Everest Bundle

How Does Everest Company Thrive in the Home Improvement Sector?

Everest Company, a leading name in home improvement, offers a wide array of windows, doors, and conservatories, primarily targeting residential customers. Understanding the Everest SWOT Analysis is key to grasping its market position. This exploration delves into Everest's operational model, revenue streams, and strategic initiatives, providing a comprehensive view for investors and stakeholders.

This analysis goes beyond the surface, dissecting the Everest business model to reveal how Everest services are delivered and how Everest products contribute to its success. We'll examine Everest operations, including its supply chain and marketing strategies, to understand its competitive advantages within the Everest market. This in-depth look will also consider the key challenges faced by Everest Company and its global presence.

What Are the Key Operations Driving Everest’s Success?

The core operations of the Everest Company revolve around a comprehensive process that includes design, manufacturing, sales, and installation of home improvement products. These products primarily consist of windows, doors, and conservatories. The Everest business model is centered on delivering customized, energy-efficient, and secure solutions tailored specifically to the needs of residential customers.

The value proposition offered by Everest Company is focused on providing a wide range of products that cater to various aesthetic and functional requirements. This includes a diverse selection of styles, materials, and finishes. The company differentiates itself through its ability to offer bespoke solutions, ensuring that each customer receives a product that perfectly matches their individual needs and preferences. Understanding the Everest operations is key to appreciating its market position.

The operational processes begin with customer consultation and design, where the company works closely with homeowners to understand their specific needs and preferences. This is followed by in-house manufacturing, which allows for stringent quality control and customization. The company emphasizes the provision of high-quality, energy-efficient products, which is a significant selling point in the current market. Following manufacturing, Everest services include managing the logistics of delivering these products to customer sites. A key differentiator is its professional installation services, ensuring products are fitted correctly and efficiently, thereby maximizing their performance and lifespan. To learn more about their strategic approach, consider reading about the Growth Strategy of Everest.

The initial phase involves detailed consultations to understand customer needs. This includes assessing the existing structures and discussing design preferences. The goal is to create customized solutions that meet specific requirements.

Manufacturing is conducted in-house to maintain strict quality control standards. This allows for the production of bespoke products tailored to individual customer specifications. This process ensures high-quality, energy-efficient products.

The company manages the logistics of delivering products directly to customer sites. This ensures timely and efficient delivery. Proper handling and transportation are crucial for product integrity.

A key differentiator is the provision of professional installation services. This ensures products are correctly fitted, maximizing performance and lifespan. Skilled installers are essential for customer satisfaction.

The Everest market strategy includes a direct sales model combined with comprehensive installation services, allowing the company to maintain control over the customer experience and product quality. The company's supply chain likely involves sourcing raw materials for manufacturing and maintaining a network of skilled installers. The company's focus on energy efficiency aligns with current consumer trends, as seen by the increasing demand for sustainable home improvement solutions.

- Direct Sales Model: Maintains control over the customer experience.

- Comprehensive Installation: Ensures product quality and longevity.

- Energy Efficiency: Meets current consumer demands for sustainable products.

- Customization: Offers bespoke solutions tailored to individual needs.

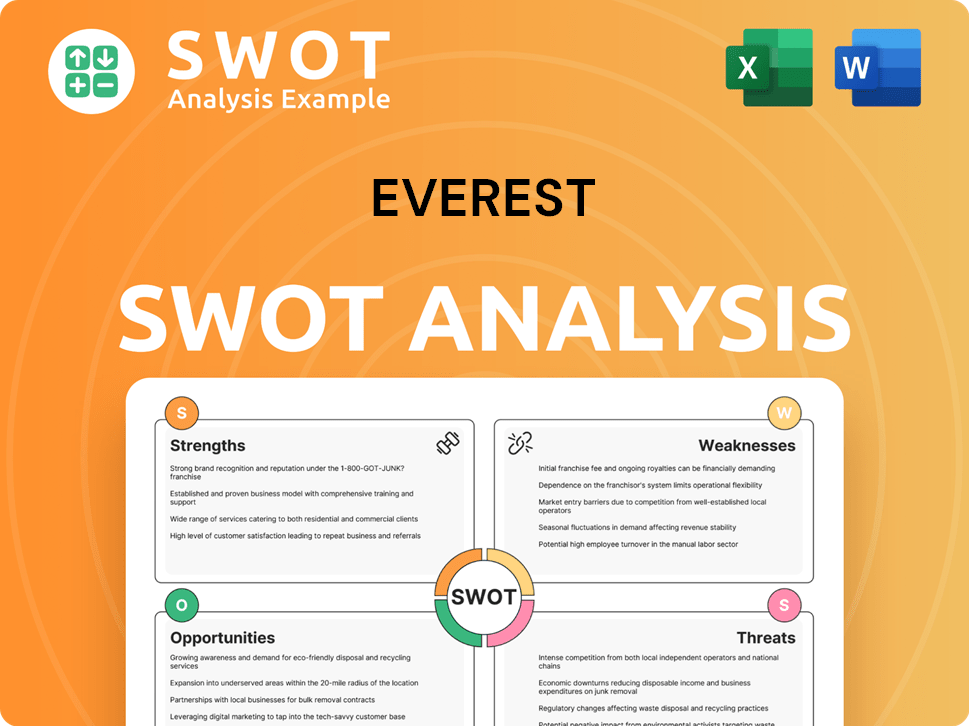

Everest SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Everest Make Money?

The Everest Company primarily generates revenue through the direct sale and professional installation of home improvement products. The core of its business model revolves around offering a comprehensive service, encompassing product selection, customization, and installation. This integrated approach allows the company to command a premium price, creating a significant revenue stream.

While specific financial details for the home improvement division are not readily available, the broader 'Everest' entity, Everest Group, Ltd., provides some insight into its financial performance. The company's monetization strategies likely mirror those common in the home improvement sector, focusing on providing complete solutions to residential customers.

The Everest Company’s revenue streams and monetization strategies are key to understanding its Everest operations. The company focuses on providing a complete solution to residential customers, from product selection and customization to professional installation. This integrated approach likely commands a premium, as it offers convenience and assurance of quality.

The Everest Company generates revenue mainly through the direct sales and installation of its home improvement products. Key revenue streams include the sale of windows, doors, and conservatories, along with associated installation fees. The company’s emphasis on energy-efficient and secure products can also be a key monetization driver, appealing to customers looking for long-term savings and enhanced property value. For a deeper understanding of the company, you can read a Brief History of Everest.

- Direct Sales and Installation: Revenue is primarily generated from the sale of products (windows, doors, conservatories) and the associated installation services.

- Tiered Pricing: Pricing strategies likely vary based on product features, customization levels, and energy efficiency ratings.

- Cross-Selling: Encouraging customers to consider additional products, such as doors when purchasing windows.

- Premium Pricing: Offering a complete solution, including product selection, customization, and professional installation, allows for premium pricing.

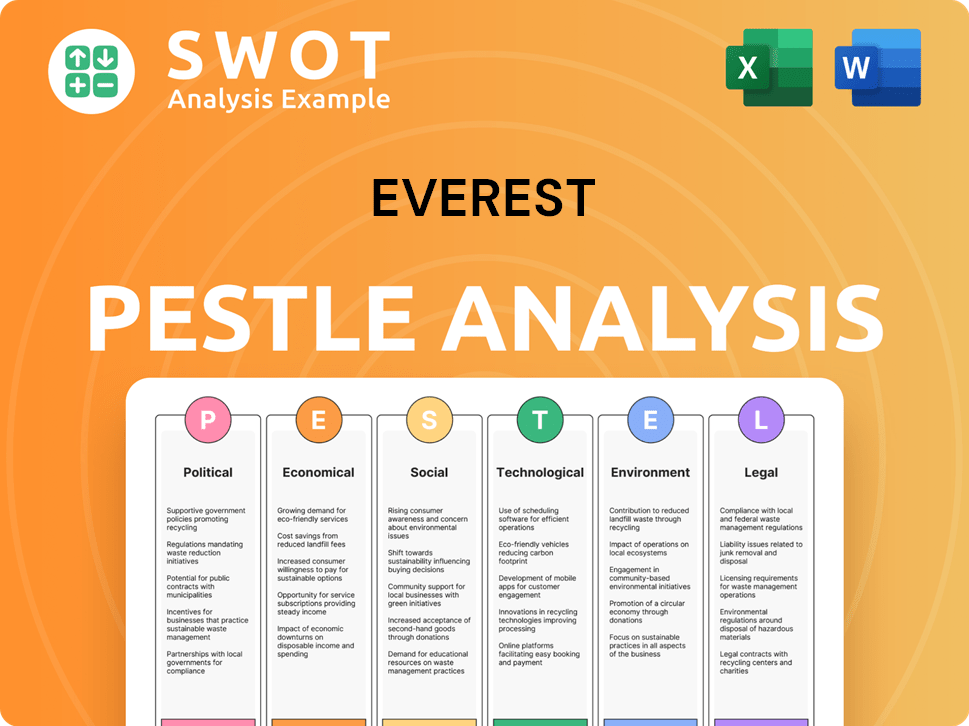

Everest PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Everest’s Business Model?

Understanding the evolution of the Everest Company involves examining its key milestones, strategic shifts, and competitive advantages. For a home improvement company, milestones could include significant product innovations, expansions into new markets, or successful campaigns focused on energy efficiency. These achievements highlight the Everest business model's adaptability and its ability to meet evolving consumer demands.

Everest Group, Ltd. has recently focused on strategically shaping its portfolio, with its International business showing strong growth in Q1 2025. In 2024, the company took decisive action to address the impact of social inflation and legal system abuse on its North American Casualty insurance business through aggressive underwriting and strengthening reserves. Furthermore, the company advanced its international insurance strategy, achieving $1.5 billion in gross written premiums in 2024.

Operational challenges have included significant catastrophe losses. Q1 2025 experienced the highest level of catastrophe losses in over a decade, amounting to $472 million, primarily due to California wildfires. Despite these challenges, CEO Jim Williamson expressed confidence in the company's ability to achieve its return objectives and noted that the company is on track with its strategic plan, focusing on U.S. casualty remediation and expanding opportunities in property and specialty lines. For more insights into the competitive environment, consider reading about the Competitors Landscape of Everest.

Everest Company's key milestones often involve product innovations and market expansions. Successful campaigns focused on energy efficiency also play a crucial role. These achievements reflect the Everest business model's responsiveness to market trends.

Recent strategic moves include portfolio shaping and international business growth. In 2024, the company addressed the impact of social inflation and legal system abuse. Advancing its international insurance strategy, with $1.5 billion in gross written premiums in 2024, also stands out.

Everest's competitive advantages include brand strength and integrated service models. The company leverages a 50-year track record of disciplined underwriting and capital management. It focuses on 'flight to quality' and advances capabilities in data and technology.

Significant catastrophe losses, such as the $472 million in Q1 2025, pose challenges. Despite these, the company is focused on U.S. casualty remediation. The company is also expanding opportunities in property and specialty lines.

Everest's competitive advantages include brand strength, a reputation for quality, and an integrated service model. The company is leveraging its lead market position and focusing on 'flight to quality'. They are advancing capabilities in data, analytics, and technology to optimize Everest operations.

- Focus on specialty and property lines.

- Investment in AI and automation.

- Disciplined underwriting and risk management.

- Global operating affiliates for insurance solutions.

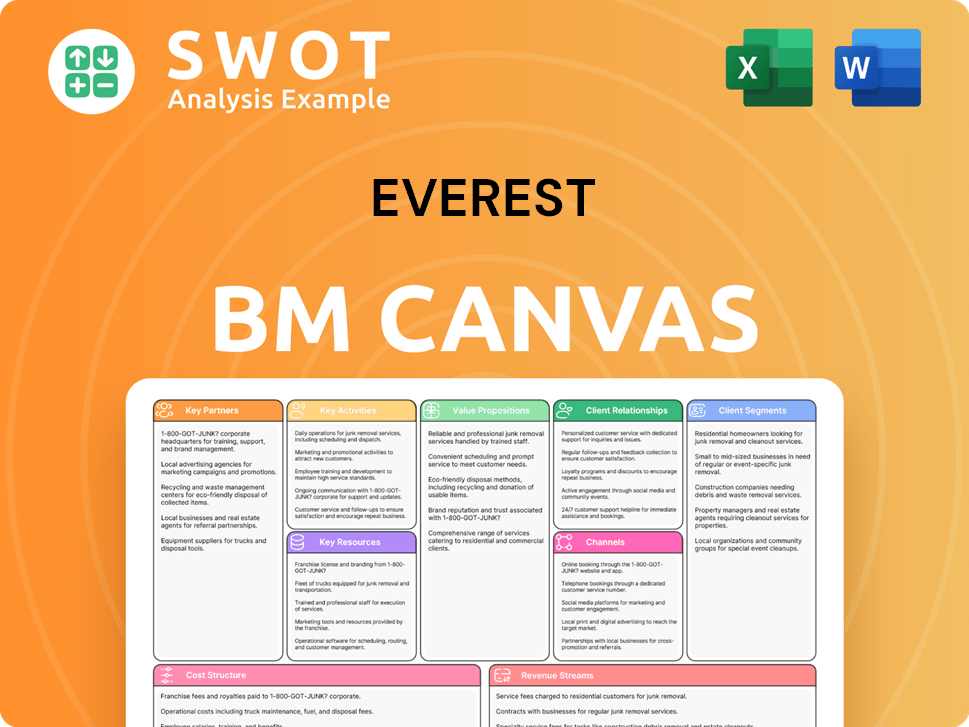

Everest Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Everest Positioning Itself for Continued Success?

The industry position of the Everest Company, focusing on home improvement, centers on residential customers. It offers customizable, energy-efficient, and secure products. While precise market share figures specific to the home improvement segment are unavailable, the Everest Group, Ltd., a global underwriting leader, had a market capitalization of $16.6 billion as of April 2025.

The Everest business model is subject to risks, including shifts in the housing market, raw material price volatility, and stiff competition. For Everest Group, Ltd., the risks include ongoing catastrophe losses, regulatory and legal uncertainties, and investment market fluctuations. The company's Q1 2025 results were significantly affected by $472 million in pre-tax catastrophe losses.

Everest's focus is on residential customers within the home improvement sector. Its products are designed to be customizable, energy-efficient, and secure, catering to specific homeowner needs. The company's market strategy is centered on providing tailored solutions.

Key risks include fluctuations in the housing market, raw material price volatility, and intense competition. For Everest Group, Ltd., risks involve catastrophe losses and regulatory uncertainties. The Q1 2025 results were significantly impacted by major catastrophe losses.

Everest Group, Ltd., is focused on executing its strategic plan, particularly in U.S. casualty remediation and expanding opportunities in property and specialty lines. Share repurchases are expected to continue. Analysts predict strong earnings growth.

Everest Group, Ltd., anticipates adjusted EPS to reach $47.35 in fiscal 2025, a 58.7% increase from $29.83 in fiscal 2024, with further growth to $61.69 per share in fiscal 2026. The company repurchased $200 million worth of common shares in Q1 2025.

Everest Group, Ltd., is concentrating on its strategic plan, emphasizing U.S. casualty remediation and expanding within property and specialty lines. The company is committed to returning capital to shareholders through share repurchases, reflecting confidence in its financial health and future prospects. The company's leadership remains confident in its ability to achieve return objectives despite challenging market conditions.

- Focus on strategic initiatives to drive growth.

- Continued share repurchases to enhance shareholder value.

- Improved terms in reinsurance renewals.

- Anticipated significant growth in adjusted EPS.

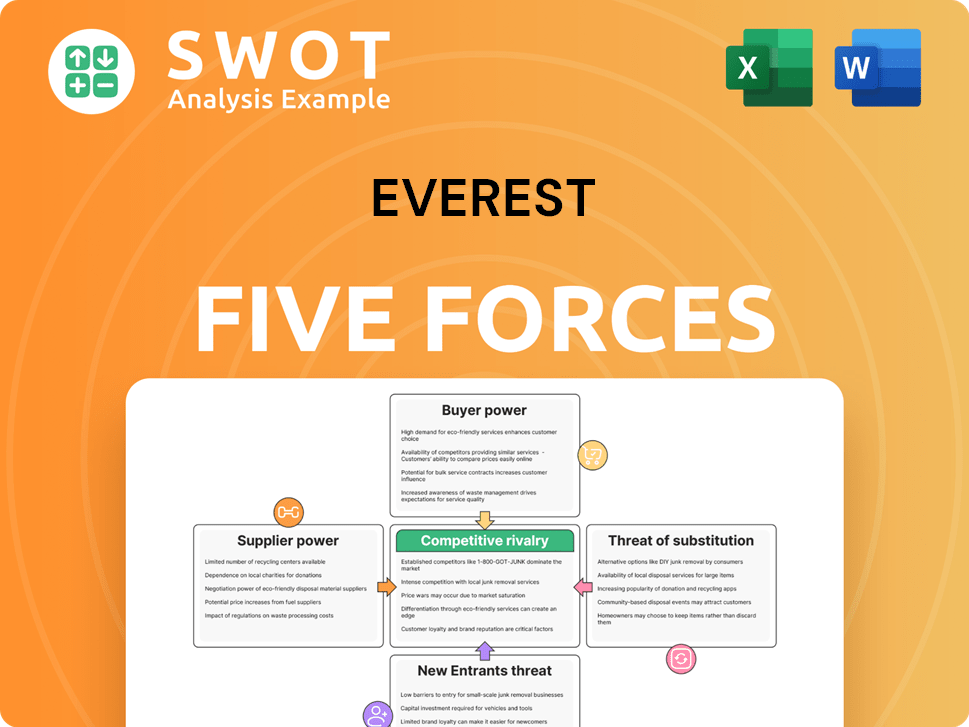

Everest Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Everest Company?

- What is Competitive Landscape of Everest Company?

- What is Growth Strategy and Future Prospects of Everest Company?

- What is Sales and Marketing Strategy of Everest Company?

- What is Brief History of Everest Company?

- Who Owns Everest Company?

- What is Customer Demographics and Target Market of Everest Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.