Freshpet Bundle

How did Freshpet revolutionize the pet food industry?

Freshpet emerged in 2006, challenging the status quo of the pet food market with a focus on fresh, refrigerated options. This innovative approach, centered around natural and less-processed ingredients, quickly resonated with pet owners seeking healthier choices for their beloved companions. The company's commitment, encapsulated by its slogan 'Real Food. Real Pets. Real Love.', has driven its remarkable growth.

Freshpet's Freshpet SWOT Analysis reveals how this company has not only survived but thrived in the competitive pet food landscape. Its financial performance in 2024, including a substantial increase in net sales and positive net income, highlights its successful transformation of consumer preferences and its strong market position. Understanding the Freshpet company history is crucial for investors and strategists alike.

What is the Freshpet Founding Story?

The story of the Freshpet company began in 2006 in Secaucus, New Jersey. It was founded by Scott Morris, John Phelps, and Cathal Walsh, all of whom had experience in the pet food industry. Their goal was to offer pets a healthier, fresher alternative to the highly processed foods common at the time.

The founders saw a gap in the market for pet food that used fresh, natural ingredients. This led them to develop a business model focused on refrigerated pet food, which would maintain its nutritional value without artificial preservatives. This approach set the stage for a new era in pet nutrition.

Freshpet's journey started with a Series A funding round in 2006, securing $7.5 million from Catterton Partners. This investment was crucial for establishing their first manufacturing facility in Quakertown, Pennsylvania, also in 2006. The company officially launched its products in 2008.

Freshpet was founded to provide fresh, minimally processed pet food.

- Founded in 2006 in Secaucus, New Jersey.

- Initial funding of $7.5 million in 2006.

- Launched products in 2008.

- Focus on refrigerated, natural ingredient pet food.

- The 2007 melamine pet food crisis boosted demand.

A key element of Freshpet's strategy was the use of branded refrigeration units placed in pet stores and grocery stores. This helped to keep the products fresh and visible, setting them apart from competitors. The 2007 melamine pet food crisis significantly boosted Freshpet's growth. This crisis increased public trust in conventional pet food, and Freshpet's fresh food products became a sought-after alternative. This event validated Freshpet's mission and accelerated its market acceptance.

Freshpet's commitment to fresh ingredients and innovative distribution has helped it grow significantly. For a deeper dive into the competitive landscape, you can explore the Competitors Landscape of Freshpet.

In 2023, Freshpet reported net sales of approximately $778.5 million, reflecting the company's continued growth and market presence. The company's focus on sustainability and reducing its environmental impact is also noteworthy, with initiatives aimed at minimizing waste and promoting responsible sourcing. Freshpet's dedication to pet health and nutrition continues to drive its success.

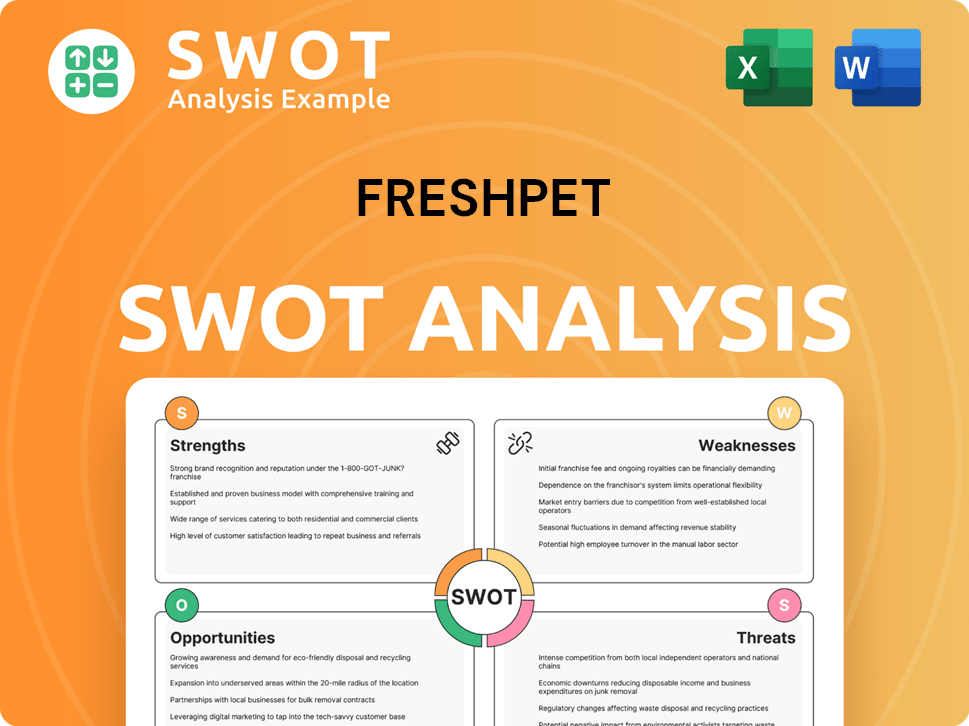

Freshpet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Freshpet?

The early growth of Freshpet was marked by a strategic focus on expanding its refrigerated distribution network and continuously innovating its product line. This involved partnerships with major retailers and investments in manufacturing capabilities to meet growing demand. A significant milestone was the Initial Public Offering (IPO) in 2014, which provided capital for further expansion and brand development. The company's growth trajectory included strategic acquisitions and expansion of its product offerings to cater to a broader range of pet dietary needs.

Freshpet significantly increased its market reach by partnering with major retailers, including Target, Walmart, and Kroger, starting in 2010. By 2008, Freshpet products were available in over 2,000 stores, and this number grew to 5,000 stores by 2010. This expansion was crucial for increasing product accessibility and brand visibility within the pet food market.

To support its rapid expansion, Freshpet invested in its manufacturing capabilities. A new factory was opened in Bethlehem, Pennsylvania, in 2013, complementing the initial facility in Quakertown. The acquisition of its own manufacturing kitchens in 2017 gave the company greater control over its production processes and product quality.

A significant milestone in Freshpet's growth was its Initial Public Offering (IPO) on the NASDAQ in November 2014, under the ticker symbol 'FRPT'. The IPO raised $164 million, providing substantial capital for further expansion and brand development. This gave the company a market capitalization of $447 million.

By 2019, Freshpet had expanded its chiller presence to over 15,000 locations. The company's net sales reached over $100 million by 2015 and surpassed $200 million by 2019, demonstrating consistent revenue growth. Freshpet launched the 'Vital' brand in 2018, expanding its product offerings.

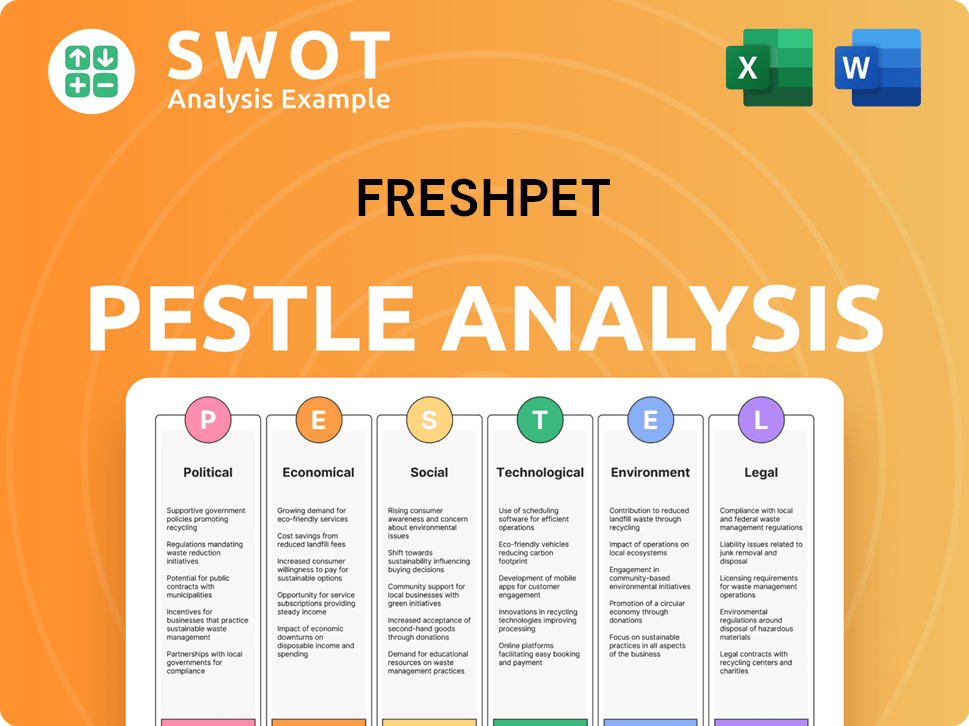

Freshpet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Freshpet history?

The Freshpet company has achieved several significant milestones throughout its history, marking its growth and impact in the pet food industry. From pioneering fresh pet food to achieving profitability, the Freshpet history reflects a journey of innovation and resilience.

| Year | Milestone |

|---|---|

| 2008 | Launched its initial line of fresh, refrigerated pet food, revolutionizing the pet food market. |

| 2018 | Introduced the Vital brand, expanding its product offerings to cater to diverse pet dietary needs. |

| 2019 | Made its kitchens wind-powered, demonstrating a commitment to sustainability. |

| 2020 | Partnered with TerraCycle for bag recycling, furthering its environmental initiatives. |

| 2024 | Achieved its first full-year positive net income of $46.9 million, a significant financial turnaround. |

Freshpet has consistently innovated within the pet nutrition sector. The company introduced its initial fresh, refrigerated pet food line in 2008, and in 2018, they launched the Vital brand, expanding their product range. Freshpet plans to introduce a lower-priced bagged product in its Complete Nutrition line and expand multi-pack options in 2025.

Freshpet pioneered the fresh, refrigerated pet food category in North America, setting itself apart from traditional dry and canned products. This innovation was a key differentiator, focusing on freshness and quality.

The introduction of the Vital brand in 2018 expanded Freshpet's offerings. This expansion allowed them to cater to a wider range of pet dietary needs and preferences.

Freshpet has demonstrated a strong commitment to sustainability by making its kitchens wind-powered by 2019. They also partnered with TerraCycle for bag recycling in 2020, reducing carbon emissions.

Freshpet continuously improves its products to meet market demands. Plans include a lower-priced bagged product and expanded multi-pack options in 2025, enhancing value and convenience.

A proprietary refrigerated distribution network is a key strategic advantage for Freshpet. This network ensures that the fresh products maintain their quality and freshness from production to the consumer.

Freshpet consistently refines its product offerings. They are committed to adapting to consumer preferences and market feedback, ensuring their products meet evolving needs.

Freshpet has faced several challenges throughout its history, including supply chain disruptions and increased costs. These issues, along with labor shortages, led to price increases and strategic adjustments.

Product shortages occurred in late 2020 due to supply limitations from winter storms and the COVID-19 pandemic. Supply chain volatility has been a recurring obstacle for Freshpet.

Capacity constraints have posed challenges to meeting the surging demand for Freshpet products. The company addressed this by expanding its manufacturing capacity.

Input cost inflation, particularly for raw materials, has impacted Freshpet's operations. The company responded by implementing price increases.

Labor shortages have presented another challenge for Freshpet. These shortages have affected production and operational efficiency.

To offset increased raw material costs, Freshpet implemented price increases in late 2021 and early 2022. This was a strategic move to maintain profitability.

Freshpet focused on increasing manufacturing capacity to meet rising demand and avoid future supply issues. This included adding new production lines and expanding facilities.

For a deeper dive into Freshpet's strategic approach, consider reading about the Growth Strategy of Freshpet.

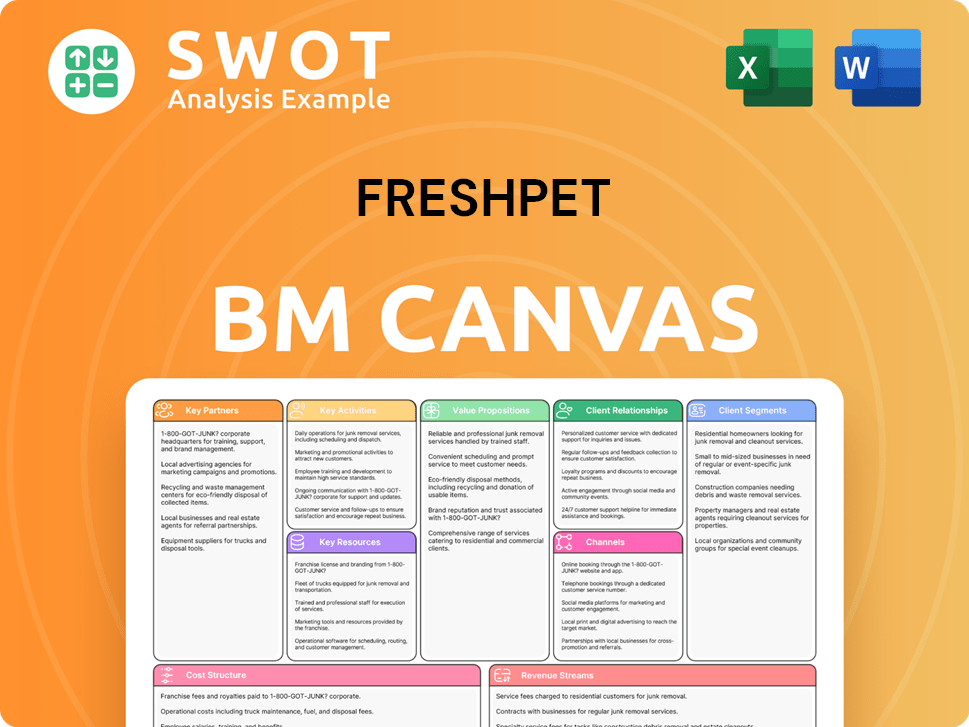

Freshpet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Freshpet?

The Freshpet company has a rich history marked by strategic growth and innovation in the pet food industry, starting with its founding in 2006. Over the years, the company has expanded its product lines, manufacturing capabilities, and distribution networks, leading to significant financial milestones.

| Year | Key Event |

|---|---|

| 2006 | Freshpet was founded in Secaucus, New Jersey, and secured $7.5 million in Series A funding, opening its first manufacturing facility in Quakertown, Pennsylvania. |

| 2008 | Freshpet launched its initial line of fresh, refrigerated pet food products. |

| 2010 | The company expanded its distribution network, partnering with major retailers and reaching 5,000 stores, with MidOcean Partners investing in Freshpet. |

| 2013 | A new manufacturing facility opened in Bethlehem, Pennsylvania. |

| 2014 | Freshpet went public on the NASDAQ under the ticker symbol 'FRPT', raising $164 million in its IPO. |

| 2017 | Freshpet acquired its own manufacturing kitchens, gaining greater control over production. |

| 2018 | The 'Vital' brand was launched, expanding product offerings. |

| 2019 | Freshpet's kitchens became wind-powered, and the company raised $90 million in a conventional debt round. |

| 2020 | Freshpet partnered with TerraCycle for bag recycling and announced plans for a third manufacturing plant in Ennis, Texas. |

| 2022 | Freshpet acquired Redbarn Pet Products, and Phase 1 of the Ennis, Texas facility was completed. |

| 2024 | Freshpet reported its first full-year positive net income of $46.9 million and net sales of $975.2 million. The company moved its headquarters to Bedminster, New Jersey. |

| 2025 (Q1) | Freshpet reported net sales of $263.2 million and expects full-year 2025 net sales to be in the range of $1.12 billion to $1.15 billion. |

Freshpet is strategically positioned for continued growth by focusing on fresh, natural pet food. The company anticipates steady growth in Q3 2025, with acceleration expected in Q4 due to new campaigns and customer activation initiatives. They plan to introduce new manufacturing technology in Q4 2025 to enhance efficiency.

For the full year 2027, Freshpet expects net sales of $1.8 billion, an Adjusted Gross Margin of 48%, and an Adjusted EBITDA margin of 22%. Freshpet is confident in becoming free cash flow positive by 2026. These projections showcase the company's strong financial trajectory.

Freshpet plans to continue expanding its distribution channels, including e-commerce, and investing in marketing to increase brand awareness. This focus on innovation and expansion is a key part of their long-term strategy, ensuring they meet the growing demand for fresh pet food.

Analysts and leadership emphasize Freshpet's strong brand, differentiated product, and insulated business model, benefiting from long-term trends like pet humanization and the demand for natural, fresher foods. This positions Freshpet well to capitalize on the evolving pet food market.

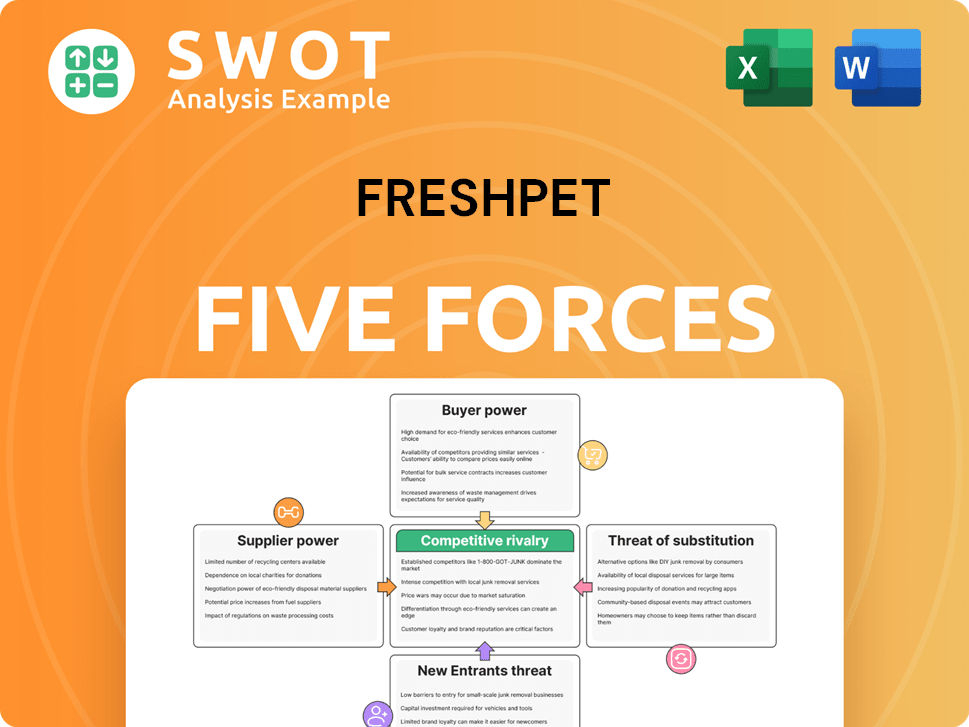

Freshpet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Freshpet Company?

- What is Growth Strategy and Future Prospects of Freshpet Company?

- How Does Freshpet Company Work?

- What is Sales and Marketing Strategy of Freshpet Company?

- What is Brief History of Freshpet Company?

- Who Owns Freshpet Company?

- What is Customer Demographics and Target Market of Freshpet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.