Fulgent Bundle

How has Fulgent Genetics reshaped the healthcare landscape?

Founded in 2011, Fulgent Genetics embarked on a mission to revolutionize patient care through advanced genetic insights. The Fulgent SWOT Analysis reveals the company's strategic positioning. Initially focusing on providing actionable diagnostic information to physicians, Fulgent quickly expanded its reach.

This brief history of Fulgent Company explores the company's evolution, from its early days to its current market position. Understanding the Fulgent history provides valuable context for investors and industry watchers. The company's journey highlights its pivotal role in advancing genetic diagnostics and therapeutics, making it a key player in the healthcare sector.

What is the Fulgent Founding Story?

The brief history of Fulgent Genetics begins in 2011. The company was established with a clear mission: to provide physicians with actionable diagnostic information through comprehensive genetic testing. From its inception, Fulgent Company focused on developing a proprietary technology platform.

The company's headquarters and main laboratory are situated in Temple City, California. Fulgent's early strategy centered on offering a broad and flexible test menu. This approach aimed to maintain affordable pricing, high accuracy, and competitive turnaround times for its services.

The founder and CEO of Fulgent Genetics is Ming Hsieh. Hsieh's background is in electrical engineering. He previously founded Cogent Systems, a fingerprint scanning system company. Fulgent Genetics went public in 2013. It initially concentrated on genetic testing for pediatric rare diseases.

Fulgent Genetics' early success was built on its ability to provide flexible testing options.

- The company's business model emphasized comprehensive technology.

- This included cloud computing, pipeline services, and automated lab services.

- Fulgent aimed to offer competitive prices.

- The company continuously improved its technology to reduce internal costs.

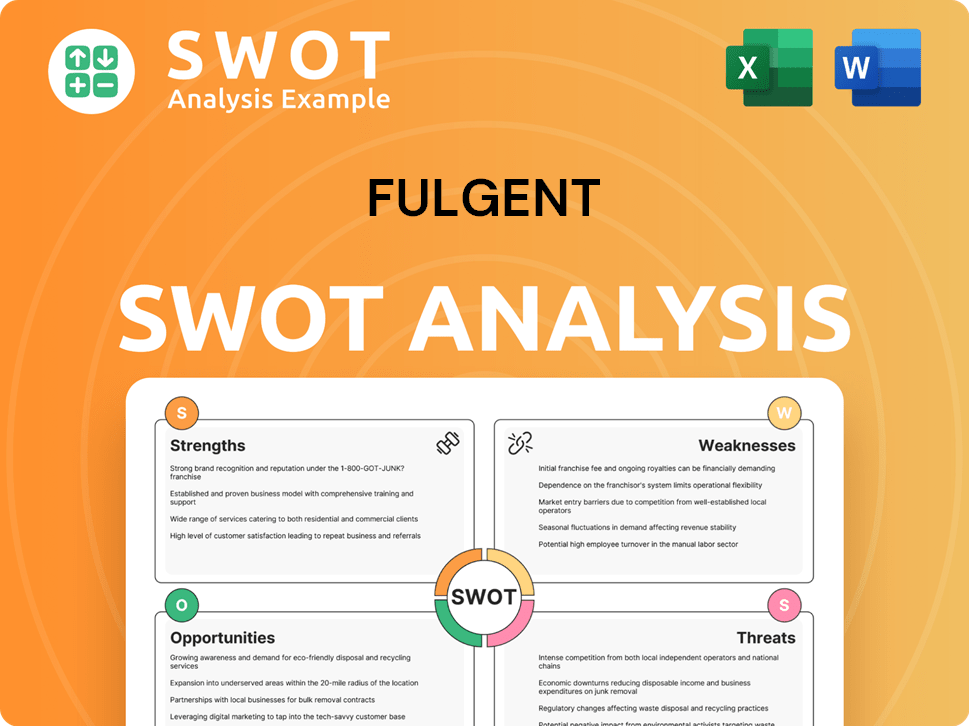

Fulgent SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Fulgent?

The early growth of Fulgent Genetics, a key part of Fulgent Company's Fulgent history, was marked by significant expansion and strategic acquisitions. Following its public launch, the company broadened its genetic testing capabilities, leading to an Initial Public Offering (IPO). This growth was fueled by proprietary technology and strategic moves to enhance its service offerings and market presence.

After its public launch in 2013, Fulgent Genetics expanded its testing capabilities to cover over 7,500 genetic conditions. This expansion was a crucial step in the company's early growth, enabling it to offer a wider range of services. The growth in testing capabilities directly contributed to its Initial Public Offering (IPO) in 2016.

Fulgent Genetics utilized a proprietary technology platform, which was a key enabler of its growth. This platform allowed for a broad and flexible test menu, helping the company to continuously expand its genetic reference library. The technological foundation supported the company's ability to scale and adapt to market demands.

In 2020, Fulgent Genetics opened 'Fulgent Houston,' a CLIA-certified laboratory in Houston, Texas. This facility was designed as a fully operational second site outside California, strategically located near major medical and cancer centers. Initially, it focused on COVID-19 testing, with a capacity for 20,000 tests per day.

Fulgent Genetics has grown through strategic acquisitions. In April 2022, the company announced an agreement to acquire Inform Diagnostics for approximately $170 million. This acquisition expanded its test menu into various pathology fields. Further acquisitions, such as CSI Laboratories in August 2021 and Fulgent Pharma Holdings, Inc. in November 2022, have shaped Fulgent Company's trajectory. For more information on the company's ownership, check out the Owners & Shareholders of Fulgent.

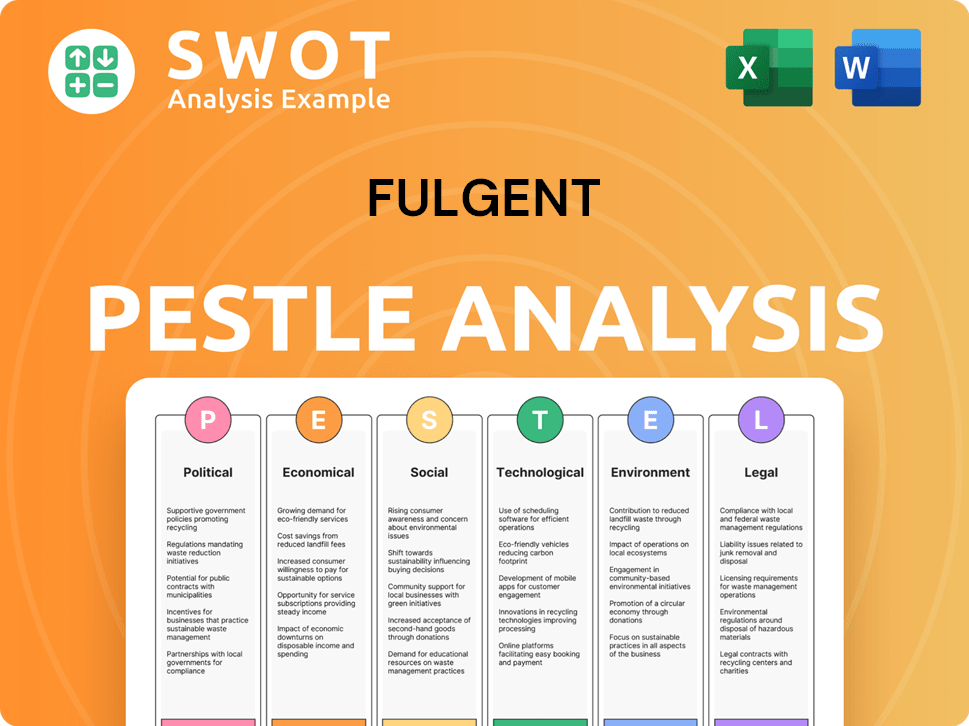

Fulgent PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Fulgent history?

The Fulgent Company, also known as Fulgent Genetics, has a history marked by significant achievements in genetic testing. The Fulgent history includes pioneering advancements and strategic responses to market demands, establishing its position in the healthcare sector. The company's journey reflects its commitment to innovation and adaptability within the dynamic field of genetic diagnostics.

| Year | Milestone |

|---|---|

| Early Years | Fulgent Genetics became the first clinical laboratory in the U.S. to offer copy number variation (CNV) detection using Next-Generation Sequencing (NGS) technology. |

| 2020 | Pivoted to offer high-capacity COVID-19 testing, contributing significantly to revenue during the pandemic, particularly in Q4 2021. |

| Recent Years | Expanded offerings with new products like Exome and GenomeRise, and launched KNOVA, a novel NIPT test. |

| 2025 | Anticipated publication of preliminary results from Phase 2 clinical trials for FID-007 at the ASCO meeting in June 2025. |

Fulgent Genetics has consistently focused on innovation. The company's proprietary technology platform, which combines NGS with sophisticated algorithms, has been central to its ability to offer a broad and flexible test menu. The introduction of Exome, GenomeRise, and KNOVA showcases its commitment to expanding its diagnostic capabilities and improving patient care.

Utilizing Next-Generation Sequencing (NGS) for accurate and efficient genetic testing.

Combining NGS with sophisticated algorithms to offer a broad and flexible test menu.

New products designed to improve the diagnosis of rare diseases.

A novel NIPT test combining aneuploidies, microdeletions, and de novo point mutations for higher detection rates.

Advancing its lead oncology candidate, which demonstrated antitumor activity in Phase 2 clinical trials for head and neck cancer.

Digitalizing over 85% of its slides in anatomic pathology to improve quality and turnaround time.

Fulgent Company has faced various challenges, including navigating a competitive market. Despite revenue growth, the company reported a GAAP loss of $42.7 million for the full year 2024, indicating the need for strategic financial management.

Facing competition from major players like Illumina and Invitae in the genetic testing market.

Managing profitability despite revenue growth, as evidenced by financial results in 2024.

Investing heavily in research and development, contributing to negative free cash flow.

Addressing challenges through strategic investments, such as digitalizing pathology slides.

The decline in COVID-19 testing revenue, which required a renewed focus on core genetic testing services.

Maintaining a strong cash position to fund key initiatives and support future growth.

For further insights into the Fulgent Company's strategic direction, consider exploring the Growth Strategy of Fulgent.

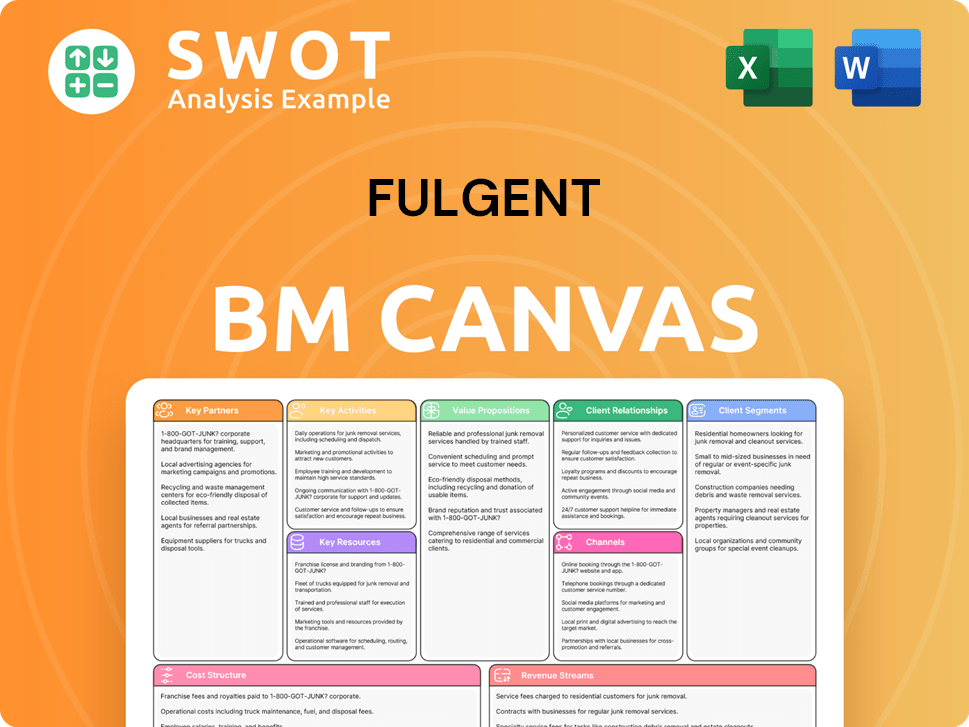

Fulgent Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Fulgent?

The Fulgent Genetics story, which started in 2011, showcases a journey of strategic expansions and technological advancements within the genetic testing sector. The company's evolution includes key moments like its IPO in 2016, acquisitions like CSI Laboratories in August 2021 and Inform Diagnostics in April 2022, and the completion of Fulgent Pharma in November 2022, all contributing to its growth and diversification.

| Year | Key Event |

|---|---|

| 2011 | Fulgent Genetics was founded, marking the beginning of its journey. |

| 2013 | The company launched publicly, initially focusing on pediatric rare diseases. |

| 2016 | Fulgent Genetics completed its IPO, a significant step in its corporate timeline. |

| 2020 | Opened 'Fulgent Houston' lab in Texas, initially for COVID-19 testing. |

| August 2021 | Acquired CSI Laboratories, expanding its service offerings. |

| April 2022 | Agreed to acquire Inform Diagnostics, broadening its scope into anatomic pathology. |

| November 2022 | Completed acquisition of Fulgent Pharma, aiming for a fully integrated precision medicine company. |

| 2024 | Reported total revenue of $283.5 million, with core revenue growing 7% year-over-year. |

| Q1 2025 | Core revenue grew 16% year-over-year to $73.5 million. |

Fulgent Genetics anticipates continued growth in its laboratory services, including Precision Diagnostics, Anatomic Pathology, and Biopharma Services. The company plans to broaden its test menu, especially in oncology, cardiology, pediatrics, and prenatal testing. This expansion is a key part of their strategy.

A significant part of Fulgent's future strategy involves advancing its therapeutic development business. This includes ongoing Phase 2 clinical trials for FID-007 in cancer treatment and planned Phase 1 trials for FID-022. These trials represent a move towards a fully integrated precision medicine company.

Fulgent intends to continue investing in operational efficiencies, such as digital pathology, to improve quality and turnaround times. These investments are designed to streamline processes and enhance overall performance. The focus is on improving service delivery.

For 2025, Fulgent projects core revenue of approximately $310 million, reflecting a 10% year-over-year growth. Despite projected GAAP losses for 2025, the company maintains a strong cash position, with an anticipated $770 million in cash and investments by the end of 2025. This cash will be used for reinvestment and potential M&A.

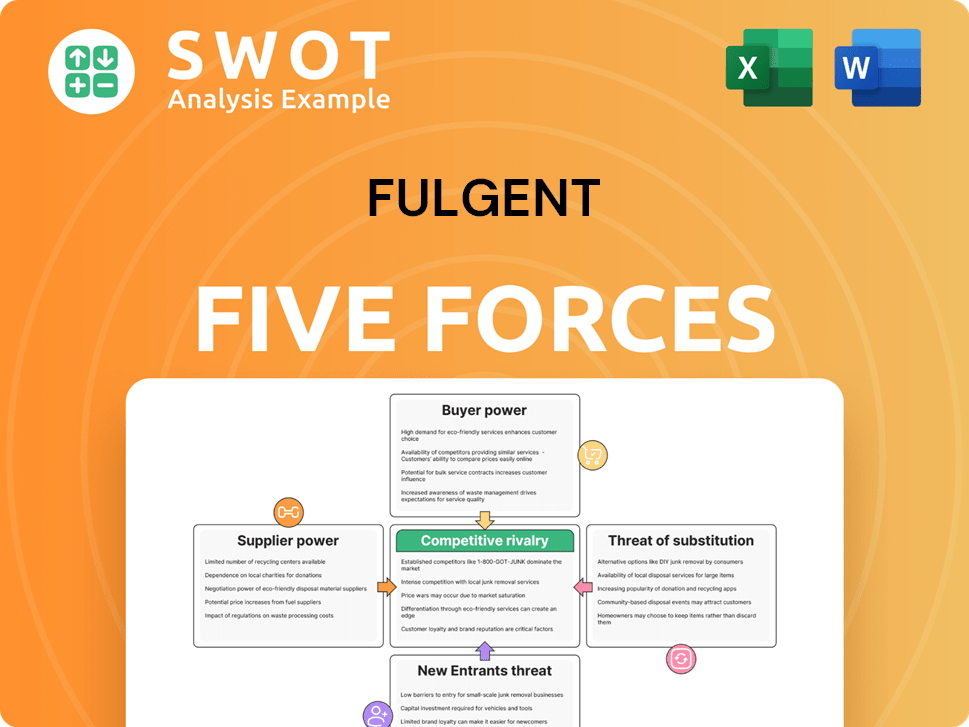

Fulgent Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Fulgent Company?

- What is Growth Strategy and Future Prospects of Fulgent Company?

- How Does Fulgent Company Work?

- What is Sales and Marketing Strategy of Fulgent Company?

- What is Brief History of Fulgent Company?

- Who Owns Fulgent Company?

- What is Customer Demographics and Target Market of Fulgent Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.