Myriad Bundle

Can Myriad Company Continue its Pioneering Legacy?

Myriad Genetics, a leader in molecular diagnostics, has significantly shaped personalized medicine, starting with its groundbreaking work in hereditary cancer testing. Founded in 1992, the company has evolved from a biotech startup to a major player in the diagnostics market, offering tests across various health areas. Today, Myriad's Myriad SWOT Analysis is a testament to its commitment to evidence-based medicine and its growth strategy.

The future prospects for Myriad Company are deeply intertwined with its ability to execute its growth strategy effectively. With reported revenue growth, Myriad is at a critical juncture, requiring strategic planning to navigate technological advancements and market shifts. This exploration will examine Myriad's expansion plans, innovation initiatives, and financial strategies, providing insights into its long-term sustainability and how it plans to improve its market position through business development.

How Is Myriad Expanding Its Reach?

The Marketing Strategy of Myriad focuses heavily on expansion initiatives to drive future growth. This involves both broadening its market reach and diversifying its product offerings. The company is actively working on strategies to increase the adoption of its core genetic tests while also exploring new opportunities in different healthcare segments.

A key element of Myriad's growth strategy involves expanding its presence in international markets. This includes adapting its commercial strategies to local healthcare systems and regulatory environments. Furthermore, the company is investing in product category expansion, particularly in women's health and mental health, to diversify its revenue streams and cater to a wider range of patient needs.

Myriad's strategic planning includes a focus on business development through partnerships and new business models. These initiatives are designed to enhance market penetration and support collaborative research and development efforts. The company's expansion plans are supported by its financial performance and growth trends, which are crucial for assessing its future outlook.

Myriad is targeting international markets to increase its global footprint. The company is adapting its commercial strategies to suit local healthcare systems and regulatory environments. This approach is essential for sustainable growth and market penetration in diverse regions.

Beyond hereditary cancer testing, Myriad is focusing on women's health and mental health. The company aims to expand the clinical utility and market penetration of these tests. This diversification supports its overall growth strategy.

Myriad is forming strategic partnerships with healthcare systems, research institutions, and pharmaceutical companies. These collaborations enable broader test adoption and support research and development efforts. Partnerships are a key element of Myriad's business development strategy.

The company is exploring direct-to-consumer offerings for certain tests. This approach aims to reach a broader audience and increase market penetration. Such models are part of Myriad's strategic planning for future growth.

In Q1 of fiscal year 2024, Myriad's Prenatal and Women's Health segment saw a 16% increase in revenue, reaching $43.4 million. This growth was driven by the strong performance of the SneakPeek Early Gender DNA Test. The mental health segment also showed strong performance, with revenue increasing by 11% to $38.9 million in Q1 fiscal year 2024.

- The company's focus on expanding its product portfolio is a key driver of its growth strategy.

- Strategic planning includes investments in women's health and mental health segments.

- Market analysis indicates that these segments offer significant growth potential.

- The company's expansion plans are supported by its financial performance and growth trends.

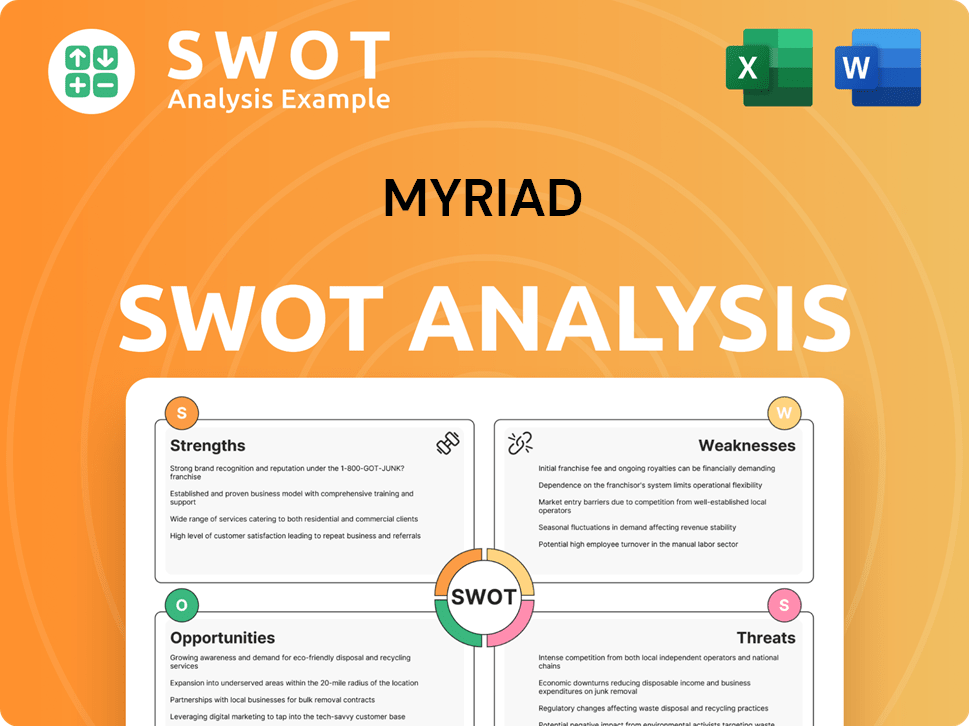

Myriad SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Myriad Invest in Innovation?

The innovation and technology strategy of Myriad Company is crucial for its long-term growth. This strategy focuses on continuous investment in research and development (R&D) to enhance existing tests and create new diagnostic solutions. This approach allows the company to stay at the forefront of molecular diagnostics.

A key aspect of Myriad's strategy is its digital transformation, which involves integrating advanced technologies like bioinformatics and artificial intelligence (AI). These technologies improve the accuracy and efficiency of genetic analysis, providing more precise clinical insights. This focus on technology is designed to improve patient care and expand market opportunities.

Myriad's commitment to innovation is evident in its ongoing development of new products and platforms. The company is actively working on next-generation sequencing (NGS) technologies to expand its testing capabilities and reduce turnaround times. This commitment to technological advancement is central to its growth strategy.

Myriad's significant investments in R&D are a cornerstone of its growth strategy. These investments support the development of new diagnostic solutions and enhancements to existing tests. This continuous investment helps maintain its competitive edge.

The integration of AI algorithms into Myriad's testing platforms is a key technological advancement. AI is used to refine variant interpretation, leading to more precise and actionable clinical insights. This improves the accuracy and efficiency of genetic analysis.

Myriad is actively developing next-generation sequencing (NGS) technologies to expand its testing capabilities. These technologies aim to reduce turnaround times and improve the overall efficiency of genetic testing. This is part of the company's expansion plans.

The development of new biomarkers and diagnostic panels for women's and mental health is a priority. This includes addressing critical unmet needs in these areas. This focus expands the company's market reach.

Myriad is committed to improving the patient and clinician experience through user-friendly digital tools and platforms. These tools facilitate test ordering, result delivery, and genetic counseling. This enhances customer satisfaction and supports business development.

Technological advancements contribute to growth objectives by expanding the company's addressable market. This includes reaching new patient populations and offering a wider range of diagnostic services. This is a key aspect of its strategic planning.

The company's strategic planning includes a strong focus on women's health and mental health, developing new diagnostic panels to address unmet needs. These advancements not only contribute to growth objectives but also reinforce its position as a leader in precision medicine. To understand the company's historical contributions, you can read a Brief History of Myriad.

Myriad's innovation strategy focuses on several key areas, including AI, NGS, and digital platforms. These advancements aim to improve diagnostic accuracy, reduce turnaround times, and enhance the overall patient and clinician experience. These improvements are essential for future prospects.

- AI-Driven Diagnostics: AI algorithms improve variant interpretation, offering more precise clinical insights.

- NGS Technologies: Next-generation sequencing expands testing capabilities and reduces turnaround times.

- Digital Platforms: User-friendly digital tools improve test ordering, result delivery, and genetic counseling.

- Focus on Women's and Mental Health: Development of new biomarkers and diagnostic panels to address unmet needs.

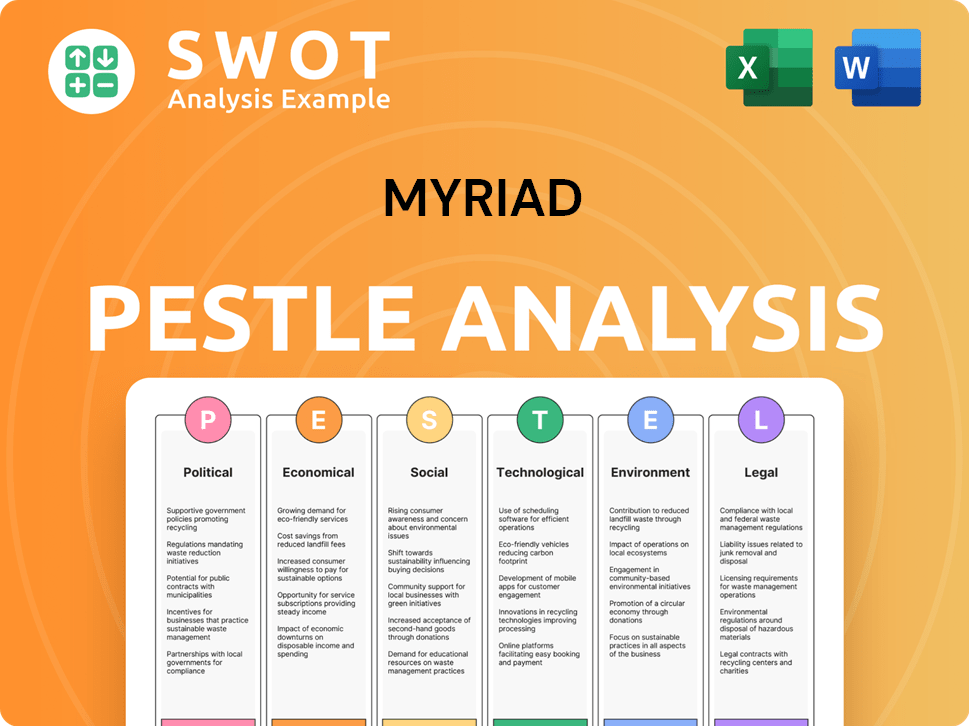

Myriad PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Myriad’s Growth Forecast?

The financial outlook for the Myriad Company reflects a strategic focus on sustainable growth and profitability. This is supported by its strong performance in key segments. The company is strategically positioning itself for continued expansion, balancing investments with a commitment to profitability.

For the first quarter of fiscal year 2024, the Myriad Company reported total revenues of $178.7 million, marking a 6% increase compared to the same period in the prior year. This growth was primarily driven by solid performance in its oncology, women's health, and mental health segments. The company's financial strategy emphasizes disciplined capital allocation, focusing on investments in R&D to fuel innovation, commercial expansion to increase market penetration, and operational efficiencies to improve profit margins.

Compared to historical performance, the projected growth indicates a positive trajectory, aligning with industry benchmarks for innovative diagnostic companies. The company's financial narrative highlights a company poised for continued expansion, balancing strategic investments with a commitment to achieving profitability. The Myriad Company's strategic planning process involves expanding the clinical utility and adoption of its existing tests while launching new products to capture emerging market opportunities.

The Myriad Company saw a 6% increase in total revenues, reaching $178.7 million in Q1 FY2024. This growth demonstrates the effectiveness of its growth strategy. This increase is a key indicator of the company's positive trajectory and future prospects.

The oncology segment generated $96.4 million, a 2% increase year-over-year. The women's health segment increased by 16% to $43.4 million. The mental health segment, largely attributed to GeneSight, grew by 11% to $38.9 million. These figures highlight the diverse revenue streams supporting the Myriad Company's growth.

For fiscal year 2024, the Myriad Company projects total revenue to be in the range of $750 million to $760 million. This projection indicates a positive outlook for the company's future prospects. The Myriad Company's expansion plans and future goals are supported by these revenue targets.

The company anticipates an adjusted diluted earnings per share (EPS) of $0.05 to $0.08 for the full fiscal year 2024. Analyzing the Myriad Company's financial performance and growth, this EPS projection reflects the company's efforts to improve profitability. This is a crucial metric for Owners & Shareholders of Myriad.

The Myriad Company's growth strategy includes disciplined capital allocation. This focuses on R&D investments, commercial expansion, and operational efficiencies. This approach supports the company's business development and market analysis efforts.

- Investments in R&D drive innovation and new product launches.

- Commercial expansion increases market penetration and revenue.

- Operational efficiencies improve profit margins and financial health.

- These investments are key to the Myriad Company's competitive advantage and future outlook.

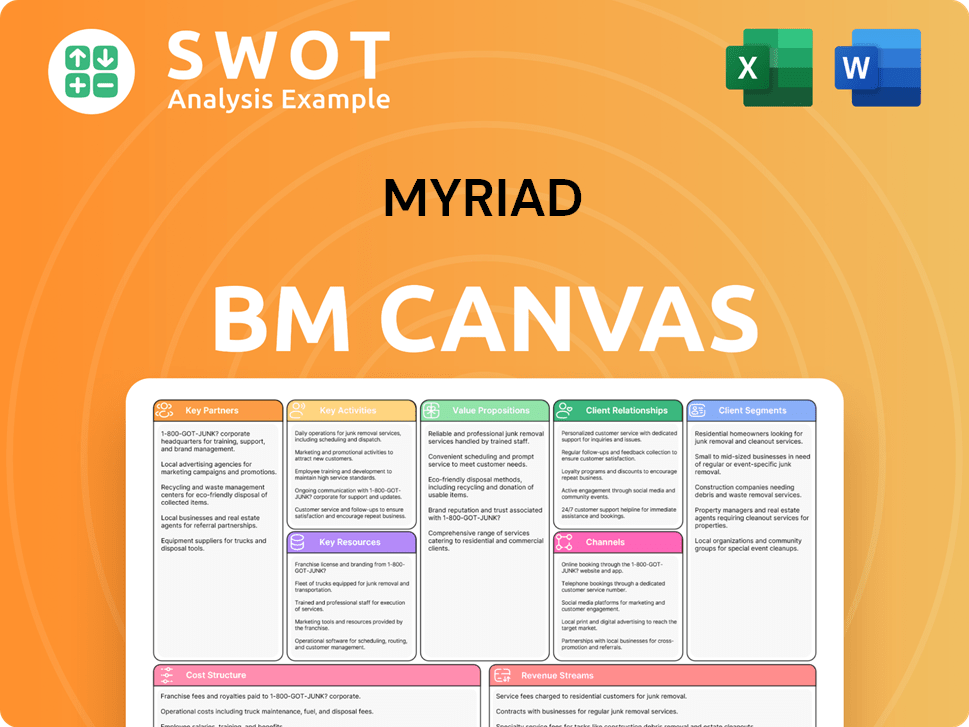

Myriad Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Myriad’s Growth?

The future prospects of Myriad Company are subject to several potential risks and obstacles. These challenges could influence the company's growth strategy and overall market position. Understanding these factors is crucial for anyone analyzing Myriad Company's future outlook and strategic planning.

Market competition and regulatory changes pose significant threats. The molecular diagnostics space is dynamic, requiring continuous innovation and adaptation. Furthermore, supply chain disruptions and technological advancements could also affect Myriad Company's ability to maintain its competitive advantage and achieve its expansion plans.

To navigate these challenges, Myriad Company employs several strategic measures. This includes diversification across different disease areas and robust risk management frameworks. Strategic partnerships and continuous R&D investments are also key to staying ahead of technological disruptions and ensuring sustainable growth.

The diagnostic market is highly competitive. Numerous companies offer similar or alternative genetic tests, leading to pricing pressures. This necessitates continuous innovation to maintain market share and drive business development.

The diagnostic industry is heavily regulated. Changes in clinical guidelines, reimbursement policies, or regulatory approvals can significantly impact operations. Adapting to evolving policies around laboratory-developed tests (LDTs) is critical.

Supply chain disruptions can affect testing operations and turnaround times. Vulnerabilities in obtaining reagents and specialized equipment are a concern. Geopolitical events and health crises can exacerbate these issues.

Rapid advancements in genomics and diagnostic technologies can render existing tests obsolete. The introduction of cost-effective alternatives poses a constant threat. Staying ahead requires significant R&D investments.

Myriad Company mitigates these risks through diversification and robust risk management. Proactive engagement with regulatory bodies and strategic partnerships are also crucial. Continuous monitoring of the competitive landscape is essential.

Analyzing Myriad Company's financial performance requires understanding these risks. Strategic planning and market analysis are essential for sustainable growth. For insights into the company's revenue model, see Revenue Streams & Business Model of Myriad.

The molecular diagnostics market is highly competitive, with major players like Roche, and Illumina. These companies, along with numerous smaller firms, compete for market share. The competitive landscape necessitates continuous innovation and strategic planning to maintain a strong market position.

The diagnostic industry is subject to stringent regulations. Changes in FDA guidelines, reimbursement policies from payers such as Medicare and private insurance, and evolving regulations on LDTs can significantly impact operations. Staying compliant and adapting to these changes is crucial for future prospects.

Supply chain disruptions, particularly for specialized equipment and reagents, pose significant risks. Geopolitical events and global health crises can exacerbate these vulnerabilities. Ensuring a resilient supply chain is essential for maintaining testing operations and turnaround times.

Rapid advancements in genomics and diagnostic technologies could render existing tests obsolete. The introduction of more cost-effective and efficient alternatives poses a constant threat. Continuous investment in research and development is critical for staying ahead of technological disruptions and maintaining a competitive advantage.

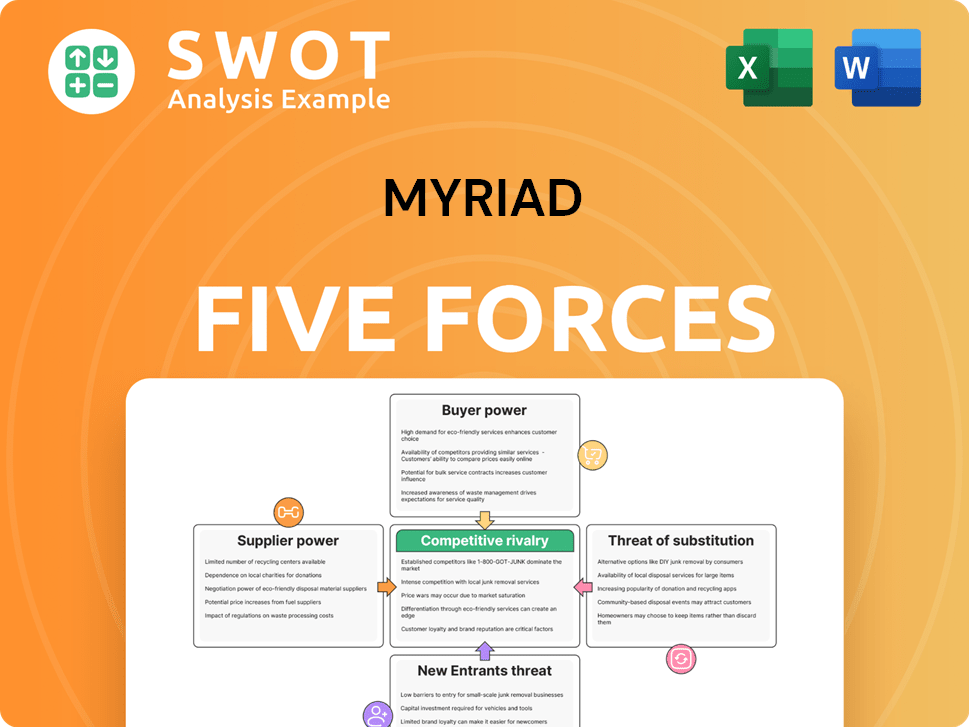

Myriad Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Myriad Company?

- What is Competitive Landscape of Myriad Company?

- How Does Myriad Company Work?

- What is Sales and Marketing Strategy of Myriad Company?

- What is Brief History of Myriad Company?

- Who Owns Myriad Company?

- What is Customer Demographics and Target Market of Myriad Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.