The GEO Group Bundle

What Shaped the Rise of the GEO Group?

Delve into the compelling The GEO Group SWOT Analysis to uncover the core of this influential company. The GEO Group, a leading real estate investment trust (REIT), has a history that mirrors the evolution of private prisons and the broader corrections industry. Its story, starting in 1984, offers a unique lens through which to view the privatization of correctional services and its global impact.

From its inception, The GEO Group company has grown significantly, becoming a major player in the ownership and management of correctional and detention facilities. Understanding the GEO Group history is essential for grasping the dynamics of the corrections industry, including its involvement in immigration detention and its relationship with government contracts. The company's journey reflects broader trends in the US criminal justice system and the ongoing debates surrounding private prisons.

What is the The GEO Group Founding Story?

The GEO Group, a prominent player in the private prison industry, traces its roots back to October 24, 1984. Founded by George C. Zoley, the company emerged to address the growing needs of correctional facilities and detention centers. Zoley's vision capitalized on the increasing strain on public resources and the rising demand for alternative solutions.

Zoley, who later became the Chairman and CEO, recognized an opportunity in the early 1980s to provide privately managed correctional facilities. This was a time when government agencies faced increasing pressure due to overcrowding in public correctional systems. The company's initial focus was on contracting with government entities to design, build, finance, and operate correctional and detention facilities.

The early business model centered around partnerships with government bodies. The company's first major contract was with the federal government. Initial funding likely came from a mix of seed capital and early investments. The company, originally known as Wackenhut Corrections Corporation, entered the market during a period of rising incarceration rates, creating a clear demand for alternative solutions. This strategic move positioned the company to capitalize on the growing trend of private-public partnerships in infrastructure and services.

The GEO Group's history is marked by its strategic entry into the private prison market.

- Founding Date: October 24, 1984.

- Founder: George C. Zoley.

- Initial Business Model: Contracting with government entities for correctional and detention facilities.

- Early Focus: Addressing overcrowding in public correctional systems and providing cost-effective solutions.

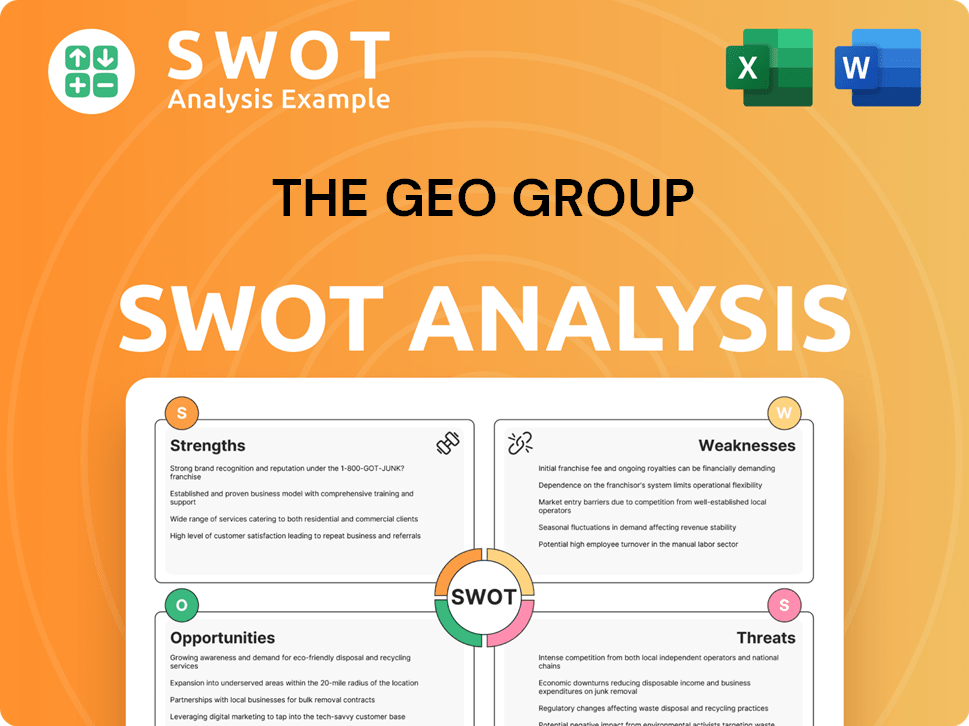

The GEO Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of The GEO Group?

The early growth of the GEO Group company, initially known as Wackenhut Corrections Corporation, was fueled by the growing need for private correctional services. This expansion involved securing contracts with various government agencies across the United States. The company broadened its offerings beyond facility management to include specialized programs. This period set the foundation for its future development.

Early on, the GEO Group focused on securing contracts with federal, state, and local government agencies. These contracts were crucial for the company's initial growth, providing a steady stream of revenue and opportunities for expansion. The ability to win these contracts was a key indicator of the company's early success and its ability to meet the needs of various governmental bodies.

The company expanded its services beyond basic facility management to include rehabilitation and offender care programs. This diversification allowed the GEO Group to offer a more comprehensive suite of services, which made them more attractive to government clients. By offering specialized programs, the company aimed to improve outcomes and address the needs of the incarcerated population.

The GEO Group's expansion strategy included both organic growth and strategic acquisitions. The acquisition of correctional assets was a significant move, helping to broaden its geographic footprint and facility portfolio. This strategy allowed the company to quickly increase its capacity and presence in the market, solidifying its position as a major player in the private prison industry.

By the late 1990s and early 2000s, the company began exploring international markets, marking its entry into new geographical categories. Leadership transitions, with George C. Zoley at the helm, played a key role in shaping its strategic direction. This period saw the company adapt to market reception, balancing support for efficiency with criticism of its role in the justice system.

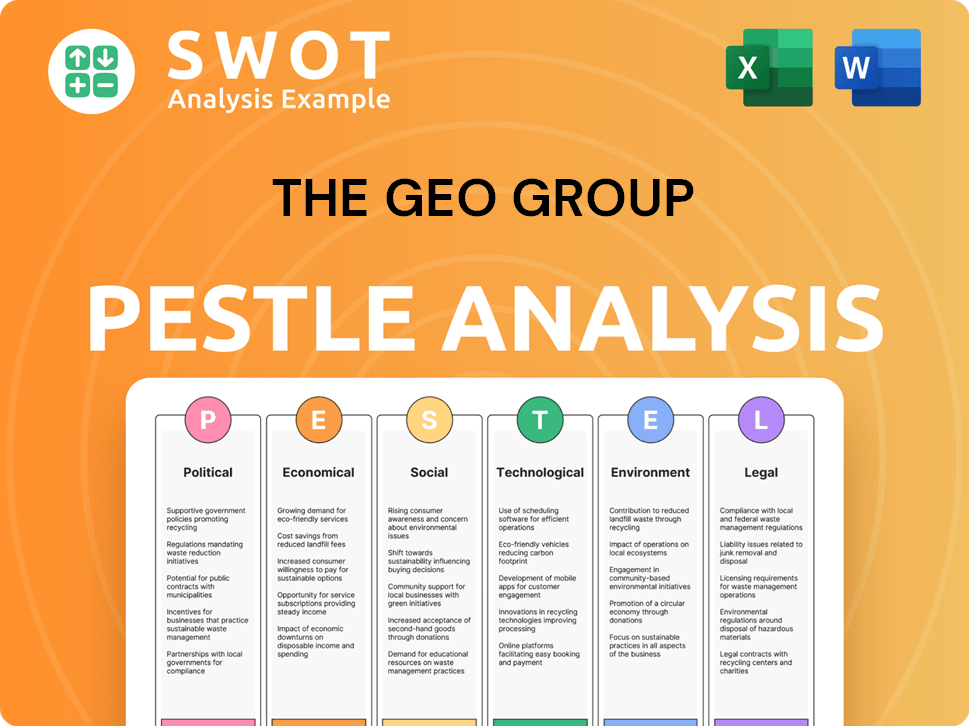

The GEO Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in The GEO Group history?

The GEO Group has a long history marked by significant milestones in the private prison and detention industry. The GEO Group company, formerly known as the Wackenhut Corrections Corporation, has evolved significantly since its founding, navigating various market dynamics and policy changes. This evolution is a key part of the GEO Group history.

| Year | Milestone |

|---|---|

| 1984 | Wackenhut Corrections Corporation is founded, marking the beginning of the company's involvement in private prisons. |

| 1990s | The company experiences rapid expansion, securing numerous contracts and growing its portfolio of facilities across the United States. |

| 2003 | Wackenhut Corrections Corporation changes its name to GEO Group, reflecting its global expansion and diversification. |

| 2010s | The company focuses on expanding its services, including electronic monitoring and reentry programs, while facing increased scrutiny regarding its operations. |

| 2015 | GEO Group launches its GEO Continuum of Care program, integrating in-facility rehabilitation with post-release support. |

| 2020 | The company faces significant challenges due to policy changes and contract terminations, leading to strategic restructuring. |

A key innovation for the GEO Group has been the development of the GEO Continuum of Care program. This program integrates in-facility offender rehabilitation with post-release support services, aiming to reduce recidivism.

Launched in 2015, this program integrates in-facility offender rehabilitation programs with post-release support services. This initiative aims to reduce recidivism and has been a central part of the company's strategic repositioning.

The company has been at the forefront of implementing evidence-based rehabilitation programs. These programs are often developed in partnership with academic institutions to measure their effectiveness in reducing recidivism rates.

GEO Group has expanded its focus on reentry programs to support individuals transitioning back into society. These programs include job training, housing assistance, and mental health services.

The company has invested in and expanded its electronic monitoring solutions, offering alternatives to incarceration. This includes GPS tracking and other technologies to supervise individuals in the community.

GEO Group has diversified its services to include secure services for various government agencies. This includes providing facilities and support for immigration detention and other government needs.

GEO Group has faced several challenges, including market downturns and intense public scrutiny. Policy changes regarding the use of private detention facilities have also impacted the company's business model.

The company has experienced market downturns and contract terminations due to shifts in federal policies. This has led to a need for diversification and strategic restructuring within the company.

GEO Group has faced intense public scrutiny and criticism regarding its operations and practices. This has led to increased pressure to improve conditions and address concerns about the impact of private prisons.

Shifts in federal policies, particularly regarding immigration detention and the use of private prisons, have significantly impacted the company. These changes have necessitated strategic adjustments to its business model.

Managing debt and adapting to changes in government contracting have posed financial challenges for the company. Strategic restructuring and operational efficiency have become key priorities.

In response to these challenges, GEO Group has developed a stronger emphasis on rehabilitation and community-based services. The goal is to align operations with broader societal goals of reducing recidivism.

The company has had to adapt to evolving public perception and policy shifts regarding private correctional facilities. This has led to a focus on transparency and improved operational practices.

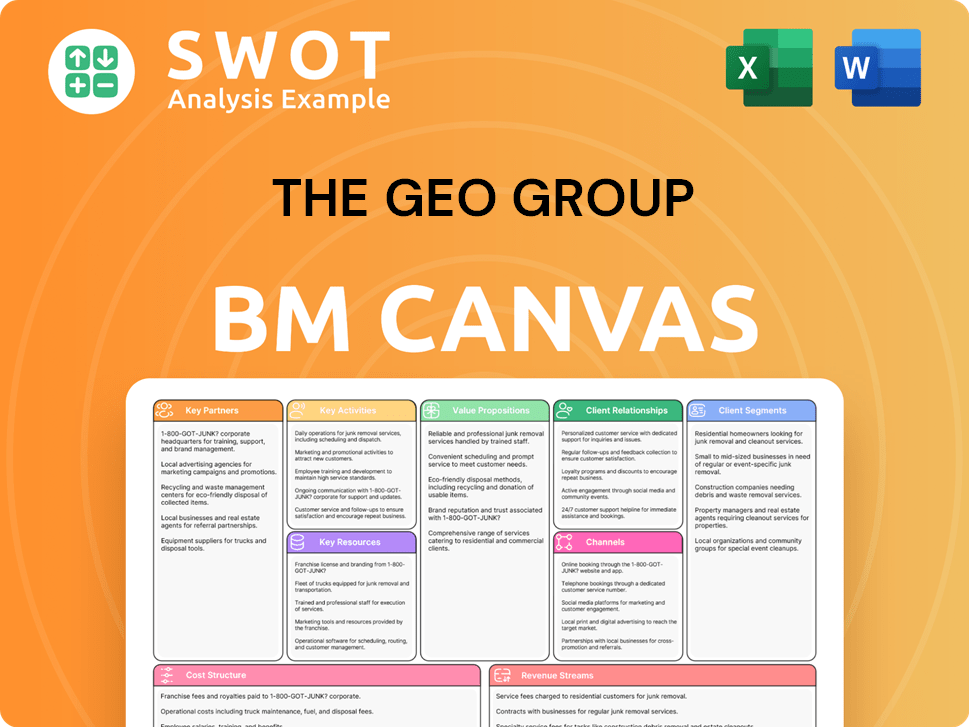

The GEO Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for The GEO Group?

The Owners & Shareholders of The GEO Group has a history marked by significant milestones. Initially founded as Wackenhut Corrections Corporation, the company secured its first contract in 1987 and began international expansion in 1994. A pivotal moment arrived in 2003 when it was renamed The GEO Group, Inc., followed by its conversion to a Real Estate Investment Trust (REIT) in 2004. In 2015, the company launched the GEO Continuum of Care program. Recent years, specifically 2020-2021, saw major shifts in policies concerning private detention facilities in the U.S. In 2024, the company reported total revenue of approximately $2.38 billion for the fiscal year ending December 31, 2023.

| Year | Key Event |

|---|---|

| 1984 | Founded as Wackenhut Corrections Corporation. |

| 1987 | Awarded first contract to operate a correctional facility. |

| 1994 | Began international expansion. |

| 2003 | Renamed to The GEO Group, Inc. |

| 2004 | Converted to a Real Estate Investment Trust (REIT). |

| 2015 | Launched the GEO Continuum of Care program. |

| 2020-2021 | Faced significant policy shifts regarding private detention facilities in the U.S. |

| 2023 | Continued focus on debt reduction and strategic asset management. |

| 2024 | Reported total revenue of $2.38 billion for the fiscal year ended December 31, 2023. |

| 2025 | Continued emphasis on providing secure services, electronic monitoring, and reentry programs. |

The GEO Group's future centers on debt reduction and optimizing its real estate portfolio. The company is actively expanding its rehabilitation and community-based services. This strategic approach aims to leverage its expertise in secure environments to meet evolving government demands. They are focused on financial flexibility and operational efficiency.

The industry is witnessing a continued demand for specialized secure facilities. There is also an increased emphasis on evidence-based rehabilitation programs. These trends are likely to influence the future of the GEO Group. The company is adapting to policy changes and exploring new opportunities in the correctional and rehabilitative services market.

The GEO Group's financial strategy for 2024-2025 emphasizes financial flexibility and operational efficiency. The company aims to maintain its position as a key service provider in the sector. They are focusing on maintaining their market position and adapting to changing demands. The company's revenue for 2023 was $2.38 billion.

The GEO Group is committed to adapting to policy changes and exploring new opportunities. This includes a focus on providing secure services, electronic monitoring, and reentry programs. The company is aligning its services with the evolving needs of government and the broader correctional services market. Their commitment is tied to its founding vision.

The GEO Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of The GEO Group Company?

- What is Growth Strategy and Future Prospects of The GEO Group Company?

- How Does The GEO Group Company Work?

- What is Sales and Marketing Strategy of The GEO Group Company?

- What is Brief History of The GEO Group Company?

- Who Owns The GEO Group Company?

- What is Customer Demographics and Target Market of The GEO Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.