Raizen Bundle

How Did Raízen Rise to Energy Dominance?

Embark on a journey through the Raizen SWOT Analysis, exploring the fascinating brief history of Raizen company, a true energy titan. From its strategic origins in 2011 as a joint venture, Raízen has rapidly evolved, transforming the energy landscape. Discover how this Brazilian powerhouse leveraged its unique position to become a leader in sugarcane, ethanol, and fuel distribution.

Raízen's story is one of remarkable growth and strategic foresight. The company's early focus on Raizen Brazil and the bioenergy sector, particularly Raizen ethanol and Raizen sugarcane production, fueled its expansion. Today, Raízen stands as a testament to the power of integrated operations and sustainable innovation in the energy market, with a compelling Raizen company timeline.

What is the Raizen Founding Story?

The brief history of Raizen company began on June 1, 2011. This marked the official establishment of the company as a joint venture. The collaboration brought together Cosan S.A., a Brazilian conglomerate, and Royal Dutch Shell plc, an Anglo-Dutch multinational energy company.

This strategic alliance aimed to integrate Cosan's expertise in sugarcane production and ethanol processing with Shell's global fuel distribution and branding capabilities. The goal was to create a fully integrated energy company, from sugarcane cultivation to the commercialization of biofuels and conventional fuels. This approach was designed to capitalize on the growing global demand for renewable energy.

The primary opportunity was to harness Brazil's abundant sugarcane resources for efficient ethanol production. Cosan contributed its agricultural land, sugar and ethanol mills, and logistics infrastructure. Shell provided its strong brand recognition, extensive retail network (Shell service stations), and financial resources. The original business model focused on vertical integration, controlling the entire value chain from feedstock to the end-consumer.

Raízen was formed on June 1, 2011, as a joint venture.

- Cosan S.A. and Royal Dutch Shell plc were the founding partners.

- The company's name, 'Raízen,' combines 'raiz' (root) and 'energia' (energy).

- Initial funding came from investments by both Cosan and Shell, each holding a 50% stake.

- Focused on vertical integration: sugarcane to fuel distribution.

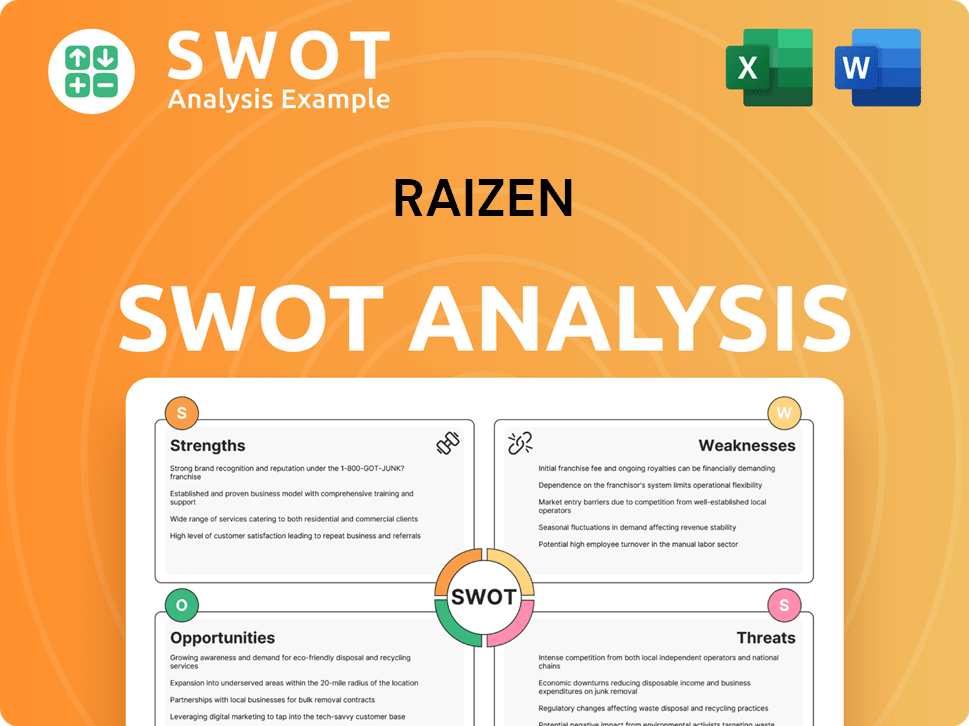

Raizen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Raizen?

The early years of the Raizen company were marked by rapid growth and strategic integration. Formed in 2011, the company quickly focused on consolidating its position as a leading integrated energy provider. This involved optimizing existing assets and expanding its operational footprint, particularly in the Brazilian and Argentinian markets.

A key initial step for Raízen was integrating Cosan's sugar and ethanol operations with Shell's fuel distribution network. This integration streamlined logistics and enhanced operational efficiencies across its 24 sugar and ethanol mills. The company leveraged Shell's extensive service station network in Brazil and Argentina to boost its market presence.

Raízen rapidly expanded its retail network, becoming a significant player in fuel distribution by 2012. The company benefited from the strong brand presence of Shell. Investment in upgrades to industrial plants increased the production capacity for sugar and ethanol, driving further growth.

Following its founding, Raízen expanded its market presence both geographically and in terms of product offerings. This included entering new markets within Brazil and solidifying operations in Argentina. The company placed a greater emphasis on bioenergy solutions, including the commercialization of bioelectricity generated from sugarcane bagasse.

The early years also saw initial team expansion, with a focus on integrating diverse expertise from both parent companies into a cohesive operational unit. Raízen's integrated model offered a compelling value proposition in a growing energy market, helping it navigate the competitive landscape. By 2024, Raízen's focus on sustainable practices and bioethanol production had become a key part of its strategy.

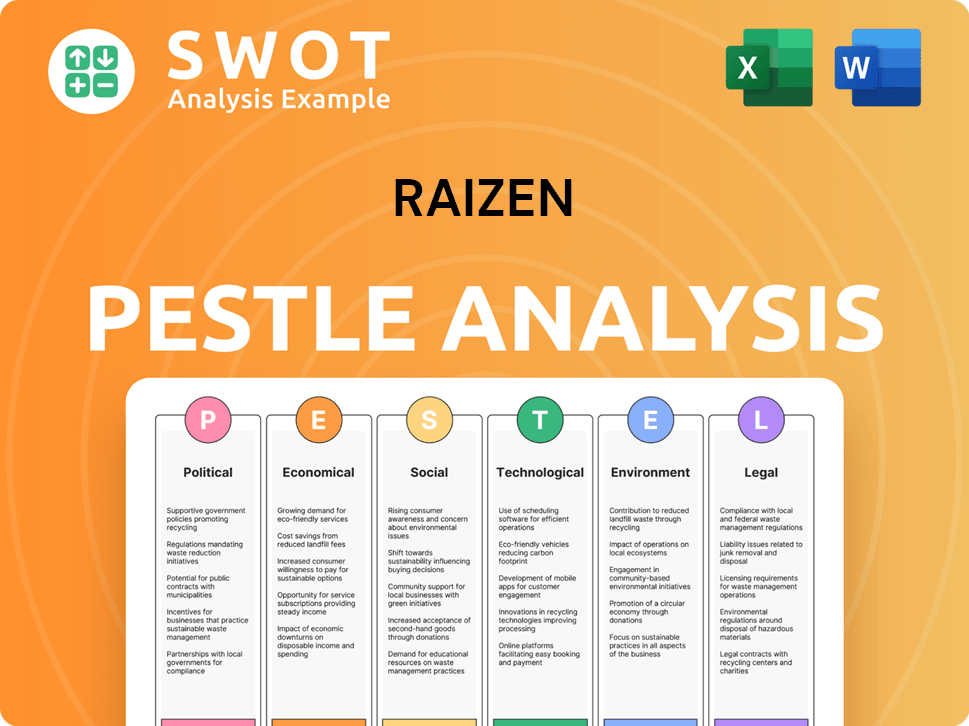

Raizen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Raizen history?

The Raizen company has a rich history, marked by significant milestones in the energy sector. These achievements showcase its evolution and strategic growth within the Brazilian and global markets.

| Year | Milestone |

|---|---|

| 2011 | Raízen, a joint venture between Cosan and Shell, is formed, marking a significant entry into the Brazilian sugar and ethanol market. |

| 2014 | Inauguration of the first second-generation ethanol (E2G) plant, a pioneering move in biofuel technology. |

| 2021 | Acquisition of Biosev, which significantly expanded its sugarcane crushing capacity and industrial assets. |

| 2023 | Announcement of plans to expand E2G production capacity to reach 1.3 billion liters by 2030, reinforcing its commitment to sustainable energy. |

Raízen has been at the forefront of innovation, particularly in the realm of sustainable energy. A key innovation is its work in second-generation ethanol (E2G), which produces ethanol from sugarcane bagasse and straw. This technology has enabled Raízen to double the energy output from the same amount of sugarcane, solidifying its position as a leader in advanced biofuels.

Raízen's pioneering work in second-generation ethanol (E2G) has been a groundbreaking innovation. This technology allows the company to extract more energy from sugarcane, enhancing efficiency and sustainability.

Raízen utilizes biomass from sugarcane processing to generate bioelectricity. This clean energy is used for its operations and sold to the grid, contributing to a reduction in carbon emissions.

The company's commitment to sustainability is evident in its investments in renewable energy sources. Raízen focuses on reducing its environmental impact through innovative and eco-friendly practices.

Navigating the energy market has presented several challenges for the Raizen company. The company has faced volatility in global commodity markets and fluctuating oil prices, which have impacted profitability. Furthermore, the COVID-19 pandemic posed logistical and demand-side challenges, requiring robust supply chain management and a focus on essential services.

Fluctuations in global commodity markets for sugar and ethanol have presented challenges. These changes require strategic cost-reduction measures and operational efficiencies to maintain profitability.

Adapting to changing regulatory environments in the energy sector is another challenge. The company must continuously innovate to stay at the forefront of the bioenergy industry.

Raízen faces competition from other energy players. The company needs to continuously innovate and adapt to maintain its market share and leadership position.

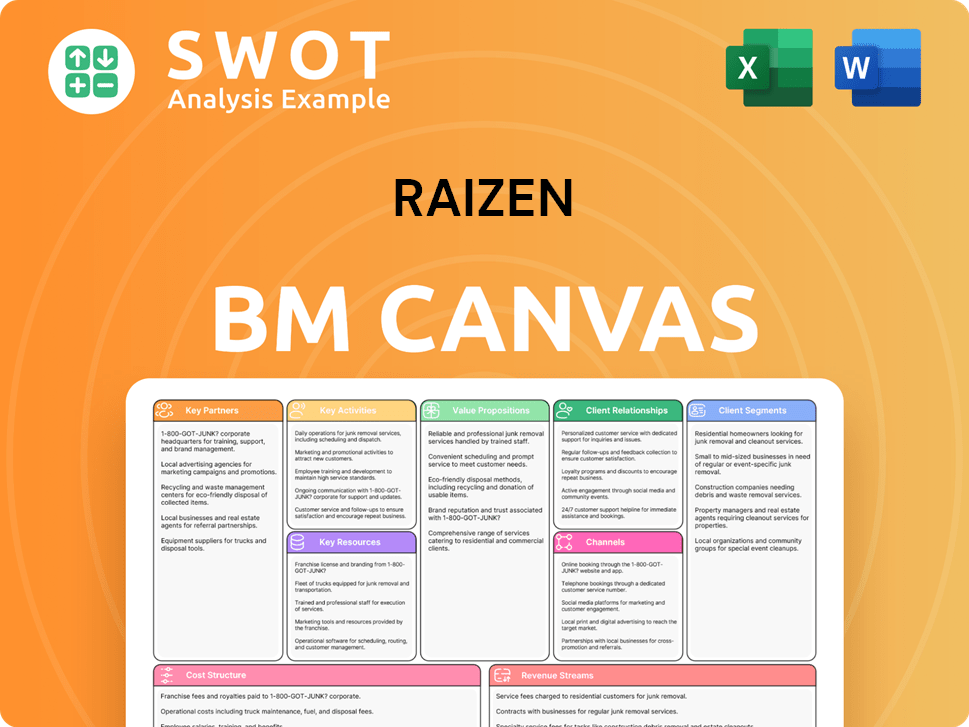

Raizen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Raizen?

The Raizen company journey is marked by strategic expansions and innovations, shaping its position in the energy sector. From its inception as a joint venture to its IPO, Raízen has consistently broadened its scope in biofuels and renewable energy. The company's timeline reflects a commitment to sustainable practices and growth, particularly in sugarcane production, ethanol, and bioelectricity.

| Year | Key Event |

|---|---|

| June 1, 2011 | Raízen was formed as a 50/50 joint venture between Cosan S.A. and Royal Dutch Shell plc. |

| 2012 | The company rapidly expanded its retail network under the Shell brand in Brazil and Argentina. |

| 2014 | Raízen inaugurated its first second-generation ethanol (E2G) plant, pioneering advanced biofuel production. |

| 2015 | The company expanded into the commercialization of bioelectricity generated from sugarcane bagasse. |

| 2018 | Raízen launched its Raízen Power segment, focusing on renewable energy generation and commercialization. |

| 2021 | Raízen acquired Biosev, significantly expanding its sugarcane crushing capacity and solidifying its market leadership. |

| 2022 | Raízen's initial public offering (IPO) on the B3 stock exchange marked a significant milestone in its financial independence and growth. |

| 2023 | The company announced plans to significantly expand E2G production capacity, targeting 1.3 billion liters by 2030. |

| 2024-2025 | Raízen continues to focus on innovation in sustainable aviation fuel (SAF) and other advanced biofuels, alongside the expansion of its retail network and energy solutions. |

Raízen plans to significantly increase its second-generation ethanol (E2G) production. The goal is to reach a capacity of 1.3 billion liters by 2030, demonstrating a strong commitment to advanced biofuels. This expansion aligns with the growing demand for sustainable energy sources and positions Raízen as a leader in the bioethanol market.

Raízen is focused on enhancing its integrated energy platform. This includes expanding its fuel distribution network and diversifying its portfolio of renewable energy solutions. The company aims to strengthen its position in the energy market through strategic investments and operational improvements. This approach supports Raízen's long-term growth strategy.

Raízen is actively exploring opportunities in sustainable aviation fuel (SAF). The company is investing in research and development to produce SAF and other emerging bioenergy technologies. This move aligns with global decarbonization efforts and enhances Raízen's commitment to sustainability. The company aims to be a key player in the global energy transition.

Industry trends, such as the increasing demand for renewable energy and stricter environmental regulations, will positively impact Raízen. The company's leadership is committed to sustainable growth, aiming to be a key player in the global energy transition. Raízen's focus on innovation and sustainability reinforces its leadership in the bioenergy sector.

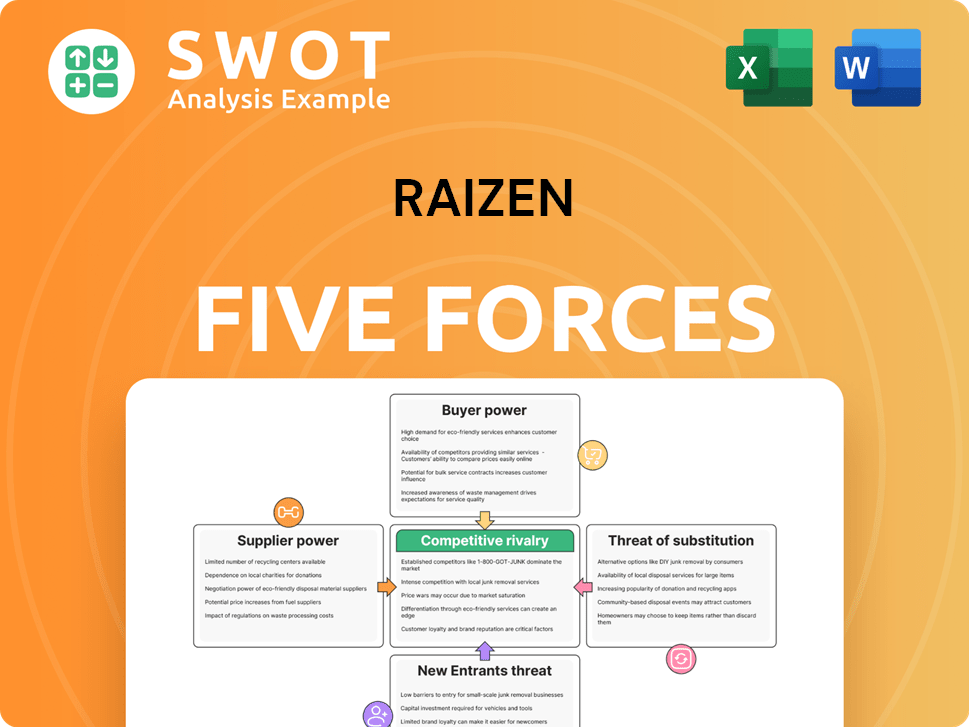

Raizen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Raizen Company?

- What is Growth Strategy and Future Prospects of Raizen Company?

- How Does Raizen Company Work?

- What is Sales and Marketing Strategy of Raizen Company?

- What is Brief History of Raizen Company?

- Who Owns Raizen Company?

- What is Customer Demographics and Target Market of Raizen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.