Freshpet Bundle

Who Really Owns Freshpet?

Understanding the Freshpet SWOT Analysis is just the beginning; the real story lies in its ownership. Freshpet, a company that has revolutionized the pet food industry, offers a compelling case study in corporate governance and market dynamics. Unraveling the Freshpet SWOT Analysis and its ownership structure is key to understanding its past, present, and future.

From its humble beginnings in 2006 to its current market capitalization of billions, the evolution of Freshpet is a testament to strategic vision and effective execution. This exploration will examine who owns Freshpet, from its early backers to its current major shareholders, and how these Freshpet investors have influenced the company's trajectory. Discover the Freshpet company financials, including its impressive growth in recent years, and gain insights into the forces shaping its future.

Who Founded Freshpet?

The origins of the Freshpet company trace back to 2006, spearheaded by a team of seasoned pet food industry veterans. This founding group, including Scott Morris, John Phelps, and Cathal Walsh, brought extensive experience from major players in the pet food sector, setting the stage for a novel approach to pet nutrition.

Scott Morris, who previously held positions at Ralston Purina and The Meow Mix Company, initially took on the role of Chief Marketing Officer at Freshpet and currently serves as President and COO. Cathal Walsh, with a marketing background from Nestlé Pet Care, now leads Freshpet's European operations. John Phelps, while instrumental in the company's early research and development efforts, is no longer actively involved in the business.

The early financial backing of Freshpet was significant, with a $7.5 million Series A funding round secured in 2006 from Catterton Partners, a private equity firm. This initial investment underscored the confidence in Freshpet's vision to establish a new category in the pet food market with fresh, refrigerated products.

The founding of Freshpet was a strategic move by industry veterans aiming to disrupt the pet food market. The company's initial funding and leadership structure highlight a focus on innovation and market penetration.

- Founders: Scott Morris, John Phelps, and Cathal Walsh.

- Initial Funding: $7.5 million in Series A funding from Catterton Partners in 2006.

- Leadership Roles: Scott Morris as President and COO, Cathal Walsh leading European operations.

- Market Focus: Fresh, refrigerated pet food products.

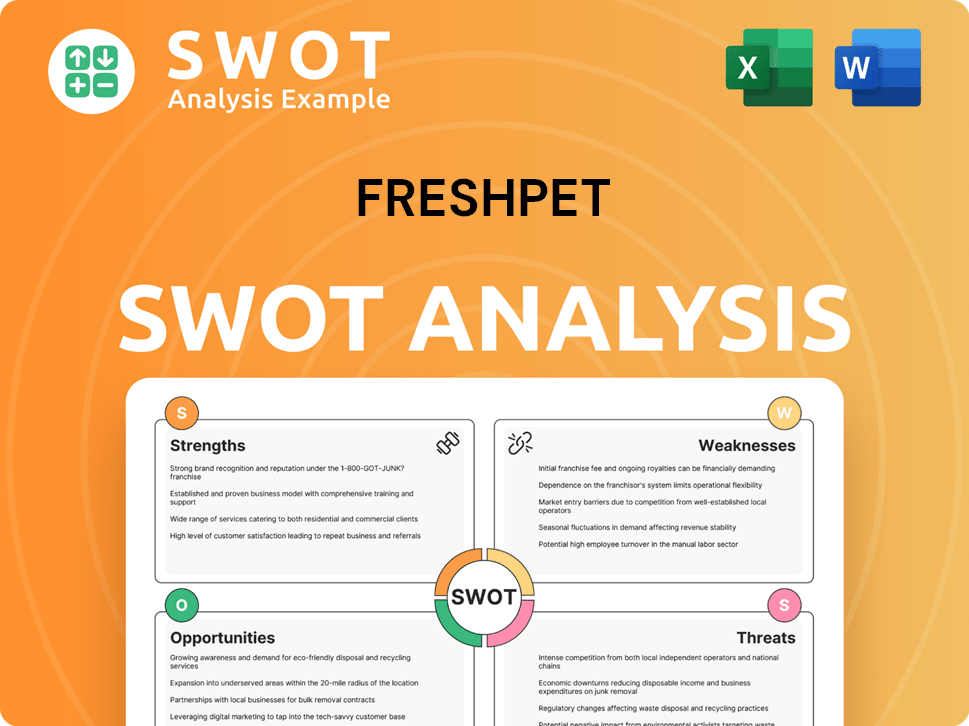

Freshpet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Freshpet’s Ownership Changed Over Time?

The ownership structure of the Freshpet company has seen significant changes since its inception. A pivotal moment was the Initial Public Offering (IPO) in November 2014. This event marked the company's entry into the public market, trading on the NASDAQ under the ticker 'FRPT'. The IPO raised $164 million, establishing a market capitalization of $447 million. This influx of capital fueled further expansion and brand development for the company.

Another significant event was in 2020, when the private equity firm KKR & Co. reportedly acquired a majority stake in the company. This move further solidified its position in the market. These shifts in ownership have influenced the company's strategic direction, including its expansion in retail channels and investments in product development.

| Ownership Details | As of March 30, 2025 | Percentage of Holdings |

|---|---|---|

| BlackRock, Inc. | 12.71% | |

| The Vanguard Group, Inc. | 10.71% | |

| WCM Investment Management, LLC | 5.76% | |

| Wasatch Advisors LP | 5.58% | |

| Wellington Management Group LLP | 5.36% |

Currently, the company is held by a mix of institutional investors and individual shareholders. As of May 2025, mutual funds held 93.55% of the shares, an increase from 92.82%. Insider holdings remained steady at 1.30% during the same period. These figures highlight the influence of major shareholders on the company's strategic decisions and its continued growth.

Understanding the ownership structure of the Freshpet company is crucial for investors and stakeholders. The company's ownership is primarily composed of institutional investors and mutual funds.

- BlackRock, Inc. and The Vanguard Group, Inc. are among the major institutional investors.

- Mutual funds have increased their holdings, indicating strong confidence in the company's future.

- Insider holdings remain consistent, reflecting the stability of the leadership's stake.

- The IPO in 2014 and the KKR & Co. acquisition in 2020 were key events that shaped the current ownership structure.

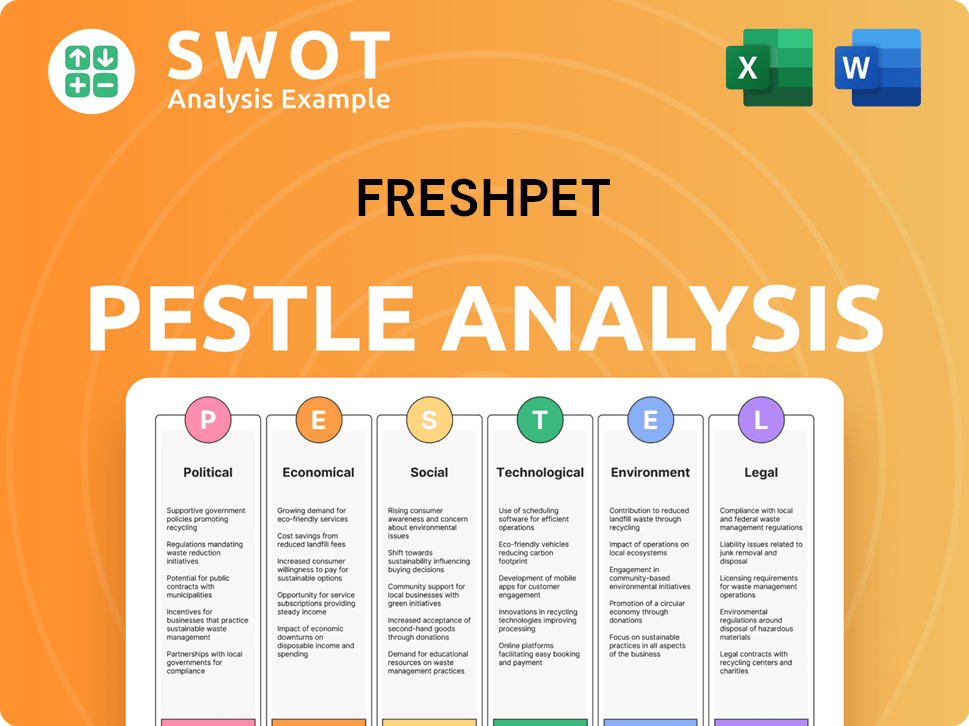

Freshpet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Freshpet’s Board?

The Board of Directors at the Freshpet company is pivotal in overseeing its strategy and governance. The company's structure, as outlined in its Certificate of Incorporation, divides the board into three classes. This means that approximately one-third of the directors are elected each year. This staggered approach can make it more difficult for shareholders to quickly change the board's composition. Furthermore, removing a director requires a specific cause and a vote of at least 75% of the outstanding common stock's voting power.

As of April 10, 2024, the board consisted of 12 directors, with 11 of them being independent. Recent changes include the retirement of Lawrence S. Coben, Ph.D., and the appointment of Lauri Kien Kotcher to the Board on April 9, 2024. Ms. Kien Kotcher, bringing over three decades of experience from consumer companies, joined as a Class II director, with her term expiring at the company’s 2025 annual meeting.

| Director | Title | Date of Appointment |

|---|---|---|

| Billy Cyr | Chairman of the Board, Director | September 2014 |

| Scott A. Perekslis | Lead Independent Director | May 2015 |

| Richard K. Thompson | Director | May 2012 |

| Charles A. Norris | Director | May 2015 |

| Robert B. Hess | Director | May 2016 |

| Timothy McLevish | Director | August 2023 |

| Joseph E. Scalzo | Director | August 2023 |

| Lauri Kien Kotcher | Director | April 2024 |

| John D. Pittari | Director | May 2017 |

| Kathleen A. Hogenson | Director | May 2018 |

| Robert J. Iser | Director | May 2022 |

| Richard B. Smucker | Director | May 2022 |

Regarding voting rights, each holder of Freshpet's common stock is entitled to one vote per share on matters brought to a stockholder vote. There are no cumulative voting rights. For most matters, a majority vote of the shares present or represented by proxy at the meeting is needed for approval. However, director elections are decided by a plurality vote. Abstentions and 'broker non-votes' are counted for quorum purposes but are not included in the total votes cast for or against a nominee's election. Understanding the Revenue Streams & Business Model of Freshpet is crucial for investors.

The company has seen engagement from activist investors, particularly with JANA Partners. In September 2022, JANA Partners became the largest shareholder with a near-10% stake. Their goals included pushing for changes to increase the stock price and exploring a potential sale.

- JANA Partners nominated directors to the board.

- Criticism of the company's financial performance and capital-raise plans.

- A cooperative agreement was reached in August 2023.

- Timothy McLevish and Joseph E. Scalzo were appointed to the board as a result.

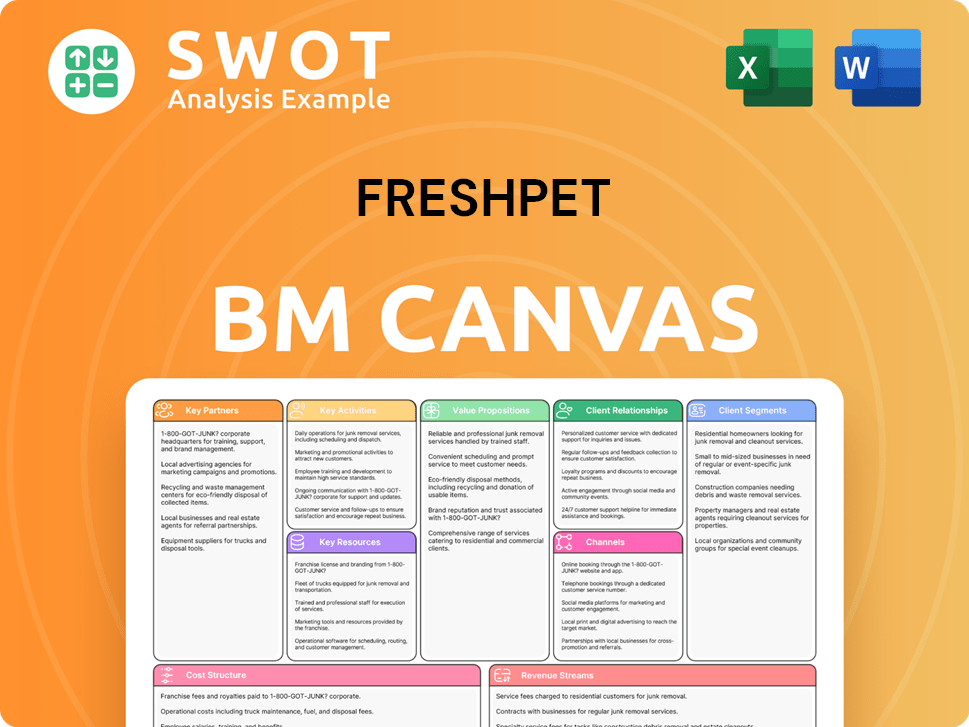

Freshpet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Freshpet’s Ownership Landscape?

Over the past few years, the ownership profile of the Freshpet company has evolved alongside its growth. In early 2025, the company reported robust financial results, with net sales reaching $955.4 million for fiscal year 2024, representing a 25.7% increase from the previous year. This growth trajectory has led to strategic developments, including updated 2027 targets aiming for $1.8 billion in net sales. Furthermore, significant investments in manufacturing capacity, such as the commissioning of the Ennis, Texas facility, reflect the company's commitment to meeting increasing demand. The company's expansion and financial performance are key factors influencing its ownership dynamics.

Leadership changes in 2024, including the appointments of Nicki Baty as Chief Operating Officer, Nishu Patel as Chief Accounting Officer, and Thembi Machaba as Chief Human Resources Officer, indicate a focus on strengthening the company's operational and financial management. While specific ownership details are subject to change, the influence of major shareholders and institutional investors remains significant. The Freshpet ownership structure is also influenced by the company's focus on expanding its store footprint and increasing sales per store, coupled with innovative product development, which is designed to capitalize on the growing demand for fresh pet food. The company aims to be free cash flow positive by 2026.

| Metric | Value | Year |

|---|---|---|

| Net Sales | $955.4 million | 2024 |

| Net Sales Growth | 25.7% | 2024 vs. 2023 |

| Institutional Ownership | 135.07% | May 2025 |

The rise in institutional ownership, with institutional investors holding 135.07% in May 2025, underscores the increasing interest in Freshpet stock. While founder dilution is a natural part of a company's growth and public listing, co-founder Scott Morris remains active in leadership. The impact of activist investor campaigns, such as those by JANA Partners in 2023, highlights the influence of major shareholders in driving strategic changes. For more insights, check out the Target Market of Freshpet.

Freshpet's strong financial performance, with substantial sales growth, is a key factor influencing its ownership profile and investor interest. The company's strategic investments in manufacturing and expansion plans also play a role.

The increase in institutional ownership indicates growing confidence from major investors. This trend reflects the company's market position and future growth prospects, influencing the Freshpet investors.

Leadership appointments and strategic initiatives, such as facility expansions, demonstrate the company's commitment to growth and operational efficiency. These changes can influence investor sentiment and ownership dynamics.

Activist investor campaigns highlight the significant influence of major shareholders in shaping the company's strategic direction and governance. These campaigns can lead to changes in the Freshpet ownership structure.

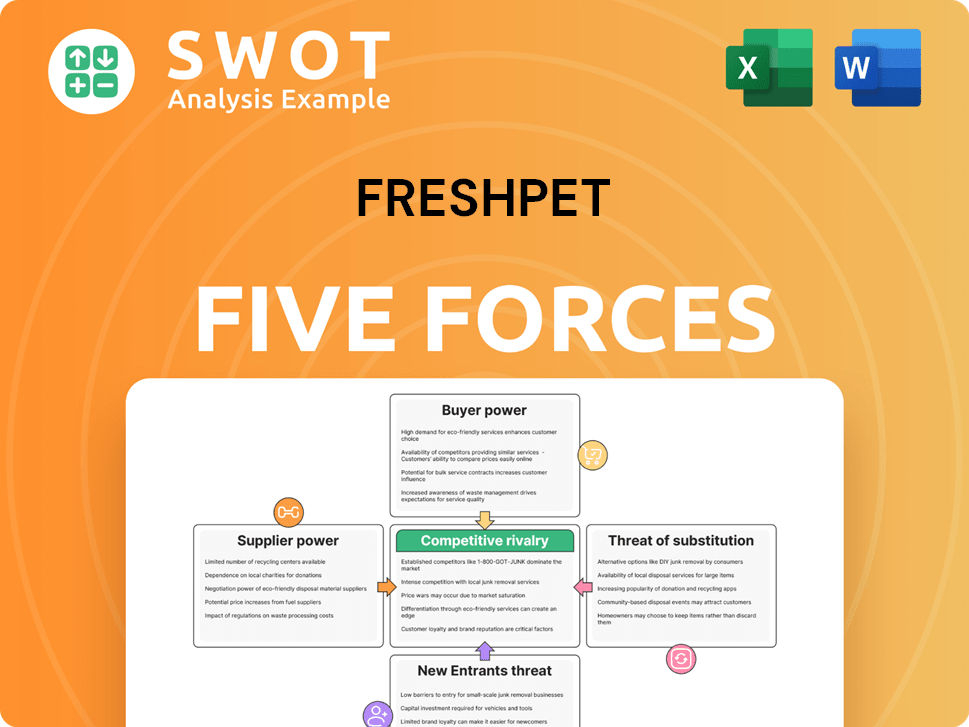

Freshpet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Freshpet Company?

- What is Competitive Landscape of Freshpet Company?

- What is Growth Strategy and Future Prospects of Freshpet Company?

- How Does Freshpet Company Work?

- What is Sales and Marketing Strategy of Freshpet Company?

- What is Brief History of Freshpet Company?

- What is Customer Demographics and Target Market of Freshpet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.