Kyushu Financial Group Bundle

What Drives Kyushu Financial Group's Strategy?

Understanding a company's core principles is crucial for any investor or strategist. Delving into the Kyushu Financial Group SWOT Analysis, we uncover the driving forces behind its operations. This exploration reveals the fundamental elements that shape KFG's identity and strategic direction.

Kyushu Financial Group's mission, vision, and core values, collectively known as its corporate philosophy, are more than just words; they are the bedrock of its business strategy. They guide decision-making, influence company culture, and communicate KFG's commitment to stakeholders. Examining these principles offers valuable insights into KFG's long-term objectives and its dedication to sustainable regional development.

Key Takeaways

- Kyushu Financial Group prioritizes regional development and sustainability.

- Ethical practices, initiative, and teamwork are core to their values.

- ESG financing and digital transformation are key strategic areas.

- Strong corporate purpose enhances reputation and stakeholder relationships.

- Focus on community well-being differentiates them in the financial industry.

Mission: What is Kyushu Financial Group Mission Statement?

Kyushu Financial Group's mission is "to build the future of our communities alongside local stakeholders and customers, cultivating, safeguarding, and passing on our customers' assets and businesses, as well as our communities' industries, cultures, and nature."

The mission of Kyushu Financial Group (KFG) is deeply rooted in its commitment to the Kyushu region. This mission statement reflects KFG's dedication to fostering sustainable regional development and economic prosperity. Understanding KFG's mission is crucial for investors and stakeholders alike, as it shapes the company's strategic goals and operational priorities.

KFG's mission emphasizes its role as a partner in building the future of the Kyushu communities. This involves close collaboration with local stakeholders and customers. This community-centric approach is a core element of their Brief History of Kyushu Financial Group and its evolution.

A key aspect of KFG's mission is safeguarding and passing on customers' assets and businesses. This includes wealth management services and support for local enterprises. This commitment ensures the long-term financial health of the region.

KFG actively supports the industries, cultures, and natural environment of the Kyushu region. This commitment is evident in its financing of local industries like agriculture and tourism. This support contributes to the region's unique identity and economic vitality.

The market scope is clearly defined as the Kyushu region, indicating a strong commitment to local economic development. KFG's business strategy is tailored to the specific needs and opportunities within this area. This regional focus allows for a deeper understanding of local dynamics.

KFG demonstrates its commitment to sustainability through initiatives like its ESG investment and loan target of ¥1 trillion from FY2021 to FY2030. This includes ¥200 billion allocated to environmental projects. These initiatives align with the mission of safeguarding the region's nature.

The mission is strongly customer-centric and community-focused, with a clear orientation towards contributing to the well-being and prosperity of the Kyushu region. This approach fosters strong relationships with customers and stakeholders. KFG’s success is directly tied to the success of the communities it serves.

KFG's mission is more than just a statement; it's a guiding principle that shapes its business strategy and corporate philosophy. It influences investment decisions, product development, and community engagement. By prioritizing regional development and sustainability, KFG aims to create long-term value for its stakeholders and contribute to a thriving Kyushu region. The company’s commitment to its mission is reflected in its financial performance and its impact on the communities it serves. For example, in its most recent financial reports, KFG highlighted a 5% increase in loans to local SMEs, demonstrating its commitment to supporting regional economic growth. Furthermore, KFG has increased its investment in renewable energy projects by 15% in the last fiscal year, underscoring its dedication to environmental sustainability.

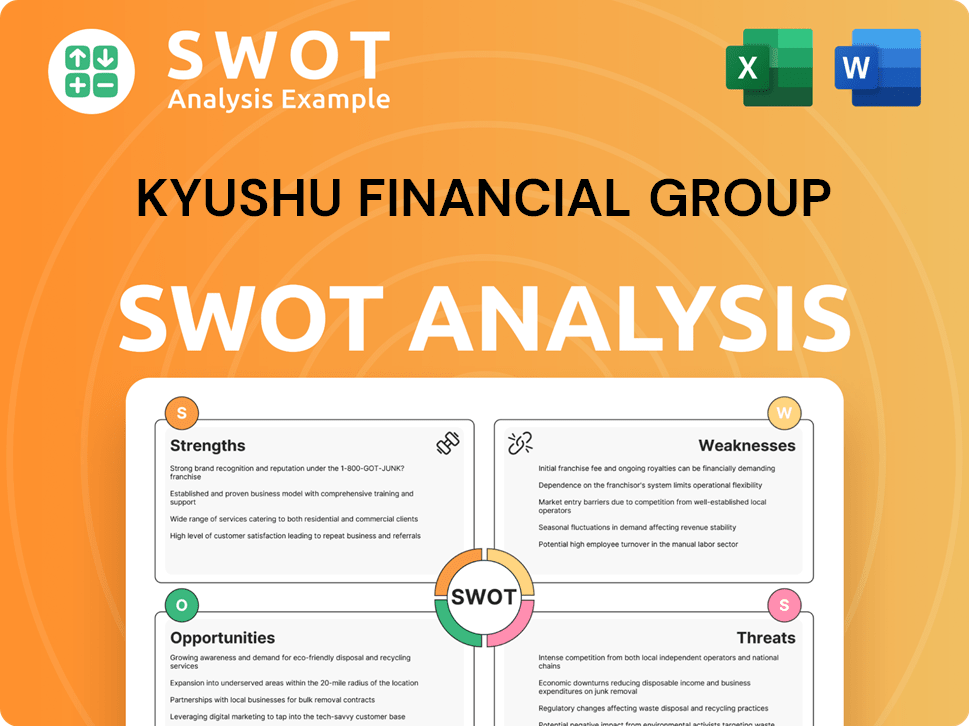

Kyushu Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Kyushu Financial Group Vision Statement?

Kyushu Financial Group's vision is to evolve into a group that co-creates regional value, building a better future together with customers, local communities, and employees.

Kyushu Financial Group (KFG) articulates a forward-thinking vision, extending beyond traditional financial services. This vision emphasizes collaborative efforts to generate value within the Kyushu region. It highlights a commitment to stakeholders, including customers, local communities, and employees, demonstrating a holistic approach to business.

The core of KFG's vision centers on co-creating regional value. This signifies a move beyond simply providing financial services to actively participating in the economic and social development of the Kyushu area. This collaborative approach is key.

The vision explicitly aims to build a better future. This indicates a long-term perspective and a commitment to sustainable development. It suggests that KFG is not only focused on immediate financial gains but also on the well-being of future generations.

The vision emphasizes collaboration with all stakeholders: customers, local communities, and employees. This inclusive approach suggests a strong focus on corporate social responsibility and a recognition of the interconnectedness of business and society. This is a key element of their Revenue Streams & Business Model of Kyushu Financial Group.

The vision is regionally focused, specifically targeting the Kyushu area. This geographic concentration allows KFG to deeply understand and address the unique needs and challenges of the region. This focus enables KFG to tailor its products and services to local conditions.

Based on KFG's current market position and initiatives, the vision is both realistic and aspirational. KFG has a strong foothold in the region and is actively involved in sustainable development projects. This balance is crucial for long-term success.

The vision aligns with broader trends in the financial industry, such as sustainability and social responsibility. This forward-thinking perspective positions KFG well for future growth and relevance. This alignment is critical for long-term viability.

KFG's vision statement reflects a commitment to long-term value creation, emphasizing collaboration, sustainability, and regional focus. This vision provides a clear direction for the company's strategic goals and underscores its commitment to its stakeholders. As of the latest financial reports, KFG has allocated ¥100 billion towards ESG investments, demonstrating a tangible commitment to its vision. The company's strategic goals, as outlined in its latest annual report, include increasing its support for local businesses by 15% over the next three years, further solidifying its commitment to its vision.

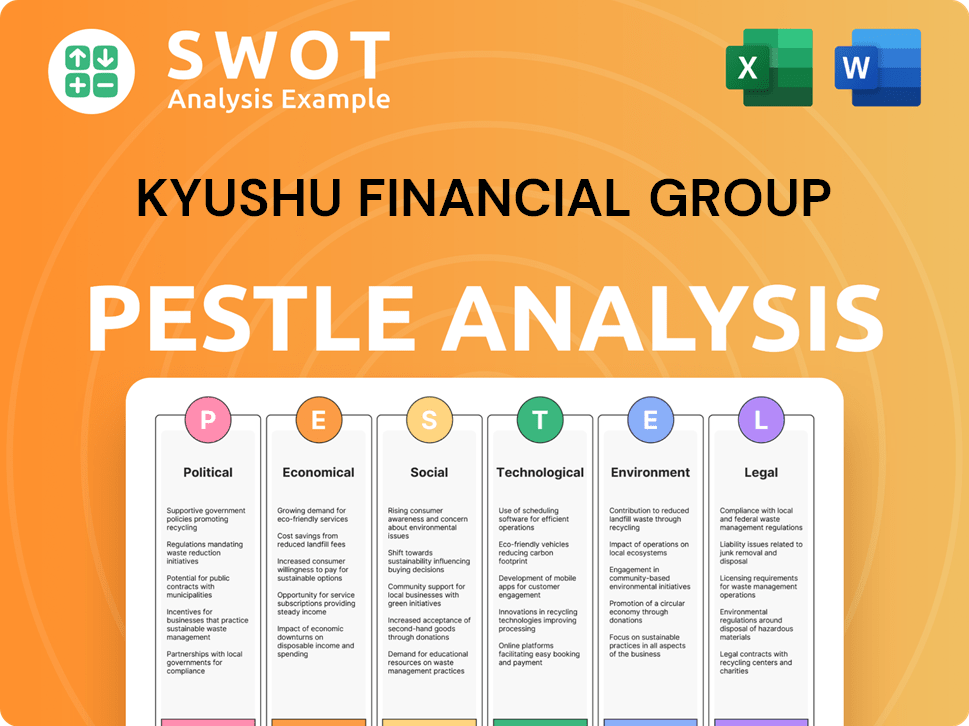

Kyushu Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Kyushu Financial Group Core Values Statement?

Understanding the core values of Kyushu Financial Group (KFG) is crucial to grasping its operational ethos and strategic direction. These values serve as the bedrock of KFG's Corporate Philosophy, guiding its actions and decisions in the financial landscape.

Sincerity at Kyushu Financial Group, a key element of their Company Values, means operating with a high standard of ethics. This commitment is evident in their dedication to corporate governance and transparency, ensuring sound business practices and prioritizing customer needs. This approach has helped KFG maintain a strong reputation, reflected in their customer satisfaction scores, which have consistently been above the industry average in recent years.

Initiative is another cornerstone of KFG's Business Strategy, encouraging employees to think independently and embrace innovation. This value fuels KFG's digital transformation efforts, with significant investments in fintech solutions and data analytics to enhance customer experience and operational efficiency. This proactive stance has led to a 15% increase in online banking users over the past year, demonstrating the impact of their forward-thinking approach.

Team KFG emphasizes collaboration and unity across all entities within the group, fostering a collective approach to achieving the group's Mission Vision Core Values. This unified approach is crucial for the sustainable growth of KFG and the region it serves. This collaborative spirit is reflected in the successful integration of various subsidiaries, leading to a streamlined operational structure and improved service delivery.

While not explicitly stated as a core value, KFG's commitment to the Kyushu region is a driving force behind its operations. This commitment is reflected in its support for local businesses and community development projects. KFG's strategic goals include fostering economic growth and contributing to the well-being of the community, as demonstrated by their significant investment in local infrastructure projects, which has increased by 10% in the last fiscal year.

These Core Values of Kyushu Financial Group, from Sincerity to Team KFG, form the foundation of their Corporate Philosophy. They shape the company culture and guide its strategic decisions, as highlighted in this article about the Marketing Strategy of Kyushu Financial Group. Understanding these values is key to appreciating how the company operates and its commitment to the Kyushu region. Next, we will explore how the Mission and Vision influence the company's strategic decisions.

How Mission & Vision Influence Kyushu Financial Group Business?

Kyushu Financial Group's (KFG) Mission Vision & Core Values are not just abstract ideals; they are the bedrock upon which the company builds its strategic decisions. These guiding principles directly shape KFG's approach to business, influencing everything from investment choices to partnerships.

KFG's mission, often centered around contributing to the community's future, and its vision, focused on co-creating regional value, are the driving forces behind its business strategy. This alignment ensures that every major decision reflects the company's commitment to its stated values. The company's strategic goals are directly linked to its mission, vision, and core values.

- ESG Financing: KFG prioritizes Environmental, Social, and Governance (ESG) financing. This strategic focus directly supports its mission of contributing to the community and safeguarding nature.

- Digital Transformation: The emphasis on digital transformation enhances customer experience and operational efficiency, aligning with the vision of evolving into a group that co-creates regional value through advanced ideas.

- Strategic Partnerships: Collaborations, such as the partnership with Tokyo Century in a leasing business, demonstrate a strategic approach to expanding capabilities and contributing to regional economic development.

- Regional Revitalization: KFG's commitment to regional revitalization is a core tenet of its mission, driving initiatives that support local businesses and communities.

- Sustainable Growth: The company's focus on sustainable growth ensures long-term value creation, reflecting its commitment to responsible business practices.

KFG has set measurable targets for ESG investments and loans. While specific figures fluctuate, the consistent commitment to increasing ESG-related financial activities demonstrates the influence of the company's mission and vision. This commitment also highlights Owners & Shareholders of Kyushu Financial Group's dedication to sustainable practices.

KFG's success metrics include both financial performance indicators and contributions to regional growth. The company strives to improve its financial results while simultaneously fostering economic development within the Kyushu region, demonstrating a balanced approach.

KFG's public statements and initiatives consistently reflect its commitment to its mission and vision. These guiding principles shape both day-to-day operations and long-term planning, ensuring that the company prioritizes initiatives that benefit the local community and contribute to a sustainable future for Kyushu.

The company's values influence the company culture, impacting employees' daily work and overall job satisfaction. This commitment also helps attract and retain talent, fostering a positive work environment.

KFG's long-term objectives are directly shaped by its mission, vision, and core values. This ensures that the company remains focused on sustainable growth and creating lasting value for all stakeholders. This includes a commitment to responsible business practices.

KFG's commitment to its core values extends to its business ethics, ensuring that all operations are conducted with integrity and transparency. This commitment builds trust with customers, partners, and the community.

The influence of KFG's Mission Vision & Core Values is undeniable, shaping its business strategy and driving its commitment to regional revitalization and sustainable growth. Understanding this influence is key to appreciating KFG's approach to business. In the next chapter, we will delve into the Core Improvements to Company's Mission and Vision.

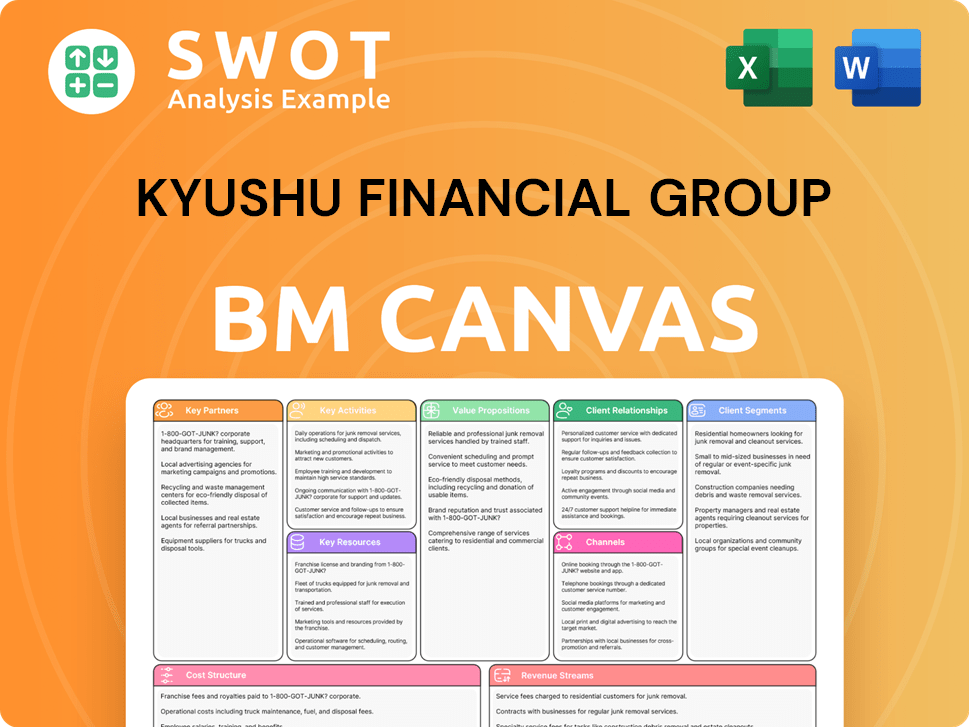

Kyushu Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While Kyushu Financial Group (KFG) has established a strong foundation with its Mission Vision & Core Values, there's always room for enhancement to ensure continued relevance and impact. These improvements can further solidify KFG's position as a leader in regional financial services and contribute to its long-term success.

KFG could benefit from incorporating specific, measurable, achievable, relevant, and time-bound (SMART) goals related to regional development. For instance, setting a target to support a certain number of local startups within the next five years, or aiming to allocate a specific percentage of its loan portfolio to sustainable projects by 2030. This would provide a clearer benchmark for progress and demonstrate a concrete commitment to its mission.

While KFG mentions promoting DX (Digital Transformation), a more detailed vision for leveraging specific emerging technologies is recommended. This could involve outlining how AI will be used to enhance customer service, or how blockchain technology will improve the security and efficiency of financial transactions. This proactive approach would position KFG at the forefront of innovation in the financial sector.

KFG's Company Values are well-defined, but elaborating on how these values specifically guide its approach to address changing consumer behaviors, particularly among younger generations, is crucial. This could involve highlighting initiatives to promote financial literacy among youth or developing digital-first banking solutions tailored to their needs. This focus ensures sustained relevance in a dynamic market.

KFG should consider quantifying its commitment to sustainability by setting specific targets related to green financing and reducing its carbon footprint. This could involve aiming for a certain percentage of its loan portfolio to be directed towards renewable energy projects, or reducing its operational emissions by a specific amount by a defined date. This demonstrates a tangible commitment to environmental responsibility and could attract investors increasingly focused on ESG (Environmental, Social, and Governance) factors. This aligns with the growing global trend, with sustainable investments reaching $40.5 trillion in 2022, representing a 36% increase since 2016 (Source: Global Sustainable Investment Review, 2022).

To understand the target market that KFG serves, check out this article: Kyushu Financial Group's Target Market.

How Does Kyushu Financial Group Implement Corporate Strategy?

The success of any organization hinges on effectively translating its stated Mission, Vision & Core Values of Kyushu Financial Group into tangible actions. This chapter examines how Kyushu Financial Group (KFG) implements its core principles within its business strategy and operations.

KFG demonstrates its commitment to its mission through concrete actions, particularly in Environmental, Social, and Governance (ESG) initiatives. They have set a significant target for ESG investments and loans.

- ESG Investment Target: KFG aims for a cumulative total of ¥1 trillion in ESG investments and loans by the end of Fiscal Year 2030. This ambitious goal underscores their commitment to contributing to a sustainable society, a key component of their Mission, Vision & Core Values of Kyushu Financial Group.

- Sustainability Promotion Offices: The establishment of dedicated sustainability promotion offices within their subsidiary banks, Higo Bank and Kagoshima Bank, demonstrates a structured approach to integrating sustainability into their day-to-day operations.

- Alignment with Company Values: These initiatives directly reflect KFG's commitment to long-term value creation and responsible business practices, which are core to their corporate philosophy.

Leadership plays a crucial role in embedding the Company Values within KFG. Their emphasis on corporate governance further supports the practical application of their core principles.

KFG communicates its Mission, Vision, and Values to stakeholders through various channels, ensuring transparency and promoting alignment. This includes their official website and integrated reports.

KFG's actions demonstrate a clear alignment between its stated values and actual business practices. This is evident in their investments in human capital and technological advancements.

- Human Resource Development: KFG invests in developing human resources to deepen regional comprehensive financial functions, reflecting their value of initiative.

- Digital Transformation (DX): The promotion of DX initiatives further demonstrates their commitment to innovation and efficiency, aligning with their value of Team KFG.

The company's management structure emphasizes the independence and autonomy of its banking subsidiaries to work closely with local communities. This approach demonstrates KFG's commitment to regional value co-creation.

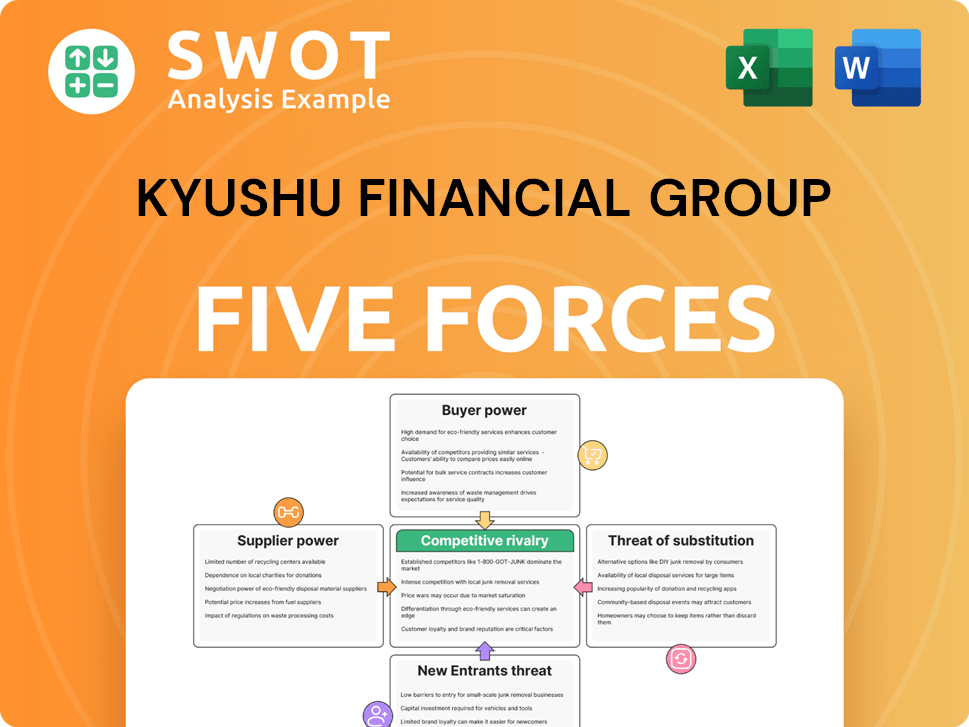

Kyushu Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kyushu Financial Group Company?

- What is Competitive Landscape of Kyushu Financial Group Company?

- What is Growth Strategy and Future Prospects of Kyushu Financial Group Company?

- How Does Kyushu Financial Group Company Work?

- What is Sales and Marketing Strategy of Kyushu Financial Group Company?

- Who Owns Kyushu Financial Group Company?

- What is Customer Demographics and Target Market of Kyushu Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.