Everest Bundle

What's the Story Behind the Everest Company?

Everest, a familiar name in home improvement, boasts a rich history in the UK market. From its humble beginnings, the Everest SWOT Analysis reveals a journey marked by innovation and resilience. This exploration uncovers the key moments that shaped the Everest brand.

The brief history of Everest Company begins in 1965, with a focus on improving homes. Understanding the Everest history is crucial for anyone interested in the evolution of home improvement. From its early days to its current status, the Everest brand has constantly adapted. Exploring this Everest timeline offers valuable insights into its enduring presence in the market.

What is the Everest Founding Story?

The story of the Everest Company began in 1965. It was initially known as 'Home Insulation Ltd' and was established in Waltham Abbey.

David Kingsley was one of the founders of the company. His vision was to address the need for insulation in post-war homes. Many of these homes were poorly built due to material shortages and under-investment.

The company's initial focus was on manufacturing and selling aluminum secondary glazing. This marked the beginning of the Everest history.

The early days of the company were marked by a commitment to quality. The goal was to 'fit the best,' which became a defining characteristic of the Everest brand in the 1970s.

- The company's windows were frequently independently tested.

- They consistently ranked as superior products.

- The brand name 'Everest' was adopted to symbolize the company's position as a leading producer.

- The economic conditions of the mid-1960s, with rising living standards and homeownership, were favorable for the company's growth.

Everest SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Everest?

The early growth of the Everest Company saw significant developments. The company's journey began with a merger that facilitated access to retail markets and raw materials. This strategic move allowed the company to establish itself and command premium prices in the market. The Everest history is marked by key milestones that shaped its trajectory.

In 1968, Home Insulation Ltd merged with Pillar Aluminium Holdings. This was later acquired by Rio Tinto, forming Pillar RTZ. This acquisition was crucial for the Everest brand, providing direct access to retail markets and raw materials, which was essential for its growth.

The 1970s and 1980s were pivotal for the company. The company launched innovative products such as aluminum double glazing and sliding patio doors. These innovations helped to solidify the company's position as a leader in the double-glazing market, shaping the Everest products portfolio.

During the 1970s oil recession, the company invested heavily in advertising. In 1978, Ted Moult, a TV personality, became the face of the brand. The company also used the Tan Hill Inn to showcase its draught-proofing capabilities, enhancing its brand image and marketing strategy.

By 2009, the company had grown to become the second-largest in the UK double-glazing market. It held 2.5% of the market with £165 million in sales, later rising to 3%. In 2014, the company introduced triple glazing to the volume market, expanding its product offerings. For more details, check out the Revenue Streams & Business Model of Everest.

Everest PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Everest history?

The Everest Company has a rich history marked by significant milestones in the home improvement sector. Throughout its journey, the company has adapted to market changes and consumer demands, leaving a notable impact on the industry. The Everest brand has become synonymous with home improvement.

| Year | Milestone |

|---|---|

| 1984 | Development of uPVC double glazing, becoming a leading choice in the UK. |

| 2014 | Introduction of triple glazing to the volume market, enhancing energy efficiency. |

| 2020 | Entered administration in June, impacted by the COVID-19 pandemic. |

| 2020 | Everest 2020 Limited formed through pre-pack administration, saving 1,000 jobs. |

| 2024 | Everest 2020 Limited entered administration on April 24, putting 350 jobs at risk. |

| 2024 | Anglian Home Improvements acquired certain assets and is fulfilling existing customer orders. |

The company has consistently pursued product innovation, aiming to improve performance and meet evolving consumer needs. The 'Mark 7' windows, with their five-chamber frame profile, exemplify this commitment. They also achieved an A+21 WER Rating for their triple-glazed windows, improving energy efficiency.

The introduction of uPVC double glazing in 1984 was a pivotal innovation. This product quickly became a preferred choice for homeowners across the UK, setting a new standard in the industry.

In 2014, the company was among the first to offer triple glazing to the mass market. This innovation significantly improved energy efficiency, aligning with the growing demand for sustainable home solutions.

The 'Mark 7' windows featured a five-chamber frame profile, enhancing performance. This upgrade demonstrated the company's commitment to improving product quality and customer satisfaction.

The triple-glazed windows achieved an A+21 WER Rating, highlighting their exceptional energy efficiency. This rating underscored the company's dedication to providing high-performance products.

The development of the GrabLock system in collaboration with Yale enhanced the security of uPVC windows and doors. This innovation provided customers with added peace of mind.

The company has faced considerable challenges, particularly in recent years. The COVID-19 pandemic significantly impacted sales due to restrictions on in-person interactions. The company has also grappled with economic pressures, including increased material costs and a decline in consumer confidence.

The pandemic severely restricted in-person sales, leading to financial strain. This disruption forced the company to adapt rapidly to changing market conditions.

The initial administration in June 2020 highlighted the financial difficulties faced. This event underscored the impact of external factors on the business.

A 30% increase in material costs from its main uPVC supplier added to the financial burden. This rise in expenses significantly affected profitability.

The cost-of-living crisis contributed to a decline in consumer confidence, impacting sales. This economic downturn reduced customer demand for home improvements.

The second administration on April 24, 2024, put 350 jobs at risk. This event underscored the ongoing financial struggles of the company.

The company owed over £30 million to creditors at the time of the second administration. This significant debt burden highlighted the severity of the financial challenges.

Everest Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Everest?

The Everest Company, a significant player in the home improvement sector, has a rich history marked by innovation and strategic shifts. Founded in 1965 as 'Home Insulation Ltd', the company has navigated various ownership changes and market challenges, evolving its product offerings and brand identity over the decades. From its early days producing aluminum secondary glazing to its later focus on uPVC and triple glazing, the company has consistently aimed to meet changing consumer demands. The company's journey, including periods of financial instability and administration, highlights the dynamic nature of the industry and the importance of adapting to market conditions.

| Year | Key Event |

|---|---|

| 1965 | Founded as 'Home Insulation Ltd' in Waltham Abbey, initially producing aluminum secondary glazing. |

| 1968 | Merged with Pillar Aluminium Holdings, later acquired by Rio Tinto to form Pillar RTZ. |

| 1970s | Began using the brand name Everest and launched new products like aluminum double glazing and sliding patio doors. |

| 1978 | Recruited Ted Moult as TV frontman, establishing the iconic 'Fit the best. Everest' slogan. |

| 1984 | Introduced uPVC double glazing, which became a popular choice in the UK. |

| 1999 | Sold to Brian Kennedy for £47 million after a period of stagnation. |

| 2012 | Private Equity firm Better Capital acquired Everest for £25 million. |

| 2014 | Introduced triple glazing to the volume market. |

| June 2020 | Everest entered pre-pack administration due to the COVID-19 pandemic; Everest 2020 Limited was formed, saving 1,000 jobs. |

| October 2023 | Everest 2020 Limited acquired the brand, order book, and assets of Evolution, a manufacturer of timber alternative windows and doors, from the defunct UK Windows and Doors Group. |

| October 2023 | Collaborated with VEKA to develop a new uPVC window and door system with an impressive U-value of 0.80, aligning with the proposed 2025 Future Homes Standard. |

| April 2024 | Everest 2020 Limited entered administration, putting 350 jobs at risk. |

| May 2024 | Anglian Home Improvements acquired certain assets of Everest and began fulfilling existing customer orders. |

The Everest brand must adapt to shifting consumer preferences and regulatory changes. The proposed 2025 Future Homes Standard, requiring significant reductions in carbon emissions, will likely influence product development. This includes energy-efficient solutions like triple glazing with a U-value of 0.80, which aligns with the company's recent collaborations.

Continued investment in product innovation is critical for the future of the Everest Company. Developing advanced window and door systems that meet or exceed the 2025 Future Homes Standard is essential. This includes exploring new materials and technologies to improve energy efficiency and performance.

Securing a stable financial future is a key priority for the Everest history. Finding a buyer or investment partner is crucial to revitalizing the brand and operational strength. The company needs to rebuild consumer trust following recent administrations to ensure long-term viability.

Maintaining a strong market position requires a focus on customer satisfaction and brand reputation. The company's ability to adapt to market conditions and maintain resilience in a volatile business environment will be critical. The goal is to continue the founder's vision of 'fitting the best.'

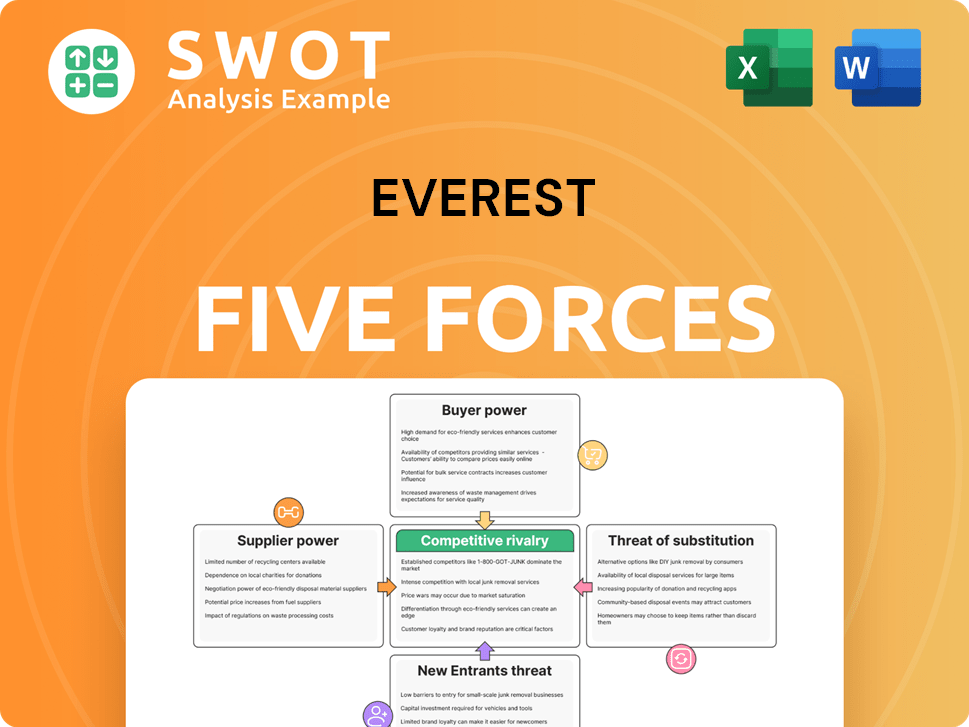

Everest Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Everest Company?

- What is Growth Strategy and Future Prospects of Everest Company?

- How Does Everest Company Work?

- What is Sales and Marketing Strategy of Everest Company?

- What is Brief History of Everest Company?

- Who Owns Everest Company?

- What is Customer Demographics and Target Market of Everest Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.