Myriad Bundle

What Secrets Does Myriad Genetics' Past Hold?

Founded in 1991 in Utah, Myriad Genetics, Inc. quickly became a trailblazer in genetic testing and precision medicine. Driven by the vision of Peter Meldrum and Dr. Mark Skolnick, the company aimed to unlock the mysteries of human diseases through genetic insights. A defining moment arrived with the sequencing of the BRCA1 and BRCA2 genes, revolutionizing hereditary cancer risk assessment.

This Myriad SWOT Analysis can provide a deeper understanding of the company's strategic positioning. Delving into the Myriad Company history reveals a journey marked by innovation and significant events. Understanding the Myriad company timeline and brief history Myriad is crucial for grasping its current market position and future potential, including its Myriad company background and Myriad company overview.

What is the Myriad Founding Story?

The story of the Myriad Company history began in 1991 in Salt Lake City, Utah. It was founded by Peter Meldrum and Dr. Mark Skolnick, who was a researcher from the University of Utah. They were joined by Nobel Laureate Walter Gilbert and Kevin Kimberlin. The company's formation was driven by the potential to apply advances in genetic research, specifically the identification of the BRCA1 gene linked to breast cancer, to create clinical diagnostic tests.

The initial business model focused on commercializing genomic testing, making it the first clinical laboratory to do so. This innovative approach set the stage for Myriad's future in the field of molecular diagnostics. The company's early years were marked by significant scientific breakthroughs and the development of proprietary technologies.

The early days of Myriad Company involved securing venture capital and strategic partnerships for initial funding. A major financial achievement was its Initial Public Offering (IPO) in 1995 on NASDAQ, which raised approximately $27 million. This funding was crucial for research and commercialization efforts. The founders' combined expertise in genetics, research, and business strategy was instrumental in establishing Myriad as a leader in the emerging field of molecular diagnostics.

Myriad's journey was marked by both successes and challenges. The company faced legal hurdles, including a landmark Supreme Court case related to its attempts to patent the BRCA1 and BRCA2 genes. This led to a strategic diversification of the company's offerings.

- 1991: Myriad Company was founded, marking the beginning of its journey in molecular diagnostics.

- 1995: The company went public with an IPO, raising crucial capital for research and commercialization.

- Early 2000s: Myriad faced legal challenges over gene patents, which influenced its strategic direction.

- Ongoing: The company continued to innovate and expand its testing services.

The Myriad Company background includes a focus on innovation and expansion. The company has continually evolved its business model to adapt to market changes and advancements in genetic technology. Myriad's evolution has been marked by significant events, including major acquisitions and technological advancements that have shaped its market position over time. For more details, you can read this article about Myriad (Myriad Company timeline) to understand its significant events.

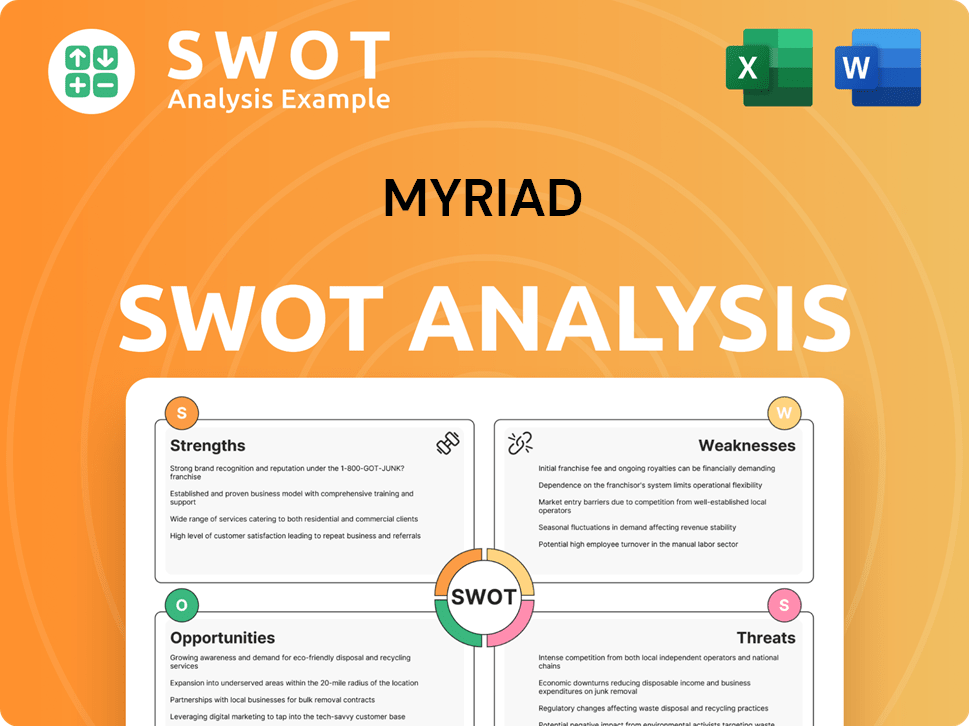

Myriad SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Myriad?

The early growth and expansion of the Myriad Company, a key part of its brief history, was marked by significant product launches and strategic acquisitions. The company's journey began with groundbreaking discoveries and a focus on establishing itself as a leader in genetic testing. This phase involved pivotal moments that shaped its market position and diversified its offerings. To understand the Myriad Company evolution, it's essential to examine these initial steps.

Between 1994 and 1996, the identification of the BRCA1 and BRCA2 genes was a critical event. This led to the launch of the BRACAnalysis test, which pioneered hereditary cancer risk assessment. This test was a significant milestone in the Myriad Company timeline, establishing its leadership in the market.

In 2016, the acquisition of Assurex Health for $351.6 million expanded Myriad's portfolio into pharmacogenomics with the GeneSight test. Further expansion occurred in 2018 with the acquisition of Counsyl for $375 million, broadening into women's health and reproductive screening. These acquisitions are key milestones in the Myriad company background.

Early customer acquisition strategies focused on establishing Myriad as the first clinical laboratory to commercialize genetic testing. The company also invested in improving its billing and reimbursement processes. Implementing systems like XiFin RPM in 2007 enhanced collections and efficiency. The Marketing Strategy of Myriad played a crucial role in this phase.

Myriad's revenue for the full year 2024 reached $838 million, reflecting an 11% increase from 2023, showcasing sustained growth. However, the company faced challenges, including pricing pressure and reimbursement uncertainties. Despite these challenges, the company's gross margin increased to 71.7% in Q4 2024, due to improved revenue per test trends and laboratory efficiencies.

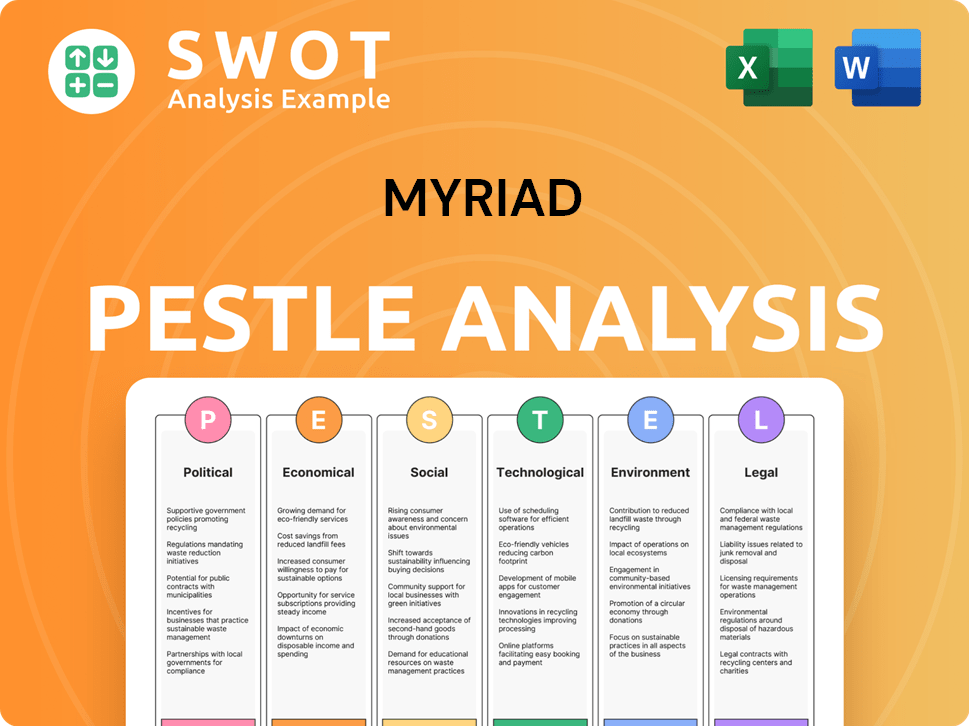

Myriad PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Myriad history?

The Myriad Company history is marked by significant milestones, starting with its pioneering work in genetic testing. The company's journey includes groundbreaking achievements in hereditary cancer testing and strategic expansions to meet market demands.

| Year | Milestone |

|---|---|

| 1994-1996 | Sequencing and commercialization of the BRACAnalysis test for hereditary breast and ovarian cancer risk, establishing a leadership position. |

| 2013 | U.S. Supreme Court ruling invalidated key gene patents, leading to increased competition. |

| 2024 | Granted three patents for foundational molecular residual disease (MRD) technology. |

| February 2025 | Secured two new patents related to automated MRD analysis and patient journey aspects of MRD. |

| February 2025 | Entered into a strategic collaboration with PATHOMIQ, licensing its AI technology platform for prostate cancer in the United States. |

| 2026 (Expected) | Commercial launch of the Precise MRD test, currently being evaluated in high-impact studies. |

Innovations have been central to the

The BRACAnalysis test was a foundational innovation, providing early insights into hereditary cancer risk. This test significantly impacted the field of genetic testing and patient care.

Precise MRD test monitors hundreds to thousands of tumor-specific variants, enhancing cancer detection and management. It is expected to launch commercially in 2026.

The collaboration with PATHOMIQ brings AI into oncology offerings, with a prostate cancer test expected by the end of 2025. This marks a significant advancement in diagnostic capabilities.

An expanded gene panel for the MyRisk Hereditary Cancer Test is expected to launch later in 2025. This will provide more comprehensive testing options.

Multiple patents related to MRD technology, including those for automated analysis, underscore its commitment to cutting-edge diagnostics. These patents support the company's leadership in this area.

The GeneSight test, despite facing reimbursement challenges, remains a key part of the company's portfolio. This highlights its commitment to personalized medicine.

The

The 2013 Supreme Court ruling invalidated key gene patents, increasing competition. This required Myriad to adapt and diversify its product offerings.

Discontinuation of coverage by UnitedHealthcare for multi-gene panel pharmacogenetic testing impacted revenue. This led to a 20% drop in Pharmacogenomics revenue in Q1 2025.

Increased competition in the genetic testing market has forced Myriad to innovate and expand its offerings. The company's response includes strategic partnerships and new product launches.

Despite challenges, Myriad reported a 7% increase in Q4 2024 revenue to $211 million. Q1 2025 revenue declined 3% year-over-year to $196 million, but increased by 5% excluding certain headwinds.

Myriad has adapted to challenges through strategic partnerships and a focus on operational efficiency. The collaboration with PATHOMIQ is a key example of this adaptation.

Focusing on operational efficiency has been crucial to Myriad's trajectory. This focus helps the company navigate financial and market challenges effectively.

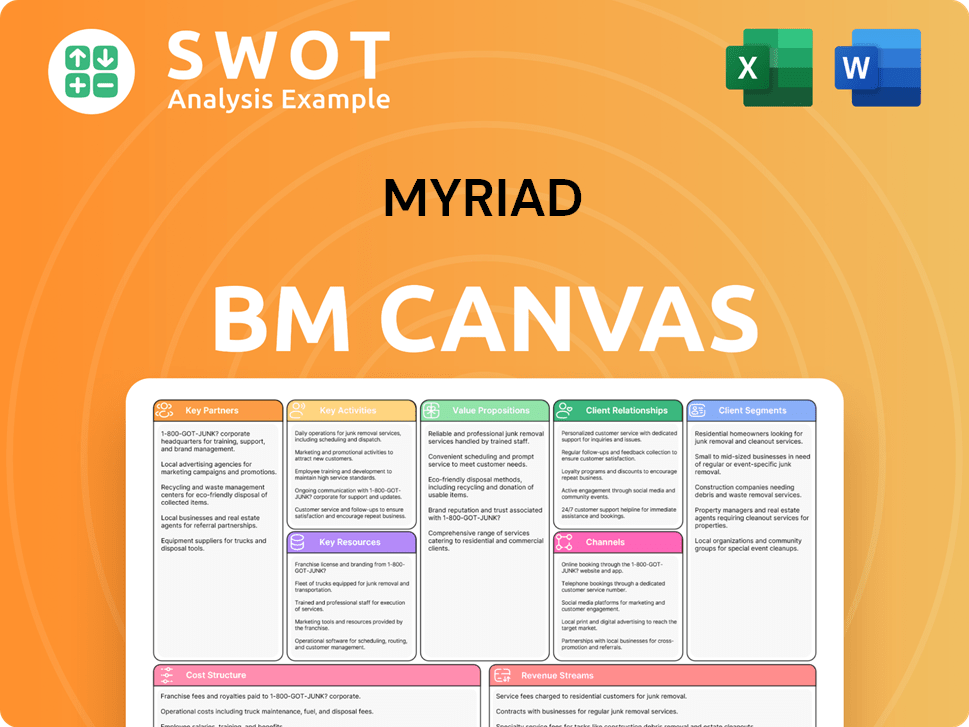

Myriad Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Myriad?

The Myriad Company history is marked by significant advancements in genetic testing and precision medicine. Founded in 1991, the company quickly became a pioneer in hereditary cancer risk assessment, launching its BRACAnalysis test in the mid-1990s. Over the years, it has expanded its offerings through strategic acquisitions and internal innovations, adapting to changes in the market and regulatory landscape. The company's evolution reflects its commitment to improving patient outcomes and advancing healthcare through genetic insights.

| Year | Key Event |

|---|---|

| 1991 | Myriad Genetics was founded in Salt Lake City, Utah. |

| 1994-1996 | The company identified the BRCA1/BRCA2 genes and launched the BRACAnalysis test, revolutionizing hereditary cancer risk testing. |

| 1995 | Myriad Genetics had its Initial Public Offering (IPO) on NASDAQ, raising approximately $27 million. |

| 2013 | The U.S. Supreme Court ruled on gene patents, which impacted the company's intellectual property. |

| 2016 | Myriad acquired Assurex Health, expanding into pharmacogenomics with the GeneSight test. |

| 2018 | The company acquired Counsyl, broadening its portfolio in women's health and reproductive screening. |

| 2020-2022 | Myriad underwent a strategic transformation and divested certain assets, focusing on core areas like Oncology, Women's Health, and Mental Health. |

| December 2023 | The Myriad Cancer Research Registry (MCRR) was launched to share data across germline and tumor testing results. |

| October 2024 | Myriad Genetics hosted an Investor Event to discuss its long-term growth strategy and product pipeline. |

| November 2024 | Myriad Genetics announced that Prequel Prenatal Screening could be performed starting at eight weeks into pregnancy. |

| December 2024 | Myriad's portfolio was elevated by updated NCCN Prostate Cancer Guidelines. |

| January 2025 | Myriad Genetics announced preliminary Q4 and full year 2024 financial results, projecting 2025 revenues between $840 million and $860 million. |

| January 2025 | The University of Texas MD Anderson Cancer Center and Myriad Genetics announced a five-year strategic alliance to advance Myriad's molecular residual disease (MRD) assay. |

| February 2025 | Myriad Genetics reported full-year 2024 revenue of $838 million, an 11% increase over 2023. |

| February 2025 | Myriad exclusively licensed PATHOMIQ's AI technology platform for prostate cancer in the United States. |

| February 2025 | Two new patents were granted for Myriad's tumor-informed, high-definition, molecular residual disease (MRD) assay. |

| May 2025 | Myriad Genetics reported a 3% decline in Q1 2025 revenue to $196 million, largely due to UnitedHealthcare's reduced coverage for GeneSight. |

Myriad plans to commercially launch its first AI-driven prostate cancer test, developed in partnership with PATHOMIQ, by the end of 2025. This represents a significant step towards incorporating advanced technology into its diagnostic offerings.

The Precise MRD test is expected to launch commercially in 2026. This assay is designed to detect minimal residual disease, which can help in the management of cancer treatment and monitoring for recurrence.

An expanded gene panel for the MyRisk Hereditary Cancer Test is planned for launch later in 2025. This expansion aims to provide more comprehensive genetic testing capabilities.

For 2025, Myriad initially projected revenues between $840 million and $860 million, with adjusted EPS ranging from $0.07 to $0.11. However, these expectations were updated in May 2025, with revenue projections lowered to $807-823 million and adjusted EPS to $(0.02)-$0.02.

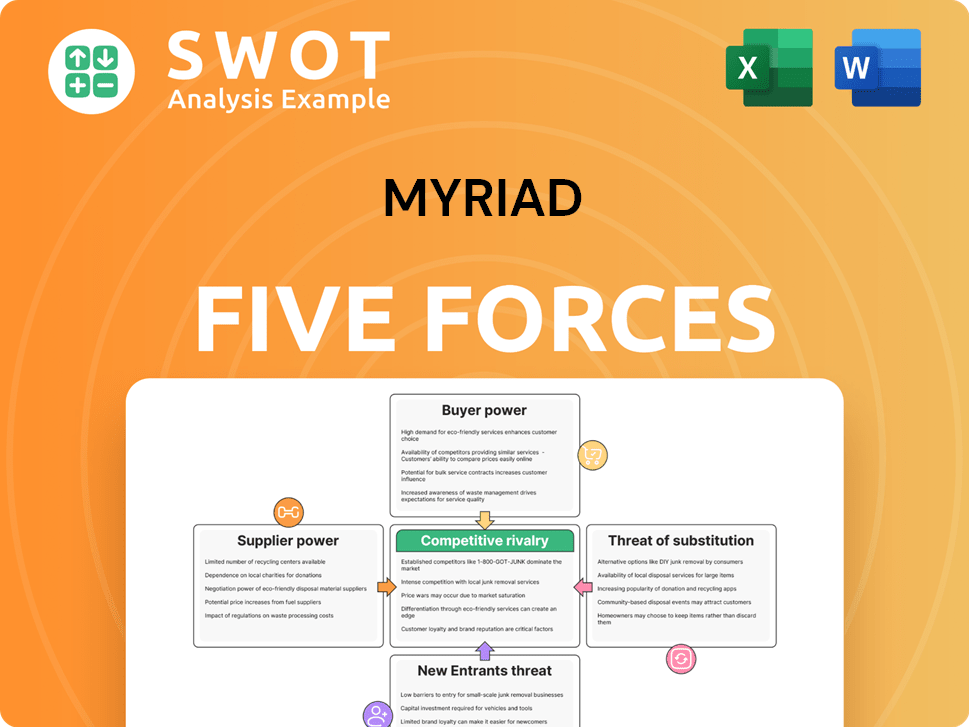

Myriad Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Myriad Company?

- What is Growth Strategy and Future Prospects of Myriad Company?

- How Does Myriad Company Work?

- What is Sales and Marketing Strategy of Myriad Company?

- What is Brief History of Myriad Company?

- Who Owns Myriad Company?

- What is Customer Demographics and Target Market of Myriad Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.