Fulgent Bundle

Who Really Owns Fulgent Genetics?

Navigating the complexities of the biotech sector requires a keen understanding of company ownership. Knowing Fulgent SWOT Analysis can help you to understand the company better. This knowledge is particularly crucial for a company like Fulgent Genetics, operating at the forefront of genetic testing and precision medicine. Unraveling the ownership structure provides critical insights into its strategic direction and long-term potential.

Understanding the ownership of Fulgent Genetics, including major shareholders and the influence of institutional investors, is vital for anyone tracking Fulgent stock. From its humble beginnings to its current market cap, the evolution of Fulgent's ownership reveals much about its growth trajectory and strategic decisions. Identifying the key players, including the Fulgent CEO and other significant stakeholders, can offer a deeper understanding of the company's future prospects. This report provides a detailed analysis of who owns Fulgent, offering valuable insights for investors and analysts alike, including information on Fulgent Genetics' company structure and how to find Fulgent's ownership information.

Who Founded Fulgent?

The story of Fulgent Genetics begins in 2011. Initially, it was part of Fulgent Therapeutics, which started in Temple City, California, in June 2011. This early phase set the stage for the company's future in the genetic testing field.

A significant shift occurred in 2016. Fulgent Therapeutics split into two separate entities: Fulgent Pharma and Fulgent Genetics. This strategic move was made in preparation for Fulgent Genetics' Initial Public Offering (IPO). The separation allowed each company to concentrate on its specific goals in genetic testing and therapeutic drug development, respectively.

The founder of Fulgent Genetics, and its current Chairman and CEO, is Ming Hsieh. He also holds the position of CEO and founder at Fulgent Pharma. Before his involvement with Fulgent Genetics and Pharma, Ming Hsieh founded Cogent Inc. in 1990, where he served as Chairman and CEO until the company's sale in 2010.

Fulgent Genetics was established in 2011 as part of Fulgent Therapeutics.

In 2016, Fulgent Therapeutics separated into Fulgent Genetics and Fulgent Pharma.

Ming Hsieh is the founder and current CEO of Fulgent Genetics.

Before Fulgent, Hsieh founded Cogent Inc., which was sold in 2010.

The separation in 2016 prepared Fulgent Genetics for its IPO.

Fulgent Genetics operates independently in the genetic testing sector.

Detailed information regarding the initial equity split, early investors, or specifics about vesting schedules for the founders or buy-sell agreements at the company's inception is not readily available in the provided search results. For a deeper understanding of the Fulgent Genetics company structure, it's beneficial to review its SEC filings, annual reports, and other official documents. These documents often provide insights into the ownership structure, major shareholders, and the evolution of the company's financial landscape. Analyzing Fulgent stock and understanding who owns Fulgent is crucial for investors looking into this company.

Understanding the ownership structure of Fulgent Genetics is essential for investors. Key aspects include the founder's role, the company's history, and the transition from Fulgent Therapeutics.

- Ming Hsieh is the founder and CEO of Fulgent Genetics.

- The company was formed in 2011 and separated from Fulgent Therapeutics in 2016.

- Detailed information on early investors and specific shareholding percentages is not readily available.

- Investors should consult SEC filings and annual reports for more information on Fulgent investors and major shareholders.

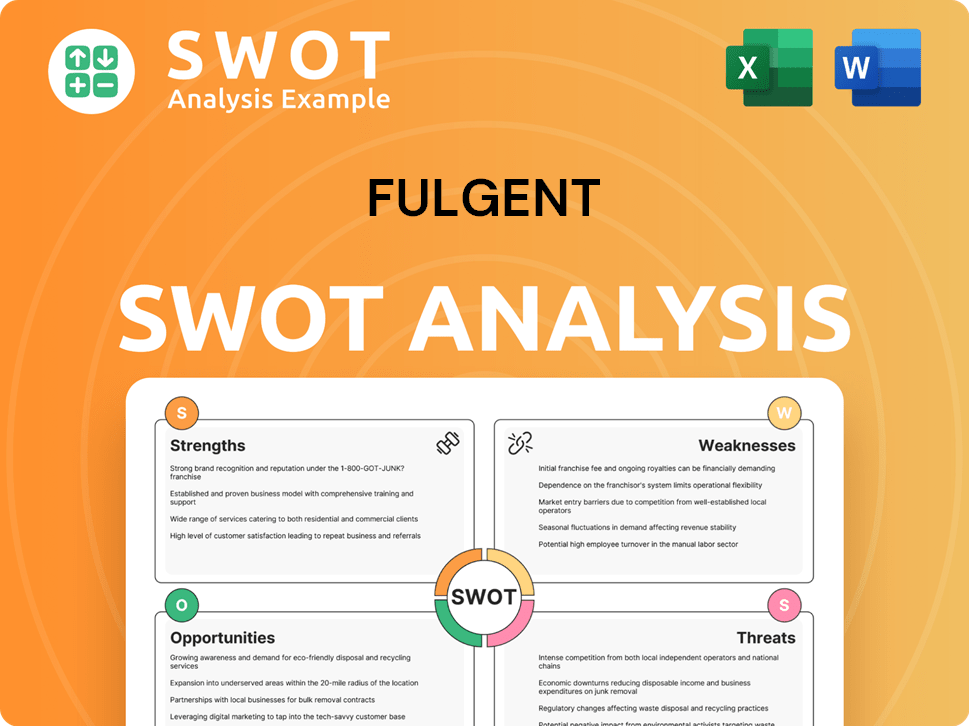

Fulgent SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Fulgent’s Ownership Changed Over Time?

The evolution of ownership in Fulgent Genetics has been marked by significant developments, primarily driven by strategic acquisitions and the company's status as a publicly traded entity. Fulgent Genetics became a publicly held company, which opened its ownership to a wide range of institutional and individual investors. Key events, such as the acquisition of Fulgent Pharma in November 2022 for approximately $100 million, and the strategic investment in FF Gene Biotech in May 2021, have reshaped the company's structure and expanded its operational scope.

As of June 8, 2025, the ownership structure of Fulgent Genetics reflects a mix of institutional and insider holdings. Institutional ownership accounts for 53.66%, while insider ownership stands at 8.47%. These figures highlight the influence of both large institutional investors and the company's leadership in shaping its direction.

| Shareholder | Shares Held (as of March 31, 2025) | Notes |

|---|---|---|

| BlackRock, Inc. | 2,244,555 | Decreased holdings |

| Millennium Management Llc | 1,969,433 | Increased holdings |

| Vanguard Group Inc. | 1,167,974 |

The largest individual shareholder, Ming Hsieh, owns 8.71 million shares, representing 28.61% of the company. Insider holdings saw an increase from 13.58% to 13.64% in May 2025. Institutional investors' holdings remained steady at 47.91% in May 2025, and mutual funds' holdings were unchanged at 28.78%. Major institutional shareholders include BlackRock, Inc., Millennium Management Llc, and Vanguard Group Inc.

Fulgent Genetics is a publicly traded company with a significant institutional and insider ownership. Understanding the ownership structure is crucial for investors and stakeholders.

- Institutional investors hold a majority stake.

- Ming Hsieh is the largest individual shareholder.

- Strategic acquisitions have reshaped the company.

- Tracking changes in ownership provides insights into the company's direction.

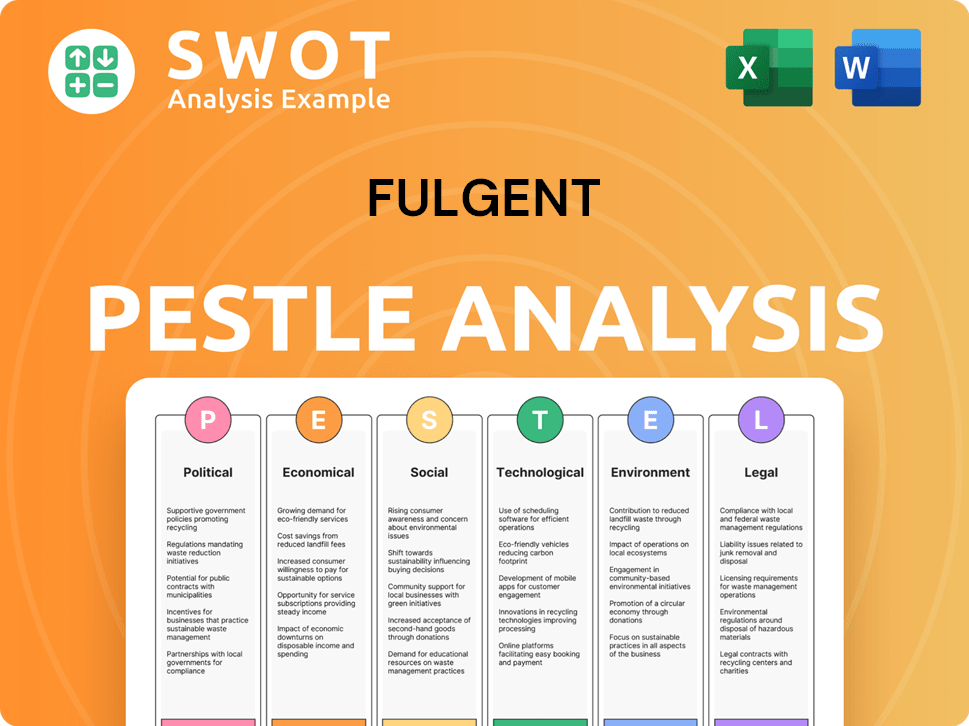

Fulgent PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Fulgent’s Board?

The leadership of Fulgent Genetics includes Ming Hsieh as Chairman and CEO. Jian Xie serves as COO & President, Paul Kim as Chief Financial Officer, and Hanlin Gao as Chief Scientific Officer & Lab Director. The board of directors has an average tenure of approximately 4.3 years, indicating a degree of stability within the company's governance structure. Understanding the board's composition is crucial for investors looking into Fulgent Genetics' target market and overall strategic direction.

As of March 20, 2025, the ownership structure is based on approximately 30,865,730 shares of common stock outstanding. The voting rights are generally one-share-one-vote, which is typical for public companies. Paul Kim, the CFO and Treasurer, increased his direct ownership by acquiring 100,000 shares on March 5, 2025, bringing his total holdings to 348,282 shares. This information is vital for Fulgent investors and anyone tracking Fulgent stock.

| Leadership Position | Name | Title |

|---|---|---|

| Chairman & CEO | Ming Hsieh | Chairman & CEO |

| COO & President | Jian Xie | COO & President |

| Chief Financial Officer | Paul Kim | Chief Financial Officer |

| Chief Scientific Officer & Lab Director | Hanlin Gao | Chief Scientific Officer & Lab Director |

The recent acquisition of shares by the CFO underscores the insider ownership dynamics at Fulgent. While specific details on proxy battles or governance controversies are not available in the provided information, the board's experience and the voting structure provide important insights for anyone researching who owns Fulgent.

Understanding Fulgent Company ownership is essential for potential investors. Key figures include Ming Hsieh, the Chairman and CEO, and Paul Kim, the CFO. The voting structure follows a one-share-one-vote system.

- Ming Hsieh is the Chairman and CEO.

- Paul Kim, CFO, recently increased his share ownership.

- The board of directors has an average tenure of 4.3 years.

- The voting structure is generally one-share-one-vote.

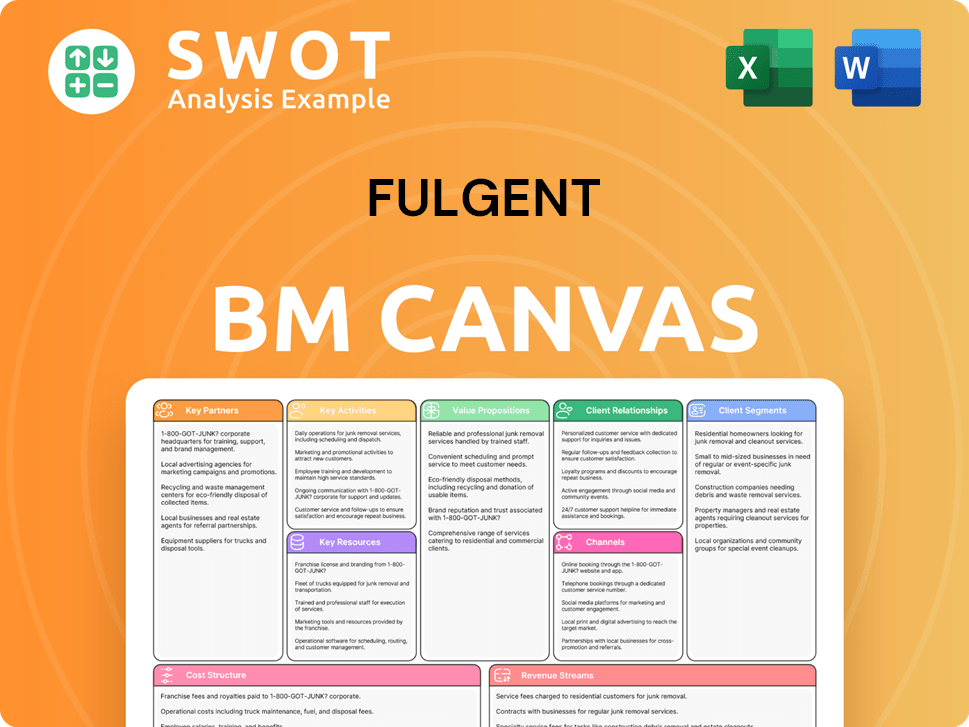

Fulgent Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Fulgent’s Ownership Landscape?

In recent years, Fulgent Genetics has shown a commitment to returning value to its shareholders through share buybacks. Since the initiation of its share repurchase plan in March 2022, the company has repurchased a cumulative total of $108.3 million in shares. In the first quarter of 2025, approximately 516,000 shares were repurchased for $8.7 million. As of March 1, 2025, there was approximately $147 million remaining under the repurchase program for future purchases.

Ownership trends also reveal interesting insights. Institutional ownership in Fulgent Genetics was reported at 53.66% as of June 8, 2025, while insider ownership stood at 8.47%. Notably, in May 2025, insiders increased their holdings from 13.58% to 13.64%. BlackRock, Inc. decreased its ownership from 3,761,878 shares to 1,819,823 shares, representing a 5.9% ownership as of April 3, 2025.

Ming Hsieh, the founder, CEO, and Chairman, continues to lead the company. Furthermore, Paul Kim, the CFO, increased his direct ownership through a stock purchase in March 2025. The company is also focusing on strategic acquisitions to enhance its market presence and technology deployment, with recent acquisitions including Fulgent Pharma, Inform Diagnostics, and CSI Laboratories.

| Metric | Details | Date |

|---|---|---|

| Share Repurchases | $108.3 million cumulative since March 2022 | Q1 2025 |

| Institutional Ownership | 53.66% | June 8, 2025 |

| Insider Ownership | 8.47% | June 8, 2025 |

| BlackRock, Inc. Ownership | 5.9% | April 3, 2025 |

The company has been actively repurchasing shares, demonstrating confidence in its value. This strategy impacts the Fulgent stock and reflects the company's financial health.

The ownership structure includes a mix of institutional and insider ownership, offering insights into Who owns Fulgent and the interests of various stakeholders.

The ongoing leadership of Ming Hsieh, the Fulgent CEO, provides stability. His continued involvement is crucial for the company's direction.

Acquisitions are integral to expanding its reach and capabilities. These moves impact the Fulgent investors by enhancing the company's potential.

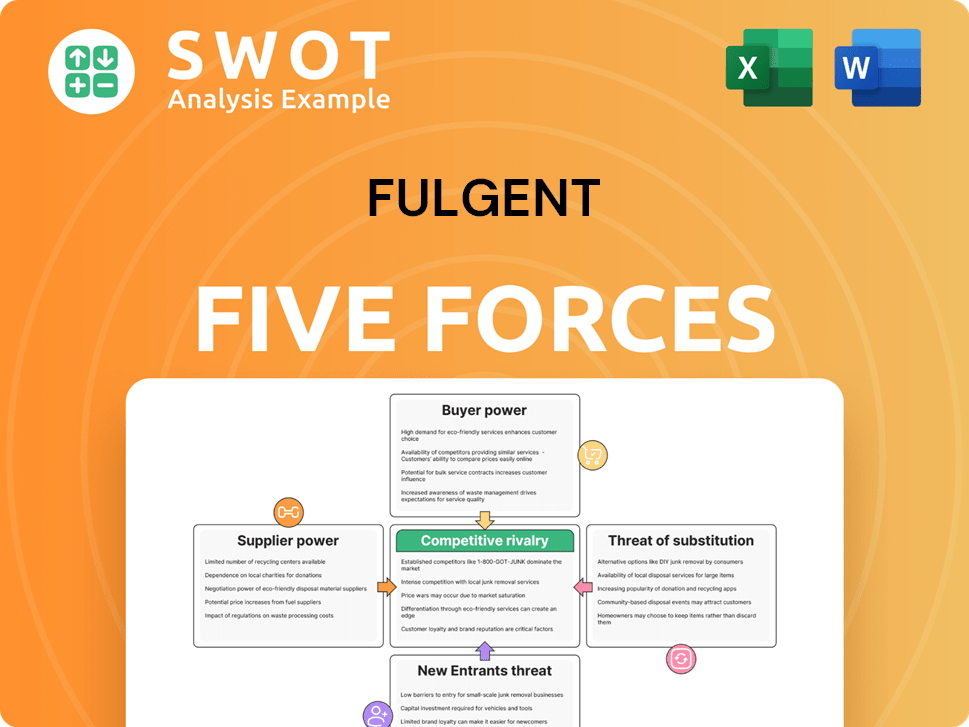

Fulgent Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fulgent Company?

- What is Competitive Landscape of Fulgent Company?

- What is Growth Strategy and Future Prospects of Fulgent Company?

- How Does Fulgent Company Work?

- What is Sales and Marketing Strategy of Fulgent Company?

- What is Brief History of Fulgent Company?

- What is Customer Demographics and Target Market of Fulgent Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.