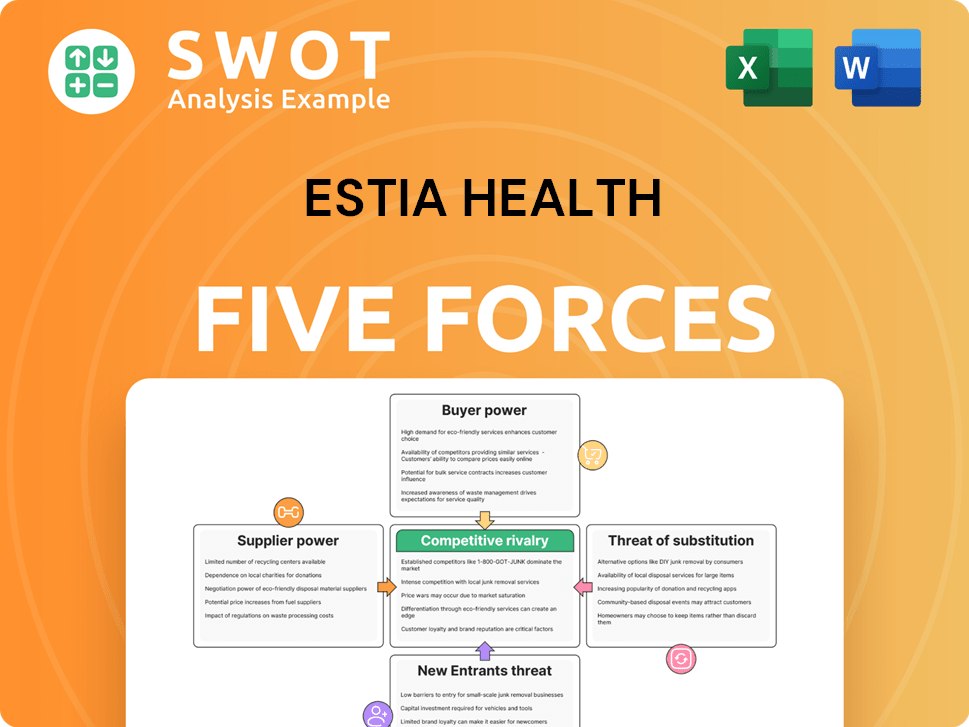

Estia Health Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Estia Health Company?

- What is Competitive Landscape of Estia Health Company?

- How Does Estia Health Company Work?

- What is Sales and Marketing Strategy of Estia Health Company?

- What is Brief History of Estia Health Company?

- Who Owns Estia Health Company?

- What is Customer Demographics and Target Market of Estia Health Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.