Kyushu Financial Group Bundle

What Makes Kyushu Financial Group a Key Player in Japan's Financial Landscape?

Kyushu Financial Group (KFG) emerged from a landmark merger, reshaping Japan's regional banking sector. Established on October 1, 2015, this financial powerhouse combined the strengths of Higo Bank and Kagoshima Bank. This strategic move aimed to foster sustainable growth and address local community needs within the Kyushu region.

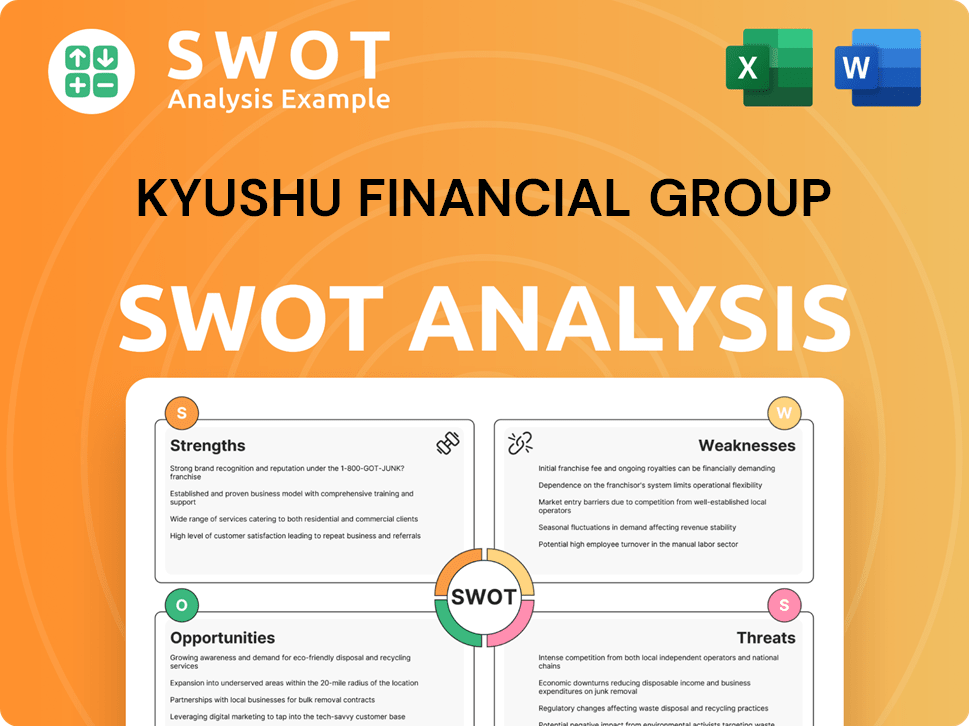

From its inception, KFG company focused on comprehensive financial services, including banking and leasing. As of May 30, 2025, Kyushu Financial Group showcases a strong market presence, with a market capitalization of $2.2 billion. For those seeking deeper insights, a comprehensive Kyushu Financial Group SWOT Analysis provides a detailed look at its strengths, weaknesses, opportunities, and threats, offering valuable perspectives on its strategic positioning within the Japanese financial institutions landscape, including its relationship with other regional banks Japan like Bank of Saga.

What is the Kyushu Financial Group Founding Story?

The founding of Kyushu Financial Group (KFG) on October 1, 2015, marked a significant event in the history of Japanese financial institutions. This event represented a pioneering merger in Japan, bringing together Higo Bank and Kagoshima Bank. This strategic move aimed to create a stronger financial entity to support local communities.

The merger was driven by a forward-looking vision to support the Kyushu region. The goal was to address challenges and foster development over the next decade or two. The leadership from the merging banks, including Yoshihisa Kasahara and Akihisa Koriyama, played key roles in the formation of the new group.

This article provides a brief history of Kyushu Financial Group, exploring its origins and evolution. For a deeper understanding of the company's values, consider reading about the Mission, Vision & Core Values of Kyushu Financial Group.

Kyushu Financial Group's establishment involved the merger of Higo Bank and Kagoshima Bank, both prominent regional banks.

- Founding Date: October 1, 2015.

- Initial Capital: ¥36.0 billion.

- Primary Objective: To strengthen financial services for the Kyushu region.

- Key Leaders: Yoshihisa Kasahara (Higo Bank) and Akihisa Koriyama (Kagoshima Bank).

Kyushu Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Kyushu Financial Group?

The early growth of Kyushu Financial Group (KFG) since its 2015 founding has been marked by strategic expansion within the Kyushu region. This expansion leveraged the established networks of Higo Bank and Kagoshima Bank, key players in Central and Southern Kyushu. This approach allowed KFG to strengthen its position in traditional banking services and broaden its financial offerings.

A significant step was the launch of trust businesses by Higo Bank and Kagoshima Bank on April 1, 2019. This broadened the range of financial products available. The group has also expanded into leasing, credit card services, and financial instrument transactions.

KFG's strategy has consistently aimed at contributing to regional economic development. This focus is evident in its support for local businesses and individual customers within Kyushu. The company's headquarters are located in Kumamoto-Shi, Kumamoto, Japan, and its main branch is in Kagoshima-shi.

KFG emphasizes enhancing human resources management and development, including group-wide hiring activities. As of March 2024, Higo Bank and Kagoshima Bank employed 17 foreign workers. This indicates an effort to diversify the workforce and strengthen ties with international markets.

The company is committed to the Sustainable Development Goals (SDGs), with a cumulative ESG investment and loan target of ¥1 trillion from FY2021 to FY2030, including ¥200 billion for environmental initiatives. This strategic shift supports local industries and climate change mitigation.

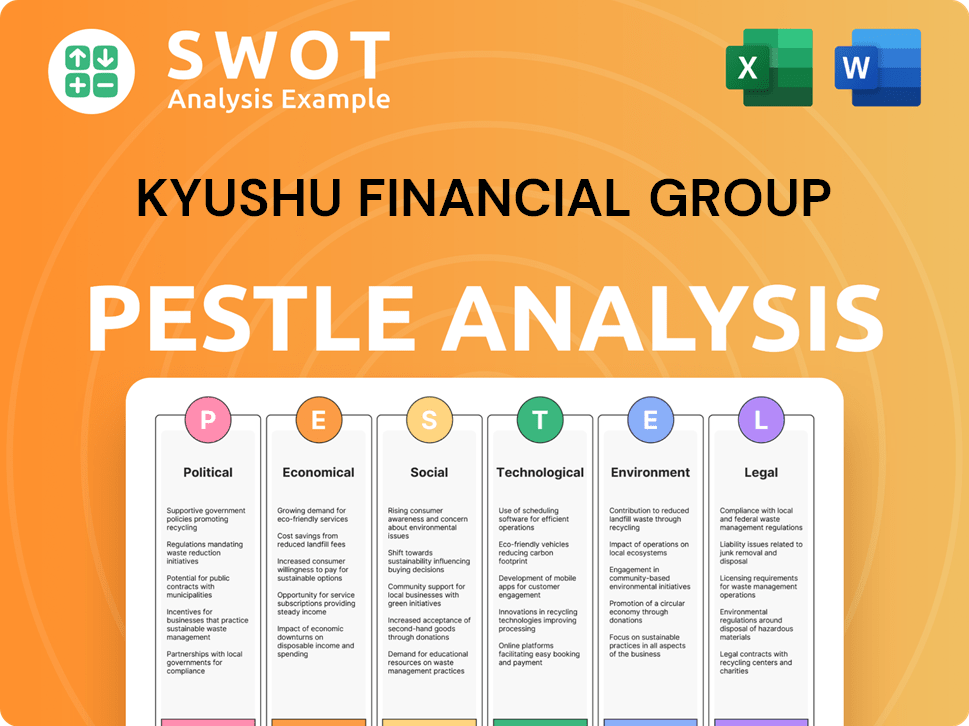

Kyushu Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Kyushu Financial Group history?

The Kyushu Financial Group has achieved significant milestones since its inception, largely through strategic mergers and innovative initiatives. The foundational merger of Higo Bank and Kagoshima Bank on October 1, 2015, marked a pioneering move in Japan's regional financial sector, setting the stage for a stronger financial entity focused on the Kyushu region's long-term development. This KFG company has shown a consistent commitment to growth and adaptation within the dynamic landscape of Japanese financial institutions.

| Year | Milestone |

|---|---|

| 2015 | Merger of Higo Bank and Kagoshima Bank, forming the Kyushu Financial Group, a landmark event in Japanese regional banking. |

| 2019 | Higo Bank and Kagoshima Bank launched their trust businesses, expanding the group's service offerings. |

| 2021-2030 | Targeted cumulative ESG investment and loans of ¥1 trillion, including ¥200 billion for environmental initiatives, demonstrating a commitment to sustainable finance. |

The Kyushu Financial Group history includes significant innovations in its service offerings and strategic direction. The group has expanded beyond traditional banking to include trust businesses, leasing, credit card services, and credit guarantees, broadening its financial services portfolio. Furthermore, the group's focus on ESG investments and loans highlights its forward-thinking approach to sustainable development and financial innovation.

Beyond traditional banking, the group offers trust businesses, leasing, and credit card services.

The group has set an ambitious cumulative ESG investment and loan target of ¥1 trillion from FY2021 to FY2030.

The company is focusing on digital transformation to enhance customer service and operational efficiency.

Investment in human capital is a key strategy to drive future growth and improve service capabilities.

The group leverages its strong regional presence to provide solutions to customers and communities.

Adjustments in securities portfolios were made in response to market fluctuations, indicating proactive management.

Despite its successes, Kyushu Financial Group faces several challenges in the current economic climate. These include the impacts of population decline and an aging society within its operational areas, alongside the growing competition from online banks and other financial service providers. Addressing climate change and adapting to market fluctuations, as seen in the FY2022 financial performance, also present significant hurdles for the company.

Population decline and an aging society in the business base pose challenges for growth.

Increased competition from online banks and other industry entrants impacts market dynamics.

Addressing climate change through CO2 emission reduction and renewable energy initiatives is a key focus.

The need for strategic adjustments in response to rising overseas interest rates and market changes.

Consolidated net income decreased in FY2022, indicating the need for strategic adaptation.

Leveraging digital transformation and human capital to drive future growth.

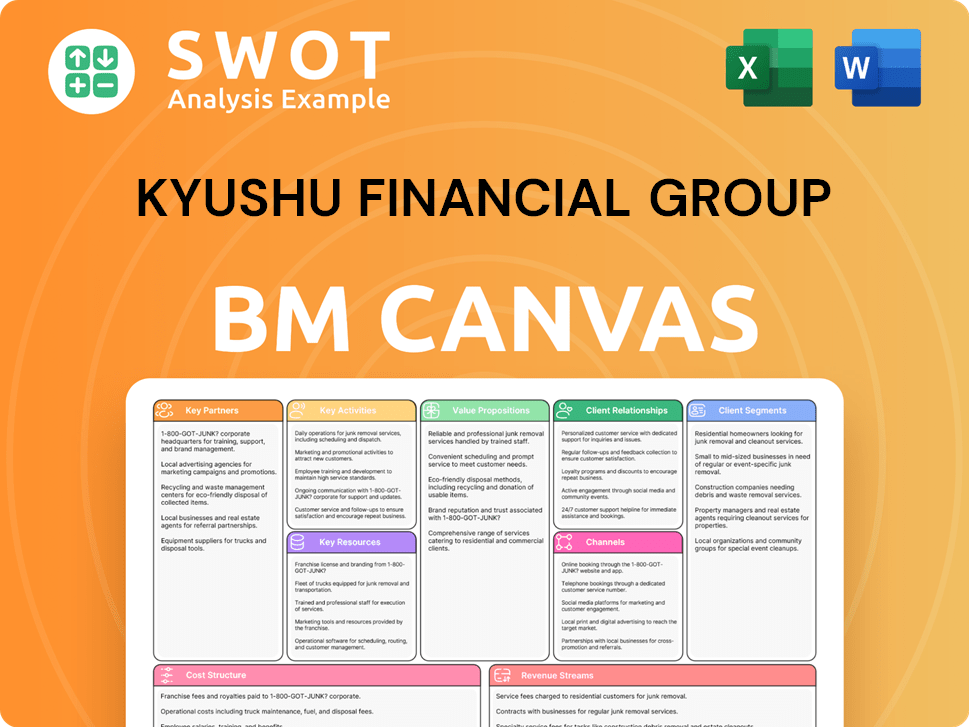

Kyushu Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Kyushu Financial Group?

The Kyushu Financial Group history is marked by strategic mergers and a focus on regional development. Key milestones include the formation through the merger of Higo Bank and Kagoshima Bank, the launch of trust businesses, and significant ESG investment targets. The company's financial performance, as of March 31, 2025, shows trailing 12-month revenue of $1.37 billion and a net income of $199.15 million. The stock price as of May 30, 2025, is $5.09, with a market capitalization of $2.2 billion.

| Year | Key Event |

|---|---|

| October 1, 2015 | Kyushu Financial Group (KFG) was founded through the merger of Higo Bank and Kagoshima Bank, a first in Japan. |

| April 1, 2019 | Higo Bank and Kagoshima Bank launched their respective trust businesses. |

| FY2021 - FY2030 | Kyushu Financial Group set a cumulative ESG investment and loan target of ¥1 trillion, with ¥200 billion allocated to environmental initiatives. |

| May 13, 2024 | Kyushu Financial Group announced its annual financial results for FY2024. |

| March 31, 2025 | Kyushu Financial Group's trailing 12-month revenue was $1.37 billion, with a net income of $199.15 million. |

| May 30, 2025 | The stock price of Kyushu Financial Group was $5.09, with a market capitalization of $2.2 billion. |

Kyushu Financial Group aims to become a 'Regional Value Co-creation Group'. This involves improving productivity, attracting demand from outside the region, and creating new industries. The group focuses on investments in DX (Digital Transformation) and SDGs to achieve these goals.

The group has identified six priority sustainability issues. These include securing human resources, addressing a declining birthrate and aging society, supporting sustainable local economic growth, and climate change countermeasures. Other priorities are respect for human rights and diversity and the formation of a digital society.

Kyushu Financial Group plans to expand its business portfolio and integrate sub-subsidiaries for synergies. They emphasize human capital management to foster innovation. The group is also focusing on transition finance and project finance to support regional revitalization.

Analyst forecasts project net sales of ¥251,292 million for Kyushu Financial Group in March 2025. The expected net income is ¥30,368 million. These projections reflect the company's commitment to the economic development of the Kyushu region and its adaptation to new challenges.

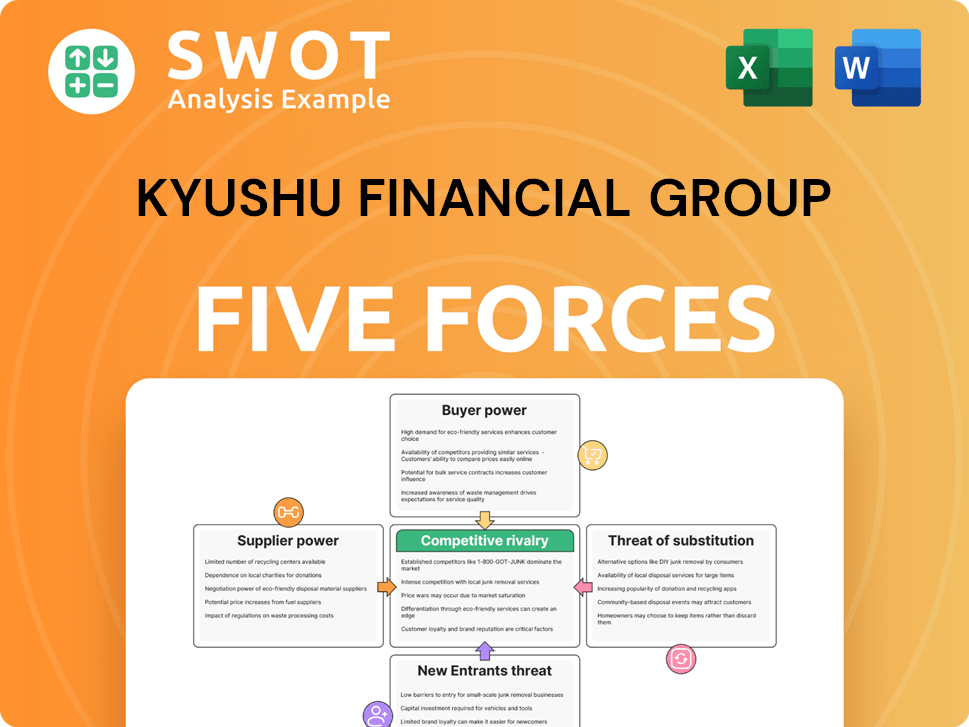

Kyushu Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Kyushu Financial Group Company?

- What is Growth Strategy and Future Prospects of Kyushu Financial Group Company?

- How Does Kyushu Financial Group Company Work?

- What is Sales and Marketing Strategy of Kyushu Financial Group Company?

- What is Brief History of Kyushu Financial Group Company?

- Who Owns Kyushu Financial Group Company?

- What is Customer Demographics and Target Market of Kyushu Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.