Palantir Technologies Bundle

Can Palantir Technologies Continue Its Ascent in the Data Analytics Arena?

Founded in 2003, Palantir Technologies has transformed from a government-focused startup to a global leader in data analytics. Its sophisticated platforms, Gotham and Foundry, empower organizations to extract critical insights from complex data, driving decisions across diverse sectors. This analysis dives into Palantir Technologies SWOT Analysis, exploring its growth strategy and future prospects within the dynamic data analytics landscape.

Palantir's strategic importance is underscored by its ability to leverage data for competitive advantage, making it a vital partner for both government and commercial clients. This exploration will examine Palantir's business model, market analysis, and recent partnerships, providing a comprehensive view of its potential. We'll also delve into Palantir's financial performance forecast, considering its challenges and risks to assess its long-term investment potential and its impact on data privacy.

How Is Palantir Technologies Expanding Its Reach?

Palantir Technologies is aggressively pursuing a multi-faceted expansion strategy, focusing on both geographical and sectoral growth, alongside product diversification and strategic partnerships. The company's growth initiatives are designed to capitalize on the increasing demand for advanced data analytics and AI solutions across various sectors and geographies. This strategic approach aims to solidify Palantir's position as a leader in the data analytics landscape and drive long-term value for its stakeholders.

A key element of Palantir's future prospects involves expanding its presence in the commercial sector, aiming to replicate the success it has achieved with government contracts. The company is actively emphasizing its Foundry platform for commercial use, which helps businesses integrate disparate data sources and build operational applications. This strategy is supported by significant investments in sales and marketing, as well as product enhancements tailored to meet the specific needs of commercial clients.

International expansion is another critical component of Palantir's growth strategy. The company is actively seeking to expand its presence beyond its traditional strongholds, with a particular emphasis on Europe and Asia. This involves establishing local sales teams, forming strategic alliances with regional businesses, and tailoring its platforms to meet specific local regulatory and market requirements. The company's pursuit of new government and commercial contracts in these regions is a clear indicator of its international growth ambitions.

Palantir's focus on the commercial sector is evident through its Foundry platform, designed to help businesses integrate data and build operational applications. The company has secured significant commercial contracts in manufacturing, automotive, and healthcare. This expansion is crucial for diversifying revenue streams and reducing reliance on government contracts.

The company is expanding its global footprint, particularly in Europe and Asia, by establishing local sales teams and forming strategic alliances. This involves tailoring its platforms to meet specific regional requirements. The company is actively pursuing new government and commercial contracts in these regions.

Palantir is investing in new product development, particularly in AI and generative AI, to enhance its analytical capabilities. The company aims to offer more sophisticated solutions to clients, making its platforms more attractive to a wider range of customers. This includes expanding its Software-as-a-Service (SaaS) offerings.

Palantir actively seeks collaborations with technology firms and industry leaders to extend its reach and integrate its platforms. While specific M&A activities are dynamic, Palantir has historically considered acquisitions to bolster its technological capabilities. These initiatives aim to diversify revenue streams and maintain a competitive edge.

Palantir's expansion strategies are designed to drive growth and capitalize on market opportunities. These initiatives are crucial for maintaining a competitive edge and achieving long-term financial success. The company's focus on both commercial and international markets is a testament to its ambitious growth plans.

- Commercial Sector Penetration: Expanding its presence in the commercial sector through the Foundry platform.

- International Expansion: Targeting Europe and Asia with local sales teams and strategic alliances.

- Product Innovation: Investing in AI and SaaS offerings to enhance platform capabilities.

- Strategic Partnerships: Collaborating with other companies to extend reach and integrate technologies.

Palantir's Target Market of Palantir Technologies includes government agencies and commercial enterprises. In Q4 2023, the company's commercial revenue in the US grew by 70% year-over-year, reaching $131 million, demonstrating the success of this commercial expansion. The company's strategic focus on these areas is expected to drive significant revenue growth and enhance its market position in the coming years. The company's ability to secure and manage government contracts, coupled with its expanding commercial client base, positions it well for continued growth.

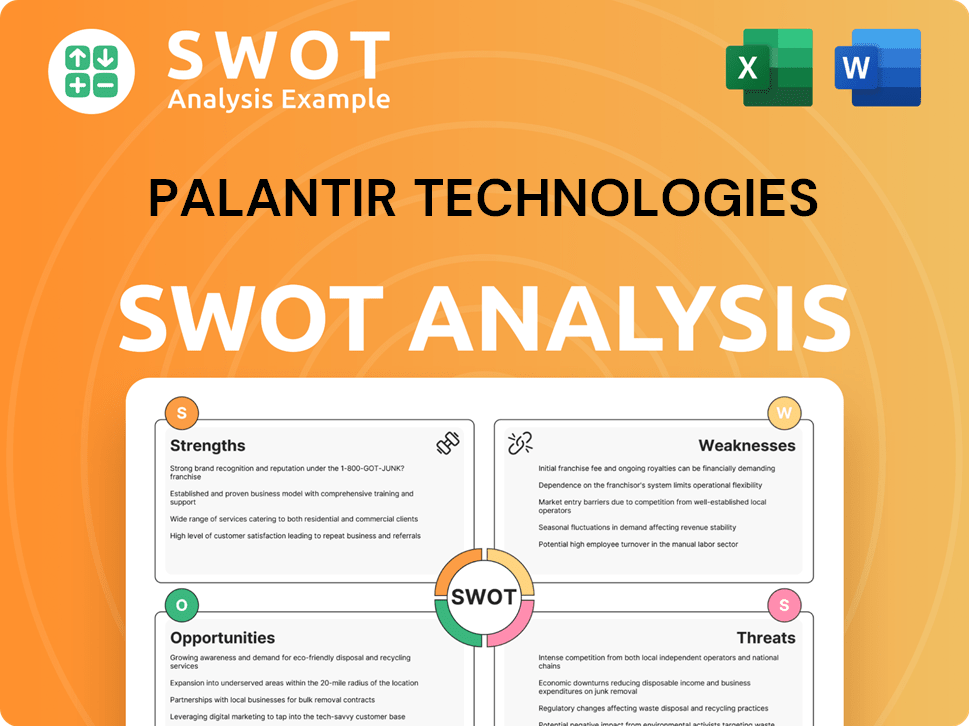

Palantir Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Palantir Technologies Invest in Innovation?

Palantir's growth strategy is deeply rooted in its commitment to innovation and technological advancement. The company consistently invests in research and development to enhance its core platforms and develop new capabilities. This focus allows Palantir to maintain a competitive edge in the rapidly evolving data analytics and artificial intelligence landscape.

The company's future prospects are closely tied to its ability to leverage cutting-edge technologies and expand its market reach. Palantir's success depends on its capacity to adapt to changing client needs and capitalize on emerging opportunities in both the government and commercial sectors. Understanding Palantir's technological strategy is crucial for assessing its long-term investment potential.

Palantir Technologies' innovation strategy is characterized by significant investments in research and development, in-house development, and a focus on cutting-edge technologies. Its core platforms, Gotham and Foundry, are continuously refined and expanded through substantial R&D efforts. This approach is key to understanding Palantir's competitive advantages.

Palantir's commitment to innovation is evident in its substantial R&D spending. In Q4 2023, R&D expenses were $146 million, representing 17% of total revenue. This investment fuels the development of new features and capabilities.

AIP is a cornerstone of Palantir's technological strategy. It allows organizations to integrate large language models with private data, enabling generative AI for decision-making. This platform showcases Palantir's artificial intelligence capabilities.

Palantir continuously develops new modules and applications to extend the functionality of its core platforms. These tools support scenario planning, supply chain optimization, and predictive analytics. This agile development methodology ensures its technology remains relevant.

Palantir actively collaborates with external innovators and participates in industry initiatives. These partnerships foster technological advancements and contribute to its leadership in innovation. The company's approach to data security solutions is also noteworthy.

Palantir emphasizes explainable AI and ethical data use. This focus, coupled with its ability to handle sensitive datasets, solidifies its position in the data analytics and AI space. This approach is critical for Palantir's long-term investment potential.

Palantir differentiates itself by deploying AI in real-world operational contexts. This approach, from military operations to commercial supply chain optimization, showcases its versatility and power. This is a key aspect of Palantir's commercial sector strategy.

Palantir’s technological strategy focuses on several key areas, driving its growth initiatives and influencing its future in data analytics. The company’s approach to innovation is a critical factor in its market analysis.

- Proprietary Platforms: Gotham and Foundry are continuously updated and expanded.

- Artificial Intelligence: AIP integrates large language models with private data for decision-making.

- Agile Development: Rapid iteration and deployment of new features ensures relevance.

- Data Security: Focus on explainable AI and ethical data use is a priority.

- Partnerships: Actively collaborates with innovators to foster technological advancements.

For a deeper dive into Palantir's financial performance and business model, you can explore the Revenue Streams & Business Model of Palantir Technologies.

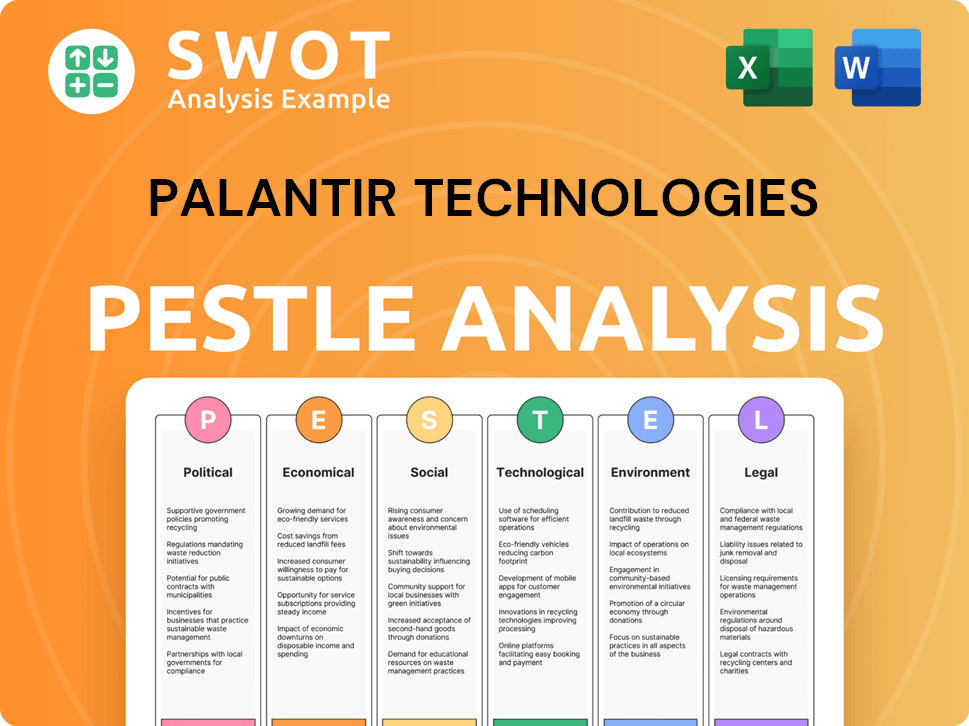

Palantir Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Palantir Technologies’s Growth Forecast?

The financial outlook for Palantir Technologies is robust, reflecting a strong trajectory of growth and profitability. The company's recent performance and future projections suggest a positive trend for investors and stakeholders. This positive outlook is supported by solid financial results and strategic initiatives aimed at expanding its market presence and enhancing operational efficiency. A deep dive into Brief History of Palantir Technologies can provide further context.

Palantir has demonstrated consistent financial success, achieving GAAP profitability for five consecutive quarters as of Q4 2023. This sustained profitability, with a net income of $93 million in Q4 2023, is a significant indicator of the company's maturing business model and its ability to manage operational costs effectively. For the full year 2023, Palantir's revenue reached $2.22 billion, marking a 16% year-over-year increase. The US commercial sector saw substantial growth, with revenue increasing by 33% to $375 million.

Looking ahead, Palantir's financial guidance for 2024 is optimistic. The company projects revenue between $612 million and $616 million for Q1 2024, with an adjusted operating income expected to be between $196 million and $200 million. For the full year 2024, Palantir anticipates total revenue to be between $2.652 billion and $2.668 billion, representing an 18% to 19% year-over-year growth. Furthermore, the company expects adjusted free cash flow for 2024 to be between $800 million and $900 million. These projections highlight Palantir's confidence in its continued expansion, particularly within the commercial sector, and its ability to generate substantial free cash flow.

Palantir's revenue growth has been consistent, with a 16% year-over-year increase in 2023. The company projects continued growth, estimating an 18% to 19% increase in total revenue for 2024, reaching between $2.652 billion and $2.668 billion. This sustained growth is driven by expansion in both government and commercial sectors.

Palantir has achieved GAAP profitability for five consecutive quarters, culminating in a net income of $93 million in Q4 2023. This demonstrates a shift towards a sustainable and profitable business model. The company's focus on operational efficiency is expected to further improve profit margins.

Palantir anticipates strong free cash flow generation in 2024, projecting between $800 million and $900 million. This robust cash flow provides the company with flexibility for strategic investments and potential acquisitions. The ability to generate strong cash flow is a key indicator of financial health.

The US commercial revenue grew by 33% to $375 million in 2023. Palantir's strategic focus on expanding its commercial client base is a significant driver of overall revenue growth. This expansion is expected to continue, supported by the increasing demand for its AI-powered data analytics platforms.

Analysts generally align with Palantir's positive outlook, emphasizing the growing demand for its AI-powered data analytics platforms across various industries. The company's strategic focus on expanding its commercial client base, coupled with its consistent government contracts, is expected to drive sustained revenue growth. Furthermore, Palantir's emphasis on operational efficiency and scalability is anticipated to contribute to improving profit margins over time.

- The company's Palantir growth strategy involves expanding its market presence and enhancing operational efficiency.

- Palantir's future prospects are promising, with strong revenue growth and robust cash flow generation.

- Palantir Technologies is focusing on expanding its commercial client base and improving profit margins.

- The company's data security solutions are crucial for maintaining client trust and ensuring operational integrity.

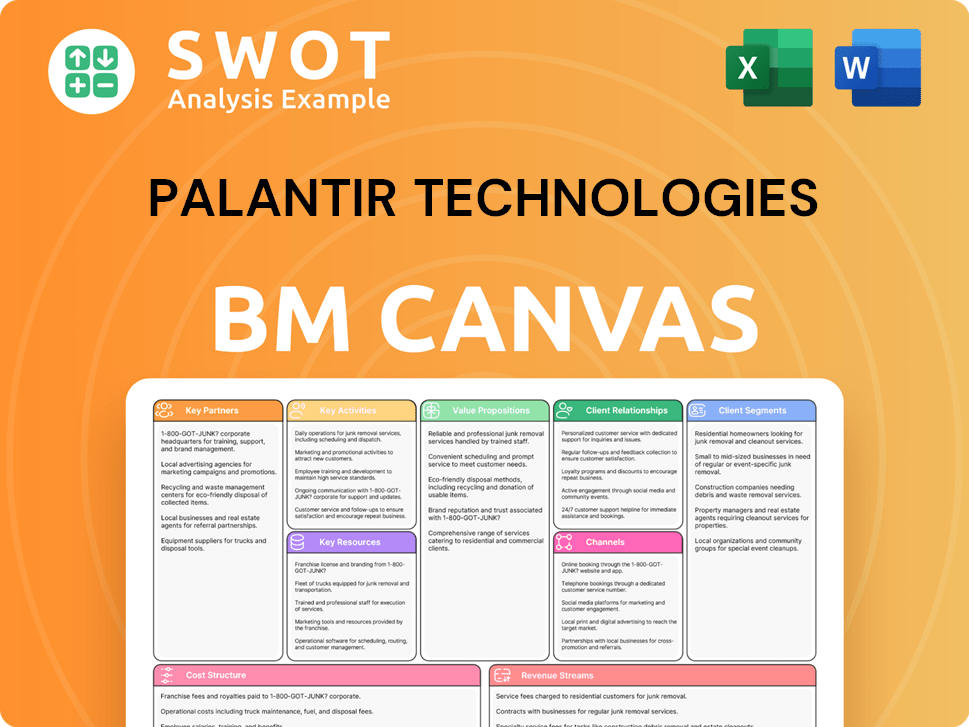

Palantir Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Palantir Technologies’s Growth?

Navigating the path of Palantir Technologies involves acknowledging potential risks and obstacles that could influence its Palantir growth strategy and Palantir future prospects. The data analytics and AI sector is highly competitive, requiring continuous innovation and strategic adaptation. Understanding these challenges is crucial for investors and stakeholders assessing Palantir Technologies' long-term viability.

Several factors could impede Palantir Technologies' progress. These include intense competition, evolving regulatory landscapes, and the rapid pace of technological advancements. Furthermore, internal resource constraints and client concentration risks pose additional hurdles that the company must manage effectively to sustain its growth trajectory.

To ensure sustained success, Palantir Technologies must proactively address these challenges. This involves strategic diversification, robust risk management, and continuous innovation. By anticipating and mitigating potential obstacles, the company can bolster the resilience of its Palantir business model and enhance its long-term prospects.

The data analytics and AI market is crowded, with established tech giants and agile startups vying for market share. Competitors offering similar solutions could pressure pricing and client acquisition. Palantir must differentiate its offerings to maintain a competitive edge.

Evolving data privacy regulations and changes in government procurement policies pose risks. Palantir's operations, especially those involving government agencies, could be affected. Adapting to these changes is essential.

Unforeseen breakthroughs by competitors could disrupt Palantir's market position. Continuous investment in R&D and a culture of innovation are vital to stay ahead. The tech sector's rapid evolution is a constant challenge.

Although a software company, indirect supply chain issues affecting clients could impact demand. These vulnerabilities require monitoring. This could affect the demand for Palantir's services.

Attracting and retaining top talent is crucial but challenging in a competitive market. Scaling the workforce while maintaining culture and expertise is a continuous effort. This impacts Palantir's ability to execute its strategy.

Reliance on a small number of large contracts, particularly in the government sector, introduces concentration risk. The loss of a major contract could significantly impact financial performance. Diversification is key.

The data analytics market is highly competitive, with key players including established tech giants and emerging startups. According to recent reports, the global data analytics market is projected to reach $650.8 billion by 2029, growing at a CAGR of 13.8% from 2022 to 2029. Palantir's ability to differentiate its offerings and secure contracts against competitors will be crucial for its Palantir market analysis and success. For more information, you can explore the Competitors Landscape of Palantir Technologies.

Palantir operates in a sector subject to stringent regulations, especially concerning data privacy and government contracts. The evolving regulatory landscape, including GDPR, CCPA, and potential new federal regulations, necessitates continuous compliance efforts. The company must adapt its technologies and practices to meet diverse and dynamic regulatory requirements across different jurisdictions. Failure to comply could result in significant penalties and reputational damage.

The rapid pace of technological advancement poses a constant challenge. Competitors may introduce innovations that surpass Palantir's current capabilities. Investments in R&D and a culture of innovation are critical. Palantir must continuously refine its Palantir's artificial intelligence capabilities and platform to maintain its competitive edge and ensure its Palantir's software platform overview remains cutting-edge.

Attracting and retaining skilled personnel in the competitive tech labor market is a significant challenge. The company’s ability to scale its workforce, while maintaining its unique culture and technical expertise, is crucial. High employee turnover or difficulty in finding qualified candidates could hinder Palantir's growth. In 2024, the average salary for data scientists reached approximately $150,000, reflecting the high demand for specialized talent.

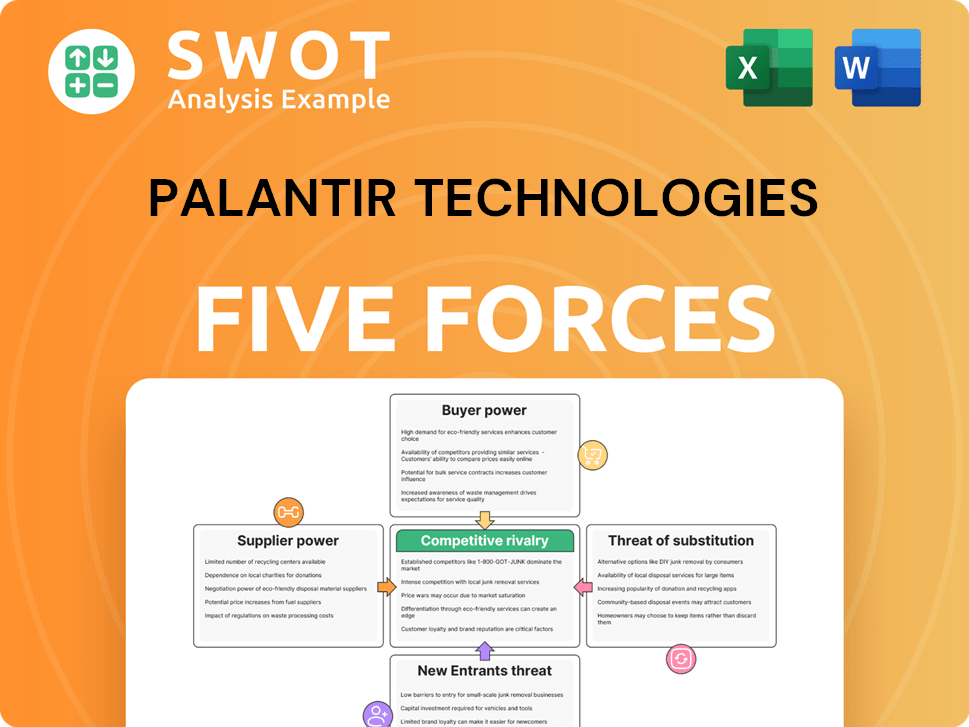

Palantir Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Palantir Technologies Company?

- What is Competitive Landscape of Palantir Technologies Company?

- How Does Palantir Technologies Company Work?

- What is Sales and Marketing Strategy of Palantir Technologies Company?

- What is Brief History of Palantir Technologies Company?

- Who Owns Palantir Technologies Company?

- What is Customer Demographics and Target Market of Palantir Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.