Future Bundle

How Did Future PLC Become a Media Powerhouse?

Embark on a journey through time to uncover the Future SWOT Analysis of Future PLC, a media giant that has redefined content creation. From its inception in 1985, this company has consistently adapted and innovated, leaving an indelible mark on the media landscape. Explore the Future SWOT Analysis and discover the pivotal moments that shaped its destiny, from its humble beginnings to its current global presence.

This Future SWOT Analysis delves into the brief history of Future Company, examining its Company Evolution and Corporate Development. We'll explore the Business Milestones that define its journey, providing insights into how Future Company navigated market changes and established itself as a leader. Learn about the Future Company History and the key events that shaped its path.

What is the Future Founding Story?

The story of Future PLC begins on July 11, 1985. This is when Chris Anderson, a former computer programmer and journalist, established the company. His vision was to fill a gap in the market by providing specialized content for the burgeoning home computer and technology enthusiast community.

Anderson's unique background in both technology and journalism equipped him to create accessible and engaging content. The initial goal was to address the lack of quality information for hobbyists and early adopters of personal computing. This marked the beginning of the Marketing Strategy of Future.

The company's name, 'Future,' was chosen to reflect its focus on emerging technologies and trends. Initial funding came from bootstrapping and personal investment by Anderson. Early challenges included establishing distribution and competing with established publications. However, Anderson's understanding of the target audience helped overcome these hurdles.

Future Company History began with a focus on print magazines. The first product was 'Amstrad Action,' a magazine dedicated to the Amstrad range of home computers. This niche approach allowed Future to quickly gain traction.

- 1985: Future PLC was founded by Chris Anderson.

- Early Products: The launch of 'Amstrad Action' magazine.

- Business Milestones: Focused on niche print magazines.

- Corporate Development: Overcoming initial challenges in distribution and competition.

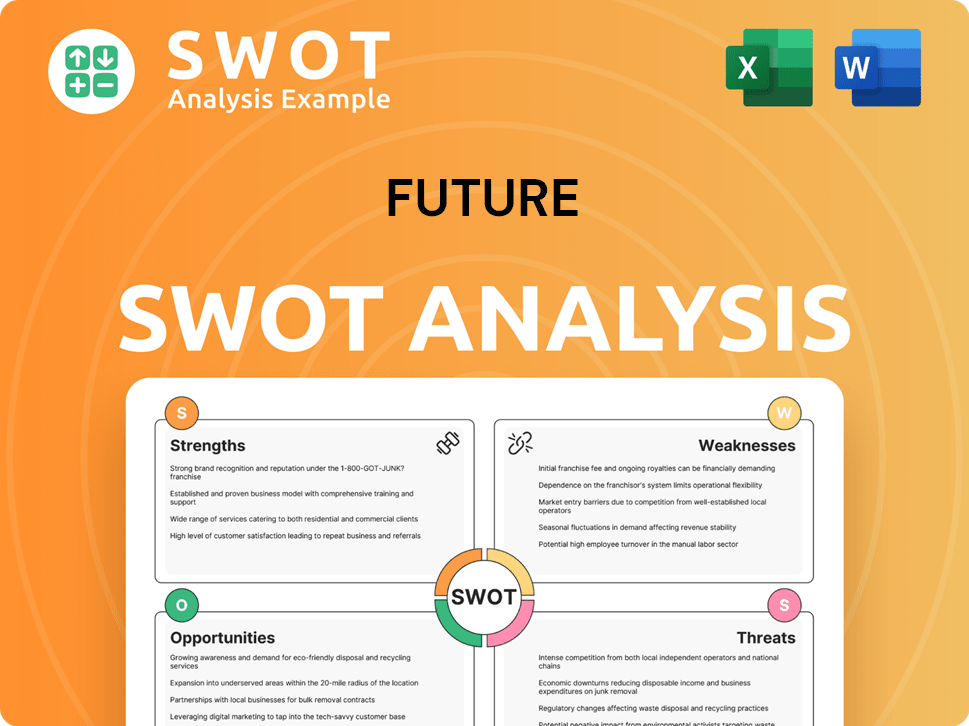

Future SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Future?

The early growth of Future PLC was marked by strategic expansions and a keen understanding of market trends. This Company Timeline highlights how the company capitalized on the burgeoning home computer market, launching successful titles that resonated with a growing audience. The company's approach to talent acquisition, focusing on individuals with deep subject matter expertise, further fueled its early success and set the stage for future growth.

Following the success of 'Amstrad Action,' the company launched titles such as 'Commodore Format' and 'Your Sinclair.' These publications catered to the rapidly expanding home computer market during the late 1980s and early 1990s, demonstrating a clear understanding of market opportunities. These early product launches were crucial in establishing a strong foundation for Future's growth, showcasing the demand for specialized content.

The initial team expansion primarily focused on editorial talent. The company secured journalists and enthusiasts who possessed in-depth knowledge of their respective subjects. This approach ensured the creation of high-quality content that resonated with readers, fostering loyalty and driving sales. This strategic hiring was key to the company's early success.

The company's first major geographical expansion came with its entry into the US market in 1994, establishing Future US. This strategic move allowed the company to tap into a larger audience and diversify its revenue streams. By entering the US market, the company broadened its reach and laid the groundwork for future international growth.

Significant acquisitions played a pivotal role in Future's transformation. The acquisition of Imagine Publishing in 2016 for £43.5 million significantly boosted its technology and gaming content. The purchase of Purch's consumer division in 2018 for $132 million further expanded its digital footprint and e-commerce capabilities. These acquisitions were instrumental in shifting Future from a print-centric publisher to a diversified media company.

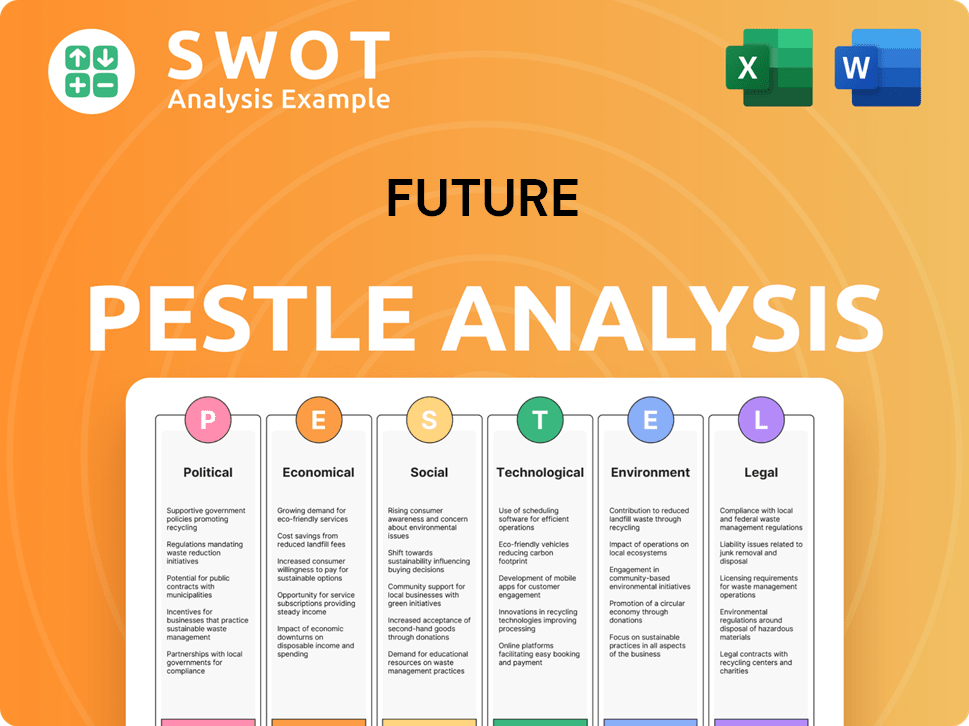

Future PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Future history?

The Future Company History is marked by significant business milestones and continuous evolution, reflecting its adaptability and strategic vision. This Company Timeline showcases key events that have shaped its journey and its role in the industry's evolution.

| Year | Milestone |

|---|---|

| 1985 | Founded as a magazine publisher, initially focusing on computer and technology titles. |

| 1990s | Pioneered the inclusion of 'coverdiscs' with magazines, a groundbreaking innovation. |

| 2000s | Successfully transitioned into digital platforms, adapting to the decline of print media. |

| 2010s-2020s | Executed an aggressive acquisition strategy, diversifying revenue streams into e-commerce and events. |

| 2023 | Reported a revenue of approximately £780 million, demonstrating strong financial performance. |

| 2024 | Continued expansion through strategic acquisitions, focusing on digital media and content creation. |

The early adoption of the 'coverdisc' in the 1990s was a groundbreaking innovation, significantly enhancing reader value by providing software and demos with magazines. This, combined with a focus on high-quality, niche content, helped build a loyal readership and set the stage for future growth.

The introduction of 'coverdiscs' in the 1990s, offering software and demos with magazines, was an industry first. This innovation significantly increased reader value and set the company apart.

The company invested heavily in online content, website development, and digital advertising infrastructure. This strategic shift was crucial for adapting to the changing media landscape.

The company's strategy included acquiring various media assets to diversify its portfolio. This helped expand its reach and revenue streams.

Expanding into new content areas, such as e-commerce and events, broadened its revenue base. This diversification strategy improved its overall financial stability.

Focusing on audience engagement through interactive content and social media platforms has been key. This strategy helped maintain a strong connection with its audience.

Integrating e-commerce platforms within its digital properties provided new revenue streams. This move capitalized on the growing trend of online shopping.

The challenges faced by the company have included the decline of print media and increased competition from digital-native publishers. Continuous adaptation and innovation in content delivery and audience engagement were essential.

The shift from print to digital media posed a significant challenge. The company had to adapt its business model to focus on online content.

Competition from digital-native publishers and social media platforms required constant innovation. This led to a need for new content strategies.

Economic downturns and market fluctuations impacted the company's performance. Strategic planning and diversification helped mitigate these effects.

Adapting content to meet the evolving needs and preferences of audiences was crucial. This included creating engaging and relevant digital content.

Restructuring efforts were necessary to optimize operational efficiency and align with the digital-first strategy. This improved overall performance.

Understanding and responding to the changing needs of the audience was a constant challenge. The company's success depended on staying connected with its readers.

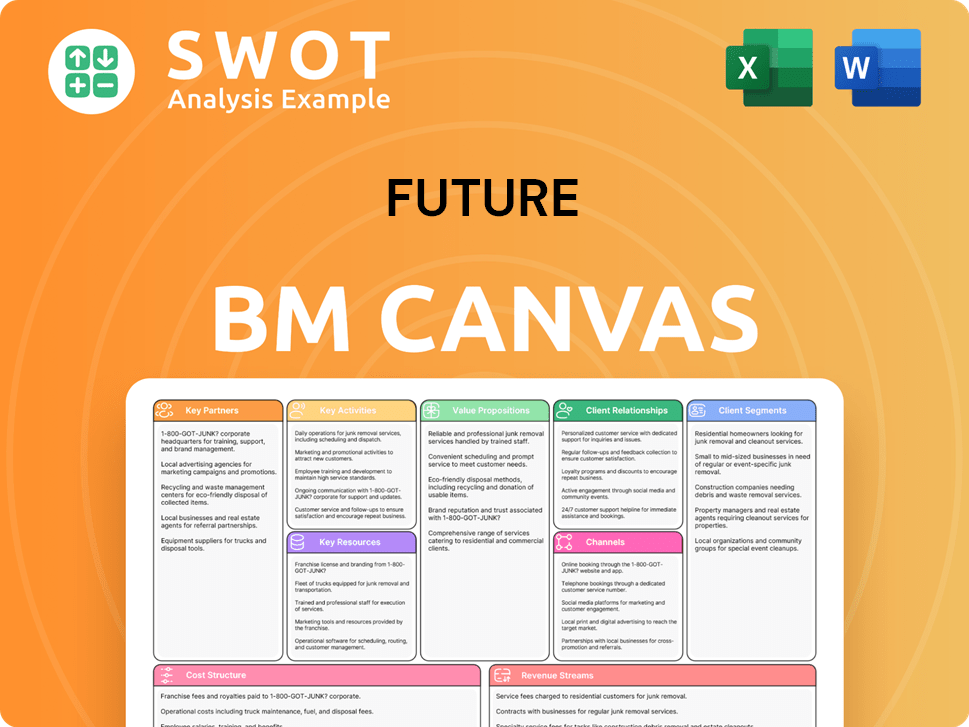

Future Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Future?

The Mission, Vision & Core Values of Future company's journey is marked by significant milestones, reflecting its adaptation and growth within the media industry. From its humble beginnings in 1985 to its current status, the company has consistently evolved, embracing digital transformation and strategic acquisitions to maintain its market position. The following table outlines key events in the company's evolution.

| Year | Key Event |

|---|---|

| 1985 | Founded by Chris Anderson in Somerton, Somerset. |

| 1994 | Establishes Future US, entering the North American market. |

| 1999 | Lists on the London Stock Exchange. |

| 2000s | Begins significant pivot towards digital content and online platforms. |

| 2014 | Appoints Zillah Byng-Thorne as CEO, initiating a period of aggressive growth and acquisitions. |

| 2016 | Acquires Imagine Publishing, significantly expanding its portfolio. |

| 2018 | Acquires Purch's consumer division, enhancing its e-commerce capabilities. |

| 2020 | Acquires TI Media, further consolidating its position in the UK magazine market. |

| 2022 | Acquires Who What Wear, strengthening its fashion and lifestyle offering. |

| 2023 | Reports strong financial results with revenue reaching £789.2 million. |

| 2024 | Continues strategic acquisitions and organic growth initiatives. |

| 2025 | Focuses on AI integration and global expansion, particularly in North America. |

The company is focusing on global expansion, especially in high-growth markets. This includes entering new territories and increasing its presence in existing ones. The company aims to diversify its revenue streams and increase its overall market share.

Investment in proprietary technology and data analytics is a key focus. The company intends to leverage artificial intelligence to optimize content creation, distribution, and monetization. This will enhance content personalization and audience engagement.

The company is well-positioned to capitalize on industry trends. The increasing demand for specialist content and the growth of e-commerce are expected to positively impact its trajectory. The evolving digital advertising landscape is also a key factor.

Analysts predict sustained growth based on the company's strong market position. The company's diversified revenue streams are seen as a key strength. The company's recent financial results, including the £789.2 million revenue in 2023, highlight its financial health.

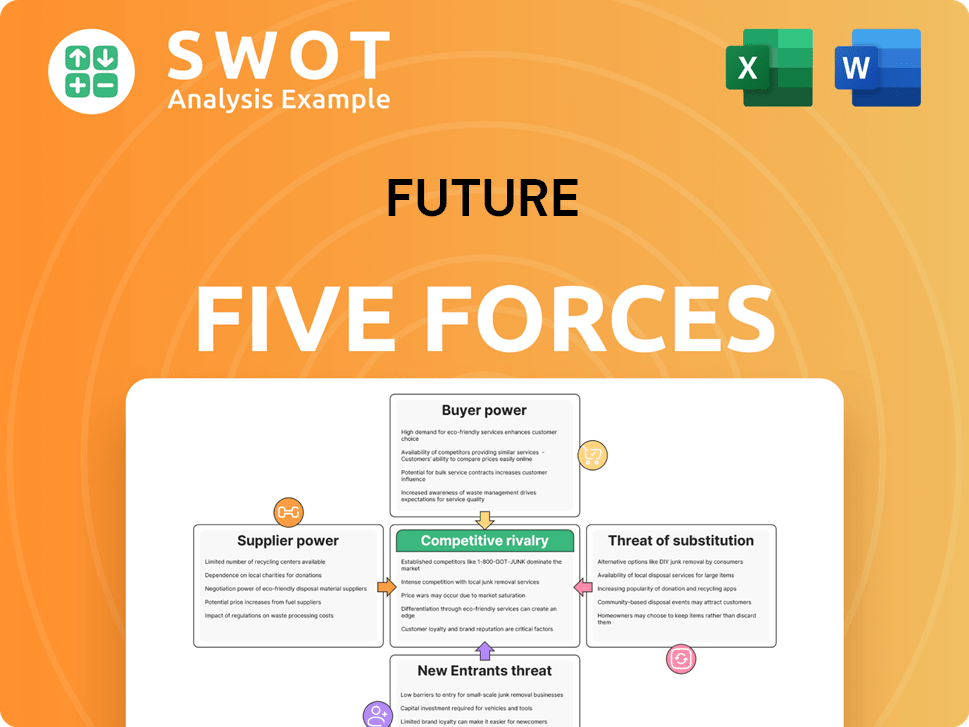

Future Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Future Company?

- What is Growth Strategy and Future Prospects of Future Company?

- How Does Future Company Work?

- What is Sales and Marketing Strategy of Future Company?

- What is Brief History of Future Company?

- Who Owns Future Company?

- What is Customer Demographics and Target Market of Future Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.