Illumina Bundle

How Did Illumina Revolutionize Genomics?

Illumina's story is one of remarkable innovation and strategic foresight, transforming the landscape of biotechnology. From its inception, the Illumina SWOT Analysis reveals a company that has consistently pushed the boundaries of what's possible in genetic research. Its acquisition of Solexa in 2007 was a pivotal moment, launching Illumina to the forefront of DNA sequencing. This brief history of Illumina showcases a journey of groundbreaking advancements.

Founded in April 1998, the Illumina company quickly recognized the immense potential of genomics, setting out to develop high-throughput tools for genetic analysis. This commitment to innovation has driven its evolution, from its early years to its current status as a dominant force in the genomics market. Exploring the Illumina timeline reveals key milestones in the development of sequencing technologies and its impact on genomics. Understanding Illumina's history offers valuable insights into the company's strategic moves and its enduring influence on the biotechnology sector.

What is the Illumina Founding Story?

The story of the Illumina company began on April 1, 1998. It was founded by David Walt, John Stuelpnagel, Anthony Czarnik, Mark Chee, and Kevin Gunderson. The founders, with varied expertise in chemistry, molecular biology, and business, saw a need for more efficient and cost-effective methods for genetic analysis.

Their initial goal was to create high-throughput array-based technologies for genetic variation analysis. This focus marked the start of what would become a significant player in the genomics field. The company's name, 'Illumina,' was chosen to suggest 'illuminating' the genome and bringing clarity to genetic information.

Early financial backing from venture capital firms, including Domain Associates and Warburg Pincus, was critical. This funding helped transform their scientific vision into a commercial enterprise, setting the stage for the company's future growth and impact on the field of genomics.

The company was founded on April 1, 1998.

- Founders: David Walt, John Stuelpnagel, Anthony Czarnik, Mark Chee, and Kevin Gunderson.

- Initial Focus: High-throughput array-based technologies for genetic variation.

- First Product: BeadArray technology.

- Funding: Venture capital from firms like Domain Associates and Warburg Pincus.

Illumina SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Illumina?

The early growth of the Illumina company was characterized by strategic product development and expansion into new markets. This period was crucial for establishing its foundation in the genomics industry. The company focused on innovation and broadening its reach to solidify its position. This proactive approach set the stage for its future dominance.

In 2001, Illumina launched its first commercial product, the BeadLab system, enhancing its genetic analysis capabilities. The introduction of the Sentrix Array Matrix in 2002 further solidified its position in the array-based genomics market. These early offerings were pivotal in attracting key clients, including major research institutions and pharmaceutical companies. This focus on innovation helped define the Mission, Vision & Core Values of Illumina.

A pivotal moment in Illumina's history was the 2007 acquisition of Solexa for approximately $600 million. This acquisition provided cutting-edge, next-generation sequencing (NGS) technology. This strategic move into the DNA sequencing market was a game-changer, shaping Illumina's trajectory. The company's expansion continued with global offices and sales channels.

By 2010, Illumina had significantly broadened its product portfolio, offering a comprehensive suite of sequencing and array platforms. These platforms catered to a wide range of genomic research and clinical applications. This period of rapid technological advancements and understanding of the genomics community's needs set the stage for its dominance in the industry. The company's early growth was marked by rapid technological advancements.

The early years of Illumina were characterized by significant milestones. The company's focus on innovation and strategic acquisitions, such as Solexa, helped it to establish a strong foothold in the genomics market. The development of sequencing technologies and expansion of its product offerings had a profound impact on the field. Illumina continues to be a leader in the genomics industry.

Illumina PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Illumina history?

The Illumina history is marked by significant advancements and strategic moves that have shaped the genomics industry. From its founding to its current status, the company has consistently pushed the boundaries of what's possible in DNA sequencing and related fields.

| Year | Milestone |

|---|---|

| 1998 | Founded as Solexa, Inc., the company focused on developing innovative sequencing technologies. |

| 2007 | Acquired by Illumina, the company began to integrate its technologies with Illumina's existing platforms. |

| 2010 | Launched the HiSeq 2000 system, which significantly increased sequencing throughput and reduced costs. |

| 2014 | Introduced the HiSeq X Ten Sequencing System, enabling the sequencing of 10,000 human genomes per year at a cost of $1,000 per genome. |

| 2017 | Launched the NovaSeq series, further increasing sequencing throughput and flexibility. |

| 2023 | Faced regulatory challenges with the acquisition of GRAIL, a liquid biopsy company, leading to a divestiture order from the European Commission. |

The company's innovations have been central to its success, particularly in the field of Illumina sequencing. These advancements have not only improved the speed and efficiency of sequencing but also expanded the applications of genomic research.

Launched in 2014, this system enabled the sequencing of 10,000 human genomes per year, significantly reducing costs to $1,000 per genome. This democratization of genomic research accelerated large-scale population studies and personalized medicine initiatives.

Introduced in 2017, the NovaSeq series further increased sequencing throughput and flexibility, allowing for even greater scalability in genomic projects. This advancement supported the processing of massive datasets, enhancing research capabilities.

The DRAGEN Bio-IT Platform provides rapid and accurate secondary analysis of genomic data. This platform is essential for processing the vast amounts of data generated by modern sequencing technologies, improving the speed of analysis.

The NextSeq series offers a balance of throughput and affordability, making it suitable for a wide range of applications. This flexibility supports diverse research needs, from small-scale projects to large-scale studies.

The iSeq 100 System provides a compact and accessible sequencing solution for various research needs. This system is designed to be user-friendly, making advanced sequencing technology available to a broader audience.

The company has expanded its focus on clinical diagnostics and precision medicine. This strategic move allows Illumina to address the growing demand for advanced diagnostic tools and personalized treatments, driving innovation in healthcare.

Despite its successes, Illumina has faced challenges, including competitive pressures and regulatory hurdles. The company's ability to navigate these issues has been critical to its continued leadership in the genomics market.

Intense competition from emerging sequencing technologies poses a constant challenge. The company must continually innovate to maintain its market share and technological edge, requiring significant investment in research and development.

Navigating intellectual property disputes and defending its patents is an ongoing concern. These legal battles can be costly and time-consuming, potentially impacting the company's ability to commercialize its innovations.

The acquisition of GRAIL faced significant regulatory hurdles, leading to a divestiture order from the European Commission in 2023. This highlights the complexities of navigating global regulatory landscapes, especially in fast-growing sectors.

Adapting to market shifts and competitive pressures is crucial for maintaining its leadership position. The company must continuously innovate and expand its applications into new areas like clinical diagnostics and precision medicine.

Economic downturns can impact research budgets and demand for sequencing services. The company must manage its costs and adapt its strategies to maintain profitability and growth during economic uncertainties.

Supply chain disruptions can affect the production and delivery of sequencing instruments and reagents. The company needs to build resilient supply chains to mitigate the impact of these disruptions.

Illumina Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Illumina?

The Illumina company has a rich history marked by significant advancements in the field of genomics. Founded on April 1, 1998, the company quickly established itself as a leader in DNA sequencing and array-based technologies. Key milestones include the launch of the BeadLab system in 2001, the introduction of the Sentrix Array Matrix in 2002, and the acquisition of Solexa in 2007, which propelled Illumina into next-generation sequencing. The launch of the HiSeq 2000 in 2010 and the HiSeq X Ten Sequencing System in 2014 further enhanced sequencing capabilities, driving down costs and increasing throughput. The release of the NovaSeq series in 2017 and the announcement of the acquisition of GRAIL in 2020, though later impacted by regulatory decisions, reflect the company's ongoing expansion and innovation. Recent financial results show that for the full year 2023, revenue declined by 1% to $4.78 billion, and Q1 2024 revenue was down 1.9% year-over-year. In May 2024, Jacob Thaysen was announced as the new CEO, effective September 2024.

| Year | Key Event |

|---|---|

| 1998 | Illumina was founded on April 1. |

| 2001 | The company launched the BeadLab system. |

| 2007 | Illumina acquired Solexa. |

| 2010 | The HiSeq 2000 was launched, increasing sequencing throughput. |

| 2014 | The HiSeq X Ten Sequencing System was introduced, enabling $1,000 genome sequencing. |

| 2020 | Illumina announced the acquisition of GRAIL. |

| 2023 | The European Commission ordered the divestiture of GRAIL. |

| 2024 | Illumina announced a 1% decline in revenue for the full year 2023 to $4.78 billion and Q1 revenue down 1.9% year-over-year. |

Illumina's future is tied to continuous innovation in sequencing technologies. The company is focused on developing new platforms that offer higher throughput and lower costs. This will enhance the accessibility of genomic sequencing for clinical applications, including oncology and reproductive health. Further developments will likely improve the accuracy and speed of genomic analysis.

Illumina is set to broaden its impact in precision medicine, drug discovery, and clinical diagnostics. The company's focus will be on expanding the clinical applications of genomics, particularly in oncology and reproductive health. This includes developing new tests and tools that can improve patient outcomes and advance medical research. The company is likely to continue to make strategic partnerships.

The genomics market is predicted to experience strong growth, driven by the increasing adoption of genomic sequencing in oncology and the growing demand for non-invasive prenatal testing. Illumina is well-positioned to maintain its market leadership through ongoing innovation and strategic partnerships. The company's ability to adapt to these market dynamics will be key.

Illumina's long-term strategic initiatives include advancing sequencing technology to achieve lower costs and higher throughput. This will make genomics more accessible for routine clinical use. The company is also focused on strategic partnerships to expand its market reach and enhance its product offerings. The appointment of a new CEO in 2024 indicates a focus on future growth.

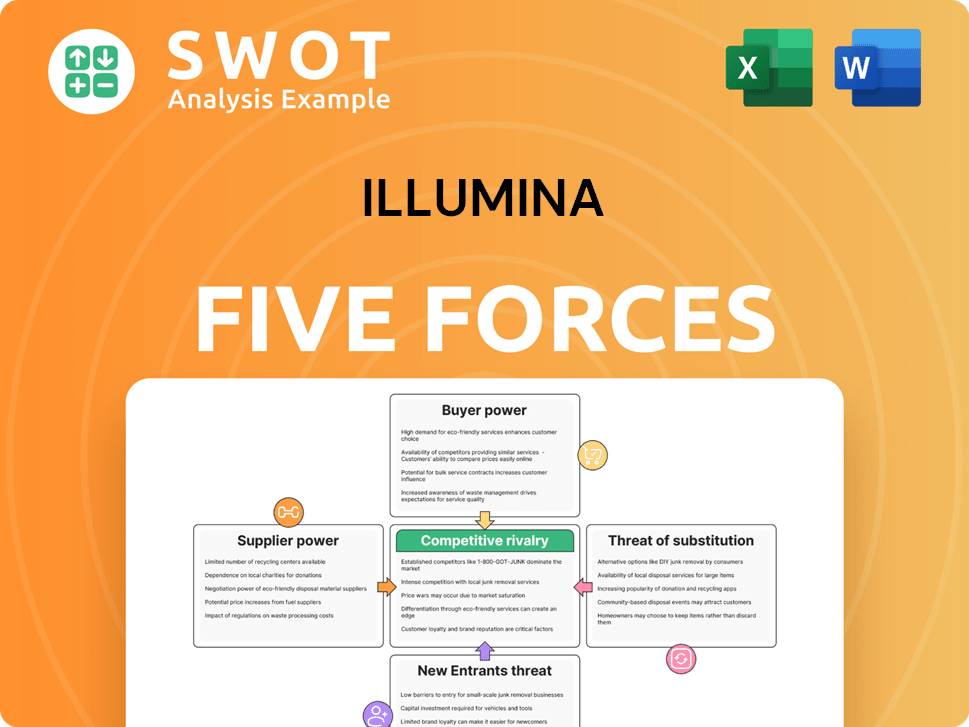

Illumina Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Illumina Company?

- What is Growth Strategy and Future Prospects of Illumina Company?

- How Does Illumina Company Work?

- What is Sales and Marketing Strategy of Illumina Company?

- What is Brief History of Illumina Company?

- Who Owns Illumina Company?

- What is Customer Demographics and Target Market of Illumina Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.