Fulgent Bundle

Can Fulgent Genetics Continue Its Impressive Growth Trajectory?

Fulgent Genetics, a pioneer in genetic testing, has rapidly transformed the healthcare sector since its inception in 2011. From its early focus on diagnostic information, the company has expanded its reach into crucial areas like oncology and reproductive health. Now, with a market capitalization of $532.43 million as of May 2, 2025, and a robust cash position, the question is: What's next for this innovative company?

This analysis delves into the Fulgent SWOT Analysis to explore Fulgent Company's Growth Strategy and Future Prospects, examining its market position, and financial health. We'll dissect Fulgent Company's business model, competitive landscape, and expansion plans to understand its long-term investment potential within the diagnostics market. Furthermore, we'll assess Fulgent Company's latest news and updates, including its strategic partnerships and innovation in genetics, to forecast its future revenue projections and impact on healthcare.

How Is Fulgent Expanding Its Reach?

The company is actively pursuing a multi-pronged expansion strategy. This strategy focuses on diversifying its revenue streams beyond traditional diagnostics and into therapeutic development. A key initiative is the company's pivot toward becoming a fully integrated precision medicine company.

This shift involves developing drug candidates for treating a broad range of cancers using a novel nanoencapsulation and targeted therapy platform. Strategic partnerships and market expansion are also crucial elements of their growth strategy. This approach aims to solidify its position in the diagnostics market and capitalize on emerging opportunities in the therapeutic space.

The company's expansion initiatives are designed to drive growth and enhance its market position. These initiatives include expanding into new areas within laboratory services, such as anatomic pathology and biopharma services. They also include collaborations with other companies to launch new tests and secure contracts to broaden their customer base.

A major focus is the development of drug candidates for cancer treatment. FID-007, a lead oncology candidate, has shown antitumor activity in head and neck cancer trials. FID-022, targeting solid tumors, is anticipated to begin Phase 1 trials in Q2 2025.

The company is strengthening its presence in precision diagnostics, particularly in reproductive health. They are also expanding into new areas within laboratory services. Anatomic pathology and biopharma services saw substantial growth in Q1 2025, increasing by 9.5% and 51.3% year-over-year, respectively.

Collaborations are a key part of the expansion strategy. The company has a partnership with Foundation Medicine to launch new next-generation sequencing-based germline tests in the US. They also secured a contract with the U.S. Department of Veterans Affairs to provide genetic testing to veterans.

The company has an operational presence in China through a joint venture, FF Gene Biotech. This venture aims to capitalize on the growing genetic testing market in the region. This market is projected to grow at a 30% CAGR from 2019 to 2030, reaching $4.5 billion.

The company’s expansion plans include a focus on precision medicine and expanding its market reach. They are investing in therapeutic development and broadening their diagnostic service offerings. These initiatives are supported by strategic partnerships and international expansion efforts.

- Development of drug candidates for cancer treatment.

- Expansion in precision diagnostics, including reproductive health.

- Growth in anatomic pathology and biopharma services.

- Strategic partnerships to launch new tests and expand customer base.

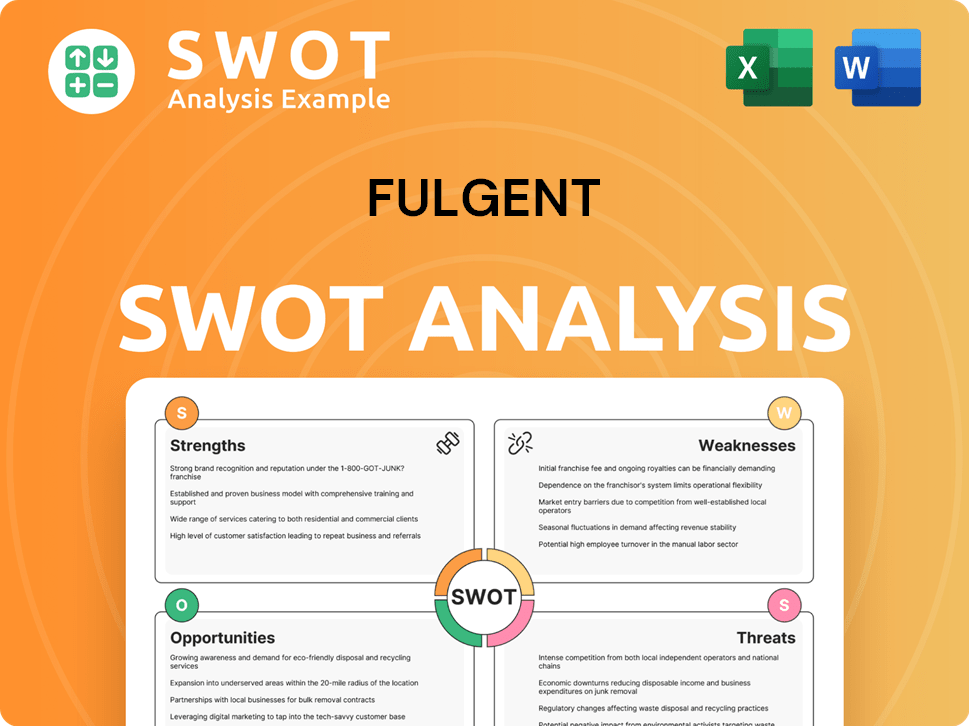

Fulgent SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Fulgent Invest in Innovation?

The growth strategy of Fulgent Genetics heavily relies on innovation and technological advancements, positioning the company for sustained expansion. Their core strength lies in a robust technology platform that integrates advanced DNA sequencing and sophisticated algorithms. This platform is crucial for developing and commercializing a wide range of genetic tests, driving their market presence and future prospects.

Fulgent Genetics' commitment to innovation is evident through significant investments in research and development. A key area of focus is their therapeutic development business, which is dedicated to creating drug candidates for cancer treatments. This strategic approach underscores their dedication to not only genetic testing but also to the broader field of precision medicine.

Digital transformation is also a key aspect of Fulgent Genetics' strategy, particularly in digital pathology. The company has made substantial progress in digitizing its operations, with over 85% of slides now digitized. This digital shift has led to significant revenue generation, as seen in the $1 million generated from digital billing in Q1 2025, highlighting their leadership in this area. The company's focus on technological leadership and innovation is crucial for their future growth, as highlighted in an article about Owners & Shareholders of Fulgent.

Fulgent Genetics' innovation strategy involves substantial investments in technology and R&D. The company is allocating approximately $25 million for therapeutic development in 2025, which includes ongoing clinical trials. This investment is crucial for advancing their drug candidates and expanding their product offerings.

- R&D Investment: Approximately $25 million allocated for therapeutic development in 2025.

- Digital Pathology: Over 85% of slides digitized, with digital billing generating over $1 million in Q1 2025.

- Clinical Trials: Ongoing Phase 2 trials for FID-007 and Phase 1/2 trials for FID-022.

- Test Menu Expansion: Continuous development of new tests and expansion of the test menu.

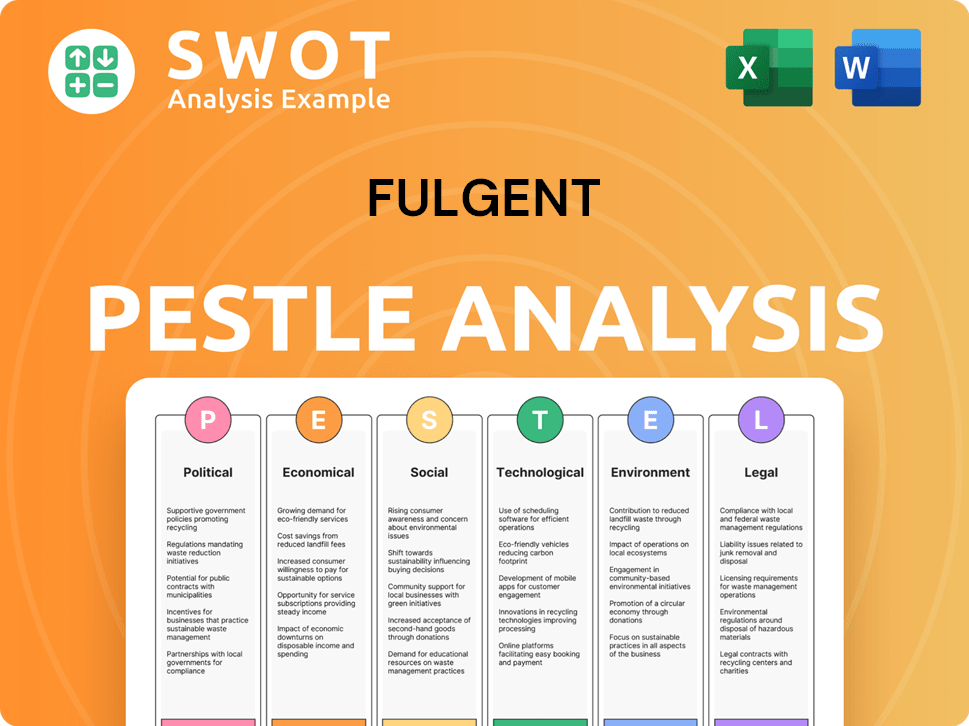

Fulgent PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Fulgent’s Growth Forecast?

The financial outlook for Fulgent Genetics in 2025 indicates a focus on sustained growth within its core business areas. The company anticipates a core revenue of approximately $310 million, which represents a 10% year-over-year increase from the $281.2 million reported in 2024. This growth is primarily driven by the expansion of its core laboratory services and therapeutic development initiatives. This strategic direction highlights the company's commitment to long-term value creation beyond COVID-19 testing revenue.

Despite the projected revenue growth, Fulgent Genetics anticipates a non-GAAP operating margin of approximately minus 15% for 2025. This reflects ongoing investments in business expansion, laboratory operations, and facility enhancements. The company's financial strategy also includes strategic investments, such as share repurchases and therapeutic development, which are designed to drive future growth and shareholder value. For a deeper understanding of the company's target audience, you can refer to the Target Market of Fulgent.

Fulgent Genetics' financial health is supported by a strong cash position. As of the end of Q1 2025, the company held approximately $814.6 million in cash, cash equivalents, restricted cash, and marketable securities. The company projects a year-end 2025 cash balance of around $770 million, even after accounting for strategic investments. These investments include share repurchases, which totaled $108.3 million since 2022, including $8.7 million in Q1 2025, and $25 million earmarked for therapeutic development.

Fulgent Genetics projects core revenue of approximately $310 million for 2025, marking a 10% increase from 2024. Non-GAAP gross margins are expected to slightly exceed 40%, while non-GAAP operating margins are projected at approximately minus 15%. The company anticipates a GAAP loss of approximately $1.95 per share and a non-GAAP loss of approximately $0.65 per share for 2025.

Fulgent Genetics ended Q1 2025 with approximately $814.6 million in cash and equivalents. The company plans to end 2025 with approximately $770 million in cash, after share repurchases and investments in therapeutic development. Share repurchases totaled $108.3 million since 2022, with $8.7 million in Q1 2025, and $25 million is allocated for therapeutic development.

Analyst forecasts for Fulgent Genetics stock have a 12-month price target of $16 as of March 4, 2025. The average brokerage recommendation for the stock is 'Hold'. The market's view reflects a balanced perspective on the company's current financial position and future prospects.

Fulgent's growth strategy emphasizes core laboratory services and therapeutic development. This strategic focus aims to drive long-term revenue growth and enhance shareholder value. The company's investments in these areas are intended to support its expansion plans and innovation in genetics.

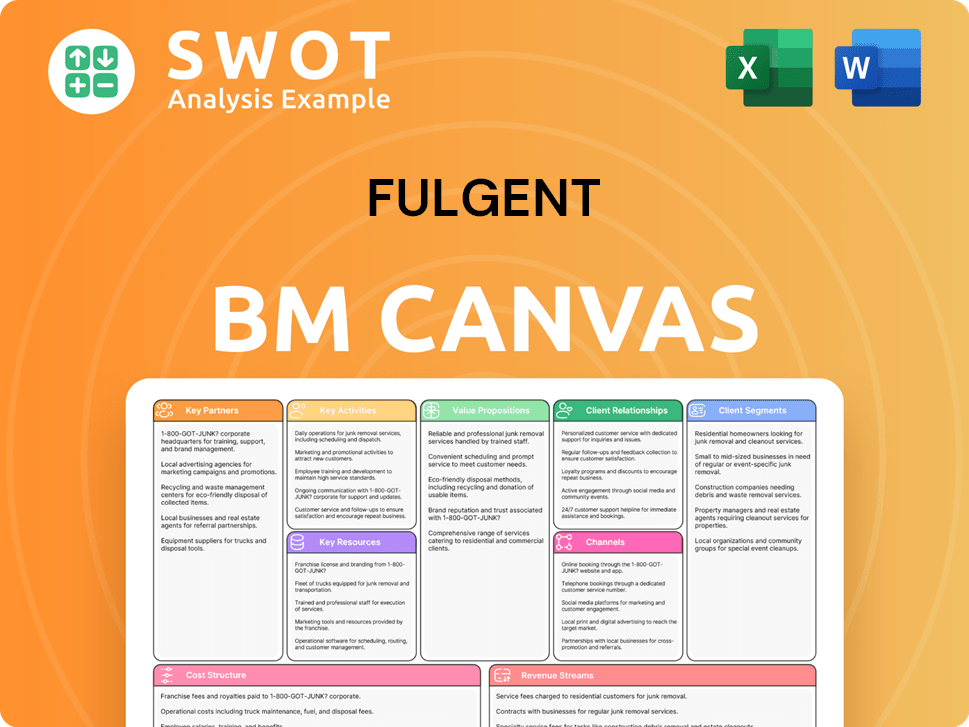

Fulgent Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Fulgent’s Growth?

The path forward for Fulgent Genetics, like any company in the dynamic genetic testing sector, is fraught with potential risks and obstacles. These challenges span market competition, regulatory shifts, operational vulnerabilities, and financial pressures, all of which can significantly impact the company's growth trajectory. Understanding these potential pitfalls is crucial for investors and stakeholders assessing the long-term viability of Fulgent's business model and its ability to capitalize on future opportunities.

Market dynamics, including competitive pressures and the sensitivity of revenue streams, pose immediate challenges. Additionally, the company must navigate the complexities of regulatory environments and supply chain disruptions. These factors, coupled with internal financial forecasts, create a landscape where strategic agility and robust risk management are essential for sustained success.

The company's future also hinges on its ability to mitigate operational and financial risks. This includes managing the volatility inherent in its revenue streams, particularly concerning the concentration of its customer base. Furthermore, the company must proactively address potential disruptions from regulatory changes and supply chain vulnerabilities, as well as the ever-present threat of IT system failures and cybersecurity breaches.

The genetic testing and diagnostics market is intensely competitive. Success depends on innovation, pricing, and market access. Companies must continuously adapt their strategies to maintain their market position and achieve growth.

Regulatory changes, particularly those affecting lab-developed tests (LDTs), can have a significant impact. The company must stay compliant with evolving regulations. Delays in therapeutic trials could also affect the company's pivot towards integrated precision medicine.

Supply chain disruptions, including those related to events like the COVID-19 pandemic, can affect the availability of necessary equipment and materials. These disruptions can lead to interruptions in laboratory operations.

Information technology and telecommunications systems are susceptible to disruptions, natural disasters, and cybersecurity breaches. Such events could compromise sensitive information or interrupt operations.

The company anticipates lower non-GAAP operating margins, projected at approximately minus 15% for 2025, due to ongoing investments in growth and expansion. This could strain profitability and require careful financial management.

The biopharma services segment has shown sequential revenue volatility. This highlights potential operational instability and the need for diversification and robust revenue streams.

The company is actively addressing these risks through strategic investments in business growth and the development of laboratory operations, focusing on enhancing existing facilities. As of Q1 2025, Fulgent held a strong cash position of $814.6 million, providing a financial buffer to navigate potential challenges and uncertainties in the market. This financial strength is a crucial asset in mitigating risks and supporting the company's long-term objectives.

The competitive landscape is a significant factor influencing the company's future, which requires ongoing adaptation. The company's ability to innovate, maintain market share, and expand its reach will be critical. For more insights into how the company approaches its business strategy, consider reading the Marketing Strategy of Fulgent.

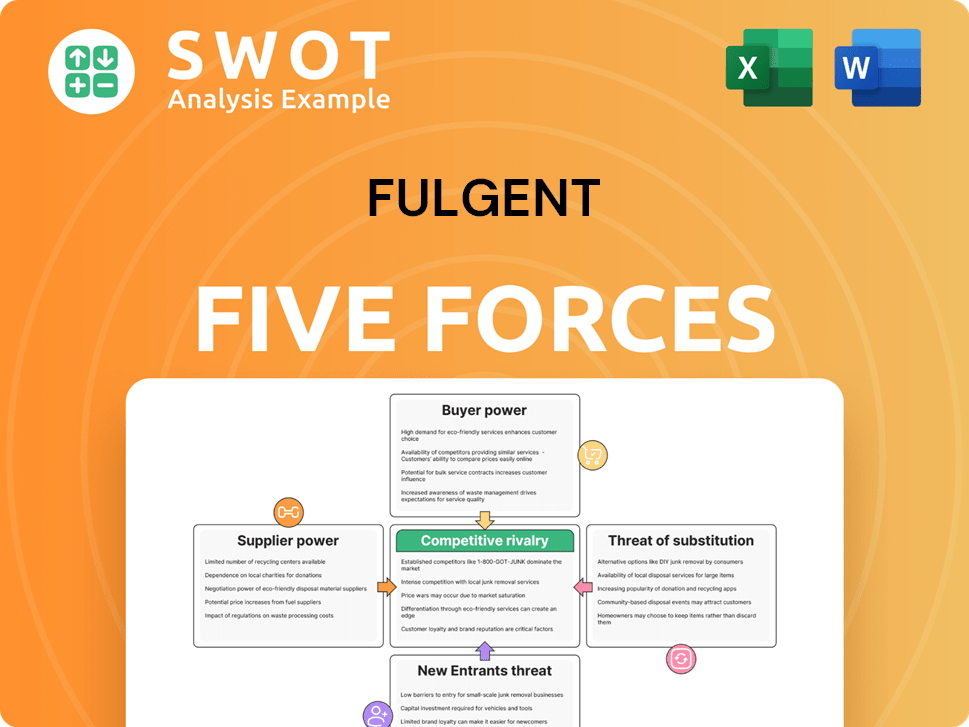

Fulgent Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fulgent Company?

- What is Competitive Landscape of Fulgent Company?

- How Does Fulgent Company Work?

- What is Sales and Marketing Strategy of Fulgent Company?

- What is Brief History of Fulgent Company?

- Who Owns Fulgent Company?

- What is Customer Demographics and Target Market of Fulgent Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.