Estia Health Bundle

How Does Estia Health Navigate the Complex Aged Care Market?

The Australian aged care industry is in constant flux, shaped by an aging population and evolving care standards. Estia Health, a major player since 2014, has rapidly expanded to meet the growing demand for residential aged care. This analysis dives into Estia Health's competitive landscape to understand its position within this dynamic sector.

This exploration of the Estia Health SWOT Analysis will reveal its strengths, weaknesses, opportunities, and threats, offering a comprehensive Estia Health market analysis. We'll identify key Estia Health competitors and assess how Estia Health differentiates itself within the competitive aged care industry, providing actionable insights for investors and stakeholders alike. Understanding the competitive advantages of Estia Health is crucial for evaluating its future outlook and investment potential within the residential aged care market.

Where Does Estia Health’ Stand in the Current Market?

Estia Health's core operations center around providing residential aged care services across Australia. The company offers accommodation, daily living support, and specialized nursing care tailored to the individual needs of its residents. This comprehensive approach aims to create a comfortable and supportive environment for elderly Australians requiring various levels of assistance.

The value proposition of Estia Health lies in its commitment to quality care and its extensive network of facilities. By focusing on the well-being and comfort of its residents, Estia Health differentiates itself within the aged care industry. Its widespread presence across key states allows it to serve a broad demographic, making it a significant player in the market.

As of late 2023, Estia Health operated 69 residential aged care homes. These homes provided a total of 6,296 operational places. This makes Estia Health one of the largest providers in the Australian aged care market.

Estia Health's facilities are strategically located across Victoria, South Australia, New South Wales, and Queensland. This widespread presence allows the company to serve a diverse population. The geographic reach is a key factor in its competitive positioning.

Estia Health offers a range of services. These include accommodation, daily living support, and specialized nursing care. The services are tailored to meet the specific needs of each resident.

In late 2023, Estia Health was acquired by Bain Capital. This acquisition indicates a strong asset base and operational capacity. It may also enable more strategic moves.

Estia Health holds a significant position in the Estia Health competitive landscape. It consistently ranks among the top aged care providers in Australia. Key competitors include Regis Healthcare and Opal HealthCare. The acquisition by Bain Capital has the potential to influence the company's future strategic direction.

- The company's focus on quality care and comfortable environments is a key differentiator.

- Its extensive network of facilities allows it to serve a broad demographic.

- The financial backing from Bain Capital supports its competitive standing and potential for expansion.

- Estia Health's market analysis reveals a strategic focus on key Australian states.

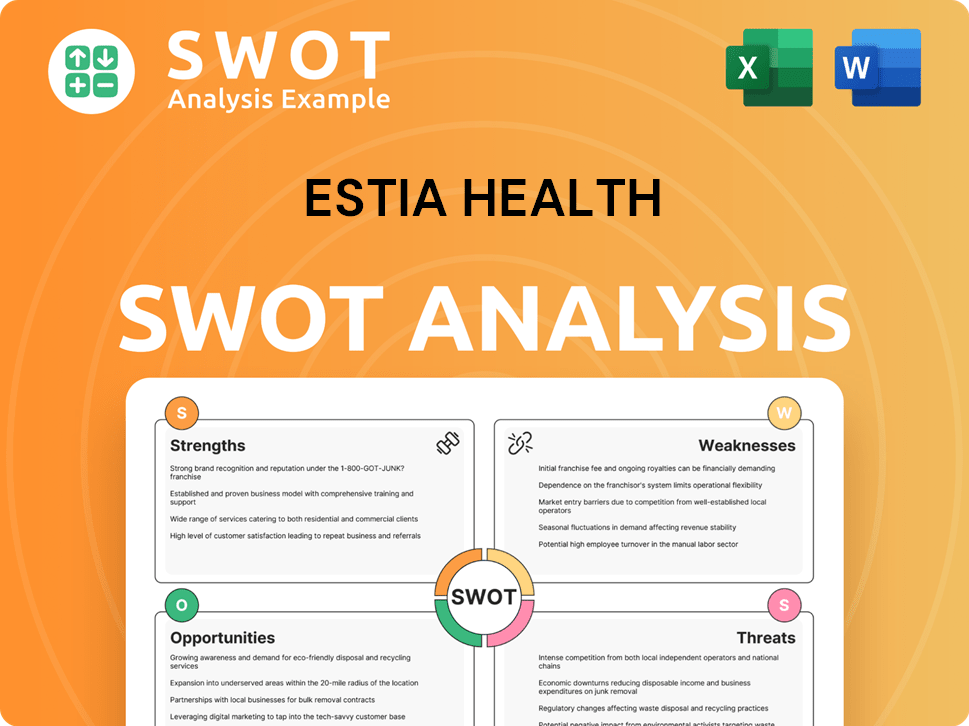

Estia Health SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Estia Health?

The Revenue Streams & Business Model of Estia Health operates within the Australian aged care sector, a market characterized by significant competition. Understanding the Estia Health competitive landscape is crucial for assessing its market position and strategic direction. This involves a detailed Estia Health market analysis to identify key players and their respective strengths.

The aged care industry in Australia is multifaceted, with various providers vying for market share. Estia Health competitors range from large, publicly listed companies to smaller, regional operators and not-for-profit organizations. The competitive dynamics are also influenced by in-home care services and the potential for new entrants, although the sector's barriers to entry are considerable.

Estia Health's primary competitors include established residential aged care providers. These companies compete on factors such as facility quality, service offerings, pricing, and geographic reach. The competitive landscape is constantly evolving, with mergers, acquisitions, and changes in regulatory frameworks impacting the market dynamics.

Regis Healthcare is a major competitor, offering residential aged care services across Australia. It competes directly with Estia Health for residents and staff. As a publicly listed company, Regis Healthcare's financial performance and strategic decisions significantly influence the market.

Opal HealthCare is another key player in the aged care industry, operating numerous facilities nationwide. It competes with Estia Health through its extensive network and service offerings. Opal HealthCare's presence is particularly strong in certain states, impacting the competitive dynamics in those regions.

Numerous smaller, regional, and not-for-profit aged care providers also compete with Estia Health. These providers may offer specialized care or cater to specific community needs. Their collective market share and localized focus pose a significant challenge.

In-home care services provide an alternative for elderly individuals who wish to remain in their homes. These services indirectly compete with residential aged care facilities by offering a different care model. The demand for in-home care is influenced by factors such as government policies and individual preferences.

New entrants to the aged care sector are limited by high capital expenditure and regulatory hurdles. However, new players can disrupt the market with innovative service models or specialized care options. The potential for new entrants influences the long-term competitive landscape.

Mergers and acquisitions, such as Estia Health's acquisition by Bain Capital in 2023, reshape competitive dynamics. These transactions can consolidate market power and lead to new strategic approaches. The financial implications of these deals impact Estia Health's financial performance review and competitive positioning.

Estia Health's competitive advantages include its established presence, service offerings, and potential for expansion. Challenges include competition from larger providers, the need to maintain high-quality care, and navigating regulatory changes. Understanding these factors is crucial for assessing Estia Health's future outlook.

- Estia Health vs. Regis Healthcare comparison reveals that both companies have a substantial national footprint.

- Estia Health service offerings analysis shows a focus on residential aged care, with potential for diversification.

- Top aged care companies Australia are constantly evolving, with market share fluctuating based on performance and acquisitions.

- Competitive advantages of Estia Health include its focus on quality care and strategic acquisitions.

- Estia Health recent acquisitions have shaped its market position and expansion strategy.

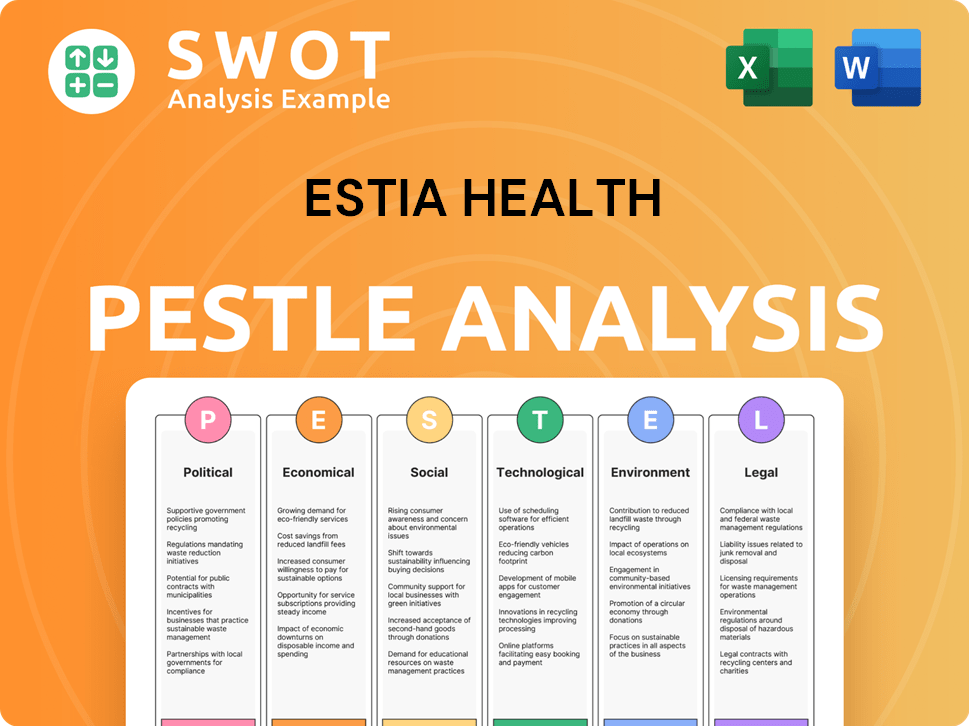

Estia Health PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Estia Health a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Estia Health involves recognizing its key strengths and how it positions itself within the aged care industry. The company's competitive advantages are primarily derived from its established network, commitment to resident-centric care, and operational scale. These factors are crucial in a sector where reputation and the quality of care are paramount. A thorough Estia Health market analysis reveals these elements as central to its strategy.

Estia Health's extensive footprint, with 69 residential aged care homes and 6,296 operational places as of late 2023, allows for significant economies of scale. This scale enables more efficient procurement processes, centralized management, and potentially better resource allocation across its facilities. The company's focus on creating a comfortable and supportive environment, tailored to individual resident needs, further differentiates it. This approach fosters trust and loyalty, which is vital in the residential aged care sector.

The recent acquisition by Bain Capital may further enhance these advantages by providing access to additional capital for facility upgrades, technology investments, and strategic initiatives, potentially strengthening its market position and allowing for more agile responses to market changes. These advantages are generally sustainable given the high barriers to entry in the aged care sector, though they require continuous investment and adaptation to evolving regulatory and consumer expectations. For a deeper dive into the company’s strategic direction, consider exploring the Growth Strategy of Estia Health.

Estia Health's large network of aged care homes provides a significant competitive advantage. This extensive presence allows for economies of scale in operations and procurement. The wide geographical reach also enhances accessibility for families seeking aged care services.

A key differentiator is Estia Health's emphasis on providing a comfortable and supportive environment. This focus on individual resident needs fosters trust and loyalty. This approach is critical in the aged care industry, where reputation is a significant factor.

Estia Health leverages its scale to optimize operational efficiencies. This includes streamlined management processes and effective resource allocation. These efficiencies contribute to the company's ability to deliver high-quality care.

The company invests in attracting and retaining a skilled workforce through training and development programs. This ensures high standards of clinical and personal care. A well-trained staff is crucial for maintaining quality of care and resident satisfaction.

Estia Health's competitive advantages are multifaceted, encompassing its extensive network, commitment to resident-focused care, and operational efficiencies. These strengths are reinforced by strategic investments and a focus on workforce development, positioning the company favorably within the aged care industry.

- Extensive Network: A large footprint across multiple states provides economies of scale and accessibility.

- Resident-Centric Approach: Prioritizing individual needs fosters trust and loyalty among residents and families.

- Operational Efficiency: Streamlined processes and resource allocation enhance service delivery.

- Skilled Workforce: Investment in training ensures high standards of care.

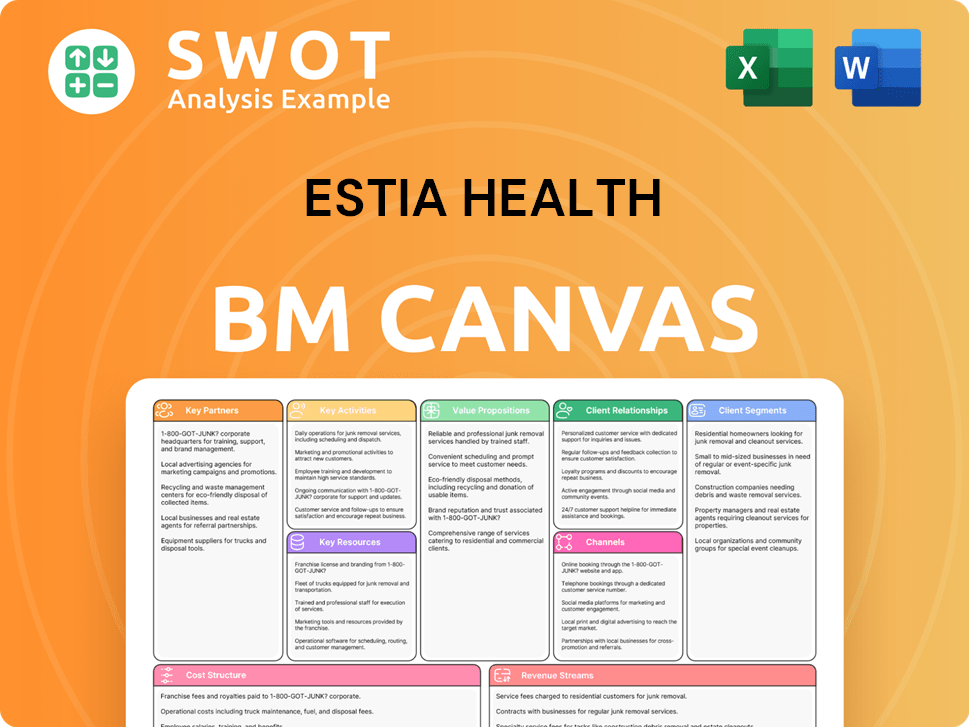

Estia Health Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Estia Health’s Competitive Landscape?

The Australian aged care sector is undergoing significant transformation, influencing the Estia Health competitive landscape. This evolution is driven by technological advancements, regulatory changes, and shifting consumer preferences. These factors shape the Estia Health market analysis, presenting both challenges and opportunities for aged care providers like Estia Health. The future outlook for the company depends on its ability to adapt and innovate within this dynamic environment.

The sector faces increased scrutiny on quality, staffing, and financial sustainability. The Royal Commission into Aged Care Quality and Safety has led to stricter compliance requirements and a focus on resident outcomes. Despite these challenges, the growing aging population ensures sustained demand, offering a strong underlying market for companies like Estia Health. Understanding these trends is crucial for assessing the company's strategic positioning and potential for growth. For a deeper dive into the company's background, consider reading a brief history of Estia Health.

Technological integration, including remote monitoring and telehealth, is growing. Regulatory changes continue, emphasizing quality and transparency. Consumer preferences are shifting toward personalized care and greater choice. These trends are reshaping the aged care industry.

Ongoing investment in technology and infrastructure is necessary. Navigating a complex regulatory landscape and attracting skilled workforce are critical. Maintaining financial sustainability amidst increasing scrutiny on care standards and staffing levels is essential. Ensuring compliance with new care minute requirements is also a significant challenge.

The growing aging population ensures sustained demand for residential aged care services. There is opportunity to invest in innovative care models and expand service offerings. Strategic partnerships with healthcare providers and technology companies can unlock growth. Differentiation through quality and transparency can provide a competitive edge.

Focus on quality, efficiency, and resident-centric care is crucial. Strategic investments to remain resilient and responsive to the dynamic needs of the sector are vital. Adapting to evolving consumer preferences and leveraging technology can enhance service delivery. Proactive responses to regulatory changes are essential for maintaining a strong market position.

Estia Health's ability to navigate these trends will determine its future success. Key factors include financial performance, market share, and customer satisfaction. The company's expansion strategy and recent acquisitions will play a role in its growth. Understanding the competitive landscape, including Estia Health competitors, is critical.

- Market Share: Estia Health's market share in Australia is a key indicator of its competitive standing.

- Financial Performance: Reviewing the company's financial results provides insights into its operational efficiency and profitability.

- Customer Satisfaction: High customer satisfaction ratings can lead to positive brand perception and loyalty.

- Expansion Strategy: Strategic acquisitions and facility expansions can drive growth.

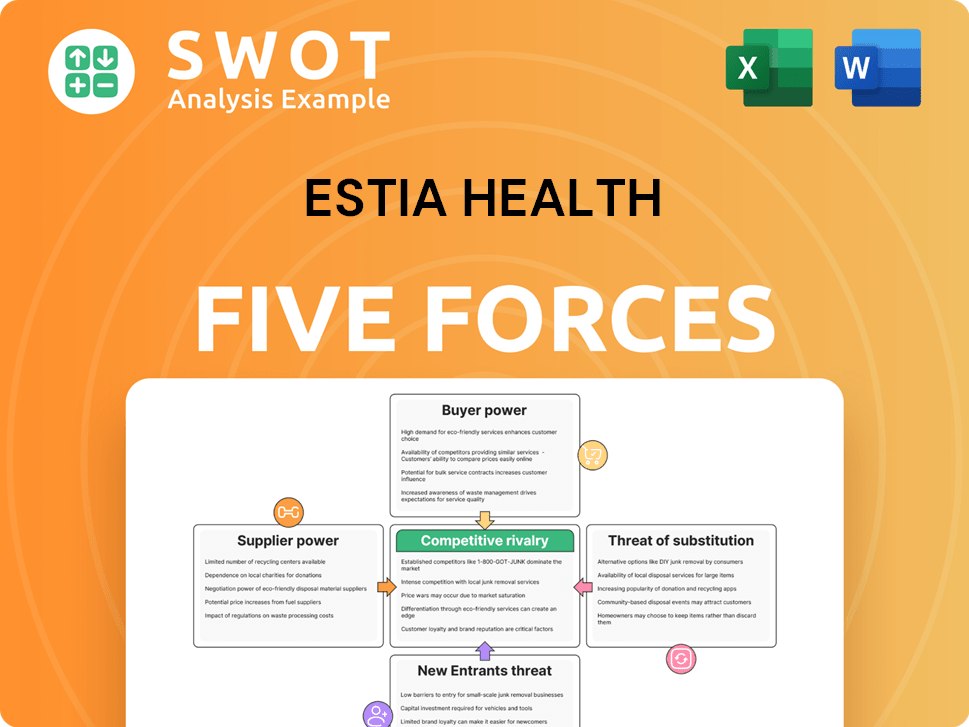

Estia Health Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Estia Health Company?

- What is Growth Strategy and Future Prospects of Estia Health Company?

- How Does Estia Health Company Work?

- What is Sales and Marketing Strategy of Estia Health Company?

- What is Brief History of Estia Health Company?

- Who Owns Estia Health Company?

- What is Customer Demographics and Target Market of Estia Health Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.