Hydro One Bundle

Can Hydro One Power Up Your Portfolio?

Hydro One Company, a key player in Ontario's energy sector, is undergoing a significant transformation. With a recent $261 million acquisition of the East-West Tie Transmission Line, the company is poised for substantial growth. This strategic move underscores Hydro One's commitment to strengthening its infrastructure and expanding its reach within the Ontario electricity market.

This analysis dives deep into Hydro One's Hydro One SWOT Analysis, exploring its growth strategy and future prospects. We'll examine Hydro One's strategic initiatives, financial performance, and expansion plans, including its renewable energy projects and infrastructure investments. Understanding Hydro One's market analysis and competitive landscape is crucial for investors and stakeholders looking to capitalize on the evolving energy sector and the future of Hydro One stock.

How Is Hydro One Expanding Its Reach?

The Hydro One Company is actively pursuing a robust growth strategy centered on significant infrastructure investments. These initiatives are designed to modernize and expand Ontario's electricity grid, ensuring it can meet increasing demand and support the province's electrification goals. The company's strategic focus includes substantial capital allocation and strategic acquisitions to enhance its market position within the energy sector.

A key aspect of Hydro One's expansion plans involves substantial capital investments. The company has earmarked an $11.8 billion capital plan for the period from 2023 to 2027. This plan is projected to achieve a compound annual growth rate (CAGR) of approximately 6% in its rate base. The rate base is expected to increase from $23.6 billion in 2022 to an estimated $31.8 billion by 2027. In 2024 alone, Hydro One invested $3.1 billion in its transmission and distribution networks. This level of investment underscores Hydro One's commitment to long-term growth and the enhancement of its infrastructure.

These investments are critical for maintaining and improving the reliability of the electricity supply across Ontario. The company's efforts are also directed at integrating new generation sources, which is essential for supporting the economic development of the province. For further insights into Hydro One's operations, consider reading about the Revenue Streams & Business Model of Hydro One.

Hydro One is developing and constructing major transmission lines to bolster its infrastructure. These projects are crucial for enhancing grid capacity and reliability. The company is focused on expanding its transmission capabilities to meet growing energy demands.

Strategic acquisitions are part of Hydro One's growth strategy. These acquisitions are designed to strengthen the company's infrastructure and market position. Hydro One aims to expand its operational capabilities through strategic investments.

Hydro One was selected to develop the new Wawa to Porcupine Transmission Line Project in Northeastern Ontario. This project is a key part of the company's expansion efforts. It will enhance the transmission capacity in the region.

The Chatham to Lakeshore Transmission Line project was completed one year ahead of schedule and under budget in 2024. This demonstrates Hydro One's efficiency in project execution. This project enhances grid reliability.

Hydro One is undertaking several key initiatives to enhance its infrastructure and market position. These projects are designed to support the long-term growth and sustainability of the company. The focus is on improving grid reliability, accommodating load growth, and integrating new generation sources.

- East-West Tie Transmission Line Acquisition: On March 4, 2025, Hydro One completed the acquisition of an approximate 48% interest in the East-West Tie Transmission Line for $261 million in cash.

- Waasigan Transmission Line Project: Hydro One is working on the Waasigan Transmission Line project, in collaboration with nine First Nations partners. This project is expected to bring an additional 350 MW of clean electricity to northwestern Ontario upon completion.

- Financial Impact of Acquisitions: The East-West Tie Transmission Line, with an Ontario Energy Board (OEB) approved rate base of approximately $880 million (on a 100% basis), is expected to be EPS accretive in 2025.

- Long-Term Goals: These initiatives are part of Hydro One's long-term goals to enhance grid reliability, accommodate load growth, and support the economic development of Ontario.

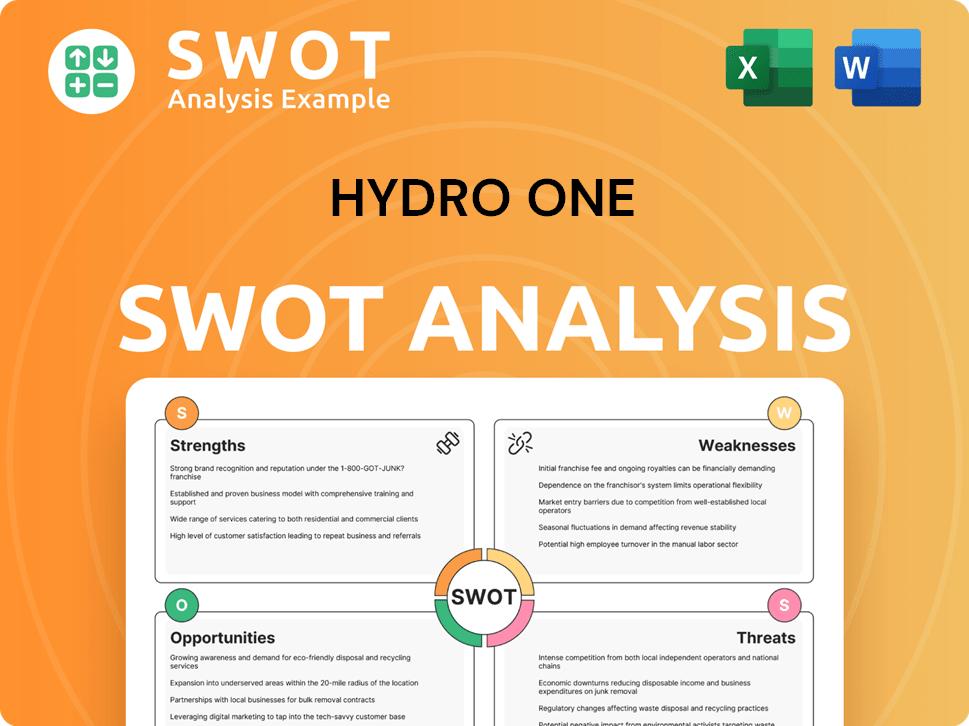

Hydro One SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hydro One Invest in Innovation?

The company's innovation and technology strategy is a key driver of its sustained growth within the energy sector. This strategy focuses on grid modernization, digital transformation, and the integration of cutting-edge solutions to enhance operational efficiency and customer service. This approach is crucial for navigating the evolving landscape of the Ontario electricity market and ensuring long-term success.

Hydro One's strategic priorities, refreshed in November 2024, highlight 'Solutions: Driving innovation and leveraging technology for an electrified future.' This involves significant investments in advanced technologies to boost grid flexibility, resilience, and efficiency. These advancements are designed to meet the growing demands of its customer base and support the broader goals of sustainability and renewable energy integration.

A commitment to technological advancement is evident in its adoption of digitalization and smart grid technologies. The company aims to improve operational efficiency, enhance grid reliability, and empower customers through data analytics, IoT devices, and automation. These initiatives contribute to the overall growth strategy and position the company for future opportunities.

Investing in advanced technologies to enhance grid flexibility, resilience, and efficiency. This includes upgrading existing infrastructure and implementing new systems to handle increasing energy demands.

Adopting digital solutions and smart grid technologies to improve operational efficiency and enhance grid reliability. This involves using data analytics, IoT devices, and automation to optimize performance.

Adapting infrastructure to accommodate renewable energy sources such as solar, wind, and hydroelectric power. This supports the company's sustainability goals and reduces its carbon footprint.

Converting its vehicle fleet to electric vehicles (EVs) and hybrids. The company has made significant progress, with approximately 44% of its sedans and SUVs converted by 2024, aiming for 100% by 2030.

Focusing on reducing carbon emissions and achieving net-zero targets. The company has reduced its Scope 1 greenhouse gas emissions by approximately 24% compared to its 2018 baseline, targeting a 30% reduction by 2030.

Supporting the electrification of transportation by exploring opportunities to develop EV charging stations across Ontario. This initiative aligns with the company's commitment to sustainability and future-proofing its operations.

The company's focus on innovation is evident through its commitment to grid modernization, digital transformation, and sustainability. These initiatives are integral to the Brief History of Hydro One and its future prospects.

- Grid Modernization: Implementing smart grid technologies to restore power faster and at a lower cost.

- Digitalization: Utilizing data analytics and IoT devices to improve operational efficiency.

- Renewable Energy: Adapting infrastructure to integrate solar, wind, and hydroelectric power.

- Fleet Electrification: Converting vehicles to EVs and hybrids, with a target of 100% by 2030.

- Emissions Reduction: Aiming for a 30% reduction in Scope 1 greenhouse gas emissions by 2030.

- EV Charging: Developing EV charging stations to support the electrification of transportation.

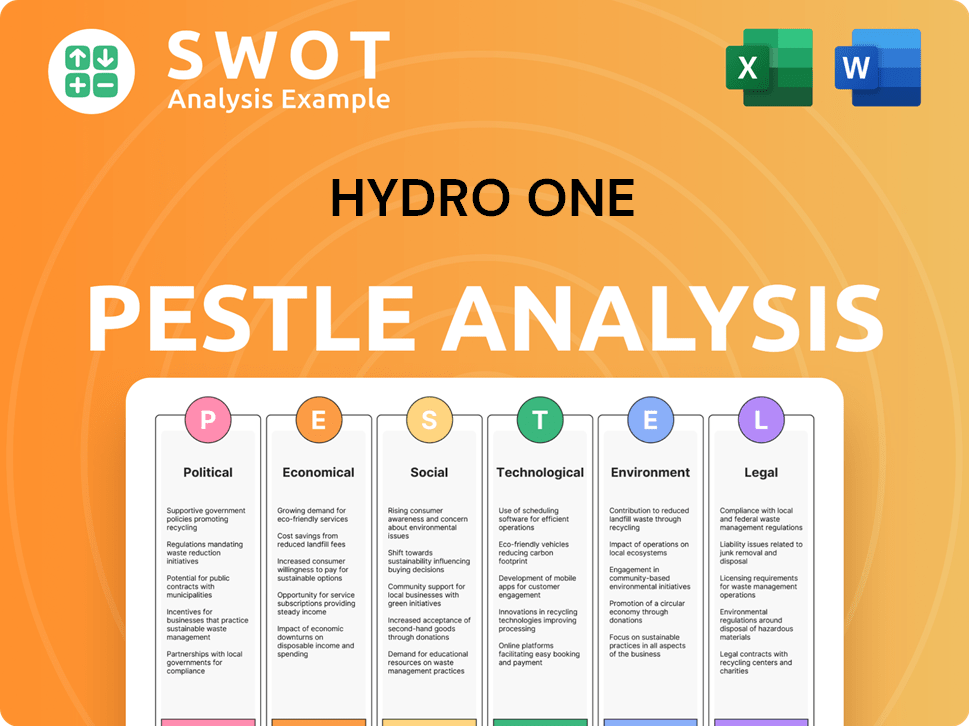

Hydro One PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Hydro One’s Growth Forecast?

The financial outlook for Hydro One, a key player in the energy sector, projects stable growth through 2027. This outlook is supported by strategic capital investments and its position as a regulated utility. The company's financial health is reflected in its recent performance and planned initiatives.

In the first quarter of 2025, Hydro One demonstrated strong financial results. Consolidated revenue reached $2,408 million, an increase of 11.2% compared to Q1 2024. Net income also saw a significant rise, reaching $358 million, which is a 22.2% increase year-over-year. Basic earnings per share (EPS) improved to $0.60, up 22.4% from the same period last year.

Hydro One has a substantial capital plan to drive future growth. The company's strategic initiatives include an $11.8 billion capital plan for the 2023-2027 period. This plan is expected to generate approximately a 6% compound annual growth rate (CAGR) in its rate base. This growth is projected to increase the rate base from $23.6 billion in 2022 to $31.8 billion by 2027. The company forecasts annual EPS growth of 6-8% through 2027, demonstrating a commitment to long-term value creation for Owners & Shareholders of Hydro One.

In 2024, Hydro One invested $3.1 billion in its transmission and distribution networks, highlighting its commitment to infrastructure investments. These investments are critical for maintaining and enhancing the reliability of Ontario's electricity grid. These investments are crucial for supporting the company's expansion plans.

Hydro One does not anticipate needing to issue equity to fund its growth, indicating its strong financial position. This self-funding capability underscores the company's financial stability and its ability to execute its growth strategy without diluting shareholder value. The company's financial performance is a key indicator of its success.

As of December 31, 2024, Hydro One had $36.7 billion in assets and annual revenues of $8.5 billion. The company's substantial asset base and revenue stream reflect its significant presence in the Ontario electricity market. These figures underscore the scale of Hydro One's operations.

Despite a net debt-to-capitalization ratio of 59.0% as of Q1 2025, up from 58.4% in Q4 2024, Hydro One maintains a disciplined dividend policy. The company offers a 3.3% dividend yield, providing a steady return to shareholders. This reflects the company's commitment to returning value to its investors.

As of May 7, 2025, Hydro One's stock had a market capitalization of approximately $29 billion. This market capitalization reflects investor confidence in the company's future prospects and its position in the energy sector. The company's stock performance is closely watched by investors.

- Hydro One's strategic investments in infrastructure are expected to drive long-term growth.

- The company's strong financial performance and disciplined dividend policy make it an attractive investment.

- Hydro One's focus on operational efficiency and productivity savings supports its financial outlook.

- The company's regulated utility model provides stability and predictability in its financial results.

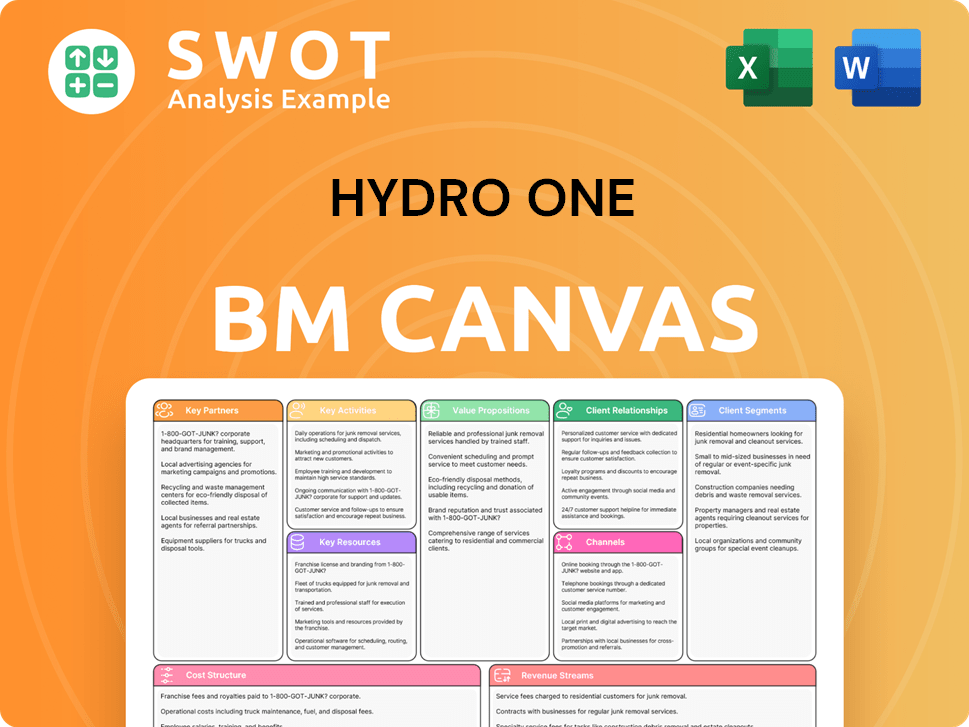

Hydro One Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Hydro One’s Growth?

The Hydro One Company's Growth Strategy and its future face several potential risks and obstacles. These challenges range from market dynamics and regulatory shifts to operational and technological disruptions. Understanding these risks is crucial for assessing the long-term viability and success of Hydro One's strategic initiatives.

Market competition, while mitigated by its regulated utility status, can still impact Hydro One's operations. Regulatory changes and policy shifts also pose significant challenges, as they directly influence the Hydro One's financial performance and expansion plans. Furthermore, supply chain vulnerabilities and technological advancements introduce additional layers of complexity that Hydro One must navigate.

Weather-related disruptions and internal resource constraints further contribute to the risk profile. However, Hydro One actively manages these risks through disciplined financial management, strategic planning, and proactive stakeholder engagement. The company's ability to adapt and respond to these challenges will be a key determinant of its future success in the Energy Sector within the Ontario Electricity market.

Even with its regulated status, Hydro One faces competitive pressures in certain aspects of its business. The competitive landscape includes other energy providers and potential new entrants. This requires Hydro One to continually optimize its services and infrastructure investments.

Changes in regulations and government policies significantly impact Hydro One's operations. Rate approvals by the Ontario Energy Board (OEB) directly affect revenue. Government regulations regarding cost allocation and recovery also play a crucial role in the company's financial outlook.

Supply chain vulnerabilities can affect project timelines and costs. Hydro One's extensive capital investments in infrastructure make it particularly sensitive to these disruptions. Technological advancements also present risks if Hydro One fails to adapt quickly.

Weather events pose an ongoing risk to infrastructure integrity. For example, the company performed over 1.1 million service restorations affecting more than 600,000 customers after a March 2025 ice storm. Preparing for and responding to these events is essential.

Labor stability and other internal resource constraints can affect operations. The recently ratified collective agreement with the Power Workers' Union, covering approximately 10,100 employees and effective October 1, 2025, mitigates this risk. This agreement is seen as eliminating a critical risk to operational continuity.

Hydro One employs disciplined financial management, operational efficiency, and productivity savings to address these challenges. Productivity savings amounted to $149.5 million in 2024. The company also uses scenario planning and maintains a strong balance sheet.

Hydro One's investments in infrastructure are a core part of its Growth Strategy. These investments are crucial for maintaining and upgrading the electricity grid. These strategic investments are essential for ensuring reliable service for its customer base and supporting the long-term goals of the company.

The company's financial performance is directly linked to regulatory approvals and operational efficiency. Hydro One's expansion plans are subject to market analysis and the competitive landscape. The company's ability to manage costs and secure favorable regulatory outcomes is crucial.

Hydro One is actively involved in embracing technological advancements. This includes smart grid technologies and other innovations. The company's sustainability efforts are also critical, reflecting its commitment to environmental stewardship and its impact on Ontario's economy.

The regulatory environment plays a significant role in shaping Hydro One's operations and financial outcomes. The company's stock performance is influenced by its ability to navigate these challenges. For more insights, you can read about the Hydro One's future prospects.

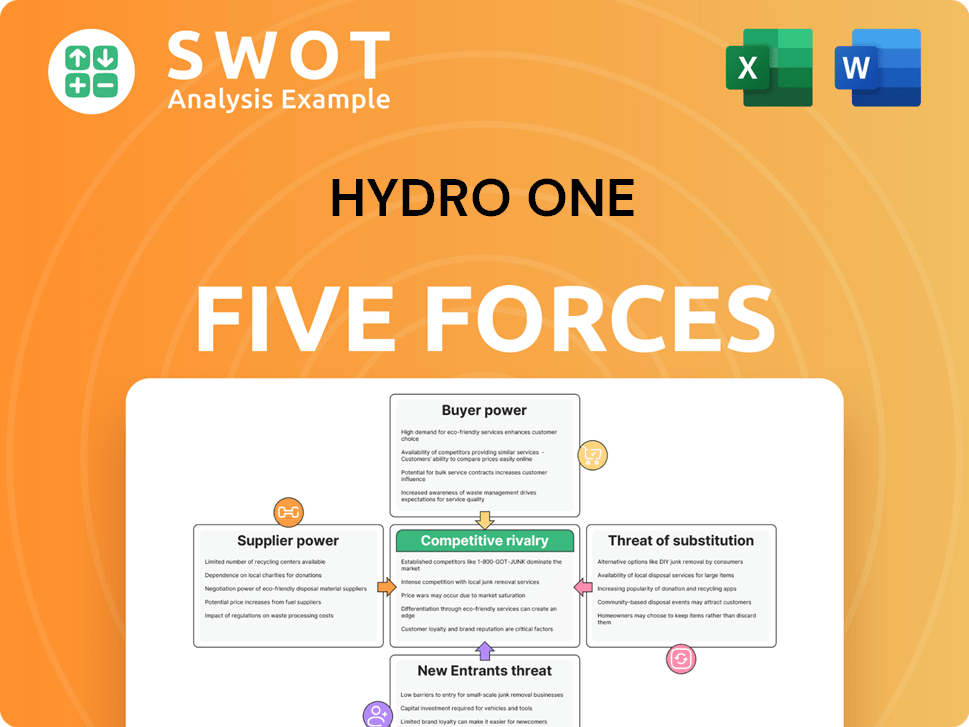

Hydro One Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hydro One Company?

- What is Competitive Landscape of Hydro One Company?

- How Does Hydro One Company Work?

- What is Sales and Marketing Strategy of Hydro One Company?

- What is Brief History of Hydro One Company?

- Who Owns Hydro One Company?

- What is Customer Demographics and Target Market of Hydro One Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.