Kyushu Financial Group Bundle

Who are Kyushu Financial Group's Key Customers?

In the ever-evolving financial landscape, understanding your customer is crucial for success. For Kyushu Financial Group (KFG), a leading Kyushu Financial Group SWOT Analysis highlights the importance of knowing its customers. This analysis dives deep into the customer demographics and target market of KFG, revealing the strategies behind their regional dominance and future growth plans.

This Target Market Analysis will explore the Customer Demographics of Kyushu Financial Group, examining their customer profile across various segments. We'll delve into market segmentation strategies, including Kyushu Financial Group customer age demographics, income levels, and geographical distribution. Further, we'll analyze how KFG caters to specific needs, such as Kyushu Financial Group target market for loans and investments, while maintaining customer satisfaction analysis in a changing market.

Who Are Kyushu Financial Group’s Main Customers?

Understanding the Customer Demographics and the Target Market Analysis of Kyushu Financial Group (KFG) is crucial for grasping its strategic positioning. KFG, a prominent Financial Institution, serves a diverse customer base within the Kyushu region of Japan. This includes both individual consumers (B2C) and businesses (B2B), primarily through its banking, leasing, and credit card services.

KFG's approach to Market Segmentation is centered on understanding the specific needs of different customer groups. The company's focus on 'life stage' for consumers and 'business development' for corporate clients suggests a segmentation strategy based on financial maturity and business requirements. This allows KFG to tailor its products and services effectively, aiming to maximize customer satisfaction and foster long-term relationships.

The company's strategic direction is also influenced by regional economic factors. The economic impact of semiconductor-related capital investments in Kyushu, estimated at ¥20.1 trillion over ten years from 2021, presents significant opportunities for KFG. This includes supporting key regional industries and their related businesses, indicating a proactive approach to regional economic development.

KFG's Consumer Banking Group is structured to meet the varied financial needs of its customers. This group is divided into several divisions, each focusing on a specific segment. The divisions include the Family Banking Division, Investment Services Division, Private Banking Division, and Remote Banking Division. This structure allows KFG to provide targeted products and services.

In the B2B sector, KFG offers a range of services including deposit, lending, foreign exchange, and securities businesses. The leasing segment focuses on leasing and lending. Credit guarantee services are also provided. KFG strategically supports key regional industries and their related businesses, particularly in sectors benefiting from major capital investments.

This division targets the 'asset-accumulating segment,' serving customers with long-term goals such as purchasing a house or saving for retirement. Products offered include principal-guaranteed instruments or those providing a hedge against inflation. The focus is on long-term financial security. This division offers products like 'Automatic Cumulative Investment Trust Purchase Service' and other long-term cumulative investment products introduced in December 1998.

This division targets the 'asset-managing segment'. With Japanese households' financial assets totaling ¥2,230 trillion (US$14.2 trillion) in December 2024 and projected to rise by about 15% to ¥2,500 trillion by 2030, this segment represents a significant growth opportunity. The division focuses on investment products and services to help customers grow their wealth. This is especially relevant with the shift from savings to investment driven by inflation and the new NISA.

The Target Market Analysis for KFG also includes a focus on specific segments within the consumer and business sectors. KFG's approach to regional revitalization and solving local issues, such as low birthrates, aging populations, and declining populations, also points to a focus on serving the broader community within Kyushu. For a deeper dive into KFG's growth strategies, you can explore the Growth Strategy of Kyushu Financial Group.

KFG's customer segmentation is designed to address the varied financial needs of its clients. This approach allows KFG to provide specialized services and products tailored to each segment. The company aims to build long-term relationships by offering tailored advice and services.

- Family Banking Division: Focuses on long-term financial goals, offering products like cumulative investment trusts.

- Investment Services Division: Targets the asset-managing segment, providing investment products and services.

- Private Banking Division: Offers advisory services to business owners, focusing on business development and personal asset management.

- Remote Banking Division: Provides payment and settlement services, emphasizing digital accessibility.

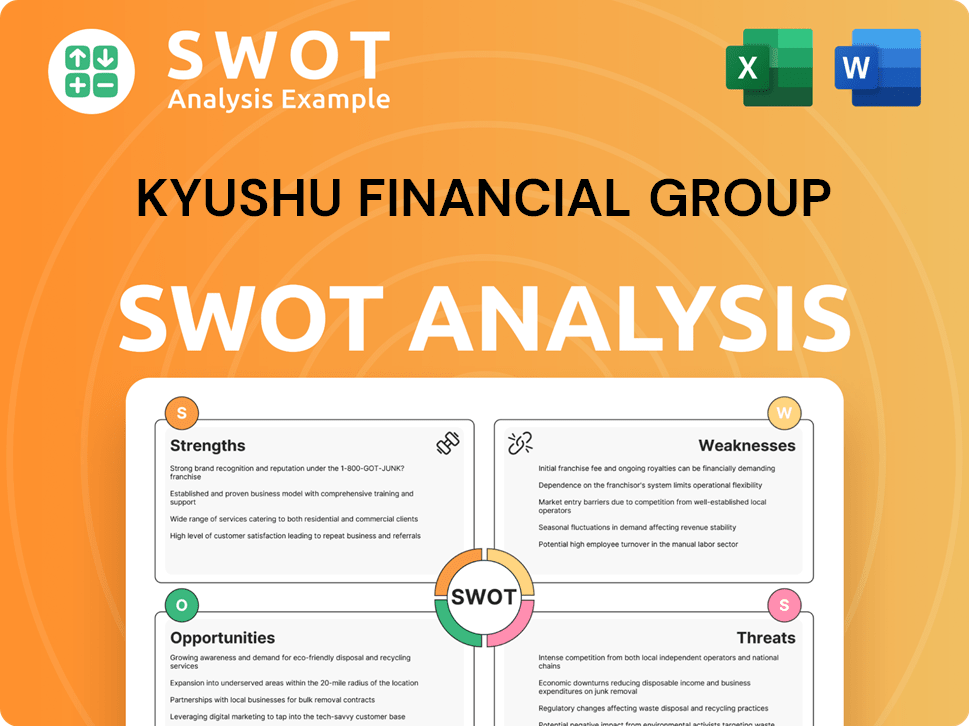

Kyushu Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Kyushu Financial Group’s Customers Want?

Understanding customer needs and preferences is central to the operational strategy of Kyushu Financial Group. Their approach involves tailoring financial products and services to meet the diverse requirements of both individual and business clients. This customer-centric focus allows them to adapt to evolving market dynamics and maintain a competitive edge in the financial services sector.

For individual customers, the focus is on wealth management and long-term financial planning. For business clients, the focus is on funding for growth and strategic financial advisory. This dual approach allows the financial institution to cater to a wide range of financial goals and needs.

Kyushu Financial Group continuously monitors market trends and customer feedback to refine its offerings. This adaptive strategy includes leveraging digital technologies to enhance accessibility and convenience, reflecting a commitment to providing the 'right product and the right service at the right time.' This approach is crucial for maintaining customer satisfaction and loyalty.

Individual customers prioritize wealth accumulation, asset management, and long-term financial planning. The financial institution offers products like principal-guaranteed options and inflation hedges. The introduction of the 'Automatic Cumulative Investment Trust Purchase Service' highlights a preference for structured, long-term investment solutions.

Business clients require funding for growth, operational efficiency, and strategic financial advisory. The Private Banking Division provides tailored advice for business development and personal asset management. Increased demand for funds across various industries in Kyushu, particularly semiconductor-related capital investment, drives the need for diverse financial solutions.

Customer feedback and market trends significantly influence product development and service offerings. The goal is to provide the 'right product and the right service at the right time.' Proactive systematization of front-end services and upgrades to payment and settlement functions are ongoing.

The financial institution is embracing digital transformation to enhance customer experience. This includes integrating digital platforms and adopting e-commerce solutions. This shift aligns with the growing customer preference for seamless digital experiences.

The Japanese market is seeing a rapid evolution in loyalty programs, driven by digital platform integration and e-commerce adoption. This indicates a growing preference for integrated financial ecosystems. The company is also involved in initiatives like the SDGs for Regional Revitalization.

Since 2024, there has been a shift in Japanese household behavior, with a decline in cash and low-interest deposit inflows and an increase in risk asset investments. This indicates a growing preference for investment products. The financial institution is adapting to meet this changing demand.

The company focuses on understanding the needs of its customer demographics. This includes market segmentation, customer profiling, and continuous analysis of customer satisfaction. The financial institution adapts its strategies to align with evolving market trends and customer preferences.

- Offering tailored financial solutions for wealth accumulation and business growth.

- Leveraging digital technologies to enhance customer experience and accessibility.

- Participating in initiatives that address societal needs and promote regional revitalization.

- Prioritizing customer feedback to drive product development and service improvements.

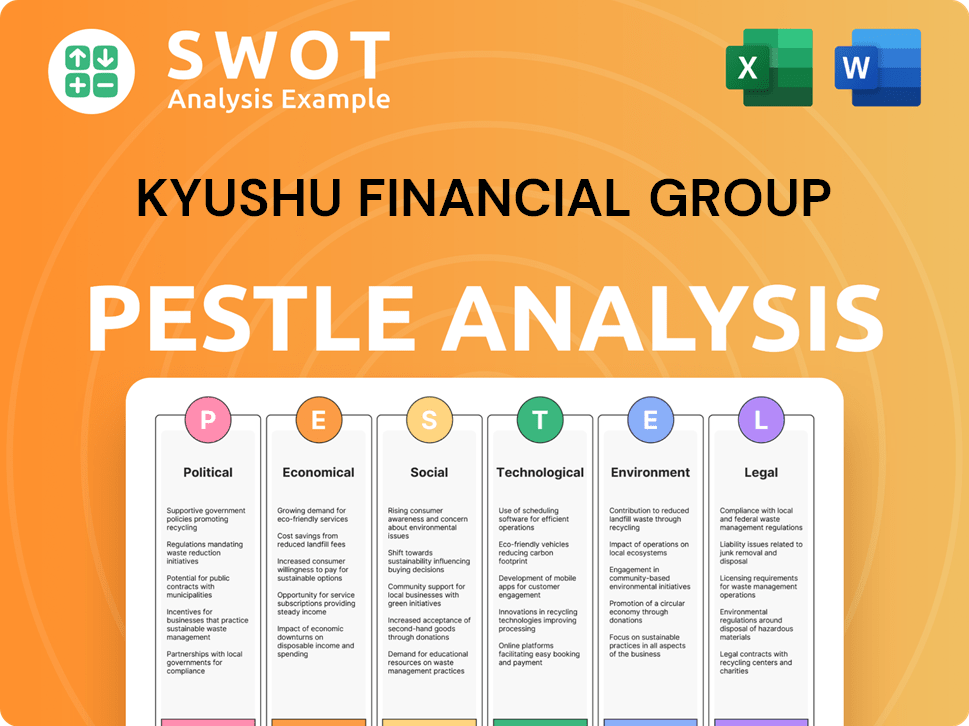

Kyushu Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Kyushu Financial Group operate?

The core geographical market for Kyushu Financial Group (KFG) is the Kyushu region of Japan. This Financial Institution solidified its presence through the merger of Higo Bank and Kagoshima Bank, focusing on Kumamoto and Kagoshima prefectures. This regional emphasis supports KFG's mission to boost the economic development of Kyushu, emphasizing an 'on-the-ground approach' in Central and Southern Kyushu, including Kumamoto, Kagoshima, and Miyazaki prefectures.

While the exact market share of KFG across all financial services in the entire Kyushu region isn't precisely detailed, the Market Segmentation shows that Fukuoka Financial Group, a key competitor, held a 24% share in loans in Kyushu and Okinawa compared to local and mega banks' 43%. Given KFG's strong regional banking roots, it likely holds a significant market share in its primary prefectures.

Understanding Customer Demographics and local economic conditions is crucial for KFG. For example, the economic impact of semiconductor-related investments in Kumamoto Prefecture, due to new factories, has increased the demand for funds across industries like real estate and commercial facilities. This suggests a localized approach to services and lending in areas experiencing industrial growth. To understand the Target Market Analysis, read more about the Owners & Shareholders of Kyushu Financial Group.

KFG establishes localized partnerships to succeed in diverse markets. For instance, the company has a 'New Regional Development Promotion Team' at Kumamoto Bank and a 'Semiconductor Business Promotion Team' to capture opportunities related to the 'New Silicon Island Kyushu' initiative. They also have comprehensive agreements with local towns like Kikuyo Town.

While KFG's primary focus is domestic, the broader Kyushu region has strong relationships with Asian countries. Financial groups in the area support customers by strengthening contact points throughout Japan and overseas. This indicates potential for future international services catering to businesses with cross-border activities.

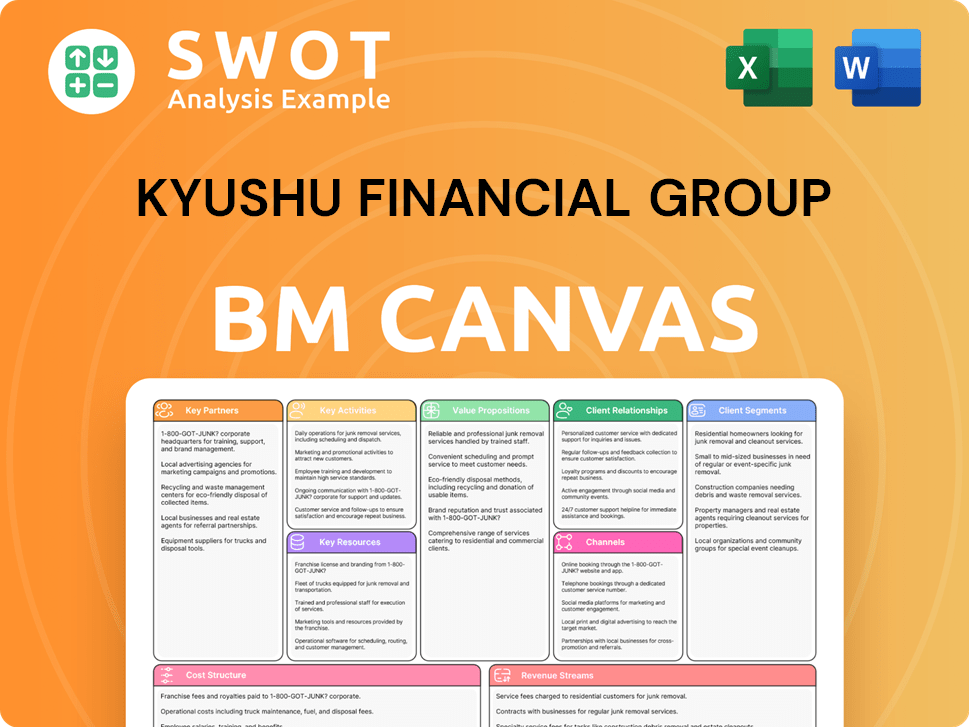

Kyushu Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Kyushu Financial Group Win & Keep Customers?

The customer acquisition and retention strategies employed by Kyushu Financial Group (KFG) are designed to foster long-term relationships by tailoring financial products and services to meet the evolving needs of its diverse Customer Demographics. This personalized approach is crucial for both attracting new clients and building loyalty. KFG leverages a combination of traditional methods and digital strategies to reach and engage its target market.

For Customer Acquisition, KFG focuses on creating new market opportunities by integrating advisory services with traditional products. This is supported by the use of electronic banking technologies, which provide timely and visual information. In the broader Japanese financial landscape, digital platform integration and mobile payment adoption are vital for acquiring new customers. This suggests a shift towards data-driven insights to identify potential customers and offer relevant solutions.

Customer Retention is a key focus for KFG, aiming for a 'lifetime relationship' built on trust and understanding customer needs. This is supported by a structured consumer banking group that caters to different segments, such as asset-accumulating and asset-managing individuals. KFG's commitment to environmental, social, and governance (ESG) factors through initiatives like joining the Partnership for Carbon Accounting Financials (PCAF) enhances brand reputation and customer loyalty, especially among environmentally conscious segments.

KFG uses digital platforms and mobile payment adoption to enhance customer acquisition. These digital channels are becoming increasingly important in the Japanese financial market. This includes using data analytics to identify potential customers and offer tailored financial products.

KFG tailors its financial products and services to the specific needs of different customer segments. This strategy helps in attracting new clients and building long-term relationships. The focus is on understanding each customer's life stage and financial requirements.

KFG aims for a 'lifetime relationship' with customers, built on trust and a deep understanding of their financial needs. This approach supports customer retention. The structured consumer banking group caters to specific customer segments.

KFG’s commitment to ESG factors, such as joining PCAF, enhances brand reputation and customer loyalty. This is particularly effective among environmentally conscious customers. This strategy helps in retaining customers by aligning with their values.

In the competitive Japanese market, KFG's approach to Market Segmentation and customer engagement includes leveraging digital tools and focusing on customer needs. The Japanese loyalty program market is expected to reach US$3.87 billion in 2025, up from US$3.35 billion in 2024, indicating a strong focus on customer retention strategies. KFG's initiatives, such as the 'New Regional Development Promotion Team' and the 'Semiconductor Business Promotion Team', also help foster strong relationships with local communities and businesses, which are essential for retention. For a deeper understanding of the competitive landscape, you can explore the Competitors Landscape of Kyushu Financial Group.

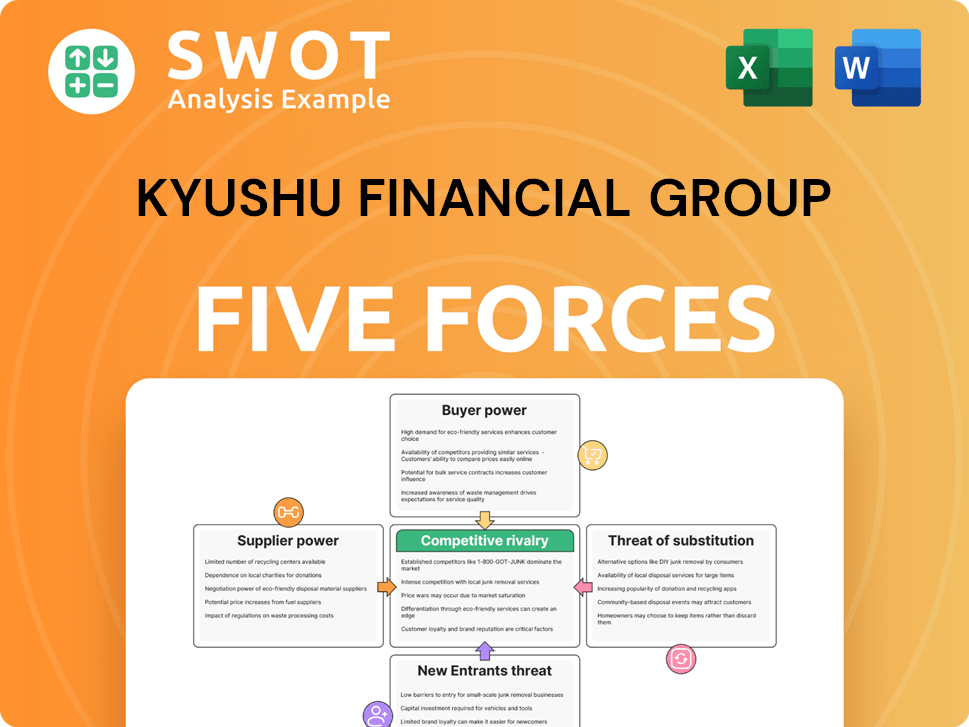

Kyushu Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kyushu Financial Group Company?

- What is Competitive Landscape of Kyushu Financial Group Company?

- What is Growth Strategy and Future Prospects of Kyushu Financial Group Company?

- How Does Kyushu Financial Group Company Work?

- What is Sales and Marketing Strategy of Kyushu Financial Group Company?

- What is Brief History of Kyushu Financial Group Company?

- Who Owns Kyushu Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.