Hydro One Bundle

How has Hydro One shaped Ontario's energy landscape?

Journey back in time to explore the fascinating Hydro One SWOT Analysis and its pivotal role in shaping Ontario's energy landscape. From its inception in 1906 as the Hydro-Electric Power Commission of Ontario (HEPC), Hydro One's story is a testament to innovation and public service. Discover how this power company evolved from a vision of affordable electricity into Ontario's largest electricity provider.

This exploration of Hydro One history unveils its transformation from a publicly owned entity to its current status. Understanding Hydro One's evolution provides valuable insights into the energy sector and its impact on communities across Ontario. Examining its infrastructure, services, and key milestones offers a comprehensive view of its enduring legacy and future plans.

What is the Hydro One Founding Story?

The story of Hydro One begins with the establishment of the Hydro-Electric Power Commission of Ontario (HEPC) on January 1, 1906. This marked the genesis of a major player in the Ontario electricity landscape. The driving force behind this initiative was Adam Beck, a key figure who championed public power.

The HEPC's creation addressed the inconsistent and often costly electricity services provided by private companies. Ontario, experiencing rapid industrial growth, needed dependable and affordable power to sustain its expansion. The province's abundant hydroelectric resources, especially Niagara Falls, presented an ideal solution, offering a clean and powerful energy source.

The initial operational model focused on public ownership and non-profit operations, aiming to supply electricity to municipalities at cost. The first major project involved constructing transmission lines to transport power from Niagara Falls to various communities in Southern Ontario. While not a 'startup' in the modern sense, the HEPC faced significant challenges, including gaining political support, overcoming opposition from private power interests, and executing large-scale infrastructure projects with then-current technology. Funding primarily came from provincial government backing and municipal debentures, reflecting its public utility mandate.

The HEPC's founding was a response to the need for reliable and affordable electricity in a rapidly industrializing Ontario. The focus was on public ownership and non-profit operation.

- Adam Beck was the key figure in establishing the HEPC.

- The primary goal was to provide electricity at cost to municipalities.

- The initial infrastructure project involved transmission lines from Niagara Falls.

- The cultural and economic context of the early 20th century favored public services.

The HEPC's early years were marked by significant infrastructure development. By the 1920s, the commission had expanded its reach, connecting more communities and industries to the power grid. This expansion was crucial for Ontario's economic development, enabling industrial growth and improving the quality of life for residents. The HEPC's commitment to public service and its ability to deliver affordable electricity played a pivotal role in shaping the province's economic landscape. The Mission, Vision & Core Values of Hydro One reflect the company's ongoing commitment to these principles.

Over time, the HEPC evolved, adapting to technological advancements and changing societal needs. The organization expanded its services and infrastructure to meet the growing demand for electricity. This included the construction of new generating stations and the development of more efficient transmission and distribution systems. The HEPC's commitment to innovation and its ability to adapt to changing circumstances were key to its continued success. By 2024, Hydro One serves approximately 1.5 million residential and business customers across Ontario.

The evolution of the HEPC into Hydro One involved significant changes in its structure and operations. The company underwent various transformations, including restructuring and privatization. These changes aimed to improve efficiency, modernize infrastructure, and enhance customer service. Throughout these transitions, Hydro One has remained committed to its core mission of providing reliable and affordable electricity to its customers. In 2024, Hydro One's total assets were valued at approximately $29.5 billion, reflecting its substantial infrastructure investments and its critical role in Ontario's energy sector.

Hydro One SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Hydro One?

The early years of Hydro One's history, then known as the Hydro-Electric Power Commission of Ontario (HEPC), were marked by rapid growth and expansion. This period saw the establishment of critical infrastructure and the development of a province-wide electricity network. The company's focus was on delivering affordable and reliable power to a growing population.

Following its establishment in 1906, the HEPC quickly started major infrastructure projects. A key achievement was the completion of the first major transmission lines from Niagara Falls, delivering power to cities like Toronto, London, and Guelph by 1910. This demonstrated the feasibility of long-distance electricity transmission. The initial projects were crucial in establishing the foundation for Ontario's electricity grid.

During this phase, the HEPC focused on expanding its transmission and distribution networks. This included acquiring smaller private utilities and integrating them into the provincial system. The company also diversified its power generation sources, although hydroelectricity remained central. This expansion was essential to serve the growing demand for electricity across the province.

Municipalities and industries eagerly embraced the promise of reliable and affordable electricity. The HEPC consolidated its position as the dominant power provider. Strategic decisions included standardizing equipment and practices and a strong emphasis on rural electrification. By the mid-20th century, the HEPC had become a cornerstone of Ontario's economic and social development, laying the groundwork for what would eventually become Hydro One.

The early team expanded significantly, encompassing engineers, technicians, and administrative staff required to manage the growing network. Leadership remained stable under Adam Beck for many years, providing consistent vision and direction. The growth in staff reflected the increasing scale and complexity of operations. Understanding the Revenue Streams & Business Model of Hydro One can provide further insights into the company's early operations.

Hydro One PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Hydro One history?

The Hydro One history is marked by significant milestones, beginning with its roots in the Hydro-Electric Power Commission of Ontario (HEPC). This evolution showcases its growth and adaptation within the Ontario electricity market, highlighting its role as a major power company and electricity provider.

| Year | Milestone |

|---|---|

| Early 20th Century | Development of high-voltage transmission networks, a pioneering effort in North America for efficient hydroelectric power distribution. |

| 2000 | Creation of Hydro One as a distinct transmission and distribution company following the unbundling of Ontario Hydro. |

| 2015 | Hydro One became a publicly traded company, marking a significant shift in its ownership structure. |

Throughout its history, Hydro One has consistently embraced technological advancements. These innovations have improved grid management and enhanced the reliability of its services within the energy sector.

Pioneering the development of high-voltage transmission networks in the early 20th century enabled the efficient distribution of hydroelectric power across vast distances. This innovation was crucial for industrial growth and improving the quality of life in Ontario.

Continuous adoption of advanced grid management systems has enhanced the monitoring and control of the electricity grid. These systems improve the reliability and efficiency of power distribution, ensuring a stable supply for consumers.

Implementation of substation automation technologies has streamlined operations and improved the responsiveness of the grid. Automation reduces the need for manual intervention, leading to faster response times during outages and other issues.

The deployment of smart meters across its service area has provided detailed consumption data and improved customer service. Smart meters offer customers greater control over their energy usage and support the implementation of time-of-use pricing.

AMI systems provide real-time data on electricity consumption and enable enhanced grid management. This technology supports more efficient energy distribution and helps in identifying and addressing outages more quickly.

Hydro One has invested in robust cybersecurity measures to protect its infrastructure from cyber threats. These measures are critical to maintaining the security and reliability of the electricity grid.

Hydro One has faced challenges including market fluctuations and operational complexities. The company has also had to navigate regulatory changes and public expectations as it evolved.

Economic downturns, such as the Great Depression, required careful resource management and austerity measures. These events highlighted the need for financial prudence and adaptability.

Competition from private utilities and independent power producers has increased over time. Hydro One has had to adapt to a more competitive market environment to maintain its position.

Maintaining and upgrading aging infrastructure has presented ongoing operational challenges. Hydro One has invested heavily in infrastructure renewal to ensure grid reliability.

Ensuring grid resilience against extreme weather events poses a significant challenge. Hydro One has implemented measures to mitigate the impact of severe weather on its operations.

Navigating evolving regulatory frameworks and public expectations has been an ongoing challenge. Hydro One has adapted to changes in the regulatory environment to meet stakeholder needs.

Managing public expectations and maintaining a positive reputation is essential for a partially privatized entity. Hydro One focuses on customer service and community engagement to address these concerns.

Hydro One Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Hydro One?

Tracing its roots back to 1906, the Hydro One history reflects a century of evolution in Ontario's electricity provider landscape. From its inception as the Hydro-Electric Power Commission of Ontario (HEPC) to its modern form, Hydro One has played a pivotal role in shaping the province's energy sector. The power company has undergone significant transformations, including unbundling and privatization, adapting to the changing demands of a growing population and the shift towards cleaner energy sources. Understanding Hydro One's timeline provides valuable insights into its strategic direction and future initiatives.

| Year | Key Event |

|---|---|

| 1906 | The Hydro-Electric Power Commission of Ontario (HEPC) is established, marking the beginning of public power in Ontario. |

| 1910 | First major transmission lines from Niagara Falls completed, delivering power to municipalities. |

| 1974 | HEPC is renamed Ontario Hydro. |

| 2000 | Ontario Hydro is unbundled, leading to the formation of Hydro One Inc. as a distinct transmission and distribution company. |

| 2015 | The Ontario government announces plans to sell a majority stake in Hydro One through an initial public offering (IPO). |

| 2016 | Hydro One completes its initial public offering, with shares listed on the Toronto Stock Exchange. |

| 2023 | Hydro One reports adjusted earnings per share of $1.76, an increase of 7% over the previous year. |

| 2024 | Hydro One continues its significant capital investments, with plans for approximately $2.8 billion in capital expenditures in 2024 to modernize the grid and connect new customers. |

Hydro One is focused on modernizing its infrastructure, including smart grid technologies and automation, to enhance reliability and efficiency. This involves significant capital investments, with approximately $2.8 billion planned for 2024, $3.0 billion for 2025, and $3.2 billion for 2026. These investments support the integration of renewable energy sources and improve the resilience of the electricity system. The company's commitment to infrastructure development is crucial for meeting the growing demands of Ontario's population.

The company's market expansion is primarily within Ontario, focusing on connecting new clean energy projects and supporting electrification initiatives. This includes the development of electric vehicle charging infrastructure and serving the growing needs of both residential and industrial customers. Hydro One is actively involved in facilitating the transition to a more sustainable energy future, aligning with broader industry trends towards decarbonization and decentralization.

Hydro One reported strong financial results in 2023, with adjusted earnings per share increasing by 7% and a net income increase to $378 million in the first quarter of 2024. Leadership emphasizes a commitment to customer service and operational excellence. The company continues to align its strategic goals with the founding vision of providing reliable and affordable electricity to the people of Ontario, adapting to the evolving energy landscape. For more details about their financial performance, you can check out this article about Hydro One's financial performance.

Industry trends such as decarbonization, decentralization of energy generation, and digitalization are expected to significantly impact Hydro One's future. The company is positioned to play a crucial role in facilitating the integration of renewable energy sources and enabling a more resilient and sustainable electricity system. Hydro One's future outlook involves navigating a complex and evolving energy landscape while remaining committed to its core mission of providing reliable and affordable electricity to the people of Ontario.

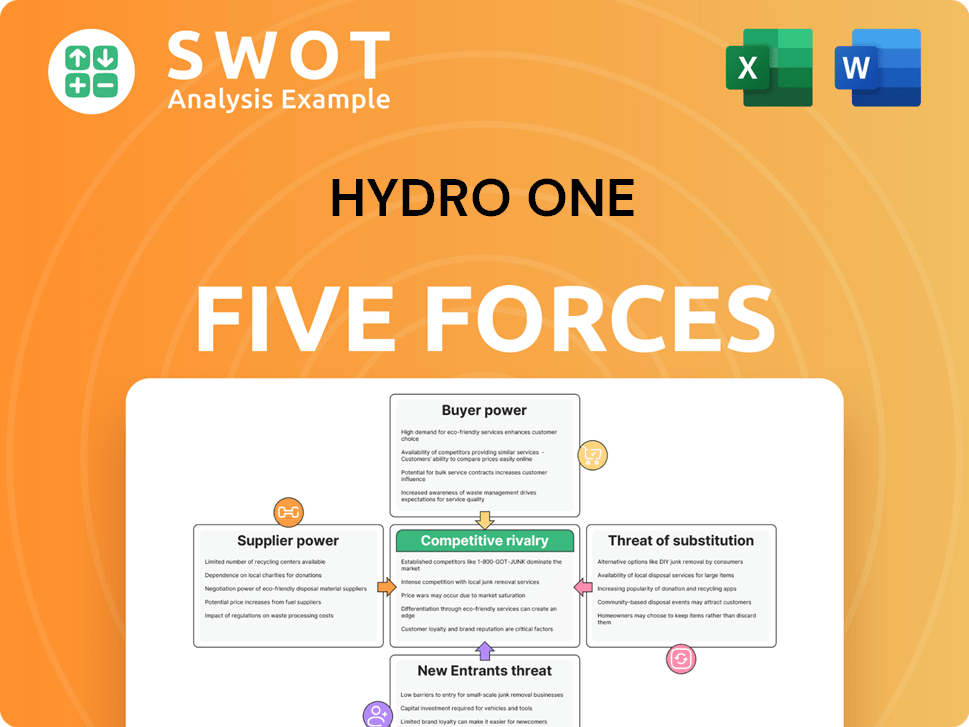

Hydro One Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Hydro One Company?

- What is Growth Strategy and Future Prospects of Hydro One Company?

- How Does Hydro One Company Work?

- What is Sales and Marketing Strategy of Hydro One Company?

- What is Brief History of Hydro One Company?

- Who Owns Hydro One Company?

- What is Customer Demographics and Target Market of Hydro One Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.