JFE Holdings Bundle

How Does JFE Holdings Navigate the Cutthroat Steel Industry?

In a world where steel shapes the infrastructure of our lives, understanding the JFE Holdings SWOT Analysis is crucial. As a leading player in the global steel market, JFE Holdings faces relentless competition and dynamic shifts. This deep dive explores the company's strategic positioning, examining its rivals and dissecting the factors that fuel its success.

This exploration of JFE Holdings' competitive landscape will provide a comprehensive market analysis, detailing its business strategy and key competitors. We will examine JFE Holdings' market share analysis, competitive advantages, and financial performance to offer a complete company profile. Furthermore, we'll delve into JFE Holdings' strategic partnerships, recent acquisitions, and sustainability initiatives, providing valuable insights for investors and industry professionals alike, including its future outlook within the global steel market.

Where Does JFE Holdings’ Stand in the Current Market?

JFE Holdings holds a significant market position within the global steel industry, ranking among the top steel producers worldwide. The company's core operations involve the production and sale of a wide range of steel products, catering to diverse sectors such as automotive, construction, and energy. This robust operational scale is supported by a global footprint, with production facilities and sales offices strategically located across key markets.

The value proposition of JFE Holdings centers on providing high-quality steel products and advanced materials, differentiating itself through technological superiority and customized solutions. This focus on value-added products, such as high-strength steel for automotive applications, allows JFE Holdings to maintain a competitive edge in the market. The company's strategic emphasis on innovation and sustainability further enhances its market position and brand reputation.

For the fiscal year ending March 31, 2024, JFE Holdings reported consolidated crude steel production of 24.38 million tons, highlighting its substantial operational scale. The company's diversified business segments, including engineering and trading, contribute to its financial resilience. A detailed look at the Marketing Strategy of JFE Holdings reveals how they maintain their competitive advantage.

JFE Holdings consistently ranks among the top steel producers globally, demonstrating its strong market share. Its substantial production volume and strategic global presence solidify its position in the competitive landscape. This high ranking reflects the company's operational efficiency and ability to meet diverse market demands.

The company's product portfolio includes a wide array of steel products, catering to various industries. This diversification helps mitigate risks associated with market fluctuations. By offering a broad range of products, JFE Holdings can serve diverse customer needs and maintain a stable revenue stream.

JFE Holdings has a significant global footprint with production facilities and sales offices strategically located. The company actively expands its presence in emerging Asian markets. This strategic geographic presence allows JFE Holdings to serve a broad international customer base and capitalize on growth opportunities.

For the fiscal year ended March 31, 2024, JFE Holdings reported consolidated revenue of 5,165.7 billion yen and a business profit of 152.0 billion yen. The company's diversified business segments contribute to its financial resilience. This financial performance demonstrates the company's ability to navigate the cyclical nature of the steel industry.

JFE Holdings' market position is bolstered by several key strengths, including its technological expertise, diversified product portfolio, and global presence. These elements contribute to its competitive advantages in the steel industry. The company’s focus on high-value-added products and strategic partnerships further enhances its market standing.

- Technological Leadership: Focus on innovation and advanced materials.

- Diversified Product Portfolio: Catering to various industries.

- Global Presence: Strategic locations in key markets.

- Financial Resilience: Demonstrated by consistent profitability.

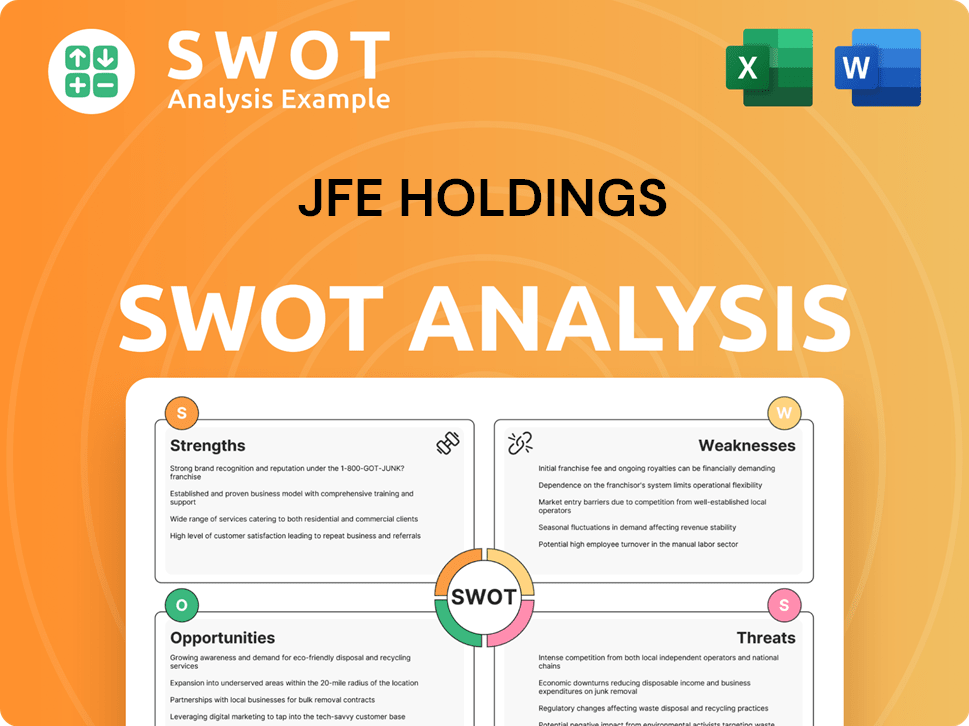

JFE Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging JFE Holdings?

The competitive landscape for JFE Holdings in the global steel industry is intense, shaped by both direct and indirect competitors. The company faces challenges from major global steel producers, domestic rivals, and specialized manufacturers. A thorough market analysis reveals the complexities of JFE Holdings' competitive positioning and the strategies it employs to maintain its market share.

JFE Holdings' business strategy must constantly adapt to the dynamic nature of the steel market. The company's financial performance is directly influenced by its ability to compete effectively. Understanding its key competitors is crucial for investors and stakeholders looking to assess its future outlook and potential for growth. For more insights into the company's overall approach, consider reading about the Growth Strategy of JFE Holdings.

The steel industry is characterized by significant consolidation and strategic partnerships. These alliances can enhance technological capabilities and market reach, further altering the competitive dynamics. JFE Holdings must remain agile and innovative to navigate these changes.

JFE Holdings competes directly with major global steel producers. These companies often have significant production capacity and broad distribution networks. The competition involves pricing strategies, technological advancements, and economies of scale.

Indirect competition comes from specialized steel manufacturers and emerging players. These companies may focus on specific product lines or geographic markets. Their growth and innovation can pose significant challenges to JFE Holdings.

Mergers, acquisitions, and strategic partnerships constantly reshape the competitive landscape. These changes require JFE Holdings to be adaptable and proactive. The company must continually assess its competitive advantages to maintain its position.

ArcelorMittal, the world's largest steel producer, is a key competitor. Nippon Steel Corporation, JFE's domestic rival, also presents a significant challenge. POSCO, a South Korean steelmaker, competes strongly in high-quality products.

In specific product lines, companies like SSAB (Sweden) compete in high-strength steel. In engineering and construction, JFE's division faces competition from global firms. These specialized competitors often focus on niche markets.

Emerging players from China and India are expanding production. Baowu Steel Group (China) poses a formidable challenge due to its scale and state support. These companies are increasingly focusing on higher-value-added products.

JFE Holdings' competitive positioning is influenced by its ability to innovate and adapt. The company's financial performance is closely tied to its strategic responses to market changes. A SWOT analysis would reveal its strengths, weaknesses, opportunities, and threats.

- Market Share: JFE Holdings holds a significant market share in Japan, but faces global competition.

- Product Portfolio: The company's product portfolio includes a wide range of steel products.

- Technological Advancements: Innovation in steel production is a key competitive factor.

- Sustainability Initiatives: Environmental considerations are increasingly important.

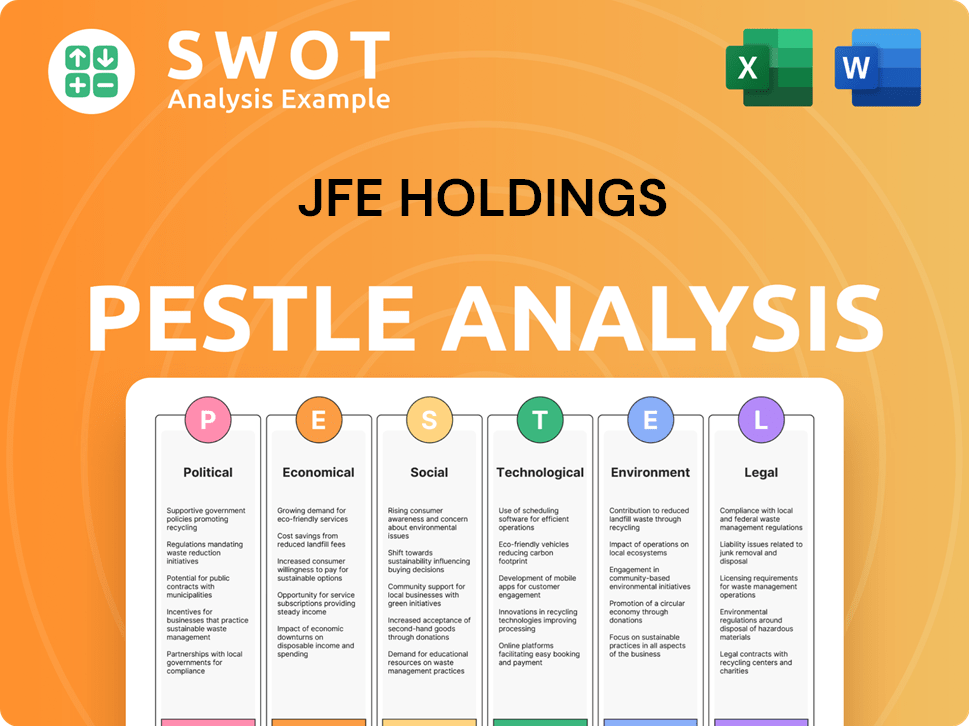

JFE Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives JFE Holdings a Competitive Edge Over Its Rivals?

The competitive landscape of JFE Holdings within the steel industry is shaped by its strategic advantages and operational excellence. The company's focus on innovation, integrated production, and diversified business interests allows it to maintain a strong market position. This approach is critical for navigating the complexities of the global steel market and sustaining long-term growth.

JFE Holdings distinguishes itself through its commitment to advanced technologies and sustainable practices, which enhances its appeal to environmentally conscious clients. Its integrated production system and strong customer relationships contribute significantly to its competitive edge. Furthermore, the company's strategic diversification and skilled workforce enable it to adapt to market shifts and maintain its leadership position.

Understanding the competitive dynamics of JFE Holdings requires an in-depth market analysis. The company's success is not only measured by its financial performance but also by its ability to innovate and adapt to changing industry trends. This analysis provides a comprehensive overview of JFE Holdings' competitive advantages and strategic positioning. For a deeper understanding of the company's ownership structure, consider reading about Owners & Shareholders of JFE Holdings.

JFE Holdings invests heavily in R&D to develop high-performance steel products. This includes high-strength steel sheets for automobiles and specialized steel for energy pipelines. These innovations enable premium pricing and secure long-term contracts.

The integrated system covers the entire steelmaking process, enhancing quality, efficiency, and cost control. This integration provides a strong foundation for competitive pricing and reliable supply. It ensures greater control over every stage, from raw material to final product.

JFE Holdings focuses on sustainable steelmaking processes to reduce CO2 emissions. This commitment aligns with global regulatory trends and enhances its appeal to environmentally conscious clients. It reflects the company's dedication to environmental stewardship.

The company's diversified portfolio includes engineering, trading, and real estate. This diversification mitigates the cyclical nature of the steel industry, providing revenue stability. It allows JFE to adapt to market shifts and sustain its leadership position.

JFE Holdings' competitive advantages are rooted in technological innovation, integrated production, and a diversified business model. These factors enable the company to maintain a strong market position and adapt to industry changes. The company’s strategic partnerships and skilled workforce further enhance its competitive edge.

- Advanced Technological Capabilities: Continuous investment in R&D leads to high-performance steel products.

- Integrated Production System: Ensures control over quality, efficiency, and cost.

- Sustainable Practices: Commitment to reducing CO2 emissions and appealing to environmentally conscious clients.

- Diversified Business Portfolio: Mitigates risks associated with the cyclical nature of the steel industry.

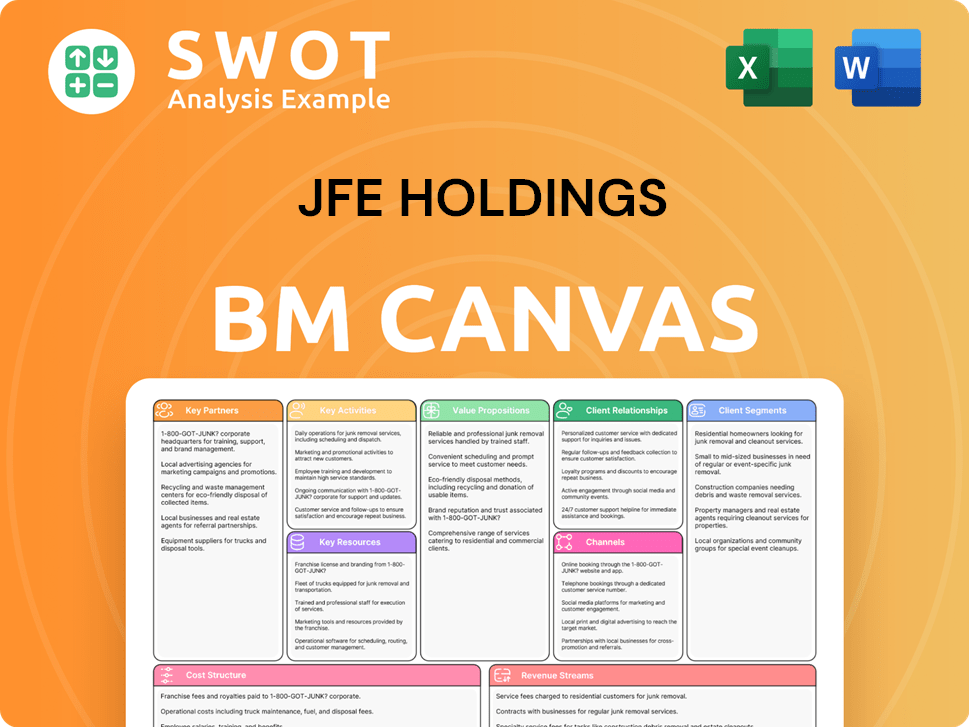

JFE Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping JFE Holdings’s Competitive Landscape?

The steel industry is undergoing significant transformations, presenting both challenges and opportunities for JFE Holdings. The company's strategic positioning, its ability to adapt to market dynamics, and its investment in advanced technologies will be crucial in determining its future success. A thorough market analysis reveals that JFE Holdings must navigate complex trends to maintain its competitive edge.

JFE Holdings faces risks from geopolitical tensions, trade protectionism, and raw material price volatility. However, the company's focus on emerging Asian markets and digital transformation offers growth opportunities. Understanding the competitive landscape and the company profile is essential for investors and stakeholders. For more insights, explore the Brief History of JFE Holdings.

Decarbonization and green steel production are key trends, requiring investments in hydrogen-based steelmaking and CCUS. Increasing demand for high-performance steel drives innovation in electric vehicles (EVs) and renewable energy. Geopolitical tensions and raw material price volatility also significantly impact the steel industry.

High capital expenditures for green technologies pose a significant challenge. Disruptions in supply chains due to geopolitical issues may affect global steel demand. Volatility in raw material prices, such as iron ore and coking coal, continues to threaten profitability.

Growth in emerging Asian markets, driven by urbanization and infrastructure development, offers significant potential. Digital transformation, including AI and IoT, enhances efficiency and productivity. Development of innovative materials for high-value segments expands market share.

Aggressive investment in next-generation steelmaking technologies is crucial. Diversification into new materials and solutions enhances resilience. Strategic partnerships expand global reach and technological capabilities.

JFE Holdings is focusing on achieving carbon neutrality by 2050, a commitment that requires significant technological advancements and investment. The company is also expanding its presence in emerging Asian markets, where steel consumption is growing rapidly. Digital transformation is a key area for JFE, with AI and IoT being integrated to improve efficiency and productivity.

- Carbon Neutrality Target: JFE aims for carbon neutrality by 2050, a significant undertaking.

- Market Focus: Emphasis on emerging Asian markets, capitalizing on urbanization and infrastructure growth.

- Digital Transformation: Adoption of AI and IoT to enhance operational efficiency and productivity.

- Investment: Aggressive investments in next-generation steelmaking technologies.

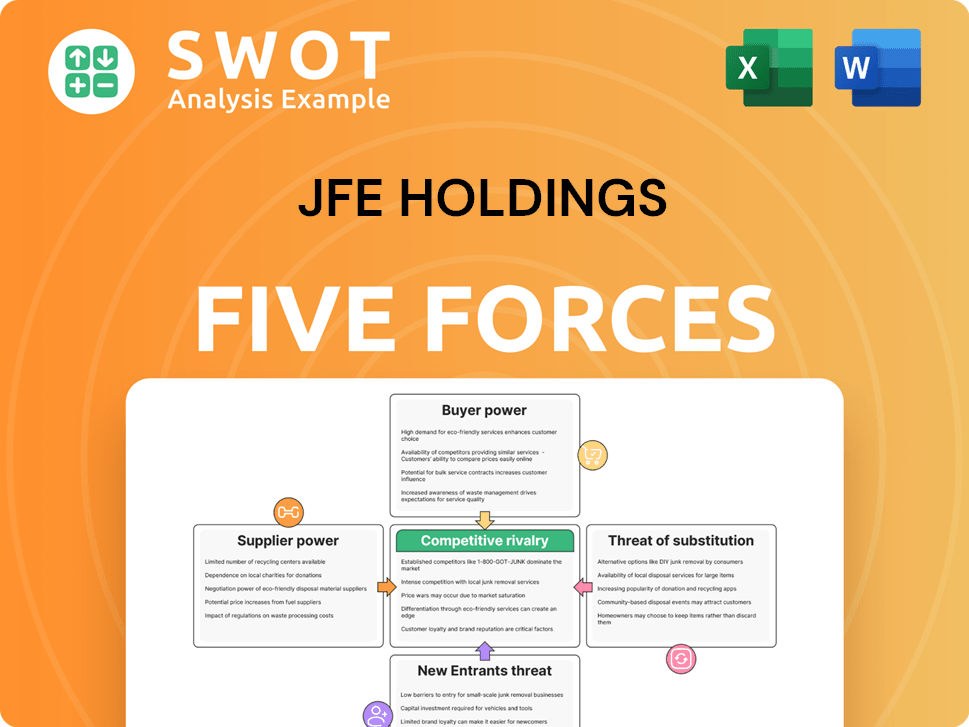

JFE Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JFE Holdings Company?

- What is Growth Strategy and Future Prospects of JFE Holdings Company?

- How Does JFE Holdings Company Work?

- What is Sales and Marketing Strategy of JFE Holdings Company?

- What is Brief History of JFE Holdings Company?

- Who Owns JFE Holdings Company?

- What is Customer Demographics and Target Market of JFE Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.