Munich Re Bundle

How Did Munich Re Shape the Insurance World?

Dive into the fascinating Munich Re SWOT Analysis and discover the story of a company that revolutionized risk management. Founded in 1880 in Munich, Germany, Munich Re, originally Münchener Rückversicherungs-Gesellschaft, pioneered the concept of independent reinsurance. This bold move aimed to stabilize the burgeoning insurance sector by diversifying risks across various classes and geographies, setting the stage for its future dominance.

From its early history as a German insurance innovator, Munich Re has grown into the world's largest reinsurer, a testament to its strategic vision and enduring financial strength. Understanding the brief history of Munich Re is crucial for anyone looking to grasp the evolution of the reinsurance industry and its impact on global financial stability. With a market capitalization of €76 billion as of June 3, 2025, and a target of €6 billion net profit in 2025, Munich Re's journey continues to be marked by innovation and resilience, making it a key player to watch in the insurance landscape.

What is the Munich Re Founding Story?

The story of the Munich Re company begins in 1880. This pivotal year marked the official founding of Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München, later known as Munich Re. The company's creation was a direct response to the challenges and opportunities within the evolving German insurance landscape.

The driving force behind Munich Re's establishment was Carl Thieme. He recognized the need for a more stable and independent reinsurance model. Thieme's foresight led to the creation of a company designed to select its risks strategically and diversify across various insurance classes. This approach set the stage for Munich Re's future as a global leader in reinsurance.

Munich Re's early history is marked by strategic partnerships and innovative approaches to risk management. Thieme teamed up with Wilhelm von Finck and Theodor von Cramer-Klett. The initial capital of the company was a significant 3 million marks, provided by eight shareholders. The company began with a small team, including Carl Schreiner, who played a crucial role in managing the office. Thieme also pioneered mutually binding treaties between insurers and reinsurers, a move away from traditional risk placement. This approach to independent risk selection and international diversification was key to Munich Re's success.

The company was founded on April 3, 1880, in Munich, Germany.

- Carl Thieme, recognizing the instability of the German insurance industry, envisioned an independent reinsurance company.

- The initial capital was 3 million marks, with eight shareholders.

- Thieme emphasized independent risk selection and international diversification.

- Munich Re's early focus on mutually binding treaties set it apart.

The early focus on independent risk selection and international diversification helped Munich Re establish itself. The company's foundation was built on innovation and strategic partnerships. This approach allowed Munich Re to navigate the complexities of the German insurance market. For more information on how Munich Re has evolved its strategies, check out the Marketing Strategy of Munich Re.

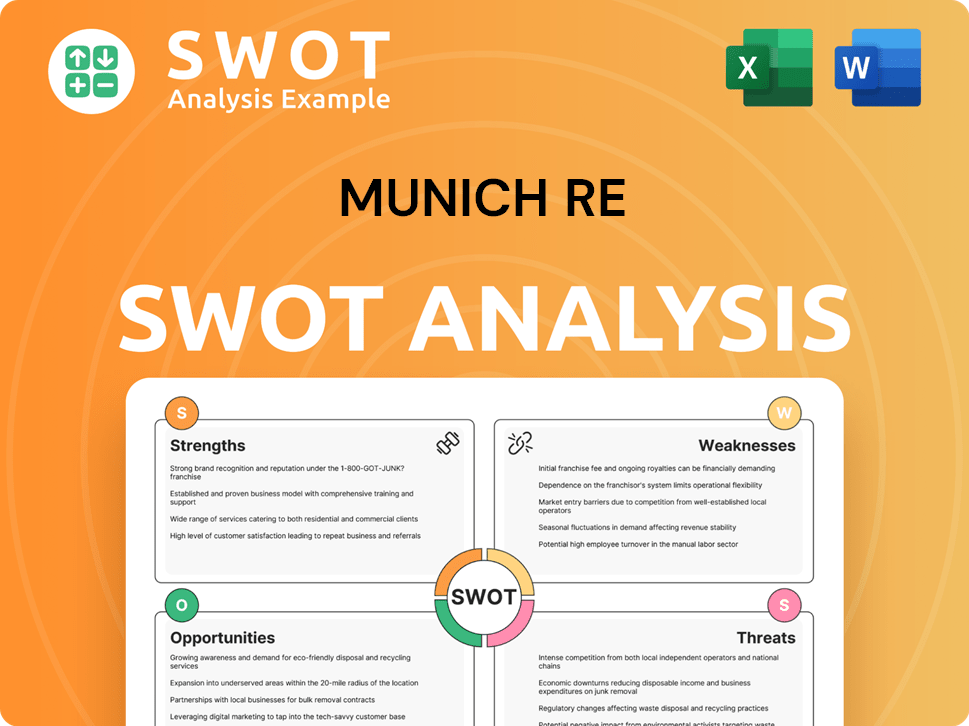

Munich Re SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Munich Re?

The early years of Munich Re were marked by rapid expansion and a strategic focus on internationalization. This growth was fueled by a vision to establish a global presence in the reinsurance market. The company quickly established itself as a leader in the German insurance sector and expanded its operations worldwide.

In its founding year, Munich Re opened offices in Hamburg and Vienna. It secured its first reinsurance treaty with a foreign insurance company, the Danish Almindelinge Brand-Assurance-Compagni of Copenhagen. By its third year, it was the leading reinsurer in Germany. The company's success was evident when its shares were first offered on the Munich stock exchange in March 1888.

By 1914, Munich Re's capital base had grown to approximately 20 million marks, allowing for a 40% dividend to shareholders. The company's turnover neared 177 million marks during the same period. The staff also grew significantly, increasing from five employees at its founding to 450 by 1914. This growth reflects the company's strong financial health and investor confidence.

A key aspect of Munich Re's early expansion was its entry into new markets, including the establishment of a London branch in 1890. The company successfully penetrated what was considered a challenging insurance market for foreign firms. This was followed by the founding of Munich Re's first U.S. operation in 1892. This strategic approach helped the company become a global leader.

Thieme's foresight in creating new classes of insurance, such as personal accident insurance, positioned Munich Re to secure reinsurance treaties. The company maintained its policy of remaining a reinsurer, helping establish new primary insurance operations. By 1913–1914, Munich Re was the undisputed global market leader among reinsurance companies, generating gross premium income of 204 million marks. For more insights, explore the Competitors Landscape of Munich Re.

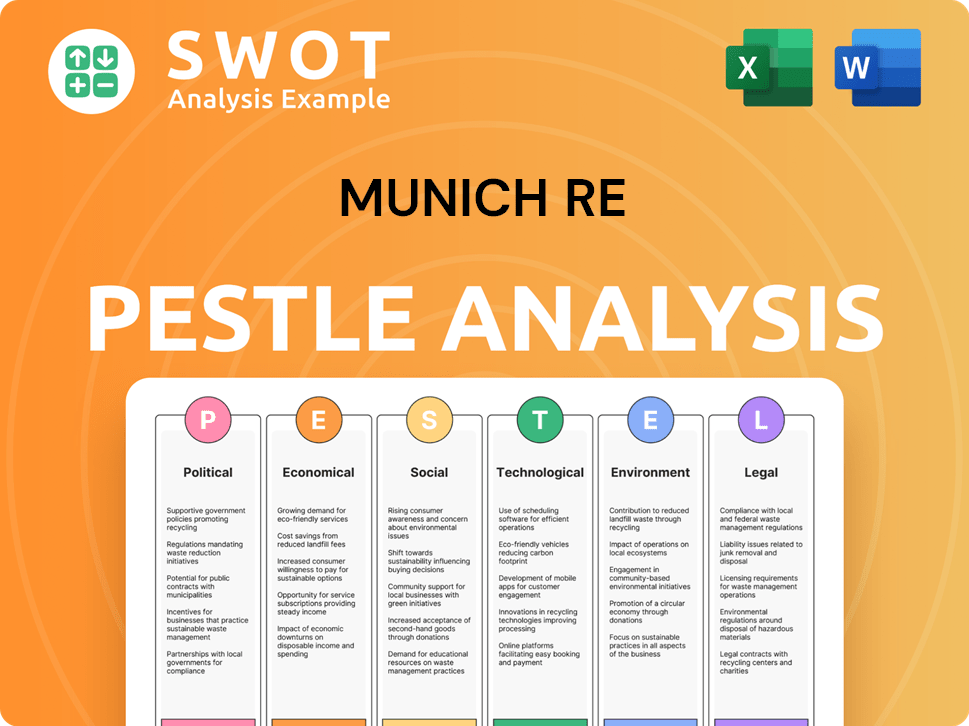

Munich Re PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Munich Re history?

The Munich Re history is a testament to its resilience and innovation within the reinsurance and insurance sectors. From its early beginnings to its current status as a global leader, the company has navigated numerous challenges and seized opportunities. A key element of the Munich Re company's success has been its ability to adapt and evolve, ensuring its continued relevance in a dynamic market.

| Year | Milestone |

|---|---|

| 1906 | Munich Re paid all claims after the San Francisco earthquake, demonstrating its financial strength. |

| 1898 | The company pioneered new insurance forms, including machinery insurance. |

| 1899 | Munich Re began offering natural hazard coverage, such as for storms and flooding. |

| 2009 | Munich Re unified its operations under a single brand, streamlining its structure. |

| 2012 | The company provided serial loss cover for offshore wind turbines. |

| 2014 | Munich Re offered insurance for commercial satellite operators covering their entire service life. |

Throughout its history, Munich Re has been at the forefront of insurance innovation. It has consistently introduced new products and services to meet evolving risks, demonstrating a proactive approach to the market. This commitment to innovation has solidified its position as a leader in the German insurance industry and beyond.

Around 1898, Munich Re introduced machinery insurance, a pioneering move that expanded the scope of insurable risks. This was a significant step in providing coverage for industrial assets.

In 1899, the company started offering coverage for natural hazards like storms and flooding, which were previously considered uninsurable. This expanded the scope of their offerings.

The company introduced luggage insurance into central Europe. This targeted a specific niche market, demonstrating its ability to adapt to the changing needs of its customers.

In 2012, Munich Re provided serial loss cover for offshore wind turbines. This insurance product was designed to address the specific risks associated with renewable energy infrastructure.

In 2014, Munich Re began offering insurance for commercial satellite operators, covering their entire service life. This was a specialized product catering to the growing space industry.

In the 1970s, Munich Re established a Geoscience Research Group to analyze natural hazards. This demonstrated a proactive approach to risk management and understanding of potential risks.

The Munich Re company has faced numerous challenges throughout its history. These obstacles have tested its resilience and forced it to adapt to changing circumstances. The company's ability to overcome these challenges has been crucial to its long-term success.

The two World Wars presented significant challenges, including the loss of its U.S. business during World War I and operational restrictions after World War II. These events significantly impacted the company's global footprint.

During the Nazi era, Munich Re benefited from anti-Semitic persecution, acquiring Jewish properties below market rates. This period represents a dark chapter in the company's history.

In 2025, Munich Re is dealing with increased natural disaster losses, such as the Los Angeles wildfires in Q1 2025, resulting in around €1.1 billion in claims. These events continue to pose significant financial risks.

The escalating cyber risk landscape is another major challenge, with the global cyber insurance market expected to reach approximately $16.3 billion in gross premiums in 2025. Addressing this risk requires continuous innovation.

The company has addressed challenges through strategic restructuring and digital transformation. This includes streamlining operations and adapting to changing market conditions.

Munich Re's 'Ambition 2025' strategy emphasizes sustainability, including decarbonization targets. This reflects the company's commitment to addressing environmental challenges and adapting to the evolving risk landscape.

To understand more about the Munich Re's market position, consider exploring the Target Market of Munich Re.

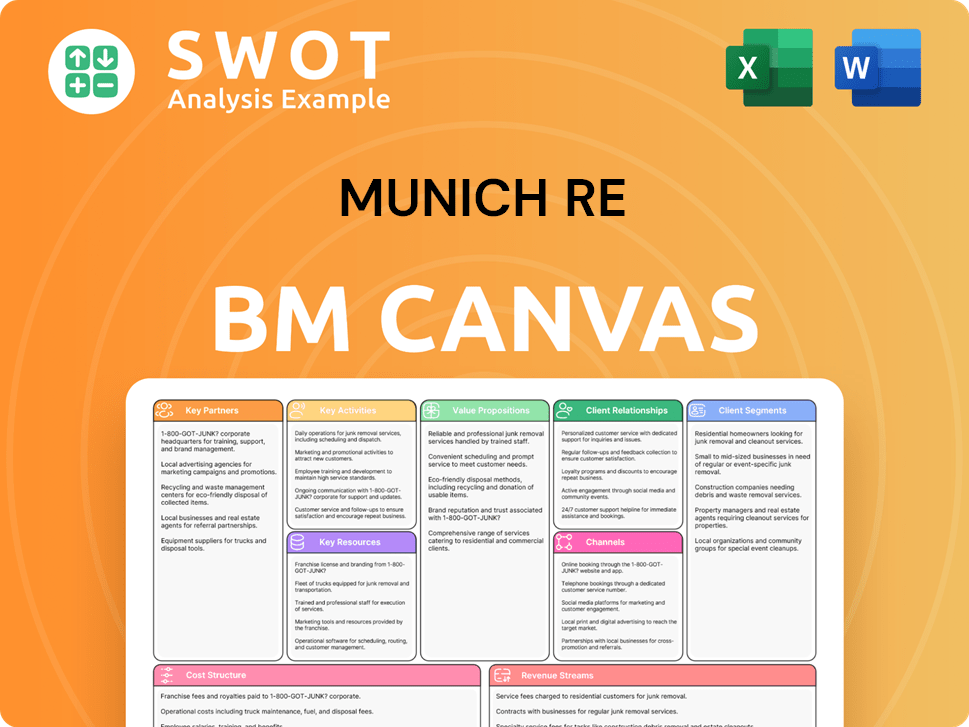

Munich Re Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Munich Re?

The Munich Re company boasts a rich history, marked by significant milestones that have shaped its position in the global insurance market. Founded in 1880 in Munich, Germany, the company quickly established itself as a key player in the reinsurance sector. Early successes included the introduction of machinery insurance in 1898 and navigating the aftermath of the San Francisco earthquake in 1906. Despite setbacks such as the loss of its U.S. business during World War I and operational restrictions after World War II, Munich Re persevered. The 1970s saw the establishment of the Geoscience Research Group, demonstrating a commitment to innovation. Over the years, Munich Re has expanded its global presence and adapted to changing market dynamics, including the launch of its 'Ambition 2025' strategy in 2020.

| Year | Key Event |

|---|---|

| 1880 | Münchener Rückversicherungs-Gesellschaft is founded in Munich, Germany. |

| 1888 | Munich Re shares are first offered on the Munich stock exchange. |

| 1892 | Establishment of Munich Re's first U.S. operation. |

| 1898 | Development of machinery insurance. |

| 1906 | Munich Re remains solvent after paying out claims from the San Francisco earthquake and fire. |

| 1917 | Total loss of U.S. business due to World War I. |

| 1945 | Munich Re is banned from operating abroad after World War II. |

| 1970s | Establishment of the Geoscience Research Group. |

| 2009 | Munich Re unites its outposts under the Munich Re brand. |

| 2012 | Becomes the first insurance group to provide serial loss cover for offshore wind turbines. |

| 2014 | Begins offering insurance for commercial satellite operators covering a satellite's whole service life. |

| 2020 | Launches 'Ambition 2025' strategy. |

| 2024 | Reports a net profit of €5.67 billion, surpassing its target for the fourth consecutive year. |

Munich Re's 'Ambition 2025' strategy focuses on 'Scale, Shape, and Succeed'. This includes organic growth in its core reinsurance business, particularly in favorable market conditions. The company also plans profitable expansion in its Risk Solutions operating field, including MR Specialty Insurance and HSB.

In life and health reinsurance, Munich Re aims to expand both traditional business and offerings for financial markets and longevity business. This strategic move is intended to capitalize on growing demand and opportunities within the sector.

ERGO, Munich Re's primary insurance arm, is set to enhance its market position in Germany and achieve profitable growth internationally, particularly in B2B and direct offers. The modernization of its IT infrastructure will support these goals.

Munich Re is actively addressing emerging industry trends such as the escalating cyber risk landscape, expecting the global cyber insurance market to reach approximately $16.3 billion in gross premiums in 2025. The company is also focused on climate change and natural disasters.

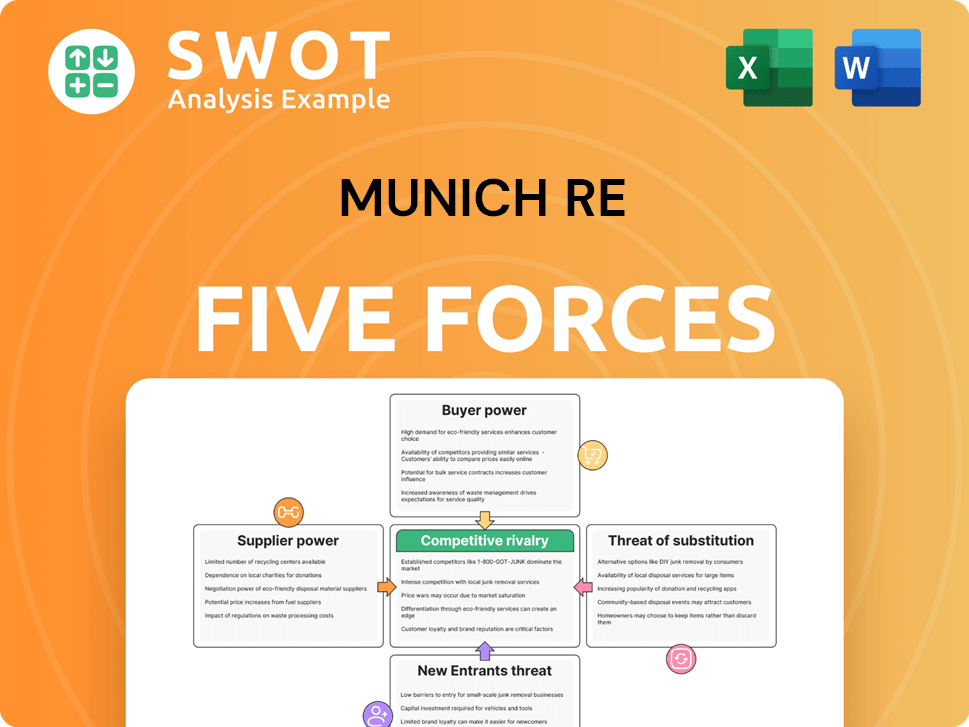

Munich Re Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Munich Re Company?

- What is Growth Strategy and Future Prospects of Munich Re Company?

- How Does Munich Re Company Work?

- What is Sales and Marketing Strategy of Munich Re Company?

- What is Brief History of Munich Re Company?

- Who Owns Munich Re Company?

- What is Customer Demographics and Target Market of Munich Re Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.