PVH Bundle

How did a small shirt-making operation become a fashion giant?

Journey back in time to explore the captivating PVH SWOT Analysis and the remarkable evolution of PVH Corp. from its humble beginnings. Discover how Moses Phillips and his wife, Endel, transformed a simple shirt-mending business into a global apparel powerhouse. Uncover the pivotal moments and strategic decisions that shaped the PVH Company we know today.

The History of PVH is a compelling narrative of innovation and adaptation within the competitive fashion industry. From its roots in 1881, the company, originally known as Phillips-Van Heusen, has consistently expanded its portfolio of apparel brands. This journey reveals not only the financial performance but also the cultural impact and leadership strategies that define PVH Corp.'s enduring success and its global presence.

What is the PVH Founding Story?

The story of PVH Corp. begins in 1881, a journey that highlights the evolution of a business from humble beginnings to a global apparel powerhouse. This timeline provides a brief history of PVH Company, tracing its roots and key milestones.

Moses Phillips and his wife, Endel, laid the foundation for what would become a major player in the fashion industry. Their initial venture, born out of necessity, would eventually transform into a corporation known worldwide. The company's early focus on providing affordable and durable shirts set the stage for its future success.

The origins of PVH Corp. can be traced back to 1881, when Moses Phillips and his wife, Endel, started their shirt-making business. They began by sewing shirts by hand and selling them directly to coal miners in Pottsville, Pennsylvania.

- Moses and Endel Phillips emigrated from Suwalki, Poland, seeking income to support their family.

- Their initial business model involved selling shirts from pushcarts, a direct-to-consumer approach.

- In 1907, the Phillips' business, M. Phillips & Son, merged with D. Jones & Sons, forming Phillips-Jones Corporation.

- Moses Phillips later sought to open a medical clinic for new immigrants, demonstrating a broader vision.

The merger of M. Phillips & Son with D. Jones & Sons in 1907 marked a significant turning point, expanding the business beyond its home-based origins. This strategic move set the stage for future growth and diversification. Understanding the Mission, Vision & Core Values of PVH provides additional insights into the company's long-term goals.

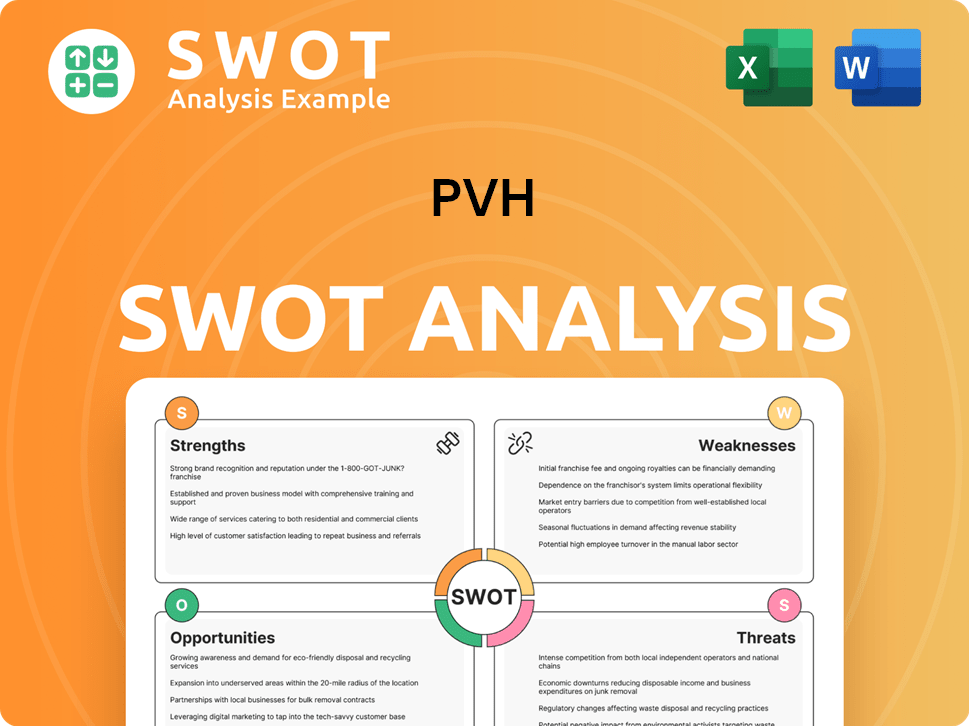

PVH SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of PVH?

The early years of the Phillips-Jones Corporation, later known as PVH Corp, were marked by significant growth and innovation. The company expanded its manufacturing capabilities and diversified its product offerings. This period saw the introduction of groundbreaking products and strategic moves that shaped its future in the fashion industry.

In 1919, the company's sales reached $7.2 million, with a net income of $1.1 million, demonstrating strong financial performance. This early success set the stage for further expansion and investment in product development. These financial figures highlight the company's robust start and its ability to generate substantial revenue and profit.

A pivotal moment came in 1919 when the company patented a self-folding collar, which was publicly launched in 1921. This innovation led to the introduction of the first collar-attached shirt in 1929, a significant advancement in apparel design. This innovation improved the ease of use and comfort of shirts.

The company strategically managed its manufacturing footprint, closing a plant in Albany and opening a new one in Geneva, Alabama, by 1940. This expansion was part of a broader strategy to optimize production and distribution capabilities. This expansion was crucial for meeting growing demand and improving operational efficiency.

During the 1940s, Phillips-Jones diversified its product line by adding neckwear. By 1950, the company's annual production included substantial quantities of dress shirts, sports shirts, neckties, collars, and pajamas. This diversification helped the company to cater to a broader consumer base.

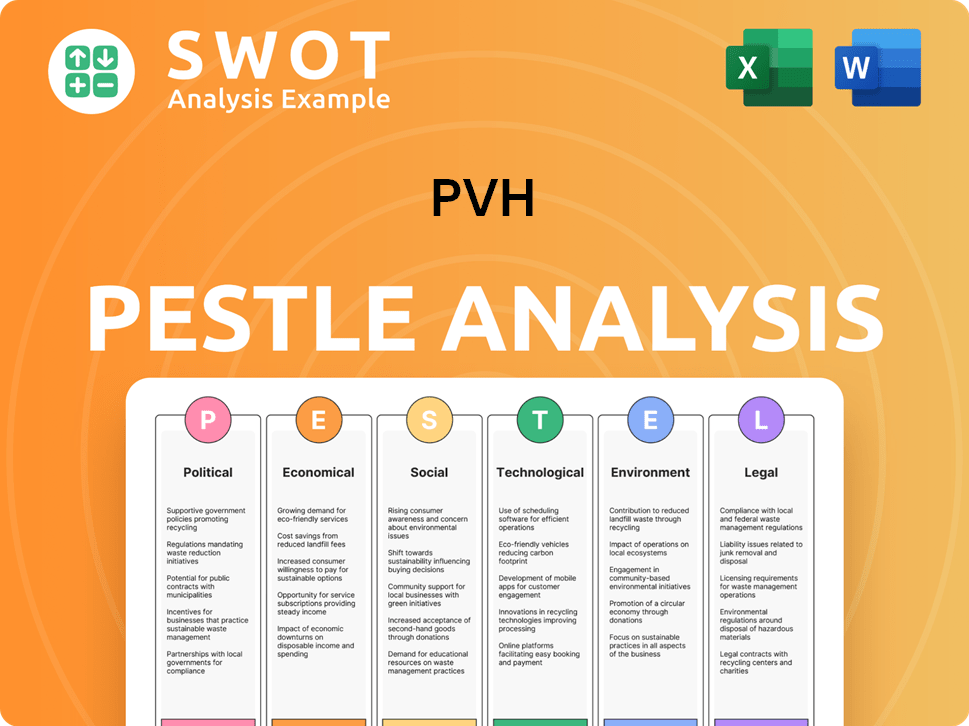

PVH PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in PVH history?

The PVH Corp, formerly known as Phillips-Van Heusen, has a rich history of PVH marked by significant milestones in the fashion industry. From its early innovations to its strategic acquisitions, the company has evolved into a global leader in the apparel brands sector. This journey reflects its adaptability and forward-thinking approach within the competitive landscape.

| Year | Milestone |

|---|---|

| 1919 | Patented the self-folding collar, a groundbreaking innovation in shirt design. |

| 1929 | Introduced the first collar-attached shirt, simplifying shirt construction. |

| 1936 | Introduced the Bass Weejun, a significant addition to its product line. |

| 1940s | Manufactured shirts for U.S. and Allied troops during World War II, receiving an award for excellence. |

| 1987 | Acquired G. H. Bass, expanding its brand portfolio. |

| 1995 | Acquired the Izod brand, further diversifying its offerings. |

| 2000 | Acquired the Arrow brand, strengthening its position in the market. |

| 2002 | Acquired the Calvin Klein company, a major strategic move. |

| 2010 | Acquired Tommy Hilfiger for $3 billion, marking a significant expansion. |

| 2013 | Acquired Warnaco Group, which included the Calvin Klein brand and expanded operations in Asia and Latin America. |

| 2021 | Sold its Heritage Brands division (Izod, Van Heusen, Arrow, and Geoffrey Beene) to Authentic Brands Group. |

PVH Corp has consistently pursued innovation to stay ahead in the fashion industry. The company's early adoption of self-folding collars and collar-attached shirts demonstrated its commitment to improving product design and functionality. This focus on innovation has allowed PVH Company to maintain a competitive edge and adapt to changing consumer preferences.

Patented in 1919, this innovation revolutionized shirt design, offering convenience and a modern look. This invention set the stage for future advancements.

Introduced in 1929, this design simplified shirt construction and manufacturing processes. This innovation improved product efficiency.

The introduction of the Bass Weejun in 1936 expanded the company's product range. This move broadened its appeal to a wider consumer base.

During World War II, the company manufactured shirts for U.S. and Allied troops. This contribution earned the company an award for excellence.

Acquisitions like Calvin Klein and Tommy Hilfiger have significantly shaped PVH's portfolio. These brands have enhanced its global presence and market share.

Initiatives like the Growth Driver 5 multi-year cost savings are key. These efforts aim to streamline operations and improve profitability.

Despite its successes, PVH Corp has faced various challenges. The company has navigated competitive pressures, leading to strategic decisions such as brand portfolio streamlining. CEO Stefan Larsson noted an 'increasingly uncertain consumer and macroeconomic backdrop' in June 2024, which has impacted the company's performance. For more insights into the company's financial performance and ownership structure, explore Owners & Shareholders of PVH.

The fashion industry is highly competitive, requiring constant adaptation. The company has to continuously innovate to maintain its market position.

The closure of retail divisions like Geoffrey Beene and Izod reflects the challenges. These closures were strategic responses to changing market dynamics.

Uncertain economic conditions and consumer behavior impact performance. These factors require agile strategies and cost management.

The sale of the Heritage Brands division was a strategic move. This aimed to focus on core brands and improve efficiency.

Initiatives such as Growth Driver 5 are crucial for profitability. These efforts aim to streamline operations and reduce costs.

Fluctuations in consumer demand and economic conditions. These require adaptability and proactive management strategies.

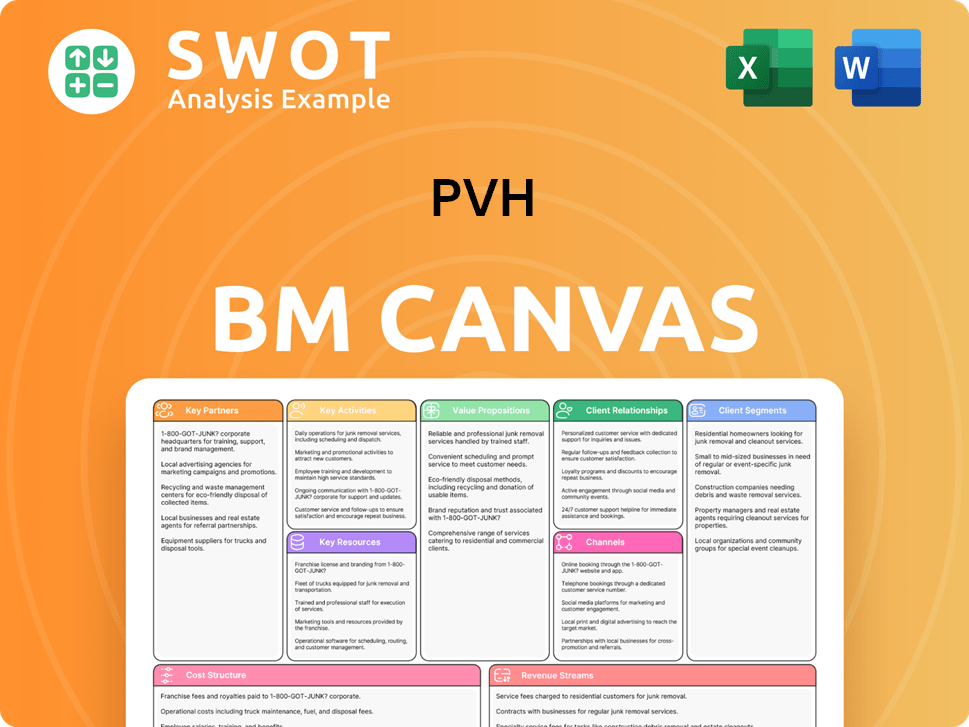

PVH Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for PVH?

The journey of PVH Corp, a prominent player in the fashion industry, began in 1881 with Moses and Endel Phillips selling shirts. Over the years, the company has evolved through mergers, acquisitions, and strategic shifts, including the acquisition of key apparel brands such as Calvin Klein and Tommy Hilfiger. The company's evolution reflects its adaptability and growth in the dynamic fashion market. This Marketing Strategy of PVH article provides further insights into the company's approach.

| Year | Key Event |

|---|---|

| 1881 | Moses and Endel Phillips begin hand-sewing and selling shirts in Pottsville, Pennsylvania. |

| 1907 | M. Phillips & Son merges with D. Jones & Sons, forming Phillips-Jones Corporation. |

| 1919 | Phillips-Jones Corporation receives a patent for a self-folding collar. |

| 1921 | The self-folding collar is released to the public and becomes successful. |

| 1929 | The first collar-attached shirt is introduced. |

| 1957 | Phillips-Jones Corporation changes its name to Phillips-Van Heusen Corporation. |

| 1987 | Phillips-Van Heusen acquires G. H. Bass. |

| 1995 | The Izod brand is acquired. |

| 2002 | Phillips-Van Heusen acquires Calvin Klein, Inc. |

| 2010 | Phillips-Van Heusen acquires Tommy Hilfiger for $3 billion. |

| 2011 | Phillips-Van Heusen Corporation is renamed PVH Corp. |

| 2013 | PVH acquires Warnaco Group, consolidating the Calvin Klein brand. |

| 2021 | PVH sells its Heritage Brands (Izod, Van Heusen, Arrow, Geoffrey Beene) to Authentic Brands Group. |

| 2022 | PVH introduces the PVH+ Plan, a multi-year strategic growth plan. |

| 2025 (Q1) | PVH Corp reports a revenue increase of 2% to $1.984 billion, surpassing guidance. |

The PVH+ Plan is a multi-year strategic growth plan. It focuses on building Calvin Klein and Tommy Hilfiger into the most desirable lifestyle brands globally. The plan includes key growth drivers such as product innovation and consumer engagement.

For full-year 2025, PVH expects adjusted earnings per share of $10.75 to $11, despite an uncertain economic backdrop. The company is focused on inventory management and marketplace investments to drive profitability. The company's Q1 2025 results show a positive trend.

PVH is strengthening its product offerings and launching impactful marketing campaigns. An example is the successful Bad Bunny campaign for Calvin Klein. The company is also focused on sharpening marketplace execution to drive growth.

PVH announced a new licensing agreement for Calvin Klein and Tommy Hilfiger outerwear in North America. This is expected to launch in Spring 2026. This initiative leverages the brand portfolio for further expansion.

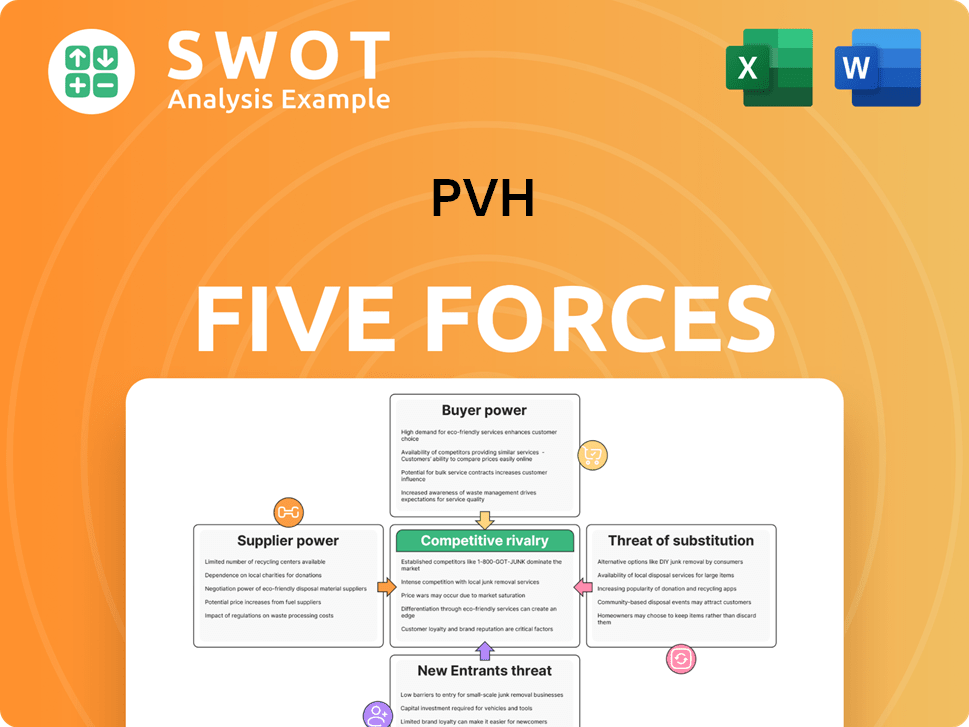

PVH Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of PVH Company?

- What is Growth Strategy and Future Prospects of PVH Company?

- How Does PVH Company Work?

- What is Sales and Marketing Strategy of PVH Company?

- What is Brief History of PVH Company?

- Who Owns PVH Company?

- What is Customer Demographics and Target Market of PVH Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.