Palantir Technologies Bundle

How Did Palantir Technologies Rise to Data Dominance?

Palantir Technologies, a titan in data analysis, empowers organizations with its sophisticated software, enabling them to harness vast datasets for data-driven decisions. The company's journey began with a mission to solve complex, real-world problems using advanced software. From its inception, Palantir set itself apart by focusing on augmenting human intelligence, a vision that has propelled its remarkable growth.

Founded in May 2003 by Palantir Technologies SWOT Analysis Peter Thiel, Stephen Cohen, Joe Lonsdale, and Alex Karp, Palantir's early focus on counter-terrorism, while preserving civil liberties, shaped its unique trajectory. This mission-oriented approach, coupled with innovative Palantir software, fueled its expansion. Today, Palantir's market capitalization reflects its transformation into a global data powerhouse, serving governments, militaries, and corporations alike, a testament to the Palantir history and impact on the tech industry.

What is the Palantir Technologies Founding Story?

The brief history of Palantir Technologies begins in the early 2000s, marking a significant entry into the data analysis and software development sectors. The company's formation was driven by a vision to create tools that could handle complex data challenges, particularly within government and intelligence domains. Understanding the Palantir history is key to grasping its current position in the tech industry.

Palantir Technologies was officially incorporated in May 2003, although its operational beginnings are often traced back to 2004. The company's mission was to provide advanced data analysis solutions, a goal that has shaped its product development and market approach. The Palantir company has evolved significantly since its inception, adapting to changing technological landscapes and market demands.

The Palantir founders included Peter Thiel, Alex Karp, Joe Lonsdale, Stephen Cohen, and Nathan Gettings. Thiel's experience at PayPal, where he helped develop a fraud detection system, influenced Palantir's initial focus. They identified a need for technology that could address new problems, deploy rapidly, and secure sensitive data while enabling collaboration. Their initial business model revolved around enhancing human intelligence with software for data analysis, rather than replacing it.

Palantir's early days were marked by significant investment and strategic partnerships, shaping its growth trajectory. The company's initial focus on government contracts and its unique approach to data analysis set it apart from other tech companies.

- Founding Date: Incorporated in May 2003, operational from 2004.

- Initial Funding: Peter Thiel invested $30 million, with additional early capital from In-Q-Tel, the CIA's venture arm.

- First Product: Palantir Gotham, designed for government and intelligence agencies.

- Name Origin: Inspired by the 'seeing stones' from J.R.R. Tolkien's Lord of the Rings.

The company's first product, Palantir Gotham, was designed for government and intelligence agencies, primarily focusing on counter-terrorism efforts. Initial funding came from Peter Thiel, who invested $30 million, and In-Q-Tel, the venture capital arm of the CIA. The name 'Palantir,' chosen by Thiel, symbolized their aim to allow users to 'gaze across vast distances to track friends and foes.' Despite its unique vision, Palantir initially struggled to attract investors, as enterprise and government sectors were not popular in Silicon Valley at the time. Understanding the Palantir software and its applications is crucial for appreciating its impact.

Palantir's early growth was fueled by government contracts, which provided a solid foundation for its business. The company's ability to secure and manage these contracts has been a key factor in its success. The Palantir IPO in 2020 marked a significant milestone, allowing the company to expand its operations and reach new markets. For more insights, you can explore the Marketing Strategy of Palantir Technologies.

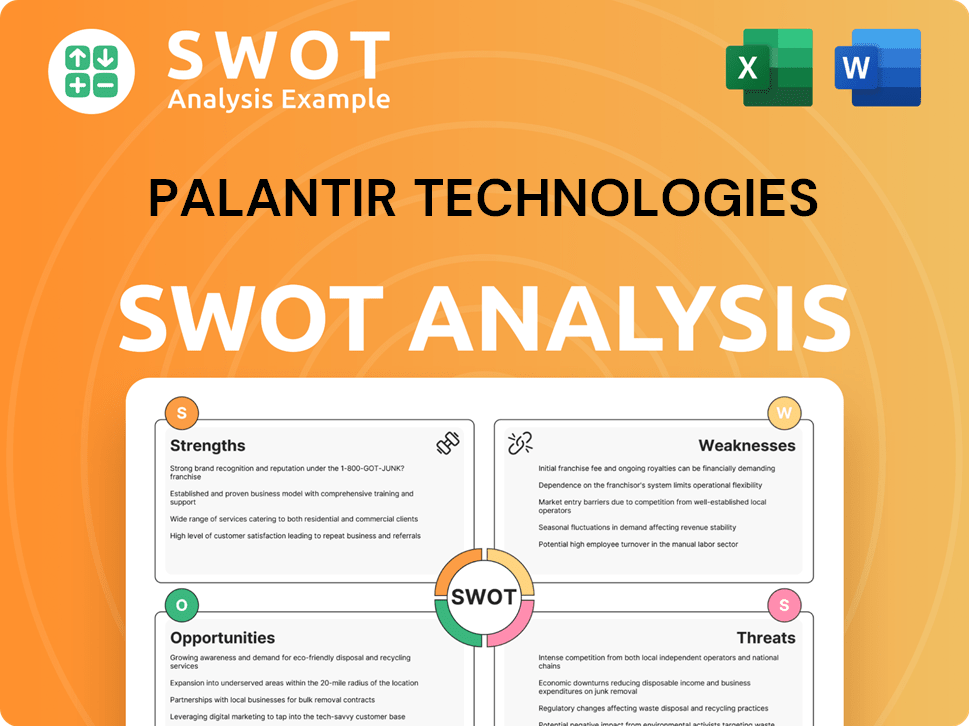

Palantir Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Palantir Technologies?

The early growth of Palantir Technologies, a company with a fascinating Palantir history, was marked by rapid expansion and strategic diversification. Initially focused on government contracts, Palantir quickly established itself in the data analytics field. This early success laid the groundwork for its later growth and its evolution into a major player in the tech industry.

By 2008, Palantir deployed its Gotham platform for counter-terrorism analysis, demonstrating its capabilities in government intelligence. The company expanded beyond government contracts by 2010, working with commercial clients. This move showcased the versatility of its Palantir software and opened new revenue streams.

The launch of the Foundry platform in 2015, specifically aimed at enterprise clients, further diversified Palantir's offerings. Substantial growth and investor confidence led to a valuation of $9 billion by 2013. The company's strategic moves solidified its position in the market.

Palantir went public through a direct listing on the New York Stock Exchange in September 2020, a significant milestone for the Palantir company. In November 2024, Palantir shifted its stock listing from the NYSE to Nasdaq. The Palantir IPO provided additional resources for expansion and innovation.

Palantir's growth has been driven by its Artificial Intelligence Platform (AIP), leading to accelerated sales growth. In Q1 2025, Palantir reported a remarkable 39% year-over-year revenue increase, reaching $883.9 million. The U.S. commercial sector saw a surge of 71% in revenue year-over-year in Q1 2025. For more details, check out the Revenue Streams & Business Model of Palantir Technologies.

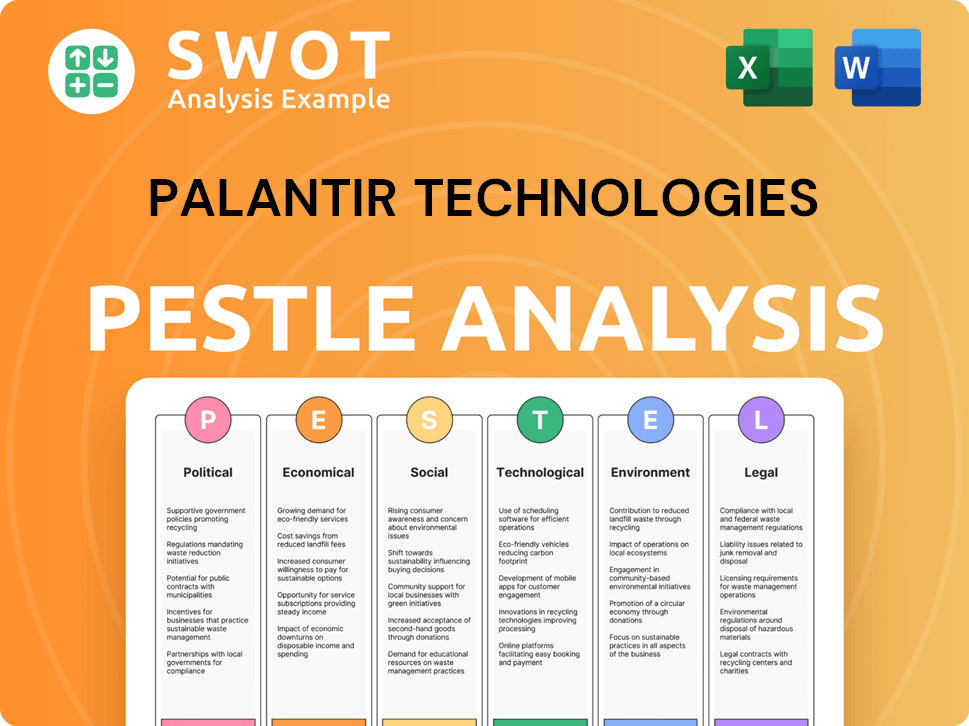

Palantir Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Palantir Technologies history?

The Palantir Technologies has achieved significant milestones, including major government contracts and its expansion into commercial markets. Its growth trajectory has been marked by strategic product launches and key financial achievements, solidifying its position in the tech industry. This Palantir history reflects its evolution from a startup to a publicly traded company with a substantial impact on data analysis and software solutions.

| Year | Milestone |

|---|---|

| 2003 | Palantir Technologies was founded. |

| 2015 | Launch of the Foundry platform, expanding into commercial enterprises. |

| 2024 | Inclusion in the S&P 500 in September and the Nasdaq-100 in December. |

| 2025 | Secured a $795 million contract with the U.S. Army for its Maven Smart System. |

Palantir Technologies has consistently innovated, developing advanced data integration and analysis platforms. A key innovation is the Artificial Intelligence Platform (AIP), central to its growth strategy, enabling customers to leverage AI in their business processes.

Gotham is a data analysis platform primarily used by government agencies and intelligence organizations. It has been instrumental in counter-terrorism efforts and national security.

Launched in 2015, Foundry expanded Palantir company's reach into commercial enterprises. It enables data integration and analysis for diverse corporate clients.

AIP enables customers to leverage AI directly within their business processes. This has led to accelerated sales growth and impressive productivity gains.

Despite its successes, Palantir Technologies has faced challenges, including concerns about high valuation multiples. The company's dependence on government contracts also presents a potential risk due to unpredictable contract cycles and political shifts.

Despite recent profitability, concerns about high valuation multiples persist. The P/E ratio was 536 compared to the software industry average of 42 in late May 2025.

Government contracts accounted for approximately 55% of its revenue in 2024. This dependence presents a potential risk due to unpredictable contract cycles and political shifts.

The business model, involving pilot costs in the initial 'Acquire' and 'Expand' phases, meant the company ran at a loss in its early years.

Analysts have warned about potential overvaluation, with some suggesting a price-to-sales ratio around 19.5x forward revenue.

For more details on the ownership structure, you can explore the Owners & Shareholders of Palantir Technologies.

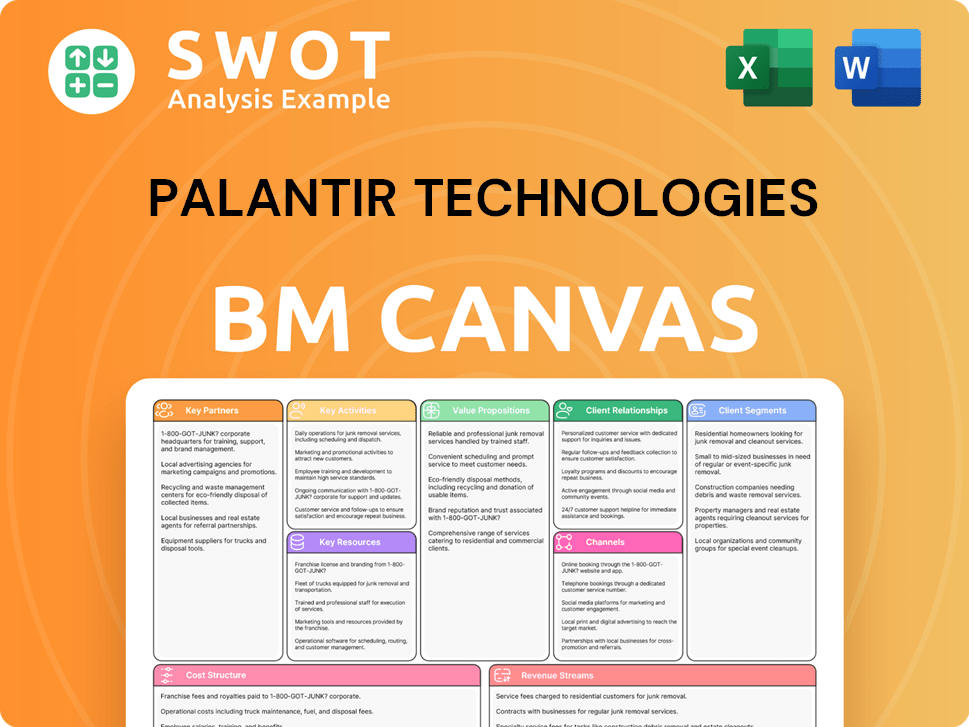

Palantir Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Palantir Technologies?

The brief history of Palantir Technologies is marked by significant milestones, from its early days and government contracts to its expansion into commercial markets and its public listing. This journey showcases the evolution of Palantir, highlighting its adaptability and growth in the tech industry. Understanding the Palantir history provides insights into its strategic shifts and its impact on the data analysis landscape.

| Year | Key Event |

|---|---|

| May 2003 | Palantir Technologies officially incorporated. |

| 2004 | Received initial funding from Peter Thiel and In-Q-Tel, the CIA's venture capital arm. |

| 2008 | Deployed its Gotham platform to support counter-terrorism analysis. |

| 2010 | Began working with commercial clients, expanding beyond government contracts. |

| 2013 | Company valuation reached $9 billion. |

| 2015 | Launched the Foundry platform for enterprise clients. |

| September 2020 | Went public via a direct listing on the NYSE. |

| September 2024 | Included in the S&P 500. |

| November 2024 | Shifted stock listing from NYSE to Nasdaq. |

| December 2024 | Added to the Nasdaq-100. |

| Q4 2024 | Reported revenue of $828 million, a 36% year-over-year growth, with U.S. revenue up 52%. |

| Q1 2025 | Reported revenue of $883.9 million, a 39% year-over-year increase, driven by a 71% surge in U.S. commercial revenue. |

| May 2025 | Secured a $795 million contract extension with the U.S. Army, bringing its total Maven Smart System contract to over $1 billion. |

Palantir projects full-year revenue for 2025 to be between $3.89 billion and $3.902 billion, reflecting approximately 36% year-on-year growth. U.S. commercial revenue is expected to exceed $1.178 billion in 2025, with a growth rate of at least 68%. The company is focusing on its Artificial Intelligence Platform (AIP) to drive future revenue.

For 2025, Palantir forecasts adjusted operating profit between $1.711 billion and $1.723 billion and adjusted free cash flow between $1.6 billion and $1.8 billion. The company expects to maintain GAAP operating income and net income in each quarter of 2025. This financial stability supports Palantir's strategic initiatives.

Analysts predict Palantir's net income will surpass $2 billion by 2030, with earnings per share (EPS) reaching $1.27 and free cash flow approaching $6 billion. This long-term outlook highlights Palantir's potential for sustained profitability. The company's focus on AIP is central to achieving these goals.

Palantir is aggressively investing in AIP and technical hiring while expanding its channel sales. The company aims to become a 'powerhouse of enterprise AI' by 2025. Its success hinges on its ability to adapt and innovate, as discussed in Growth Strategy of Palantir Technologies.

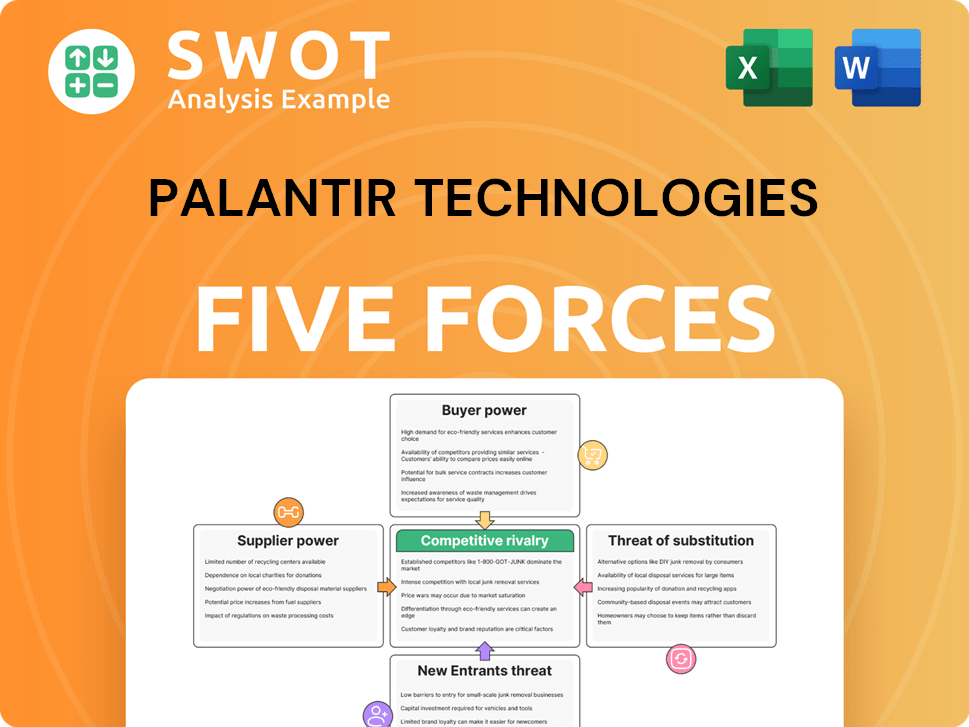

Palantir Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Palantir Technologies Company?

- What is Growth Strategy and Future Prospects of Palantir Technologies Company?

- How Does Palantir Technologies Company Work?

- What is Sales and Marketing Strategy of Palantir Technologies Company?

- What is Brief History of Palantir Technologies Company?

- Who Owns Palantir Technologies Company?

- What is Customer Demographics and Target Market of Palantir Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.