The GEO Group Bundle

Unraveling the Operations of The GEO Group: How Does It Function?

The GEO Group company, a leading real estate investment trust (REIT), is a major player in the corrections corporation sector, managing numerous detention facilities and private prisons. As of early 2025, its impact on the justice system is considerable, offering a range of services from secure housing to offender rehabilitation. But how does this multifaceted business model really work, and what are its key drivers?

This exploration of the GEO Group business will provide crucial insights for anyone interested in understanding the complexities of private prisons. We'll analyze its revenue streams, examine its strategic positioning within the market, and assess its overall financial performance. For a deeper dive into the company's strategic landscape, consider reviewing The GEO Group SWOT Analysis to understand its strengths, weaknesses, opportunities, and threats. Understanding "How does GEO Group make money" is key to understanding its long-term viability.

What Are the Key Operations Driving The GEO Group’s Success?

The core operations of the GEO Group company center on the ownership, leasing, and management of correctional, detention, and reentry facilities. This corrections corporation primarily serves government agencies at the federal, state, and local levels. Their value proposition focuses on providing cost-effective and specialized solutions for offender management, often including rehabilitation programs designed to reduce recidivism.

The GEO Group business model involves designing, constructing, maintaining, and managing secure environments. They offer comprehensive inmate care, including medical, mental health, and educational services. Additionally, the company provides community-based services and electronic monitoring. Their supply chain includes procurement for facility operations, and they use strategic partnerships to enhance service delivery and expand their reach.

What makes the GEO Group unique is its specialized expertise in managing complex correctional environments, combined with a focus on rehabilitation programs. This integrated approach benefits government clients by offering comprehensive solutions and supports broader society by supporting rehabilitation efforts. The company's operations are crucial in the US prison system.

The company is responsible for facility design, construction, and ongoing maintenance. This includes ensuring the physical infrastructure meets all safety and operational standards. They manage security, including staffing, surveillance, and emergency response protocols within their detention facilities.

They provide comprehensive inmate care, including medical, mental health, and substance abuse treatment. They offer educational and vocational programs to support rehabilitation. These services are essential for the well-being of the individuals and the safety of the facilities.

The company offers community-based services like halfway houses and day reporting centers. These programs help offenders transition back into society. Electronic monitoring and transportation services are also provided.

They leverage strategic partnerships to enhance service delivery and expand their geographic reach. The supply chain involves procurement for facility operations, ensuring they have the necessary resources. This includes food, medical supplies, and other essential items.

The company's operations are characterized by specialized expertise in managing complex correctional environments. They focus on rehabilitation programs to improve outcomes for individuals and communities. This integrated approach translates into benefits for government clients and broader society.

- Facility Design and Construction: Ensuring secure and functional facilities.

- Security Management: Maintaining safety and order within facilities.

- Inmate Care: Providing essential medical, mental health, and educational services.

- Reentry Programs: Supporting successful reintegration into society.

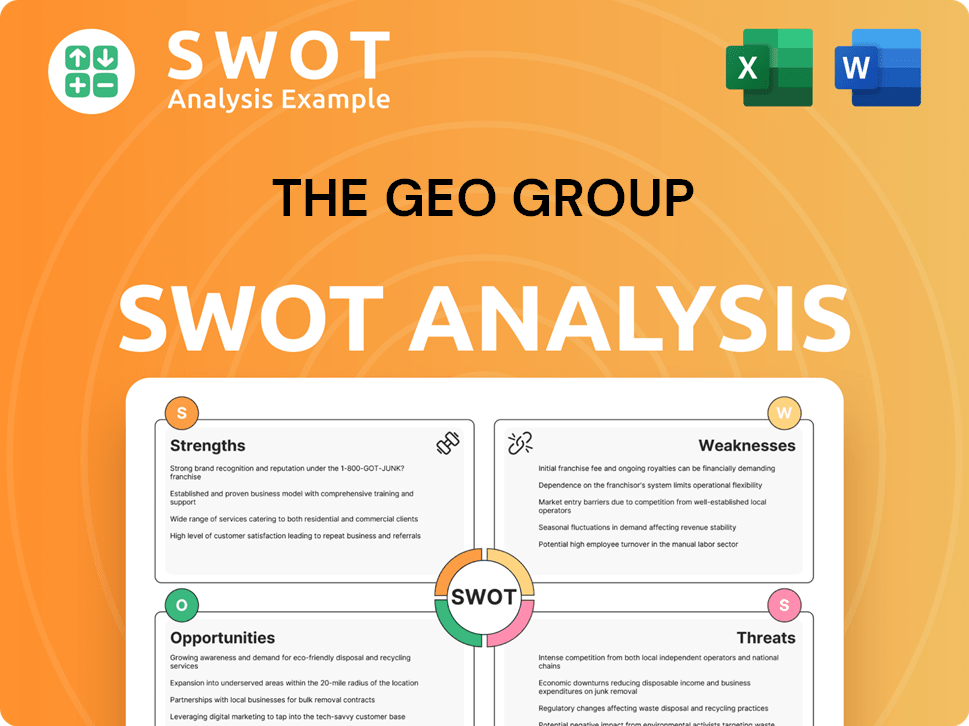

The GEO Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does The GEO Group Make Money?

The GEO Group company primarily generates revenue through contracts with governmental bodies. These contracts involve managing and operating correctional, detention, and reentry facilities. A significant portion of its income comes from per diem rates based on facility occupancy.

The GEO Group business model relies heavily on long-term contracts with government agencies. This approach provides a relatively stable and predictable revenue stream. In its Q1 2024 earnings, the company reported total revenues of approximately $580 million, illustrating the scale of its operations.

Beyond facility management, the company has diversified its revenue streams. These include community-based services, electronic monitoring, and transportation services. The company also utilizes facility leasing, owning the real estate and leasing it to government entities, further diversifying its income.

The GEO Group generates revenue through various channels, primarily focusing on contracts with government agencies. The company's approach to monetization is centered around long-term contracts, ensuring a stable revenue base. The company has also expanded into other areas to diversify its income sources.

- Facility Management: This is the core of the company's business, involving the operation of correctional, detention, and reentry facilities under contract with government agencies. Revenue is often based on per diem rates tied to facility occupancy.

- Community-Based Services: These services include programs and support provided outside of traditional detention settings, such as halfway houses and electronic monitoring.

- Electronic Monitoring: This involves the use of technology to monitor individuals in the community, offering an alternative to incarceration.

- Transportation Services: The company provides transportation services for individuals within the correctional system.

- Facility Leasing: The company owns real estate and leases it to government entities, generating additional income.

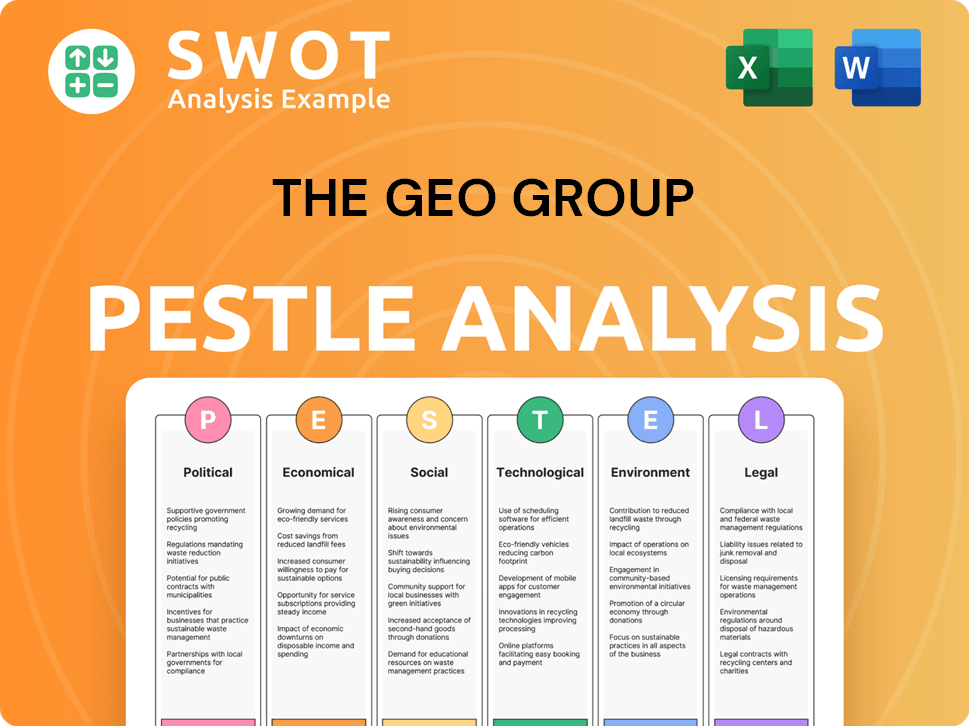

The GEO Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped The GEO Group’s Business Model?

The GEO Group has a long history marked by significant milestones and strategic shifts, adapting to market demands and regulatory changes. A key strategic move was its transition to a Real Estate Investment Trust (REIT) structure, which impacted its financial reporting and investor appeal. The GEO Group company has consistently expanded its portfolio through new facility developments, acquisitions, and contract awards, solidifying its position as a major player in the corrections industry.

Operational challenges have included fluctuating inmate populations and public scrutiny. The company has responded by emphasizing its commitment to rehabilitation programs and increasing transparency. The GEO Group business model has evolved to address these challenges while maintaining its core operations. Recent contract awards and renewals, such as the continued operation of the Federal ICE Processing Center in Aurora, Colorado, demonstrate its ongoing operational stability and reliance on government contracts.

The company's competitive advantages stem from its extensive experience, specialized expertise, and established relationships with government clients. Its real estate portfolio and economies of scale allow it to offer a comprehensive suite of services, differentiating it from smaller competitors. The GEO Group continues to adapt by focusing on evidence-based rehabilitation programs and exploring opportunities in alternative justice solutions.

The GEO Group was founded in 1984. A significant milestone was the conversion to a REIT in 2013. The company has expanded its operations through numerous acquisitions and contract wins over the years.

The REIT conversion was a major strategic shift. The company has focused on diversifying its services to include rehabilitation programs. Marketing Strategy of The GEO Group outlines some of these strategic approaches.

Its long-standing relationships with government agencies provide a competitive advantage. The company's size and economies of scale enable it to offer a wide range of services. Its extensive real estate portfolio supports its operational capabilities.

Recent contract renewals, such as the Aurora facility, demonstrate its continued operational stability. The company is increasingly focusing on evidence-based rehabilitation programs. It is exploring opportunities in alternative justice solutions.

In recent years, the company has faced fluctuating revenues due to changes in inmate populations and contract terms. The GEO Group's financial performance is closely tied to government contracts and occupancy rates. The company's debt levels and interest expenses are significant factors in its financial health.

- The company's revenue for 2023 was approximately $2.3 billion.

- The company operates approximately 68 facilities worldwide.

- The company's stock price has experienced volatility, reflecting the challenges in the private prisons sector.

- The company has been involved in various controversies related to private prisons and detention facilities.

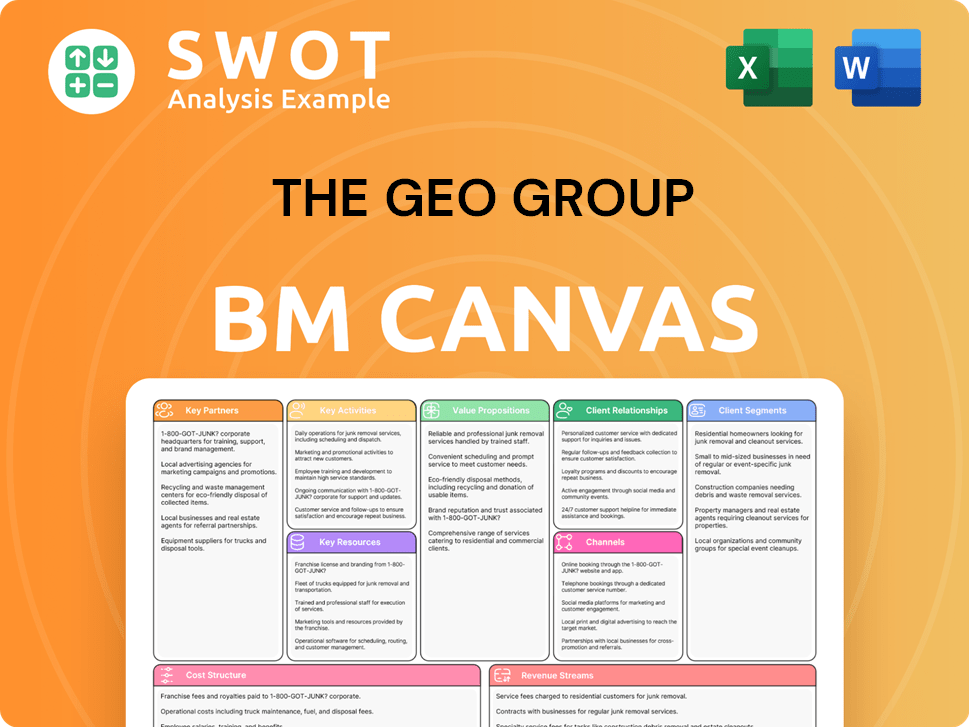

The GEO Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is The GEO Group Positioning Itself for Continued Success?

The GEO Group maintains a significant position in the private corrections and detention industry, alongside other major players. Its extensive portfolio of owned and managed facilities across the U.S. and internationally supports a substantial market share. Customer loyalty is often secured through long-term government contracts, offering a degree of stability. Its global reach further strengthens its industry standing.

Key risks include ongoing political and public debate surrounding private correctional facilities, potentially leading to regulatory changes. For example, shifts in federal immigration policies or state-level criminal justice reforms can directly impact facility occupancy rates and contract renewals. The company also faces risks related to healthcare costs for detainees and the potential for litigation. The Growth Strategy of The GEO Group involves a continued focus on its core operations, emphasizing its role in rehabilitation and community-based services.

The GEO Group is a leading corrections corporation with a substantial market share in the private prison industry. Its facilities are located across the United States, Australia, South Africa, and the United Kingdom. The company's scale allows it to compete for large government contracts.

The company faces several risks, including public scrutiny, regulatory changes, and political pressures. Changes in government policies, such as those related to immigration or criminal justice reform, can significantly impact its operations. Healthcare costs for detainees and potential litigation also pose financial risks.

The future outlook for the GEO Group involves adapting to evolving societal demands and policy changes. Strategic initiatives include optimizing its facility portfolio, pursuing contract renewals, and investing in programs that demonstrate positive outcomes. The company aims to remain a reliable partner for government agencies.

In recent years, the GEO Group has shown varying financial performance. For example, in Q1 2024, the company reported revenue of approximately $550 million. However, the company's profitability can be impacted by occupancy rates and contract terms. The company's stock price is subject to market volatility and investor sentiment.

The GEO Group focuses on several strategic initiatives to adapt to the changing landscape of the corrections industry.

- Optimizing Facility Portfolio: This includes evaluating and potentially reconfiguring its existing facilities to meet changing needs and demands.

- Contract Renewals and New Opportunities: Actively pursuing the renewal of existing contracts and bidding on new opportunities to maintain and grow its revenue streams.

- Investing in Programs: Implementing programs that focus on rehabilitation and community-based services to demonstrate positive outcomes.

- Focus on Stakeholders: The company is committed to providing high-quality, secure, and humane environments for those in its care.

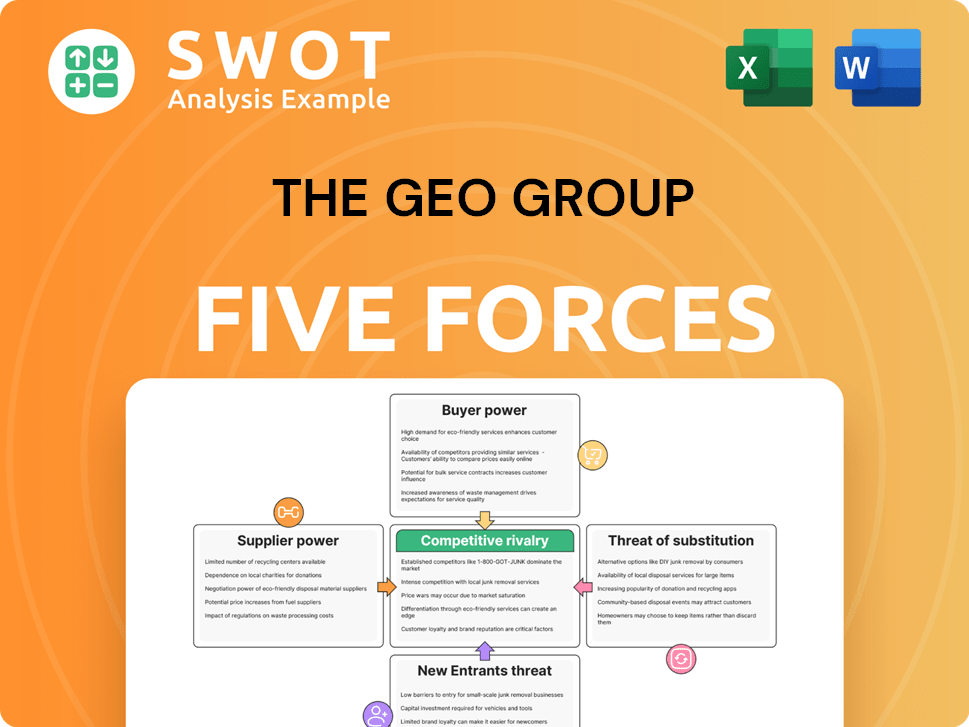

The GEO Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of The GEO Group Company?

- What is Competitive Landscape of The GEO Group Company?

- What is Growth Strategy and Future Prospects of The GEO Group Company?

- What is Sales and Marketing Strategy of The GEO Group Company?

- What is Brief History of The GEO Group Company?

- Who Owns The GEO Group Company?

- What is Customer Demographics and Target Market of The GEO Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.