JFE Holdings Bundle

How Resilient is JFE Holdings in Today's Market?

JFE Holdings, a titan in the Japanese industrial sector, is a key player in the global economy. Despite a challenging fiscal year in 2024, the JFE Holdings SWOT Analysis reveals the company's core strengths and strategic positioning. This overview will explore the operational dynamics of JFE Company and its subsidiaries, providing insights into its financial performance and future prospects.

The JFE Group's operations, spanning steel manufacturing to engineering and trading, are essential to understanding its overall business structure. Examining the company's response to fluctuating raw material costs and supply chain disruptions offers critical insights for investors and industry watchers. Furthermore, understanding the impact of JFE Holdings on the Japanese economy and its investment strategies will provide a comprehensive view of its operations.

What Are the Key Operations Driving JFE Holdings’s Success?

The core of JFE Holdings' operations revolves around three main companies: JFE Steel, JFE Engineering, and JFE Shoji. Each company contributes uniquely to the group's overall value proposition, serving distinct customer segments and engaging in specialized operational processes. This integrated approach allows the group to offer a wide array of products and services, enhancing its competitive edge through technological innovation and a strong global presence.

JFE Steel is the cornerstone, producing a broad spectrum of steel products essential for various industries. JFE Engineering focuses on environmental and energy solutions, as well as social infrastructure projects. JFE Shoji acts as the global trading arm, managing a diverse portfolio of products and leveraging extensive supply chain networks. This structure enables JFE Holdings to maintain a diversified business model, mitigating risks and capitalizing on opportunities across multiple sectors.

The value proposition of JFE Holdings lies in its ability to deliver high-value-added products and comprehensive services. This is achieved through advanced manufacturing capabilities, specialized engineering expertise, and a robust global trading network. The group's commitment to sustainability, particularly in decarbonization efforts within JFE Steel, further enhances its value by aligning with global trends and customer demands for environmentally responsible products and solutions.

JFE Steel is the primary steel producer, offering a wide range of steel products. These products include sheets, plates, shapes, and pipes, serving sectors like automotive and construction. The company's operational strength is supported by advanced technologies and major integrated steelworks in Japan.

JFE Engineering provides technologies for environmental and energy fields. It specializes in waste-to-resource solutions and offshore wind power projects. The company also focuses on social infrastructure projects, such as bridge construction.

JFE Shoji is the trading arm, handling a wide array of products globally. It manages steel raw materials, nonferrous metals, chemicals, and equipment. This arm leverages extensive supply chain networks to support the group's overall operations.

JFE Holdings is actively pursuing decarbonization initiatives. These include expanding Electric Arc Furnace (EAF) operations and developing hydrogen-based steelmaking technologies. The goal is to reduce crude steel production capacity to approximately 21 million tons by fiscal year 2028, down from 26 million tons in fiscal year 2024.

JFE Holdings differentiates itself through technological prowess, diversified offerings, and a robust global presence. The company's integrated approach combines advanced manufacturing, specialized engineering, and global trading. This strategy allows JFE to offer high-value-added products and comprehensive services.

- World-class steelmaking technologies.

- Expertise in environmental and energy solutions.

- Extensive global supply chain network.

- Commitment to sustainable development and decarbonization.

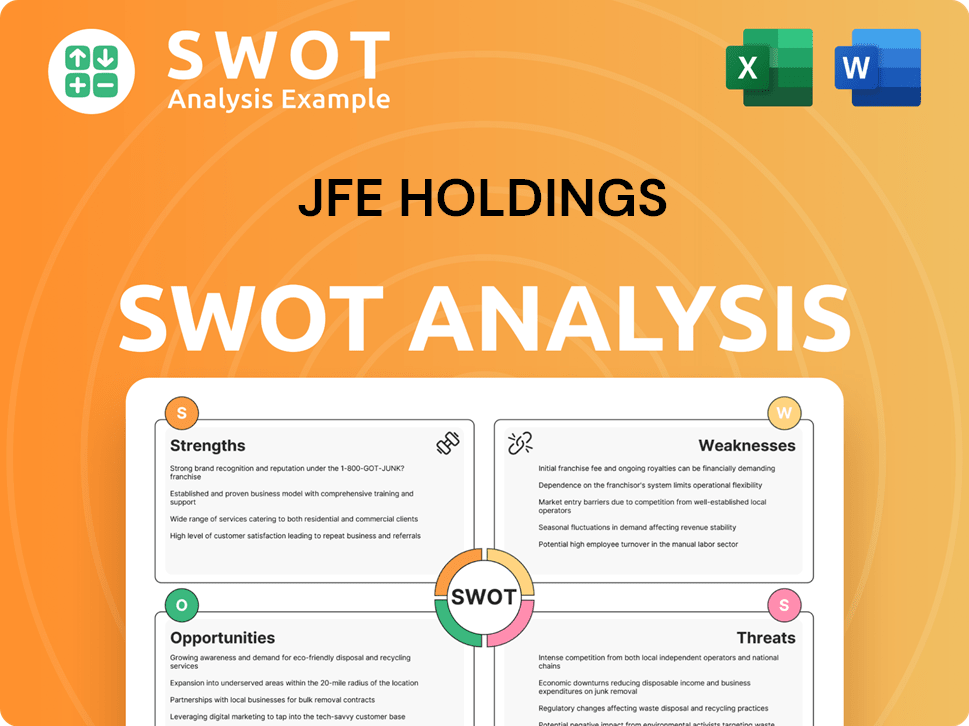

JFE Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does JFE Holdings Make Money?

JFE Holdings, a prominent entity in the Japanese industrial sector, generates revenue through a diversified business model. Its primary revenue streams stem from three core segments: Steel, Engineering, and Trading. The company's financial performance reflects its strategic focus and operational efficiency across these key areas.

In fiscal year 2024, ending March 31, 2025, JFE Holdings reported consolidated annual revenue of ¥4.86 trillion. This figure represents a 6.09% decrease from the previous fiscal year. For fiscal year 2025, the company projects consolidated net sales of ¥4.75 trillion, indicating strategic adjustments and market expectations.

The JFE Group employs various monetization strategies to enhance its financial performance. These strategies include a shift towards high-value-added steel products, overseas business expansion, and securing EPC contracts in growing sectors. Furthermore, the trading business focuses on strategic M&A deals to bolster its processing and distribution capabilities.

The steel business, a major contributor to JFE Company's revenue, focuses on producing and marketing a wide range of steel products. This segment's segment profit for fiscal year 2024 was ¥36.3 billion, with a forecast of ¥40.0 billion for fiscal year 2025.

The engineering business is focused on securing EPC contracts in expanding fields. This segment recorded a segment profit of ¥19.3 billion in fiscal year 2024, with a forecast of ¥20.0 billion for fiscal year 2025.

The trading business aims to expand through M&A deals. This segment achieved a segment profit of ¥47.9 billion in fiscal year 2024, with a forecast of ¥50.0 billion for fiscal year 2025.

JFE Holdings employs several key strategies to enhance its revenue streams and profitability. These strategies include:

- Shifting the focus in the steel business from quantity to quality, emphasizing high-value-added products.

- Expanding business operations overseas by leveraging its technological expertise and talent.

- Securing Engineering, Procurement, and Construction (EPC) contracts in growing sectors such as carbon neutrality and circular economy solutions.

- Expanding the trading business through mergers and acquisitions to improve processing and distribution capabilities.

For further insights into JFE Holdings' marketing approach, you can explore the Marketing Strategy of JFE Holdings.

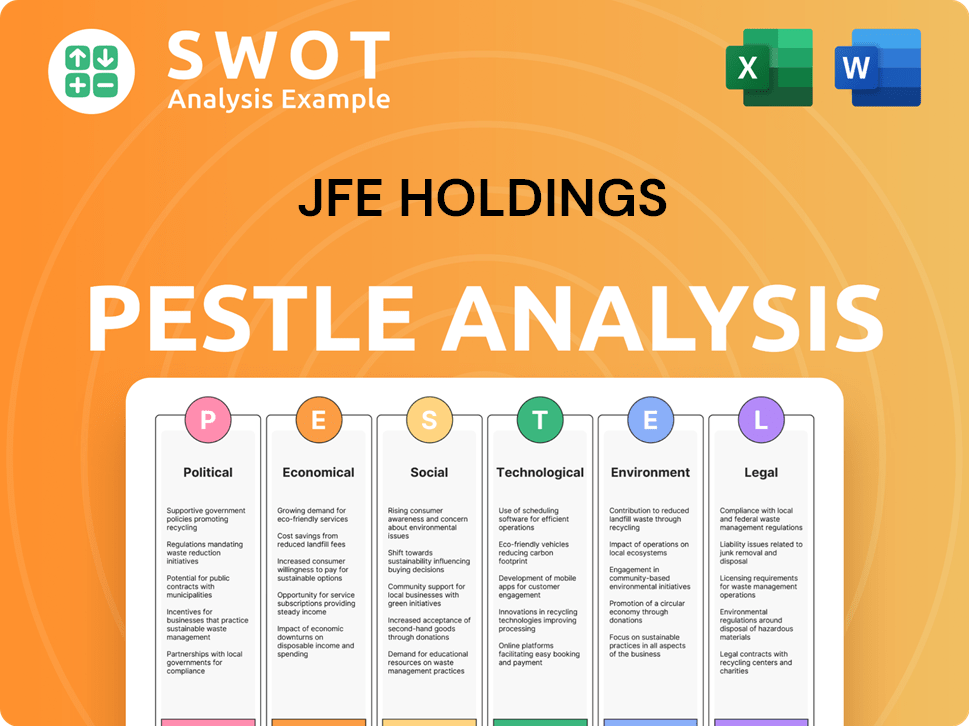

JFE Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped JFE Holdings’s Business Model?

The evolution of JFE Holdings has been marked by significant milestones and strategic shifts, particularly in response to changing market conditions and the push for decarbonization. The company has adapted its operational strategies to navigate challenges and capitalize on opportunities within the global steel market. These efforts are crucial for maintaining its competitive edge and ensuring long-term sustainability.

A key strategic move for JFE Company is the implementation of 'JFE Vision 2035' and the Eighth Medium-term Business Plan (FY2025-2027). This plan prioritizes decarbonization, automation, and the development of high-value products. The company's focus on these areas reflects its commitment to adapting to global trends and enhancing its operational efficiency. This strategic direction is vital for the group's future growth.

The group's response to operational challenges, including market downturns and economic pressures, demonstrates its resilience. The company's financial performance in fiscal year 2024, with a 53.5% drop in net profit to ¥91.8 billion and a 6.1% decrease in revenue to ¥4.86 trillion, underscores the need for strategic adjustments. These adjustments include cost-cutting measures and strategic investments to improve its position.

The launch of 'JFE Vision 2035' and the Eighth Medium-term Business Plan (FY2025-2027) is a significant milestone. The company is transitioning from a crude steel production capacity of 26 million tons with seven blast furnaces to a leaner 21 million tons with five blast furnaces and one innovative electric arc furnace by fiscal year 2028. This shift is part of its strategy to reduce its environmental footprint and improve efficiency.

A key strategic move is the introduction of a high-efficiency electric arc furnace at the Kurashiki facility, scheduled to begin operations in fiscal year 2028. This move is supported by government grants. The company is also implementing aggressive cost-cutting measures, including suspending blast furnace No. 3 at Kurashiki and reducing its annual dividend by 20% to ¥80 per share.

Technological prowess allows the company to produce high-value-added steel products. Strategic partnerships, such as those with JSW Steel Limited in India and Nucor Corporation in North America, are key for expanding its overseas business. The company is also making steady progress in reducing CO2 emissions, achieving an 18% reduction by the end of fiscal year 2024 (compared to FY2013), and aiming for over a 30% reduction by fiscal year 2030.

In fiscal year 2024, net profit plunged 53.5% to ¥91.8 billion, and revenue fell 6.1% to ¥4.86 trillion. The company is investing around ¥110 billion over a three-year period in digital transformation (DX) initiatives. These investments are aimed at improving data utilization, upgrading systems, and reinforcing IT risk management.

The company's focus on decarbonization, automation, and high-value product development is central to its future strategy. JFE is actively investing in digital transformation to enhance operational efficiency and competitiveness. These initiatives support its long-term goals.

- Transitioning to a leaner steel production model with fewer blast furnaces and the introduction of electric arc furnaces.

- Aggressive cost-cutting measures, including the suspension of blast furnaces and dividend reductions, to mitigate financial impacts.

- Strategic partnerships and technological investments to maintain a competitive edge in the global market.

- Commitment to reducing CO2 emissions, with targets set for 2030 and beyond.

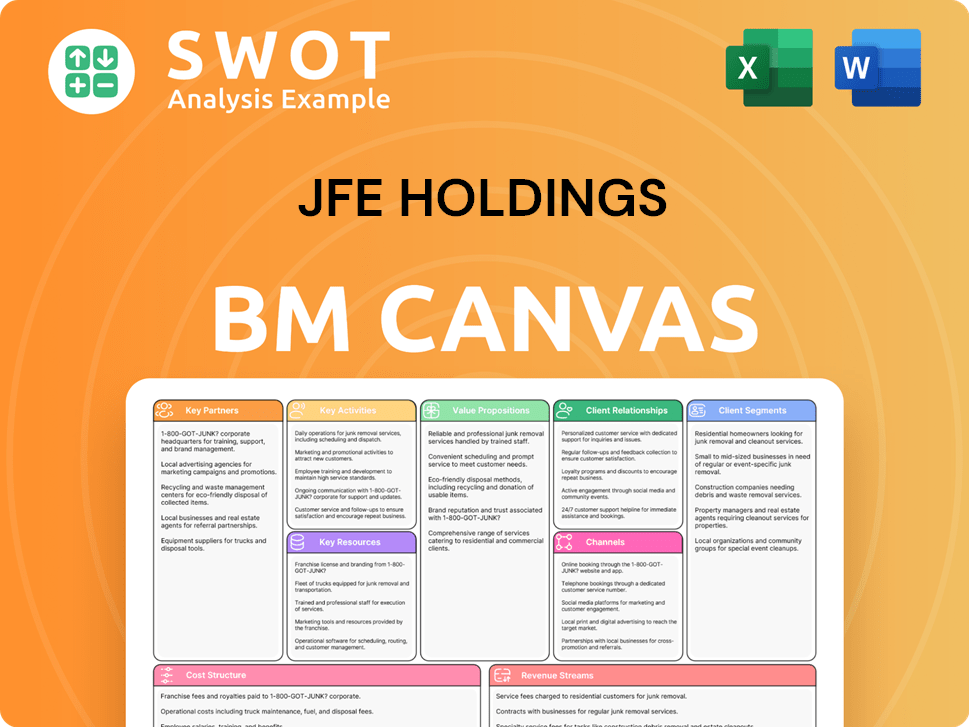

JFE Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is JFE Holdings Positioning Itself for Continued Success?

JFE Holdings, a prominent player in the global steel industry, holds the position of the second-largest crude steel producer in Japan. The company's operations span diverse sectors, including construction, automotive, and infrastructure, with a significant market share domestically and a considerable presence across Asia. Understanding the Brief History of JFE Holdings helps in grasping its evolution and current standing.

Despite its strong foundation, JFE operates in a challenging environment marked by intense competition and the impact of overproduction, particularly from China. This situation continues to exert downward pressure on markets, especially in Asia. The company faces various risks, including fluctuations in raw material costs and supply chain disruptions, impacting its financial performance and strategic outlook.

JFE Holdings maintains a strong position in the global steel market, serving diverse sectors. The company's extensive presence in Asia and its considerable market share in Japan highlight its importance. JFE faces competition from major global steel producers, impacting its market dynamics.

Key risks include the prolonged slump in overseas markets and trade risks in the United States. The rapid appreciation of the yen affects export profitability. Rising raw material costs and weaker demand pose further challenges. Tariff measures by the U.S. administration are expected to negatively impact earnings.

JFE Holdings focuses on sustaining and expanding profitability through strategic initiatives. The company aims to improve its earning power by reducing costs and strengthening competitiveness. Strategic investments include advanced electric arc furnaces and expansion in engineering and trading businesses.

The company forecasts a consolidated business profit of ¥140.0 billion for fiscal year 2025. This projection reflects ongoing efforts to improve earnings across all segments. Strategic investments and cost reduction measures are expected to contribute to this financial performance.

JFE Holdings is implementing strategic initiatives to enhance its market position and financial performance. These initiatives include investments in advanced technologies and expansion into new business areas. The focus is on sustainable growth and adapting to changing market conditions.

- Introduction of advanced electric arc furnaces to contribute to carbon neutrality.

- Expansion of the engineering business in waste-to-resource and offshore wind power fields.

- Growth of the trading business in North America.

- Focus on cost reduction and strengthening competitiveness.

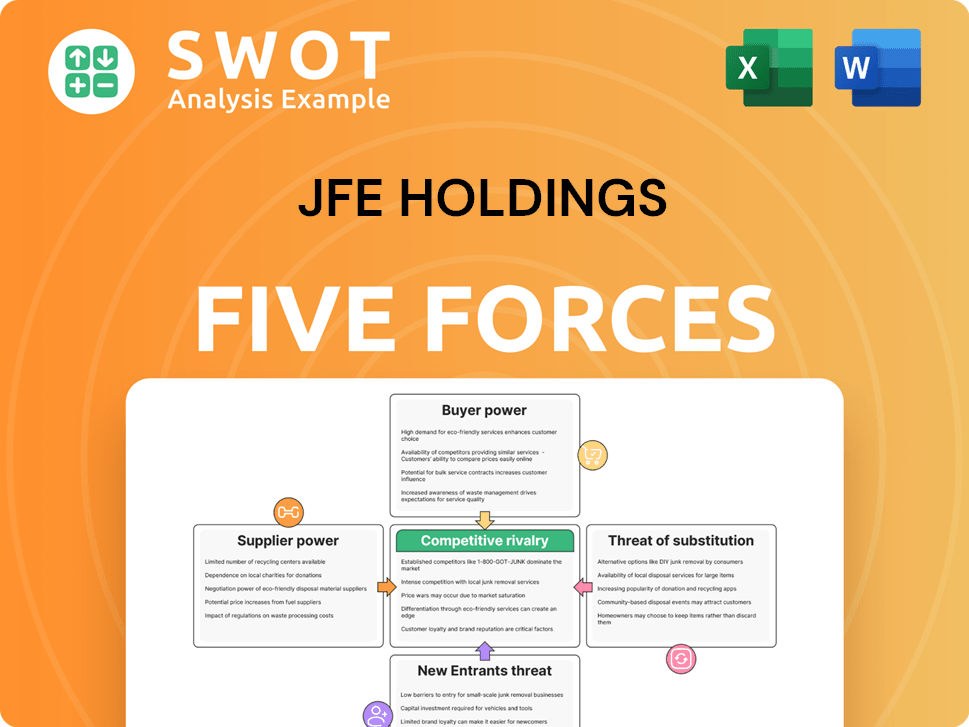

JFE Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JFE Holdings Company?

- What is Competitive Landscape of JFE Holdings Company?

- What is Growth Strategy and Future Prospects of JFE Holdings Company?

- What is Sales and Marketing Strategy of JFE Holdings Company?

- What is Brief History of JFE Holdings Company?

- Who Owns JFE Holdings Company?

- What is Customer Demographics and Target Market of JFE Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.