Future Bundle

Decoding Future PLC: How Does Future Company Work?

Future PLC, a leading global media entity, captivates audiences across diverse sectors. With adjusted diluted EPS up 4% as of March 31, 2025, the company showcases robust performance. This exploration delves into the operational dynamics of Future PLC, providing critical insights for investors and industry watchers alike.

Understanding the Future SWOT Analysis is key to grasping the company's strategic positioning. Future company's business model revolves around curating specialized content across its Future company platform, reaching engaged audiences through print and online channels. This analysis will dissect how Future company services generate revenue and sustain its market leadership, including Future company technology and its impact on the industry.

What Are the Key Operations Driving Future’s Success?

The Future company creates value by delivering specialist content across various platforms. This approach caters to a wide range of customer segments, each passionate about specific topics. Their core offerings include digital websites, print magazines, email newsletters, videos, and live events, spanning sectors like technology, gaming, music, and home & garden.

The company also operates Go.Compare, a price comparison website, which has expanded into home insurance, demonstrating consistent growth. This diversification highlights Future company's ability to adapt and capitalize on market opportunities, enhancing its overall value proposition. This broad portfolio is a key aspect of How Future Company works.

Operational processes at Future company are driven by proprietary technology and data, enabling the connection of specialist content with engaged audiences. This involves robust content creation, technology development for digital platforms, effective sales channels for advertising and e-commerce, and dedicated customer service. The company's supply chain includes content creators, technology partners, and distribution networks for both digital and print media.

Content creation is a core operation, involving the development of high-quality, specialist content tailored to specific audience interests. This includes articles, videos, and other media formats designed to engage and inform. The company's success relies on producing content that resonates with its target audiences, driving traffic and engagement across its platforms.

Technology development is crucial for Future company's digital platforms, ensuring they remain user-friendly, efficient, and capable of delivering content effectively. This includes website development, app creation, and the maintenance of digital infrastructure. Continuous innovation in technology is essential to stay competitive in the digital media landscape.

Sales and marketing efforts focus on monetizing content through advertising, e-commerce, and other revenue streams. This involves building strong relationships with advertisers and partners, optimizing ad placements, and driving sales through various channels. Effective sales strategies are vital for the company's financial performance.

Customer service ensures that users and customers have a positive experience with the company's products and services. This includes handling inquiries, resolving issues, and providing support. Excellent customer service contributes to customer loyalty and positive brand perception.

What makes Future company's operations unique is its focus on intent-led specialist media, leveraging proprietary technology to drive audience engagement and monetize content through various channels. This integrated approach allows the company to translate its core capabilities into customer benefits by delivering highly relevant content and services. This fosters market differentiation through deep engagement with niche communities.

- Intent-led specialist media allows for targeted content delivery, increasing audience engagement.

- Proprietary technology enhances content delivery and monetization capabilities.

- Diverse revenue streams, including advertising and e-commerce, contribute to financial stability.

- Strong audience engagement builds brand loyalty and drives repeat business.

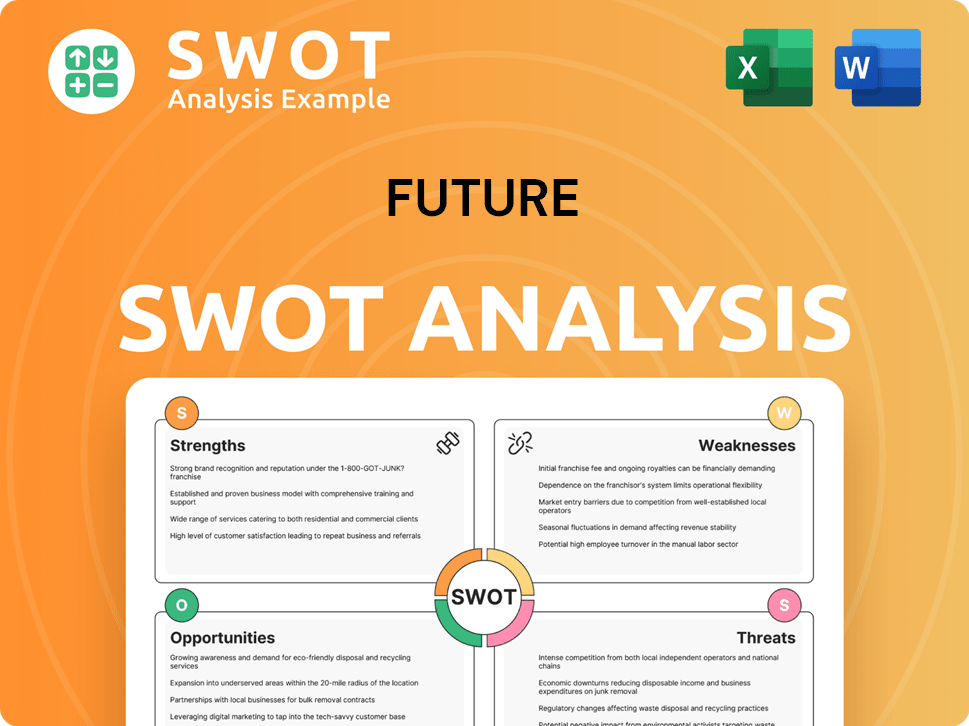

Future SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Future Make Money?

Understanding how the Future company generates revenue is key to grasping its business model. The company employs a multi-faceted approach, utilizing various platforms to maximize its income streams. This strategy allows it to adapt to market changes and capitalize on different opportunities.

Future company focuses on several core monetization strategies. These include advertising revenue, income from e-commerce affiliates, and direct consumer engagement through subscriptions and magazine sales. This diversified approach helps to ensure a stable financial performance.

For the half-year ending March 31, 2025, Future company reported total revenue of £378.4 million. This represents a 3% year-on-year decrease, with a 1% organic decline. Understanding these figures provides insight into the company's financial health and areas for improvement.

Digital advertising and e-commerce in the US showed year-on-year growth. This growth positively impacted the B2C division, keeping its organic revenue flat during the period. This highlights the importance of digital platforms for revenue generation.

Magazines demonstrated strong performance, achieving 1% organic growth. This indicates that traditional media still holds value and contributes to the company's revenue streams. This is a key part of How Future Company works.

Go.Compare, the price comparison business, saw a 1% decline in revenue. However, it experienced a 10% revenue increase from non-car insurance. This shows the impact of diversification within its business units.

B2B revenue faced challenges, with a 13% organic decline, mainly due to the tech enterprise sector. However, other sectors like financial services and education are experiencing growth. This shows the need for strategic adaptation.

Branded content grew by 9% in FY 2024, while vouchers contributed £13.0 million in revenue, up 40%. These areas represent growing revenue streams for the company. Learn more about the Marketing Strategy of Future.

Future company leverages multiple revenue streams, including advertising, e-commerce, subscriptions, and magazine sales. This diversification helps to mitigate risks and ensure financial stability. This is a key aspect of the Future company business model.

Future company's revenue streams are diverse, including advertising, e-commerce, subscriptions, and magazine sales. The company's ability to adapt and innovate is critical for its continued success. This diversification is a core element of Future company services.

- Advertising: Revenue generated from digital and print advertising.

- E-commerce: Income from affiliate sales and direct product sales.

- Subscriptions: Revenue from digital and print subscriptions.

- Magazine Sales: Revenue from newsstand and subscription sales.

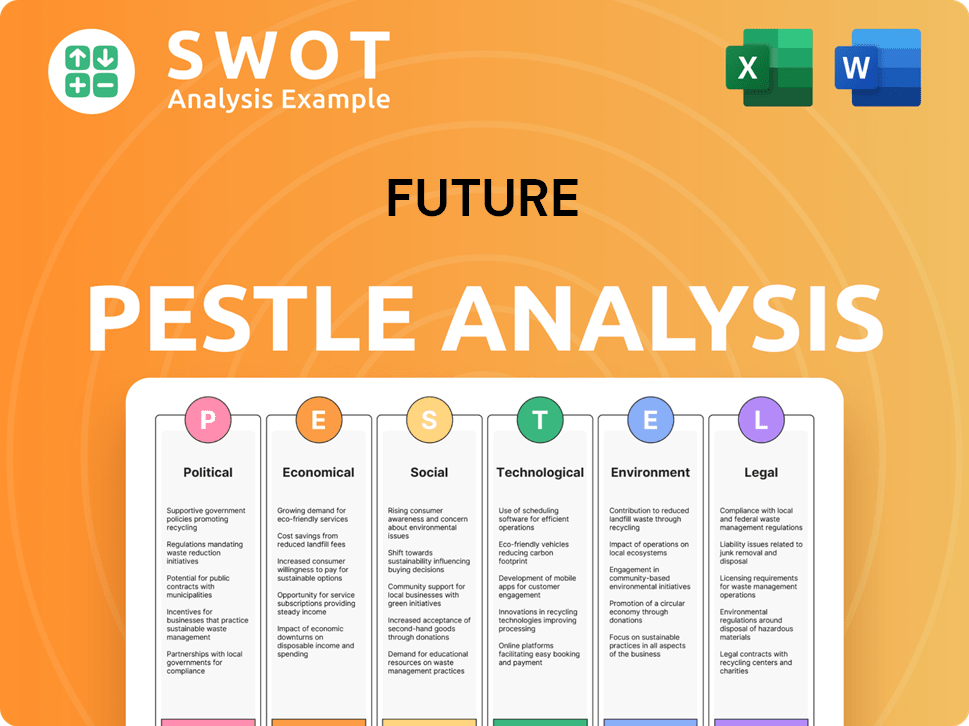

Future PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Future’s Business Model?

Let's explore the key milestones, strategic moves, and competitive edge of Future PLC. The company has been actively shaping its operations and financial performance through various strategic initiatives. A major move is the Growth Acceleration Strategy (GAS), a two-year investment program launched in December 2023, designed to boost organic revenue growth and optimize its portfolio. This strategy underscores Future's commitment to sustained growth and market leadership.

In the first half of FY 2025, Future made significant acquisitions. In March 2025, it acquired RNWL for £2.8 million, and in May 2025, Kwizly for £0.7 million. These acquisitions are aimed at enhancing customer loyalty and improving audience engagement tools. Furthermore, on March 31, 2025, Kevin Li Ying was appointed as CEO, signaling a leadership transition and a potential shift in strategic direction. These actions highlight Future's proactive approach to strengthening its market position.

Future has faced operational challenges, including macroeconomic uncertainty and a tough UK advertising market. Despite these headwinds, the company has maintained a stable adjusted operating margin of 27% in HY 2025. This resilience indicates effective cost management and operational efficiency. The company's ability to navigate these challenges is a testament to its robust business model and strategic agility.

The Growth Acceleration Strategy (GAS) launched in December 2023, is a two-year investment program. Acquisitions of RNWL (March 2025) and Kwizly (May 2025) aimed at enhancing customer loyalty. Kevin Li Ying appointed CEO on March 31, 2025, marking a leadership change.

Focus on organic revenue growth and portfolio optimization through GAS. Strategic acquisitions to boost customer loyalty and engagement. Leadership transition with the appointment of a new CEO.

Strong brand strength with over 200 specialist media brands. Proprietary technology that supports content and monetization strategies. Diversified revenue streams and strong cash generation provide resilience.

Maintained a stable adjusted operating margin of 27% in HY 2025. The company's ability to generate strong cash flows is a key strength. Strategic investments in growth areas and brand optimization.

Future's competitive advantages are rooted in its strong brand portfolio and proprietary technology. This allows the company to maintain a significant presence in the market. The company continues to adapt by optimizing its portfolio, including brand closures to focus on growth areas, and investing in new areas like home insurance through Go.Compare.

- Brand Strength: Over 200 specialist media brands.

- Proprietary Technology: Underpins content and monetization strategies.

- Diversified Revenue Streams: Ensures resilience.

- Strategic Investments: Focus on growth areas and new ventures.

For a deeper understanding of the competitive landscape, consider reading about the Competitors Landscape of Future. This will provide valuable insights into how Future Company operates within its industry. The company's ability to adapt and innovate is crucial for its long-term success. The strategic moves and competitive advantages of Future Company position it well for future growth.

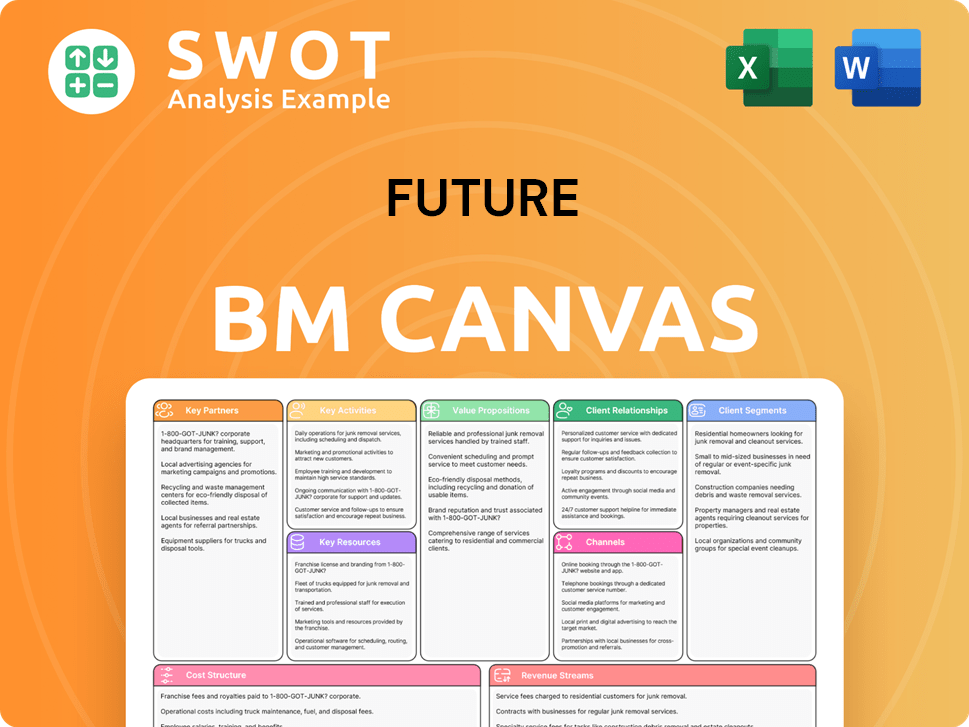

Future Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Future Positioning Itself for Continued Success?

Understanding how Future company operates involves assessing its position within the media industry, recognizing the associated risks, and considering its future outlook. As a global platform specializing in media, the company holds a significant presence, reaching a substantial audience across the US and UK. This widespread reach underscores the company's influence and its ability to connect with a broad consumer base.

The company's business model is built on specialist media, fostering customer loyalty through deeply engaged communities. However, it faces challenges such as macroeconomic uncertainty and technological disruption. Despite these hurdles, the company is actively implementing its Growth Acceleration Strategy to sustain and accelerate growth.

Future company maintains a strong market position, especially in the US and UK. It reaches a considerable audience, with a market share distributed across various sectors. The company's success is linked to its ability to create deeply engaged communities around its specialist content.

The company faces risks, including macroeconomic uncertainty and adverse foreign exchange rates. The UK advertising market presents ongoing challenges. Technological disruption and evolving consumer preferences are constant factors. These factors can impact Future company's performance.

Future company anticipates a low single-digit decline in organic revenue for FY 2025. They expect accelerating organic revenue growth beyond FY 2025. The company is aiming for a stable adjusted operating margin of 28% and strong cash generation. To learn more about the company, you can read the Brief History of Future.

The company's Growth Acceleration Strategy focuses on expanding engaged audiences. It also aims to diversify revenue per user and optimize its portfolio. These initiatives are designed to mitigate risks and drive sustainable growth, ensuring Future company's continued success.

Future company is focused on maintaining financial stability and driving growth. Key goals include sustaining a stable adjusted operating margin and strong cash generation. These objectives are central to the company's long-term strategy and financial health.

- Stable adjusted operating margin of 28%.

- Strong cash generation.

- Accelerating organic revenue growth beyond FY 2025.

- Focus on growing engaged audiences.

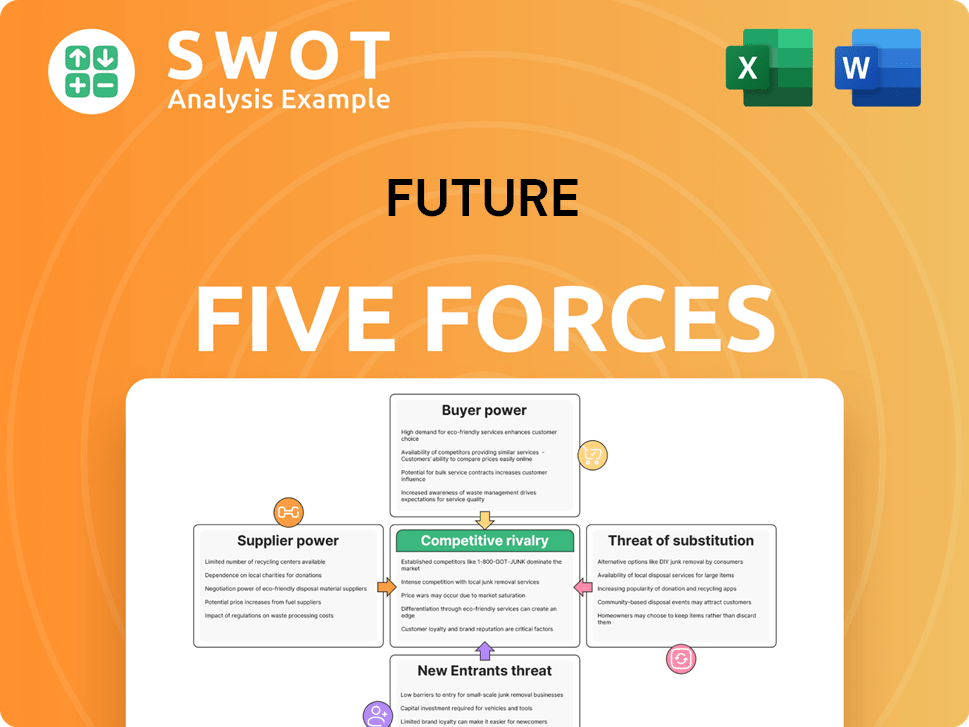

Future Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Future Company?

- What is Competitive Landscape of Future Company?

- What is Growth Strategy and Future Prospects of Future Company?

- What is Sales and Marketing Strategy of Future Company?

- What is Brief History of Future Company?

- Who Owns Future Company?

- What is Customer Demographics and Target Market of Future Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.