Myriad Bundle

Unraveling Myriad Company: How Does It Thrive?

Myriad Genetics, a leader in molecular diagnostics, is reshaping healthcare with its innovative genetic tests. Focusing on critical areas like cancer and women's health, Myriad Company empowers informed decisions for both individuals and healthcare providers. But how does this Myriad SWOT Analysis actually work, and what drives its impressive financial growth?

Understanding the Myriad business model is essential for anyone looking to invest in or understand the future of personalized medicine. This deep dive will explore the Myriad services, its cutting-edge Myriad technology, and the unique Myriad platform that powers its success. We'll dissect how Myriad Company generates revenue, its competitive advantages, and its impact on the industry, providing a comprehensive view of this dynamic company.

What Are the Key Operations Driving Myriad’s Success?

The core operations of the Myriad Company involve the development and provision of molecular diagnostic tests. These tests inform crucial healthcare decisions across oncology, women's health, and mental health. The Myriad business model centers on offering these services to a diverse customer base, including patients, healthcare providers, and pharmaceutical partners.

Myriad's value proposition lies in its ability to deliver highly sensitive and specific genetic insights. This is achieved through advanced technology, laboratory processing, and data analysis. The company's focus is on enabling earlier disease detection, personalized treatment strategies, and improved patient outcomes. The company is actively investing in research and development, with expenses increasing by 27.8% year-over-year in 2024.

Myriad's services include tests for cancer risk assessment, such as MyRisk Hereditary Cancer Test with RiskScore. They also provide tests to guide cancer treatment decisions, like Precise Tumor and myChoice CDx. In addition, they offer prenatal screening options, including Foresight and Prequel. Furthermore, the company provides the GeneSight test, which analyzes how genetic variations affect responses to depression and ADHD medications. To learn more about their growth strategy, check out the Growth Strategy of Myriad.

Myriad Company offers a range of diagnostic tests. These include tests for cancer risk assessment, cancer treatment guidance, and prenatal screening. The GeneSight test is also a key offering.

The company's operations involve sophisticated technology and lab processing. They maintain state-of-the-art facilities, like the one in Salt Lake City. Investments in research and development are ongoing, with a focus on new product development.

Myriad's services cater to patients, healthcare providers, and pharmaceutical partners. The company's offerings address diverse healthcare needs. This broad customer base supports the Myriad ecosystem.

Myriad's competitive advantage stems from its focus on genetic insights. The company holds numerous patents related to its tests. They are also exploring AI technology to enhance their oncology portfolio.

Myriad's services offer significant benefits to customers. They enable earlier disease detection and personalized treatment. This leads to improved patient outcomes and potentially lower healthcare costs.

- Earlier Disease Detection

- Personalized Treatment Strategies

- Improved Patient Outcomes

- Potential Cost Savings

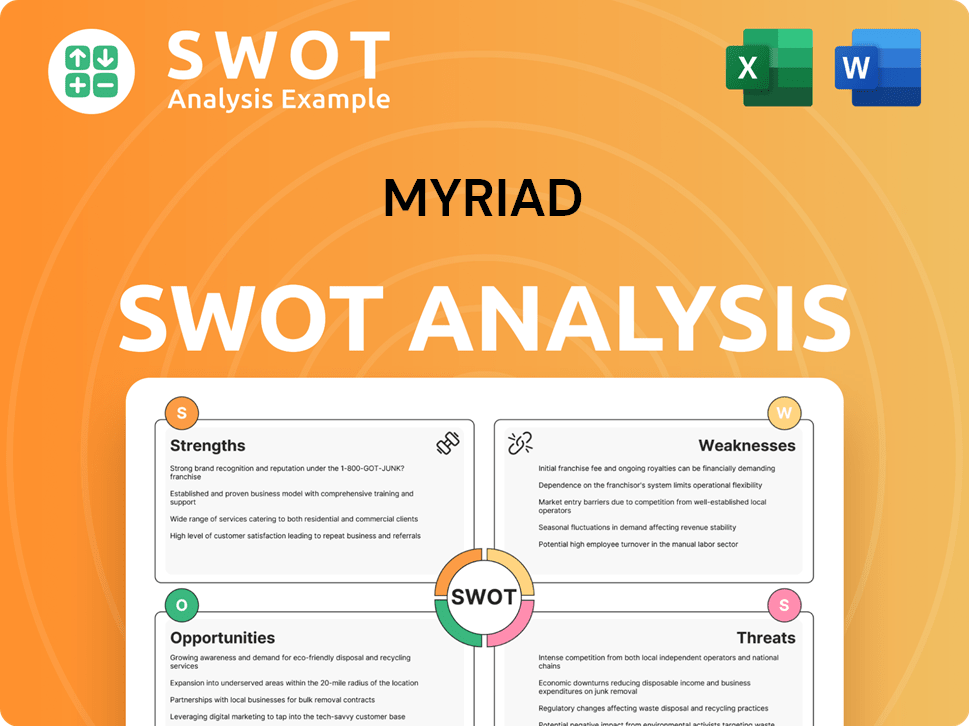

Myriad SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Myriad Make Money?

The Myriad Company's revenue model centers on providing molecular diagnostic tests. The company primarily generates income through the sales of these tests across its core business segments, including Oncology, Women's Health, and Pharmacogenomics. This approach allows the company to address diverse healthcare needs, driving its financial performance.

For the full year 2024, the Myriad Company reported total revenues of $838 million. This figure represents an 11% increase compared to the revenues generated in 2023. This growth underscores the company's ability to expand its market presence and increase sales across its various testing services.

Understanding the Myriad business model is crucial for assessing its financial strategy. The company focuses on leveraging its comprehensive test portfolio and expanding payer coverage to boost its revenue. By improving the average revenue per test and expanding market reach, the company aims to sustain and enhance its financial performance.

The Myriad Company's revenue streams are primarily driven by product sales of genetic tests and related services. The company's ability to monetize its Myriad technology and Myriad platform is central to its financial strategy.

- Product Sales: This is the main source of revenue, derived from the sales of various genetic tests. In the fourth quarter of 2024, Pharmacogenomics testing saw a 14% year-over-year growth. Prenatal testing revenue increased by 12% year-over-year. Additionally, hereditary cancer testing in Oncology grew by 8% year-over-year, contributing $82.8 million.

- Services: While specific figures are not broken down separately, the company offers extensive laboratory services and data analysis, which are crucial to the value proposition of its tests. These services support the overall Myriad ecosystem and enhance the utility of its diagnostic offerings.

The company's monetization strategies include improving average revenue per test, which saw a 2% increase in the first quarter of 2024 compared to the previous year. Furthermore, Myriad Company is expanding its market reach through collaborations and integrations, such as EMR integrations. These efforts are expected to increase testing volume significantly. While challenges exist, such as potential reimbursement changes for GeneSight, the company anticipates continued growth, with full-year 2025 revenue guidance between $840 million and $860 million.

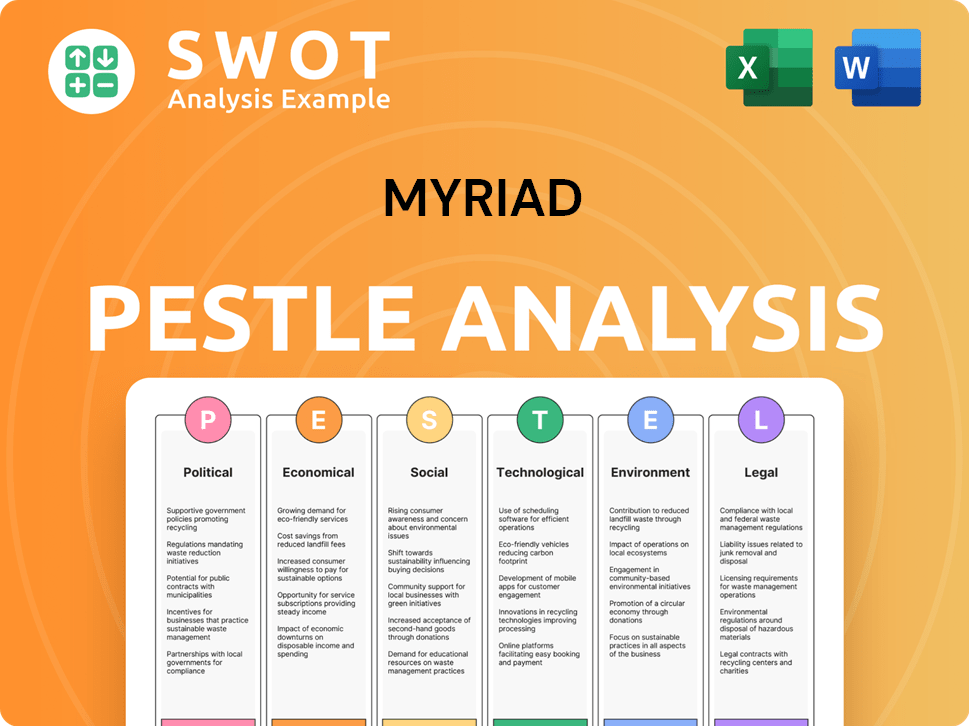

Myriad PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Myriad’s Business Model?

The evolution of the Myriad Company showcases significant milestones, strategic decisions, and competitive advantages. The company's journey is marked by consistent revenue growth and strategic expansions. This includes the launch of innovative products and the acquisition of key assets to strengthen its market position. The company's ability to adapt to market changes and invest in research and development highlights its commitment to innovation and growth within the genetic testing market.

Myriad's strategic moves have been crucial in shaping its operations and financial performance. These include product launches, enhancements, and strategic acquisitions. The company has also faced operational challenges, such as pricing pressures and competitive dynamics, which have prompted strategic adjustments. These adjustments include cost-cutting measures and prioritizing investments in new product development to drive revenue growth. The company's proactive approach to navigating these challenges is a key aspect of its business strategy.

The competitive edge of the Myriad Company is built on its robust intellectual property, established market position, and innovative product pipeline. The company's MyRisk Hereditary Cancer Test and strategic partnerships further enhance its competitive advantage. Myriad continues to adapt by investing in research and development, enhancing its product portfolio, and improving operational efficiency to navigate evolving market dynamics and competitive threats. Understanding the Marketing Strategy of Myriad provides additional insights into the company's approach.

Myriad has achieved consistent revenue growth, with double-digit growth in 2024, reaching $838 million. Product launches and enhancements, such as the Prequel test and the expanded Foresight Universal Plus Panel, have been crucial. Strategic acquisitions, like acquiring assets from Intermountain Precision Genomics, have also played a significant role.

The company has focused on product innovation and market expansion. It has also responded to challenges by reducing expenditures while prioritizing investments in new product development. The acquisition of assets from Intermountain Precision Genomics and the exclusive license of PATHOMIQ's AI technology platform are examples of strategic moves.

Myriad's competitive advantages include a strong intellectual property portfolio and an innovative product pipeline. The MyRisk Hereditary Cancer Test and strategic partnerships enhance its market position. The company continues to invest in research and development to adapt to evolving market dynamics.

The company faced pricing pressures and competitive dynamics in the hereditary cancer testing market. UnitedHealthcare's policy changes, discontinuing coverage for certain tests, presented a challenge. Myriad responded by reducing expenditures and prioritizing investments in new product development.

In 2024, Myriad achieved $838 million in revenue, marking the second consecutive year of double-digit growth. The company is adapting to market changes and focusing on innovation and strategic partnerships to maintain its competitive edge.

- Revenue Growth: Double-digit growth in 2024.

- Product Launches: Prequel test and expanded Foresight Universal Plus Panel.

- Strategic Acquisitions: Assets from Intermountain Precision Genomics.

- Challenges: UnitedHealthcare's policy changes impacting coverage.

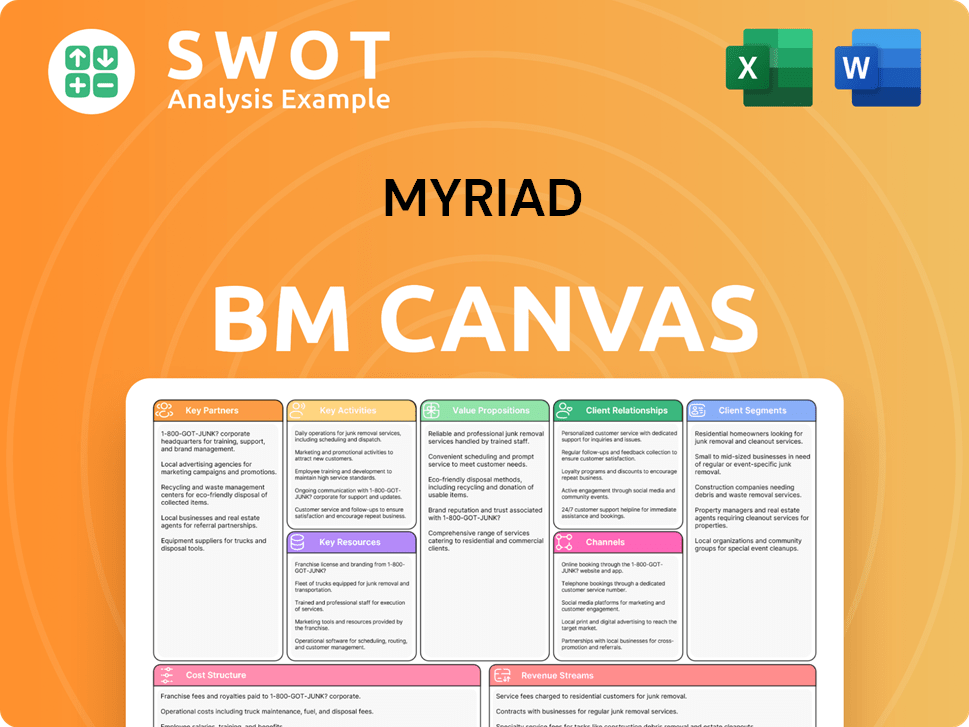

Myriad Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Myriad Positioning Itself for Continued Success?

Myriad Genetics holds a strong position in the genetic testing industry, particularly in areas like oncology and women's health. The company is known for its comprehensive molecular diagnostic tests. Its services include hereditary cancer screening, pharmacogenomics, and prenatal testing, solidifying its status as a leading provider in the field. The Owners & Shareholders of Myriad can see a detailed overview of the company's market position.

However, Myriad faces risks, including competition and regulatory changes. Pricing pressures from competitors and shifts in reimbursement policies pose challenges. Technological advancements and evolving consumer preferences also present ongoing hurdles for the company. These factors can impact the company's ability to generate revenue.

Myriad is a leader in genetic testing, especially in oncology and women's health. It offers a wide range of tests, including those for hereditary cancer and pharmacogenomics. Its comprehensive services help it maintain a strong market presence.

The company faces intense competition and potential pricing pressures. Regulatory changes, such as shifts in reimbursement policies, also pose risks. Technological advancements and changing consumer preferences create additional challenges for Myriad.

Myriad is investing in new product development, with launches planned for 2025. It is also leveraging AI and expanding access to genetic testing. The company's ability to innovate and adapt will be crucial for its sustained success.

For 2025, Myriad projects revenue between $807 million and $823 million. The company anticipates adjusted earnings per share (EPS) to be between $(0.02) and $0.02. These projections reflect the company's strategic initiatives.

Myriad is focusing on new product development and leveraging AI. Partnerships and EMR integrations are key strategies. These initiatives aim to expand access to genetic testing and drive revenue growth.

- New product launches, including FirstGene and Precise Liquid in 2025.

- AI-driven prostate cancer test launch by the end of 2025, in partnership with PATHOMIQ.

- Expansion of electronic medical record (EMR) integrations.

- Breast cancer risk assessment programs.

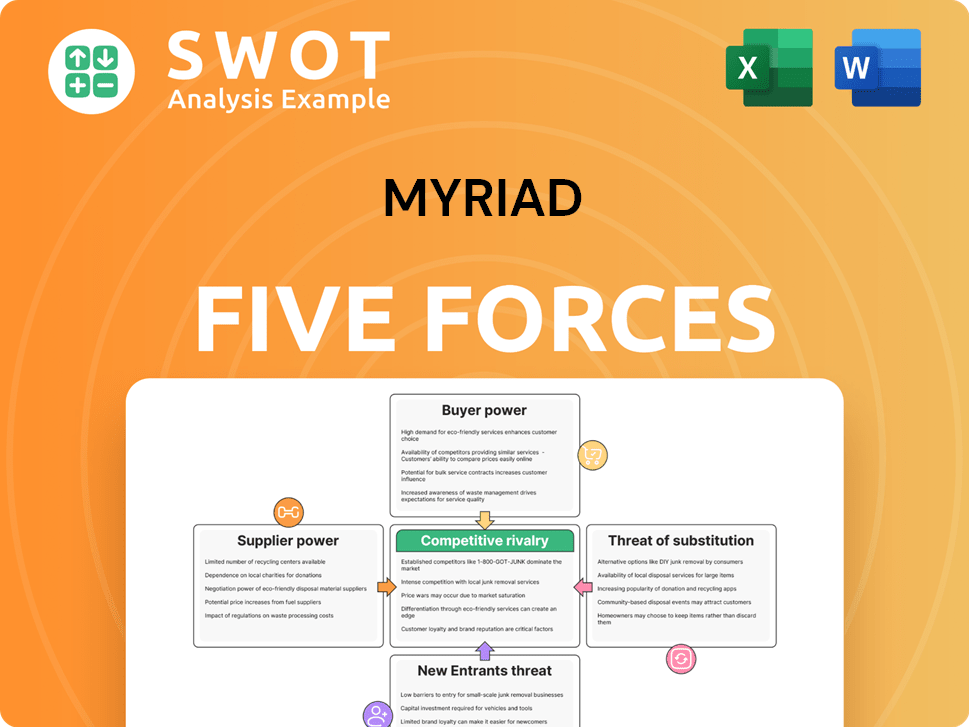

Myriad Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Myriad Company?

- What is Competitive Landscape of Myriad Company?

- What is Growth Strategy and Future Prospects of Myriad Company?

- What is Sales and Marketing Strategy of Myriad Company?

- What is Brief History of Myriad Company?

- Who Owns Myriad Company?

- What is Customer Demographics and Target Market of Myriad Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.