PVH Bundle

Can PVH Corp. Maintain Its Fashion Empire?

PVH Corp., the name behind iconic brands like Calvin Klein and Tommy Hilfiger, has a rich history of strategic growth in the ever-changing fashion industry. From its roots as a shirt manufacturer to a global apparel powerhouse, PVH's journey is a testament to the power of strategic acquisitions and brand building. This PVH SWOT Analysis provides a deeper dive into the company's strengths and weaknesses.

Understanding the PVH growth strategy is crucial for anyone interested in fashion industry trends and apparel market forecasts. This PVH company analysis will explore the company's future prospects, including its 'PVH+ Plan' and how it intends to navigate challenges and capitalize on opportunities in a competitive market. We'll delve into PVH's brand portfolio strategy and its approach to international market expansion, offering insights into the company's potential for sustainable growth and financial performance.

How Is PVH Expanding Its Reach?

The expansion initiatives of PVH Corp are primarily guided by its 'PVH+ Plan.' This strategy focuses on boosting the performance of its core brands, Calvin Klein and Tommy Hilfiger. The company aims to achieve growth through product innovation, stronger consumer engagement, and success in the digitally-driven marketplace. This approach is central to understanding the PVH growth strategy.

A key element of the 'PVH+ Plan' involves bringing previously licensed product categories in-house. This strategic move is expected to enhance long-term profitability. For example, the company plans to relaunch the Calvin Klein women's sportswear business at U.S. wholesale in 2025, after reclaiming the license from G-III Apparel Group Ltd. This decision underscores PVH's commitment to controlling its brand portfolio and maximizing revenue potential.

Geographically, PVH is strategically expanding its international business. The company is seeing improvements in European order books and robust growth in the Asia-Pacific region. While navigating challenges in North America, the company is focused on achieving a double-digit EBIT margin in the region. Furthermore, the Fall '25 order books in Europe are showing positive growth. These initiatives are crucial for the PVH future prospects.

PVH's strategy centers on strengthening its main brands, Calvin Klein and Tommy Hilfiger. This includes product innovation and enhancing consumer engagement. These brands are key drivers of the PVH company analysis and overall financial performance.

Taking control of previously licensed categories is a strategic move. This allows PVH to manage its brand presence more effectively. The relaunch of Calvin Klein women's sportswear in 2025 is a prime example of this strategy.

PVH is actively growing its international presence, particularly in Europe and the Asia-Pacific region. This expansion is vital for long-term growth. The company is also focused on improving sales quality within wholesale channels.

The company continues to innovate with new product offerings. These span sportswear, jeanswear, underwear, swimwear, footwear, and accessories. Innovation is key to staying competitive in the fashion industry trends.

PVH is also concentrating on the quality of sales within its wholesale channels and fostering strong partnerships with major wholesale accounts. The company continues to innovate with new product offerings across sportswear, jeanswear, underwear, swimwear, footwear, and accessories under its key brands. To understand how PVH generates revenue, consider reading Revenue Streams & Business Model of PVH.

PVH's expansion strategy includes focusing on core brands, bringing licensing in-house, and international growth. These strategies are designed to drive sustainable growth and improve profitability. The company's focus on digital transformation also plays a crucial role.

- Enhancing Calvin Klein and Tommy Hilfiger brands.

- Taking control of key product categories.

- Expanding internationally, especially in Europe and Asia-Pacific.

- Focusing on high-quality sales and wholesale partnerships.

- Innovating with new product offerings.

PVH SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does PVH Invest in Innovation?

The company, formerly known as Phillips-Van Heusen Corporation, strategically leverages innovation and technology to fuel sustained growth. Its 'PVH+ Plan' is a cornerstone of this approach, emphasizing a demand and data-driven operating model. This plan is designed to streamline processes and improve efficiency across the organization.

A key aspect of PVH's strategy involves digital transformation, particularly in building e-commerce capabilities. The company is focused on succeeding in the digitally-led marketplace. This includes driving efficiencies and investing in growth through the PVH+ Plan, which aims to centralize processes and improve systems.

While specific details on research and development investments or patents are not extensively highlighted in recent reports, the company's strategic focus indicates an ongoing commitment to technological advancements. The company's commitment to sustainability initiatives is also a key component of its overall strategy.

The company prioritizes digital transformation to enhance e-commerce capabilities and overall market presence. This includes a focus on data-driven strategies and improved systems to support growth objectives.

The 'PVH+ Plan' is central to the company's strategy, aiming to simplify operations through centralized processes and improved systems. This plan focuses on efficiency and cost-effectiveness across the organization.

Sustainability is a key component of PVH's overall strategy, aligning with broader industry trends and consumer expectations. This reflects a commitment to responsible business practices.

A data-driven operating model is at the core of PVH's strategy, enabling informed decision-making and improved operational efficiency. This supports the company's growth objectives.

Building robust e-commerce capabilities is a key focus area, reflecting the increasing importance of digital channels in the fashion industry. This supports market expansion and consumer reach.

The PVH+ Plan aims to drive efficiencies and reduce costs through streamlined processes and improved systems. This supports the company's financial performance and competitiveness.

The company's commitment to innovation and technology is crucial for its Mission, Vision & Core Values of PVH, particularly in the context of evolving fashion industry trends and the competitive apparel market forecast. While specific financial figures for 2024 are not yet fully available, the strategic direction indicates a continued investment in these areas to achieve its goals. The company's ability to adapt to PVH company growth strategy 2024 and leverage technology will be vital for its PVH future prospects.

PVH's technological initiatives include digital transformation, e-commerce expansion, and a data-driven operating model. These efforts are designed to enhance efficiency, improve customer experience, and drive growth. The company's focus on sustainability also plays a crucial role.

- Digital Transformation: Building robust e-commerce capabilities.

- Data-Driven Model: Utilizing data for informed decision-making.

- PVH+ Plan: Centralizing processes and improving systems.

- Sustainability: Integrating sustainability initiatives.

PVH PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is PVH’s Growth Forecast?

The financial outlook for PVH Corp. (PVH Corp) in fiscal year 2025 indicates a stable performance, with revenue expected to remain flat or experience a slight increase compared to 2024. This is a positive sign, especially when considering the apparel market forecast and the broader fashion industry trends. This financial stability is crucial for the company's PVH growth strategy and future prospects, especially in a dynamic market.

For the full fiscal year 2024, the company reported a consolidated revenue of $8.653 billion, reflecting a 6% year-over-year decline. Despite this, the company is demonstrating resilience and strategic planning. The company's focus on its PVH future prospects includes strategic initiatives to navigate economic challenges and capitalize on emerging opportunities. Understanding the PVH company analysis is key to assessing the company's position in the competitive landscape.

The company projects its non-GAAP operating margin to be approximately 8.5% in 2025, slightly down from 10.0% in 2024. Non-GAAP earnings per share (EPS) for 2025 are anticipated to be in the range of $10.75 to $11.00. This revised outlook accounts for an estimated net negative impact of about $1.05 per share due to tariffs on goods imported into the U.S., partially offset by mitigation actions and a positive impact of approximately $0.10 per share from foreign currency translation. For more insights into the company's marketing approach, check out the Marketing Strategy of PVH.

The company anticipates flat to slightly increased revenue in fiscal year 2025, both on a reported and constant currency basis. This indicates stability and potential for growth despite challenging market conditions. This is a crucial aspect of the PVH growth strategy, demonstrating the company's ability to maintain its market position.

The projected non-GAAP operating margin for 2025 is around 8.5%, a slight decrease from the 10.0% recorded in 2024. This reflects the company's ability to manage costs effectively while navigating economic challenges. This is a key indicator in assessing the PVH financial performance analysis.

Non-GAAP EPS for 2025 is projected to be between $10.75 and $11.00. This revised forecast includes the impact of tariffs and currency fluctuations. This forecast is a critical component of the PVH company analysis, providing insights into the company's profitability.

In 2024, the company completed approximately $500 million in stock repurchases and plans another $500 million in 2025 through ASR agreements. This demonstrates confidence in the company's future and commitment to shareholder value. This is a key element of PVH's sustainable growth initiatives.

The company's gross profit margin for the latest twelve months is 59.4%, peaking in February 2025. This indicates the company's ability to maintain profitability. Understanding the gross profit margin is critical for PVH market share and competitors analysis.

The updated outlook reflects a negative impact of approximately $1.05 per share due to tariffs, partially offset by mitigation efforts and a positive impact of approximately $0.10 per share from foreign currency translation. These factors are crucial in understanding the Impact of economic trends on PVH.

PVH Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow PVH’s Growth?

The future prospects of PVH Corp face several hurdles that could affect its growth strategy. The company operates in a highly competitive market, contending with both established global brands and emerging digitally native competitors. Economic uncertainties, particularly in key markets like Europe, also pose significant risks to PVH's performance.

One of the major challenges for PVH includes macroeconomic factors, such as inflation and currency volatility, which can impact consumer spending. These factors are especially critical in Europe, where a substantial portion of PVH's sales originate. Furthermore, international tourism, a significant driver of sales in North America, remains soft, adding another layer of complexity.

A significant emerging risk concerns ongoing trade tensions and the potential for increased tariffs. The U.S. has imposed tariffs on textile and apparel imports from various countries, which directly affects PVH's sourcing strategies. These trade-related challenges could impact PVH's global operations and financial outcomes.

PVH Corp faces intense competition from a wide array of designers, brand owners, manufacturers, and retailers. This includes both established companies and digitally native brands. The fashion industry trends demonstrate a dynamic landscape with evolving consumer preferences and rapid market changes.

Macroeconomic uncertainties, such as inflation and volatile currencies, pose risks to consumer demand. These factors are particularly relevant in Europe, where about half of PVH's sales are generated. International tourism also plays a role in North American sales.

Ongoing trade tensions and the potential for increased tariffs represent a significant risk. The U.S. has imposed tariffs on textile and apparel imports, directly affecting PVH's sourcing strategies. These tariffs could impact the company's global operations and financial performance.

The Chinese Ministry of Commerce (MOFCOM) initiated an investigation into PVH's cotton sourcing practices in September 2024 and placed the company on its List of Unreliable Entities. This could lead to fines, restrictions, or limitations on investments. This could potentially impact 15% of the company's calculated total EBITDA in 2024.

PVH's supply chain is another area of concern, as its products are manufactured by independent manufacturers in approximately 40 countries, primarily in Asia. The company relies on foreign suppliers for products and raw materials. This dependence creates vulnerabilities.

Analysts have noted new pressure points, including slowing sales in China. This adds to the challenges PVH faces in its international market expansion. The company must adapt its strategies to maintain growth.

PVH is addressing these risks through strategic initiatives, such as the 'PVH+ Plan,' which aims to drive efficiencies and invest in growth. The company has shown its ability to manage challenges, as demonstrated by its better-than-expected revenue and EPS performance in the fourth quarter of 2024, despite a difficult macroeconomic environment. For more detailed insights, you can read more about it in the article about PVH company analysis.

PVH's management is actively working to assess and prepare for these risks. The company is focused on adapting its strategies to navigate the challenges. The ability to navigate challenges is evident in its recent financial results. The company is also managing supply chain vulnerabilities.

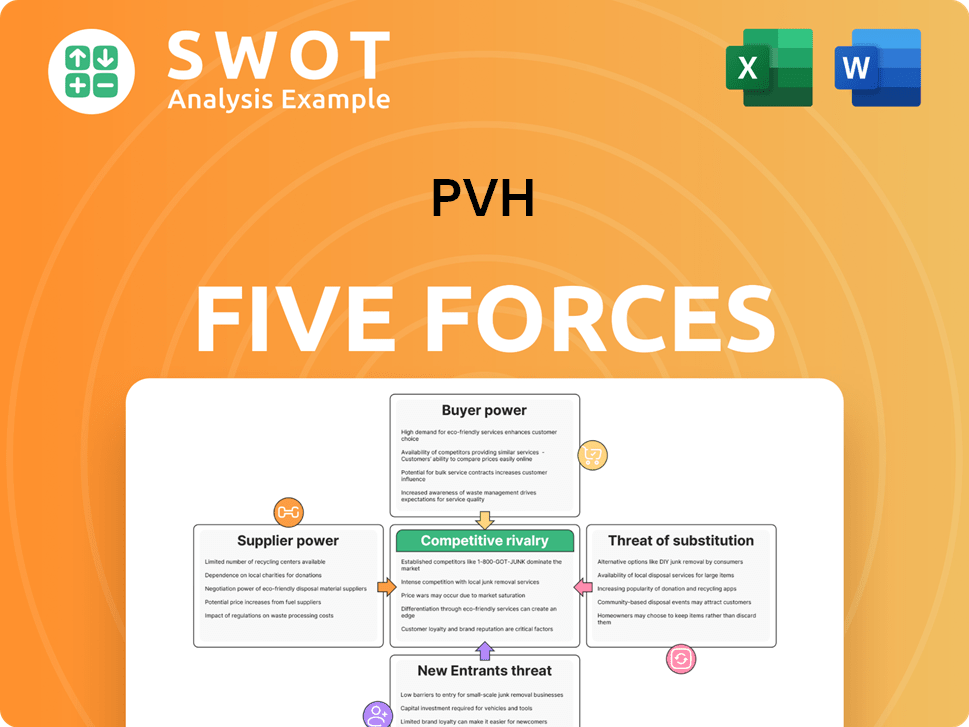

PVH Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.