JFE Holdings Bundle

What's the Story Behind JFE Holdings?

Born from a strategic merger, JFE Holdings, a leading Japanese steel company, has a compelling history of innovation and adaptation. From its inception in 2002, this global powerhouse has navigated the complexities of the steel manufacturing industry. This brief overview explores the key milestones and transformations that have shaped JFE Holdings into the entity it is today, including its expansion beyond steel.

The JFE Holdings SWOT Analysis reveals the internal and external factors influencing its trajectory. Understanding the JFE Group's corporate history is crucial for investors and business strategists alike. This article delves into the formation, evolution, and current standing of JFE Holdings, providing valuable insights into its strategic decisions and market position.

What is the JFE Holdings Founding Story?

The story of JFE Holdings, Inc. began on September 27, 2002. This marked the official establishment of the company through the merging of NKK Corporation and Kawasaki Steel Corporation. This strategic move created a powerhouse in the steel industry, aiming for global competitiveness.

Before the merger, NKK was Japan's second-largest steelmaker, and Kawasaki Steel was the third-largest. Both companies had long histories within Japanese industry. The merger was a response to a changing global landscape, designed to combine strengths and adapt to new challenges.

The formation of JFE Holdings was a pivotal moment in the Marketing Strategy of JFE Holdings corporate history. It was driven by the need to enhance competitiveness and capitalize on the combined strengths of two major players in the steel manufacturing sector. The merger aimed to utilize the combined sales networks, technological capabilities, and manufacturing facilities of both companies.

The merger was a strategic response to global competition, economic uncertainty, and the need to address climate change and digital transformation.

- The name 'JFE' represents the integration: 'J' for Japan, 'Fe' for iron, and 'E' for engineering.

- In April 2003, the core business segments were reorganized into JFE Steel, JFE Engineering, JFE Urban Development, and JFE R&D.

- Kawasaki Steel's origins trace back to Shozo Kawasaki's Kawasaki Tsukiji Shipyard established in 1878.

- Nippon Kokan K.K. (NKK) was founded in 1912.

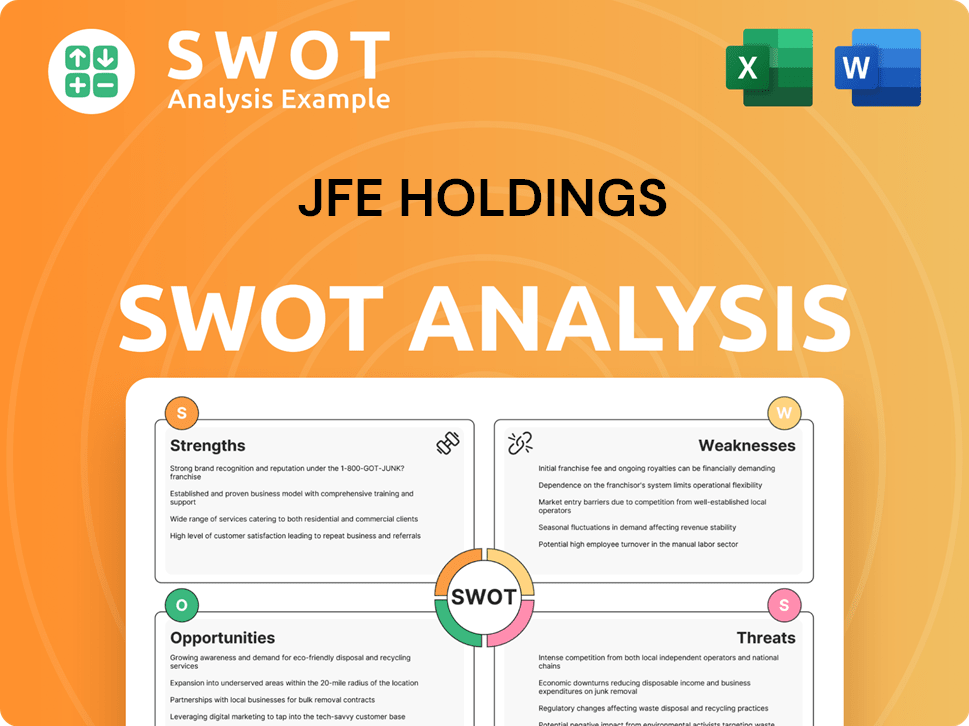

JFE Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of JFE Holdings?

Following its establishment in 2002, and the formal reorganization into JFE Steel, JFE Engineering, and other subsidiaries in 2003, JFE Holdings began its strategic growth and expansion. This period involved establishing global partnerships and acquisitions, expanding its global footprint. This expansion included ventures in China, Korea, and Australia, marking the beginning of its international presence and strengthening its position in the steel industry.

In December 2003, JFE Holdings established a joint venture in China, Guangzhou JFE Steel Sheet Co., Ltd., to manufacture and sell hot-dip galvanized steel sheets. In 2004, the company acquired a small stake in Korea's Union Steel. These early moves were crucial for establishing a strong foundation in the Asian market and expanding its steel manufacturing capabilities.

JFE history includes key partnerships, such as signing a long-term iron ore supply contract with CVRD in 2004. In 2005, a joint venture deal with BHP and other partners in Australia was finalized. These strategic alliances were essential for securing resources and expanding its global influence within the JFE Group.

In 2006, JFE Holdings strengthened ties with South Korea's Dongkuk Steel. By 2008, it signed a Memorandum of Understanding (MOU) for a pelletizing project in Oman. The company continued its expansion with strategic partnerships, including an auto sheet partnership with JSW Steel in 2009. These actions highlight the company's commitment to growth and diversification.

In 2010, JFE Holdings acquired a stake in Vietnam's Sun Steel. The company began operating a cold rolling mill in Guangzhou City, China, in 2011. By 2013, a continuous galvanizing line in Thailand was operational. These investments aimed to increase the ratio of high-value-added products, reflecting a shift towards quality over quantity.

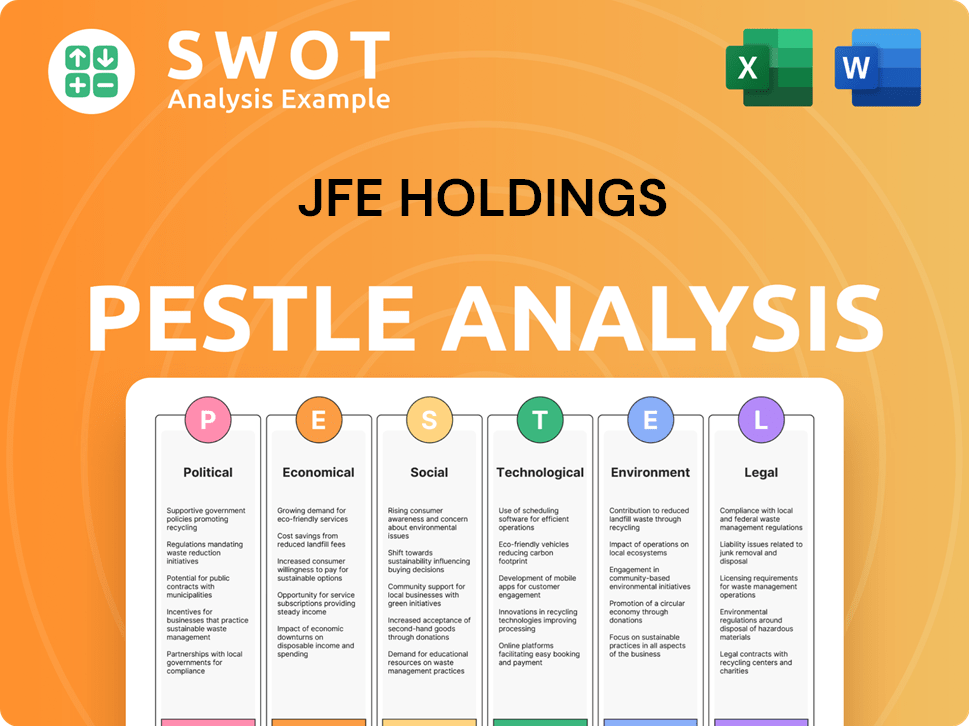

JFE Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in JFE Holdings history?

Throughout its history, JFE Holdings has achieved significant milestones, particularly in steel manufacturing. The JFE Group has consistently focused on high-value-added steel products, leveraging advanced technologies to meet diverse customer needs and solidify its position as a leading Japanese steel company.

| Year | Milestone |

|---|---|

| 2024 | JFE Steel was recognized as a 2024 Steel Sustainability Champion for the third consecutive year, highlighting its commitment to environmental sustainability. |

| 2024 | JFE acquired a 10% interest in the Blackwater coal mine to secure a stable supply of high-quality metallurgical coal. |

| 2025 | The company aims to launch a hydrogen-based Direct Reduced Iron (DRI) process and plans to import low-carbon hot briquetted iron (HBI) from the UAE in the second half of FY2025. |

JFE Holdings has also been at the forefront of innovation, especially in the steel industry. The company has been actively involved in digital transformation, using AI, IoT, and data science to enhance its competitive advantages across its steel, engineering, and trading businesses.

JFE Steel has been developing innovative technologies to reduce its environmental impact, reflecting its commitment to sustainable practices.

The company is utilizing AI, IoT, and data science to improve its competitive advantages across its various business segments.

JFE is investing heavily in decarbonization, including a hydrogen-based DRI process and importing low-carbon HBI.

Despite these achievements, JFE Holdings has faced several challenges, particularly in recent years. The company reported a significant decline in earnings for the fiscal year ending March 31, 2025, due to weak global steel demand and intense price competition.

The company's revenue was down 6.1% from FY 2024 to JP¥4.86 trillion, and net income decreased by 54% to JP¥91.9 billion for the fiscal year ending March 31, 2025.

Persistent weak global steel demand, along with intense price competition and manufacturing troubles, significantly impacted the company's performance.

The steel business, JFE's core sector, was particularly affected by sluggish domestic demand and a surge in low-cost steel exports from China.

JFE's crude steel production fell by 6.4% year-on-year to 23.2 million tons during the fiscal year ending March 31, 2025.

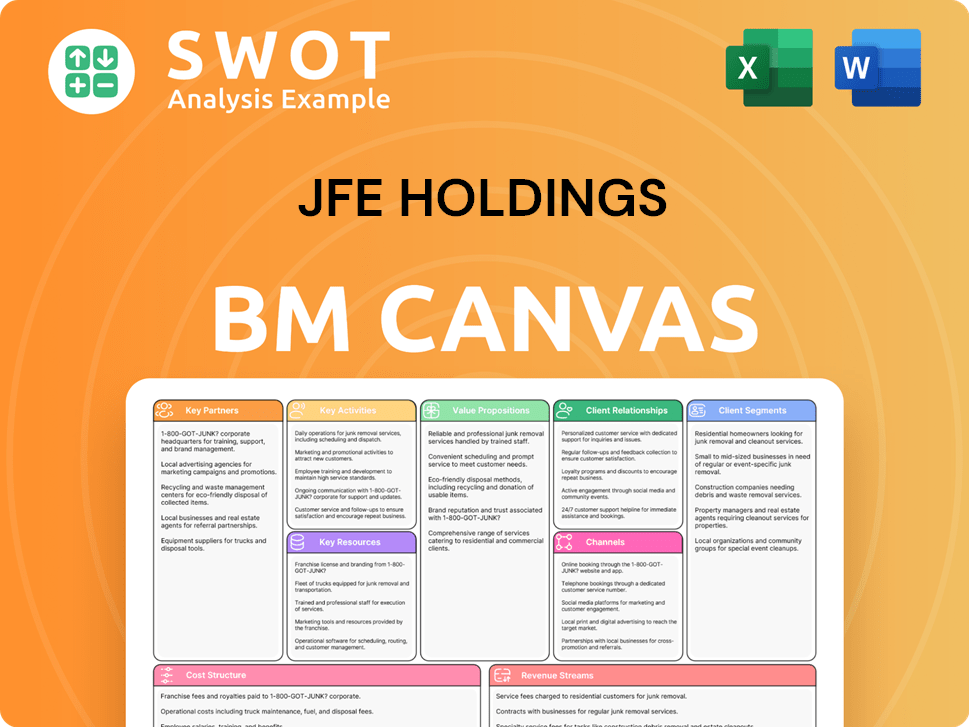

JFE Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for JFE Holdings?

The JFE history is marked by significant strategic developments and expansions, reflecting its evolution as a major player in the steel industry. From its formation through mergers to its global expansions and technological advancements, JFE Holdings has consistently adapted to meet market demands and technological changes.

| Year | Key Event |

|---|---|

| September 2002 | NKK and Kawasaki Steel Corporation integrated their managements to establish JFE Holdings, Inc. |

| April 2003 | JFE Holdings reorganized its core business segments into JFE Steel, JFE Engineering, and other subsidiaries. |

| December 2003 | JFE Steel established Guangzhou JFE Steel Sheet Co., Ltd. in China. |

| 2009 | JFE Steel agreed to a strategic auto sheet partnership with JSW Steel. |

| 2013 | JFE commenced operation of a continuous galvanizing line in Thailand. |

| 2015 | JFE completed an iron ore mining business merger in Brazil. |

| 2017 | An automotive sheet joint venture was established with Nucor in Mexico. |

| 2024 | JFE acquired a 10% interest in the Blackwater coal mine in Australia. |

| February 2025 | JFE Holdings announced consolidated financial results for the first three quarters of FY2024-25, reporting a net profit of JPY 100.11 billion, down 39.5% year-on-year. |

| March 2025 | JFE's investment to expand Electric Arc Furnace (EAF) capacity at its Sendai site is expected to conclude, aiming for an annual CO2 reduction of around 100,000 tonnes. |

| May 2025 | JFE Holdings released its Full Year 2025 results, with revenue at JP¥4.86 trillion (down 6.1% from FY 2024) and net income at JP¥91.9 billion (down 54% from FY 2024). The company also announces its Eighth Medium-Term Business Plan and 'JFE Vision 2035.' |

JFE Holdings is committed to achieving carbon neutrality by 2050, positioning itself as a leader in developing cutting-edge, process-transforming technologies within the JFE Group. This long-term goal underscores the company's dedication to sustainability and environmental responsibility.

The Eighth Medium-Term Business Plan (FY2025-2027) targets a consolidated business profit of ¥260.0 billion by FY2027. This plan involves significant capital investments of ¥1.84 trillion by FY2027, focused on growth areas and decarbonization. JFE aims to increase the ratio of high-value-added products in its steel business.

JFE plans to build a new EAF with an annual production capacity of around two million metric tons at its West Japan Works, starting operations in the first quarter of FY2028-29. The company is also focused on expanding its global presence through strategic local partnerships, particularly in growing markets like India.

JFE anticipates continued investment in metallurgical coal for its blast furnace operations while also pursuing hydrogen-based DRI processes and HBI imports. These initiatives are part of JFE's broader strategy to adapt to global demands for sustainability and high-performance materials, reflecting its commitment to technological innovation.

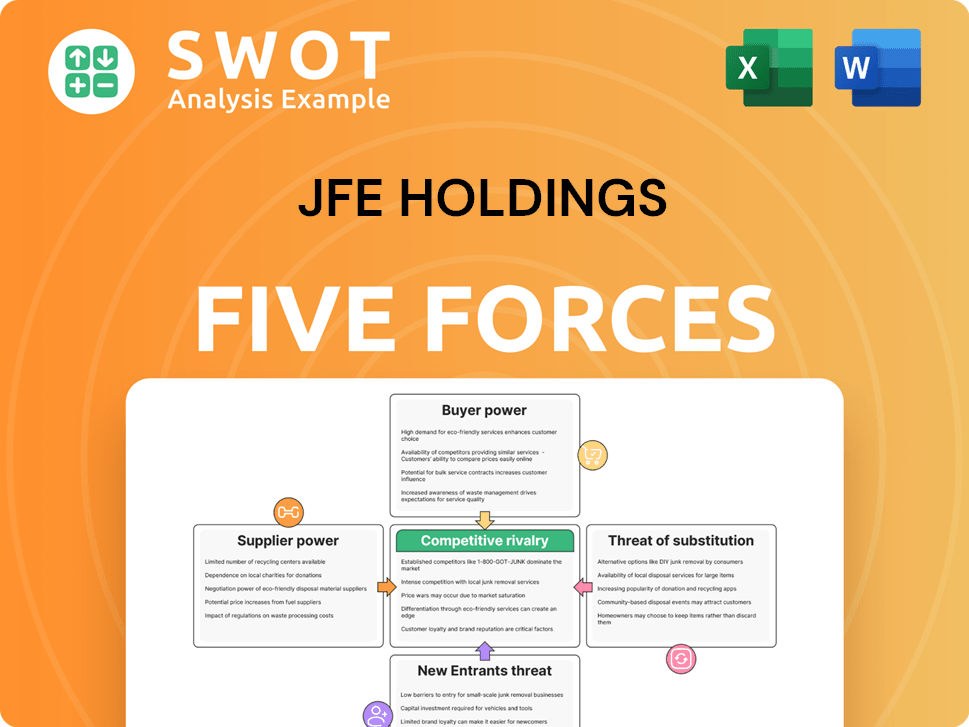

JFE Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of JFE Holdings Company?

- What is Growth Strategy and Future Prospects of JFE Holdings Company?

- How Does JFE Holdings Company Work?

- What is Sales and Marketing Strategy of JFE Holdings Company?

- What is Brief History of JFE Holdings Company?

- Who Owns JFE Holdings Company?

- What is Customer Demographics and Target Market of JFE Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.