Munich Re Bundle

How Does Munich Re Thrive in a World of Risk?

Munich Re, a titan in the reinsurance industry, consistently delivers impressive financial results, including a €5.7 billion net result in 2024, exceeding expectations. This success highlights its critical role in safeguarding businesses and governments worldwide through expert risk management solutions. With a legacy stretching back to 1880, Munich Re has solidified its position as a global leader in the insurance sector.

The Munich Re SWOT Analysis can provide a deeper understanding of the company's strengths, weaknesses, opportunities, and threats. Its Q1 2025 net result of €1.1 billion, despite major losses, showcases the effectiveness of its diversified portfolio and risk management strategies. Understanding the Munich Re company's operations is crucial for anyone seeking to understand the broader insurance market, including its response to events like natural disasters and climate change.

What Are the Key Operations Driving Munich Re’s Success?

The Munich Re company operates primarily through two core segments: reinsurance and primary insurance (ERGO). In the reinsurance sector, Munich Re insurance provides a crucial layer of financial protection to other insurance companies. This involves assessing and managing risks across various sectors, including property-casualty, life, and health.

Munich Re's value proposition centers on its deep risk expertise, financial strength, and global diversification. The company's solvency ratio was at 285% in Q1 2025, significantly above its optimal range, highlighting its robust financial capacity. Its global presence allows it to spread risks across different regions and lines of business, helping to mitigate the impact of localized events.

The company also operates ERGO, its primary insurance business, which directly serves retail and corporate clients with a range of insurance products. This dual approach allows Munich Re to capture value across the insurance value chain and enhance its operational effectiveness through continuous innovation.

Munich Re assesses risks for other insurance companies, offering financial protection against large losses. This includes sophisticated risk assessment, pricing, and portfolio management. It enables direct insurers to underwrite policies they might otherwise deem too risky.

ERGO, Munich Re's primary insurance business, directly serves retail and corporate clients. It offers a range of insurance products, allowing Munich Re to capture value across the insurance value chain. This dual approach strengthens the company's market position.

Munich Re uses extensive data analysis and actuarial science to evaluate complex risks. This includes natural catastrophes, cyber threats, and longevity trends. The company's global network of experts is crucial for assessing and managing these risks effectively.

Munich Re's financial strength is demonstrated by its high solvency ratio, ensuring its ability to absorb significant claims. Its global reach diversifies risks across different geographies and lines of business. This diversification helps mitigate the impact of localized events.

Munich Re's 'Ambition 2025' strategy focuses on developing new business models across the entire value chain. This includes developing covers for new risks such as rocket launches, renewable energies, cyber risks, and artificial intelligence. The company aims to develop new business models that span the entire value chain.

- Focus on innovation and scalability in insurance.

- Development of insurance solutions for emerging risks.

- Expansion of services across the entire insurance value chain.

- Continuous scrutiny of insurance innovations.

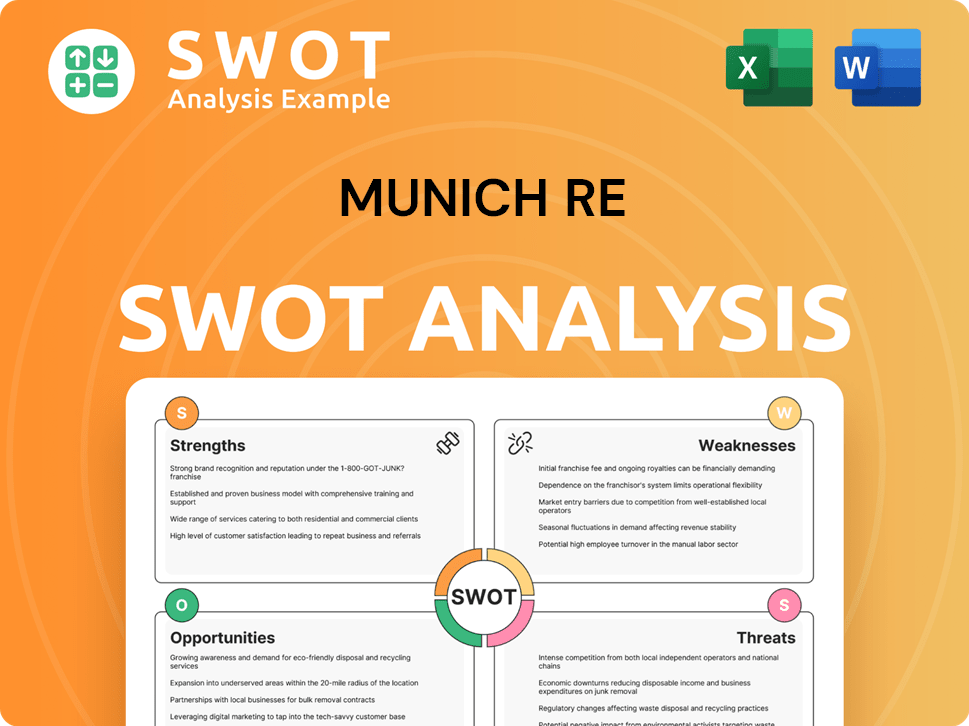

Munich Re SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Munich Re Make Money?

The Munich Re company generates significant revenue through a diversified set of streams, primarily focused on reinsurance and primary insurance operations. These core activities are further supported by substantial investment income, contributing to its overall financial strength. In 2024, the company's total insurance revenue from insurance contracts issued reached €60.83 billion, highlighting its robust market presence and operational efficiency.

The company's financial success is rooted in its ability to accurately assess and manage risk, a core element of its business model. This expertise allows it to offer competitive pricing and terms, adapting to changing market dynamics and loss trends. This approach is crucial in maintaining profitability and driving shareholder value.

The Munich Re insurance business model is built on several key revenue streams, each contributing significantly to its overall financial performance. These streams are strategically managed to ensure a balanced and resilient financial profile. The company's ability to navigate market fluctuations and maintain profitability is a testament to its strong risk management practices.

The primary revenue streams for Munich Re include reinsurance, primary insurance (through ERGO), and investment results, each playing a critical role in the company's financial performance. The reinsurance segment remains the largest contributor, with primary insurance and investment results providing substantial support. Understanding these streams is key to assessing the Munich Re financial performance.

- Reinsurance: This segment is the largest revenue generator for Munich Re. In 2024, the reinsurance business contributed €4.88 billion to the net result, exceeding its target. Insurance revenue from insurance contracts issued in reinsurance reached €40.034 billion. Life and health reinsurance alone generated a strong result of €2.014 billion, surpassing its target of €1.45 billion. This highlights the importance of reinsurance in the Munich Re business model explained.

- Primary Insurance (ERGO): The ERGO business contributes significantly to the group's revenue. In 2024, ERGO posted a net result of €791 million, meeting its profit target. Insurance revenue from insurance contracts issued for ERGO increased to €20.796 billion in 2024.

- Investment Result: The investment portfolio is a crucial component of Munich Re's profitability. The investment result surged to €7.19 billion in 2024, up from €5.37 billion in 2023. In Q1 2025, regular income from investments increased to €2.1 billion.

The monetization strategies of Munich Re center on precise risk assessment and management, leveraging extensive data and expertise. The company continuously adjusts pricing and terms to reflect market conditions and loss trends. For example, in July 2024, prices across its portfolio saw a slight increase of 0.6%. Furthermore, the 'Ambition 2025' strategy focuses on expanding traditional business and offerings, including longevity business in life and health, and exploring organic growth opportunities in reinsurance, particularly in specialty insurance. This includes share buy-back programs, such as the new €2 billion program announced for 2025-2026, to enhance shareholder value. To gain a broader perspective, consider the Competitors Landscape of Munich Re.

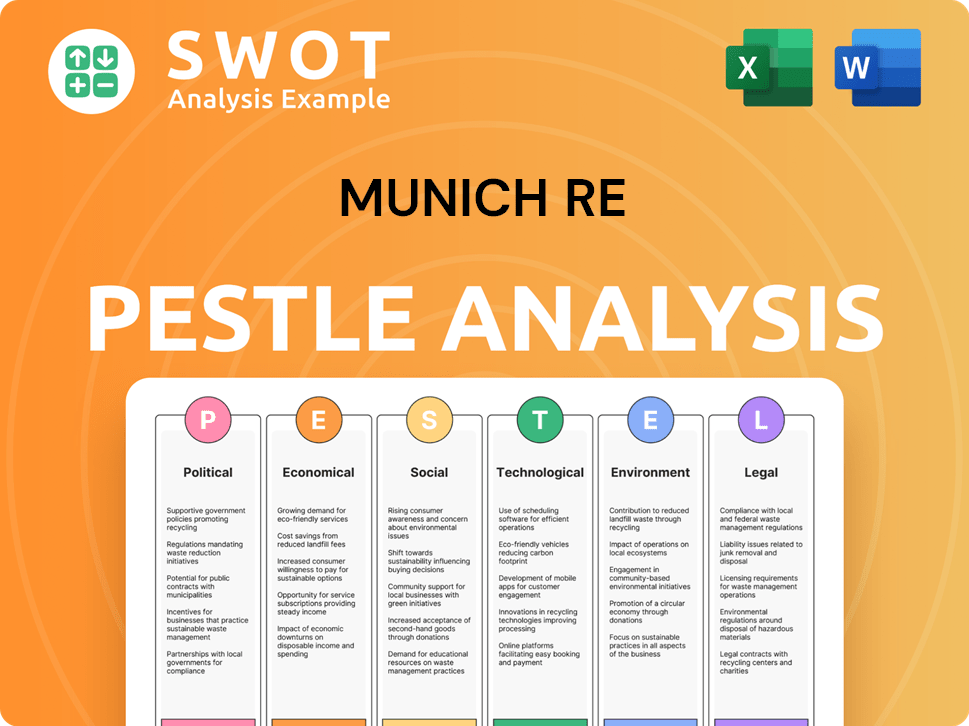

Munich Re PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Munich Re’s Business Model?

The operational and financial journey of the Munich Re company has been marked by key milestones and strategic shifts. A central element of its recent strategy is 'Ambition 2025,' a five-year program launched in 2020, which focuses on 'scale, shape, and succeed.' This plan aims to enhance the company's financial performance and sustainability efforts.

Munich Re's resilience is evident in its ability to navigate operational and market challenges. Despite facing significant losses from natural catastrophes, such as the Los Angeles wildfires in January 2025 (approximately €1.1 billion) and Hurricane Helene in 2024 (€500 million), the company has maintained strong profitability. Its robust financial position, with a solvency ratio of 287% at the end of 2024, underscores its capacity to absorb such impacts.

Munich Re's competitive advantages are diverse, rooted in its brand strength, technological leadership, and financial stability. The company's approach to emerging risks, such as cyber threats and climate change, further distinguishes it in the market. This proactive stance, coupled with its commitment to sustainability, positions it well for future growth. For a deeper dive into how Munich Re is evolving, consider reading about the Growth Strategy of Munich Re.

Founded in 1880, Munich Re has a long history in the reinsurance industry. The 'Ambition 2025' strategy, launched in 2020, is a critical milestone, focusing on growth and sustainability. The company consistently surpasses its annual profit guidance, reflecting effective strategic execution.

A key strategic move is the 'Ambition 2025' program, targeting a return on equity (RoE) of 12-14% by 2025. Munich Re actively develops insurance covers for new risks, such as rocket launches and artificial intelligence. The company is also expanding its focus on sustainability and decarbonization.

Munich Re's competitive edge stems from its risk-related expertise and sound financial position. Economies of scale, derived from its global operations, allow for efficient risk spreading. The company's proactive approach to emerging risks, including cyber and climate change, is a key differentiator.

The company's solvency ratio of 287% at the end of 2024 demonstrates its financial strength. Munich Re has consistently exceeded its annual profit guidance. The focus on increasing earnings per share and dividend per share by more than 5% annually is a key financial goal.

Munich Re distinguishes itself through a combination of factors, including its long-standing expertise in the reinsurance industry and a strong financial foundation. The company's ability to adapt to new and emerging risks, such as cyber threats and climate change, is a key differentiator. Its commitment to sustainability, including a decarbonization strategy, reflects a proactive approach to global trends.

- Unrivalled risk-related expertise.

- Global operations and diversified portfolio.

- Proactive approach to emerging risks.

- Commitment to sustainability and decarbonization.

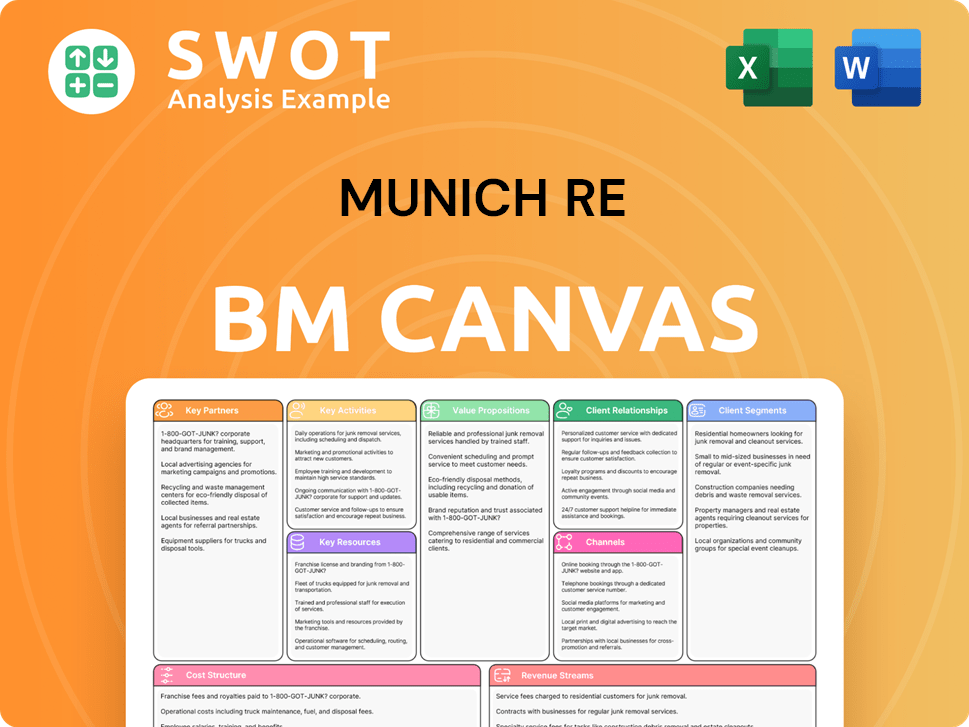

Munich Re Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Munich Re Positioning Itself for Continued Success?

Munich Re, a prominent player in the global reinsurance market, holds a strong industry position. Its expertise in risk management and robust financial standing are key strengths. The company has consistently surpassed profit targets, achieving a net result of €5.7 billion in 2024, demonstrating its competitive edge. Customer loyalty is fostered through comprehensive risk solutions, and its global reach extends across various continents, serving a diverse clientele.

Despite its advantageous position, Munich Re faces several significant risks and challenges. Natural catastrophes continue to pose a considerable threat, with losses from such events totaling €2.644 billion in 2024. Geopolitical risks, economic uncertainties, and regulatory changes also present ongoing considerations. Furthermore, technological disruption, particularly in the cyber insurance market, adds to the complexity of its operating environment. The evolving cyber insurance market, projected to reach USD 16.3 billion in 2025, offers both opportunities and challenges for the company.

Munich Re's leading position in the reinsurance market is supported by its extensive risk expertise and strong financial health. The company's ability to provide substantial capacity for complex risks and its global reach contribute to its market leadership. The company serves insurers, corporations, and public entities globally.

Natural catastrophes, geopolitical risks, and economic uncertainties are key challenges. Regulatory changes, competition, and technological disruption, especially in cyber insurance, also pose risks. The impact of natural disasters, such as the losses of €2.644 billion in 2024, highlights the vulnerability to external events.

Munich Re aims for a net result of €6 billion in 2025, driven by advantageous business opportunities. Strategic initiatives include organic growth in reinsurance, expansion in life and health, and enhancing shareholder value. The company is also focused on decarbonization across its investment portfolio and insurance business.

The company plans to increase dividends, with a proposed dividend of €20 per share for 2024, and a new €2 billion share buy-back program. Munich Re is committed to reaching net-zero emissions by 2050. These strategic moves are designed to sustain and expand profitability in a changing global landscape.

Munich Re's future strategy centers on sustained organic growth, particularly in reinsurance and life and health sectors. The company is focused on enhancing shareholder value through increased dividends and share buy-back programs. Furthermore, Munich Re is actively pursuing decarbonization efforts across its business operations.

- Expansion in Global Specialty Insurance and life and health offerings.

- Proposed dividend of €20 per share for 2024.

- New €2 billion share buy-back program.

- Commitment to net-zero emissions by 2050.

For more in-depth information on the company's ownership structure and financial performance, you can explore the details in this article about Owners & Shareholders of Munich Re.

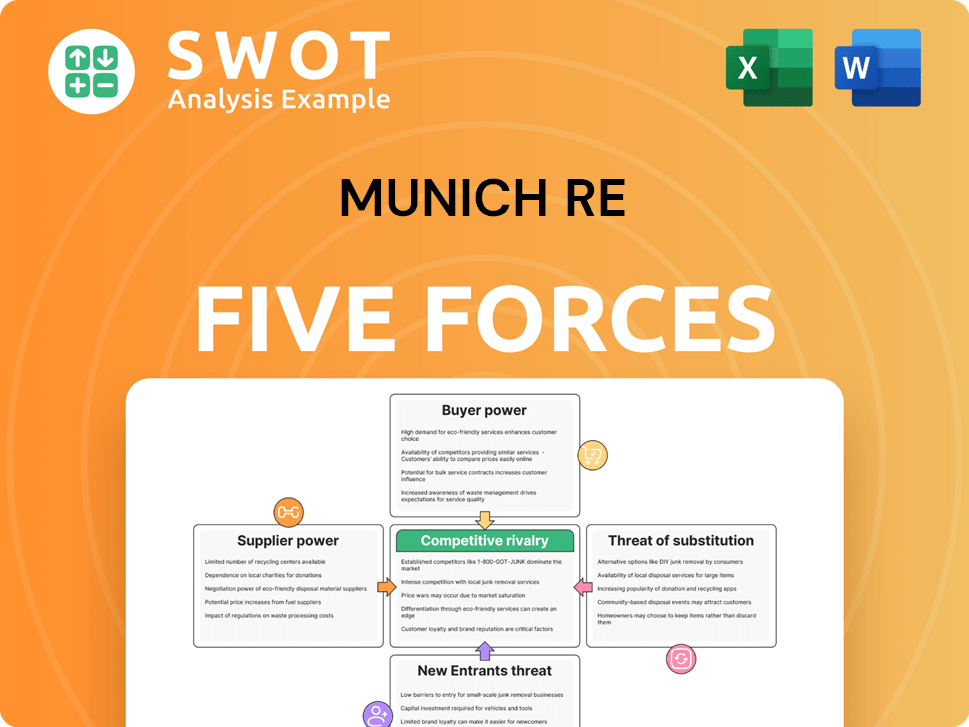

Munich Re Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Munich Re Company?

- What is Competitive Landscape of Munich Re Company?

- What is Growth Strategy and Future Prospects of Munich Re Company?

- What is Sales and Marketing Strategy of Munich Re Company?

- What is Brief History of Munich Re Company?

- Who Owns Munich Re Company?

- What is Customer Demographics and Target Market of Munich Re Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.