Munich Re Bundle

How Does Munich Re Dominate the Reinsurance Arena?

The reinsurance industry is a high-stakes game, constantly reshaped by global events and technological advancements. Munich Re, a venerable giant in this sector, has consistently demonstrated its ability to thrive. But in a market brimming with competition, how does this 145-year-old company maintain its edge and what does the Munich Re SWOT Analysis reveal about its standing?

Understanding the Munich Re SWOT Analysis is crucial for grasping its position within the Munich Re competitive landscape. This analysis will delve into Munich Re competitors, offering a detailed Munich Re market analysis to identify its strengths, weaknesses, opportunities, and threats. We'll explore its financial performance compared to rivals, its strategic partnerships, and its innovative approaches to risk management in the ever-evolving reinsurance industry and insurance market.

Where Does Munich Re’ Stand in the Current Market?

Munich Re's core operations revolve around its position in the global reinsurance industry, consistently ranking among the largest players. The company offers a broad spectrum of services, including property-casualty, life and health reinsurance, and risk management solutions. Its value proposition lies in providing financial stability and risk transfer mechanisms to insurers, corporations, and public entities worldwide.

Munich Re's financial strength is a key aspect of its competitive standing. In 2024, the company reported a net result of €5.7 billion, with insurance revenue from insurance contracts issued of €60.8 billion. This financial performance, coupled with its robust solvency ratio, underscores its ability to fulfill its commitments and maintain a strong market presence.

The company's competitive advantage is also bolstered by its global reach, serving clients in over 50 countries. This extensive network allows Munich Re to diversify its risk portfolio and capitalize on opportunities in various markets. Munich Re's commitment to innovation and sustainability further enhances its market position, ensuring it remains relevant in a rapidly evolving insurance market.

Munich Re has consistently held a leading position in the global reinsurance industry. It is one of the largest reinsurers worldwide by gross premiums written since 2010, with the exception of 2017. This consistent performance highlights its strong market share and influence.

In 2024, Munich Re achieved a net result of €5.7 billion and insurance revenue of €60.8 billion. The company's return on equity (RoE) for 2024 was 18.2%, a significant increase from the prior year. These figures demonstrate Munich Re's financial health and profitability.

Munich Re is strategically expanding its Global Specialty Insurance (GSI) division. The company aims for GSI to account for 30% of overall property and casualty reinsurance gross premiums written by year-end 2025. This expansion is a key part of its growth strategy.

For 2025, Munich Re targets an IFRS net profit of €6 billion and group insurance revenue of €64 billion. The company anticipates insurance revenue growth to €42 billion in the reinsurance sector. These goals reflect Munich Re's confidence in its continued success.

Munich Re's strong market position is supported by its financial stability, global presence, and strategic initiatives. Its diversified earnings profile and robust solvency ratio are key competitive advantages. Brief History of Munich Re provides insights into the company's evolution and growth.

- Financial Strength: High solvency ratio of 287% as of December 31, 2024.

- Global Reach: Operations in over 50 countries, serving diverse clients.

- Strategic Focus: Expansion of the Global Specialty Insurance (GSI) division.

- Profitability: Targeting €6 billion in IFRS net profit for 2025.

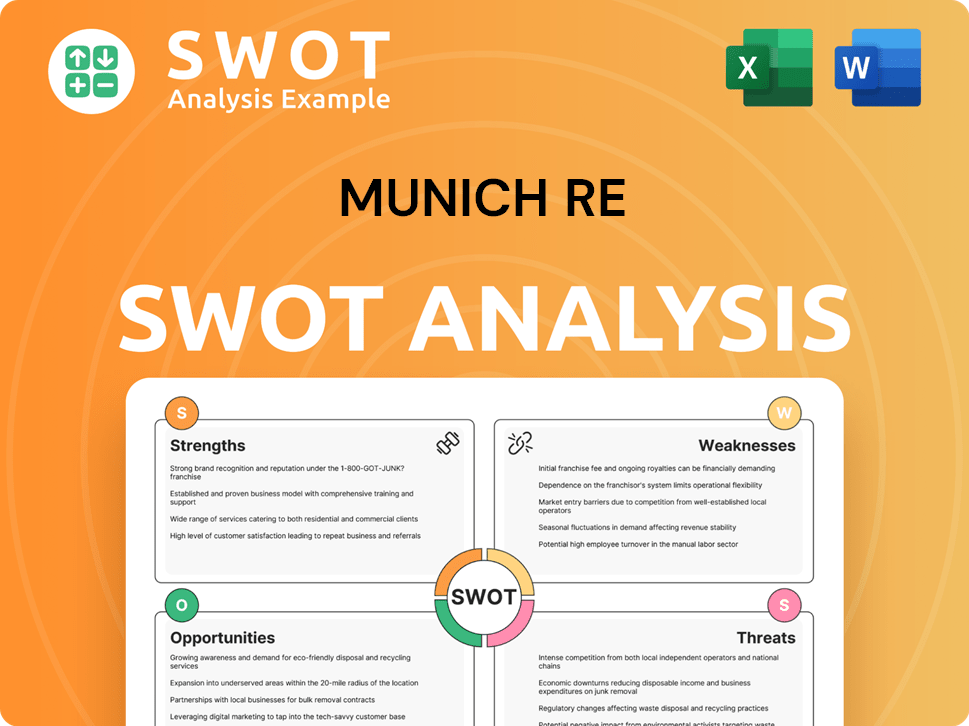

Munich Re SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Munich Re?

The Munich Re competitive landscape is primarily shaped by a few major players in the global reinsurance market. This landscape includes direct competitors like Swiss Re, Hannover Re, and SCOR. These companies compete across a broad spectrum of reinsurance products, including property-casualty and life and health segments.

The reinsurance industry is dynamic, and the competitive environment is influenced by market conditions and emerging trends. For instance, the market has experienced a 'hard market' phase, which has created favorable pricing conditions. Munich Re market analysis shows that the company is leveraging these conditions to achieve substantial growth.

Innovation and the ability to adapt to new risks are also key factors in the competitive landscape. The emergence of new risks, such as cyber risks and those related to renewable energies, presents both challenges and opportunities for reinsurers. Munich Re's position in the global reinsurance market is constantly evolving as it navigates these complexities.

Munich Re competitors include Swiss Re, Hannover Re, and SCOR. These companies are the main rivals in the reinsurance industry. They offer a wide range of reinsurance products globally.

The reinsurance market is subject to cyclical changes, such as 'hard market' phases. These phases influence pricing and profitability. Munich Re's financial performance compared to rivals is often tied to its ability to capitalize on these market dynamics.

Reinsurers are increasingly focused on new and complex risks, like cyber risks. The cyber insurance market is projected to reach approximately $16.3 billion in gross premiums by 2025. Munich Re's innovation in the insurance sector involves developing solutions for these emerging risks.

Competitive advantages of Munich Re include its ability to leverage favorable market conditions and its focus on innovation. The company's global presence and diverse product offerings also contribute to its competitive edge. How Munich Re compares to Swiss Re often involves assessing their responses to market changes.

Mergers and alliances can reshape the competitive landscape. Expanding data volumes and new business models are opening new avenues in risk assessment. Companies are also addressing climate change risks, which is a key consideration in the reinsurance industry.

The insurance market is constantly evolving, with new players and technologies emerging. Munich Re's challenges and opportunities involve adapting to these changes and maintaining its market position. The company's strategic initiatives will be crucial for its long-term success.

Understanding Munich Re's key strengths and weaknesses is essential for a thorough Munich Re market analysis. The company's strengths often include its strong capital base, global reach, and expertise in risk management. Weaknesses might include exposure to large-scale natural disasters and the cyclical nature of the reinsurance market.

- Strong Capital Base: Munich Re typically has a robust financial position, enabling it to absorb large losses and maintain its solvency.

- Global Reach: Munich Re operates worldwide, providing diversification and access to various markets.

- Risk Management Expertise: The company has a long history of managing complex risks, which is critical in the reinsurance industry.

- Exposure to Natural Disasters: A significant weakness is the potential for large losses from natural catastrophes, which can impact financial performance.

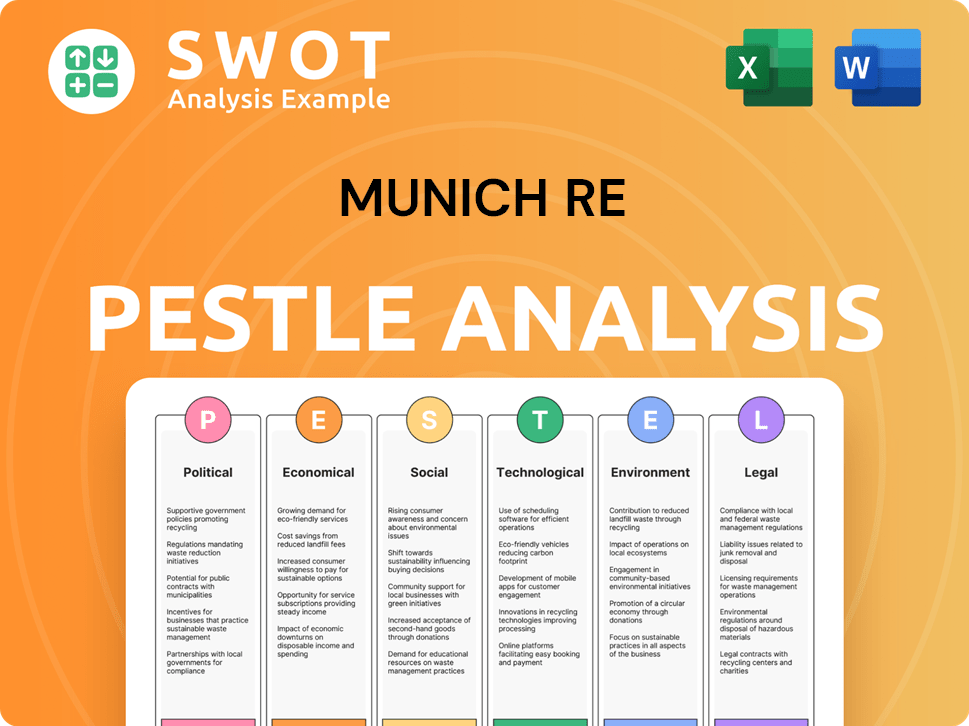

Munich Re PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Munich Re a Competitive Edge Over Its Rivals?

The Target Market of Munich Re is shaped by its significant competitive advantages, which are rooted in its deep expertise, financial strength, and strategic adaptability. These elements are critical in navigating the complexities of the global risk landscape. Munich Re's ability to provide tailored solutions for evolving risks, coupled with its robust financial position, positions it strongly within the reinsurance industry and the broader insurance market.

Munich Re's strategic moves and competitive edge are further enhanced by its diversified business portfolio and technological innovations. The company's focus on transferring institutional knowledge and leveraging advancements in information technology helps drive down expenses and improve operational metrics. This approach allows Munich Re to maintain a competitive advantage in a dynamic market, ensuring its continued success and resilience.

Munich Re's competitive advantages are crucial for its position in the reinsurance industry. The company's financial strength, with a solvency ratio of 287% as of December 31, 2024, provides a significant buffer against economic downturns and major catastrophic events. This financial stability is a key differentiator, enabling Munich Re to offer reliable financial protection and maintain its market leadership.

Munich Re excels in risk-related expertise, offering tailored solutions for complex risks. This includes developing covers for new areas like rocket launches and cyber risks. This deep understanding allows the company to stay ahead in the reinsurance industry and provide innovative insurance solutions.

The company's financial solidity is a major advantage, with a solvency ratio of 287% as of December 31, 2024. This strong financial position allows Munich Re to manage large losses and navigate market fluctuations effectively. Its resilience is a key factor in the insurance market.

Munich Re's diversified portfolio, including reinsurance, primary insurance (ERGO), and asset management, reduces its dependence on cyclical businesses. This diversification enhances its ability to withstand significant natural catastrophes and market volatility. This is a key element of its market analysis.

Munich Re leverages innovative technology to drive down expenses and improve operational metrics. The new AI-driven feature, REALYTIX ZERO CoPilot, automates product design, providing a competitive advantage. This focus on technology supports clients' digital transformation.

Munich Re's competitive advantages include its deep risk expertise, strong financial position, and diversified business model. These strengths enable the company to provide reliable financial protection and adapt to changing market conditions. The company's focus on innovation and sustainability further strengthens its position in the global reinsurance market.

- Unrivalled risk-related expertise and profound risk knowledge.

- Strong balance sheet and capital position, with a solvency ratio of 287% as of December 31, 2024.

- Highly diversified business portfolio, including reinsurance, primary insurance, and asset management.

- Innovative technology, such as REALYTIX ZERO CoPilot, to drive down expenses and improve operational metrics.

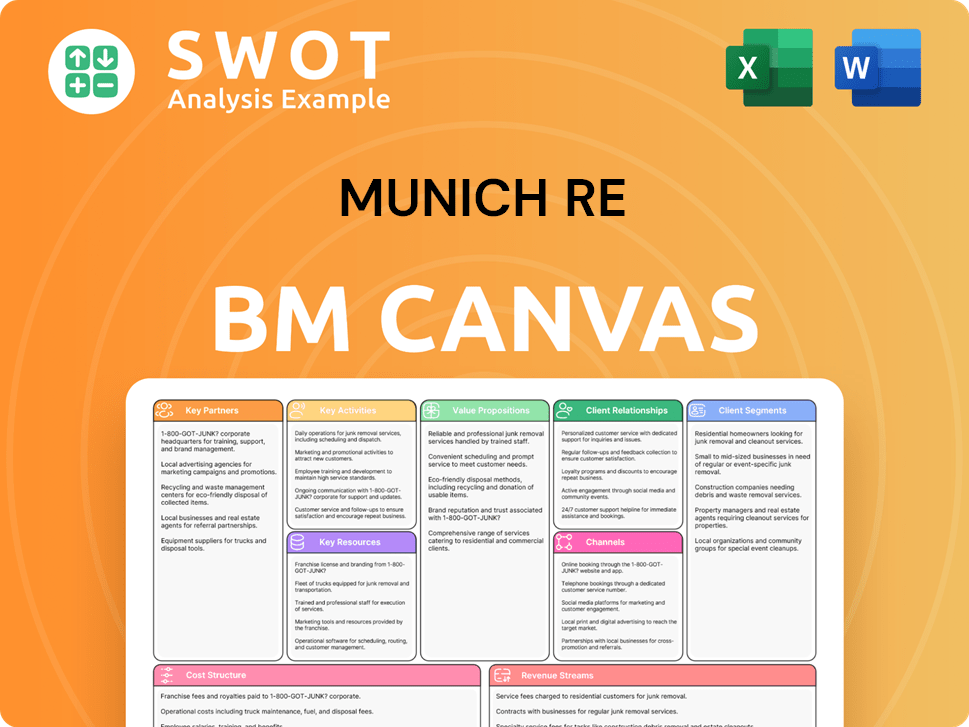

Munich Re Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Munich Re’s Competitive Landscape?

The reinsurance industry is experiencing significant shifts, with technological advancements, regulatory changes, and environmental factors reshaping the Munich Re competitive landscape. As a global leader in the reinsurance industry, Munich Re faces both challenges and opportunities in this dynamic environment. Understanding these trends is crucial for evaluating Munich Re's strategic positioning and future prospects.

Munich Re's market analysis reveals a focus on adapting to evolving risks, including climate change and cyber threats. The company's ability to navigate geopolitical and macroeconomic uncertainties, along with a commitment to sustainable practices, will be key to its long-term success. Munich Re's strategic initiatives aim to capitalize on growth opportunities while mitigating potential risks in the insurance market.

Technological advancements, particularly in AI, are transforming the reinsurance industry, improving risk assessment and pricing. Climate change drives increased insured losses, presenting both challenges and opportunities for risk management. The cyber insurance market is expanding, with projected gross premiums of approximately $16.3 billion in 2025, highlighting a key growth area.

Geopolitical and macroeconomic uncertainties, including inflation and interest rate fluctuations, can lead to market volatility. Stricter regulatory oversight and reporting requirements demand proactive risk management strategies. Legal system abuse in the US and rising tariffs pose additional business risks for the industry.

Emerging markets in Asia-Pacific offer significant growth potential, increasing demand for reinsurance. Product innovations, such as new coverage concepts, and strategic partnerships can drive expansion. Munich Re aims for a net profit target of €6 billion in 2025, emphasizing profitable growth.

Munich Re is expanding in specialized areas like Global Specialty Insurance and Risk Solutions. The company is committed to decarbonization, aiming for a 25–29% reduction in net greenhouse gas emissions in its investment portfolio by 2025. Munich Re is also focused on enhancing its market position in Germany through ERGO.

Munich Re's competitive landscape is evolving through its Ambition 2025 strategy, focused on profitable growth and ambitious financial targets. The company is expanding in emerging markets and innovating with new product offerings. Munich Re is actively addressing climate change risks and integrating ESG considerations into its operations.

- Focus on profitable growth across all segments.

- Expansion in emerging markets like India and China.

- Development of new coverage concepts for complex risks.

- Commitment to reducing greenhouse gas emissions.

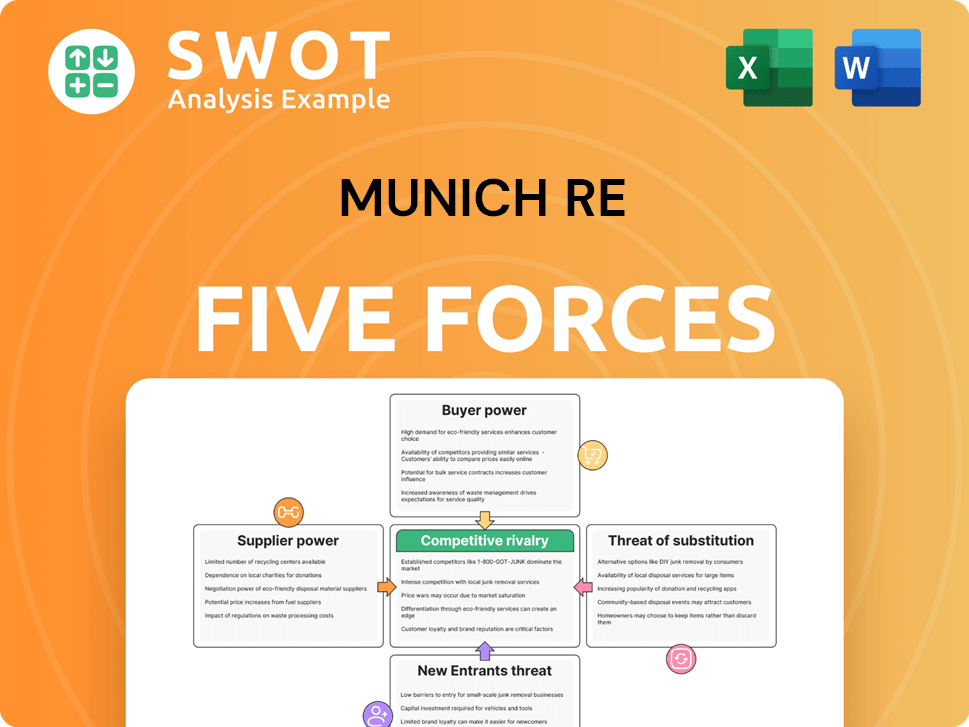

Munich Re Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Munich Re Company?

- What is Growth Strategy and Future Prospects of Munich Re Company?

- How Does Munich Re Company Work?

- What is Sales and Marketing Strategy of Munich Re Company?

- What is Brief History of Munich Re Company?

- Who Owns Munich Re Company?

- What is Customer Demographics and Target Market of Munich Re Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.