Freshpet Bundle

How Did Freshpet Achieve Its Remarkable Turnaround?

Freshpet, a leader in the fresh pet food market, recently celebrated a historic milestone: its first full-year net profit. This financial success, with a $46.9 million profit in 2024, highlights the company's impressive growth and ability to meet consumer demand for healthier pet food. Known for its refrigerated Freshpet SWOT Analysis, the company has become a significant player in the pet food industry.

With annual sales soaring to $975.2 million in 2024, Freshpet's expansion continues with products now available in over 28,000 stores. Understanding how the Freshpet company operates, from sourcing ingredients to its unique distribution model, is key for anyone interested in the pet food sector. This analysis will provide insights into how Freshpet food is made and its strategies for success.

What Are the Key Operations Driving Freshpet’s Success?

The Freshpet company creates value by providing fresh, refrigerated pet food products. This caters to the increasing demand for natural and less-processed options for dogs and cats. Their core offerings, sold under brands like Freshpet Select, Vital, and Nature's Fresh, include dog food, cat food, and dog treats.

The company primarily targets pet owners who prioritize the health and nutrition of their animals, capitalizing on the trend of humanizing pets. The operational processes are vertically integrated, emphasizing quality control and freshness. Freshpet manufactures its products in its own kitchens, sourcing high-quality, fresh ingredients.

A key element of its operations is its refrigerated distribution network, which maintains product freshness from manufacturing to the point of sale. This unique approach differentiates Freshpet from traditional shelf-stable pet food options. This focus on freshness translates into customer benefits such as healthier food options and market differentiation.

Freshpet offers a range of fresh, refrigerated pet food products, including dog and cat food, and treats. Their primary target is pet owners who prioritize health and nutrition for their animals. The company taps into the growing trend of the humanization of pets.

Freshpet's operations are vertically integrated, with manufacturing in their own kitchens. They focus on sourcing high-quality, fresh ingredients, with a significant portion sourced locally. Their refrigerated distribution network ensures product freshness from production to the point of sale.

The value lies in offering fresh, refrigerated pet food that prioritizes health and nutrition. Freshpet differentiates itself through its unique refrigerated retail presence and commitment to maintaining the integrity of natural ingredients. This approach provides healthier options for pets.

Freshpet utilizes a network of approximately 36,500 company-owned refrigerated coolers in over 28,000 retail stores. This 'fridge infrastructure' provides a significant competitive edge. They also have a DTC presence through online channels and platforms like Chewy.

Freshpet's commitment to fresh, refrigerated pet food sets it apart from traditional shelf-stable options. Their vertically integrated operations and focus on local sourcing contribute to product quality and freshness. Their unique refrigerated retail presence is a significant advantage.

- Focus on fresh, refrigerated products.

- Vertically integrated operations.

- Extensive refrigerated retail presence.

- Emphasis on natural ingredients.

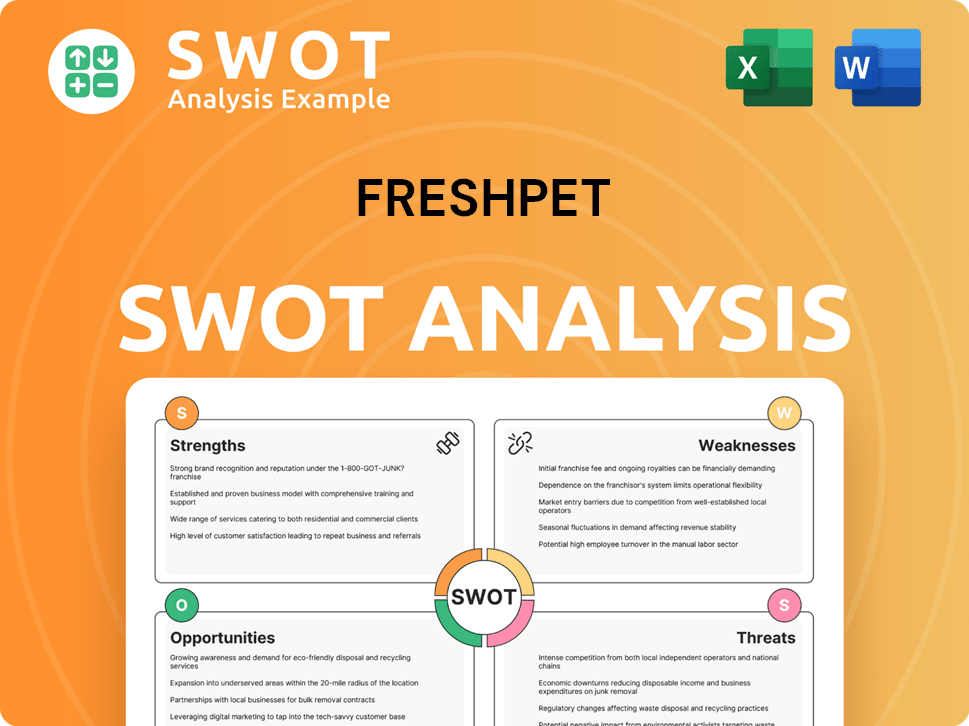

Freshpet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Freshpet Make Money?

The primary revenue stream for the Freshpet company is the sale of its refrigerated pet food products, primarily for dogs and cats. The company's financial success is heavily reliant on its dog food offerings, which constituted the majority of its revenue in 2024.

In 2024, Freshpet reported net sales of $975.2 million, a significant increase of 27.2% from $766.9 million in 2023. This growth was primarily driven by a substantial increase in sales volume. The first quarter of 2025 showed continued growth, with net sales reaching $263.2 million, a 17.6% increase compared to $223.8 million in the same period the previous year.

Freshpet's monetization strategy is closely linked to its distribution model, where each new fridge placed in a store acts as a new point of sale, boosting brand visibility and sales. The company also leverages its growing household penetration, which reached 14.1 million households in 2025, a 13% increase from 2024. Furthermore, the average spending per buyer increased by 6% to $110.

Freshpet employs several strategies to maximize revenue and maintain its market position. These include:

- Expanding fridge placements in high-demand stores to increase product visibility and sales.

- Introducing new product offerings, such as a lower-priced bagged product in the Complete Nutrition line, to cater to a wider range of consumers.

- Growing multi-pack options to offer more value and convenience, adapting to economic conditions.

- Focusing on e-commerce, which saw a 43% increase in Q1 2025, to reach a broader customer base. For more insights, explore the Competitors Landscape of Freshpet.

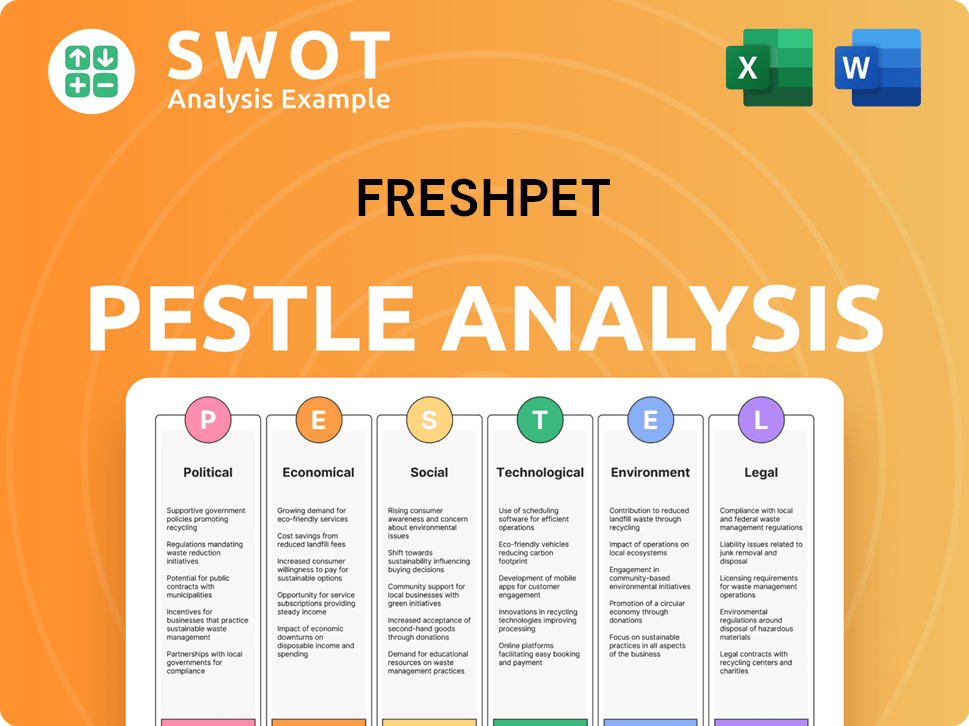

Freshpet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Freshpet’s Business Model?

Freshpet has achieved significant milestones, including reporting its first full-year net profit in company history for fiscal year 2024, reaching $46.9 million, a major turnaround from a $33.6 million loss in 2023. The company's net sales for 2024 also saw a substantial increase of 27.2% to $975.2 million. This financial performance reflects the growing demand for Freshpet food in the pet food market.

The company has expanded its retail footprint, with products in approximately 28,141 stores as of December 31, 2024, and a strategy of adding second and third fridges in high-demand locations. Despite these achievements, Freshpet faces challenges, including macroeconomic headwinds impacting consumer spending in early 2025. As a result, the company has adjusted its sales outlook and adjusted EBITDA guidance for 2025.

Freshpet is adapting to these challenges and focusing on innovation and sustainability. The company's commitment to high-quality, natural ingredients and continuous product innovation appeals to health-conscious pet owners, driving demand. Freshpet is also planning to introduce a lower-priced bagged product and grow multi-pack options to offer more value, demonstrating its strategic agility in a dynamic market. You can read more about the Marketing Strategy of Freshpet.

In 2024, Freshpet reported its first full-year net profit of $46.9 million. Net sales for 2024 increased by 27.2% to $975.2 million. These figures highlight the company's strong financial performance and growth in the pet food market.

Due to macroeconomic headwinds, Freshpet adjusted its full-year 2025 sales outlook to between $1.12 billion and $1.15 billion (15% to 18% growth). The company also revised its adjusted EBITDA guidance to between $190 million and $210 million. These adjustments reflect the company's proactive approach to market challenges.

Freshpet’s unique distribution model, featuring company-owned refrigerated coolers in retail stores, ensures product freshness. The company's commitment to high-quality, natural ingredients and continuous product innovation appeals to health-conscious pet owners. Freshpet has invested in educating consumers and building a nationwide cold-chain supply network.

Freshpet is focusing on innovation and sustainability, including efforts to source ingredients responsibly, reduce waste, and use renewable energy. The company aims to be 100% regeneratively sourced by 2025 for its Nature's Fresh line. Freshpet is working towards carbon neutrality for scopes 1, 2, and 3 by 2025.

Freshpet is expanding its retail presence and adapting to economic challenges by adjusting its sales outlook and EBITDA guidance. The company is also focusing on product innovation and sustainability to maintain its competitive edge. These moves are designed to drive future growth and profitability.

- Introduction of a lower-priced bagged product.

- Expansion of multi-pack options to offer more value.

- Continued investment in its unique distribution model.

- Focus on responsible sourcing and carbon neutrality.

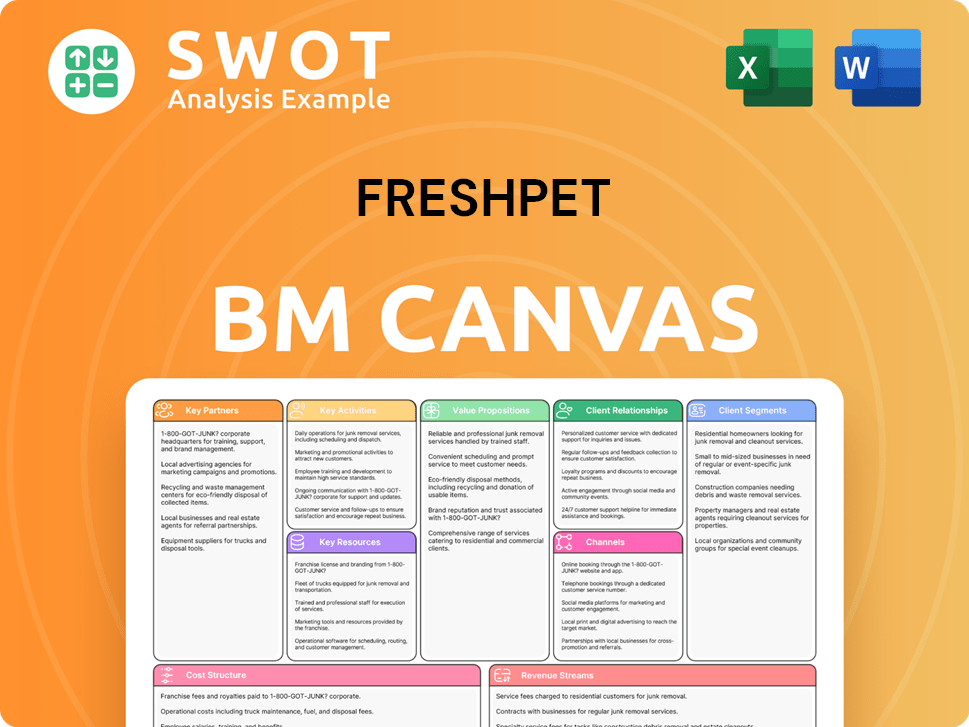

Freshpet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Freshpet Positioning Itself for Continued Success?

The [Company Name] holds a strong position in the U.S. premium fresh dog food market, essentially creating and leading this segment. The company continues to capture a significant portion of the growth within the fresh pet food category. As of Q1 2024, [Company Name] held a 3% market share of dog food in the U.S., but its overall market share in the total pet food market is estimated at about 1%. [Company Name] faces competition from larger companies like Nestle, Mars Inc., General Mills, and Colgate-Palmolive, as well as private label brands and smaller startups.

Several risks and challenges could impact [Company Name]'s operations and revenue. These include shifts in consumer preferences, particularly a potential decrease in demand for premium pet food during economic downturns. The company's premium pricing, ranging from $3-$5 per serving, makes it vulnerable to economic fluctuations. Moreover, [Company Name] faces heightened food safety risks due to its fresh, refrigerated products; any contamination or recall could harm its reputation and shelf space. Execution risks also exist with strategic shifts, such as distributor transitions and international market strategies.

As a leader in the premium fresh dog food category, [Company Name] has a strong market position. The company is focused on expanding its market share in the pet food industry. [Company Name] faces competition from major players like Nestle and Mars Inc., as well as smaller brands.

Economic downturns could impact demand for premium pet food. Food safety is a significant risk for [Company Name] because of its fresh products. Strategic shifts, such as distributor changes, also pose execution risks.

Despite macroeconomic challenges, [Company Name] is moving forward with its strategic plans. The company adjusted its 2025 net sales outlook to $1.12 billion to $1.15 billion (15%-18% growth) and adjusted EBITDA to $190 million to $210 million. [Company Name] expects to surpass canned dog food sales in 2025. For more details on the company's performance, you can read Owners & Shareholders of Freshpet.

- Focus on increased capacity utilization.

- Optimize distribution networks.

- Increase product turnover in refrigerators.

- Targeted digital advertising campaigns.

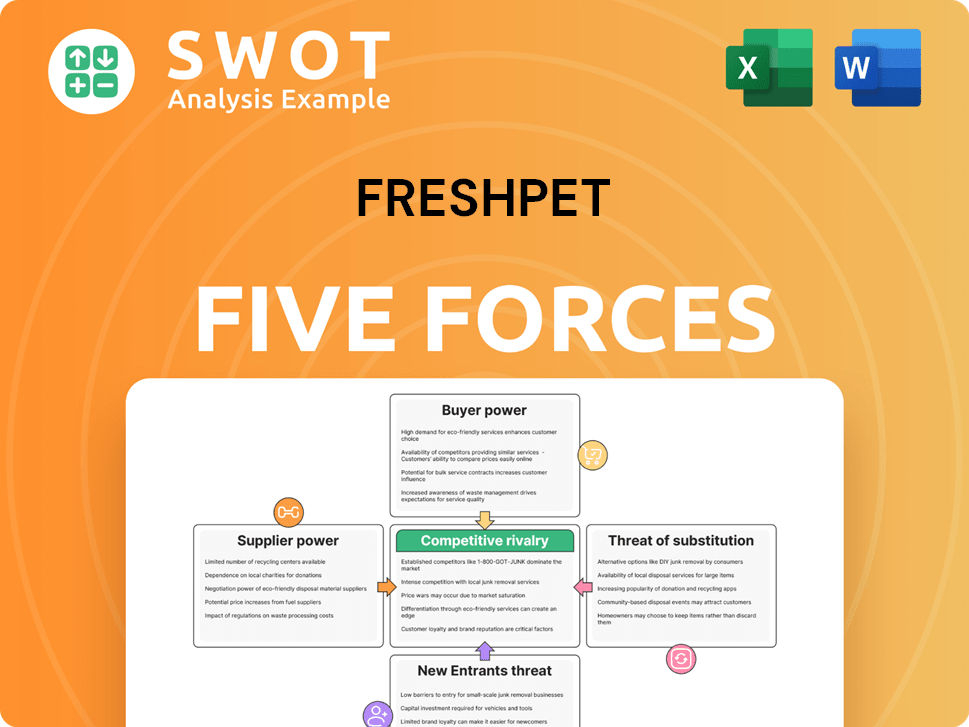

Freshpet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Freshpet Company?

- What is Competitive Landscape of Freshpet Company?

- What is Growth Strategy and Future Prospects of Freshpet Company?

- What is Sales and Marketing Strategy of Freshpet Company?

- What is Brief History of Freshpet Company?

- Who Owns Freshpet Company?

- What is Customer Demographics and Target Market of Freshpet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.