Illumina Bundle

How Does Illumina Dominate the Genomics Race?

Illumina has revolutionized the Illumina SWOT Analysis, transforming how we understand the building blocks of life. From its humble beginnings in 1998, the company has become a global leader, driving innovation in the DNA sequencing market. Its technologies are at the forefront of advancements in genomics, drug discovery, and clinical diagnostics.

This exploration will dissect the Illumina competitive landscape, examining its primary rivals in the next-generation sequencing (NGS) space and assessing its market share. We'll analyze Illumina's competitive advantages and disadvantages, providing insights into its strategies for maintaining market leadership within the dynamic genomics industry. Understanding Illumina's position is crucial for anyone seeking to navigate the complexities of this rapidly evolving sector.

Where Does Illumina’ Stand in the Current Market?

Illumina has a strong market position in the genomics industry, especially in the next-generation sequencing (NGS) market. The company is a leader in the DNA sequencing market, holding a significant share. Its dominance is due to its range of sequencing platforms, from benchtop models to high-throughput systems, meeting diverse research and clinical needs.

The company's main offerings include sequencing instruments, reagents, and services, along with microarray solutions. Illumina serves customers globally, including academic institutions, pharmaceutical companies, and clinical diagnostic labs. Illumina has shifted its focus to clinical applications and population genomics, making genomics more accessible for routine diagnostics.

In 2023, Illumina reported approximately $4.49 billion in total revenue. Illumina's financial strength and investment in research and development highlight its commitment to innovation. The company's strong position is most evident in high-volume sequencing applications, although it faces increasing competition in more specific markets.

Illumina maintains a commanding market share in the genomics industry, particularly within the NGS market. While exact figures fluctuate, estimates often place its market share above 70-80% in the NGS instrument market. This dominance is supported by a comprehensive portfolio of sequencing platforms.

Illumina's product lines include sequencing instruments, reagents, and services, as well as microarray solutions. The company offers a wide array of products that cater to various research and clinical needs. This diverse portfolio supports its strong market position.

Illumina has a strong global presence, serving customers across North America, Europe, Asia-Pacific, and other regions. Its customer segments include academic and government research institutions, pharmaceutical and biotechnology companies, clinical diagnostic labs, and agricultural organizations. This broad reach supports its market leadership.

In 2023, Illumina reported total revenue of approximately $4.49 billion. The company's financial strength allows for significant investment in research and development. This commitment to innovation helps Illumina maintain its competitive edge.

Illumina's strategic shift towards clinical applications and population genomics initiatives has broadened its market reach. This move aims to make genomics more accessible for routine diagnostic use, expanding its customer base. The company's ability to adapt to market changes is crucial.

- The company continues to compete in the genomics industry.

- Illumina faces competition in more niche markets.

- The company's focus is on innovation and expansion.

- Illumina's strategies are crucial for maintaining market leadership.

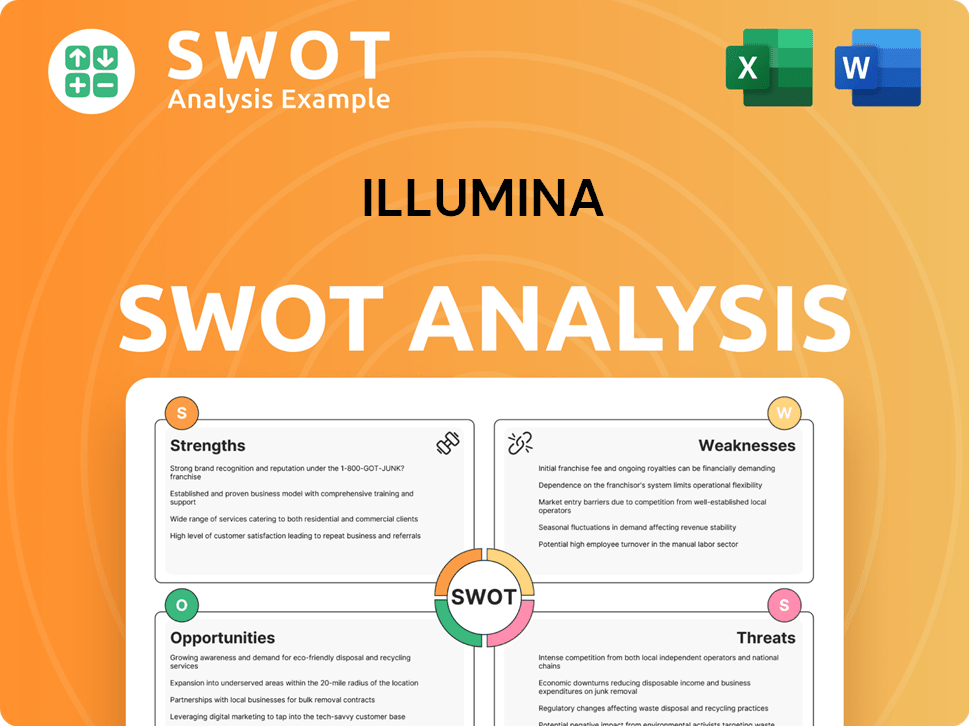

Illumina SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Illumina?

The Illumina competitive landscape is dynamic, with various companies vying for market share in the DNA sequencing market and broader genomics industry. Illumina's primary focus is on next-generation sequencing (NGS) technologies, which are essential for a wide range of applications, from research to clinical diagnostics. Understanding Illumina's competitors is crucial for assessing its market position and future growth prospects.

The Illumina market share is significant, but it faces challenges from both direct and indirect competitors. These competitors employ various strategies, including technological innovation, strategic partnerships, and competitive pricing, to gain an edge. The competitive environment is continuously evolving, influenced by technological advancements and strategic moves by key players.

Illumina's success depends on its ability to innovate and maintain its competitive edge in the face of evolving market dynamics. For more insights into the company's positioning, consider reading about the Target Market of Illumina.

Direct competitors primarily focus on the same NGS technologies as Illumina. These companies offer sequencing platforms and related services, directly challenging Illumina's market share. The competition often revolves around factors like accuracy, throughput, and cost per base.

Indirect competitors operate in related segments of the genomics market, such as sample preparation, bioinformatics, and other life science tools. These companies may not directly compete in sequencing but offer products that are integral to the overall genomic workflow. They can influence Illumina's market position.

The genomics industry is seeing the emergence of new companies with innovative technologies. These companies may focus on novel sequencing chemistries or specialized applications. Their entry into the market can disrupt the competitive landscape, potentially impacting Illumina's position.

Technological advancements are a key driver of competition in the genomics market. Innovations in sequencing technologies, such as improvements in accuracy, throughput, and cost-effectiveness, can significantly impact Illumina's market share. These advancements also influence the broader DNA sequencing market.

Market dynamics, including mergers, acquisitions, and strategic partnerships, play a crucial role in shaping the competitive environment. These strategic moves can consolidate technologies, expand market reach, and intensify competition. Understanding these dynamics is essential for evaluating Illumina's competitive position.

Illumina employs various competitive strategies, including product innovation, pricing strategies, and partnerships, to maintain its market leadership. Analyzing these strategies helps in understanding how Illumina aims to compete and sustain its position in the genomics industry. These strategies are critical for navigating the Illumina competitive landscape.

Several companies pose significant competition to Illumina. These competitors offer a range of products and services, challenging Illumina's market share in different segments of the genomics market.

- Pacific Biosciences (PacBio): Specializes in long-read sequencing technology, which is advantageous for certain genomic applications. PacBio's Revio system, launched in 2023, aims to enhance throughput and cost-efficiency. In 2024, PacBio's revenue was approximately $166.1 million.

- Oxford Nanopore Technologies (ONT): Known for portable and real-time sequencing devices like MinION and PromethION. ONT's technology is particularly suited for field-based research and rapid diagnostics. In 2023, ONT reported revenues of £177.3 million.

- Thermo Fisher Scientific: A diversified life science company offering a broad range of products, including qPCR instruments and microarrays. Thermo Fisher often competes for laboratory budgets and market share in research and diagnostic tools. In 2024, the company's revenues reached approximately $42.9 billion.

- Qiagen: Focuses on sample preparation and bioinformatics solutions, essential components of genomic workflows. Qiagen's products are crucial for both upstream and downstream processes in sequencing. In 2024, Qiagen's net sales were around $2.01 billion.

- BGI Genomics: A significant player, particularly in the Asian market, offering sequencing services and instruments. BGI Genomics provides competitive sequencing solutions. In 2023, BGI Genomics' revenue was approximately 6.5 billion RMB.

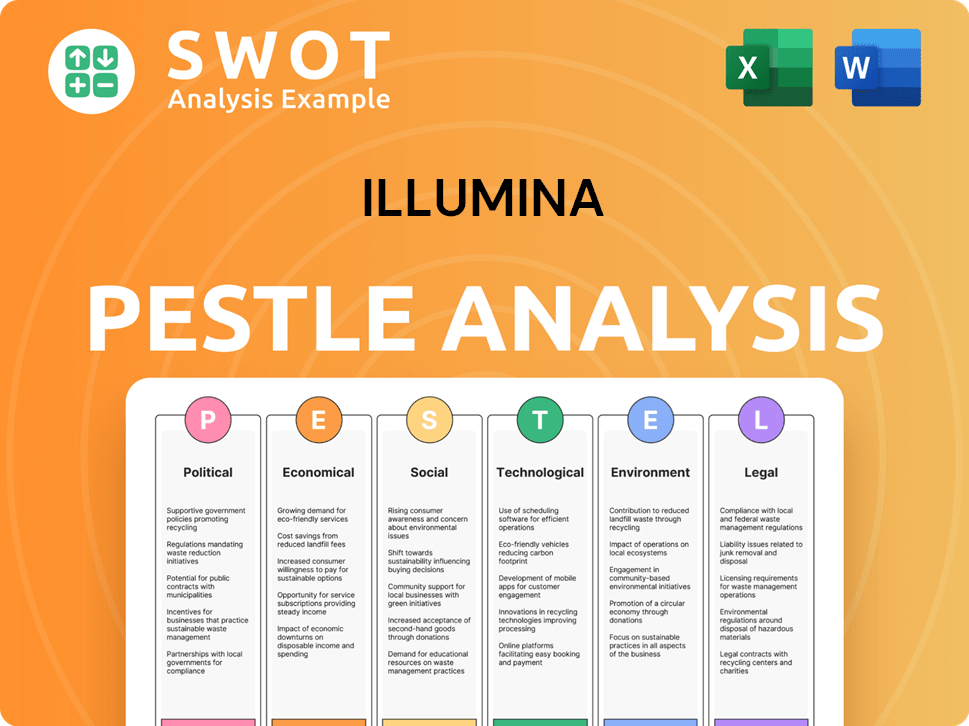

Illumina PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Illumina a Competitive Edge Over Its Rivals?

Illumina's competitive advantages are rooted in its proprietary sequencing technology and strong market presence. The company's core strength lies in its reversible terminator-based sequencing by synthesis (SBS) chemistry, which offers high accuracy and cost-effectiveness for short-read sequencing. This technological advantage is protected by a significant patent portfolio, creating barriers to entry for competitors in the DNA sequencing market.

Brand equity and customer loyalty are also key advantages for the company. It has built a strong reputation for reliability and data quality among its global customer base. This trust is reinforced by its extensive installed base of instruments and established workflows. The company benefits from economies of scale, allowing for competitive pricing and higher profit margins.

Furthermore, Illumina's robust distribution network and global sales force ensure widespread access to its products and services. Its strong talent pool drives continuous innovation and product development. The company also leverages strategic partnerships to expand the applications of its technology and integrate genomics into routine clinical practice. To understand the company's approach, consider the Marketing Strategy of Illumina.

Illumina's SBS chemistry provides industry-leading accuracy and throughput. The company's patent portfolio protects its core technologies, creating a significant barrier to entry. This technological advantage is crucial in the Next-generation sequencing (NGS) space.

Illumina has a substantial installed base of instruments and a global customer base. The company benefits from economies of scale in manufacturing. The company has a strong distribution network and sales force.

Illumina has cultivated a strong reputation for reliability and data quality. The company's established workflows and support systems reinforce customer trust. Customer loyalty is a key factor in the Illumina competitive landscape.

Illumina collaborates with pharmaceutical companies and research institutions. These partnerships expand the applications of its technology. This approach helps integrate genomics into clinical practice.

Illumina's competitive advantages are substantial, but the rapid pace of innovation requires continuous investment in R&D. The company must maintain its technological edge to defend against emerging threats. Illumina's strategies aim to maintain market leadership in the face of evolving Illumina competitors.

- Proprietary Sequencing Technology: SBS chemistry provides superior accuracy and cost-effectiveness.

- Extensive Intellectual Property: A vast patent portfolio protects Illumina's core technologies.

- Brand Equity and Customer Loyalty: Strong reputation for reliability and data quality.

- Economies of Scale: Competitive pricing and higher profit margins due to manufacturing scale.

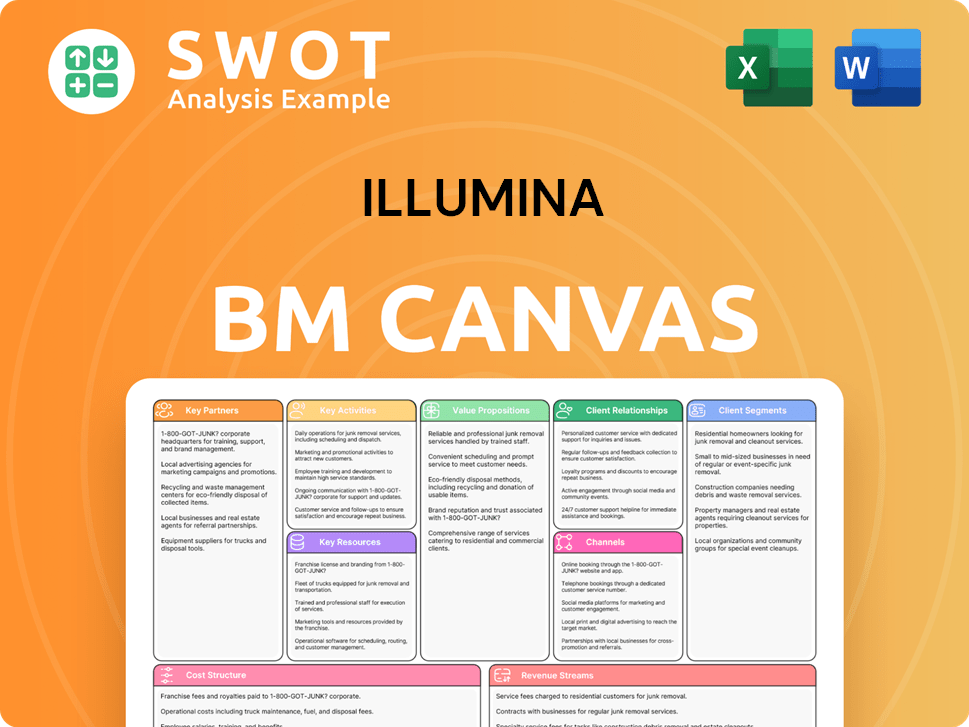

Illumina Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Illumina’s Competitive Landscape?

The genomics industry is experiencing rapid transformation, driven by the increasing adoption of next-generation sequencing (NGS) in clinical diagnostics, the rise of long-read sequencing technologies, and the growing demand for personalized medicine. This dynamic environment presents both opportunities and challenges for companies like Illumina. The competitive landscape of Illumina is shaped by technological advancements, regulatory changes, and evolving market dynamics.

The company faces potential threats from competitors and market shifts. Illumina's position in the genomics market is influenced by factors such as pricing strategies, healthcare reimbursement policies, and geopolitical considerations. Despite these challenges, the expanding applications of genomics in oncology, rare disease diagnostics, and other areas offer significant growth prospects. Strategic initiatives, including partnerships and continuous innovation, are crucial for maintaining a competitive edge.

Key trends include the growing use of genomics in clinical diagnostics, the advancement of long-read sequencing, and the push for personalized medicine. These trends are driving innovation and shaping the DNA sequencing market. The increasing demand for faster and more accurate sequencing technologies is also a significant factor.

Challenges include competition from rivals like Pacific Biosciences and Oxford Nanopore, and the potential for commoditization of basic sequencing services. Regulatory changes and healthcare reimbursement policies also pose challenges. Furthermore, supply chain disruptions and geopolitical factors can impact market access.

Illumina has significant opportunities in expanding applications of genomics in oncology, rare disease diagnostics, and infectious disease surveillance. Strategic partnerships and collaborations can unlock new revenue streams. The increasing focus on population genomics initiatives worldwide also presents a substantial opportunity for large-scale sequencing projects.

The company's strategy should focus on continuous innovation, strategic collaborations, and expanding its presence in emerging clinical markets. This includes developing more accessible and cost-effective solutions tailored for clinical use. A diversified portfolio emphasizing both research and clinical applications is crucial.

Illumina's revenue streams are primarily derived from the sale of sequencing instruments, consumables, and services. The company's market share in the DNA sequencing market remains significant, although it faces competition from various players.

- Market Share: Illumina holds a dominant position in the NGS market, with estimates suggesting it controls over 70% of the market share.

- Revenue Growth: Despite competitive pressures, Illumina has shown consistent revenue growth. In 2023, Illumina's revenue was approximately $4.5 billion.

- Strategic Partnerships: Illumina has formed partnerships with pharmaceutical companies and healthcare providers to expand its market reach and develop new applications.

- Innovation: Continuous investment in R&D is critical to maintain its competitive edge, with R&D spending in 2023 exceeding $1 billion.

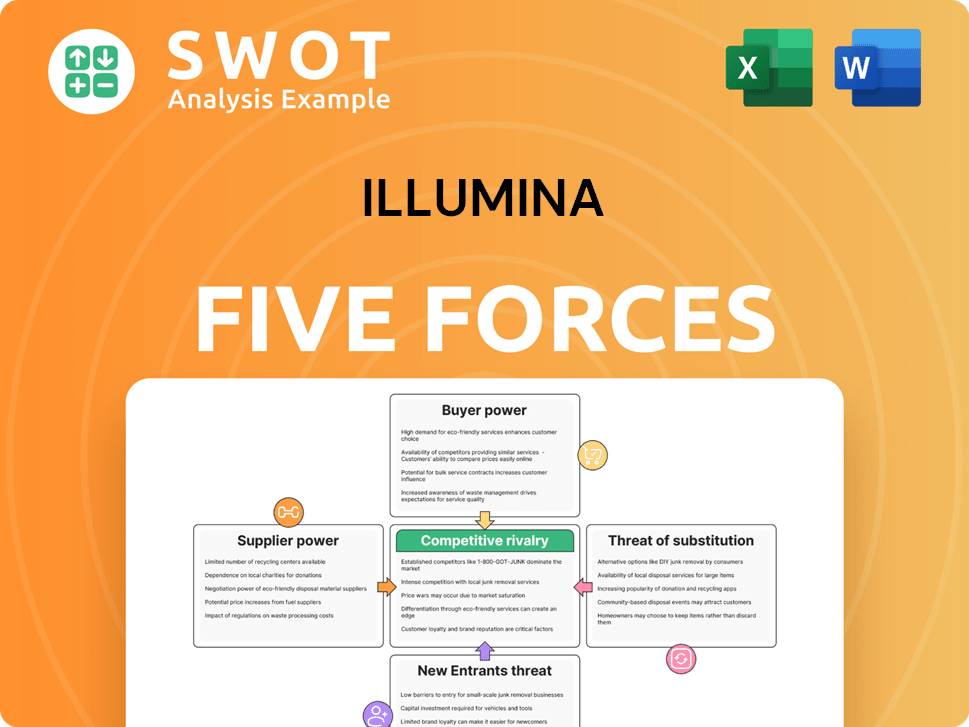

Illumina Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Illumina Company?

- What is Growth Strategy and Future Prospects of Illumina Company?

- How Does Illumina Company Work?

- What is Sales and Marketing Strategy of Illumina Company?

- What is Brief History of Illumina Company?

- Who Owns Illumina Company?

- What is Customer Demographics and Target Market of Illumina Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.