Palantir Technologies Bundle

Who Really Owns Palantir Technologies?

Ever wondered who truly calls the shots at Palantir Technologies? Unraveling the Palantir Technologies SWOT Analysis is just the beginning. Understanding Palantir's ownership structure is crucial for anyone looking to navigate the complexities of the data analytics giant. From its inception to its public listing, Palantir's journey offers a fascinating case study in corporate control and investor influence.

The evolution of Palantir ownership, from its Palantir founders to its current roster of Palantir investors and executives, is a key factor in assessing its strategic direction. Knowing who controls Palantir Technologies and the extent of Palantir Technologies insider ownership provides valuable insights. This exploration will delve into Palantir stock dynamics, including major shareholders and the influence of the board of directors, to help you understand how to invest in Palantir stock and its financial performance.

Who Founded Palantir Technologies?

The inception of Palantir Technologies in 2003 marked the beginning of a company that would become a significant player in the data analytics sector. The initial formation involved a core group of individuals, each bringing unique expertise to the table. Understanding the early ownership structure is crucial for grasping the company's trajectory and the influence of its key players.

Palantir's early days were shaped by its founders and early investors. The company's focus on data analysis and its applications in intelligence and defense were evident from the start. The initial funding and strategic partnerships played a vital role in shaping the company's direction and securing its position in the market.

The founders of Palantir Technologies included Peter Thiel, Alex Karp, Joe Lonsdale, Stephen Cohen, and Nathan Gettings. Peter Thiel, a co-founder of PayPal and a well-known venture capitalist, provided the initial funding of $2 million. Alex Karp, the current CEO, brought expertise in social theory and law. Joe Lonsdale, an entrepreneur and investor, played a key role in the company's early development. Stephen Cohen and Nathan Gettings were instrumental in the technical architecture of Palantir's platforms. While specific equity splits at the absolute inception are not publicly detailed, Peter Thiel's initial investment and continued involvement through his Founders Fund venture capital firm underscore his significant early stake and influence.

Peter Thiel, a co-founder of PayPal, provided the initial funding of $2 million. His continued involvement through Founders Fund highlights his significant early stake and influence on the company.

In-Q-Tel, the venture capital arm of the CIA, invested in Palantir in 2005. This early government backing was crucial for Palantir's development and its focus on intelligence and defense applications.

Alex Karp, the current CEO, has a background in social theory and law. Joe Lonsdale, an entrepreneur and investor, played a key role in the company's early development.

Stephen Cohen and Nathan Gettings were instrumental in the technical architecture of Palantir's platforms. Their expertise was crucial for the company's early technological advancements.

The company received early backing from In-Q-Tel, the venture capital arm of the CIA, in 2005. This early government backing was crucial for Palantir's development.

Vesting schedules and other standard startup agreements would have been in place to ensure founder commitment, though specific details are not publicly disclosed.

The early ownership structure of Palantir Technologies was characterized by a close-knit group of founders and strategic early investors. The founders' vision for a powerful data analysis platform was directly reflected in the concentration of control within this initial group. For more details, you can read about the Brief History of Palantir Technologies. As of Q1 2024, institutional investors hold a significant portion of Palantir stock, reflecting the company's growing presence in the market. The insider ownership also remains substantial, highlighting the continued commitment of the founders and key executives. The current stock price and financial performance can be found on various financial platforms, providing insights into the company's market valuation and growth potential. The company's headquarters is located in Denver, Colorado.

Understanding the founders and early investors provides a foundation for analyzing Palantir's trajectory.

- Peter Thiel's initial investment was crucial.

- Early backing from In-Q-Tel shaped the company's focus.

- The founders' vision drove the company's initial direction.

- The company's commitment to data analysis is reflected in its ownership structure.

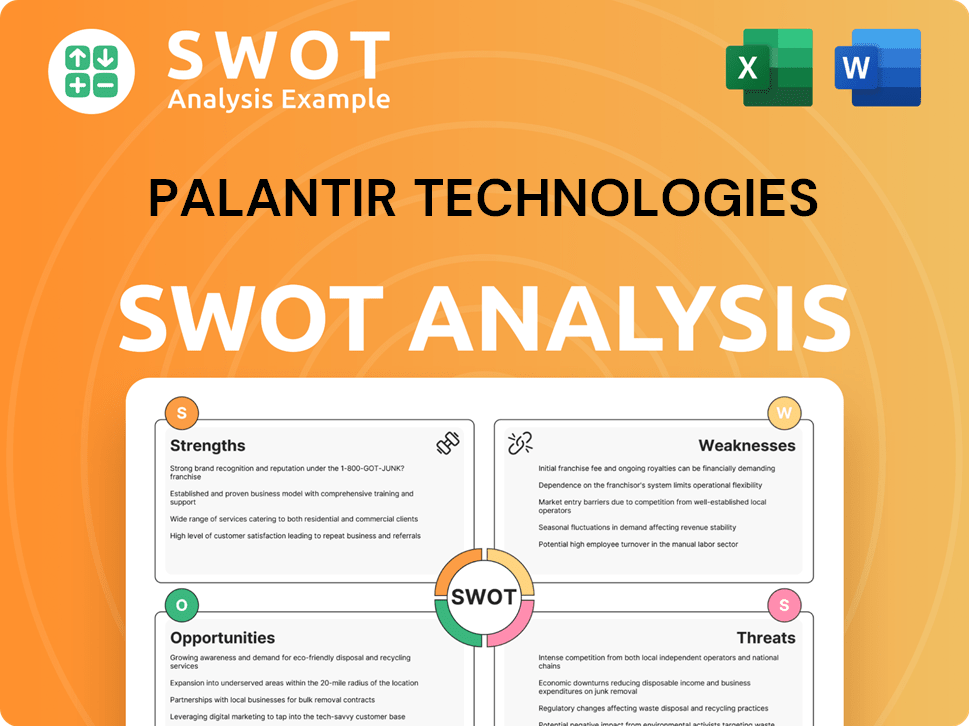

Palantir Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Palantir Technologies’s Ownership Changed Over Time?

The ownership structure of Palantir Technologies has seen significant changes since its inception. A pivotal moment was the direct listing on September 30, 2020, which allowed the company to go public without an initial public offering. The initial reference price was $7.25 per share. This event marked a transition from private to public ownership, opening the door for broader investor participation and impacting the dynamics of Palantir stock.

As of late 2024 and early 2025, the ownership landscape includes a mix of institutional investors, mutual funds, and individual insiders. The founders, however, have retained considerable control through a dual-class share structure. This structure is a key element in understanding who controls Palantir Technologies and its strategic direction. The evolution of Palantir's ownership is closely tied to its growth strategy, which is discussed in detail in the Growth Strategy of Palantir Technologies.

| Date | Event | Impact on Ownership |

|---|---|---|

| September 30, 2020 | Direct Listing | Transition to public ownership; increased investor base. |

| Early 2025 | Institutional Ownership Updates | Reflects the ongoing influence of institutional investors like Vanguard and BlackRock. |

| Ongoing | Founder's Control | Maintained through dual-class shares, ensuring strategic direction. |

Institutional ownership plays a crucial role in Palantir's shareholder base. As of March 31, 2025, institutional ownership accounted for approximately 32.7% of the total shares outstanding. Major players such as Vanguard Group Inc. and BlackRock Inc. consistently hold significant stakes, reflecting their passive investment strategies. As of December 31, 2024, Vanguard Group Inc. held 8.44% of shares, and BlackRock Inc. held 4.88% of shares. Other key Palantir investors include ARK Investment Management LLC, known for its focus on innovative companies. These institutional holdings influence the Palantir stock performance and the overall market perception of the company.

The dual-class share structure gives the founders significant control, ensuring their long-term strategic vision. This structure involves Class A and Class B shares, where Class B shares, held primarily by founders and early investors, have more voting rights.

- Palantir founders Alex Karp and Peter Thiel maintain substantial control.

- Institutional investors like Vanguard and BlackRock hold significant shares.

- The direct listing in 2020 was a pivotal moment in its ownership evolution.

- Understanding the ownership structure is key to assessing Palantir's strategic direction.

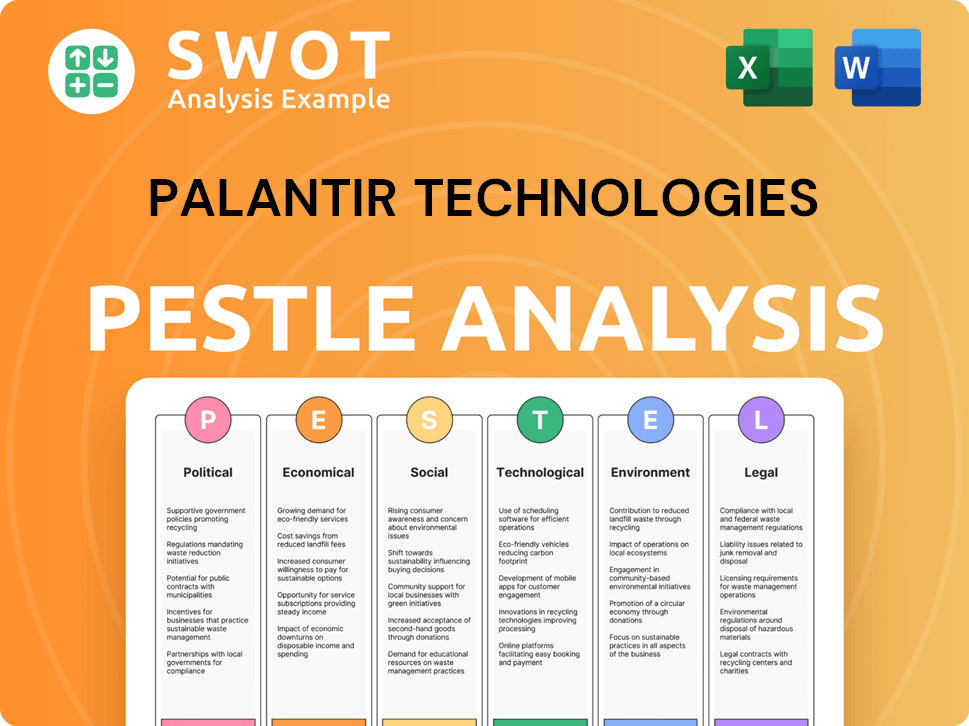

Palantir Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Palantir Technologies’s Board?

The composition of the Board of Directors at Palantir Technologies is pivotal to the company's governance. As of early 2025, the board includes key figures such as CEO Alex Karp and co-founder Peter Thiel, reflecting significant founder influence. Stephen Cohen, another co-founder, also serves on the board. The board also includes independent directors and individuals with expertise in technology, finance, and government. This structure, with the founders and their associates, ensures the original leadership's vision remains central to the company's strategy. Understanding the Revenue Streams & Business Model of Palantir Technologies is also key to understanding the company's direction.

The presence of Palantir founders and their close associates on the board, combined with the dual-class share structure, reinforces their long-term control over the company's strategic direction. This setup largely protects Palantir from proxy battles or activist investor campaigns, as the founders' voting power makes it difficult for external shareholders to influence significant changes in governance or strategy. This structure supports the company's ability to pursue its long-term, often unconventional, strategic objectives.

| Board Member | Title | Key Affiliation |

|---|---|---|

| Alex Karp | CEO | Palantir Technologies |

| Peter Thiel | Director | Palantir Technologies, Founders Fund |

| Stephen Cohen | Director | Palantir Technologies, Co-founder |

| Other Directors | Various | Independent, Technology, Finance, Government |

Palantir operates with a dual-class share structure. Class A common stock, traded publicly, carries one vote per share, while Class B common stock, mainly held by founders and early investors, carries ten votes per share. Furthermore, the 'Class F' stock, originally held by Karp, Thiel, and Lonsdale, gives them control over future capital structure changes, solidifying their long-term control. This arrangement gives the founders outsized control, maintaining a majority of the voting power despite holding a minority of the economic interest. This structure reinforces Palantir's ability to pursue its long-term strategic goals.

Palantir's ownership structure is designed to maintain founder control. The dual-class share structure and the 'Class F' stock provide significant voting power to the founders. This structure impacts how to invest in Palantir stock and influences the company's strategic decisions.

- Dual-class shares: Class A (1 vote), Class B (10 votes).

- 'Class F' stock grants founders control over capital structure changes.

- This structure shields Palantir from external influence.

- The founders' voting power allows them to maintain control.

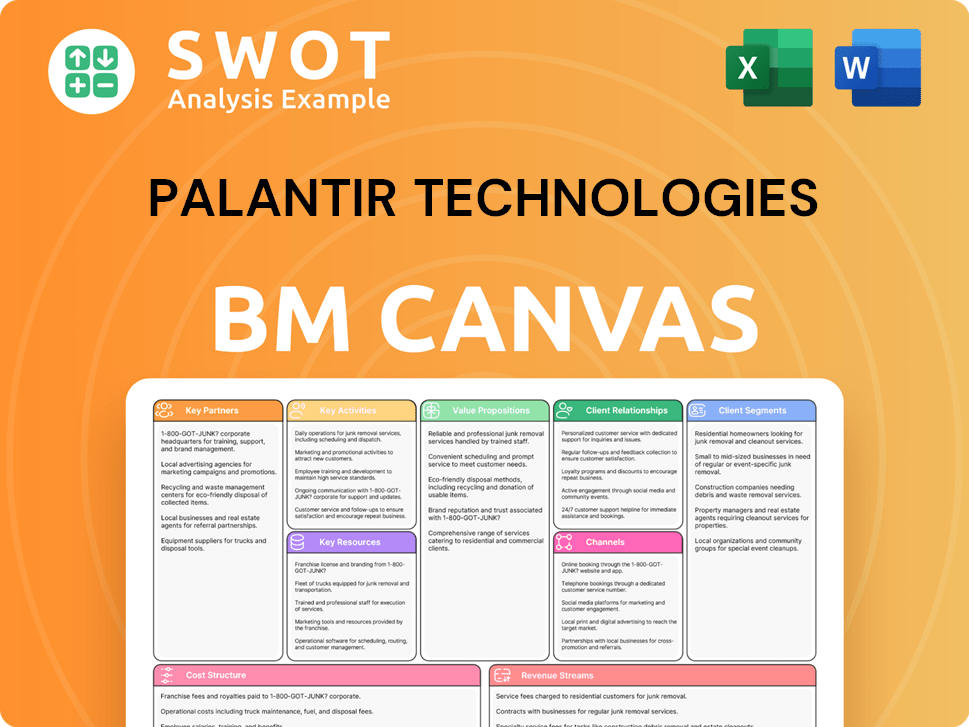

Palantir Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Palantir Technologies’s Ownership Landscape?

Over the past few years, the ownership landscape of Palantir Technologies has evolved, particularly following its direct listing. The company's structure, with its dual-class shares, has allowed the Palantir founders and early Palantir investors to retain significant control. However, as a publicly traded entity, there's been a natural rise in institutional ownership. This shift is a common trend in the tech sector, reflecting the increasing involvement of large-scale investors in the company's Palantir stock.

In early 2024, Palantir initiated share buyback programs, such as the $1 billion repurchase program authorized in February 2024. This action aims to return value to shareholders and potentially concentrate ownership. While founder dilution is a typical occurrence for public companies, Palantir's structure has largely mitigated significant founder dilution in terms of voting power. Moreover, strategic investments and partnerships have also played a role in shaping the company's stakeholder network. Public statements from Palantir's leadership often emphasize the company's long-term vision, which suggests a continued preference for the current ownership structure.

The evolution of Palantir's ownership is crucial for understanding its strategic direction and market performance. For more insights into the company's approach, consider reading about the Marketing Strategy of Palantir Technologies. Recent data indicates that institutional investors hold a substantial portion of the outstanding shares, reflecting confidence in Palantir's long-term prospects. The company's executive team, including key personnel, continues to shape Palantir's trajectory, which is reflected in the company's financial performance and stock price.

| Metric | Data | Notes |

|---|---|---|

| Institutional Ownership | ~40-50% | Estimate as of early 2025 |

| Share Repurchase Program | $1 Billion | Authorized February 2024 |

| Founder Voting Power | Significant | Due to dual-class structure |

Major Palantir investors include institutional entities that hold a significant percentage of outstanding shares. These Palantir investors shape the company's direction.

Palantir Technologies' ownership structure features a dual-class share system, which grants the Palantir founders greater voting power. This structure ensures control.

Recent developments involve share buybacks, which can increase the percentage of ownership for remaining shareholders. This strategy boosts value.

Palantir has been active in forming strategic partnerships, which may include equity components. These partnerships evolve the stakeholder network.

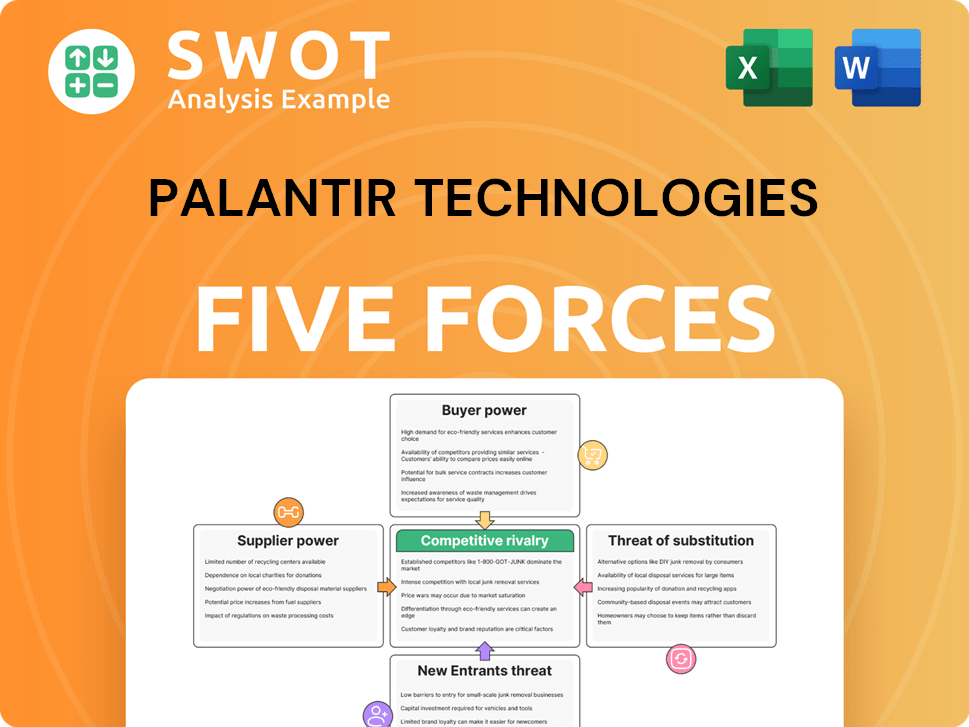

Palantir Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Palantir Technologies Company?

- What is Competitive Landscape of Palantir Technologies Company?

- What is Growth Strategy and Future Prospects of Palantir Technologies Company?

- How Does Palantir Technologies Company Work?

- What is Sales and Marketing Strategy of Palantir Technologies Company?

- What is Brief History of Palantir Technologies Company?

- What is Customer Demographics and Target Market of Palantir Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.